Global Welding Controllers Market By Product Type(Spot Welding, Seam Welding), By End-Use(Heavy Machinery, Electronics and Semiconductors, Aerospace and Defense, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 51641

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

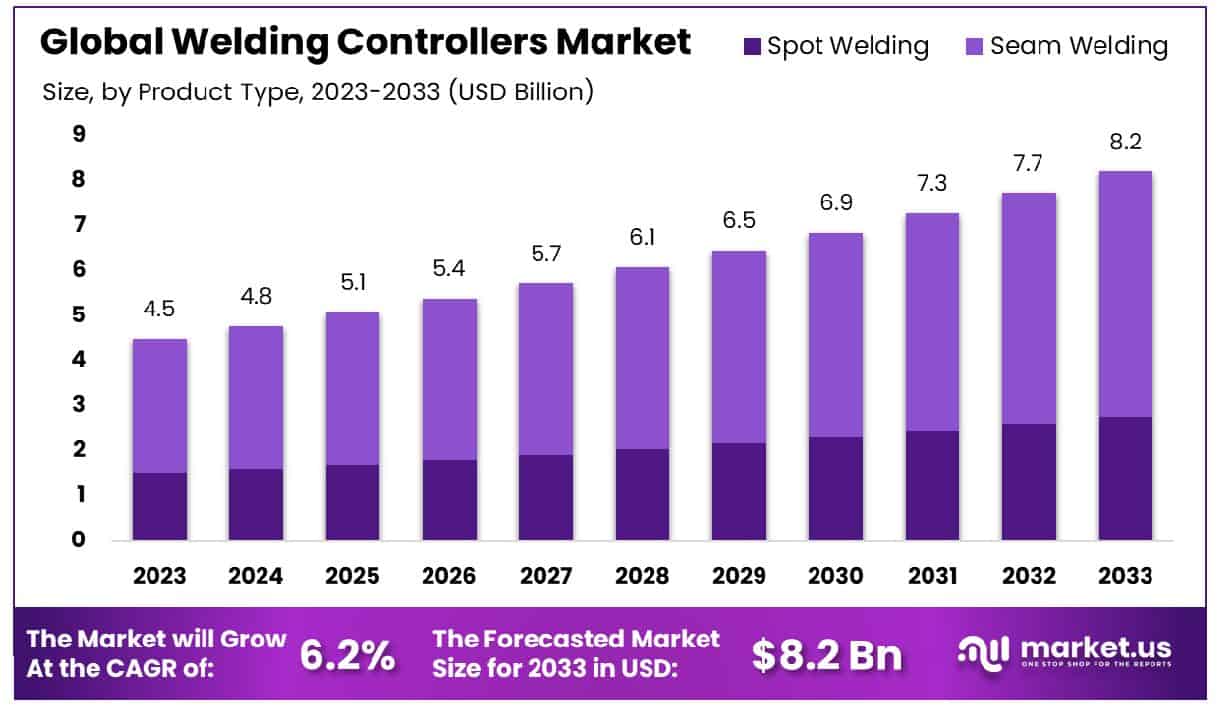

The Global Welding Controllers Market size is expected to be worth around USD 8.2 Billion by 2033, From USD 4.5 Billion by 2023, growing at a CAGR of 6.20% during the forecast period from 2024 to 2033.

The Welding Controllers Market encompasses a range of advanced devices essential for managing and monitoring the welding process in various industrial applications. These controllers ensure precise control over parameters such as time, pressure, and electrical output, facilitating consistent and high-quality welds. Key segments within this market include resistance welding controllers and arc welding controllers, catering to sectors such as automotive, aerospace, and manufacturing.

As industries increasingly adopt automation and seek efficiency improvements, the demand for sophisticated welding controllers is projected to rise. This market is pivotal for leaders aiming to enhance production capabilities and maintain competitive advantages in high-stakes manufacturing environments.

The Welding Controllers Market is positioned for notable growth, influenced by trends within the broader Welding Materials Market. In the United States, the Welding Materials Market has demonstrated substantial growth, with the market size expanding from USD 3,180.61 million in 2022 to USD 3,468.12 million in 2023. This represents a robust year-on-year growth, highlighting increasing demand for welding materials, which is a positive indicator for the ancillary Welding Controllers sector.

Additionally, the employment landscape for welders is expected to experience modest growth. Projections suggest a 2 percent increase in the number of welders from 2021 to 2031, resulting in an estimated workforce of 434,900 by the end of the forecast period. However, the sector faces a critical challenge due to a significant shortage of skilled welders. It is anticipated that there will be a shortage of 360,000 welding professionals by 2023, necessitating the annual recruitment of approximately 90,000 welders between 2023 and 2027 to mitigate this deficit.

This skilled labor shortage presents both a challenge and an opportunity within the Welding Controllers Market. The pressing need for skilled welders is likely to drive demand for advanced welding technologies, including sophisticated welding controllers that can enhance productivity and compensate for the labor deficit. As manufacturers and construction industries seek more efficient and consistent welding solutions, the demand for technologically advanced welding controllers is expected to rise.

Key Takeaways

- Market Growth: The Global Welding Controllers Market size is expected to be worth around USD 8.2 Billion by 2033, From USD 4.5 Billion by 2023, growing at a CAGR of 6.20% during the forecast period from 2024 to 2033.

- Regional Dominance: North America holds a 42.5% share in the global welding controllers market.

- Segmentation Insights:

- By Product Type: Seam welding dominates, holding 66.4% of the market share.

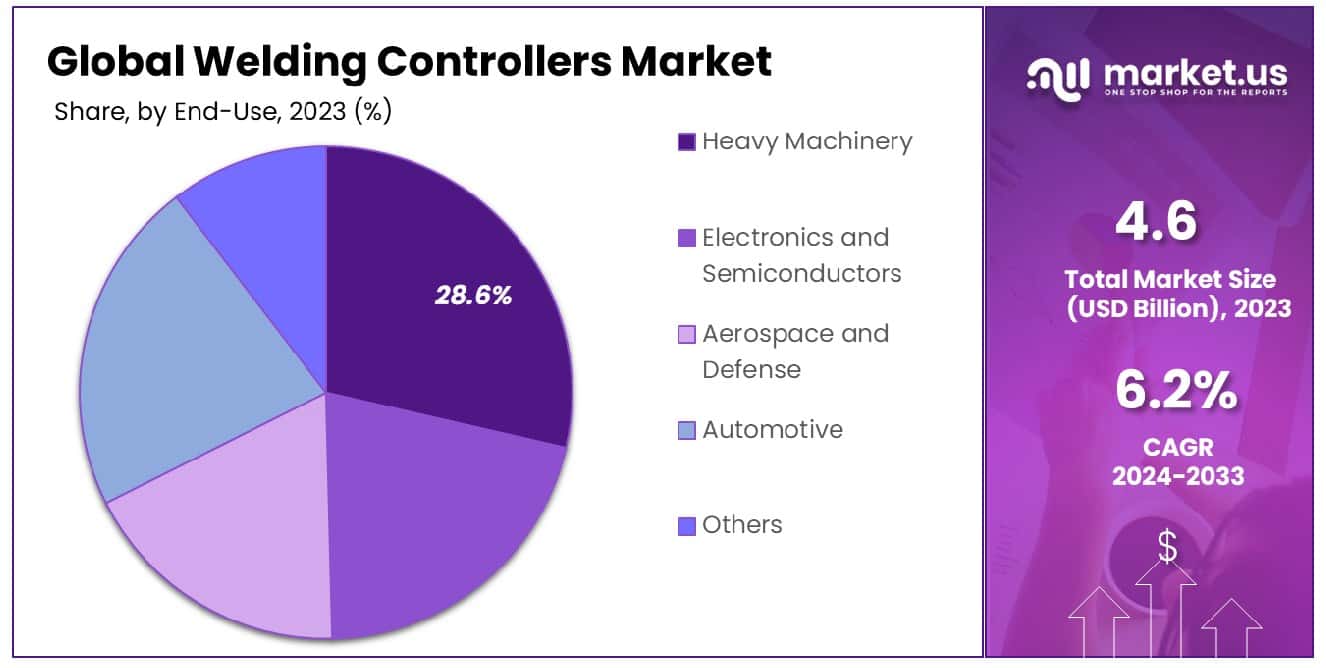

- By End-Use: Heavy machinery leads, comprise 28.6% of the market’s end-users.

- Growth Opportunities: The global welding controllers market is growing due to increased demand across various industries and significant opportunities in the expanding electric vehicle industry.

Driving Factors

Precision and Accuracy Driving Adoption in Welding Technologies

The welding industry is witnessing a significant shift towards technologies that enhance precision and accuracy, crucial factors in sectors like aerospace, automotive, and electronics where joint integrity is paramount. The increased emphasis on precision ensures higher quality welds, reducing waste and the need for rework, which in turn drives demand for advanced welding controllers.

These controllers facilitate precise control over welding parameters like current, voltage, and speed, aligning with the stringent quality standards required in modern manufacturing. This demand is reflected in the integration of sensors and feedback mechanisms that can adjust parameters in real time to maintain optimal weld quality.

Efficiency and Cost-Effectiveness Catalyzing Market Growth

Efficiency and cost reduction are pivotal in today’s competitive manufacturing environment. Welding controllers play a vital role in achieving these objectives by optimizing welding cycles and reducing operational costs. The ability of these controllers to streamline the welding process results in faster production times and lower energy consumption, which is particularly appealing to industries looking to enhance sustainability and reduce carbon footprints.

Additionally, the reduction in material waste and energy usage directly correlates with cost savings, investing in advanced welding controllers a financially sound decision for businesses aiming to improve their bottom line.

Diverse Industrial Applications Fueling Expansion

The versatility of welding controllers allows for their application across a broad spectrum of industries, further propelling market growth. From construction and heavy machinery to automotive electronics manufacturing, the need for robust and reliable welding solutions is ubiquitous.

As these sectors continue to expand, so too does the demand for specialized welding technology capable of meeting the unique challenges presented by each industry. This cross-industry demand diversifies the market base for welding controllers, ensuring steady growth and innovation within the sector to meet the evolving needs of these varied applications.

Restraining Factors

Technical Complexities Stifling Market Penetration

The inherent technical complexities associated with advanced welding controllers can significantly impede their adoption across various industries. These systems often require specialized knowledge to operate effectively, making them less accessible to welding professionals who may not have the necessary technical training.

The sophistication of these controllers, which includes programming for precise control of multiple parameters and integration with other manufacturing systems, adds a layer of complexity that can be daunting for small to medium-sized enterprises (SMEs). The reluctance to adopt complex systems can slow market growth, particularly in regions where access to technical training and support is limited.

Awareness and Understanding Limiting Adoption

A substantial barrier to the wider adoption of welding controllers is the limited understanding and awareness of their benefits and operational methodologies. This lack of awareness is particularly pronounced in emerging markets and among smaller operators who may not recognize the potential efficiency gains and cost savings these controllers can offer.

Without adequate knowledge of how welding controllers can optimize welding tasks, potential users may hesitate to invest in these technologies, preferring to stick with more familiar manual or semi-automatic welding methods. The industry faces the challenge of educating the market, not only about the capabilities and advantages of welding controllers but also on how to integrate them smoothly into existing workflows.

By Product Type Analysis

Seam welding dominates with 66.4% of the market, reflecting its crucial role in manufacturing efficiency.

In 2023, Seam Welding held a dominant market position in the By Product Type segment of the Welding Controllers Market, capturing more than a 66.4% share. This substantial market share is contrasted with that of Spot Welding, which accounted for a smaller portion of the market. The prominence of Seam Welding can be attributed to its extensive application in industries that require continuous, durable welds, such as automotive, aerospace, and shipbuilding.

The preference for Seam Welding is driven by its ability to produce high-quality, uniform welds over long lengths, which is essential for ensuring structural integrity and meeting rigorous industry standards. The technique’s adaptability to automated processes also supports higher production rates, contributing to its widespread adoption.

Economic factors have played a significant role in shaping the market dynamics. The automotive sector, in particular, has seen increased investment in automated welding technologies, aiming to enhance efficiency and reduce production costs. This trend is expected to continue, given the ongoing push towards electric vehicles and the corresponding need for reliable battery enclosures, which rely heavily on Seam Welding.

Technological advancements in controller systems for welding have further bolstered the growth of the Seam Welding market. Innovations in welding technology, including the integration of IoT and AI, have improved precision and repeatability, which are critical for high-volume manufacturing environments.

By End-Use Analysis

Heavy machinery is a leading sector, accounting for 28.6% of end-use in the market.

In 2023, Heavy Machinery held a dominant market position in the By End-Use segment of the Welding Controllers Market, capturing more than a 28.6% share. This was followed by segments including Electronics and Semiconductors, Aerospace and Defense, Automotive, and Others, each contributing variably to the market landscape.

The significant share held by Heavy Machinery is largely due to the extensive deployment of welding technologies in the construction, mining, and agricultural machinery sectors. These industries require robust and reliable welding to ensure the durability and longevity of heavy equipment under extreme operating conditions. The demand for advanced welding solutions in Heavy Machinery is driven by the need for high-quality welds that can withstand wear and tear, contributing to the segment’s leading position.

Economic growth in emerging markets has spurred expansions in infrastructure and energy projects, which in turn has increased the demand for heavy machinery. This economic condition fosters a favorable environment for the growth of the welding controllers market within this sector. Moreover, advancements in welding technology, including enhanced automation and improved precision, have made it possible to meet the stringent quality standards required by heavy machinery manufacturers.

Key Market Segments

By Product Type

- Spot Welding

- Seam Welding

By End-Use

- Heavy Machinery

- Electronics and Semiconductors

- Aerospace and Defense

- Automotive

- Others

Growth Opportunities

Increasing Demand for Welding Equipment Across Various Industries

The global market for welding controllers is experiencing significant growth, primarily driven by increasing demands across diverse industrial sectors. This expansion is notably evident in industries such as construction, oil and gas, and manufacturing, where welding technologies play a crucial role in fabrication and assembly processes. The integration of advanced welding technologies is essential for enhancing production efficiency and ensuring high-quality outputs.

As industries continue to emphasize durability and precision in fabricated products, the adoption of sophisticated welding controllers is expected to rise, further propelling market growth. The evolution of these industries, coupled with technological advancements in welding processes, underscores a robust trajectory for the welding controllers market.

Growth in the Electric Vehicle Industry and Rising Adoption in the Automotive Sector

The burgeoning electric vehicle (EV) industry presents substantial opportunities for the welding controllers market. The shift towards EVs, driven by global efforts to reduce carbon emissions, necessitates advanced welding solutions to accommodate new materials and complex assembly requirements inherent in EV manufacturing. Welding controllers are critical in achieving the precision required for battery enclosures and lightweight vehicle structures, which are integral to EV design.

The automotive sector’s adoption of these technologies not only supports the production scalability of electric vehicles but also aligns with broader industry trends toward automation and sustainability. Consequently, the expansion of the electric vehicle industry is anticipated to significantly enhance the demand for welding controllers, fostering considerable market growth.

Latest Trends

Need for Efficient and Cost-Effective Welding Processes

In 2023, the global market for welding controllers is witnessing a pivotal shift towards more efficient and cost-effective welding processes. This trend is driven by the industry’s need to reduce operational costs and increase productivity through technological innovation. As manufacturers face pressures to improve the bottom line while maintaining high-quality standards, the adoption of advanced welding controllers that offer precision and speed is escalating.

These controllers facilitate seamless welding operations, minimize waste, and reduce the incidence of errors, which can lead to significant cost savings for businesses. The deployment of such technologies is particularly relevant in sectors where high throughput and continuous operation are critical, highlighting the increasing reliance on efficient welding solutions to meet industry demands.

Rising Demand for Welding Controllers in Various Industries

The demand for welding controllers is surging across a broad range of industries, including automotive, aerospace, construction, and heavy machinery. This rise can be attributed to the growing complexity of welding tasks and the need for specialized equipment to handle diverse materials and thicknesses. Industries are increasingly turning to sophisticated welding controllers that can automate processes and enhance control over intricate welding operations.

The integration of these technologies ensures higher consistency and quality in welds, essential for the production of safety-critical components. As industries continue to innovate and expand, the versatility and capability of welding controllers are becoming crucial factors in maintaining competitive advantage and meeting the stringent standards of modern manufacturing practices.

Regional Analysis

North America holds a 42.5% share of the global welding controllers market, leading significantly.

The global welding controllers market exhibits significant variation across different regions, reflecting diverse industrial dynamics and technological adoption rates. North America dominates the market with a 42.5% share, driven by robust manufacturing sectors and advanced automotive industries, particularly in the U.S. and Canada. This region benefits from high investment in automation technologies, which supports the widespread use of advanced welding controllers.

Europe follows, with a strong emphasis on incorporating energy-efficient and technologically advanced welding solutions to maintain its manufacturing prowess and compliance with stringent regulatory standards. Germany, Italy, and the UK are significant contributors, focusing on the automotive and aerospace sectors, which demand precise and efficient welding technologies.

The Asia Pacific region is experiencing rapid growth in the welding controllers market, fueled by expanding manufacturing bases and industrialization in China, India, and Southeast Asia. Investments in infrastructure and increased automotive production are propelling the demand for sophisticated welding technologies in this region.

The Middle East & Africa (MEA) and Latin America regions, while holding smaller shares of the global market, are witnessing growth due to industrial development and an increase in construction activities. In MEA, the focus on diversifying economies and developing the manufacturing sector, particularly in Saudi Arabia and the UAE, is boosting the market. Latin America is seeing gradual growth with Brazil and Mexico leading the way, driven by the automotive and energy sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2023, the global welding controllers market is notably influenced by several key players, each contributing distinct technological advancements and market strategies.

Pangborn Group and Rösler Surface Technology GmbH are leading in the development of surface treatment technologies that complement their welding solutions, enhancing the overall efficiency and quality of welds in heavy-duty manufacturing environments.

Sintokogio, Ltd. and Norican Group stand out with their broad international reach and a strong emphasis on innovation in automated welding technologies. These companies are pioneers in integrating smart technologies with traditional welding practices, improving precision and reducing operational costs.

Engineered Abrasives Inc. and Wheelabrator focus on niche markets by providing specialized welding solutions tailored to meet the rigorous demands of industries requiring high precision such as aerospace and automotive. Their products are designed to enhance surface preparation, a critical step in achieving quality welds.

Agtos and Goff Inc. have carved out a market space by offering robust equipment suited for larger and more abrasive operations, making them preferred suppliers for industries involved in construction and heavy machinery.

AMADA Weld Tech is known for its precision welding technologies that are crucial for the electronics and automotive sectors, where high detail and consistency are paramount.

ESAB Welding and Cutting Products offers a wide range of welding solutions that cater to virtually every sector of the market, making it one of the most versatile players in the arena.

WeldComputer Corporation and Lincoln Electric Co. are at the forefront of welding technology with their advanced control systems and comprehensive welding solutions that ensure optimal performance and adherence to quality standards across various industries.

Market Key Players

- Pangborn Group

- Sintokogio, Ltd

- Rösler Surface Technology GmbH

- Norican Group

- Engineered Abrasives Inc.

- Wheelabrator

- Agtos

- Goff Inc.

- AMADA Weld Tech

- ESAB Welding and Cutting Products

- WeldComputer Corporation

- Lincoln Electric Co.

Recent Development

- In March 2024, Bechtel Innovation Design Center offers free access to woodworking, metalworking, 3D printing, and electronics labs for Purdue University students, facilitating diverse projects and fostering innovation across engineering disciplines.

- In November 2023, Olympus Controls hosts a “Waves of Innovation” event at AT&T Stadium, showcasing robotics solutions for manufacturing. Dallas companies, like Aircraft Tooling Inc., benefit from automation, addressing labor challenges.

- In October 2023, AccuteX debuts AZ-600A Wire Cut EDM Machine at EMO Hannover 2023, featuring innovative E-circuit technology and a frag-type linear motor for precision manufacturing. Phillips Machine Tools to represent AccuteX in India.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Billion Forecast Revenue (2033) USD 8.2 Billion CAGR (2024-2033) 6.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Spot Welding, Seam Welding), By End-Use(Heavy Machinery, Electronics and Semiconductors, Aerospace and Defense, Automotive, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pangborn Group, Sintokogio, Ltd, Rösler Surface Technology GmbH, Norican Group, Engineered Abrasives Inc., Wheelabrator, Agtos, Goff Inc., AMADA Weld Tech, ESAB Welding and Cutting Products, WeldComputer Corporation, Lincoln Electric Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Welding Controllers Market in 2023?The Global Welding Controllers Market size is USD 4.5 Billion in 2023.

What is the projected CAGR at which the Global Welding Controllers Market is expected to grow at?The Global Welding Controllers Market is expected to grow at a CAGR of 6.20% (2024-2033).

List the segments encompassed in this report on the Global Welding Controllers Market?Market.US has segmented the Global Welding Controllers Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa).By Product Type(Spot Welding, Seam Welding), By End-Use(Heavy Machinery, Electronics and Semiconductors, Aerospace and Defense, Automotive, Others)

List the key industry players of the Global Welding Controllers Market?Pangborn Group, Sintokogio, Ltd, Rösler Surface Technology GmbH, Norican Group, Engineered Abrasives Inc., Wheelabrator, Agtos, Goff Inc., AMADA Weld Tech, ESAB Welding and Cutting Products, WeldComputer Corporation, Lincoln Electric Co.

Name the key areas of business for Global Welding Controllers Market?The US, Canada, Mexico are leading key areas of operation for Global Welding Controllers Market.

Welding Controllers MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Welding Controllers MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Pangborn Group

- Sintokogio, Ltd

- Rösler Surface Technology GmbH

- Norican Group

- Engineered Abrasives Inc.

- Wheelabrator

- Agtos

- Goff Inc.

- AMADA Weld Tech

- ESAB Welding and Cutting Products

- WeldComputer Corporation

- Lincoln Electric Co.