Global Whiskey Market By Type (Scotch whiskey, American whiskey, Canadian whiskey, Irish whiskey and Others) By Product (Malt, Wheat, Rye, Corn, Blended and Others) By Distribution Channel (On-Trade and Off-Trade) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2021-2031

- Published date: Dec 2023

- Report ID: 74484

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

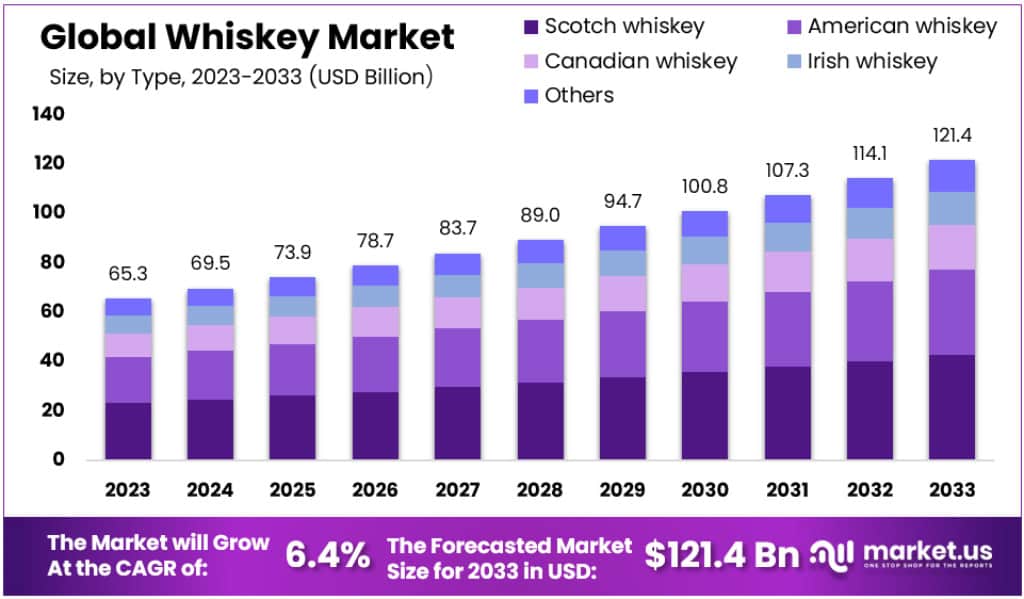

The Global Whiskey Market size is expected to be worth around USD 121.4 Billion by 2033, from USD 65.3 Billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

Whiskey, also spelled whisky, is a distilled spirit made from fermented grain mash. It is typically aged in wooden casks, usually made of oak, which gives it its characteristic color and flavor. The types of grains used and the aging process can vary, resulting in different varieties such as bourbon, Scotch, rye, and Irish whiskey.

The whiskey market is experiencing a robust growth period, primarily driven by factors such as rising disposable incomes, evolving lifestyles, and shifting consumer preferences. Notably, millennials are emerging as pivotal consumers due to their significant spending power. Whiskey, crafted from farm-grown grains and enriched with whole spices, herbs, and grains, appeals to this demographic’s desire for quality and taste.

Key Takeaways

- The Global Whiskey Market is expected to reach approximately USD 121.4 billion by 2033, compared to USD 65.3 billion in 2023.

- This growth is projected to occur at a compound annual growth rate (CAGR) of 6.4% during the period from 2023 to 2033.

- Scotch whiskey dominated the market in 2023, with a 35.2% share.

- Wheat whiskey held a dominant market position in 2023, with a 48.6% share.

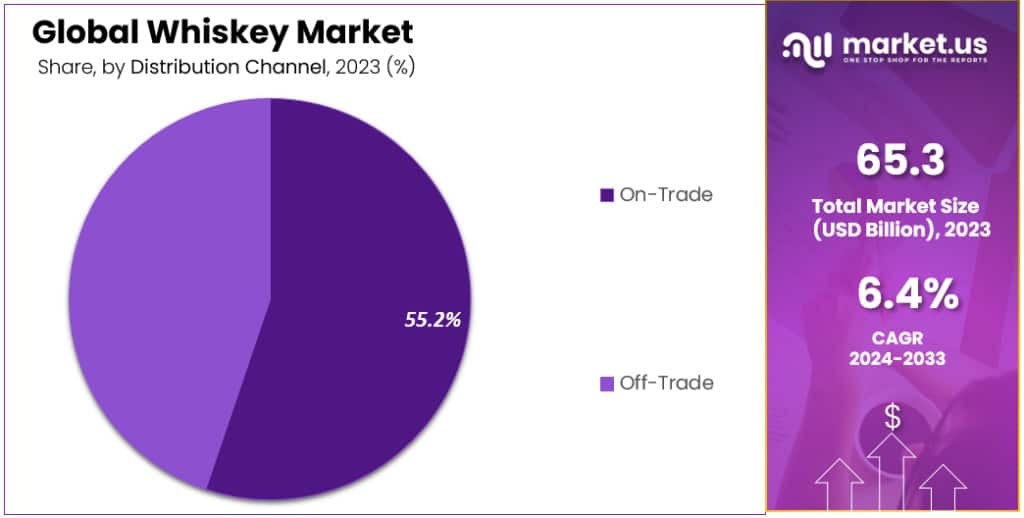

- On-Trade distribution channels held a dominant market position in 2023, with 55.2% share, followed by Off-Trade channels, particularly supermarkets and hypermarkets.

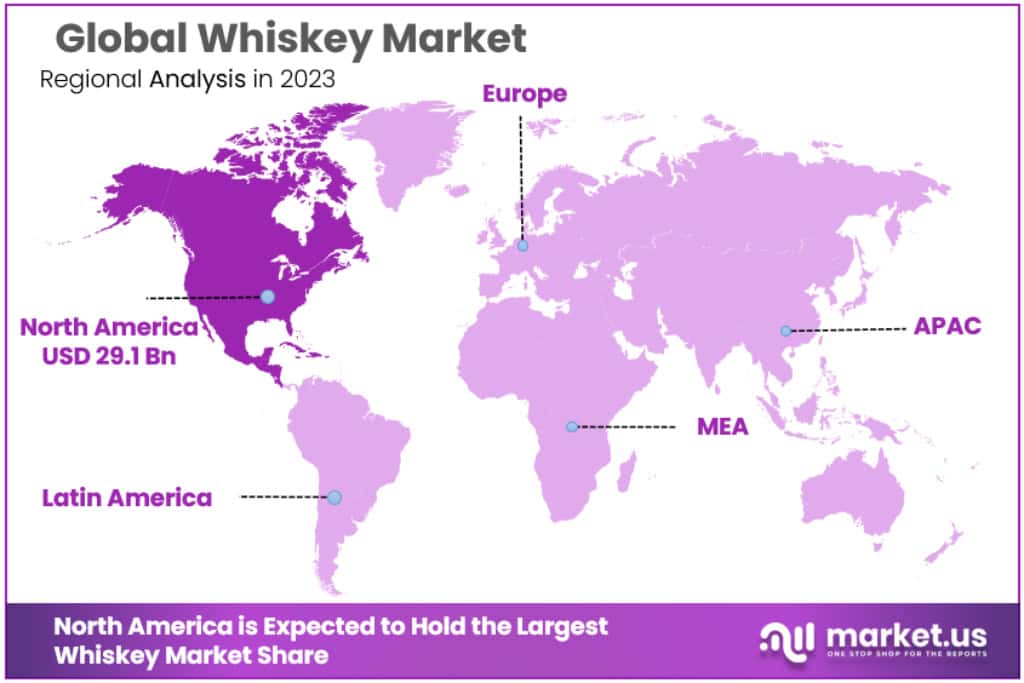

- North America is dominating Whiskey Market with 36.1% share, with USD 9.1 Billion in 2023.

According to studies, the market is seeing a surge in demand for blended whiskey globally, with a notable consumer base expansion. Developed countries like the U.K., France, the U.S., and Canada are particularly witnessing a rise in the demand for super-premium drinks. This trend is fueled by factors including innovation, premiumization, modernized alcohol laws, the burgeoning cocktail culture, and a growing interest in craft products.

Europe stands out as a major market, especially driven by a strong preference for premium products in the U.K., France, and Spain. North America follows closely, with the U.S. being a significant contributor to market growth. Meanwhile, regions like Asia Pacific, Central & South America, and the Middle East and Africa are gaining momentum, promising substantial market expansion opportunities.

However, the industry’s growth is not without challenges. Government regulations and taxation policies, especially stringent in the U.S., pose hurdles to market expansion. Yet, emerging markets such as India, Brazil, and China present untapped opportunities, with increasing consumer awareness expected to fuel further growth.

The global palate is becoming more sophisticated, with a growing inclination towards high-quality, natural ingredient alcoholic beverages. This shift in consumer lifestyle and preferences is a driving force behind the expanding whiskey market. The COVID-19 pandemic did bring setbacks, as seen with companies like Pernod Ricard experiencing profit declines due to reduced sales channels. However, the market is on a recovery path, with a resurgence in alcoholic beverage consumption noted post-pandemic.

According to the American Addiction Centers, over 445 billion liters of alcohol are consumed worldwide annually, indicating a rising trend in alcohol consumption, particularly in urban areas with growing middle-class populations. This, coupled with supportive government initiatives for food & beverage production, is set to further boost the whiskey market. As consumers continue to seek quality and unique experiences, the whiskey market is poised for continued growth and evolution.

Type Analysis

In 2023, Scotch whiskey held a dominant market position, capturing more than a significant 35.2% share. Renowned for its rich heritage and stringent production standards, Scotch whiskey has a loyal consumer base that values its distinctive taste and quality. The market’s robust growth can be attributed to increasing global appreciation for premium spirits and a strong demand for age-labeled single malts.

Following closely, American whiskey emerged as a substantial segment, leveraging its versatility and wide range of flavors. The surge in craft distilleries and innovative aging techniques has propelled its popularity, especially among younger consumers seeking unique and authentic experiences. The growth in exports and a rising trend of cocktail culture have further fueled its market expansion.

Canadian whiskey, known for its smoothness and mixability, also commands a notable share. It benefits from a perception of being an accessible and affordable option without compromising on quality. The segment has seen a revival with premiumization strategies and the introduction of small-batch and high-end variants.

Irish whiskey, with its triple-distilled smoothness, has been the fastest-growing segment. The category’s revival is driven by an increase in distilleries, a booming tourism sector, and widespread global distribution. Its approachable flavor profile continues to attract new enthusiasts, significantly contributing to its escalating market presence.

The ‘Others’ category includes diverse whiskey types from around the world, each bringing unique flavors and traditions. This segment caters to a niche but growing audience keen on exploring different whiskey styles. As consumers become more adventurous and knowledgeable, these alternative whiskeys are poised for growth, highlighting the global whiskey market’s dynamic and evolving nature.

Product Analysis

Wheat whiskey held a dominant market position, capturing more than a significant 48.6% share, in 2023. Predominantly produced in the U.S., wheat whiskey requires a minimum of 51% wheat in its composition, giving it a distinctive light and gently sweet profile. Its spice factor varies based on the secondary grains used, but typically, it remains subtly flavored. Notable examples include Bernheim Original Wheat, A.D. Laws Triticum Straight Wheat Whiskey, and Dry Fly Straight Washington Wheat Whiskey. The segment’s growth is bolstered by its increasing popularity in cocktails, driving a substantial market expansion.

Malt whiskey, particularly favored in regions like China, Taiwan, and South Korea, is witnessing notable growth. The uniqueness of whiskey festivals and clubs, along with a rising presence in specialized venues, is enhancing its appeal. Additionally, the growing preference for single-malt scotch in the Asia Pacific is significantly contributing to the market’s upward trajectory.

Rye whiskey, known for its spicy and fruity notes, is making a strong comeback, especially in the North American market. Its bold flavor profile resonates well with consumers seeking a robust whiskey experience. The growing interest in classic cocktails, where rye is a key ingredient, is further propelling its market share.

Corn whiskey, traditionally popular in the U.S., is characterized by its high corn content and smooth, sweet taste. This segment benefits from the historical and cultural significance of corn in American whiskey production. Its approachability and versatility in various drink mixes keep it a steady choice among consumers.

Blended whiskey, a mix of different types of whiskeys and sometimes grain alcohol, offers a wide range of flavors and price points. This diversity makes it accessible and appealing to a broad audience, contributing to its steady market presence. The innovation in blending techniques and the introduction of premium blends are enhancing its profile and market reach.

The ‘Others’ category includes various niche whiskeys that cater to specific tastes and preferences. This segment might be smaller, but it’s growing, driven by consumers’ curiosity and the desire to explore different whiskey styles from around the world.

Distribution Channel Analysis

In 2023, On-Trade distribution channels held a dominant market position in the whiskey market, capturing more than a significant 55.2% share. This channel, comprising restaurants, bars, and liquor stores, serves as a primary avenue for consumers to enjoy whiskey in engaging and social settings. These establishments not only offer a vast selection of whiskey brands but also provide a platform for patrons to explore various whiskey expressions. The expertise of bartenders and the ambiance of these venues significantly enhance the drinking experience, thereby attracting a steady flow of customers and driving sales within this segment.

Despite the prominence of On-Trade, Off-Trade distribution currently represents the largest channel. This includes supermarkets, hypermarkets, discount stores, online stores, and more. Off-Trade accounted for the most considerable market share due to its widespread availability and convenience. Consumers favor Off-Trade for the ease of purchasing whiskey for home consumption or gifting. The ability to compare prices, read reviews, and enjoy doorstep delivery further boosts the attractiveness of this channel.

Supermarkets and hypermarkets, under the Off-Trade umbrella, are particularly significant due to their vast reach and the variety of whiskey brands they stock. These outlets cater to a wide consumer base, offering everything from budget-friendly options to premium selections. Discount stores, appealing to price-sensitive consumers, also contribute to the segment’s growth by providing affordable whiskey choices.

Online stores are revolutionizing how consumers buy whiskey, offering a hassle-free shopping experience with the added advantage of a broader selection. Consumers can easily browse and purchase from a global selection of whiskey brands, benefiting from competitive pricing and detailed product information.

Liquor stores, an essential part of both On-Trade and Off-Trade channels, offer a curated selection of mainstream and niche whiskey brands. Knowledgeable staff in these stores play a crucial role in guiding consumers, helping them make informed choices based on their taste preferences and budget, thereby enhancing the customer experience and fostering market growth.

Маrkеt Ѕеgmеntѕ

By Type

- Scotch whiskey

- American whiskey

- Canadian whiskey

- Irish whiskey

- Others

By Product

- Malt

- Wheat

- Rye

- Corn

- Blended

- Others

By Distribution Channel

- On-Trade

- Off-Trade

Drivers

- Escalating Demand: There’s a rising demand for whiskey, especially among individuals who appreciate the craftsmanship and heritage of whiskey production. This is largely driven by increasing disposable incomes and a growing socializing culture. According to a study, the appreciation for premium and aged whiskeys has surged, with consumers willing to invest in unique experiences.

- Extensive Promotional Activities: Manufacturers are boosting market visibility through advertising campaigns, event sponsorships, and digital marketing strategies. These initiatives are crucial in educating consumers and sparking interest in various whiskey offerings. The expansion of online retailing portals, offering a vast selection of whiskeys with the convenience of doorstep delivery, has also significantly contributed to market growth.

- Innovative Product Variants: The introduction of flavored whiskeys and organic options caters to a diverse range of consumer tastes and preferences. Whiskey producers are also experimenting with different cask finishes, imparting unique flavors and expanding the market. For instance, the demand for flavored whiskey is expected to rise, especially in developing regions, at a CAGR of ~15.5%.

Restraints

- Regulatory Challenges: The whiskey industry faces stringent government regulations and taxation policies, particularly in countries like the U.S. These can act as significant hurdles to market growth, affecting production, distribution, and overall sales.

Opportunities

- Emerging Markets: Countries like India, China, and Brazil present untapped opportunities for market expansion. With a growing middle-class population and increasing consumer awareness, these markets are ripe for growth. India’s alcoholic beverage trade, for instance, is expected to grow at a strong CAGR of ~14.6% between 2023 and 2033.

- Non-alcoholic and Health-conscious Trends: There’s a rising focus on wellness and health, driving sales of non-alcoholic whiskey variants. The global market for drinks with health benefits is expected to grow rapidly at a CAGR of ~15%, presenting significant opportunities for companies supplying non-alcoholic whiskey.

Challenges

- Pandemic Impact: The COVID-19 pandemic had a considerable impact on the whiskey market, with closures of hotels, restaurants, and bars leading to a decline in sales. However, the market is on a path to recovery, adapting to the new normal and consumer behaviors.

Trends

- Brand Ownership and Premiumization: Consumers are showing a preference for brand ownership and premium products. Top brands offering organic whiskey are gaining traction. For example, Bainbridge Organic Distillers have seen a positive response to their artisan-distilled spirits made from USDA-certified organic grains.

- Online Retail Growth: The convenience of purchasing whiskey from home has changed market dynamics significantly. Online sales channels are expected to grow at a CAGR of ~16%, as consumers enjoy the benefits of a wide selection, detailed product information, and home delivery.

- Flavored Whiskey Appeal: Younger generations are particularly drawn to flavored whiskey, driving market demand. The segment is anticipated to grow substantially, with a distinct taste profile catering to a diverse consumer base.

Regional Analysis

In 2023, North America leads the whiskey market with a commanding 44.6% share, translating to a robust USD 29.1 billion. This dominance is significantly fueled by the U.S. market, which is predicted to secure about ~36% of the global market share by 2023. The Distilled Spirits Council notes a ~5.5% volume increase in U.S. spirit sales in 2021, driven by a strong demand for super-premium American whiskey, including categories like Scotch, Bourbon, Irish, and Canadian, all experiencing double-digit growth.

The U.S. market’s appetite for high-end whiskey is evident with Single Malt Scotch and Irish whiskey revenues soaring to USD ~735 million and USD ~665 million, respectively, marking significant annual increases. This trend is expected to continue bolstering the regional market.

Turning to India, the market is diverse, offering whiskeys across various price points. Economy whiskies dominate, accounting for almost ~69% of total volume, despite the growing popularity of prestige and premium categories. With a unique 42.8% ABV content in Indian whiskies, the market is set to grow at a CAGR of approximately ~5.5% from 2023 to 2033.

In South Korea, the whiskey market is also expanding, marked by a high consumption rate and significant imports. South Koreans are the world’s leading Scotch whiskey consumers, with imports growing annually. The country has seen a ~17.5% increase in whiskey value and a ~24% rise in quantity from 2017 to 2021. The development of a domestic whiskey brand could further boost South Korea’s market, enhancing its global presence.

In the startup scene, innovations like Bespoken Spirits’ accelerated aging process, which has attracted USD ~2.5 million in seed funding, are set to revolutionize the industry with cost-effective and environmentally friendly production methods. Similarly, Ginglani Distillers’ expansion plans signify the growing entrepreneurial spirit and market potential within the whiskey sector.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Major whiskey manufacturers are adopting several key strategies to stay ahead in the market. They are expanding their product portfolios, entering into joint ventures, increasing their production capacities, and engaging in mergers and acquisitions. Additionally, they’re focusing on brand promotion to enhance their customer base. These companies are also emphasizing the use of local grains and spices to give their products a unique taste and flavor.

For instance, La Martiniquaise-Bardinet collaborated with Scotland’s Thistly Cross in October 2018 to create an exclusive single-malt portfolio for the U.K. market. Key players in this field include well-known names like Bacardi Limited, Pernod Ricard, Brown-Forman, Diageo, and Suntory Holdings Ltd.

In the U.S., the whiskey market is thriving due to a trend towards premiumization and an increasing consumer interest in innovative and high-end brands. Over the past five years, a shift towards premium products and super-premium brands has significantly driven market growth. Additionally, a notable portion of Canadians, about 15.6% as per Statistics Canada, are heavy alcohol drinkers, indicating a solid market for whiskey in North America.

Companies are also leveraging technology to enhance customer experience. Diageo, for instance, launched an AI-based whisky selector to help customers choose single malt scotches tailored to their taste. Aston Martin Lagonda partnered with Bowmore Islay Single Malt Scotch Whisky to offer exclusive products and experiences. Whyte & Mackay introduced a new bottle with triple matured and smooth whiskey, while Bacardi expanded its brands with Dewar’s, King Edward, and several others, also adding a bottle library to educate its customers. William Grant & Sons have expanded their production facilities globally, aiming to provide the best quality drinks. Chivas Brothers, too, have broadened their brand portfolio with names like Ballantine’s and The Glenlivet, penetrating the market with strategic international brands.

Market Key Players

- Asahi Group Holdings Ltd. (Asahi Breweries)

- Diageo Plc

- Kirin Holdings Company, Limited

- Pernod Ricard SA

- Constellation Brands Inc. (High West Distillery)

- Bacardi Ltd

- Brown–Forman Corporation

- Beam Suntory Inc.

- Sazerac Company Inc.

- Radico Khaitan Ltd.

- Tilaknagar Industries Ltd.

- John Distilleries Private Limited

- Alexandrion Group

- Highwood Distillers

- Shiva Distilleries Private Limited

- Boone County Distilling Company Llc

- Willett Distilling

- Michter’s Distillery

- Barrel House Distilling Co

- Heaven Hill Distilleries Inc.

- Alltech Inc. (Lexington Brewing and Distilling Co.)

- Gruppo Campari

- Suntory Holdings Limited

- Heaven Hill Brands

- William Grant & Sons Ltd.

- Rémy Cointreau SA

- The Edrington Group Limited

- Other Key Players

Recent Developments

Acquisitions:

- October 2023: Suntory Holdings Ltd. acquires Beam Suntory Inc. for $16 billion, creating the world’s third-largest spirits company. This deal strengthens Suntory’s presence in the American whiskey market, particularly with brands like Jim Beam and Maker’s Mark.

- November 2023: Diageo Plc. acquires High West Distillery for an undisclosed amount. This acquisition expands Diageo’s portfolio of American craft whiskeys and gives them access to High West’s popular Rendezvous Rye and Campfire whiskeys.

New Trends:

- Rise of “hyper-local” whiskeys: Consumers are increasingly interested in whiskeys made with local grains and water, reflecting a desire for authenticity and provenance. This trend is particularly strong in emerging whiskey markets like India and Japan.

- Focus on sustainability: Distilleries are increasingly adopting sustainable practices, such as using recycled water and locally sourced ingredients. This trend is driven by consumer demand for environmentally conscious products, as well as rising costs of water and energy.

- Experimentation with flavor: Distillers are pushing the boundaries of flavor by using unique casks, grains, and finishing techniques. This is leading to a wider variety of whiskeys on the market, appealing to adventurous palates.

Company News:

- Brown-Forman Corporation announces plans to invest $100 million in its Kentucky and Tennessee distilleries over the next five years. This investment will expand production capacity and create new jobs.

- Pernod Ricard SA launches “The Glenlivet Cipher”, a limited-edition single malt Scotch whisky finished in casks previously used for Armagnac. This innovative release highlights the growing trend of cask experimentation in the whiskey industry.

- Heaven Hill Brands celebrates its 110th anniversary with the release of a special edition Elijah Craig Small Batch Barrel Proof Reserve. This limited-edition whiskey is a testament to the company’s long history and commitment to quality.

Report Scope

Report Features Description Market Value (2023) USD 65.3 Billion Forecast Revenue (2033) USD 121.4 Billion CAGR (2023-2032) 6.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Scotch whiskey, American whiskey, Canadian whiskey, Irish whiskey and Others) By Product (Malt, Wheat, Rye, Corn, Blended and Others) By Distribution Channel (On-Trade and Off-Trade) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Asahi Group Holdings Ltd. (Asahi Breweries), Diageo Plc, Kirin Holdings Company, Limited, Pernod Ricard SA, Constellation Brands Inc. (High West Distillery), Bacardi Ltd, Brown–Forman Corporation, Beam Suntory Inc., Sazerac Company Inc., Radico Khaitan Ltd., Tilaknagar Industries Ltd., John Distilleries Private Limited, Alexandrion Group, Highwood Distillers, Shiva Distilleries Private Limited, Boone County Distilling Company Llc, Willett Distilling, Michter’s Distillery, Barrel House Distilling Co, Heaven Hill Distilleries Inc., Alltech Inc. (Lexington Brewing and Distilling Co.), Gruppo Campari, Suntory Holdings Limited, Heaven Hill Brands, William Grant & Sons Ltd., Rémy Cointreau SA, The Edrington Group Limited. and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asahi Group Holdings Ltd. (Asahi Breweries)

- Diageo Plc

- Kirin Holdings Company, Limited

- Pernod Ricard SA

- Constellation Brands Inc. (High West Distillery)

- Bacardi Ltd

- Brown–Forman Corporation

- Beam Suntory Inc.

- Sazerac Company Inc.

- Radico Khaitan Ltd.

- Tilaknagar Industries Ltd.

- John Distilleries Private Limited

- Alexandrion Group

- Highwood Distillers

- Shiva Distilleries Private Limited

- Boone County Distilling Company Llc

- Willett Distilling

- Michter's Distillery

- Barrel House Distilling Co

- Heaven Hill Distilleries Inc.

- Alltech Inc. (Lexington Brewing and Distilling Co.)

- Gruppo Campari

- Suntory Holdings Limited

- Heaven Hill Brands

- William Grant & Sons Ltd.

- Rémy Cointreau SA

- The Edrington Group Limited

- Other Key Players