Global Waste To Diesel Market Size, Share, And Business Benefits By Source (Oil and Fat Waste, Municipal Waste, Plastic Waste, Others), By Technology (Gasification, Pyrolysis, Depolymerisation, Incineration), By Application (Transportation Fuels, Industrial Fuels, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154909

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

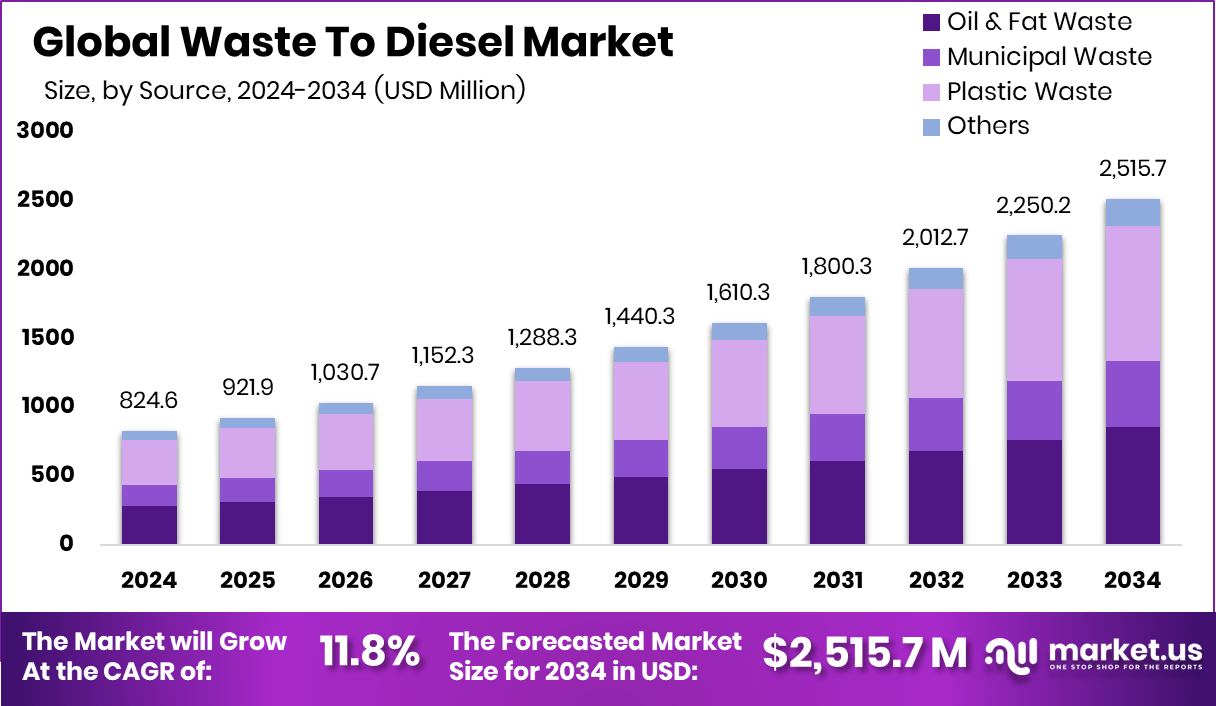

The Global Waste To Diesel Market is expected to be worth around USD 2,515.7 million by 2034, up from USD 824.6 million in 2024, and is projected to grow at a CAGR of 11.8% from 2025 to 2034. Strong waste management policies supported Europe’s Waste to Diesel Market growth to 45.80% share.

Waste to Diesel is a technology-driven process that converts various types of waste—such as plastic, municipal solid waste (MSW), agricultural residues, and industrial by-products—into synthetic diesel fuel through thermal and chemical methods, primarily pyrolysis or gasification, followed by catalytic upgrading. The diesel produced through this method is cleaner-burning and can be used in existing diesel engines, offering a sustainable solution to both waste management and energy production challenges.

The Waste to Diesel market is emerging as a critical component of the circular economy, where waste is no longer treated as a burden but as a valuable resource. This market is witnessing growing adoption due to increasing concerns over landfills, plastic pollution, and the global push for alternative fuels. Many countries are implementing supportive policies and funding initiatives to scale up waste conversion technologies that reduce greenhouse gas emissions and dependence on fossil fuels.

Demand is increasing from transportation, construction, and backup power sectors, where diesel fuel remains dominant. Unlike biodiesel, waste-derived diesel closely mimics the chemical structure of fossil diesel, enabling easy integration without major engine modifications. This compatibility makes it a preferred option in off-grid and remote locations.

The U.S. Department of Energy has committed $3 million to support community-led waste-to-energy initiatives aimed at advancing clean energy solutions at the local level. Meanwhile, Repsol has announced plans to invest over €800 million in the Tarragona Ecoplanta, a groundbreaking European facility focused on the production of renewable methanol.

Key Takeaways

- The Global Waste To Diesel Market is expected to be worth around USD 2,515.7 million by 2034, up from USD 824.6 million in 2024, and is projected to grow at a CAGR of 11.8% from 2025 to 2034.

- Plastic waste drives a 39.3% share in the waste-to-diesel market.

- Pyrolysis technology leads with a 45.7% share in conversion methods.

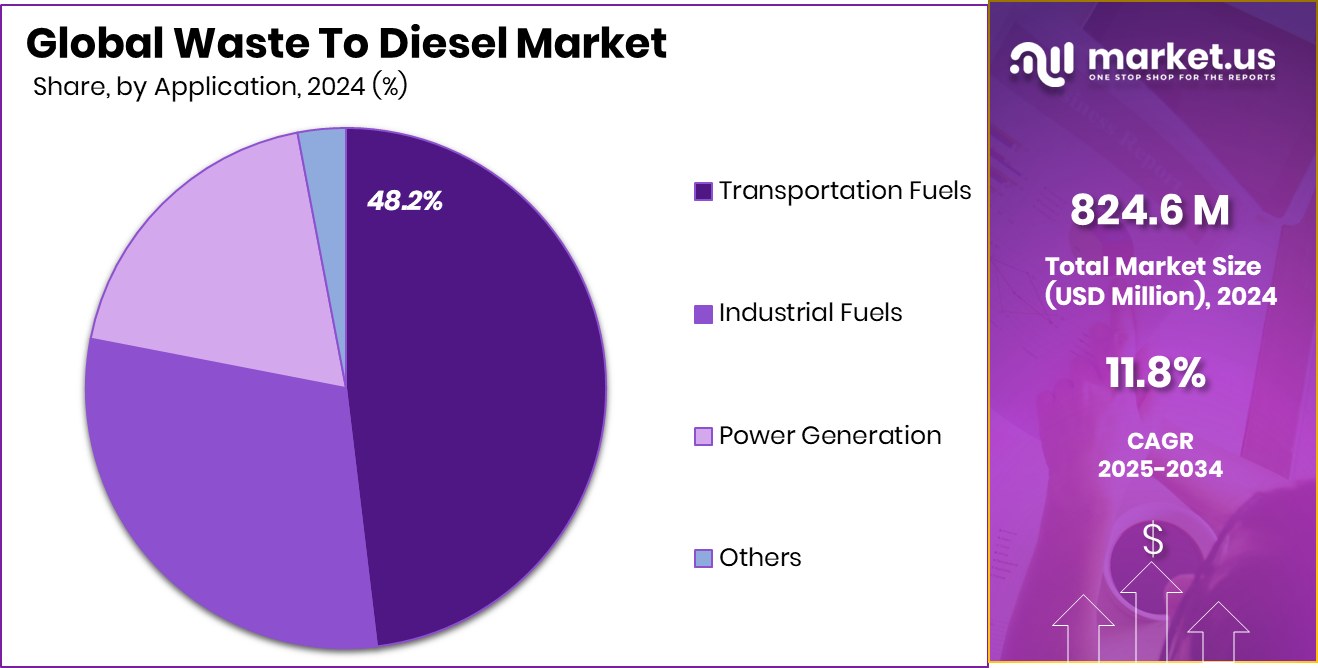

- Transportation fuels dominate application, capturing 48.2% market share globally.

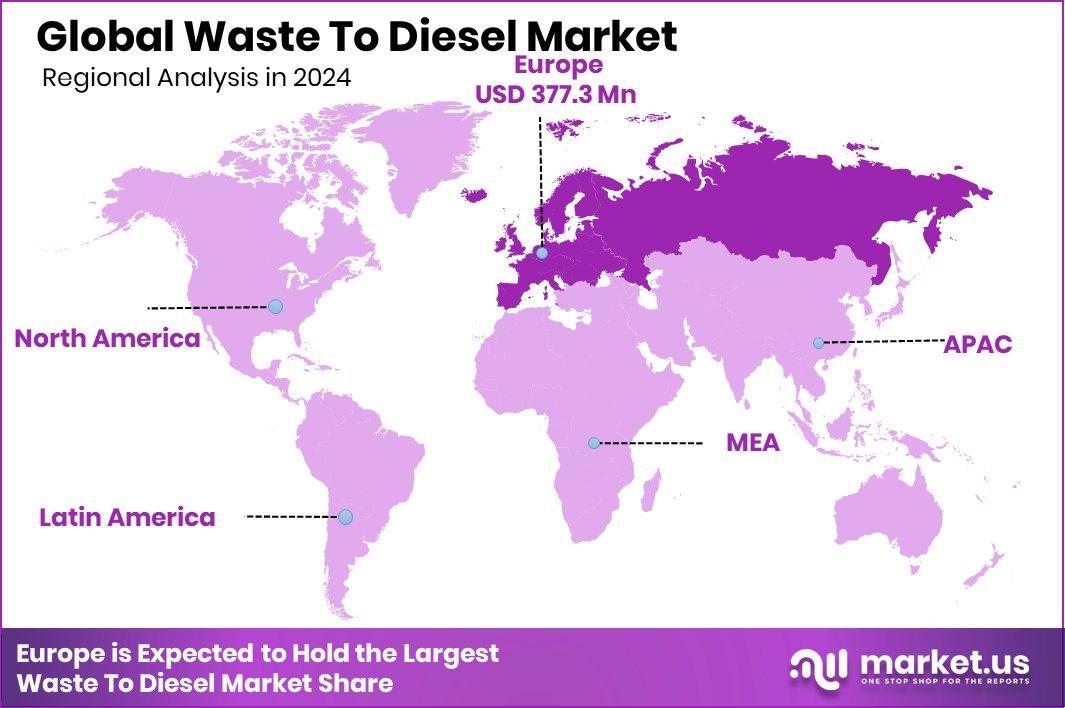

- The regional market in Europe was valued at USD 377.3 million in 2024.

By Source Analysis

Plastic waste contributes 39.3% to the Waste to Diesel market, highlighting its major feedstock role.

In 2024, Plastic Waste held a dominant market position in the By Source segment of the Waste to Diesel Market, with a 39.3% share. This dominance can be attributed to the large-scale generation of plastic waste globally and its suitability for thermochemical conversion processes such as pyrolysis, which efficiently converts plastics into high-quality diesel-like fuels.

The persistent challenges posed by non-biodegradable plastics, especially polyethylene and polypropylene, have made plastic waste an ideal and abundant feedstock for waste-to-diesel technologies. Governments and environmental agencies have increased focus on plastic recovery and valorization, further accelerating the utilization of plastic waste as a primary input.

The growing volumes of post-consumer plastic waste, particularly from packaging, containers, and single-use products, have compelled urban municipalities and industrial players to adopt waste-to-fuel approaches for sustainable disposal. The diesel derived from plastic waste offers lower sulfur content and reduced environmental impact compared to traditional fossil diesel, aligning well with clean fuel standards.

The economic viability of converting plastic into diesel, coupled with rising landfill tipping fees and plastic disposal restrictions, has strengthened the plastic waste segment’s lead in the market. As regulatory pressure continues to mount against landfilling and incineration of plastics, this segment is expected to maintain its dominant position.

By Technology Analysis

Pyrolysis dominates the technology segment with 45.7%, driving efficient waste-to-fuel conversion processes globally.

In 2024, Pyrolysis held a dominant market position in the By Technology segment of the Waste to Diesel Market, with a 45.7% share. This dominance is largely due to the widespread applicability of pyrolysis in converting organic and plastic waste into liquid hydrocarbons, particularly diesel-grade fuels.

The technology’s ability to handle mixed waste streams without the need for extensive pre-sorting has made it a preferred method in both developed and developing regions. Pyrolysis operates under oxygen-free conditions, which minimizes emissions during processing and allows for a more controlled thermal breakdown of complex waste materials.

The increasing efficiency and modular scalability of pyrolysis units have contributed significantly to their adoption across urban and industrial waste management infrastructures. It enables decentralized fuel production, especially in areas facing logistical challenges in fuel supply.

Moreover, the diesel output from pyrolysis is known for its close chemical similarity to conventional diesel, which makes it directly usable in existing diesel engines without modification. As the need for sustainable waste disposal and alternative fuels intensifies, the pyrolysis technology has emerged as a reliable and commercially viable solution, reinforcing its leading position in the Waste to Diesel Market’s technological landscape during the year.

By Application Analysis

Transportation fuels account for 48.2%, showing strong market demand for diesel alternatives from waste resources.

In 2024, Transportation Fuels held a dominant market position in the By Application segment of the Waste to Diesel Market, with a 48.2% share. This strong market position was supported by the growing demand for alternative liquid fuels in sectors such as freight, logistics, and public transport, where diesel engines remain the primary mode of propulsion.

Waste-derived diesel, produced through processes like pyrolysis, offers a cleaner-burning substitute that meets existing fuel standards, making it a practical replacement for conventional diesel without requiring modifications to vehicle engines or infrastructure.

The increasing focus on reducing greenhouse gas emissions and dependency on fossil fuels has further encouraged the use of waste-to-diesel solutions in transportation. As regulatory norms tighten around carbon emissions, especially in urban and high-traffic areas, the appeal of low-sulfur and renewable diesel alternatives has risen.

Transportation fuels derived from waste sources also present an economically viable option in regions where diesel imports contribute significantly to energy costs. The availability of abundant waste feedstocks, coupled with the logistical ease of integrating the end-product into the existing fuel distribution network, has made the transportation sector the leading consumer of waste-to-diesel outputs, firmly securing its top position in this segment for the year.

Key Market Segments

By Source

- Oil and Fat Waste

- Municipal Waste

- Plastic Waste

- Others

By Technology

- Gasification

- Pyrolysis

- Depolymerisation

- Incineration

By Application

- Transportation Fuels

- Industrial Fuels

- Power Generation

- Others

Driving Factors

Rising Plastic Waste Volumes Boosting Fuel Recovery

One of the main driving forces behind the Waste to Diesel Market is the increasing volume of plastic waste generated worldwide. With millions of tonnes of plastic ending up in landfills and oceans every year, there is a growing need for better waste management solutions. Waste-to-diesel technology, especially through pyrolysis, provides an efficient way to convert plastic waste into usable diesel fuel.

This process not only reduces pollution but also creates a valuable energy source. Governments and local bodies are encouraging the recovery of fuel from waste by setting up collection systems and supporting clean fuel alternatives. As the problem of plastic waste grows, more industries and municipalities are turning to this technology to manage waste and produce clean fuel.

Restraining Factors

High Setup Costs Limiting Commercial Scale Adoption

A key restraining factor in the Waste to Diesel Market is the high cost of setting up and operating conversion plants. Technologies like pyrolysis and gasification require advanced equipment, skilled labor, and strict safety systems, all of which add to the initial investment. In many regions, especially in developing countries, this cost becomes a major barrier to implementation. Additionally, waste sorting and pre-treatment processes increase operational expenses.

Small and medium enterprises often find it difficult to secure funding for such capital-intensive projects. Without strong financial support, subsidies, or long-term policies from governments, many potential projects remain at the pilot or demonstration stage, limiting the market’s expansion and reducing the overall impact of this promising technology.

Growth Opportunity

Government Support Creating New Investment Growth Avenues

One major growth opportunity in the Waste to Diesel Market comes from increasing government support for clean energy and waste management solutions. Many countries are introducing favorable policies, tax benefits, and financial incentives to promote waste-to-fuel technologies. These efforts aim to reduce landfill usage, cut greenhouse gas emissions, and support renewable energy goals.

National and local programs are encouraging public-private partnerships, funding pilot projects, and helping scale up commercial plants. As environmental concerns rise, waste-to-diesel systems are being recognized as practical solutions to both energy and waste problems. This growing policy push is opening new investment opportunities for companies and entrepreneurs, especially in regions with large waste volumes and strong demand for cleaner fuel alternatives.

Latest Trends

Mobile Waste-To-Diesel Units Gaining Strong Interest

A key trend emerging in the Waste to Diesel Market is the development of mobile and modular waste-to-diesel units. These compact systems can be transported and installed directly at waste generation sites, such as industrial zones, landfills, or remote areas. By reducing the need for long-distance waste transport and centralized processing, mobile units lower overall costs and improve fuel recovery efficiency.

They are especially useful in rural or disaster-affected areas where permanent infrastructure may not exist. Many innovators and startups are focusing on container-sized pyrolysis units that can process plastic and municipal waste on-site. This trend is making the technology more flexible, scalable, and accessible, helping to expand its use across diverse geographies and smaller waste markets.

Regional Analysis

In 2024, Europe led the Waste to Diesel Market with a 45.80% share.

In 2024, Europe dominated the global Waste to Diesel Market, accounting for 45.80% of the total market share, valued at USD 377.3 million. This leadership position is supported by the region’s strong regulatory framework, circular economy goals, and widespread adoption of advanced waste recovery technologies.

Countries across Western and Central Europe have implemented strict landfill diversion targets and plastic waste reduction policies, which have encouraged investment in waste-to-fuel systems. The presence of established waste management infrastructure and supportive government initiatives has further accelerated the adoption of pyrolysis and similar technologies for diesel production.

In North America, the market is gaining traction, driven by environmental mandates and the need for alternatives to fossil diesel, especially in industrial and transport sectors. Asia Pacific is showing growing interest, particularly in urban centers where rising waste generation is pushing the demand for scalable waste conversion solutions.

Meanwhile, the Middle East & Africa and Latin America remain at earlier stages of market development, with growing awareness and pilot projects beginning to shape future opportunities. However, these regions currently contribute smaller shares compared to Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Amec Foster Wheeler emerged as a technical enabler, leveraging its extensive engineering and project management capabilities. It assumed a critical role in designing and commissioning large‑scale waste conversion facilities. The company’s experience in complex industrial infrastructure enabled efficient integration of pyrolysis systems into existing operations. Its contributions helped to streamline process optimization and compliance adherence, reinforcing its position as a trusted engineering partner for industrial‑scale deployment.

Klean Industries Inc. is recognized for its focus on modular and scalable waste processing solutions. By developing compact units suitable for diverse geographic and logistical environments, the company addressed the need for flexible installations. Such adaptability enabled deployment in both densely populated urban zones and remote locations. Klean’s modular focus allowed for phased expansion, reducing capital burden and enhancing accessibility for mid‑sized operators.

Plastic2Oil Inc. distinguished itself by emphasizing feedstock versatility, particularly in converting municipal and plastic waste streams into high‑grade diesel. The company’s technological refinements enhanced yield and product quality, positioning it as a specialist in efficient conversion pathways. Its approach held promise for improving economic feasibility where feedstock composition varied.

Reworld adopted a supply‑chain oriented strategy, integrating collection, pre‑treatment, and conversion under a unified model. This end‑to‑end coordination aimed to secure steady waste inputs and end‑product distribution. By controlling multiple value‑chain stages, Reworld reinforced operational reliability and optimized logistics, enhancing its competitive posture.

Top Key Players in the Market

- Amec Foster Wheeler

- Klean Industries Inc

- Plastic2Oil Inc.

- Reworld

- Veolia Environnement

- TotalEnergies

- Rentech Inc

- Enerkem

Recent Developments

- In July 2025, Klean Industries completed a Detailed Feasibility Study (DFS) for a plastic pyrolysis facility in Abbotsford, British Columbia, in partnership with Terragreen Investments. The plant is designed to process 10,000 tonnes per year of non-recycled plastics, producing high-grade pyrolysis oil for sustainable aviation fuel and road-use decarbonized fuels. Construction is planned for early 2026.

- In March 2025, Klean signed a Memorandum of Understanding (MOU) with Viva Energy to explore building a tire recycling facility in Melbourne, capable of processing up to 80,000 tonnes of used tyres per year. This facility is designed to extract recovered carbon black, steel, and biogenic pyrolysis oil for low‑carbon fuel production.

Report Scope

Report Features Description Market Value (2024) USD 824.6 Million Forecast Revenue (2034) USD 2,515.7 Million CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Oil and Fat Waste, Municipal Waste, Plastic Waste, Others), By Technology (Gasification, Pyrolysis, Depolymerisation, Incineration), By Application (Transportation Fuels, Industrial Fuels, Power Generation, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Amec Foster Wheeler, Klean Industries Inc, Plastic2Oil Inc., Reworld, Veolia Environnement, TotalEnergies, Rentech Inc, Enerkem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amec Foster Wheeler

- Klean Industries Inc

- Plastic2Oil Inc.

- Reworld

- Veolia Environnement

- TotalEnergies

- Rentech Inc

- Enerkem