Global Webcomics Market Size, Share Analysis Report By Genre (Action, Comedy, Sci-Fi, Horror, Romance, Others), By Revenue Model (Subscription Webcomic, Advertising Webcomic), By Target Audience (Kids, Adults), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153187

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

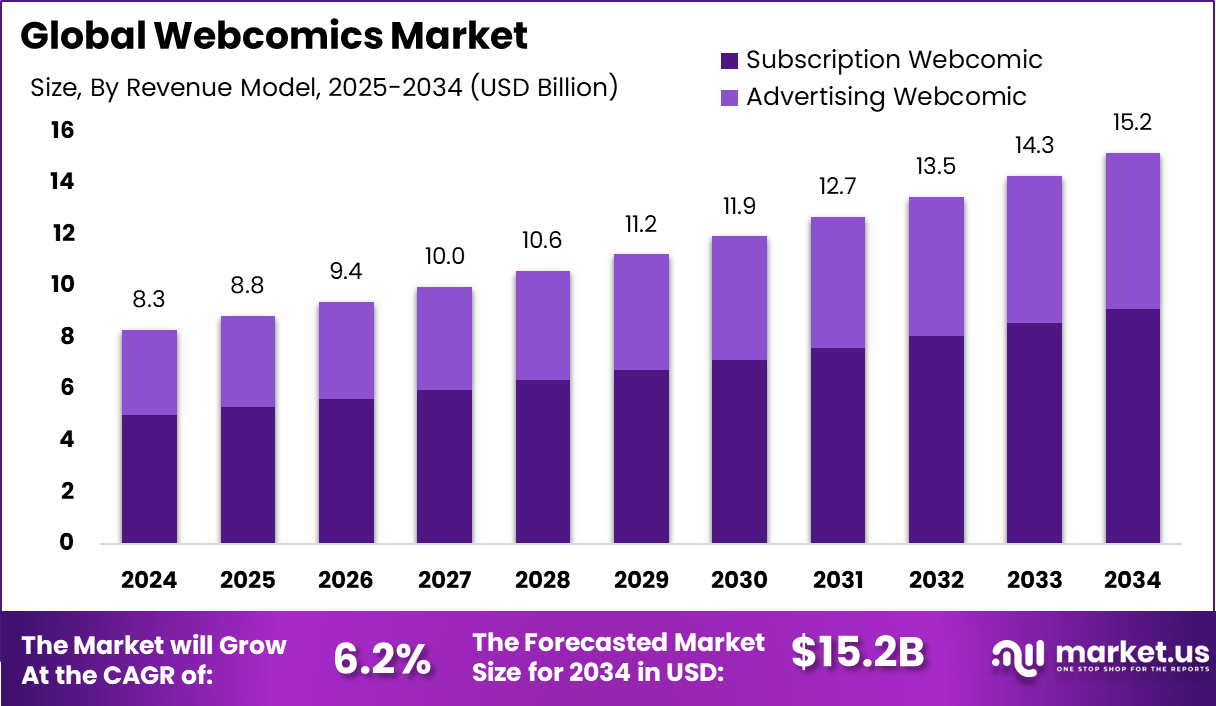

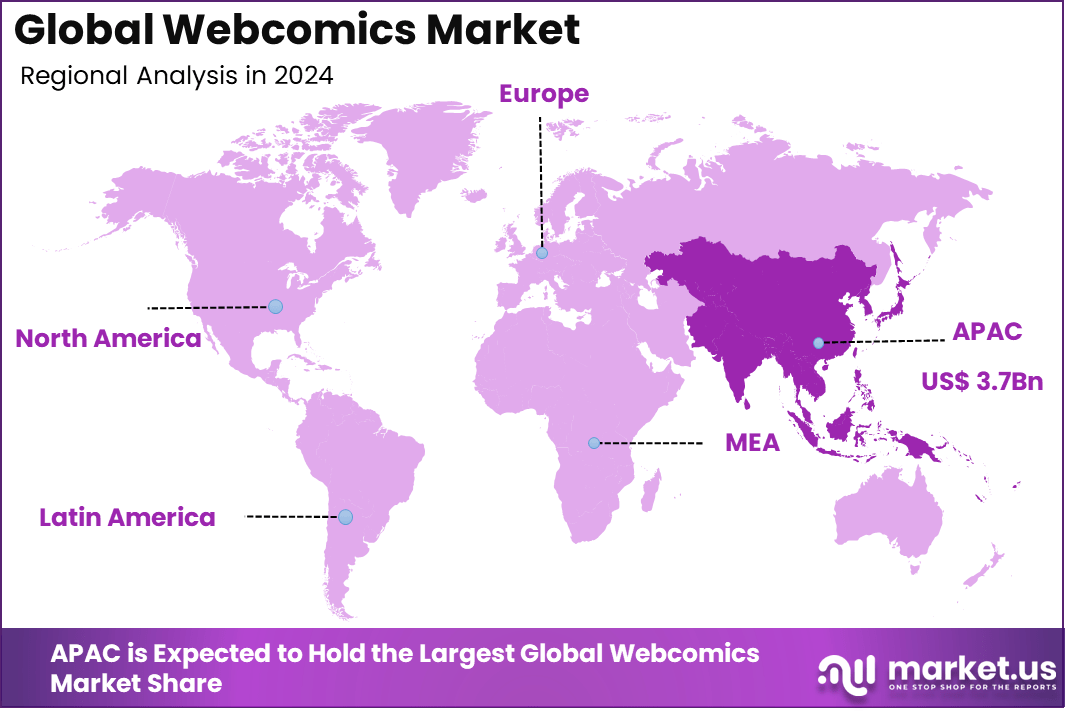

The Global Webcomics Market size is expected to be worth around USD 15.2 Billion By 2034, from USD 8.3 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 45% share, holding USD 3.7 Billion revenue.

The webcomics market represents a growing segment within the digital content ecosystem, driven by the increasing consumption of online entertainment and the democratization of publishing tools. Webcomics refer to comic strips or graphic novels published primarily on digital platforms, which can be accessed via websites, apps, or social media.

According to Gitnux, the United States accounts for nearly 40% of global comic book sales, reflecting its strong influence in the global market. Marvel Comics leads the U.S. publishing space with around 40% market share, supported by its popular characters and consistent content output. Over 50,000 comic books are released worldwide each year, showing high creative activity.

The top driving factors of this market are rooted in shifting consumer behavior towards digital content and the cultural acceptance of comic art forms among younger demographics. A notable rise in smartphone ownership and affordable mobile internet plans has allowed readers to engage with serialized content conveniently. Creators can now earn directly through subscriptions, ads, and merchandise, motivating both professionals and amateurs to join the webcomics space.

Scope and Forecast

Report Features Description Market Value (2024) USD 8.3 Bn Forecast Revenue (2034) USD 15.2 Bn CAGR (2025-2034) 6.2% Largest market in 2024 Asia-pacific [45% market share] Key Insight Summary

- The global webcomics market is projected to grow from USD 8.3 billion in 2024 to approximately USD 15.2 billion by 2034, registering a steady CAGR of 6.2% during 2025–2034, driven by rising digital content consumption and growing preference for interactive storytelling formats.

- In 2024, Asia-Pacific held a dominant position with over 45% market share, generating about USD 3.7 billion, supported by high smartphone penetration and strong readership in key markets.

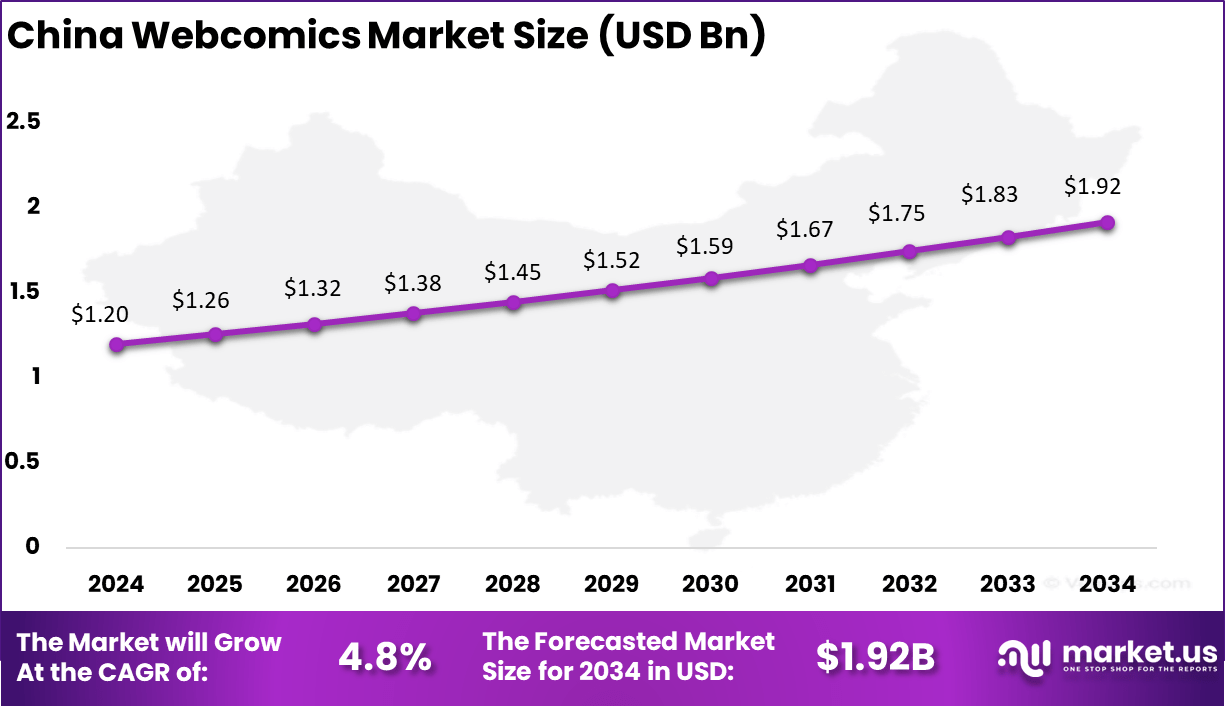

- Within APAC, China contributed USD 1.2 billion in 2024, with a projected CAGR of 4.8%, reflecting sustained demand for localized and culturally relevant content.

- By genre, romance led with a 32% share, attributed to its broad appeal and consistent popularity among diverse reader segments.

- By revenue model, subscription-based webcomics accounted for 60% share, as readers increasingly opt for premium, ad-free experiences.

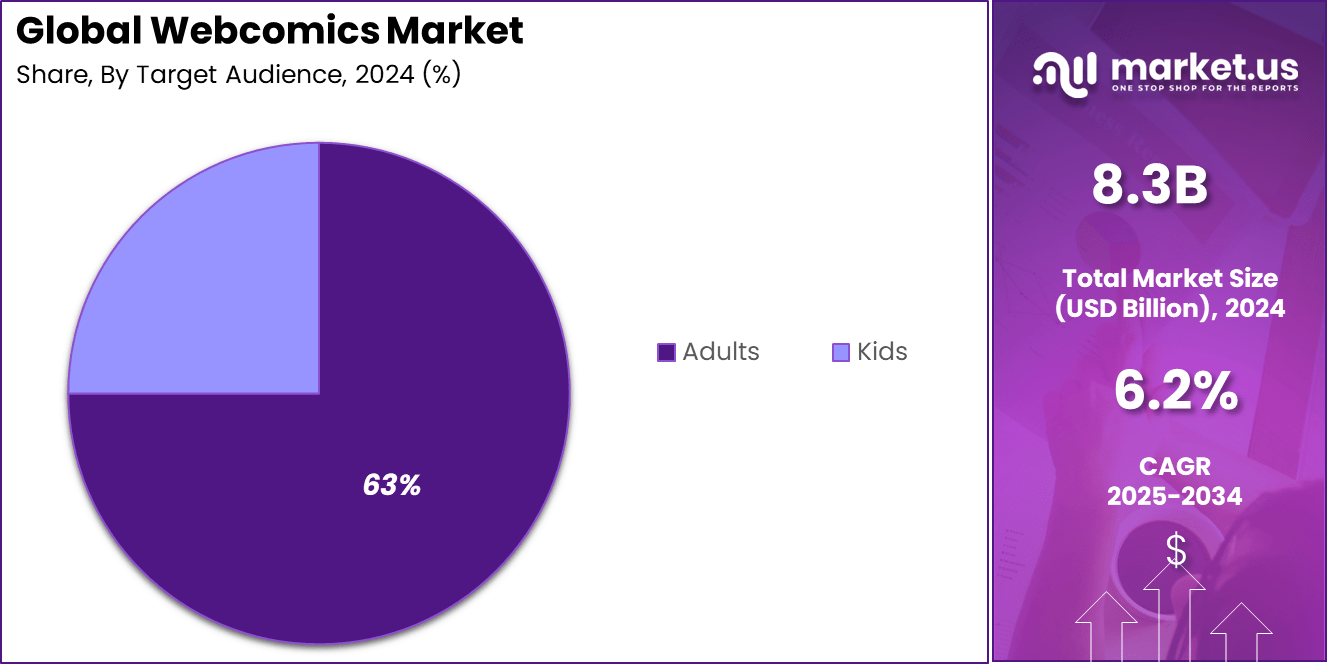

- By target audience, adults dominated the market with a commanding 75% share, underpinned by mature themes and stories tailored to adult readership preferences.

Analysts’ Viewpoint

Increasing adoption of technologies such as artificial intelligence, cloud-based hosting, and analytics tools is reshaping the webcomics landscape. AI tools are increasingly used for automated translation and personalized content recommendations, which enhance reader experiences and broaden international reach.

The key reasons for adopting these technologies are primarily linked to the need for higher engagement, wider reach, and operational scalability. AI-powered recommendation engines increase user stickiness by surfacing content aligned with reader preferences. Automated localization opens up new geographies without the prohibitive costs of manual translation.

Investment opportunities are emerging across platform development, content creation, and ancillary services such as licensing and merchandise. Venture capital interest has been observed in platforms that aggregate webcomics and build robust monetization models. There is also a growing interest in intellectual property acquisition and adaptation of popular webcomics into films, series, and games, creating further revenue streams.

China Market Size

The China Webcomics Market was valued at USD 1.2 Billion in 2024 and is anticipated to reach approximately USD 1.92 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.8% during the forecast period from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than a 45% share, holding USD 3.7 Billion revenue, driven primarily by widespread smartphone penetration and high digital content consumption among younger demographics.

Countries such as South Korea, Japan, China, and Indonesia have emerged as core consumption hubs for webcomics, with culturally rooted storytelling and strong demand for manga-style content. Local platforms continue to receive strong user engagement, and the availability of multilingual content formats has supported deeper market reach, especially among Gen Z and Millennial readers.

The leadership of APAC is also reinforced by the rising influence of K-webtoons and their seamless integration with entertainment sectors, such as animation and gaming. Adaptations of popular webcomics into TV dramas and anime series have created a multi-platform content ecosystem that increases readership.

In addition, governments in countries like South Korea and Japan actively promote digital creative industries, which further boosts both production and export of webcomic IPs. Affordable mobile data and digital payment infrastructure have also enabled easier subscription and micropayment-based monetization, reinforcing APAC’s sustained dominance in this space.

By Genre: Romance

In 2024, the Romance segment held a dominant market position in the global webcomics market, capturing more than a 32% share. This genre’s remarkable popularity stems from its universal themes of love, relationships, and emotional connection, which resonate deeply across various demographics.

Readers are drawn to stories that reflect real-life experiences, such as marriage, heartbreak, jealousy, and contemporary romance, as well as fantasy and LGBTQ+ relationships. These narratives connect with both teenagers and adults, providing escapism, comfort, and a sense of belonging in digital communities.

The growth of the Romance segment is further fueled by the surge in digital content consumption and the active release of new titles by major platforms. Providers such as Webtoon and Tapas regularly adapt popular novels into interactive romance comics, continually expanding their libraries to meet readers’ evolving interests.

By Revenue Model: Subscription Webcomic

In 2024, the Subscription Webcomic segment accounted for roughly 60% of the webcomics market share. The subscription model thrives because it delivers a seamless, ad-free reading experience and answers growing consumer concerns about privacy and intrusive advertising.

Readers prefer the convenience of having unlimited access to a rich library of webcomics for a fixed monthly fee, without interruptions from pop-ups or data tracking. For creators and platforms, the subscription approach provides reliable, recurring revenue and enhances user loyalty by offering exclusive content, early releases, or bonus chapters.

With widespread support for international payments and pricing that fits diverse budgets, subscription-based platforms have created vibrant communities of avid readers. These users are willing to pay for convenience and quality, which drives the market forward. The value proposition of subscriptions is further boosted by personalized recommendations and unique perks for members, strengthening user engagement and platform growth.

By Target Audience: Adults

In 2024, adults held a commanding 75% share of the global webcomics market audience. The adult segment’s dominance is rooted in the wide availability of digital comics tailored specifically for mature readers, who often revisit their long-standing interests in graphic storytelling.

These adults not only find relaxation and nostalgia in webcomics but also collect rare or exclusive editions, treating them as both hobby items and potential investments. Adult readers are typically more independent and have greater spending power, fueling the purchase of premium or specialized webcomics content.

The broad appeal of romance, drama, fantasy, and even adult-oriented genres creates a highly engaged user base that platforms are eager to serve. This demographic’s willingness to invest both time and money in digital comics ensures that adults continue to lead as the most significant consumer segment in the webcomics landscape.

Key Market Segments

By Genre

- Action

- Comedy

- Sci-Fi

- Horror

- Romance

- Others

By Revenue Model

- Subscription Webcomic

- Advertising Webcomic

By Target Audience

- Kids

- Adults

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Interactive Storytelling and AI-Driven Content

A standout trend within webcomics is the move towards interactive storytelling and the integration of AI tools. Readers are engaging with more dynamic stories that can adapt or offer immersion beyond traditional reading.

The digitized format not only opens the door for interactive panels, animation, and user choices, but it also encourages the use of AI-driven translations and adaptive recommendations, making stories accessible globally and highly personalized.

Driver

Rising Smartphone and Internet Usage

The biggest push behind the growth of webcomics is the widespread use of smartphones and better internet access across the world. With digital devices in almost every hand today, readers can access new and diverse webcomic content instantly, making reading a part of their daily routine. Trends in digital entertainment consumption favor instant, bite-sized content easily available through mobile apps and websites, inviting people of all ages to explore webcomics wherever they are.

Restraint

Competition from Alternative Digital Entertainment

Despite these strengths, webcomics face a significant restraint due to the booming landscape of other digital entertainment. As people split their time between video games, social media, streaming platforms, and audiobooks, webcomics must continuously fight for users’ attention. The preference for alternative media, especially formats that allow for multitasking like audiobooks or passive viewing, makes it challenging for webcomics to maintain and grow their audience base.

Market Opportunity

Untapped Audiences in Emerging Regions

A major opportunity exists in reaching readers in emerging markets. As affordable smartphones and mobile internet plans become available to more people in regions like Asia, Africa, and South America, there is a new wave of audiences looking for low-cost but engaging entertainment.

Webcomics, due to their digital-first nature and easy accessibility, are well-positioned to capture interest in these markets, providing both creators and readers with access to global content that was previously out of reach.

Challenge

Piracy and Intellectual Property Concerns

One of the lasting challenges is piracy. Digital content is easily copied and distributed without proper compensation to creators, affecting the overall revenue and artist motivation. High rates of content theft remain a worry, especially in regions with less strict enforcement around copyright. Piracy not only leads to direct loss of earnings but can also hurt the ecosystem by making it less economically viable for new creators to publish original works.

Key Player Analysis

Leading players like The Walt Disney Company, Warner Bros. Discovery, and Naver Corp are actively expanding their digital storytelling through webcomics. Disney and Warner Bros. are leveraging known franchises, while Naver’s LINE Webtoon continues to dominate the global scene. Kakao Corp and NHN Corp have also built strong platforms in South Korea, offering monetization tools and serialized content that attract creators and audiences alike.

In Japan, Shueisha Inc. and KADOKAWA CORPORATION have digitized manga for global consumption. Dark Horse Media, under Embracer Group, targets English-speaking readers through web-first releases. Korean players like Lezhin Entertainment and Toomics Global focus on mature content and subscription models, helping retain loyal users.

Chinese platforms including Tencent, Kuaikan Manhua, and China Literature continue to grow through mobile-first strategies. Tapas Media is expanding in Western markets with localized content, while Indian publishers like Holy Cow Entertainment and Diamond Toons tap into regional storytelling. Other players contribute to growing diversity in content, language, and distribution channels.

Top Key Players Covered

- Walt Disney Company

- Naver Corp

- Warner Bros. Discovery, Inc

- Shueisha Inc

- Embracer Group (Dark Horse Media)

- NHN Corp

- Kakao Corp

- KADOKAWA CORPORATION

- Lezhin Entertainment, LLC

- Toomics Global Co., Ltd.

- Kuaikan Manhua

- Tencent

- China Literature

- Tapas Media

- Holy Cow Entertainment

- Diamond Toons

- Other Key Players

Recent Developments

- In November 2023, Disney announced the acquisition of the remaining 33% stake in Hulu from Comcast for approximately $8.61 billion. This move strengthens its streaming and digital distribution capabilities, which indirectly benefits its webcomics and manga business by widening its potential cross-media audience in 2024.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Genre (Action, Comedy, Sci-Fi, Horror, Romance, Others), By Revenue Model (Subscription Webcomic, Advertising Webcomic), By Target Audience (Kids, Adults) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Walt Disney Company, Naver Corp, Warner Bros. Discovery, Inc, Shueisha Inc, Embracer Group (Dark Horse Media), NHN Corp, Kakao Corp, KADOKAWA CORPORATION, Lezhin Entertainment, LLC, Toomics Global Co., Ltd., Kuaikan Manhua, Tencent, China Literature, Tapas Media, Holy Cow Entertainment, Diamond Toons, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Walt Disney Company

- Naver Corp

- Warner Bros. Discovery, Inc

- Shueisha Inc

- Embracer Group (Dark Horse Media)

- NHN Corp

- Kakao Corp

- KADOKAWA CORPORATION

- Lezhin Entertainment, LLC

- Toomics Global Co., Ltd.

- Kuaikan Manhua

- Tencent

- China Literature

- Tapas Media

- Holy Cow Entertainment

- Diamond Toons

- Other Key Players