Global Vitrification Market By Product Type (Devices and Kits & Consumables), By Specimen (Oocytes, Embryo, and Sperm), By End-user (IVF Clinics and Biobanks), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154119

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

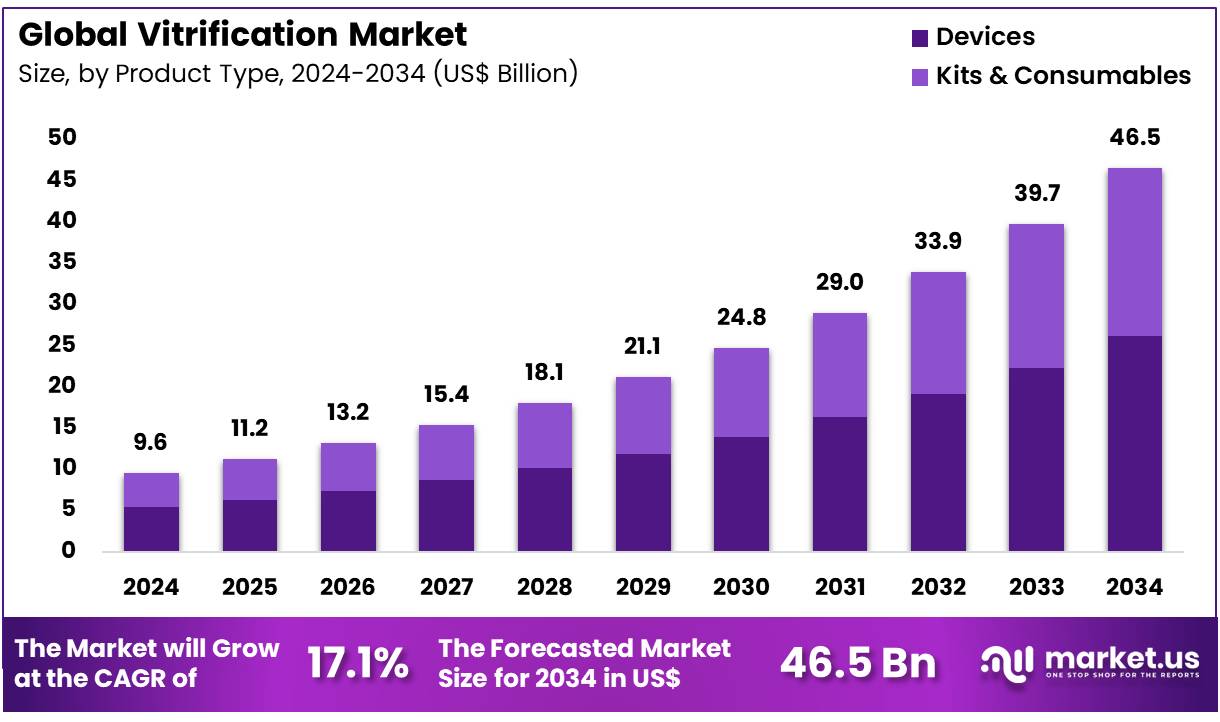

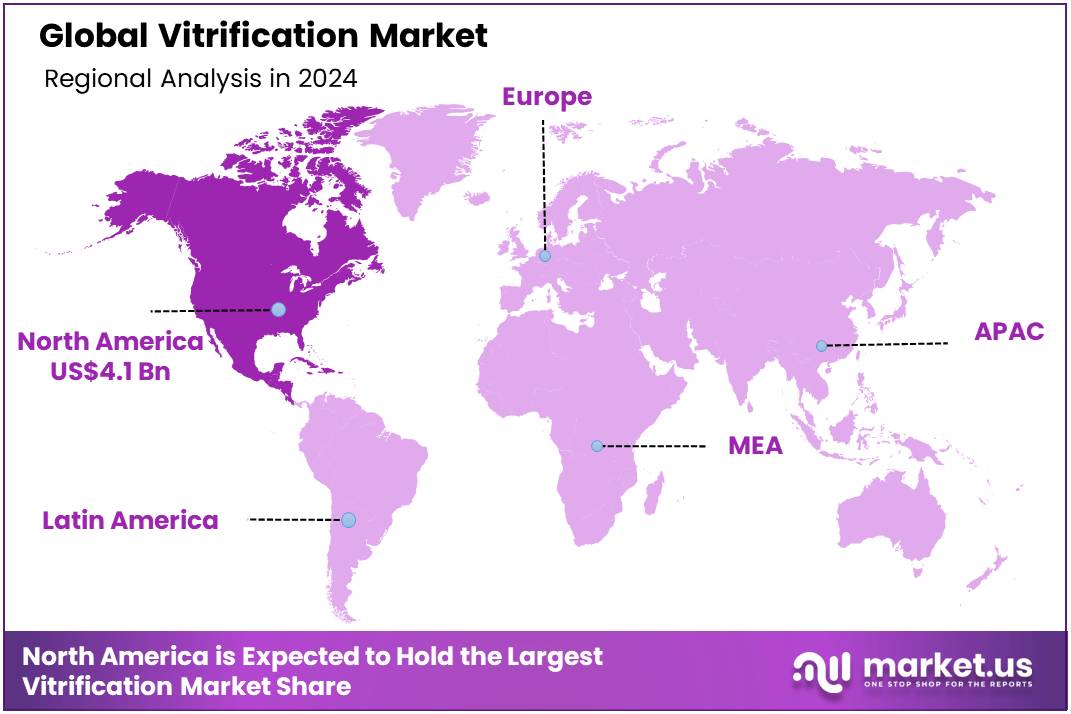

Global Vitrification Market size is expected to be worth around US$ 46.5 Billion by 2034 from US$ 9.6 Billion in 2024, growing at a CAGR of 17.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.6% share with a revenue of US$ 4.1 Billion.

Increasing advancements in assisted reproductive technologies (ART) and the rising demand for fertility preservation are driving the growth of the vitrification market. Vitrification, a rapid freezing process used to preserve sperm, oocytes, and embryos, is crucial for assisted reproduction and offers higher success rates compared to traditional freezing methods. The rising number of people opting for delayed parenthood, particularly among women seeking to preserve fertility due to age or medical conditions, has significantly contributed to the market’s growth.

Additionally, the increase in cancer treatments requiring fertility preservation, such as chemotherapy and radiation, further drives demand for vitrification techniques. The market also benefits from the rising awareness of reproductive health and advancements in ART, such as IVF and egg freezing, where vitrification plays a key role in improving outcomes.

In November 2023, Cooper Companies expanded its fertility and women’s health product range by acquiring select assets from Cook Medical, strengthening its position in the fertility sector and broadening its product offerings. This acquisition highlights a key trend in the market where companies are increasingly focusing on expanding their portfolios to meet the growing demand for fertility preservation solutions.

Recent trends show ongoing innovations in vitrification techniques, with improvements in cryoprotectants and cooling rates, which enhance the viability of frozen embryos and oocytes. As the global demand for fertility preservation and ART continues to rise, the vitrification market is poised for continued growth, presenting new opportunities for companies to develop more efficient and accessible solutions.

Key Takeaways

- In 2024, the market for vitrification generated a revenue of US$ 9.6 billion, with a CAGR of 17.1%, and is expected to reach US$ 46.5 billion by the year 2034.

- The product type segment is divided into devices and kits & consumables, with devices taking the lead in 2024 with a market share of 56.2%.

- Considering specimen, the market is divided into oocytes, embryo, and sperm. Among these, oocytes held a significant share of 42.3%.

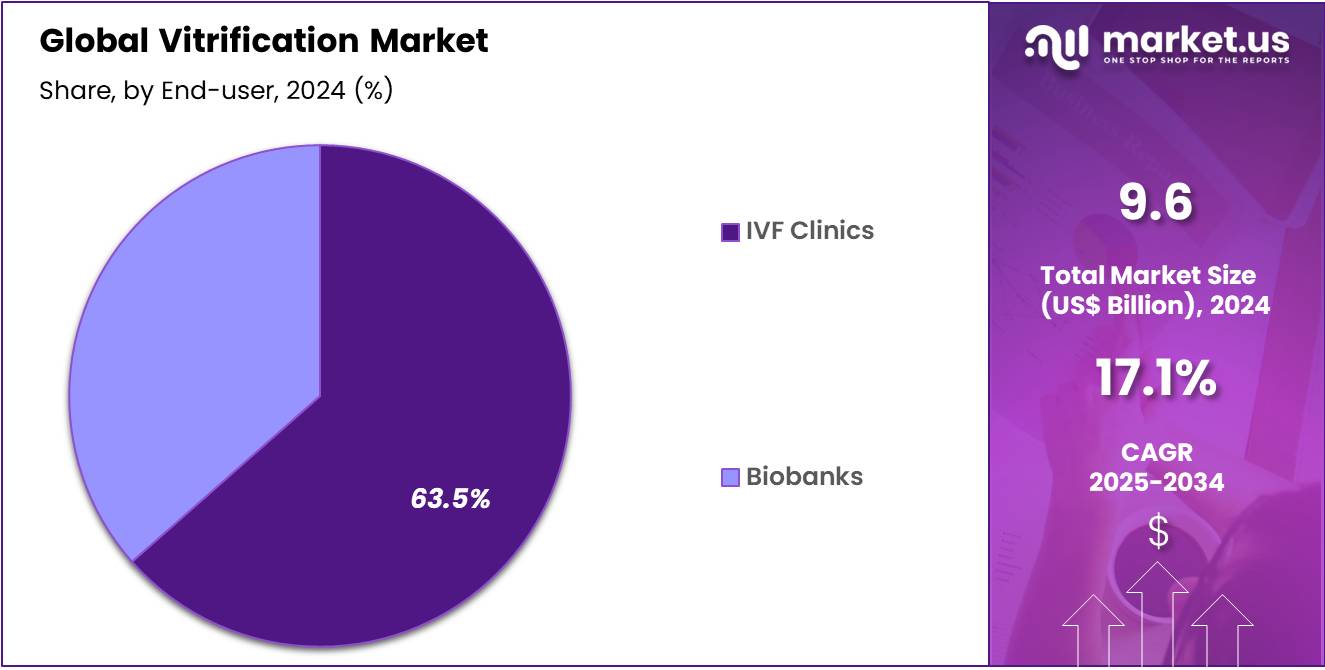

- Furthermore, concerning the end-user segment, the market is segregated into IVF clinics and biobanks. The IVF clinics sector stands out as the dominant player, holding the largest revenue share of 63.5% in the vitrification market.

- North America led the market by securing a market share of 42.6% in 2024.

Product Type Analysis

Devices hold the largest share of 56.2% in the vitrification market. This growth is expected to continue as vitrification devices are critical for ensuring the safe and effective cryopreservation of reproductive cells. The increasing use of vitrification in assisted reproductive technologies, such as in vitro fertilization (IVF), drives the demand for specialized devices that can rapidly freeze oocytes, embryos, and sperm at very low temperatures. The ongoing development of more advanced and user-friendly vitrification devices, designed to improve cell survival rates and reduce the risk of damage during the freezing and thawing process, is projected to fuel market growth.

As the IVF industry continues to grow, especially with the increasing number of women delaying childbirth, the demand for high-quality vitrification devices is expected to rise. Additionally, the technological advancements in vitrification devices, which enhance the precision and automation of the process, will likely contribute to the segment’s continued dominance in the market.

Specimen Analysis

Oocytes (eggs) account for 42.3% of the specimen segment in the vitrification market. This segment’s growth is anticipated to continue as oocyte vitrification is crucial for preserving fertility in women who wish to delay childbearing or preserve their eggs for future use. The increasing number of women opting for egg freezing, particularly for social or medical reasons, is expected to drive demand for oocyte vitrification.

Additionally, advancements in egg retrieval and vitrification techniques have improved the success rates of oocyte preservation, contributing to the growth of this segment. The rising awareness of fertility preservation among women, coupled with the growing adoption of assisted reproductive technologies (ART), is likely to further increase the demand for oocyte vitrification. As IVF treatments become more widely available and successful, the need for high-quality egg freezing services is expected to rise, ensuring continued growth in this segment.

End-User Analysis

IVF clinics represent the largest end-user segment in the vitrification market, holding 63.5% of the market share. This growth is expected to continue as IVF clinics are at the forefront of assisted reproductive technologies, using vitrification to preserve oocytes, embryos, and sperm for patients undergoing fertility treatments. The increasing demand for IVF treatments, driven by factors such as delayed pregnancies, infertility, and rising awareness of reproductive options, is projected to drive further growth in IVF clinics’ use of vitrification.

As IVF success rates improve and more couples turn to assisted reproduction, the need for effective and reliable vitrification techniques is likely to increase. Moreover, as IVF clinics expand their services and adopt more advanced technologies, the demand for high-quality vitrification solutions will continue to grow. The increasing focus on personalized reproductive care and the ability to offer cryopreservation options will further contribute to the dominance of IVF clinics in this market.

Key Market Segments

By Product Type

- Devices

- Kits & Consumables

By Specimen

- Oocytes

- Embryo

- Sperm

By End-user

- IVF Clinics

- Biobanks

Drivers

Increasing Success Rates and Expanding Applications are Driving the Market

The increasing success rates of vitrification techniques in preserving biological materials, coupled with their expanding applications across various fields, are significant drivers propelling the vitrification market. Vitrification, a rapid cooling process that prevents ice crystal formation, offers superior preservation outcomes compared to traditional slow freezing, leading to higher viability rates for cells, tissues, and even organs. This improved efficacy is crucial for enhancing success rates in procedures like in vitro fertilization (IVF), preserving gametes and embryos, and for biobanking diverse biological samples for research and therapeutic purposes.

For instance, the Centers for Disease Control and Prevention (CDC) reported in its “2022 Fertility Clinic Success Rates Report” that for embryo transfers using frozen embryos (which are typically vitrified), the percentage of transfers resulting in a live birth was 55.0% for fresh nondonor eggs/embryos, and 54.9% for frozen nondonor eggs/embryos in 2022, demonstrating the high efficacy of cryopreservation.

The ability of vitrification to maintain the structural and functional integrity of delicate biological specimens is driving its adoption in fertility clinics, research institutions, and pharmaceutical companies for drug discovery and toxicology testing. This continuous improvement in cryopreservation outcomes and the broadening scope of its use across the life sciences underpin the market’s robust growth.

Restraints

Technical Expertise Requirements and High Equipment Costs are Restraining the Market

The demanding technical expertise required to perform vitrification procedures correctly and the substantial initial investment in specialized equipment pose considerable restraints on the market. Vitrification is a highly sensitive process that requires skilled personnel with extensive training to achieve optimal cooling rates, precisely manage cryoprotective agent concentrations, and handle delicate biological samples without damage.

Any deviation from protocol can lead to suboptimal outcomes, including cellular damage or reduced viability. This steep learning curve and the need for continuous training increase operational costs for facilities. Furthermore, the specialized equipment, including high-precision controlled-rate freezers, vitrification devices, and dedicated storage systems (such as liquid nitrogen tanks), represents a significant capital outlay.

A 2024 analysis of laboratory equipment costs often places a high-end cryopreservation system, including advanced vitrification tools, in the range of tens of thousands to over a hundred thousand US dollars. This significant financial barrier, coupled with the need for highly skilled staff, particularly impacts smaller clinics, research laboratories, or institutions in developing regions, thereby limiting the widespread adoption of vitrification technologies and restraining overall market expansion.

Opportunities

Advancements in Cryoprotectant Agents and Automation are Creating Growth Opportunities

Significant advancements in the development of novel cryoprotectant agents (CPAs) and the increasing integration of automated vitrification systems are creating substantial growth opportunities in the market. Traditional CPAs can be toxic at high concentrations, limiting their application and requiring careful handling. New generation CPAs are being developed with lower toxicity and improved permeability, enhancing cell viability post-thaw and expanding the range of biological materials that can be successfully vitrified.

Concurrently, the introduction of automated vitrification devices reduces operator variability, improves consistency, and standardizes the process, making it more accessible and reliable. For instance, a 2024 study published in the journal Cryobiology highlighted research into novel vitrification solutions for human oocytes and embryos that demonstrated reduced exposure time to CPAs while maintaining high survival rates. While the study did not provide commercial figures, it reflects ongoing innovation.

Furthermore, several key players in the assisted reproductive technology (ART) industry have introduced automated vitrification workstations, designed to streamline the vitrification process and improve standardization, which became more widely available in 2023. These technological enhancements address key limitations of manual methods, reduce the need for highly specialized manual skills, and improve reproducibility, thereby broadening the appeal and expanding the applicability of vitrification across various research and clinical settings.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the overall investment in healthcare and life sciences research, significantly influence the vitrification market by affecting capital expenditure budgets and R&D funding. Inflation can increase the cost of specialized equipment, cryoprotectant agents, and liquid nitrogen, impacting the operational expenses for fertility clinics and research laboratories utilizing vitrification. This can pressure institutions to defer equipment upgrades or limit expansion.

However, the consistent global investment in healthcare, particularly in assisted reproductive technologies and regenerative medicine, often ensures a sustained demand. The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many high-income countries allocating over 10% of their GDP to health in 2023.

For instance, France’s health expenditure was 12.18% of GDP in 2022, and Germany’s was 12.78% in 2023, showcasing significant national commitments. Geopolitical stability also plays a role in maintaining stable supply chains for critical components and consumables. Despite economic fluctuations, the deeply personal desire for family and the scientific imperative to advance research ensure continued allocation of resources, fostering resilience and growth in the vitrification market.

Evolving US trade policies, including the imposition of tariffs on imported laboratory equipment and specialized components, are shaping the vitrification market by influencing procurement costs and supply chain stability. Vitrification relies on sophisticated equipment, such as automated vitrification devices, high-precision freezers, and specific consumables like vitrification media, many of which contain components or are entirely manufactured internationally.

Tariffs on these imports can increase the capital expenditure for US fertility clinics, biobanks, and research institutions, potentially leading to higher costs for vitrification procedures or slower adoption of new technologies. The US Bureau of Economic Analysis (BEA) reported in February 2025 that US imports of capital goods increased by US$103.3 billion in 2024, with specific categories like laboratory and scientific instruments contributing to this, highlighting the significant volume of such imports.

While specific tariffs directly targeting vitrification equipment may not be always explicit, broader tariffs on laboratory and medical devices can impact the market. These policies, while sometimes aimed at encouraging domestic manufacturing, primarily create a more complex and potentially more expensive operational environment. The critical role of vitrification in reproductive medicine and scientific research, however, often drives efforts to mitigate these impacts through supply chain diversification and advocacy for exemptions on essential laboratory equipment.

Latest Trends

Increased Adoption in Reproductive Medicine and Biobanking for Rare Diseases is a Recent Trend

A prominent recent trend shaping the vitrification market in 2024 and continuing into 2025 is the accelerated adoption of vitrification techniques within reproductive medicine, specifically for oocyte (egg) freezing, and its growing application in biobanking for rare diseases. The societal trend of women delaying childbirth for career or personal reasons has led to a surge in elective egg freezing, where vitrification is the preferred method due to its high success rates compared to slow freezing.

Simultaneously, vitrification is becoming indispensable for establishing comprehensive biobanks for rare disease research, where preserving limited and precious patient samples (e.g., tissues, stem cells, organoids) is critical for understanding disease mechanisms and developing therapies. The Society for Assisted Reproductive Technology (SART) 2022 report (released in 2024) indicated that over 25,000 egg freezing cycles were performed in the US in 2022, a significant increase from previous years, reflecting the rising demand for fertility preservation.

Furthermore, a June 2024 report on the “Advancements in Rare Disease Research” by the National Institutes of Health (NIH) underscored the critical role of high-quality biobanking to accelerate discovery, with an increasing emphasis on cryopreservation methods that ensure sample integrity. This dual emphasis on elective fertility preservation and specialized biobanking for challenging and rare samples is driving both the volume and the technological advancements within the vitrification market.

Regional Analysis

North America is leading the Vitrification Market

The vitrification market in North America, representing a significant 42.6% share, experienced robust growth in 2024. This expansion was primarily driven by the increasing demand for fertility preservation services, particularly egg and embryo cryopreservation, due to evolving societal trends such as delayed childbearing and rising awareness of reproductive health options. The Society for Assisted Reproductive Technology (SART) reported that the total number of in vitro fertilization (IVF) cycles performed at its member clinics in the US increased from 389,993 in 2022 to 432,641 in 2023, reflecting a growing reliance on assisted reproductive technologies that heavily utilize vitrification techniques.

Additionally, egg-freezing cycles also saw a notable increase, rising from 24,560 in 2021 to 29,803 in 2022, indicating a burgeoning interest in elective fertility preservation. Advancements in vitrification protocols, leading to improved post-thaw survival rates and clinical outcomes, have further bolstered confidence in these procedures. Key players in the fertility solutions market have demonstrated strong performance in the region.

CooperCompanies, through its CooperSurgical segment, reported that its fertility revenue grew by 15% in constant currency for the fourth quarter of fiscal year 2024 compared to the same period in 2023, and by 13% organically, underscoring the increasing demand for its products and services in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The vitrification market in Asia Pacific is expected to grow significantly during the forecast period. This anticipated expansion is primarily fueled by a rising prevalence of infertility, increasing access to and acceptance of assisted reproductive technologies, and substantial investments in healthcare infrastructure across the region. As more individuals and couples in Asia Pacific seek solutions for fertility challenges, demand for effective cryopreservation methods will undoubtedly increase.

Governments in several countries are implementing policies and initiatives to support fertility treatments, including financial rebates for procedures, which are likely to enhance accessibility and affordability. For instance, Australia has expanded fertility treatment rebates to include egg freezing, with women potentially claiming a US$2,000 rebate as part of a broader government initiative.

Japan has also observed a steady increase in patients undergoing fertility preservation treatments, reflecting growing awareness and access. Vitrolife, a global leader in reproductive health, reported that its sales in Asia Pacific grew by 57.9% in 2024, an increase from US$7.87 billion in 2023, demonstrating the region’s overall growth in the life sciences and healthcare sectors that utilize cryopreservation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the vitrification market employ several strategies to drive growth and enhance patient care. They focus on developing advanced cryopreservation technologies, such as automated vitrification systems and high-performance cryoprotectants, to improve the efficiency and success rates of fertility preservation. Companies are also investing in research and development to innovate and refine vitrification techniques, ensuring better outcomes for patients undergoing assisted reproductive technologies.

Strategic partnerships and collaborations with fertility clinics and research institutions enable these organizations to expand their reach and integrate cutting-edge solutions into clinical practices. Additionally, market leaders are enhancing their product portfolios by offering comprehensive vitrification kits and reagents, catering to the diverse needs of reproductive health professionals. Emphasis on regulatory compliance and quality assurance ensures the safety and efficacy of vitrification products, fostering trust among healthcare providers and patients alike.

Vitrolife, a prominent player in the vitrification market, specializes in providing high-quality products for assisted reproduction. The company offers a range of vitrification solutions, including media, devices, and kits, designed to optimize the preservation of oocytes and embryos. Vitrolife’s commitment to innovation and quality has positioned it as a leader in the field, with a strong presence in global markets. The company’s ongoing research and development efforts aim to further enhance vitrification techniques, contributing to improved success rates in fertility treatments. Through strategic partnerships and a focus on customer needs, Vitrolife continues to advance the field of reproductive medicine.

Top Key Players

- Vitrolife

- NidaCon International AB

- Minitube

- Legacy

- Kitazato Corporation

- IMV TECHNOLOGIES GROUP

- Genea Biomedx

- Cooper Companies

Recent Developments

- In July 2024, Legacy launched an enhanced version of its innovative at-home sperm testing and freezing kit. The upgraded kit improves accuracy, security, and ease of use, elevating Legacy’s service that enables men to test and preserve their fertility from the comfort of their own homes. These updates offer a more streamlined and reliable experience, further simplifying fertility preservation for users.

- In February 2024, Kitazato Corporation formed a strategic partnership with IVF2.0 to incorporate AI-based technologies for enhanced sperm selection and embryo ranking in IVF procedures, aiming to improve the efficiency and outcomes of fertility treatments.

Report Scope

Report Features Description Market Value (2024) US$ 9.6 Billion Forecast Revenue (2034) US$ 46.5 Billion CAGR (2025-2034) 17.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Devices and Kits & Consumables), By Specimen (Oocytes, Embryo, and Sperm), By End-user (IVF Clinics and Biobanks) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vitrolife, NidaCon International AB, Minitube, Legacy, Kitazato Corporation, IMV TECHNOLOGIES GROUP, Genea Biomedx, Cooper Companies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vitrolife

- NidaCon International AB

- Minitube

- Legacy

- Kitazato Corporation

- IMV TECHNOLOGIES GROUP

- Genea Biomedx

- Cooper Companies