Global Virtualization Security Market Size, Share, Statistics Analysis Report By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Education, Manufacturing, Healthcare, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135587

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Component

- By Deployment Mode

- By Organization Size

- By Industry Vertical

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunites

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

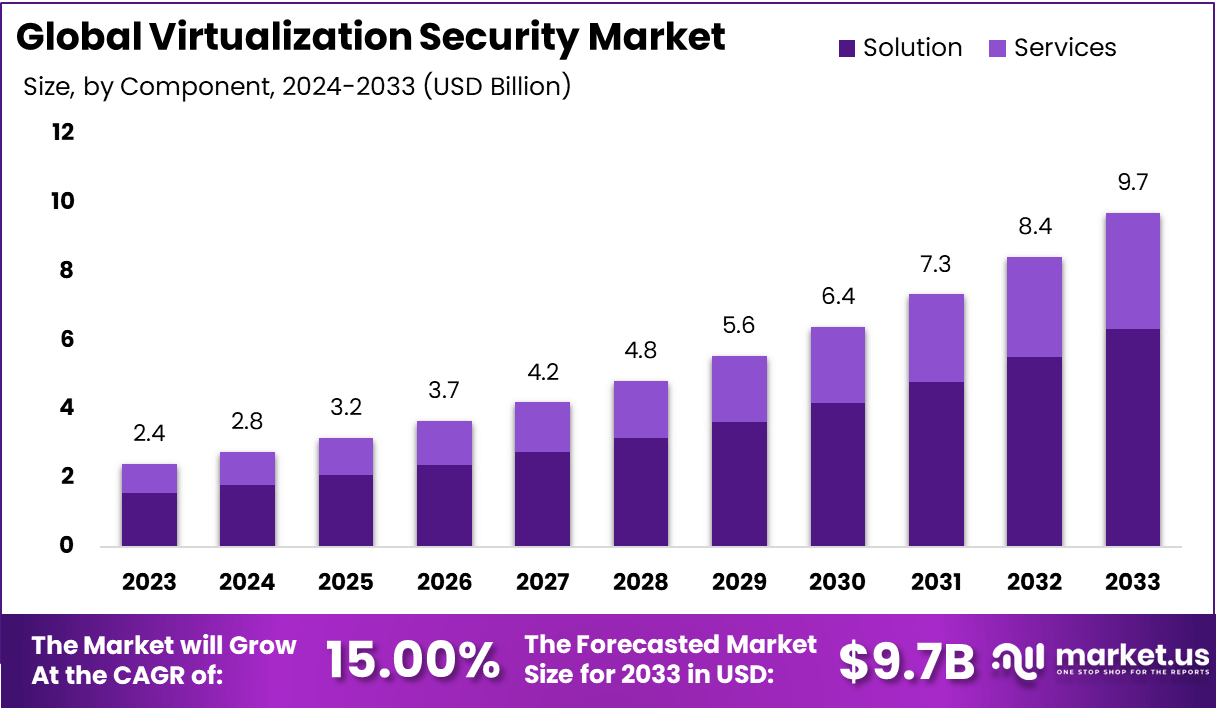

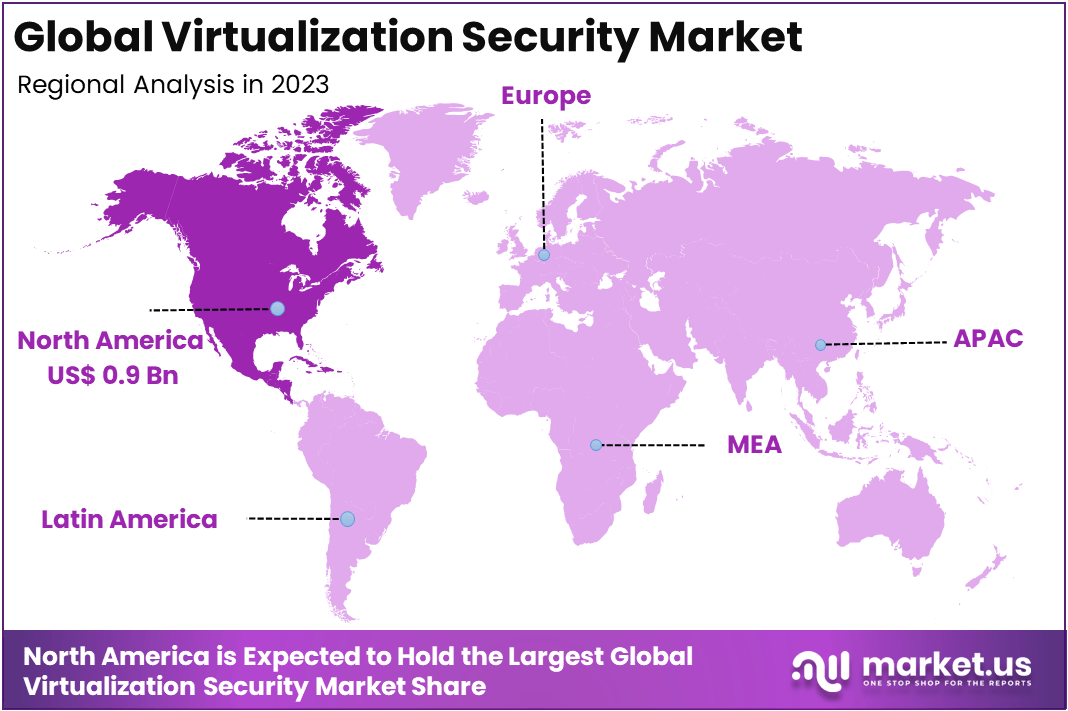

The Global Virtualization Security Market is expected to be worth around USD 9.7 Billion By 2033, up from USD 2.4 billion in 2023, growing at a CAGR of 15.00% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing over a 37.5% share and holding USD 0.9 billion in revenue.

Virtualization security refers to the strategies, tools, and practices designed to protect virtualized environments, including virtual machines (VMs), hypervisors, and virtual networks, from unauthorized access, data breaches, and other cyber threats.

Virtualization allows multiple operating systems and applications to run on a single physical machine, making it a highly efficient and cost-effective way for businesses to optimize their IT resources. However, the increased complexity of virtualized infrastructures introduces unique security challenges.

Virtualization security ensures that virtual environments are as protected as traditional physical environments by implementing robust security controls, data encryption, access management, and continuous monitoring.

In a virtualized setup, the hypervisor, which manages multiple VMs, is a primary target for attackers, making it critical to ensure its security. Additionally, because virtual machines share the same physical hardware, attacks can easily propagate between them.

Virtualization security also extends to network security within virtual environments, as virtual networks may have different configurations than traditional physical networks. With the growing adoption of cloud services and hybrid infrastructures, securing virtualized environments has become a priority for organizations to prevent data loss, service disruption, and cyber threats.

The Virtualization Security market is growing rapidly, driven by the increasing adoption of virtualized IT environments, cloud computing, and hybrid cloud architectures. This market involves the provision of security solutions specifically designed to protect virtual machines, hypervisors, and the underlying virtual networks.

As businesses move more of their workloads to virtualized infrastructures, the demand for virtualization security solutions has surged, especially in industries like IT, finance, healthcare, and government, where data security is paramount.

The market has been experiencing steady growth due to the rising volume of cyberattacks targeting vulnerabilities in virtual environments. In 2023, the market is expected to reach a substantial value and continue to expand at a robust compound annual growth rate (CAGR) over the next few years.

Virtualization security solutions include a variety of technologies such as firewall security for virtualized networks, encryption tools, virtual machine monitoring, and hypervisor protection. Furthermore, companies are increasingly integrating automation, artificial intelligence (AI), and machine learning into their security frameworks to proactively identify and mitigate security threats in real time.

The major driving factors behind the growth of the virtualization security market include the increasing adoption of cloud computing and the growing trend of hybrid cloud environments. As organizations transition from traditional physical infrastructures to virtualized and cloud-based environments, the need for robust security solutions becomes more critical.

Virtualized environments present unique security challenges such as resource sharing between virtual machines, which can make systems more vulnerable to data breaches or attacks. In addition, regulatory compliance requirements across industries like healthcare, finance, and government have led to a greater emphasis on securing virtualized infrastructures to meet privacy and security standards.

The demand for virtualization security is being driven by the growing need to protect cloud-based and virtualized data environments. Many businesses are moving critical applications and data to virtualized infrastructures or hybrid clouds to increase operational efficiency and reduce costs.

As this shift occurs, the need for secure, scalable, and efficient security solutions has risen significantly. Organizations need to ensure that their virtual environments are protected from both internal and external threats, making virtualization security solutions a top priority.

Additionally, the rapid digitization of businesses, including the increase in remote work and e-commerce, has expanded the attack surface, creating an even greater need for robust security measures. Enterprises are increasingly looking for solutions that provide end-to-end security across hybrid IT environments, including virtual machines, containers, and networks. This demand is expected to continue growing as more industries embrace virtualization technologies to scale operations, enhance flexibility, and reduce IT costs.

The virtualization security market presents significant opportunities for growth, driven by several factors. The growing shift to cloud computing and hybrid cloud environments presents a major opportunity for security vendors to offer tailored solutions that address the specific needs of virtualized infrastructures. The increasing sophistication of cyberattacks targeting virtualized and cloud-based systems opens up avenues for innovation, as businesses look for advanced security tools to safeguard their data and applications.

Emerging technologies such as artificial intelligence (AI), machine learning (ML), and automation are also playing a key role in creating opportunities within the market. These technologies allow for proactive threat detection, faster response times, and the ability to identify vulnerabilities in real time. By integrating AI and ML into virtualization security solutions, providers can offer smarter, more adaptive security systems that can prevent attacks before they happen.

Technological advancements are a key factor driving innovation in the virtualization security market. The integration of AI and machine learning into virtualization security solutions is one of the most significant advancements.

These technologies enable more efficient detection of threats by analyzing patterns in data traffic and user behavior. AI-driven systems can automatically identify anomalies and respond to them faster than traditional security systems, which helps mitigate risks in real time.

Virtualization security is increasingly vital as organizations shift their workloads to virtual environments. Currently, over 80% of enterprise workloads are virtualized, indicating a significant reliance on these technologies. However, this transition also introduces various security challenges.

For instance, 60% of organizations report that they have experienced at least one security incident related to virtualization in the past year. Among these incidents, 30% involved unauthorized access to virtual machines (VMs), highlighting the risks associated with managing multiple VMs.

In terms of user data, a survey revealed that 45% of IT professionals believe their organization lacks adequate security measures for their virtual environments. This sentiment is echoed by 70% of respondents, who stated that they are concerned about the potential for data breaches in virtualized systems. Additionally, the impact of these breaches can be severe; organizations can face costs averaging $3.86 million per data breach, according to recent studies.

Moreover, the prevalence of VM sprawl—where unmanaged and unmonitored VMs proliferate—can lead to vulnerabilities. A staggering 75% of organizations admit to having more VMs than they can effectively manage, resulting in potential security gaps.

As cyber threats continue to evolve, the need for comprehensive virtualization security strategies becomes more pressing. For instance, a report indicated that 32% of businesses in the UK experienced breaches or attacks in the past year, with the rates being even higher among medium and large enterprises.

Key Takeaways

- Market Growth: The global Virtualization Security market is projected to expand significantly from USD 2.4 billion in 2023 to USD 9.7 billion by 2033, reflecting a robust CAGR of 15.00%.

- Dominant Component: The Solution segment holds the largest market share, accounting for 65.4% in 2023, driven by increasing demand for advanced security solutions to safeguard virtualized environments against cyber threats.

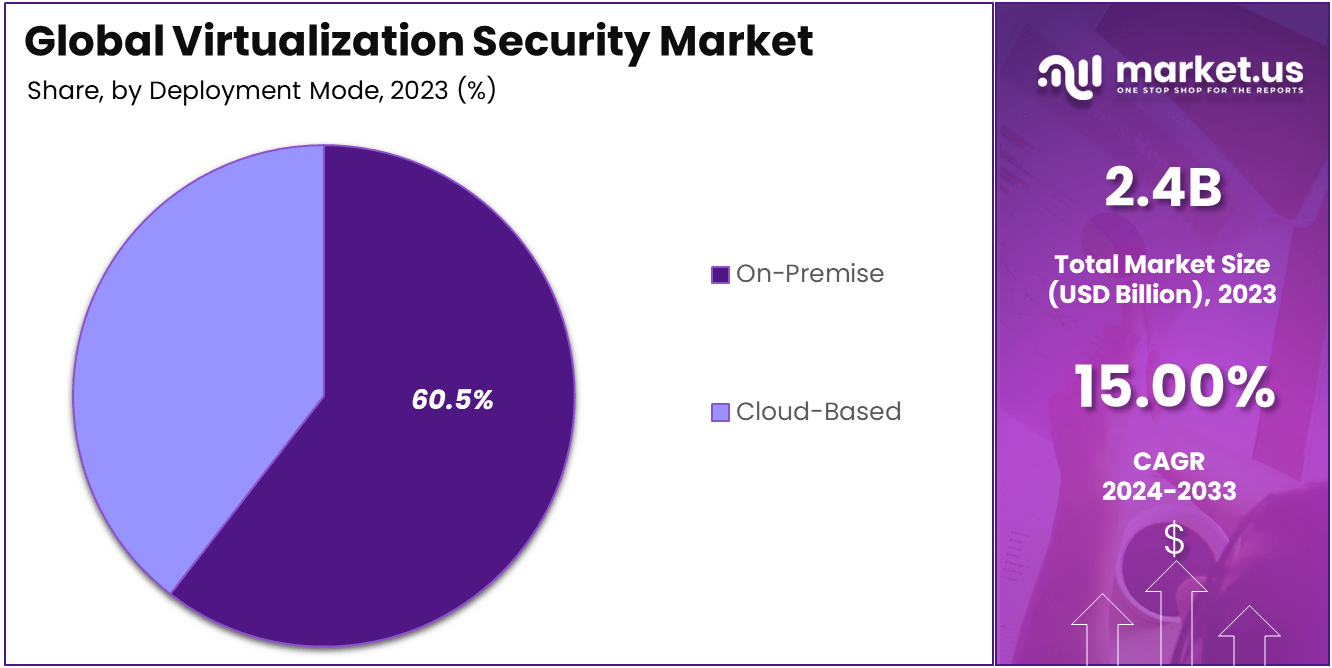

- Preferred Deployment Mode: On-premise deployment is the leading choice for businesses, capturing 60.5% of the market share in 2023, as many organizations prefer to have full control over their security infrastructure.

- Organization Size: Large Enterprises dominate the market with a significant 67.1% share in 2023. Larger organizations tend to have more complex IT environments, requiring comprehensive and scalable virtualization security solutions.

- Key Industry Vertical: The BFSI (Banking, Financial Services, and Insurance) sector is the largest end-user, contributing 25.3% to the market in 2023, as the industry requires robust security measures to protect sensitive financial data in virtualized environments.

- Geographical Dominance: North America leads the market with a 37.5% share in 2023, driven by a high adoption rate of virtualization technologies, growing cybersecurity concerns, and the presence of key players in the region.

By Component

In 2023, the Solution segment held a dominant market position, capturing more than a 65.4% share of the global Virtualization Security market. This dominance is primarily driven by the increasing need for advanced, integrated security solutions that can safeguard complex virtualized environments.

With virtualization being a fundamental part of modern IT infrastructures, organizations require robust solutions that not only protect against external threats but also address vulnerabilities unique to virtual environments, such as hypervisor exploits and inter-VM attacks.

The growing complexity of data and applications in virtualized systems has amplified the demand for sophisticated security solutions. Virtualization platforms, such as VMware, Microsoft Hyper-V, and others, often provide features that improve operational efficiency, but they also introduce new attack vectors.

To combat this, organizations are increasingly relying on virtualization security solutions that offer real-time threat detection, network segmentation, and encryption, along with tools for managing access control and compliance. As these solutions are designed to integrate with existing virtual environments, they are crucial for maintaining business continuity and data protection in an evolving IT landscape.

Furthermore, the rapid growth of hybrid cloud environments has pushed the need for these solutions. As more organizations migrate their data and applications to cloud environments, there is a greater emphasis on securing both on-premise and cloud-based virtualized infrastructures.

Solutions that provide a unified approach to securing these environments, while offering scalability and flexibility, are highly preferred by organizations. As a result, the Solution segment is expected to continue its dominance in the coming years.

By Deployment Mode

In 2023, the On-Premise segment held a dominant market position, capturing more than a 60.5% share of the global Virtualization Security market. This leadership can be attributed to several factors, primarily the higher level of control and customization that on-premise solutions provide.

For many large enterprises, having security systems within their data centers allows for better governance, more stringent compliance, and greater visibility into their virtualized environments. On-premise deployment is seen as a safer choice for organizations that handle sensitive data or have regulatory requirements, such as those in the financial services, healthcare, and government sectors.

The on-premise approach also allows businesses to maintain full control over their infrastructure, ensuring that security protocols are tailored to their specific needs. Many organizations are hesitant to adopt cloud-based solutions due to concerns about data sovereignty, external breaches, and a lack of direct control over the security processes.

As a result, on-premise virtualization security solutions continue to be the preferred choice, particularly for enterprises with large IT teams capable of managing and maintaining their security infrastructure. Another factor contributing to the dominance of the on-premise segment is the high cost associated with cloud security solutions, especially for organizations that require advanced security features and compliance certifications.

For businesses with complex IT environments, on-premise solutions offer the advantage of more direct and customizable integration with their existing infrastructure. This makes on-premise virtualization security particularly attractive to enterprises looking for a long-term, self-sustaining security model that reduces reliance on external cloud service providers.

By Organization Size

In 2023, the Large Enterprises segment held a dominant market position, capturing more than a 67.1% share of the global Virtualization Security market. This is largely due to the high demand for robust security solutions within large-scale organizations, which operate complex and often globalized IT infrastructures.

Large enterprises typically have vast virtualized environments that require comprehensive security measures to protect sensitive data, and intellectual property, and ensure business continuity. Given the scale and complexity of their operations, these organizations tend to invest heavily in sophisticated security solutions to safeguard their virtualized resources.

The need for stringent compliance and regulatory adherence in many industries, including banking, healthcare, and government, also drives the dominance of large enterprises in this segment. These organizations must meet industry-specific regulations, such as GDPR, HIPAA, and PCI DSS, which require advanced security protocols that can be better managed with on-premise or highly customized security solutions.

For large enterprises, virtualization security is not just a technical need; it is a critical component of their risk management strategy. Additionally, large enterprises typically have dedicated IT teams and resources that enable them to implement, manage, and scale virtualization security solutions effectively.

With the increasing complexity of cyber threats, these organizations are more likely to prioritize comprehensive solutions that offer advanced features, such as intrusion detection systems, data encryption, and automated compliance monitoring. The need to secure expansive, multi-cloud, and hybrid environments further propels large enterprises to choose high-end, tailored security options.

By Industry Vertical

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment holds a dominant market position, capturing more than a 25.3% share of the Virtualization Security market. This is primarily due to the highly sensitive nature of the data handled by institutions in this sector.

Financial institutions, including banks and insurance companies, manage vast amounts of personal and financial data, making them prime targets for cyberattacks. As virtualization becomes increasingly widespread in BFSI operations, ensuring the security of virtualized environments is critical to protect both sensitive customer information and the integrity of financial transactions.

The BFSI sector has stringent regulatory requirements such as the Sarbanes-Oxley Act, PCI DSS, and GDPR, which mandate high levels of data security. Virtualization technologies in the BFSI space must comply with these regulations, prompting institutions to invest heavily in advanced security solutions.

These regulations require continuous monitoring, risk mitigation, and real-time threat detection, which makes virtualization security a fundamental part of their IT infrastructure. Another factor driving the dominance of BFSI in the virtualization security market is the growing shift towards digital banking, cloud computing, and mobile financial services.

As financial institutions embrace digital transformation, the complexity of their virtualized environments increases, thereby heightening the need for secure virtualization platforms. This digital shift further amplifies the demand for solutions that can safeguard virtualized infrastructures from cyber threats, data breaches, and financial fraud.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Retail

- Education

- Manufacturing

- Healthcare

- Other Industry Verticals

Driving Factors

Increasing Demand for Secure Virtualization in Financial Institutions

The rising demand for secure virtualization solutions in industries like BFSI (Banking, Financial Services, and Insurance) is one of the primary drivers fueling the growth of the virtualization security market. With organizations in these sectors increasingly adopting virtualized infrastructures to enhance operational efficiency and scalability, ensuring robust security has become paramount.

In particular, financial institutions handle vast amounts of sensitive data, such as customer financial records, transaction histories, and personally identifiable information. This makes them attractive targets for cybercriminals.

Virtualization introduces complexities in securing such critical data, especially as environments become more dynamic and diverse with the proliferation of multi-cloud and hybrid-cloud systems. As a result, there is a growing need for advanced virtualization security technologies that can provide robust protection against evolving cyber threats.

Financial institutions are subject to stringent regulatory requirements, including GDPR, PCI-DSS, and SOX, which mandate comprehensive data protection. These regulations require organizations to adopt solutions that can ensure secure data storage, processing, and transfer across virtualized environments. Virtualization security solutions such as intrusion detection systems, encryption, and data loss prevention tools help BFSI companies meet compliance requirements while mitigating risks.

Restraining Factors

High Implementation Costs of Virtualization Security Solutions

One of the key restraints facing the growth of the virtualization security market is the high implementation costs associated with these solutions. Many organizations, especially small and medium-sized enterprises (SMEs), may find it challenging to allocate sufficient budget to implement advanced virtualization security tools.

While large enterprises are typically equipped with the resources to invest in comprehensive virtualization security systems, smaller organizations often struggle to meet the financial demands of securing their virtualized environments.

Advanced solutions such as endpoint protection, virtual machine monitoring, and intrusion detection systems require significant capital investment, as well as ongoing costs for maintenance, updates, and monitoring.

Additionally, the complexity of deploying and integrating these solutions into existing IT infrastructures can add to the costs. Organizations need to factor in the costs of training staff, hiring specialized security professionals, and possibly upgrading their existing hardware and software to support the new security measures. The lack of skilled professionals in the field of virtualization security further complicates the deployment process and drives up costs.

Growth Opportunites

Growing Demand for Cloud-Based Virtualization Security Solutions

The growing adoption of cloud computing and hybrid cloud infrastructures presents a significant opportunity for the virtualization security market. As more organizations shift to cloud-based environments, there is an increasing need to secure virtualized resources, data, and applications across these platforms.

Cloud environments are inherently more complex than traditional on-premise systems due to the multi-tenant nature, distributed architecture, and dynamic scalability they offer. This complexity makes cloud-based virtualization environments more vulnerable to cyberattacks, creating a robust demand for specialized cloud security solutions.

Cloud service providers and enterprises adopting hybrid or multi-cloud infrastructures need security solutions that are capable of providing seamless protection across different cloud environments while also addressing on-premise requirements. As businesses increasingly rely on public, private, and hybrid clouds for their IT needs, the demand for cloud-based virtualization security solutions will continue to surge.

Challenging Factors

Evolving Cyber Threats in Virtualized Environments

One of the biggest challenges faced by the virtualization security market is the constant evolution of cyber threats targeting virtualized environments. Virtualization technology is designed to enable greater flexibility and scalability within IT systems, but it also introduces new security vulnerabilities that cybercriminals are quick to exploit.

The dynamic and multi-layered nature of virtualized infrastructures presents challenges in terms of visibility, control, and compliance. Cyberattackers often target virtual machines, hypervisors, and network layers within virtual environments, where security gaps may exist.

For instance, a compromised virtual machine can potentially affect all other virtual machines running on the same physical hardware, making it harder to isolate and mitigate attacks.

Moreover, many virtualized environments operate in a distributed manner across multiple locations, which further complicates the monitoring and detection of cyber threats. This dispersed structure makes it harder for security teams to get a holistic view of the entire network, increasing the risk of undetected attacks.

Growth Factors

The rapid adoption of cloud computing and virtualization technologies across various industries is a key growth factor for the virtualization security market. As organizations increasingly migrate their workloads to virtual environments and multi-cloud infrastructures, the demand for robust security solutions to protect virtualized networks, applications, and data is growing.

This shift is not only about improving efficiency and reducing costs but also about ensuring that business operations remain secure in an evolving cyber threat landscape. Virtualization security solutions are now crucial for managing complex IT infrastructures that span across on-premise, private, and public clouds.

These technologies offer scalability and flexibility, but they also introduce new security challenges, including vulnerabilities associated with hypervisors, virtual machines (VMs), and cloud management platforms. As a result, businesses are investing heavily in virtualization security technologies to safeguard their networks, applications, and sensitive data.

Emerging Trends

One of the emerging trends in virtualization security is the integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms to enhance threat detection and response capabilities.

AI-based security solutions can monitor real-time activities across virtual environments, identify anomalous behavior, and respond faster to potential threats. Additionally, the increasing use of automation in security management is making it easier for organizations to scale their security efforts and handle the growing complexity of virtualized infrastructures.

Business Benefits

Implementing effective virtualization security measures not only protects organizations from cyber threats but also ensures compliance with industry standards and regulations.

Furthermore, virtualization security solutions can boost operational efficiency by enabling businesses to securely manage their virtualized environments, minimize downtime, and reduce operational risks. With enhanced security, organizations can also accelerate their digital transformation journey, ensuring business continuity even as they adopt new technologies.

Regional Analysis

In 2023, North America held a dominant market position in the virtualization security market, capturing more than a 37.5% share, equating to a revenue of approximately USD 0.9 billion. The region’s leadership can be attributed to several factors, primarily the extensive presence of large enterprises and advanced technological infrastructure.

North America is home to some of the world’s biggest technology firms, including major players in cloud computing, IT services, and cybersecurity, which naturally drives the demand for robust virtualization security solutions. As organizations increasingly adopt virtualized environments to enhance operational efficiency, there is a growing need to safeguard sensitive data and ensure uninterrupted services.

Additionally, North America benefits from a well-established regulatory framework for data protection, such as GDPR (for international firms) and CCPA (California Consumer Privacy Act), which compels companies to adopt advanced security measures, including virtualization security solutions. The increasing focus on compliance, coupled with rising concerns over data breaches and cyberattacks, has resulted in substantial investments in security technologies.

The region is also at the forefront of cloud adoption, where hybrid and multi-cloud strategies are becoming the norm. This trend, along with the rise of remote work models post-pandemic, further fuels the demand for virtualization security solutions. With businesses relying on cloud platforms and virtualized infrastructure, the need for effective security measures to protect virtual machines, hypervisors, and cloud networks continues to grow.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

IBM Corporation continues to be a significant player in the virtualization security market, with its strong portfolio of security solutions for virtualized and cloud environments. The company has consistently expanded its reach in this space through both strategic acquisitions and product innovations.

For example, IBM’s acquisition of Red Hat in 2019 enhanced its ability to provide more comprehensive hybrid cloud and security solutions. This acquisition has allowed IBM to offer cutting-edge security for virtualized infrastructure, combining Red Hat’s open-source expertise with IBM’s AI-driven security capabilities.

Cisco Systems, Inc. has long been a leader in network infrastructure and security, and its role in the virtualization security market is no different. Cisco has leveraged its established presence in the networking space to offer integrated security solutions for virtualized environments.

One of the company’s key innovations is the Cisco SecureX platform, which provides end-to-end visibility and control over cloud, network, and virtualization security. Cisco has also made strategic investments in cybersecurity solutions, including acquiring companies like Duo Security and OpenDNS to enhance its security offerings.

Trend Micro Incorporated has been a strong contender in the virtualization security market, focusing on providing comprehensive security solutions designed to protect virtualized environments across cloud and on-premise infrastructures. Known for its proactive approach to cybersecurity, Trend Micro offers a range of products specifically designed to secure virtual machines, networks, and cloud environments.

The company has heavily invested in innovations to support advanced security measures for virtualized workloads, including its Deep Security platform, which provides real-time protection for virtual environments. Additionally, Trend Micro has made strategic moves to strengthen its security capabilities, such as the acquisition of TippingPoint, a leader in network security and threat intelligence.

Top Key Players in the Market

- IBM Corporation

- Cisco Systems, Inc.

- Trend Micro Incorporated

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Sophos Ltd.

- Palo Alto Networks, Inc.

- Juniper Networks, Inc.

- Kaspersky

- Broadcom Inc.

- Other Key Players

Recent Developments

- In 2023: Trend Micro Incorporated made a strategic move by acquiring Cloud Conformity, a leader in cloud security posture management (CSPM). This acquisition aligns with Trend Micro’s goal to strengthen its offerings in cloud-native security, particularly in virtualized environments.

- In 2024: Cisco Systems, Inc. introduced its Secure Network Analytics platform designed to enhance security in virtualized and cloud environments. The new platform integrates Cisco’s existing security technologies with advanced machine learning and network telemetry, enabling better threat detection and response across virtualized and hybrid infrastructures.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Bn Forecast Revenue (2033) USD 9.7 Bn CAGR (2024-2033) 15.00% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Small and Medium Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Retail, Education, Manufacturing, Healthcare, Other Industry Verticals) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape IBM Corporation, Cisco Systems, Inc., Trend Micro Incorporated, Check Point Software Technologies Ltd., Fortinet, Inc., Sophos Ltd., Palo Alto Networks, Inc., Juniper Networks, Inc., Kaspersky, Broadcom Inc., Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtualization Security MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Virtualization Security MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Cisco Systems, Inc.

- Trend Micro Incorporated

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Sophos Ltd.

- Palo Alto Networks, Inc.

- Juniper Networks, Inc.

- Kaspersky

- Broadcom Inc.

- Other Key Players