Global Voicebot Market Size, Share, Industry Analysis Report By Type (Rule-based Voice Bots, AI-assisted Voice Bots, and Conversational Voice Bots), By Technology (Natural Language Understanding (NLU), Natural Language Processing (NLP), Machine learning, ASR (automatic speech recognition), TTS (Text to Speech), and Others), By Application (Banking, Travel, Consumer Durables, Retail and eCommerce, and Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162690

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

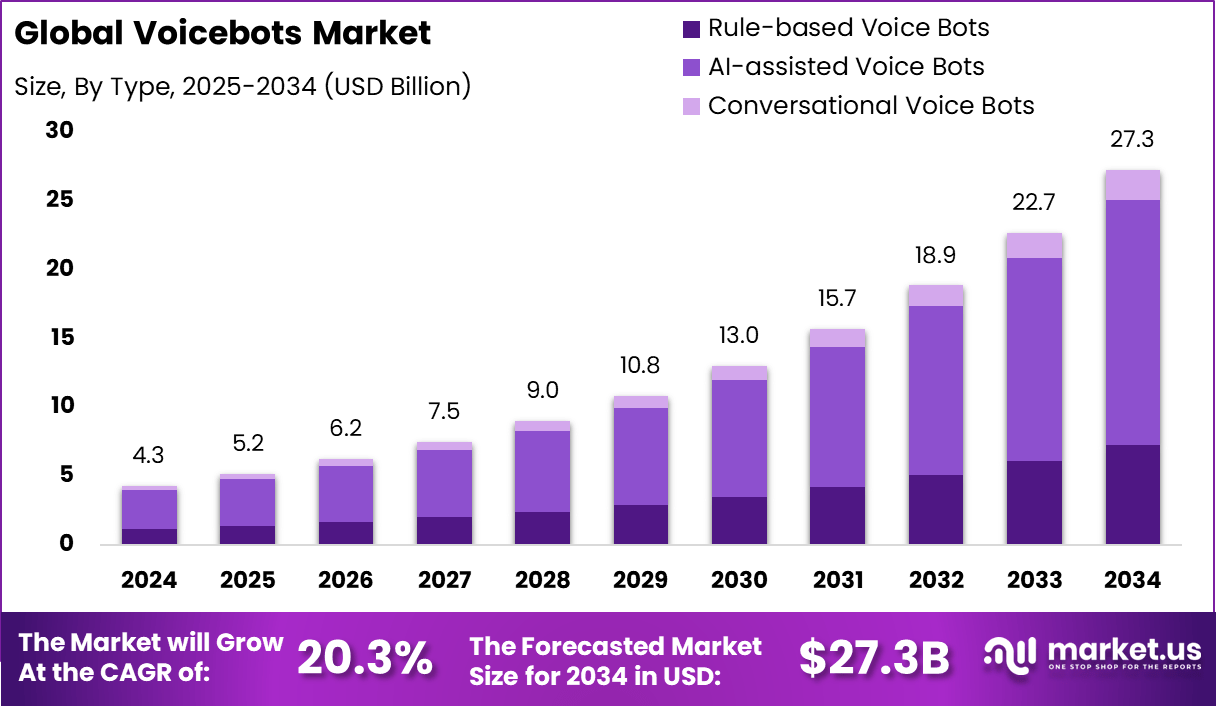

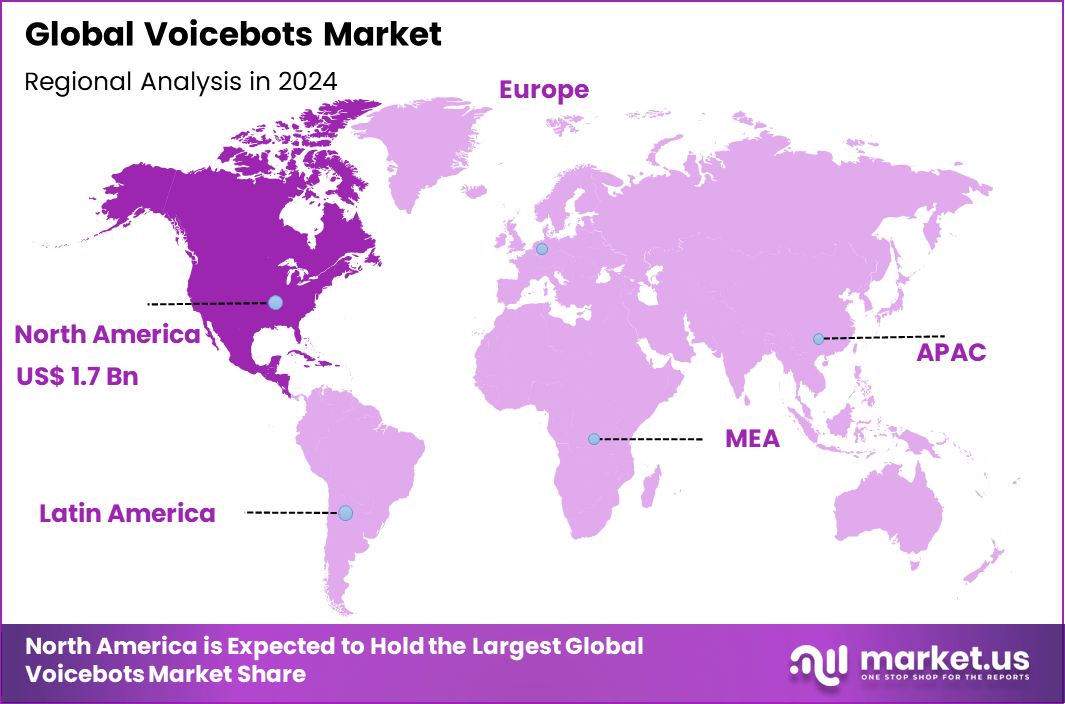

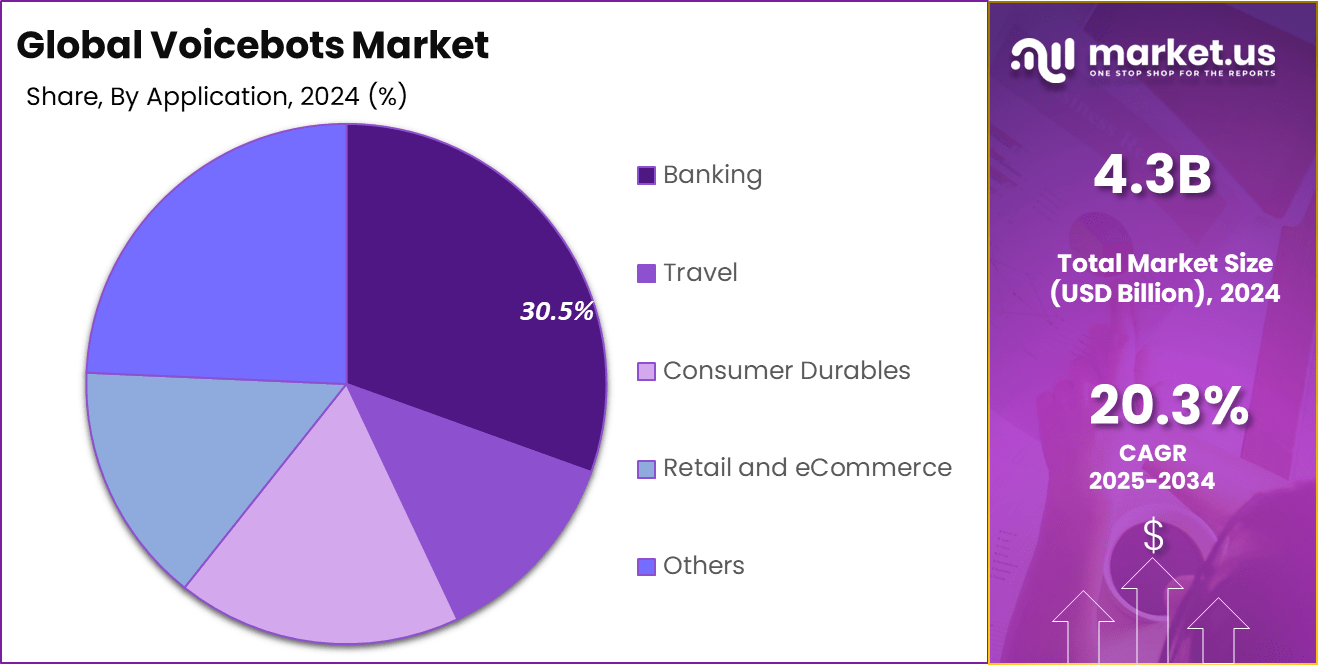

The Global Voicebots Market size is expected to be worth around USD 27.3 billion by 2034, from USD 4.3 billion in 2024, growing at a CAGR of 20.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.7% share, holding USD 1.7 billion in revenue.

The Voicebots market is rapidly evolving as these AI-powered conversational agents gain traction across industries. Voicebots are digital assistants that interact with users through natural spoken language, relying on speech recognition and natural language processing (NLP) technologies. Increasingly, they are preferred over traditional text-based chatbots due to their hands-free convenience and more natural user experience.

Voicebots provide seamless communication in various applications like customer support, smart devices, healthcare, and banking, with over 90% of routine customer interactions now able to be automated through voicebots, cutting wait times by nearly half and boosting customer satisfaction by around 30%.

The main factors that support growth in the voicebots market include increasing demand for hands-free and natural interaction modes, rising adoption of smart speakers and voice assistants, and the desire of organisations to improve customer experience while reducing operational cost. The move to virtual and remote engagement models has also accelerated interest in voice-enabled automation.

According to verloop.io, By 2024, there will be around 8.4 billion voice assistants worldwide. The AI in Voice Assistants Market is projected to reach USD 31.9 billion by 2033. Nearly 91% of users access voice assistants through smartphones, and 74% prefer using them at home. Additionally, half of global consumers (50%) report that AI has already influenced their daily lives.

Demand is strongest among sectors such as banking, financial services and insurance (BFSI), retail, healthcare and telecommunications, where voicebots are used for call-center automation, self-service, appointment scheduling and voice commerce. Regions such as North America currently lead in adoption owing to mature infrastructure and high deployment of voice-enabled devices. Meanwhile, Asia-Pacific represents a region of rapid growth as mobile penetration rises and enterprises invest in voice solutions.

Key Takeaways

- The global Voicebot Market reached USD 4.3 Billion in 2024 and is projected to grow steadily at a 20.3% CAGR from 2025 to 2034, driven by increasing enterprise automation and customer experience optimization.

- AI-assisted voice bots dominated with 65.2% share in 2024, supported by their superior ability to deliver contextual, personalized, and human-like interactions compared to traditional rule-based models.

- By technology, Natural Language Understanding (NLU) led with 25.4%, reflecting the growing demand for deep semantic analysis to enhance conversational accuracy and intent recognition.

- The Banking, Financial Services & Insurance (BFSI) sector held the largest share at 30.5%, leveraging voicebots for round-the-clock customer service, fraud detection, and secure voice-based authentication.

- North America led regionally with 39.7% of the global market, while the US alone accounted for USD 1.57 Billion in 2024, supported by strong enterprise AI adoption and integration of voice-driven technologies across sectors.

Performance Highlights

User Statistics

- Over 8 billion voice-enabled devices are in use worldwide.

- 65% of adults aged 25-49 use voicebot platforms for daily interactions.

- The number of voice assistant users was expected to reach 1.8 billion in 2021.

Business and Operational Statistics

- Businesses adopting AI voicebots can achieve up to 80% lower operational costs.

- Customer satisfaction can increase by 75% with AI-driven voice interactions.

- A contact center study found that if voicebots handle 50% of inbound requests, staffing could be reduced by 40%.

- AI agents can reach 99% accuracy and automate over 60% of interactions, delivering strong ROI.

- The global voice-based customer service market is projected to grow to $5.6 billion by 2028.

Performance and Accuracy Statistics

- Voice word accuracy rates now exceed 90% across most major platforms.

- Advanced systems show 92% transcription accuracy with 1.5-second response times.

- 71% of consumers prefer voice search over typing.

- 53.1% of users say the most important feature of a voice assistant is its ability to understand speech accurately.

Role of Generative AI

Generative AI has transformed voicebots from basic command responders to advanced conversational agents that deliver richer, more natural user interactions. In 2025, over 115 million daily active users engage with generative AI technologies, reflecting its growing acceptance and utility. These AI-powered voicebots leverage real-time context awareness, enabling them to remember user preferences and tailor responses more humanely.

The technology has led to a reported 40% reduction in call handling time for companies, while improving the quality and empathy of customer service interactions. This shift indicates that generative AI is no longer an add-on but central to voicebot performance and user satisfaction. Generative AI voicebots drive enhanced personalization and multi-lingual support, making global communication seamless and inclusive.

According to recent findings, 67% of users approve of artificial intelligence managing support tasks, with 91% of customer experience leaders vouching for its ability to offer highly personalized services. This acceptance fuels continuous optimization of voicebot capabilities, positioning generative AI as a critical innovation for automating complex and sensitive conversational scenarios across finance, healthcare, and retail sectors.

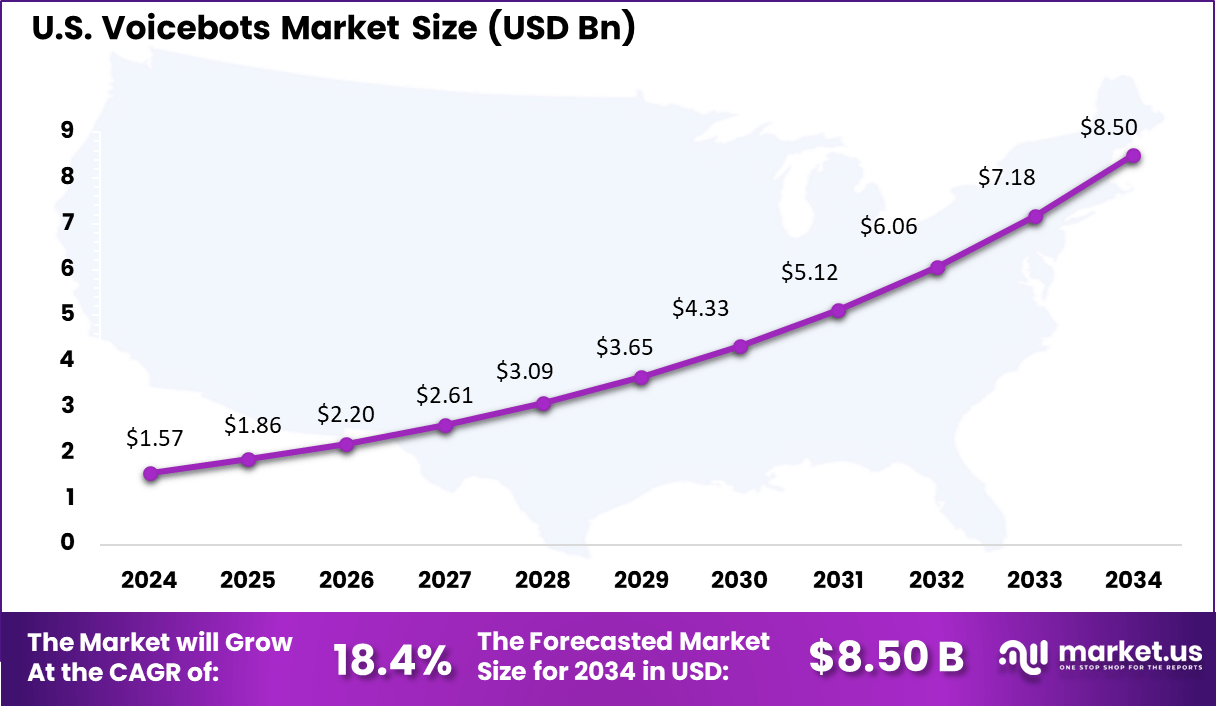

U.S. Voicebots Market

The U.S. voicebots market is one of the most advanced globally, valued at USD 1.57 billion in 2024, and is projected to expand steadily with a CAGR of 18.4% through 2034. The strong adoption is driven by the country’s mature digital ecosystem, high smartphone penetration, and widespread use of AI-driven virtual assistants across industries.

American enterprises are increasingly leveraging voicebots to streamline operations, improve customer engagement, and reduce service costs. For instance, Bank of America’s Erica voice assistant has handled over a billion client interactions, offering automated banking services and personalized financial guidance.

In retail, Walmart has integrated voice-based shopping assistants, enabling customers to place orders through smart speakers like Google Home. The healthcare sector is also adopting voicebots, with solutions like Orbita providing voice-driven patient engagement tools, appointment scheduling, and medication reminders.

In 2024, North America leads the global voicebot market with a 39.7% share, supported by early AI adoption and advanced telecom infrastructure. Businesses across the U.S. and Canada are rapidly integrating voice automation into customer service frameworks to improve scalability and client retention. Strong investment from technology providers has positioned the region as a leader in speech processing and language learning innovation.

By Type

In 2024, AI-assisted voice bots hold the dominant share at 65.2% of the global voicebot market. These platforms combine automated speech recognition with contextual machine learning to handle customer queries more effectively. Their hybrid design allows them to escalate complex requests to human agents when required, maintaining both efficiency and accuracy.

Businesses favor them for their ability to deliver personalized interactions, reduce waiting times, and provide consistent service across voice channels. This segment’s growth is closely linked with advances in conversational AI and multilingual support, which allow users to communicate naturally and seamlessly.

Enterprises are integrating AI-assisted voicebots in call centers, mobile apps, and smart devices to enhance real-time engagement. As customers increasingly prefer voice over text for service interactions, adoption of AI-driven assistance continues to grow rapidly, especially in customer-intensive industries such as retail, travel, and banking.

By Technology

In 2024, Natural Language Understanding (NLU) contributes around 25.4% of the market share, serving as the foundational layer behind effective voicebot performance. NLU systems help interpret complex user expressions by identifying intent and emotional tone, which leads to more natural conversations.

This technology is enabling voicebots to go beyond scripted responses, making them capable of understanding regional accents, mixed languages, and context. Major improvements in NLU frameworks are enhancing accuracy and reducing misinterpretation in high-volume service environments.

Companies are investing in refining domain-specific models to improve contextual responses for industry-specific use cases. As model training improves through larger data sets, voicebots are becoming more adaptive and intuitive, helping organizations minimize human intervention without losing conversational quality.

By Application

In 2024, The Banking, Financial Services & Insurance (BFSI) segment leads with 30.5% market share due to the sector’s heavy investment in digital client servicing and automation. Voicebots are becoming essential in this field for tasks such as balance inquiries, fraud detection alerts, and investment support.

Banks are implementing personalized voice assistants that integrate with mobile apps and ATMs to simplify account management and enhance customer convenience. Security has also become a key driver for voicebot use in the BFSI sector. Modern implementations now incorporate biometric voice recognition and real-time fraud analytics for safer authentication.

Financial institutions see these tools as vital in reducing operational costs and maintaining 24/7 support availability. This makes AI-powered voice automation a critical component in improving customer experience and operational resilience in the financial landscape.

Global Voicebots Market Segments

By Type

- Rule-based Voice Bots

- AI-assisted Voice Bots

- Conversational Voice Bots

By Technology

- Natural Language Understanding (NLU)

- Natural Language Processing (NLP)

- Machine learning

- ASR (automatic speech recognition)

- TTS (Text to Speech)

- Others

By Application

- Banking

- Automated Banking Services

- Customer Support

- Enhanced Security

- Others

- Travel

- Travel Information

- Hotel and Travel Reservations

- Language Translation

- Others

- Consumer Durables

- Product Information

- Personalized Recommendations

- Remote Diagnostics

- Retail and eCommerce

- Voice-guided Customer Support

- Analytics

- Others

Driver Analysis

Growing Demand for 24/7 Customer Support

A major driver for the voicebot market is the rising demand for round-the-clock customer service. Businesses across sectors are looking to provide seamless, always-on support to customers without the constraints of human agent availability.

Voicebots, powered by advanced AI and natural language processing, offer an efficient solution by handling common queries and tasks at any time, increasing customer satisfaction and operational efficiency. This continuous availability helps companies reduce wait times and costly staffing challenges while meeting consumer expectations for instant responses.

Additionally, the increasing adoption of smart devices and voice assistants among consumers has made voice interactions more familiar and accepted. This has boosted the overall demand for voicebot technology in both consumer and enterprise applications, fueling market growth as companies strive to enhance user experience through hands-free, conversational interfaces.

Restraint Analysis

Privacy and Security Concerns

One significant restraint slowing voicebot adoption is the growing concern over data privacy and security. With voicebots processing sensitive user information like financial details or health data, ensuring secure interactions is critical.

Vulnerabilities such as deepfake voice cloning and unauthorized data access create fears among users and regulators, leading to stricter compliance requirements. These constraints increase the complexity and cost of deploying voicebots, particularly in regulated industries such as healthcare and finance.

Moreover, persistent fears about voice recordings being misused or stored without consent create a trust barrier for some consumers. Companies must invest heavily in robust encryption, biometric verification, and transparent privacy policies to gain user confidence, which can delay market expansion despite the technology’s capabilities.

Opportunity Analysis

Multilingual and Regional Language Support

Expanding voicebot capabilities to support multiple languages and regional dialects presents a major growth opportunity. Many emerging markets are digitally underserved due to language barriers in existing voice AI solutions, which often focus on major languages like English or Mandarin.

Customized voicebots that understand local languages and accents can unlock vast new customer bases and drive adoption in regions such as South Asia, Africa, and Latin America. This localization enhances user experience and makes voicebots more relevant across diverse populations.

Businesses can leverage this by offering tailored services in native languages to access previously unreachable markets. Furthermore, integrating voicebots with IoT and smart environments in vernacular languages opens new possibilities in sectors like retail, healthcare, and smart homes, expanding the overall voicebot ecosystem.

Challenge Analysis

Technical Limitations in Natural Language Understanding

A key challenge in voicebot deployment remains the technical difficulty of accurately understanding and processing human language in real-time. Despite advancements, voicebots often struggle with complex conversations, slang, accents, or overlapping speech, which can reduce effectiveness and frustrate users. This limitation restricts voicebots primarily to handling basic or scripted interactions rather than nuanced dialogues.

Improving natural language understanding requires continuous investment in AI, machine learning, and speech recognition improvements. Additionally, creating domain-specific voicebots that understand specialized terminology adds further development complexity. These technical hurdles slow the pace of adoption, especially in industries needing high accuracy and sensitivity in communication, such as legal or healthcare services.

Key Player Analysis

The Voicebot Market is dominated by global technology leaders such as Amazon Web Services, Apple Inc., Google LLC, Microsoft Corporation, and Alibaba Group. These companies have developed advanced conversational AI platforms that support natural language understanding, contextual awareness, and voice-based automation.

Specialized providers including Nuance Communications, NICE, Enghouse Interactive, Aspect Software, and Wit.ai deliver enterprise-grade voicebot solutions focused on customer engagement, call center automation, and voice analytics. Their AI-driven systems enable real-time speech recognition, sentiment analysis, and personalized interactions that enhance service quality and operational efficiency across industries such as banking, healthcare, and retail.

Emerging and regional players such as Neospeech, Smartly.AI, Samsung, and Yandex, along with other key participants, are contributing to multilingual voice synthesis, voice biometrics, and cross-platform integration. Their innovations in neural speech modeling, emotion-based interaction, and low-latency response systems are advancing the global shift toward intelligent, human-like conversational interfaces across both consumer and enterprise ecosystems.

Top Key Players in the Voicebots Market

- AliBaba Group

- Amazon Web Services

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Neospeech

- Samsung

- Smartly.AI

- Yandex

- NICE

- Enghouse Interactive

- Wit.ai

- Aspect Software

- Nuance Communications

- Other Key Players

Recent Developments

- April 2025: BLS International has launched the industry’s first AI-powered VoiceBot in Canada, offering 24/7 assistance for visa and consular services. The system handles FAQs, guides users through documentation, and reduces reliance on human agents, enhancing speed, accuracy, and accessibility. Phase 2 will add 22+ languages, while future phases will introduce AI chatbots, email responses, and quality management solutions, advancing intelligent automation and customer-centric service delivery.

- February 2024: Haloocom has launched Hexa, India’s first multilingual AI voicebot, supporting six major languages – Hindi, English, Tamil, Telugu, Kannada, and Malayalam. Hexa provides 24/7 customer support, understands intent, sentiment, and regional accents, and enhances agent productivity by handling routine queries. Powered by ASR, TTS, and voice biometrics, Hexa aims to expand globally while enabling SMEs to adopt AI-driven, agent-less customer service solutions.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Bn Forecast Revenue (2034) USD 27.3 Bn CAGR(2025-2034) 20.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (Rule-based Voice Bots, AI-assisted Voice Bots, and Conversational Voice Bots), By Technology (Natural Language Understanding (NLU), Natural Language Processing (NLP), Machine learning, ASR (automatic speech recognition), TTS (Text to Speech), and Others), By Application (Banking, Travel, Consumer Durables, Retail and eCommerce, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AliBaba Group, Amazon Web Services, Apple Inc., Google LLC, Microsoft Corporation, Neospeech, Samsung, Smartly.AI, Yandex, NICE, Enghouse Interactive, Wit.ai, Aspect Software, Nuance Communications, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- AliBaba Group

- Amazon Web Services

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Neospeech

- Samsung

- Smartly.AI

- Yandex

- NICE

- Enghouse Interactive

- Wit.ai

- Aspect Software

- Nuance Communications

- Other Key Players