Global Welding Equipment Market Report By Automation Type (Automatic, Semi-Automatic, Manual), By Technology (Arc Welding, Laser Beam Welding, Resistance Welding, Oxy-Fuel Welding, Other Technologies), By End-Use Industry (Building and Construction, Automotive, Oil & Gas, Energy, Aerospace, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 18489

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

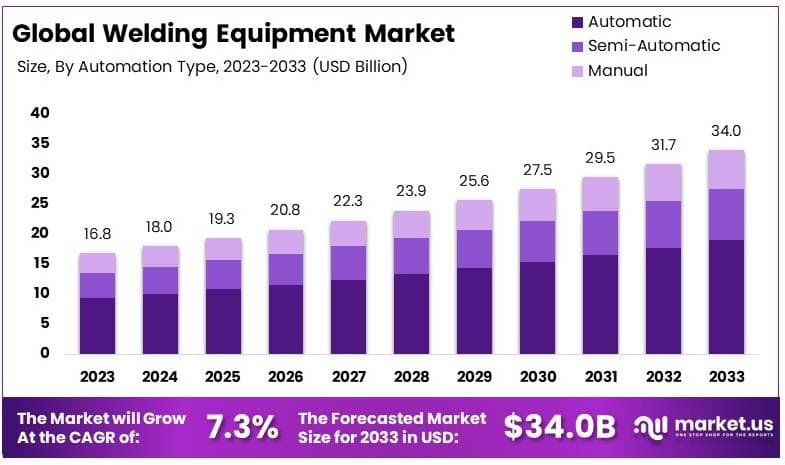

The Global Welding Equipment Market size is expected to be worth around USD 34.0 Billion by 2033, from USD 16.8 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

Welding equipment refers to tools and machines used to join metals or thermoplastics together. These machines use heat, pressure, or both to create strong bonds between materials. Welding equipment includes items like welding machines, torches, electrodes, and accessories.

The welding equipment market consists of the global industry involved in manufacturing and selling tools, machines, and accessories used in welding processes. It includes products for various industries like construction, automotive, and manufacturing. This market is driven by industrial growth, infrastructure projects, and increasing demand for efficient welding solutions in various sectors.

The growth of the welding equipment market is largely driven by expanding construction and manufacturing sectors. With industrial development in emerging economies, the demand for efficient welding technologies has increased. Additionally, innovations such as automation and advanced welding techniques have contributed to market growth.

Automation in manufacturing also presents significant opportunities for the welding industry. As of 2024, 82% of manufacturers report productivity gains from automation, and 73% expect improvements in supply chain transparency due to automated processes.

The demand for welding equipment is rising, particularly in industries like automotive, construction, and aerospace. Companies in these sectors require reliable, durable welding tools to support production and infrastructure projects.

Federal initiatives such as the CHIPS Act, which injected $52 billion into manufacturing construction, and the Infrastructure Investment and Jobs Act (IIJA), which allocated $58.8 million to infrastructure projects, are key drivers of this growth.

There is substantial opportunity in the adoption of automated and robotic sensors, which improve precision and efficiency in industrial processes. Additionally, the growing trend towards sustainable welding practices offers potential for companies producing eco-friendly equipment.

Government investment in infrastructure and industrial development is a key factor driving the welding equipment market. Regulations around workplace safety and energy efficiency are also shaping the development of new welding technologies. Governments may also support the adoption of advanced welding techniques, such as automated systems, to enhance productivity and safety in manufacturing and construction industries.

In the U.S., total construction spending reached $1.98 trillion by August 2023, reflecting a 7.4% increase compared to the previous year. This growth was particularly strong in non-residential construction, which saw a 17.6% rise year-over-year.

The construction of energy-efficient and sustainable buildings is also gaining momentum. Green buildings, which can reduce operational costs by up to 10% annually, are becoming more prevalent, creating additional demand for welding equipment that meets these sustainability goals.

Key Takeaways

- Welding Equipment Market was valued at USD 16.8 Billion in 2023, and is expected to reach USD 34.0 Billion by 2033, with a CAGR of 7.3%.

- In 2023, Automatic welding machines dominate with 55.8%, driven by demand for precision and efficiency in industrial applications.

- In 2023, Arc welding leads with 69.4%, reflecting its widespread use in multiple industries.

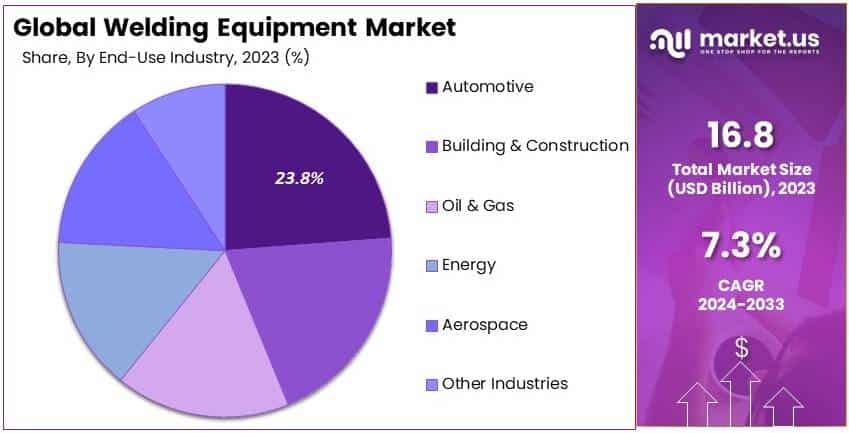

- In 2023, Automotive industry holds 23.8%, highlighting its reliance on welding technology for manufacturing processes.

- In 2023, Asia Pacific dominates with 35.6% market share, due to industrial growth in key countries like China and India.

Automation Type Analysis

Automatic Welding Machines dominate with 55.8% due to efficiency and precision in operations.

In the Welding Equipment Market, automatic welding machines have emerged as the dominant sub-segment, holding a significant 55.8% market share. This dominance is primarily due to the efficiency and precision these machines bring to welding operations. Automatic welding technology enhances productivity by speeding up the welding process and reducing the margin for error, which is critical in high-volume manufacturing environments.

The growing adoption of automatic welding machines is closely linked to the increasing automation across various industries, including automotive and aerospace, where consistent quality and precision are paramount. These machines also reduce labor costs and improve safety by minimizing human involvement in potentially hazardous welding operations.

While automatic welding machines lead the market, semi-automatic and manual welding equipment still play vital roles. Semi-automatic machines offer a balance between welding controllers and automation, suitable for applications requiring frequent adjustments during the welding process.

Manual welding equipment is indispensable in situations where intricate, customized welding is needed or in environments where automation is not feasible.

The future growth of the welding equipment market depends on technological advancements in automation and the increasing integration of artificial intelligence and machine learning, which could enhance the capabilities of automatic welding systems even further.

Technology Analysis

Arc Welding dominates with 69.4% due to its versatility and cost-effectiveness.

Arc welding holds the largest share in the Welding Equipment Market by technology, accounting for 69.4%. This predominance is attributed to the technology’s versatility and cost-effectiveness, making it suitable for a wide range of materials and applications.

Arc welding is renowned for its ability to quickly produce strong welds in industrial settings, contributing to its widespread use in heavy manufacturing, construction, and automotive industries.

The dominance of arc welding is supported by its continuous evolution, including developments in both equipment and consumables that enhance the quality, efficiency, and safety of the welding process. Innovations such as flux-cored wires and advanced power sources have further broadened the applications of arc welding, making it more efficient and adaptable to different environmental conditions.

Other welding technologies, such as laser beam welding, resistance welding, and oxy-fuel welding, also contribute to the market, each serving specific niche applications. Laser beam welding offers high precision and speed, ideal for industries where these factors are critical, such as in medical device manufacturing or aerospace.

Resistance welding is favored in mass production settings like automotive manufacturing, where consistency and throughput are key. Oxy-fuel welding remains relevant in repair work and industries where portability is necessary.

End-Use Industry Analysis

Automotive dominates with 23.8% due to continuous production demands and technological advancements.

The automotive industry is the largest end-user of welding equipment, accounting for 23.8% of the market. This sector’s dominance is driven by its substantial requirements for durable and reliable welding to assemble vehicles. Welding technologies are critical in automotive manufacturing due to the need for strong, consistent welds that can withstand the rigors of vehicle operation.

The reliance on welding equipment in the automotive industry is compounded by the continuous evolution in vehicle design and materials, which necessitates adaptable and advanced welding solutions. As automotive manufacturers increasingly turn to lighter and stronger materials to improve fuel efficiency and performance, welding technologies must evolve to handle these new materials without compromising on quality.

While the automotive industry leads, other sectors such as building and construction, oil & gas, energy, and aerospace also significantly utilize welding equipment. Each of these industries has unique requirements that influence welding practices, from thick, heavy materials in construction and oil & gas to highly specialized alloys in aerospace.

The ongoing development in welding technologies and the integration of digital and automated solutions across these industries are pivotal for meeting the growing and changing demands of the market. As end-use industries continue to advance, the welding equipment market is expected to see sustained growth and innovation, driven by the need for more efficient, precise, and versatile welding solutions.

Key Market Segments

By Automation Type

- Automatic

- Semi-Automatic

- Manual

By Technology

- Arc Welding

- Laser Beam Welding

- Resistance Welding

- Oxy-Fuel Welding

- Other Technologies

By End-Use Industry

- Building and Construction

- Automotive

- Oil & Gas

- Energy

- Aerospace

- Other End-Use Industries

Driver

Growing Construction and Automotive Sectors Drives Market Growth

The Welding Equipment Market is significantly driven by the growth of the construction and automotive sectors. As infrastructure development accelerates globally, the demand for welding equipment in building and construction projects rises, driving market expansion.

Additionally, the automotive industry’s need for advanced welding technologies to enhance vehicle production efficiency contributes to the increasing demand for welding solutions.

The rising adoption of automation in manufacturing further fuels market growth. Automated welding systems improve precision and productivity, making them highly sought after in industries like aerospace and shipbuilding. Moreover, the growing focus on energy infrastructure, such as pipeline monitoring systems and renewable energy installations, requires advanced welding equipment, boosting demand.

These driving factors work in synergy to expand the welding equipment market by catering to critical industrial needs, fostering innovation, and enabling large-scale production across sectors.

Restraint

High Equipment Cost and Lack of Skilled Workforce Restraints Market Growth

The Welding Equipment Market faces several restraints, including the high cost of advanced welding equipment, which limits its adoption among small and medium-sized enterprises (SMEs). Many businesses may find the initial investment in automated welding systems and specialized machinery prohibitive, slowing market penetration.

Additionally, the lack of a skilled workforce to operate modern welding equipment poses a significant challenge. The gap in technical expertise hinders the efficient utilization of advanced welding technologies, restricting market growth. Furthermore, the high maintenance costs associated with sophisticated welding systems add to operational expenses, creating additional barriers.

Strict safety regulations and environmental standards also constrain market growth, as companies must invest in costly compliance measures. These restraining factors collectively impede the market’s full potential by creating financial and operational hurdles for businesses.

Opportunity

Technological Advancements Provides Opportunities

The Welding Equipment Market holds substantial growth opportunities due to ongoing technological advancements. The development of innovative welding techniques, such as laser and ultrasonic welding, offers more precise and efficient solutions, enabling companies to meet the evolving needs of various industries.

Additionally, the integration of the Internet of Things (IoT) in welding equipment provides opportunities for real-time monitoring and predictive maintenance, improving operational efficiency and reducing downtime. The growing demand for lightweight materials in automotive and aerospace applications also opens new avenues for welding technology that supports such innovations.

Emerging markets, particularly in Asia-Pacific and Latin America, present significant opportunities for market expansion. The rapid industrialization and infrastructural development in these regions increase the demand for welding equipment. Companies that capitalize on these opportunities can broaden their global footprint and enhance their product offerings.

Challenge

Complex Technological Integration Challenges Market Growth

The Welding Equipment Market faces several challenges, one of which is the complex integration of new technologies into traditional welding systems. Many companies struggle to incorporate automation and digital solutions into their existing manufacturing processes, causing delays and inefficiencies.

Another challenge is the high cost of research and development (R&D) required to develop advanced welding technologies. Smaller companies may find it difficult to keep pace with technological innovation due to limited budgets. Moreover, the volatility in raw material prices, such as steel and aluminum, adds uncertainty to the market, making it challenging for manufacturers to maintain stable production costs.

Regulatory compliance in different regions also presents a challenge, as companies must navigate varying safety and environmental standards. These challenges slow down market growth by complicating operations and increasing production costs.

Growth Factors

Increased Industrialization and Infrastructure Development Are Growth Factors

The Welding Equipment Market benefits from the growth factor of increased industrialization and infrastructure development. Rapid urbanization and industrial expansion, particularly in emerging markets, are driving the need for advanced welding equipment in sectors like construction, automotive, and energy.

The rise of renewable energy projects, such as wind and solar installations, is another critical growth factor, as these projects require specialized welding equipment for assembly and maintenance. Furthermore, the adoption of lightweight materials in manufacturing demands new welding techniques, pushing the development of innovative welding solutions.

The globalization of supply chains also fosters growth in the welding equipment market, as multinational companies seek consistent, high-quality welding solutions across their operations. These growth factors contribute to the ongoing expansion of the market by addressing key industrial and technological demands.

Emerging Trends

Automation and Smart Welding Systems Are Latest Trending Factor

Automation and smart welding systems are the latest trending factors in the Welding Equipment Market. The adoption of robotic welding solutions is gaining momentum as companies seek to improve production efficiency and accuracy while reducing labor costs.

The rise of smart welding systems that incorporate AI and IoT technologies further enhances the market. These systems offer real-time data analytics, enabling predictive maintenance and process optimization. This trend aligns with the broader industrial shift toward smart manufacturing and Industry 4.0.

Another trending factor is the increasing demand for eco-friendly welding solutions. Companies are investing in technologies that reduce energy consumption and emissions, contributing to sustainability goals. These trending factors reflect the market’s adaptation to modern industrial needs and technological advancements.

Regional Analysis

Asia-Pacific Dominates with 35.6% Market Share

Asia-Pacific holds a dominant 35.6% share and was valued at USD 5.98 Bn in the global Welding Equipment Market. This dominance is driven by rapid industrialization and major infrastructure projects in countries like China, India, and Japan. The region’s large manufacturing sector, especially in automotive, construction, and shipbuilding, fuels strong demand for welding equipment.

Key factors contributing to this high market share include the region’s focus on industrial development and modernization. Governments in Asia-Pacific are investing heavily in infrastructure, driving up the need for advanced welding solutions. Additionally, the region benefits from low production costs and a skilled workforce, making it a global hub for manufacturing and welding equipment production.

Market dynamics in Asia-Pacific are influenced by the region’s growing industrial base and increasing automation. The high demand for welding in key sectors such as automotive manufacturing, heavy machinery, and energy projects ensures a steady market growth. Local manufacturers are also innovating to meet the region’s specific needs, offering cost-effective solutions and advanced welding technologies.

Regional Mentions:

- North America: North America’s welding equipment market is driven by the aerospace, automotive, and construction industries. High demand for precision welding and advanced technologies ensures steady market growth.

- Europe: Europe’s market is focused on innovation and automation, with demand driven by advanced manufacturing industries. The region prioritizes sustainable and efficient welding solutions, which support its industrial goals.

- Middle East & Africa: The Middle East & Africa region shows growing demand for welding equipment due to increasing construction and infrastructure projects. The oil and gas industry also contributes to the market’s expansion.

- Latin America: Latin America’s welding equipment market is gradually growing, supported by industrial development in Brazil and Mexico. The demand is mainly driven by construction, automotive, and energy sectors.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Welding Equipment Market, Lincoln Electric, AIR LIQUIDE, and Illinois Tool Works Inc. are leading companies that have significantly influenced the industry with their innovation and global reach. These companies play a critical role in driving market growth, maintaining competitive positioning through advanced technologies, and expanding their customer base across various sectors.

Lincoln Electric is recognized as a global leader in welding equipment and technology solutions. Its strong focus on research and development allows it to introduce cutting-edge products, including automation and robotic welding systems. Lincoln Electric‘s expansive distribution network and commitment to sustainability ensure it remains a dominant force in the market, catering to industries such as automotive, construction, and heavy machinery.

AIR LIQUIDE is another key player that has strategically positioned itself through its gas-based welding solutions and strong global presence. Its focus on offering high-performance welding gases and services to a wide range of industries has helped the company maintain a competitive edge. AIR LIQUIDE continues to expand its market share by leveraging its expertise in gas technologies, particularly in energy, manufacturing, and healthcare sectors.

Illinois Tool Works Inc. (ITW) holds a strong position in the welding equipment market, offering an extensive portfolio of welding products under brands like Miller Electric. ITW‘s ability to innovate and adapt to market needs has allowed it to cater to a broad customer base, from small businesses to large industrial clients. Its focus on providing high-efficiency and user-friendly welding solutions has further solidified its position as a market leader.

These three companies dominate the global welding equipment market by leveraging innovation, a strong international presence, and a commitment to meeting the needs of diverse industries. Their market influence and technological advancements continue to drive the industry’s growth.

Top Key Players in the Market

- ACRO Automation Systems Inc.

- Lincoln Electric

- AIR LIQUIDE

- voestalpine Böhler Welding Group GmbH

- Carl Cloos Schweisstechnik GmbH

- OTC DAIHEN Inc.

- Panasonic Industry Co. Ltd.

- Polysoude S.A.S.

- Coherent Inc.

- Illinois Tool Works Inc.

- Other Key Players

Recent Developments

- UK Battery Manufacturer: 2024 – A UK-based battery manufacturer acquired an advanced laser welding machine to enhance its production capabilities. This acquisition is expected to increase the precision and efficiency of battery assembly, crucial for applications in electric vehicles and renewable energy systems.

- Burnsview Secondary School: June 2024 – Burnsview Secondary School in North Delta received a $3,500 grant from the CWB Welding Foundation to support its welding education program. The funds will be used to purchase a TIG welder, offering students hands-on experience with industry-standard equipment and materials.

- ESAB Corporation: 2024 – ESAB Corporation, a global leader in welding and cutting technologies, announced its acquisition of the welding business of Linde Bangladesh. This strategic move will allow ESAB to expand its market presence in the region and enhance its portfolio of welding products and services.

- Innovative Technology Developer: December 2023 – An innovative development transformed traditional welding machines into electric vehicle (EV) chargers. By repurposing welding equipment, this new technology aims to make EV charging more accessible and affordable, particularly in regions with limited infrastructure.

Report Scope

Report Features Description Market Value (2023) USD 16.8 Billion Forecast Revenue (2033) USD 34.0 Billion CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Automation Type (Automatic, Semi-Automatic, Manual), By Technology (Arc Welding, Laser Beam Welding, Resistance Welding, Oxy-Fuel Welding, Other Technologies), By End-Use Industry (Building and Construction, Automotive, Oil & Gas, Energy, Aerospace, Other End-Use Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ACRO Automation Systems Inc, Lincoln Electric, AIR LIQUIDE, voestalpine Böhler Welding Group GmbH, Carl Cloos Schweisstechnik GmbH, OTC DAIHEN Inc., Panasonic Industry Co. Ltd., Polysoude S.A.S., Coherent Inc., Illinois Tool Works Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Welding Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Welding Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ACRO Automation Systems Inc

- Lincoln Electric

- AIR LIQUIDE

- voestalpine Böhler Welding Group GmbH

- Carl Cloos Schweisstechnik GmbH

- OTC DAIHEN Inc.

- Panasonic Industry Co. Ltd.

- Polysoude S.A.S.

- Coherent Inc.

- Illinois Tool Works Inc.