Global Animation Software Market Size, Share Analysis Report By Type (2D Animation, 3D Animation, Stop Motion, Flipbook Animation), By Deployment Mode (Cloud-Based, On-Premise), By Industry Vertical (Media and Entertainment, Education, Healthcare, Automotive, Architecture and Construction, Other Industry Verticals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 132594

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- North America Animation Software Market

- AI Impact on Animation Software

- Type Analysis

- Deployment Mode Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

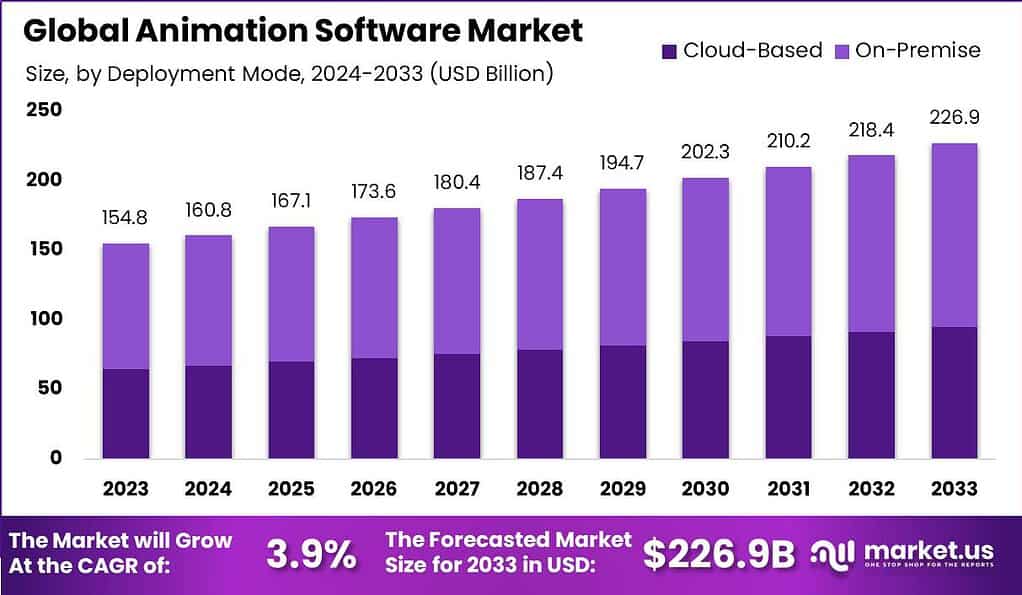

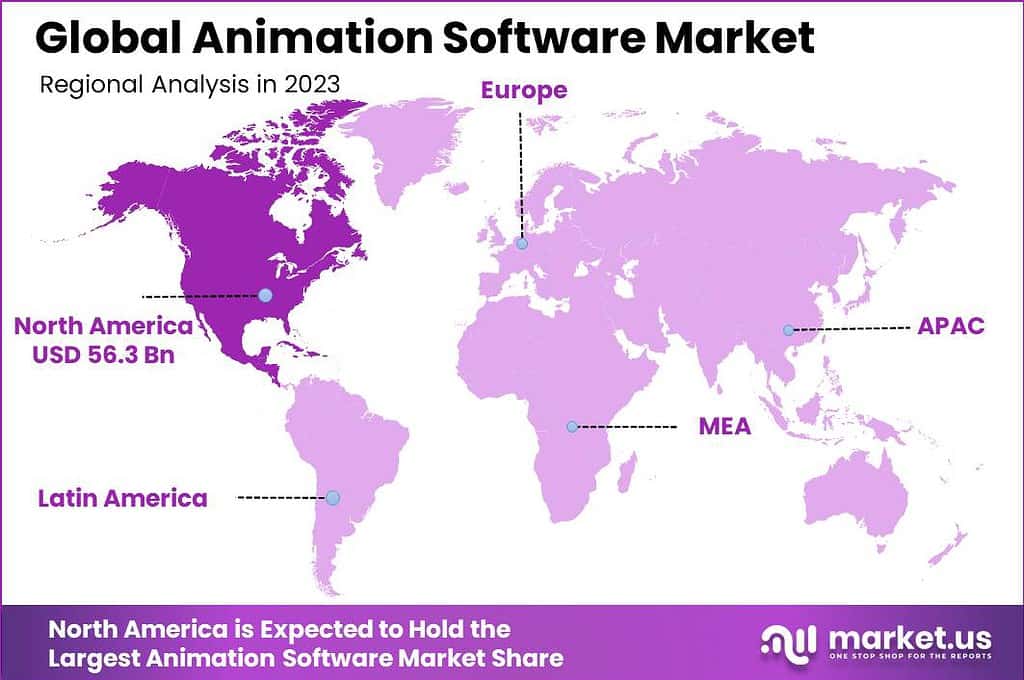

The Global Animation Software Market size is expected to be worth around USD 226.9 Billion By 2033, from USD 154.8 Billion in 2023, growing at a CAGR of 3.9% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 36.4% share, holding USD 56.3 Billion revenue.

Animation software is a category of computer programs designed specifically for the creation of animated graphics. It allows users to generate moving graphics from visual files. Depending on the functionality, users can create everything from simple animations to complex 3D modeling. Such software is utilized in numerous fields including film and video production, gaming, and advertising, to create dynamic and interactive visual content.

The animation software market is a rapidly expanding sector of the digital content creation industry. It encompasses a range of software types, including 2D and 3D animation tools, visual effects software, and character animation solutions. The market caters to professionals in film and television, game developers, and designers, providing them with advanced tools to create detailed animations and effects.

The significant growth in the animation software market can be attributed to several factors. Firstly, the increasing demand for animated movies and cartoons among various age groups fuels the need for sophisticated animation tools. Secondly, the expansion of the gaming industry, where animation plays a critical role in game design and storytelling, also boosts the market growth.

Additionally, advancements in virtual reality (VR) and augmented reality (AR) are pushing professionals to adopt high-quality animation software to create immersive environments. Market demand for animation software is driven by the growing popularity of animated content across television, movies, and online platforms. As consumers engage more with animated content, producers seek efficient and versatile software solutions to reduce production time and enhance creativity.

The rise in independent content creators, leveraging platforms like YouTube and TikTok, also contributes significantly to the demand, as these creators seek accessible professional-grade animation tools. The animation software market is ripe with opportunities, especially with the integration of AI and machine learning technologies.

These technologies automate key animation processes, making the software more accessible to beginners and reducing workload for professionals. The educational sector also presents new opportunities, as schools and universities increasingly incorporate animation into their curricula to enhance learning through interactive media.

For instance, In February 2024, Autodesk, Inc. expanded its capabilities in the media and entertainment sector by acquiring the PIX business from X2X. This acquisition is strategically aimed at enhancing production management solutions, facilitating improved collaboration and secure content review processes among creatives and executives. The move is designed to drive better customer outcomes by streamlining communication, increasing production efficiency, and offering significant time and cost savings.

Technological advancements in animation software are centered around improving the realism and quality of animations. Real-time rendering technologies, such as those seen in game engines, are being integrated into animation software, allowing animators to view changes instantly without lengthy processing times. Developments in motion capture technology have also advanced, enabling more nuanced and complex animations that are more lifelike and dynamic.

In 2023, consumer spending on video games in the U.S. reached a substantial $57.2 billion, as reported by the Entertainment Software Association and Circana. This total reflects robust engagement across multiple gaming formats, showing that video gaming remains a staple in American entertainment. Spending encompasses everything from physical and digital full-game purchases to the rapidly growing areas of downloadable content (DLC) and microtransactions (MTX).

Key Takeaways

- The Animation Software Market is poised for steady growth, with projections indicating a rise in market size from USD 154.8 billion in 2023 to USD 226.9 billion by 2033. This growth represents a CAGR of 3.9% over the next decade.

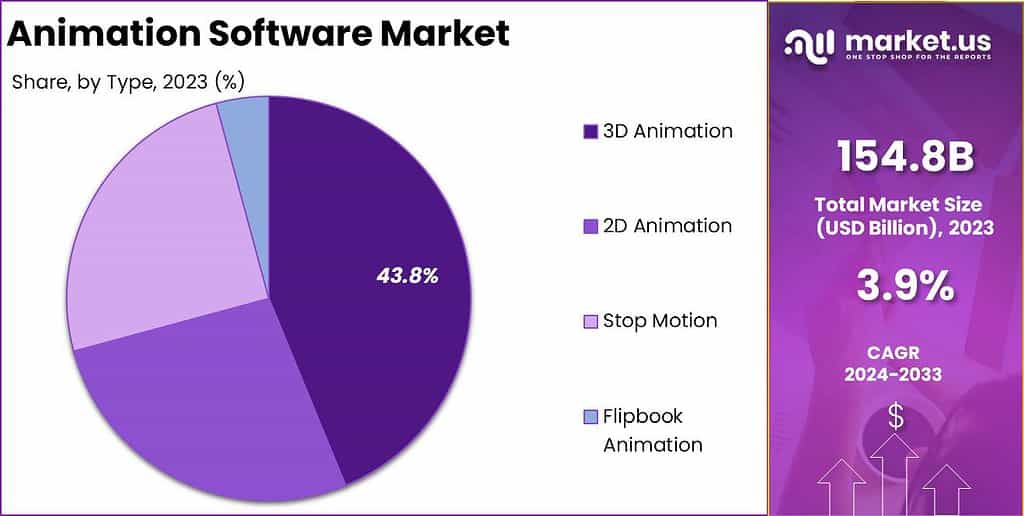

- Focusing on specific segments, the 3D Animation category is notably prominent, securing a significant 43.8% share of the market in 2023. This dominance underscores the ongoing demand and technological advancements in 3D animation across various industries.

- In terms of deployment, the On-Premise solutions continue to lead, accounting for 58.1% of the market in 2023. This preference highlights concerns related to security and control over proprietary animations and data.

- The Media and Entertainment industry remains the largest consumer of animation software, holding a 39.5% market share in 2023. This sector’s reliance on cutting-edge animation tools underlines its central role in content creation and digital storytelling.

- Geographically, North America is at the forefront of the animation software market, with a 36.4% share in 2023. The region’s robust market share is propelled by a strong presence of leading animation studios and technological innovators.

North America Animation Software Market

In 2023, North America held a dominant market position in the Animation Software Market, capturing more than a 36.4% share with revenue amounting to USD 56.3 billion. This leadership is primarily attributed to the region’s strong presence of major animation studios and technology companies, such as Disney, Pixar, and Adobe, which are pioneers in advancing animation technologies and content.

The region’s market dominance is further bolstered by its robust entertainment and media industry, which extensively utilizes animation for film, television, and online content, driving demand for sophisticated animation software solutions.

Moreover, North America is at the forefront of technological advancements in areas such as 3D animation and visual effects, supported by heavy investments in research and development by key market players. These advancements are increasingly being applied in other sectors such as healthcare for medical animations and education for e-learning solutions, thereby expanding the application scope of animation software.

The region’s well-established infrastructure for digital content creation, coupled with high internet penetration and the rapid adoption of cloud-based animation solutions, also contribute to its leading position in the global market. These factors enable seamless collaboration and accessibility, enhancing the efficiency of animation processes and supporting the trend towards remote working and decentralized production teams.

AI Impact on Animation Software

Artificial Intelligence (AI) is making significant inroads into the animation industry, transforming how animations are created and the nature of animation work itself. One of the most impactful changes brought by AI is the automation of repetitive tasks within the animation process.

AI technologies, particularly generative AI, are now capable of automating the creation of certain visual elements like backgrounds and textures, which helps speed up the production process and allows human animators to focus more on creative and complex aspects of animation such as character design and story development.

AI is also enhancing the quality of animation by generating high-quality visual effects, realistic textures, and complex motion dynamics that would be very resource-intensive if done manually. This not only improves the visual appeal of animations but also opens up new possibilities for more nuanced and detailed storytelling.

For instance, In June 2024, DeepMotion, a company specializing in AI-driven motion-capture technology, introduced SayMotion. This innovative service operates directly within web browsers, allowing users to generate character animations using simple text prompts. SayMotion leverages generative AI to transform textual descriptions into detailed animations, streamlining the animation process and making it accessible to a broader audience

However, the integration of AI into animation isn’t without challenges. There are concerns about job displacement as AI technologies advance and potentially take over tasks traditionally performed by human animators. Moreover, while AI can enhance the efficiency of certain processes, there’s an ongoing debate about whether it could ever fully replace the creative nuances that human animators bring to the table

Type Analysis

In 2023, the 3D Animation segment held a dominant market position within the Animation Software Market, capturing more than a 43.8% share. This significant market presence can be attributed to the widespread adoption of 3D animation across various industries, including film and television, video games, and advertising.

The technology’s ability to produce highly realistic and visually appealing images has made it a preferred choice for creators and businesses aiming to deliver engaging and immersive experiences to their audiences. The demand for 3D animation is further bolstered by advancements in rendering technologies and motion capture systems, which have made the animation process more efficient and cost-effective.

Innovations such as real-time rendering and AI-driven animation tools have streamlined workflows, enabling animators to achieve higher-quality outputs faster than ever before. This efficiency has expanded the use of 3D animation not only in entertainment but also in sectors such as architecture, healthcare, and education, where detailed visual representation is crucial.

Moreover, the rise of virtual reality (VR) and augmented reality (AR) has opened new avenues for 3D animation. These technologies rely heavily on 3D content to create immersive environments, pushing companies to invest in 3D animation software to capitalize on this trend. The ongoing development and accessibility of VR and AR applications are expected to drive further growth in the 3D animation segment, as businesses seek to enhance interactive user experiences and stand out in a competitive digital landscape.

Overall, the prominence of the 3D Animation segment is supported by its versatility and integration with the latest technological advancements, ensuring its continued growth and relevance across multiple industries. As these technologies continue to evolve, the demand for 3D animation is likely to increase, reinforcing its position as a leader in the animation software market.

Deployment Mode Analysis

In 2023, the On-Premise segment held a dominant market position within the Animation Software Market, capturing more than a 58.1% share. This leadership is largely due to the high control and security that on-premise solutions offer to organizations.

Many companies, particularly those in industries such as film, animation studios, and gaming, where large file sizes and sensitive intellectual property are norms, prefer on-premise software to maintain tighter control over their data and the overall animation process.

Moreover, the on-premise deployment allows for better customization of the software to fit specific workflow requirements. Companies can tailor the animation tools to their unique needs, an advantage that is especially valuable in a sector where creative processes vary significantly from one project to another. This customization potential, combined with concerns about data latency and bandwidth constraints that can come with cloud solutions, makes on-premise software a preferred choice for many businesses.

Another factor contributing to the popularity of the on-premise segment is the one-time purchase model, which often leads to lower long-term costs for companies that prefer to avoid recurring subscription fees associated with cloud-based software. This economic efficiency, combined with the declining cost of on-premise hardware, enhances the appeal of this deployment mode.

Despite the growing trend towards cloud-based solutions in many sectors, the on-premise model continues to thrive in the animation software industry due to its provision of enhanced security, performance reliability, and customization capabilities. As technology evolves and the needs of animation professionals change, the on-premise deployment mode remains a cornerstone for creators who prioritize control and security in their animation processes.

Industry Vertical Analysis

In 2023, the Media and Entertainment segment held a dominant market position within the Animation Software Market, capturing more than a 39.5% share. This leading stance is attributed primarily to the integral role of animation in the production of movies, television shows, and video games. As audiences seek increasingly sophisticated visual experiences, studios are investing heavily in advanced animation software to create detailed and engaging content that meets these high expectations.

The proliferation of streaming platforms has also significantly driven demand within this segment. These platforms are continuously expanding their libraries with original animated content, which requires robust and versatile animation software capable of handling complex animations and visual effects. This demand is not only limited to large studios but also independent content creators who are now accessing professional-grade animation tools that were once out of reach, thanks to more competitive pricing and technological advancements.

Furthermore, the global increase in the production of animated feature films and the rise of virtual production techniques have contributed to the growth of the Media and Entertainment segment. Animation software is crucial in blending real-world and digital content, enabling creators to produce hybrid cinematic experiences that are becoming more popular among international audiences.

Overall, the dominance of the Media and Entertainment segment in the animation software market is sustained by continuous technological innovations and the growing demand for high-quality animated content across various media platforms. As the boundaries of digital storytelling continue to expand, so too does the reliance on advanced animation software to meet the creative and operational needs of this dynamic industry.

Key Market Segments

By Type

- 3D Animation

- 2D Animation

- Stop Motion

- Flipbook Animation

By Deployment Mode

- Cloud-Based

- On-Premise

By Industry Vertical

- Media and Entertainment

- Education

- Healthcare

- Automotive

- Architecture and Construction

- Other Industry Verticals

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expanding Application in Various Industries

The growth of the animation software market is significantly driven by its expanding application across diverse industries beyond media and entertainment, such as automotive, healthcare, and education. The ability of animation software to simplify complex concepts, demonstrate procedures, and visualize designs effectively contributes to its widespread adoption.

In automotive design, for instance, 3D animation allows for intricate modeling and simulations that are crucial for vehicle aesthetics and functional testing. Similarly, in healthcare, animation software helps in explaining surgical procedures and complex medical conditions to patients, enhancing understanding and communication. This broadening scope of applications showcases the software’s versatility and opens up new market avenues, thus driving demand and adoption globally.

Restraint

High Cost of Animation Software

One significant challenge facing the animation software market is the high cost associated with advanced software solutions. These costs are not limited to the initial purchase but also include maintenance, upgrades, and training expenses. For small firms and independent animators, these costs can be prohibitively high, limiting their ability to adopt the latest technologies.

Moreover, the ongoing need for upgrades to keep up with industry standards and technological advancements adds a layer of financial burden, which can restrain the market growth by limiting the user base to larger companies or well-funded entities that can afford these investments.

Opportunity

Rise of Cloud-Based Solutions

The market sees a significant opportunity in the rise of cloud-based animation software, which offers advantages such as scalability, flexibility, and remote accessibility. This shift is particularly relevant in today’s increasingly remote and flexible working environments. Cloud-based platforms allow animators and designers to collaborate in real-time from various locations, enhancing productivity and creative possibilities.

Additionally, the subscription-based models often associated with cloud solutions provide a more cost-effective entry point for small to medium-sized enterprises and freelance professionals. This trend is expected to propel the growth of the animation software market by making it more accessible to a wider range of users across different regions and industries.

Challenge

Technological Complexity and Skill Gap

A persistent challenge in the animation software market is the technological complexity of advanced animation tools, which requires a high level of skill and technical knowledge. This complexity can pose a significant barrier to entry for newcomers and can hinder the adoption rate among traditional industries that may benefit from animation software.

Additionally, the rapid pace of technological advancements means that continuous learning and professional development are necessary to remain competent, which can be a daunting prospect for professionals and institutions. This skill gap necessitates significant investment in training and education, which can be a deterrent for smaller organizations and individual users.

Growth Factors

The Animation Software Market is experiencing robust growth, driven by several key factors. Firstly, the increasing integration of advanced technologies such as AI, AR, VR, and 3D printing into animation processes is enhancing the capabilities and applications of animation software across various industries. This technological integration allows for more realistic and immersive visual content, which is highly sought after in media, entertainment, education, and even healthcare for complex visualizations and marketing.

Additionally, the global trend towards digitization and the rise of digital media consumption have significantly fueled the demand for animation software. Urbanization and modernization efforts are prompting industries to adopt digital solutions for visual content creation, thereby expanding the market reach of animation software.

Emerging Trends

Emerging trends within the animation software sector reflect the industry’s rapid evolution driven by technological advancement. The blend of 2D and 3D animation techniques is becoming more popular, providing a unique aesthetic that benefits from the strengths of both techniques. AI-integration is another trend on the rise, optimizing tasks such as animating complex sequences and enhancing creative processes, thereby reducing time and labor costs.

Moreover, the use of VR and AR in animation is creating more immersive experiences, pushing the boundaries of traditional animation into more interactive spaces. This is particularly impactful in sectors like real estate and education, where immersive content can provide more engaging and effective experiences.

Business Benefits

The use of animation software offers significant business benefits, including enhanced communication through visual storytelling, which can be more engaging and informative than traditional media. In sectors like healthcare, for example, animation is used to simplify patient communication regarding medical procedures and conditions, thus enhancing understanding and patient care.

In the educational sector, animation software facilitates more interactive and engaging learning materials that can help in explaining complex subjects in a simpler manner, thereby improving learning outcomes. For businesses, particularly in marketing and advertising, animation helps in creating more engaging content that can lead to higher conversion rates and enhanced customer engagement.

Key Players Analysis

The Animation Software market is characterized by the presence of several key players that dominate the landscape, contributing to its growth and innovation.

Autodesk Inc. stands out as a leading player in animation software, thanks to its renowned software, Maya. Maya’s advanced capabilities in animation, modeling, and rendering make it a go-to tool for professionals across film, gaming, and design. Autodesk’s commitment to continuous innovation ensures its solutions are always relevant and highly competitive. The company’s wide range of tools supports creators in bringing high-quality visuals to life, solidifying Autodesk’s strong presence in the market.

Adobe Systems Inc. has cemented its position in the animation market with popular software like Adobe Animate and After Effects. Known for its versatility, Adobe’s tools cater to both 2D and 3D animation needs and are widely used across media and entertainment industries. Adobe’s seamless integration with other Adobe products, combined with cloud support, adds convenience and enhances productivity for users.

Top Key Players in the Market

- Adobe, Inc.

- Corel Corporation

- Autodesk Inc.

- Maxon Computer GmbH

- SideFX

- Toon Boom Animation Inc.

- Reallusion Inc.

- Blender Foundation

- Animaker Inc.

- Renderforest

- Other Key Players

Recent Developments

- In April 2024, Vizrt introduced a Free Graphics Packages library for its cloud-native HTML5 platform, Viz Flowics users. The SaaS platform has delivered live production workflows and seamless cloud live graphics across industries from esports to sports, broadcast, and corporate.

- In March 2024, MAGIX Software GmbH launched the latest version of its iconic audio editing software, SOUND FORGE Pro 18. Developed with around three decades of innovation, SOUND FORGE Pro is the most chosen solution among audio engineers, producers, and content creators.

Report Scope

Report Features Description Market Value (2023) USD 154.8 Bn Forecast Revenue (2033) USD 226.9 Bn CAGR (2024-2033) 3.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (2D Animation, 3D Animation, Stop Motion, Flipbook Animation), By Deployment Mode (Cloud-Based, On-Premise), By Industry Vertical (Media and Entertainment, Education, Healthcare, Automotive, Architecture and Construction, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adobe Inc., Corel Corporation, Autodesk Inc., Maxon Computer GmbH, SideFX, Toon Boom Animation Inc., Reallusion Inc., Blender Foundation, Animaker Inc., Renderforest, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adobe, Inc.

- Corel Corporation

- Autodesk Inc.

- Maxon Computer GmbH

- SideFX

- Toon Boom Animation Inc.

- Reallusion Inc.

- Blender Foundation

- Animaker Inc.

- Renderforest

- Other Key Players