Global Virtual Legal Advisory Services Market Size, Share, Industry Analysis Report By Service Type (Legal Document Preparation, Legal Advice and Consultation, Legal Representation, Legal Research, Others), By Platform Type (Websites, Mobile Applications, Desktop Applications), By User Type (Individuals, Small and Medium-sized Enterprises (SMEs), Large Enterprises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160450

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Technology in Legal Practice

- Role of Generative AI

- Analysts’ Viewpoint

- Investment and Business Benefits

- U.S. Market Size

- Service Type Analysis

- Platform Type Analysis

- User Type Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

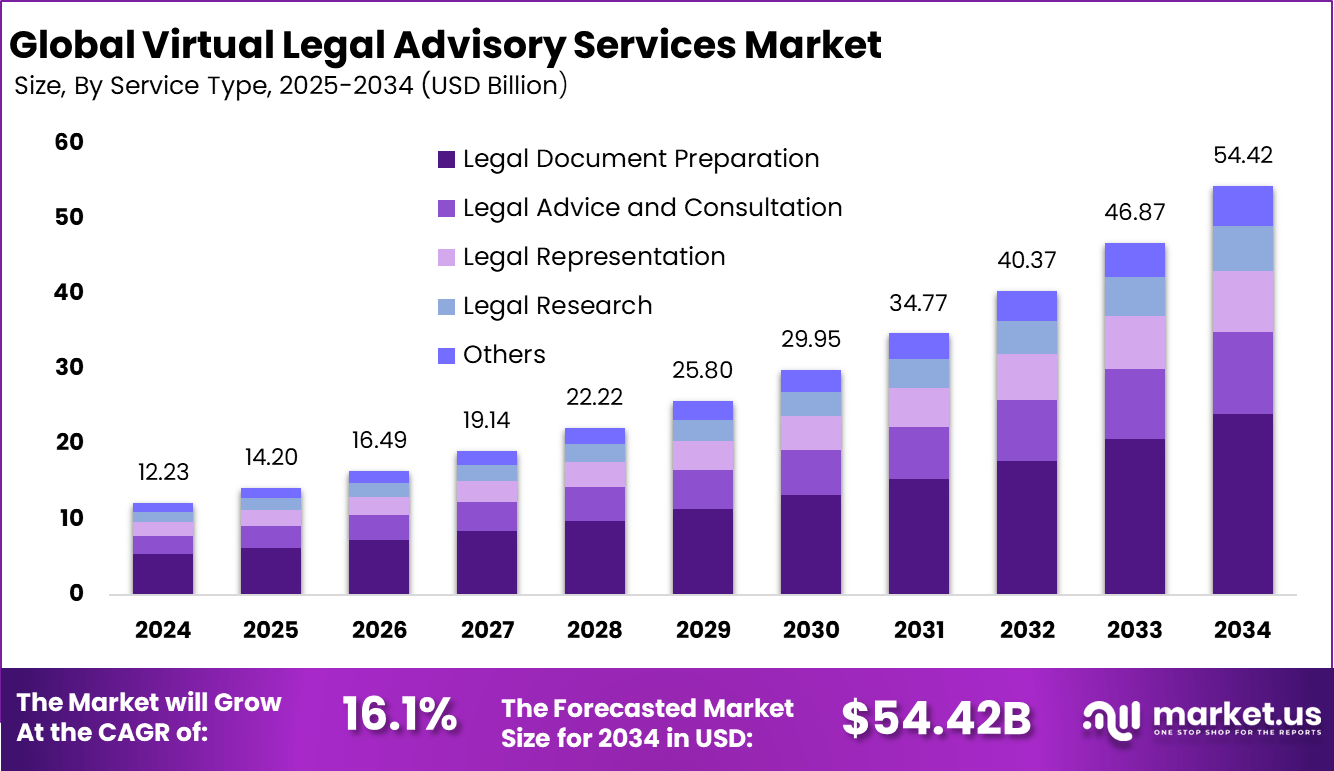

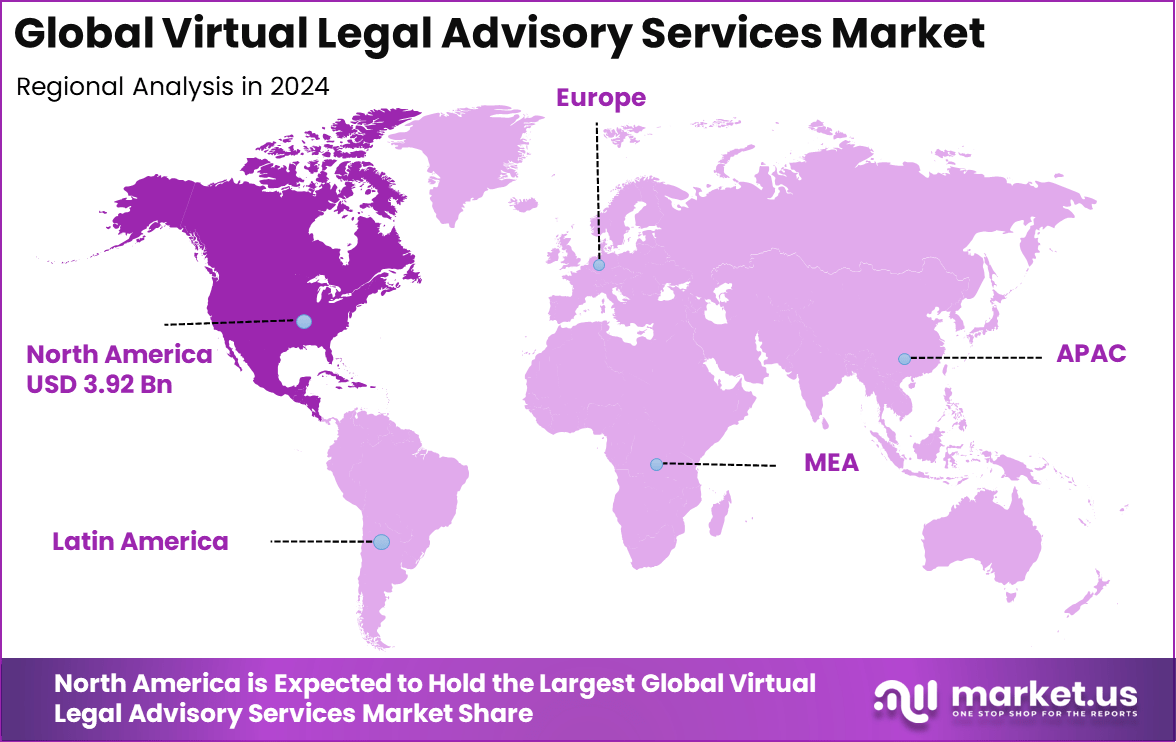

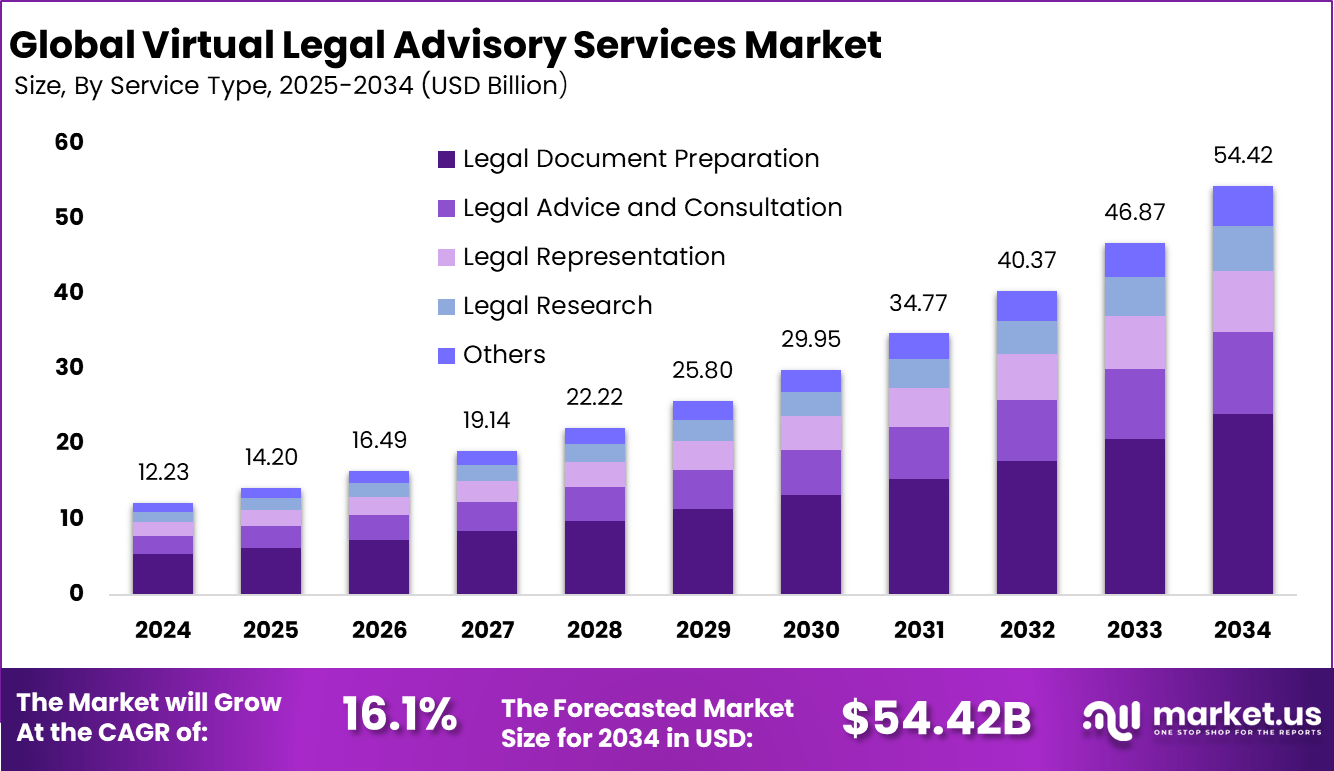

The Global Virtual Legal Advisory Services Market size is expected to be worth around USD 54.42 billion by 2034, from USD 12.23 billion in 2024, growing at a CAGR of 16.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.1% share, holding USD 3.92 billion in revenue.

Virtual Legal Advisory Services refers to the delivery of legal counsel, document review, contract drafting, compliance guidance, and dispute-resolution assistance over digital platforms rather than in person. These services rely on video consultations, chatbots, automated document tools, e-signatures, AI assistants, and secure client portals. The model allows clients to interact with legal professionals remotely, and many tasks traditionally handled in offices are now handled virtually.

For instance, in July 2025, Trident Wealth Partners announced the expansion of its national reach with the launch of virtual financial and legal advisory services. The initiative leverages digital platforms to provide clients with seamless access to wealth management and legal guidance, eliminating geographical barriers. By integrating financial planning with virtual legal support, Trident aims to deliver comprehensive, client-centric solutions.

Top driving factors for this market include increased demand for affordable and accessible legal services, the rise of startups and small businesses seeking flexible support, and broader acceptance of remote consultations accelerated by changing work patterns globally. The adoption of AI-powered tools that automate legal research and document generation also fuels growth. Furthermore, the convenience of on-demand legal help and subscription models meets the preferences of cost-conscious clients who need timely and ongoing legal assistance.

Over 70% of small businesses now prefer virtual legal services due to these benefits, contributing strongly to market expansion. Demand analysis highlights strong growth in sectors such as business legal advisory, real estate, intellectual property, family law, and immigration services. Startups and SMEs lead business legal advisory demand due to regulatory complexities and corporate governance needs. Individual clients increasingly rely on virtual services for estate planning and dispute management.

Top Market Takeaways

- In 2024, Legal Document Preparation led with 44.2%, highlighting strong demand for standardized legal services online.

- The Websites segment accounted for 39.7%, reflecting the dominance of digital platforms in delivering legal advisory services.

- Individuals as end users held 64.3%, showing widespread adoption of virtual legal tools for personal legal needs.

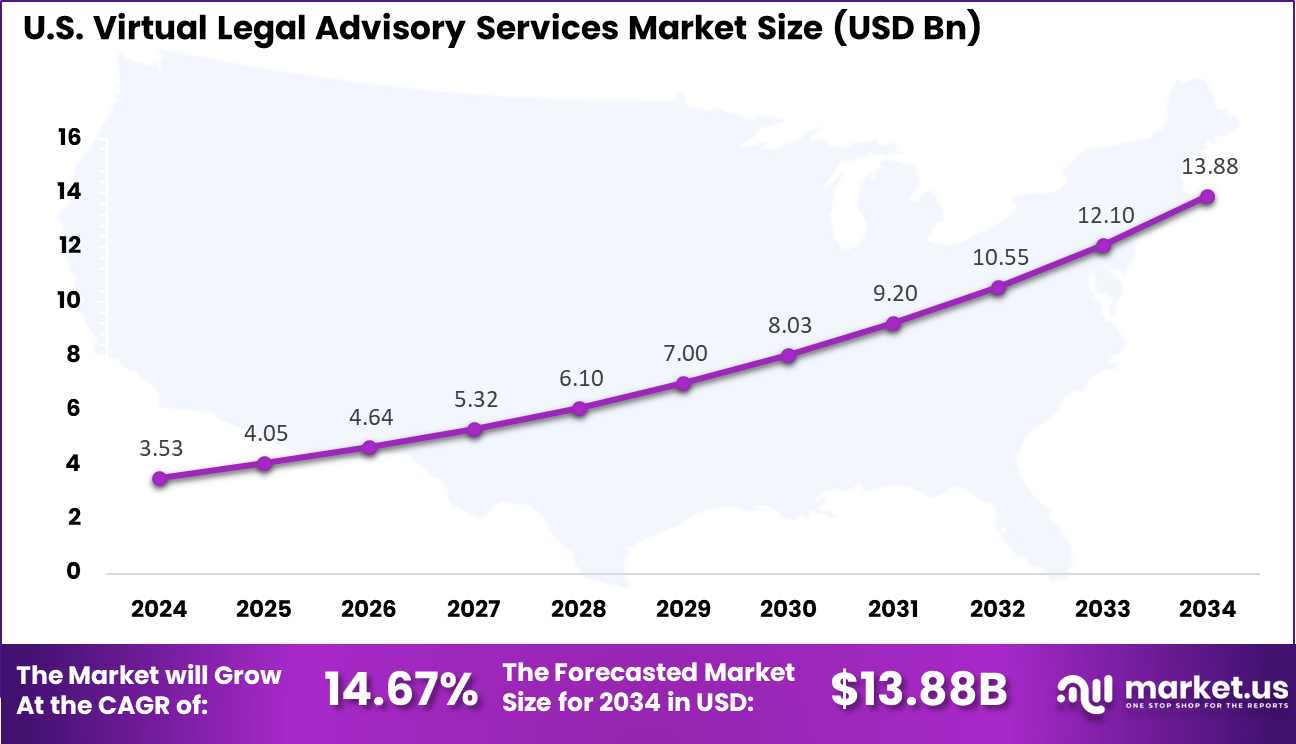

- The US market reached USD 3.53 billion in 2024 and is expanding at a CAGR of 14.67%, underscoring rapid digital transformation in legal services.

- North America captured 32.1%, affirming its leadership in the global market through strong adoption and technology integration.

According to Market.us, The Legal Process Outsourcing (LPO) market is set to surge from USD 32.3 billion in 2024 to nearly USD 503.2 billion by 2034, reflecting a strong 31.6% CAGR. North America remains at the forefront, holding 43% of the global market in 2024, with the U.S. contributing USD 13.14 billion, supported by its cost-efficient and scalable operations.

Alongside this, the Generative AI in Legal market is gaining momentum, projected to expand from USD 68.2 million in 2023 to about USD 992.1 million by 2033, growing at a 31.5% CAGR. Early adoption in North America has been significant, with the region capturing 36.8% share and revenues of USD 25 million in 2023. The demand is being driven by automated document drafting, contract review, and predictive legal analytics that are reshaping client services.

In parallel, the Legal AI Software market is evolving as a broader ecosystem, expected to grow from USD 1.5 billion in 2023 to nearly USD 19.3 billion by 2033, at a 29.1% CAGR. North America again leads this segment, securing 37.2% share with USD 0.5 billion revenue in 2023. This reflects rising adoption of AI-powered compliance monitoring, e-discovery, and litigation support tools, positioning legal AI as a critical pillar in modern law practices.

Technology in Legal Practice

Technology adoption by legal professionals

- Increasing comfort with AI:According to an August 2025 report, 74% of legal professionals expect to use AI-driven tools within the next year, with 80% now considering themselves knowledgeable about AI.

- Growth in individual vs. firm-wide AI use:A 2025 report found that 31% of individual legal professionals used generative AI tools in their work, up from 27% the previous year. However, firm-wide adoption slightly decreased, indicating a cautious, phase-in approach, especially in smaller firms.

- Virtual assistants and paralegals:Some firms are already embracing virtual assistants, with reports indicating they can increase productivity by 13% and decrease operating costs by 78%.

Client experience and satisfaction

- Demand for online tools:A 2020 Legal Trends Report found that 69% of consumers prefer working with a lawyer who can share documents electronically through an app or online portal.

- Preference for virtual meetings:The same report noted that 37% of consumers prefer virtual meetings for initial consultations, and 50% prefer them for follow-up meetings.

- Technology drives client satisfaction:Law firms that proactively seek and act on client feedback using modern technology are 124% more likely to see a significant rise in client satisfaction.

Role of Generative AI

Generative AI is playing a crucial role in transforming virtual legal advisory services by making processes faster, more efficient, and highly accurate. It can generate legal documents, review large volumes of legal data, and provide instant insights that support better decision-making.

Recent stats reveal that around 96% of legal professionals see AI’s potential to assist with tasks like legal research and document drafting, although most still see AI as a tool rather than a replacement in client representation. The technology also supports automation of repetitive tasks, improves due diligence, and powers virtual assistants that are available around the clock.

These developments highlight how generative AI is making legal services more accessible and responsive, while also offering law firms a notable competitive edge. As AI continues to evolve, its role in legal advisory services is expected to deepen, ultimately reshaping client engagements and operational workflows.

Analysts’ Viewpoint

Technological adoption driving this market includes AI and automation for document review and predictive legal analytics, cloud-based practice management, online client portals, electronic signature platforms, and virtual communication tools like video conferencing. These technologies improve legal process efficiency, reduce errors, and enhance client interaction. Smart contracts based on blockchain are emerging as innovative tools for automating contract enforcement.

More than 80% of virtual legal service providers use AI to optimize workflow, highlighting technology as a key enabler for market growth. Key reasons for adopting virtual legal advisory are cost savings, time efficiency, increased accessibility, and improved client service. Hiring virtual legal experts can cut legal support costs by up to 70%, while clients gain 500+ extra billable hours annually through productivity boosts.

The flexibility to scale services during workload fluctuations allows firms to maintain lean operations without compromising quality. Additionally, clients benefit from prompt communication and seamless service delivery, which strengthens client satisfaction and loyalty. These advantages explain the widespread shift to virtual legal models.

Investment and Business Benefits

Investment opportunities lie in developing AI-driven legal platforms, expanding cloud-based infrastructure, integrating blockchain for secure transactions, and targeting underserved segments such as rural areas and gig economy workers. Emerging markets in Asia Pacific and Latin America offer promising adoption growth due to improving digital literacy and government support for online services.

Investments that enable multilingual support and cross-border legal services also present attractive potential as virtual legal advisory expands globally. Business benefits include reduced overhead from staffing and office space, faster service delivery, improved accuracy via automated tools, and greater operational scalability.

Law firms leveraging virtual legal advisory can increase client reach and diversify service offerings. Enhanced client experience through virtual assistants and instant access to legal advice also boosts firm reputations and referral rates. Overall, firms gain agility to respond quickly to legal market changes and client demands.

U.S. Market Size

The market for Virtual Legal Advisory Services within the U.S. is growing tremendously and is currently valued at USD 3.53 billion, the market has a projected CAGR of 14.67%. The market is expanding quickly, driven by digital adoption, shifting client preferences, and the need for more affordable legal services.

The complexity of U.S. regulations and increasing corporate compliance requirements are creating strong demand for accessible, specialized legal support. Subscription-based pricing and the normalization of remote work make virtual services more attractive. At the same time, advancements in AI are enhancing service efficiency and personalization, reinforcing the shift toward flexible, technology-driven legal solutions across industries.

In 2024, North America held a dominant market position in the Global Virtual Legal Advisory Services Market, capturing more than a 32.1% share, holding USD 3.92 billion in revenue. This dominance is due to its advanced digital infrastructure, high legal service demand, and early adoption of legal technology.

The region’s mature regulatory environment and increasing acceptance of remote legal services among both firms and clients contributed significantly. Additionally, ongoing reforms allowing innovative legal service models, combined with widespread use of AI and automation, positioned North America as a leader in delivering efficient, scalable, and client-centric virtual legal solutions.

Service Type Analysis

In 2024, Legal document preparation holds a dominant 44.2% share in the virtual legal advisory services market. This segment caters primarily to users seeking cost-effective alternatives to traditional legal assistance, focusing on the drafting and review of contracts, wills, and other essential legal forms.

The convenience of preparing legally recognized documents online without needing full attorney involvement appeals especially to individuals and small businesses aiming to manage routine legal needs with increased efficiency. The rise in digital platforms automating document creation and verification has accelerated adoption.

Providers have improved user experience through guided templates and AI-powered tools, making complex legal processes accessible to users with limited legal knowledge. This service type’s growth is also supported by regulatory acceptance of electronically prepared and notarized documents.

For Instance, In July 2025, FinancialDocs acquired LegalDocs to merge financial document automation with a wide range of legal templates and compliance tools. The move enables a unified platform for generating legally compliant financial and legal documents, expanding the company’s virtual document-preparation capabilities.

Platform Type Analysis

In 2024, Web-based platforms represent 39.7% of the market, serving as the primary interface for virtual legal advisory services. These websites offer an integrated environment where clients can access document preparation, live consultations, and legal resources in one place. The accessibility and flexibility of web platforms allow users to conveniently address legal matters from any device, boosting the demand for online legal help.

Beyond simple access, these websites are continuously enhancing functionalities such as secure client portals, chatbots, and AI-driven document review features. Such advancements improve efficiency while reducing human error and operational costs. This combination of user-friendly technology and comprehensive legal service offerings contributes to the significant market share of website platforms.

For instance, in June 2025, a new platform called LegalTech Connect was launched to unite the legal tech community through a dedicated website offering events, advisory services, and educational resources. The platform is designed to foster collaboration among legal professionals, technology providers, and innovators, creating a centralized hub for knowledge sharing and networking.

User Type Analysis

In 2024, the Individuals are the largest user group, accounting for 64.3% of demand. This predominance reflects the growing trend among consumers to seek affordable, accessible legal services for personal matters like estate planning, family law issues, and small claims. Virtual platforms empower these users with self-service options and on-demand consultations, making legal support more democratic and less intimidating.

The convenience of virtual legal services has particularly resonated with younger demographics comfortable with digital tools and looking for flexible legal solutions outside traditional office hours. Moreover, the high cost and complexity of traditional legal services have driven individuals to embrace virtual platforms for straightforward legal needs.

For Instance, in April 2024, a virtual legal consulting firm was featured for its focus on providing individual clients with affordable and accessible legal advisory services online. The firm offers support in areas such as wills, contracts, family law, and consumer rights, enabling individuals to resolve legal matters without the need for traditional in-person consultations.

Emerging Trends

Emerging trends in virtual legal advisory market are heavily driven by advancements in AI, cloud computing, and digital platforms. There is a noticeable increase in online legal service providers offering automated document generation, dispute resolution, and legal consultation through virtual platforms.

These services are increasingly preferred, with some estimates indicating that the online legal services market could grow at a compound annual rate of approximately 14.4% from 2024 to 2029, reflecting heightened demand for accessible and tech-driven legal support.

Furthermore, regulatory support for online legal access and the rise of virtual courtrooms are boosting the adoption of remote legal services. The trend towards more personalized, yet cost-effective, legal solutions suggests a shift in how clients prefer to engage with legal professionals, favoring faster, digital-based interactions over traditional in-person consultations.

Growth Factors

The growth factors fueling this market are multifaceted. The increasing complexity of legal regulations worldwide demands more sophisticated legal tools, which AI and automation provide efficiently. Cost reduction remains a significant driver, with online legal services substantially lowering the expenses associated with traditional legal processes.

Additionally, digitalization in the legal sector enhances efficiency by streamlining workflows and reducing turnaround times. Data indicates that legal technology investments are expected to surge, with the market size projected to surpass $63 billion by 2032, driven by the rising adoption of AI-powered legal tools and platforms.

The expansion of the freelance economy and the demand for on-demand legal services among small businesses and individuals further support market growth, as digital platforms facilitate affordable and rapid legal assistance. These factors create a robust environment for continuous expansion and innovation in virtual legal advisory services.

Key Market Segments

By Service Type

- Legal Document Preparation

- Legal Advice and Consultation

- Legal Representation

- Legal Research

- Others

By Platform Type

- Websites

- Mobile Applications

- Desktop Applications

By User Type

- Individuals

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Digital Transformation in Legal Services

The accelerated digital transformation of professional services, spurred by the COVID-19 pandemic, has reshaped client expectations in the legal industry. Law firms and solo practitioners are increasingly adopting virtual platforms to provide seamless, remote legal counsel.

Law firms and solo practitioners are responding by adopting virtual tools for consultations, document sharing, and case management. This digital transformation improves client convenience and also reduces overhead costs. The legal sector is evolving rapidly to meet these new expectations and stay competitive in a digital-first world.

For instance, in July 2025, First Legal announced a major investment in digital transformation initiatives to modernize legal services and enhance client experience. The company is leveraging advanced technologies, including cloud-based platforms, automation, and AI-driven tools, to streamline workflows, improve efficiency, and provide faster, more reliable legal support.

Restraint

Regulatory and Licensing Restrictions

A significant restraint on virtual legal advisory services comes from the complex web of jurisdictional regulations and licensing requirements. Lawyers must be licensed in the client’s jurisdiction to lawfully offer legal advice, which complicates cross-border service delivery. This limitation restricts how some virtual firms operate and requires careful compliance to avoid unauthorized practice of law.

Additionally, varying regulations across states and countries create layers of compliance steps, limiting the speed at which firms can scale virtually or serve clients remotely. These restrictions slow growth and sometimes deter adoption among lawyers unfamiliar with multi-jurisdictional legal frameworks.

Opportunities

Offering Subscription and On-Demand Models

Clients increasingly prefer flexible legal solutions that match their business rhythms. Subscription and on-demand models offer affordable, scalable options for individuals, startups, and small businesses. Instead of paying hourly rates, clients can access ongoing legal support at predictable prices.

This approach builds loyalty, smooths revenue for firms, and allows legal providers to offer tailored services across different industries. It also opens new markets, especially among clients who previously avoided legal help due to cost concerns.

For instance, in May 2025, a Gurugram-based startup gained attention for introducing subscription and on-demand models in virtual legal advisory services, making legal support more accessible and affordable for individuals and businesses. Through its digital platform, users can access legal consultations, document drafting, and compliance guidance on a pay-per-use or subscription basis.

Challenges

Addressing Ethical Concerns in Online Legal Practice

Operating online raises new ethical issues that legal service providers must manage carefully. Maintaining client confidentiality over digital platforms, preventing conflicts of interest, and ensuring only qualified professionals offer advice are critical concerns.

The risk of unauthorized practice is higher in virtual settings, especially across jurisdictions. Firms need clear protocols, secure systems, and strong compliance frameworks to protect clients and uphold trust while delivering legal services remotely.

For instance, In March 2025, a report by Clement, Gates & Clark LLP pointed to rising ethical challenges in virtual legal advisory services, citing risks such as unauthorized practice of law, insufficient supervision of remote teams, and cross-jurisdictional legal conflicts. While virtual platforms improve access to legal support, the report stressed concerns over confidentiality, oversight, and regulatory compliance.

Key Players Analysis

The Virtual Legal Advisory Services Market is led by prominent online legal platforms such as LegalZoom, Rocket Lawyer, LegalShield, and DoNotPay. These companies provide digital access to legal documentation, contract creation, and automated advisory tools.

Legal marketplace providers including LegalMatch, Avvo, UpCounsel, and Lexoo specialize in connecting clients with licensed attorneys through virtual consultations. These platforms streamline legal service discovery, pricing transparency, and case matching.

Meanwhile, DocuSign.com, Contractbook, and LawDepot contribute by offering legally binding electronic signatures and contract automation tools used across business, real estate, and compliance workflows. Practice management and workflow providers such as MyCase, Clio, and Nolo serve law firms and independent practitioners with virtual case handling, billing, and document storage capabilities.

Their platforms support remote legal operations and client collaboration. A growing number of other market participants continue to expand the industry through AI chatbots, dispute resolution portals, and self-help legal templates, driving digital transformation across legal services.

Top Key Players in the Market

- LegalMatch

- DoNotPay

- DocuSign

- Lawyers.com

- MyCase

- Contractbook

- Lexoo

- LegalZoom

- Rocket Lawyer

- Avvo

- Clio

- LawDepot

- UpCounsel

- LegalShield

- Nolo

- Others

Recent Developments

- In April 2025, LegalZoom partnered with Divorce.com to streamline and simplify the divorce process for users seeking legal support online. This collaboration expands LegalZoom’s offerings in family law by integrating Divorce.com’s technology and services, enabling clients to access both DIY and full-service divorce solutions.

- In June 2025, LegalZoom announced a strategic partnership with Perplexity, an AI-powered search engine, to expand access to legal services through intelligent digital platforms. This collaboration integrates LegalZoom’s legal expertise with Perplexity’s AI capabilities, enabling users to access contextual, real-time legal assistance directly within the search experience.

Report Scope

Report Features Description Market Value (2024) USD 12.23 bn Forecast Revenue (2034) USD 54.4 bn CAGR(2025-2034) 16.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Legal Document Preparation, Legal Advice and Consultation, Legal Representation, Legal Research, Others), By Platform Type (Websites, Mobile Applications, Desktop Applications), By User Type (Individuals, Small and Medium-sized Enterprises (SMEs), Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LegalMatch, DoNotPay, DocuSign, Lawyers.com, MyCase, Contractbook, Lexoo, LegalZoom, Rocket Lawyer, Avvo, Clio, LawDepot, UpCounsel, LegalShield, Nolo, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Virtual Legal Advisory Services MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Virtual Legal Advisory Services MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LegalMatch

- DoNotPay

- DocuSign

- Lawyers.com

- MyCase

- Contractbook

- Lexoo

- LegalZoom

- Rocket Lawyer

- Avvo

- Clio

- LawDepot

- UpCounsel

- LegalShield

- Nolo

- Others