Global Vutrisiran Market By Product Type (Antisense Oligonucleotide, Nucleotide, Nucleic Acids, Nucleoside and Others), By Route of Administration (Oral, Subcutaneous and Injectable), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177517

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

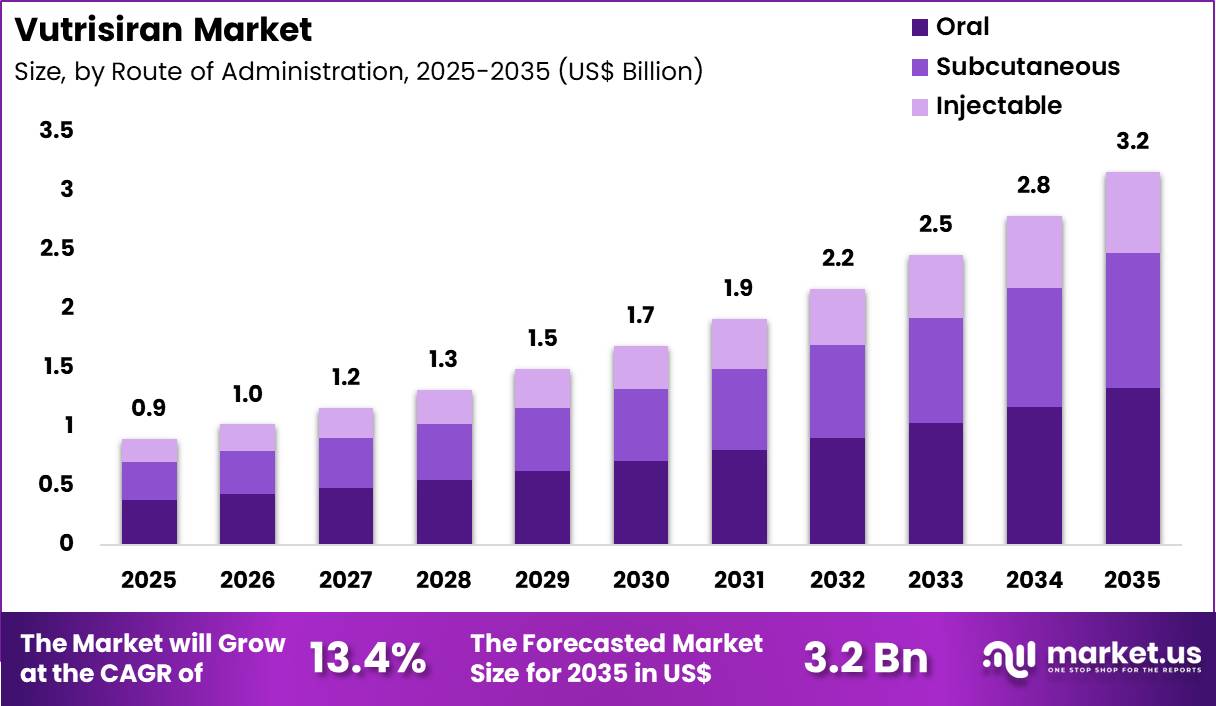

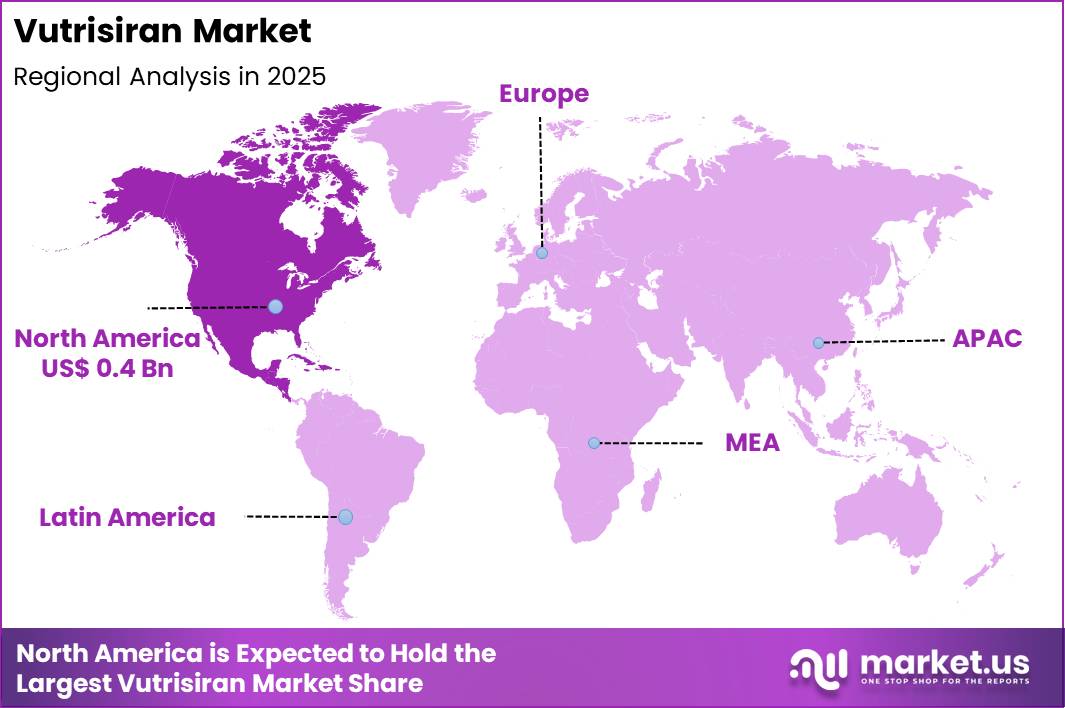

Global Vutrisiran Market size is expected to be worth around US$ 3.2 Billion by 2035 from US$ 0.9 billion in 2025, growing at a CAGR of 13.4% during the forecast period 2025 to 2035. In 2025, North America led the market, achieving over 39.9% share with a revenue of US$ 0.4 Billion.

Increasing awareness of hereditary transthyretin-mediated amyloidosis propels the Vutrisiran market as patients and clinicians seek targeted RNAi therapeutics that silence mutant TTR gene expression to halt disease progression.

Physicians increasingly prescribe Vutrisiran for polyneuropathy symptoms in adult hATTR patients, where quarterly subcutaneous injections reduce neuropathic pain, improve motor function, and enhance quality of life by minimizing amyloid deposition in peripheral nerves. These applications extend to managing autonomic dysfunction, where Vutrisiran stabilizes gastrointestinal motility and orthostatic hypotension by curbing TTR protein buildup.

Cardiologists utilize the drug in off-label contexts for cardiomyopathy manifestations, addressing cardiac rhythm disturbances and heart failure through reduced amyloid infiltration in myocardial tissue. Oncologists explore Vutrisiran in combination regimens for amyloid-related complications in plasma cell dyscrasias, leveraging its gene-silencing mechanism to complement chemotherapy and improve organ function.

Pharmaceutical developers pursue opportunities to expand Vutrisiran indications through clinical trials targeting pediatric hATTR populations, potentially offering early intervention that prevents irreversible nerve and cardiac damage. Companies advance formulations with extended dosing intervals, broadening applications in elderly patients requiring simplified regimens for long-term adherence.

These innovations facilitate partnerships with diagnostic firms to integrate genetic screening, identifying candidates earlier for proactive therapy initiation. Opportunities emerge in hybrid therapies combining Vutrisiran with small molecule stabilizers, optimizing outcomes in multi-organ involvement. Recent trends emphasize patient-centric delivery systems and real-world evidence collection, positioning Vutrisiran as a cornerstone in value-based care for rare genetic disorders.

Key Takeaways

- In 2025, the market generated a revenue of US$ 0.9 Billion, with a CAGR of 13.4%, and is expected to reach US$ 3.2 Billion by the year 2035.

- The product type segment is divided into antisense oligonucleotide, nucleotide, nucleic acids, nucleoside and others, with antisense oligonucleotide taking the lead with a market share of 46.8%.

- Considering route of administration, the market is divided into oral, subcutaneous and injectable. Among these, oral held a significant share of 41.9%.

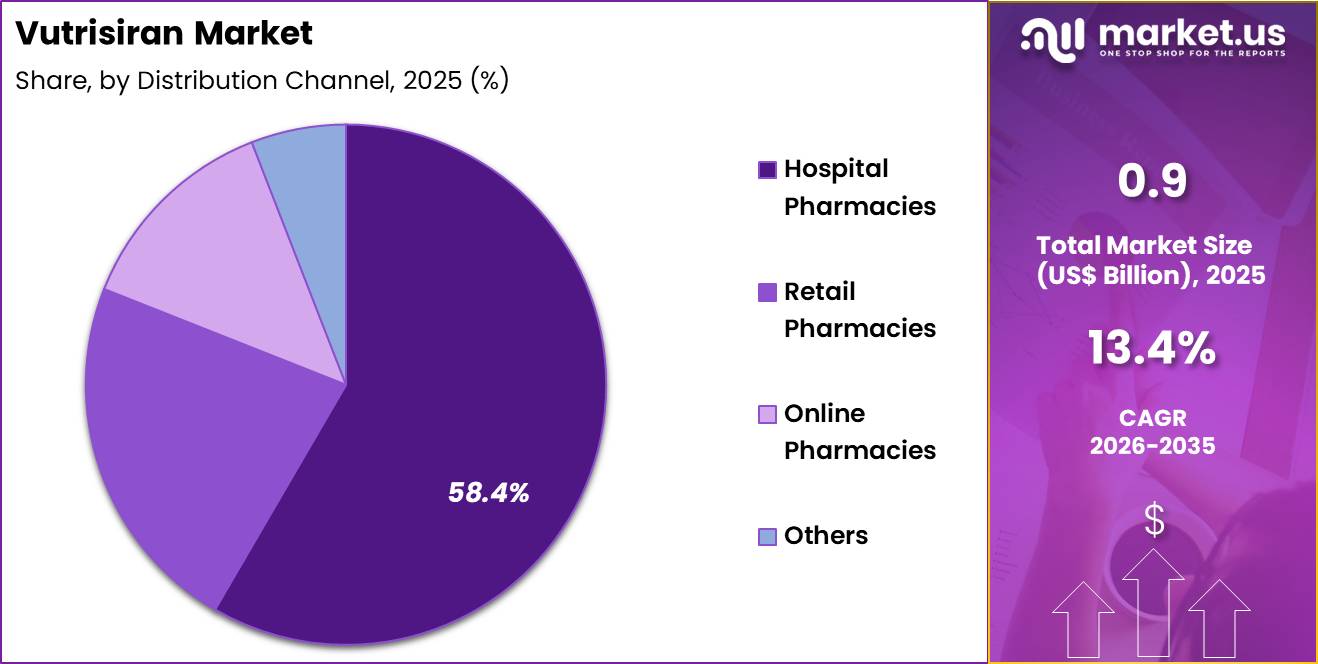

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, online pharmacies, retail pharmacies and others. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 58.4% in the market.

- North America led the market by securing a market share of 39.9%.

Product Type Analysis

Antisense oligonucleotide contributed 46.8% of growth within product type and led the Vutrisiran market due to its targeted mechanism of action and strong clinical alignment with disease-modifying therapy strategies. Clinicians and researchers favor antisense oligonucleotides because they enable precise gene expression control at the RNA level, which supports long-term disease management.

High specificity reduces off-target effects, improving treatment confidence among prescribers. Ongoing advancements in oligonucleotide chemistry enhance stability and tissue delivery, which strengthens adoption across therapeutic programs.

Growth strengthens as precision medicine approaches gain traction in rare and chronic disease management. Investment in RNA-based therapeutics increases manufacturing scale and clinical familiarity. Regulatory pathways for antisense therapies continue to mature, which reduces development risk. Expanded clinical evidence supports sustained prescribing. The segment is expected to remain dominant as RNA-targeted interventions continue to redefine treatment paradigms.

Route of Administration Analysis

Oral administration generated 41.9% of growth within route of administration and emerged as the leading segment due to patient preference for convenient and non-invasive dosing. Oral delivery improves adherence by reducing clinic visits and procedural burden.

Patients managing long-term therapy value simplified routines that integrate easily into daily life. Healthcare providers recognize improved compliance outcomes associated with oral regimens, which supports prescribing confidence.

Growth accelerates as formulation technologies improve bioavailability and dosing consistency. Home-based care trends favor oral therapies that reduce dependence on healthcare facilities. Payer considerations also support oral routes due to lower administration costs. Expanded patient education further reinforces acceptance. The segment is anticipated to sustain leadership as treatment models increasingly prioritize convenience and adherence.

Distribution Channel Analysis

Hospital pharmacies accounted for 58.4% of growth within distribution channel and dominated the Vutrisiran market due to their role in managing specialized and high-value therapies. Hospitals oversee therapy initiation, monitoring, and follow-up, which centralizes dispensing within institutional settings.

Clinical oversight requirements and inventory control strengthen reliance on hospital pharmacies. Multidisciplinary care coordination further supports hospital-based distribution.

Growth continues as treatment protocols emphasize supervised initiation and outcome monitoring. Hospital pharmacies maintain cold-chain and handling capabilities required for advanced therapeutics. Reimbursement processes align closely with hospital dispensing models. Patient trust in institutional care reinforces channel preference. The segment is projected to remain the primary growth driver as specialized therapy management continues to concentrate within hospital systems.

Key Market Segments

By Product Type

- Antisense Oligonucleotide

- Nucleotide

- Nucleic Acids

- Nucleoside

- Others

By Route of Administration

- Oral

- Subcutaneous

- Injectable

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Drivers

Increasing prevalence of ATTR amyloidosis is driving the market.

The growing number of diagnosed cases of ATTR amyloidosis has significantly boosted the demand for targeted treatments like Vutrisiran, which addresses the underlying protein misfolding in this rare condition. Enhanced genetic testing and awareness among physicians have contributed to earlier identification, expanding the patient base eligible for RNA interference therapies.

Healthcare systems are prioritizing orphan drugs to manage the progressive neuropathy and cardiomyopathy associated with ATTR. Regulatory incentives for rare diseases encourage pharmaceutical investments in specialized treatments such as Vutrisiran. The correlation between cardiac involvement and mortality in ATTR patients underscores the need for efficacious options to halt disease progression.

National registries track rising cases, prompting greater resource allocation for amyloidosis management. Key developers focus on subcutaneous formulations to improve patient adherence in long-term therapy. This driver aligns with global efforts to tackle hereditary disorders through innovative biotechnology.

According to a study using Clarivate Real-World Data from 2016-2023, the estimated incidence of ATTR amyloidosis in the USA in 2022 was 16.6 cases per million people using a narrow definition. Overall, the prevalence trend sustains market momentum for Vutrisiran as a leading therapeutic in this space.

Restraints

High competition from alternative therapies is restraining the market.

The presence of established treatments for ATTR amyloidosis, such as inotersen and eplontersen, competes directly with Vutrisiran for market share in polyneuropathy management. Pricing pressures from generics and biosimilars in related categories limit premium positioning for newer RNA-based drugs. Healthcare payers scrutinize cost-effectiveness, often favoring older therapies with proven long-term data over innovative options.

Regulatory hurdles for label expansions delay competitive advantages for Vutrisiran in cardiomyopathy indications. In regions with limited access to specialty care, simpler oral alternatives gain preference over injectable formulations. Providers weigh administration convenience against efficacy when selecting among multiple RNAi and stabilizer drugs. This restraint curtails rapid adoption in saturated therapeutic landscapes.

Collaborative pricing negotiations aim to mitigate these competitive challenges. Despite unique mechanisms, overlapping indications hinder exclusive market penetration for Vutrisiran. According to Alnylam’s 2024 SEC filing, Vutrisiran competes with therapies like TEGSEDI, WAINUA, VYNDAQEL, and ATTRUBY in various ATTR segments.

Opportunities

Strong revenue growth of Vutrisiran is creating growth opportunities.

The robust sales performance of Vutrisiran opens avenues for expanded indications and geographic reach in the ATTR treatment landscape. Increased adoption in hereditary polyneuropathy supports investments in combination therapies for comprehensive disease management. Healthcare collaborations facilitate access programs, enhancing patient uptake in underserved populations.

Strategic partnerships with distributors enable compliance and entry into new markets for RNA therapeutics. The substantial revenue base amplifies R&D funding for next-generation formulations of Vutrisiran. Policy advancements in orphan drug reimbursements bolster infrastructure for broader distribution.

According to Alnylam’s 2024 SEC filing, net product revenues for AMVUTTRA (Vutrisiran) were $93,795 thousand in 2022, $557,838 thousand in 2023, and $970,450 thousand in 2024. This opportunity corresponds with initiatives to elevate standards in rare disease care. Primary corporations initiate expansions to capitalize on economic recoveries in biopharma. Focused developments can yield notable progress in ATTR management segments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the Vutrisiran market through payer budgets, reimbursement scrutiny, and funding stability for rare disease therapies. Inflation and higher interest rates increase pressure on healthcare spending, which intensifies value based assessments and lengthens access discussions with payers.

Geopolitical tensions affect global supply chains for oligonucleotide inputs, lipid excipients, and specialized manufacturing equipment, raising operational complexity. Current US tariffs on imported raw materials and precision components increase production and logistics costs, which tightens margins across the value chain. These challenges can slow market expansion and elevate negotiation intensity around pricing and access.

On the positive side, trade pressure supports domestic manufacturing investment, supply chain redundancy, and long term sourcing contracts. Strong clinical demand for durable RNA based treatments in hereditary transthyretin amyloidosis sustains utilization momentum. With disciplined cost management, regulatory support for orphan drugs, and continued innovation, the market remains positioned for steady and confident growth.

Latest Trends

Submission for expanded indication in ATTR-CM is a recent trend in the market.

In 2024, the filing of supplemental applications for Vutrisiran in cardiomyopathy marked a shift toward broader ATTR therapeutic coverage. These submissions leverage Phase 3 data demonstrating cardiovascular benefits in affected patients. Manufacturers prioritize regulatory pathways to expedite reviews for label expansions in structural heart conditions.

Clinical analyses emphasized reduced mortality risks with quarterly dosing regimens. Alnylam submitted a supplemental New Drug Application to the FDA in 2024 for Vutrisiran in ATTR amyloidosis with cardiomyopathy, accepted with a PDUFA date of March 23, 2025. This progress addresses unmet needs in wild-type and hereditary cardiomyopathy variants.

Industry focus on parallel filings in Europe and Japan accelerates global availability. The trend incorporates real-world evidence to support efficacy in diverse ATTR phenotypes. Sector synergies refine protocols for integrated neuropathy and cardiomyopathy care. These evolutions position expanded indications as central to Vutrisiran’s market trajectory in 2025.

Regional Analysis

North America is leading the Vutrisiran Market

North America held a 39.9% share of the Vutrisiran market in 2024, supported by strong uptake of RNA interference therapies across specialized neurology and cardiology centers. Clinicians increasingly favored long-acting treatments that reduce dosing frequency and improve adherence for patients with hereditary transthyretin amyloidosis.

Earlier diagnosis through genetic testing programs expanded the treated patient pool, while specialist networks accelerated therapy initiation after confirmation. Payer familiarity with orphan drugs improved access pathways for eligible patients. Patient advocacy efforts also raised disease awareness among physicians and families.

Established cold-chain logistics and specialty pharmacy support strengthened consistent delivery. A relevant indicator of the underlying demand environment comes from the National Institutes of Health, which states that rare diseases collectively affect an estimated 25 to 30 million people in the US, reinforcing the growing focus on advanced therapies for small but high-need populations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Vutrisiran market in Asia Pacific is expected to grow steadily during the forecast period as rare disease recognition and treatment access improve across key countries. Governments invest in orphan drug frameworks to accelerate approvals and reimbursement decisions. Specialist centers expand genetic screening, which increases identification of transthyretin amyloidosis cases.

Cross-border collaboration and medical tourism also support access to advanced therapies in regional hubs. Physician training and guideline updates strengthen confidence in RNA-based treatments. Improving cold-chain infrastructure supports wider distribution beyond top tier cities.

A clear signal of commercial momentum comes from Alnylam Pharmaceuticals, which reported total global net revenues of about USD 1.05 billion in 2023, reflecting expanding international adoption of its RNA interference portfolio and supporting continued growth potential across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the vutrisiran market drive growth by deepening clinical evidence through robust Phase III trials, securing expanded regulatory approvals that broaden indications beyond hereditary polyneuropathy to include cardiomyopathy, and investing in physician and payer education to support broader adoption in rare disease care pathways.

They also strengthen their position by forming strategic alliances and co-commercialization partnerships to accelerate global reach and share development risk, particularly across North America, Europe, and emerging healthcare markets.

Firms tailor patient access programs and reimbursement strategies to reduce out-of-pocket cost barriers and improve long-term treatment continuity for eligible patients living with transthyretin amyloidosis. Geographic expansion into high-potential regions with rising diagnosis rates and enhanced rare disease infrastructure further supports volume growth projections that anticipate double-digit CAGR over the next decade.

Alnylam Pharmaceuticals Inc. stands as a leading RNA interference-focused biopharma company headquartered in Cambridge, Massachusetts, with a strategic emphasis on genetically defined diseases and a growing portfolio of RNAi therapeutics including its AMVUTTRA (vutrisiran) program backed by global regulatory clearances and coordinated commercialization efforts.

The company advances performance through disciplined research investment, targeted partnerships, and a commercialization strategy that connects novel genetic science with unmet clinical needs.

Top Key Players

- Alnylam Pharmaceuticals

- Sanofi

- Regeneron Pharmaceuticals

- Ionis Pharmaceuticals

- Pfizer

- Takeda Pharmaceutical

- Roche

- AstraZeneca

- Novartis

- Eli Lilly

Recent Developments

- In August 2025, Alnylam Pharmaceuticals announced a strategic collaboration with a biotechnology partner to jointly advance next-generation therapies for hereditary transthyretin amyloidosis (hATTR). The alliance is intended to strengthen Alnylam’s R&D depth and shorten development timelines, while broadening its late-stage pipeline and supporting improved clinical outcomes through advanced therapeutic approaches.

- In September 2025, Sanofi rolled out an initiative to widen patient access to Vutrisiran by expanding distribution across emerging markets. The program aims to extend the therapy’s geographic reach and aligns with global access objectives, positioning Sanofi to address rising demand for hATTR treatments in underserved regions.

Report Scope

Report Features Description Market Value (2025) US$ 0.9 Billion Forecast Revenue (2035) US$ 3.2 Billion CAGR (2026-2035) 13.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Antisense Oligonucleotide, Nucleotide, Nucleic Acids, Nucleoside and Others), By Route of Administration (Oral, Subcutaneous and Injectable), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alnylam Pharmaceuticals, Sanofi, Regeneron Pharmaceuticals, Ionis Pharmaceuticals, Pfizer, Takeda Pharmaceutical, Roche, AstraZeneca, Novartis, Eli Lilly Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alnylam Pharmaceuticals

- Sanofi

- Regeneron Pharmaceuticals

- Ionis Pharmaceuticals

- Pfizer

- Takeda Pharmaceutical

- Roche

- AstraZeneca

- Novartis

- Eli Lilly