Global Virtual Goods Market Size, Share, Growth Analysis By Type (In-Game Virtual Goods, Digital Collectibles (Non-NFT), Non-Fungible Tokens (NFT-Based Collectibles), Virtual Currency (Coins, Gems, Tokens), Virtual Land and Property, Virtual Services (Avatar Styling, Event Tickets, etc.)), By Platform (Mobile Games and Apps, PC/Console Games, Metaverse Platforms and Virtual Worlds, Social-Media Networks, Crypto-Native Marketplaces), By Device (Smartphones and Tablets, PCs and Consoles, VR/AR Head-Mounted Displays), By Technology (Blockchain-Enabled, Non-Blockchain (Centralized)), By Payment Model (Micro-transactions and Loot Boxes, Subscription / Season Pass, Pay-to-Own (One-Time Purchase)), By Application (Online Games, Metaverse and Virtual Events, Social-Media Gifting and Tipping, Digital Commerce and Advertising), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178246

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Platform Analysis

- By Device Analysis

- By Technology Analysis

- By Payment Model Analysis

- By Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Company Insights

- Recent Developments

- Report Scope

Report Overview

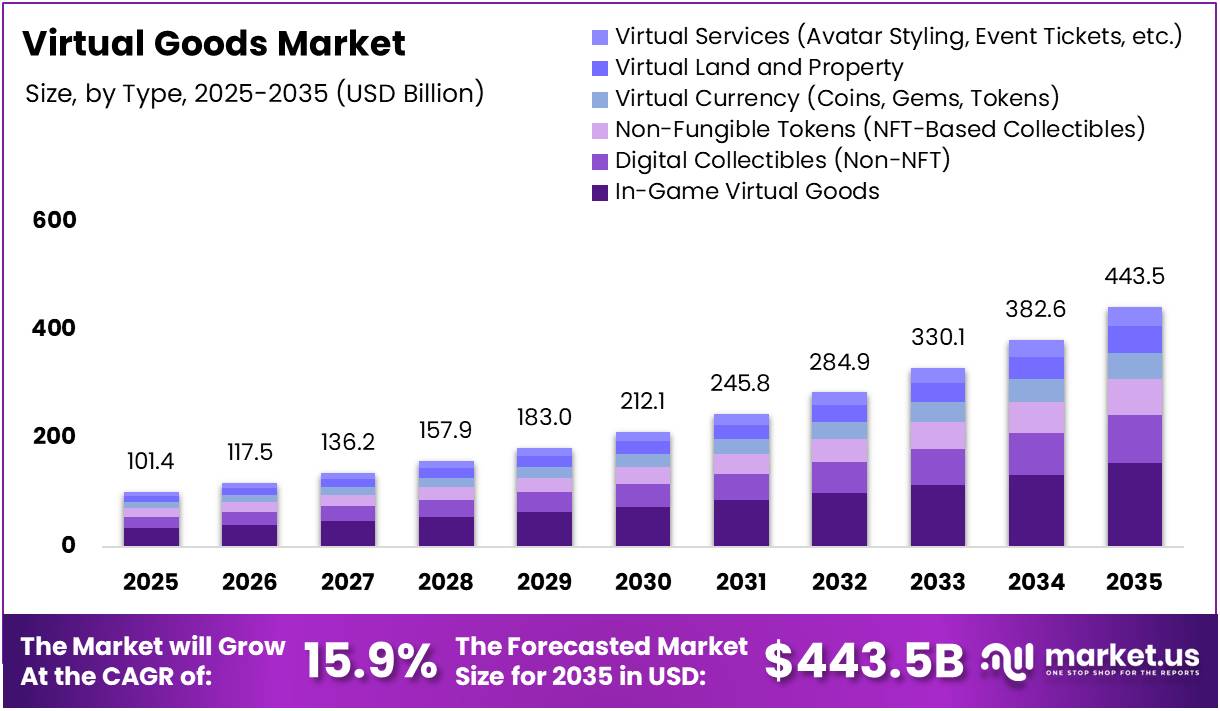

The Global Virtual Goods Market size is expected to be worth around USD 443.5 Billion by 2035 from USD 101.4 Billion in 2025, growing at a CAGR of 15.9% during the forecast period 2026 to 2035.

The virtual goods market encompasses digital products and assets exchanged within online environments. These include in-game items, digital collectibles, virtual currencies, and avatar accessories. Consumers purchase these goods to enhance experiences in gaming, social media, and virtual worlds.

Virtual goods derive value from user demand, scarcity, and platform ecosystems. Moreover, the rise of multiplayer games, metaverse platforms, and live streaming has broadened the scope of digital ownership. Consequently, virtual goods now serve functional, aesthetic, and social purposes across diverse digital environments.

The market is experiencing strong growth driven by increased screen time, digital identity expression, and expanding mobile gaming audiences. Additionally, integration of blockchain technology has introduced new ownership models, making virtual goods more transferable and verifiable. These factors are reshaping how consumers perceive and invest in digital assets.

Government and regulatory bodies are paying closer attention to virtual economies, particularly around loot boxes and digital asset taxation. However, several regions are also exploring frameworks that support digital commerce innovation. This regulatory evolution is creating both challenges and structured growth pathways for market participants.

According to WAX.io,trading virtual items in video games has become increasingly popular, with around 60% of console gamers having purchased virtual items at some point, along with 43% of PC gamers and 33% of smartphone gamers. These figures reflect how mainstream virtual goods consumption has become.

According to Vorhaus Advisors, nearly half (46%) of virtual good buyers expressed interest in having real ownership of their virtual goods. Furthermore, 52% of virtual goods buyers are more likely to see blockchain as a way to guard against removal or tampering, signaling strong demand for decentralized ownership models.

Additionally, peer-to-peer trading of virtual goods (40%) and a universal marketplace that works across any game (39%) were the features virtual goods buyers expressed the most interest in. These preferences are directly shaping platform development strategies and investment priorities across the global virtual goods ecosystem.

Key Takeaways

- The Global Virtual Goods Market is valued at USD 101.4 Billion in 2025 and is projected to reach USD 443.5 Billion by 2035.

- The market is growing at a CAGR of 15.9% during the forecast period 2026 to 2035.

- By Type, In-Game Virtual Goods dominates with a market share of 34.8%.

- By Platform, Mobile Games and Apps holds the leading share at 37.1%.

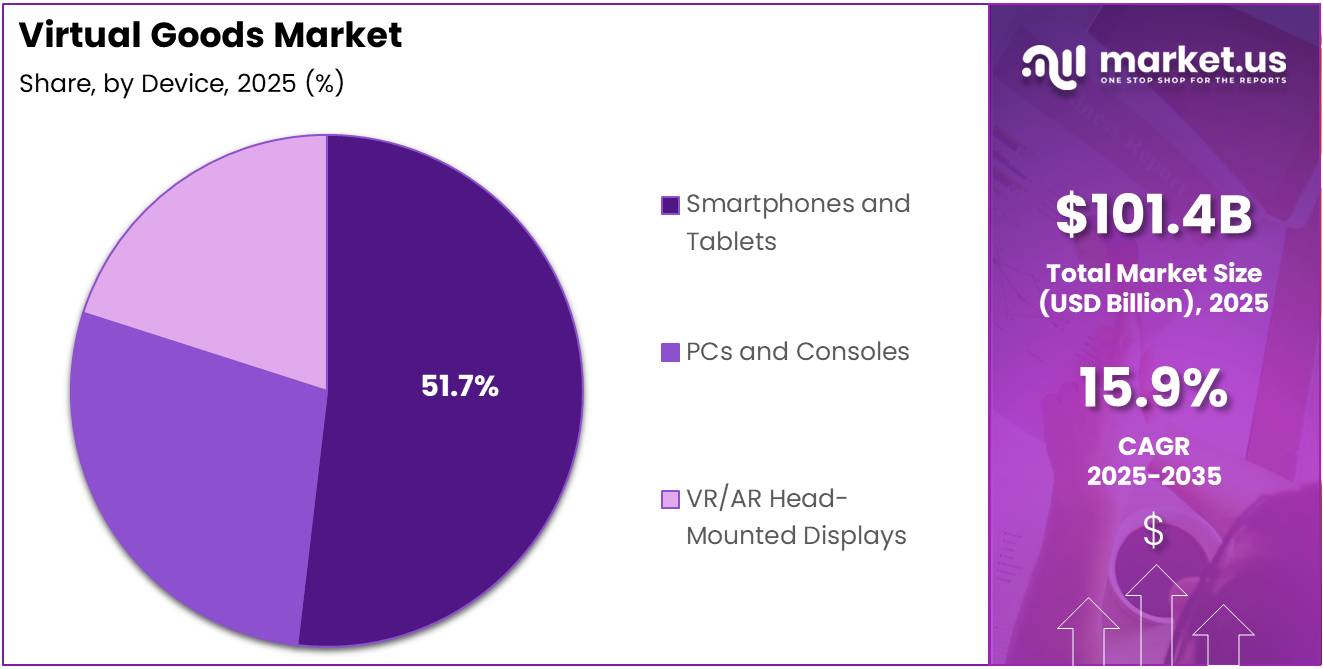

- By Device, Smartphones and Tablets lead the segment with a share of 51.7%.

- By Technology, Blockchain-Enabled solutions dominate with 67.2% market share.

- By Payment Model, Micro-transactions and Loot Boxes account for 49.4% of the market.

- By Application, Online Games leads with a share of 48.9%.

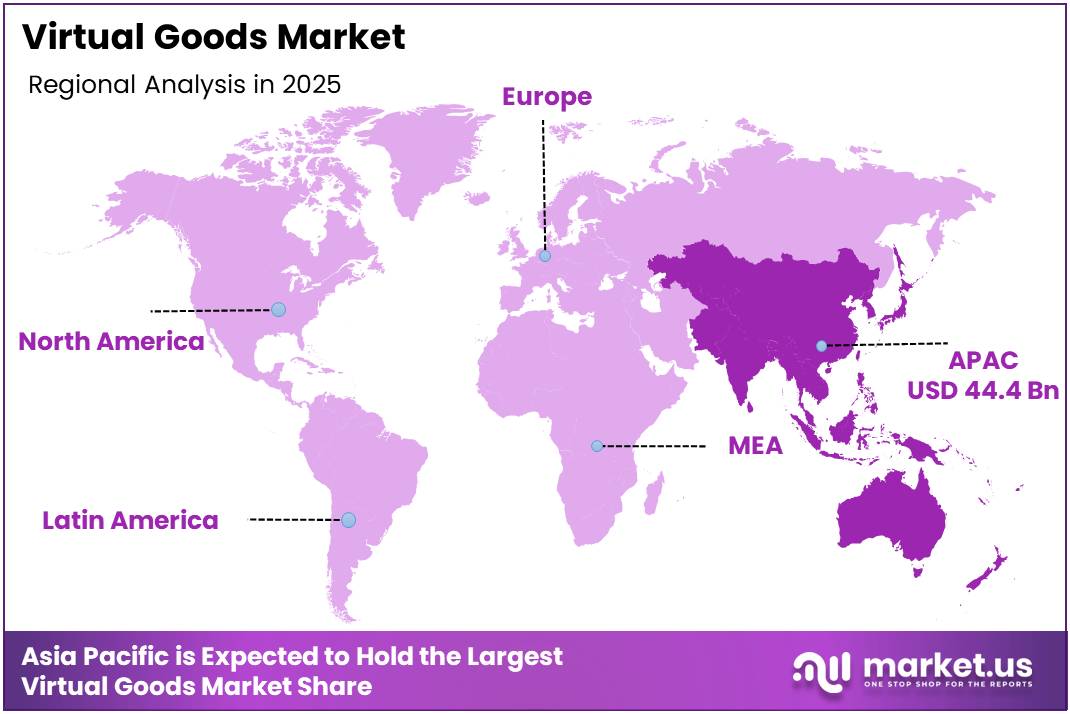

- Asia Pacific dominates the regional landscape with a share of 43.8%, valued at USD 44.4 Billion.

By Type Analysis

In-Game Virtual Goods dominates with 34.8% due to high consumer engagement in multiplayer and mobile gaming ecosystems.

In 2025, In-Game Virtual Goods held a dominant market position in the By Type segment of the Virtual Goods Market, with a 34.8% share. Demand for skins, weapons, and character upgrades continues to rise. Moreover, live-service game models have made in-game purchases a consistent revenue stream for developers and platforms worldwide.

Digital Collectibles (Non-NFT) represent a growing segment driven by nostalgia, brand loyalty, and limited availability. Consumers actively seek exclusive digital memorabilia tied to sports, entertainment, and gaming franchises. However, the absence of blockchain verification means ownership remains platform-dependent, limiting secondary market activity compared to NFT-based alternatives.

Non-Fungible Tokens (NFT-Based Collectibles) offer verifiable ownership through blockchain, attracting both gamers and digital investors. Additionally, high-profile IP collaborations and artist drops have expanded their appeal beyond core crypto audiences. Consequently, NFT collectibles continue to attract speculative and utility-driven buyers across global digital marketplaces.

Virtual Currency (Coins, Gems, Tokens) serves as the transactional backbone of most virtual economies. These currencies enable microtransactions within games and platforms without requiring real-money gateways at every step. Therefore, they remain a critical enabler of spending behavior across both casual and competitive gaming audiences globally.

Virtual Land and Property is gaining traction through metaverse platforms where digital real estate holds commercial and social value. Brands and creators are investing in virtual spaces for events, advertising, and immersive experiences. However, market maturity remains limited, and adoption depends heavily on the growth of active metaverse user bases.

Virtual Services (Avatar Styling, Event Tickets, etc.) reflect a shift toward experience-based digital spending. Consumers now pay for avatar makeovers, access to exclusive virtual events, and personalized digital experiences. Moreover, as social interactions increasingly move online, demand for these service-based virtual goods is expected to expand steadily across platforms.

By Platform Analysis

Mobile Games and Apps dominates with 37.1% due to mass-market smartphone penetration and accessible in-app purchase ecosystems.

In 2025, Mobile Games and Apps held a dominant market position in the By Platform segment of the Virtual Goods Market, with a 37.1% share. Affordable smartphones and widespread internet access have made mobile gaming the most accessible channel. Consequently, in-app purchase behavior is deeply embedded in mobile gaming culture globally.

PC/Console Games remain a strong segment, particularly among core gamers who invest heavily in cosmetic upgrades and expansion content. Premium titles with ongoing live-service components continue to drive consistent virtual goods revenue. Moreover, high-spending demographics on consoles make this segment a significant contributor to overall market value.

Metaverse Platforms and Virtual Worlds represent a high-growth segment where virtual goods serve social, commercial, and creative functions. Users purchase land, avatars, and event access within these persistent digital environments. However, broader adoption depends on improved user experience and hardware accessibility for immersive platforms.

Social-Media Networks are emerging as a meaningful platform for virtual gifting and tipping. Creators receive digital goods from followers as a form of engagement and monetization. Additionally, platform-native currencies and gifting features are deepening the integration of virtual goods within mainstream social media ecosystems.

Crypto-Native Marketplaces serve a distinct audience that prioritizes ownership, transferability, and blockchain-verified assets. These platforms support peer-to-peer trading of NFTs and digital collectibles outside traditional gaming environments. Therefore, they play a key role in expanding the virtual goods economy beyond conventional gaming and entertainment channels.

By Device Analysis

Smartphones and Tablets dominates with 51.7% due to global mobile-first consumer behavior and broad gaming app adoption.

In 2025, Smartphones and Tablets held a dominant market position in the By Device segment of the Virtual Goods Market, with a 51.7% share. The combination of affordable devices and accessible app stores has made mobile the primary gateway for virtual goods consumption. Moreover, casual and mid-core gamers on mobile spend consistently on in-app digital items.

PCs and Consoles attract high-value spenders who engage with premium game titles and extensive content libraries. Virtual goods on this segment include rare skins, seasonal passes, and exclusive downloadable content. Additionally, dedicated gaming hardware users tend to have higher average transaction values compared to mobile audiences.

VR/AR Head-Mounted Displays represent the emerging frontier for virtual goods consumption. As immersive technology improves and pricing declines, virtual goods tied to spatial environments will become more relevant. However, current adoption remains limited by device cost and content availability, making this a long-term growth opportunity rather than a near-term driver.

By Technology Analysis

Blockchain-Enabled dominates with 67.2% due to growing demand for verifiable ownership, transparency, and decentralized asset management.

In 2025, Blockchain-Enabled technology held a dominant market position in the By Technology segment of the Virtual Goods Market, with a 67.2% share. Blockchain provides verifiable ownership and enables peer-to-peer trading of digital assets without platform intermediaries. Consequently, it has become the preferred technology infrastructure for NFT-based goods, digital collectibles, and virtual currency systems.

Non-Blockchain (Centralized) solutions continue to serve the majority of traditional gaming platforms where speed, simplicity, and developer control are priorities. Centralized systems allow for faster transaction processing and easier content moderation. However, they limit user ownership rights, which is increasingly becoming a point of friction as consumer expectations around digital asset portability evolve.

By Payment Model Analysis

Micro-transactions and Loot Boxes dominates with 49.4% due to low per-transaction cost that encourages high-frequency spending behavior.

In 2025, Micro-transactions and Loot Boxes held a dominant market position in the By Payment Model segment of the Virtual Goods Market, with a 49.4% share. Small, frequent purchases lower the psychological barrier to spending, making this model effective across both casual and competitive gaming audiences. Moreover, randomized reward mechanics in loot boxes generate recurring engagement and revenue.

Subscription / Season Pass models offer predictable revenue for platforms and consistent value for consumers. Seasonal content drops tied to subscriptions create urgency and ongoing player retention. Additionally, this model appeals to engaged gamers who prefer structured value over random reward systems, making it a growing alternative to microtransaction-heavy approaches.

Pay-to-Own (One-Time Purchase) reflects consumer demand for permanence and clear value in digital spending. Buyers prefer knowing exactly what they receive without randomization or recurring fees. Therefore, this model is gaining relevance as discussions around consumer rights and digital ownership regulation push platforms toward more transparent monetization practices.

By Application Analysis

Online Games dominates with 48.9% due to deeply embedded virtual economies within live-service and multiplayer game environments.

In 2025, Online Games held a dominant market position in the By Application segment of the Virtual Goods Market, with a 48.9% share. Multiplayer and live-service games have built entire economies around virtual goods, from cosmetics to competitive advantages. Moreover, ongoing game updates and seasonal content cycles sustain consistent consumer spending throughout the year.

Metaverse and Virtual Events are attracting both consumer and brand investment as digital spaces evolve into venues for commerce and entertainment. Companies host product launches, concerts, and networking events within virtual environments. Additionally, exclusive virtual goods tied to these events create unique monetization opportunities that extend beyond traditional gaming applications.

Social-Media Gifting and Tipping represent a fast-growing application where virtual goods serve as digital expressions of appreciation between users and creators. Platform-native tokens and gifting features drive engagement and creator monetization. Consequently, this application is becoming an important revenue channel for both social platforms and individual content creators.

Digital Commerce and Advertising leverages virtual goods as marketing assets within branded gaming collaborations and in-world advertising placements. Brands invest in virtual merchandise to reach younger, digitally native audiences. Therefore, virtual goods in this context serve dual purposes: driving brand awareness while generating direct revenue through limited-edition digital product releases.

Key Market Segments

By Type

- In-Game Virtual Goods

- Digital Collectibles (Non-NFT)

- Non-Fungible Tokens (NFT-Based Collectibles)

- Virtual Currency (Coins, Gems, Tokens)

- Virtual Land and Property

- Virtual Services (Avatar Styling, Event Tickets, etc.)

By Platform

- Mobile Games and Apps

- PC/Console Games

- Metaverse Platforms and Virtual Worlds

- Social-Media Networks

- Crypto-Native Marketplaces

By Device

- Smartphones and Tablets

- PCs and Consoles

- VR/AR Head-Mounted Displays

By Technology

- Blockchain-Enabled

- Non-Blockchain (Centralized)

By Payment Model

- Micro-transactions and Loot Boxes

- Subscription / Season Pass

- Pay-to-Own (One-Time Purchase)

By Application

- Online Games

- Metaverse and Virtual Events

- Social-Media Gifting and Tipping

- Digital Commerce and Advertising

Drivers

Rapid Expansion of In-Game Microtransactions and Digital Identity Spending Drives Virtual Goods Market Growth

The rapid growth of multiplayer and mobile gaming has created vast ecosystems where in-game microtransactions are a standard monetization tool. Players routinely spend on skins, upgrades, and seasonal content. Moreover, the low cost per transaction reduces friction, encouraging high-frequency purchases across millions of active users globally.

Rising consumer interest in digital identity and avatar personalization is a significant driver. Users increasingly invest in virtual appearances to express individuality across games and social platforms. Consequently, demand for cosmetic virtual goods has grown consistently, making personalization one of the most reliable revenue categories for platform operators and game developers.

Integration of virtual goods within social media and live streaming platforms is expanding the market beyond gaming. Creators monetize through digital tipping and gifting features, while followers use virtual goods as engagement tools. Additionally, platform ecosystems are investing in native currency systems that deepen the role of virtual goods in everyday digital interactions.

Restraints

Regulatory Scrutiny and Platform Governance Limitations Restrain Virtual Goods Market Expansion

Increasing regulatory scrutiny on loot boxes and digital asset monetization is creating compliance pressure across major markets. Several governments are evaluating or implementing restrictions on randomized reward systems. Consequently, platforms relying heavily on loot box mechanics must adapt their monetization strategies or risk facing penalties and reduced consumer trust.

Digital asset taxation and disclosure requirements are adding operational complexity for virtual goods businesses. Moreover, inconsistent regulations across regions make it difficult for global platforms to maintain unified monetization frameworks. This regulatory fragmentation increases legal and operational costs, which can slow product development cycles and reduce investment appetite in emerging markets.

Platform governance limitations significantly restrict asset portability and user control over virtual goods. Users often cannot transfer purchased items between games or platforms, reducing perceived ownership value. Therefore, the lack of interoperability acts as a disincentive for higher consumer spending, particularly among buyers who prioritize long-term value over short-term in-game utility.

Growth Factors

Cross-Platform Interoperability and Branded Virtual Merchandise Collaborations Accelerate Virtual Goods Market Expansion

Cross-platform interoperability of virtual assets is emerging as a major growth enabler. When users can carry digital goods across multiple games and metaverse environments, perceived value increases significantly. Moreover, this portability encourages higher spending, as consumers feel more confident that their virtual purchases will retain long-term utility and relevance.

Branded virtual merchandise collaborations between intellectual property owners and game publishers are creating new revenue streams. Fashion brands, sports leagues, and entertainment companies are licensing their IP for virtual use. Consequently, these partnerships attract new consumer segments and create premium virtual goods categories that command higher price points and sustained demand.

Emerging demand for virtual goods in AR and VR-based immersive commerce experiences is expanding the market’s growth horizon. As headset adoption grows and spatial computing matures, virtual goods will play a central role in digital retail and social interaction. Additionally, immersive environments create stronger emotional connections with digital products, supporting higher willingness to pay among consumers.

Emerging Trends

AI-Generated Collectibles, Digital Drops, and Creator Monetization Models Are Reshaping the Virtual Goods Market

The surge in user-generated content monetization within creator-driven gaming platforms is redefining how virtual goods are produced and sold. Creators now design and sell their own digital items within platform ecosystems. Moreover, this democratization of virtual goods creation is driving volume, diversity, and community-driven engagement across major gaming and metaverse environments.

Limited-edition and time-bound digital drops are establishing artificial scarcity models that drive urgency and exclusivity. Platforms release exclusive virtual goods for short windows, generating significant demand spikes. Consequently, these drops have become powerful tools for user retention, community building, and revenue concentration within specific launch periods across gaming and digital collectible platforms.

Integration of AI-generated digital fashion and virtual collectibles is emerging as a transformative trend. AI tools enable rapid creation of unique, customizable virtual goods at scale. Additionally, AI-designed items can be tailored to individual user preferences, enabling hyper-personalized virtual goods offerings. Therefore, AI is becoming a core creative and operational technology within the virtual goods production pipeline.

Regional Analysis

Asia Pacific Dominates the Virtual Goods Market with a Market Share of 43.8%, Valued at USD 44.4 Billion

Asia Pacific leads the global virtual goods market with a dominant share of 43.8%, valued at USD 44.4 Billion in 2025. The region benefits from massive gaming populations in China, Japan, South Korea, and India. Moreover, mobile-first consumer behavior, strong in-game spending culture, and rapid adoption of blockchain-based digital assets reinforce Asia Pacific’s market leadership.

North America Virtual Goods Market Trends

North America represents a high-value market driven by strong consumer spending power and a well-established gaming industry. The United States leads regional demand for in-game purchases, digital collectibles, and NFT-based assets. Additionally, the presence of leading game studios and technology platforms provides a robust foundation for continued virtual goods market growth.

Europe Virtual Goods Market Trends

Europe is a mature and growing market, with strong demand for virtual goods across gaming, social media, and metaverse platforms. However, regulatory scrutiny around loot boxes in countries like Belgium and the Netherlands has introduced compliance challenges. Consequently, European platforms are increasingly shifting toward transparent payment models such as direct purchase and subscription systems.

Latin America Virtual Goods Market Trends

Latin America is emerging as a fast-growing region driven by rising smartphone penetration and expanding internet access. Brazil and Mexico lead regional virtual goods consumption, particularly in mobile gaming. Moreover, growing youth demographics and increasing disposable income are creating new consumer segments for microtransactions and digital collectibles across the region.

Middle East and Africa Virtual Goods Market Trends

The Middle East and Africa region represents an early-stage but high-potential market for virtual goods. Rising smartphone adoption and a young, digitally engaged population are key enablers. Additionally, government-led digital economy initiatives across GCC countries are supporting the growth of digital entertainment infrastructure, creating favorable conditions for virtual goods market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Tencent Holdings Ltd. is one of the most influential players in the global virtual goods market, operating a vast ecosystem of gaming, social media, and digital entertainment platforms. The company’s extensive portfolio of mobile and PC titles generates substantial revenue from in-game purchases and virtual currency systems. Moreover, its investments across global gaming studios reinforce its dominance in virtual goods distribution and monetization infrastructure.

Meta Platforms Inc. is strategically positioned at the intersection of social media and metaverse development, making it a critical player in the virtual goods space. Its investments in VR hardware and virtual world platforms create new channels for avatar-based and experience-driven digital goods. Additionally, Meta’s social gifting features and creator monetization tools are expanding virtual goods consumption beyond traditional gaming contexts.

Epic Games Inc. has built one of the most successful virtual goods ecosystems through its flagship title Fortnite, where cosmetic items generate significant recurring revenue. The company’s Unreal Engine also empowers third-party developers to create virtual goods-rich experiences. Consequently, Epic’s dual role as both a game publisher and technology provider gives it exceptional influence over virtual goods market standards and practices.

Valve Corporation operates one of the largest digital game distribution platforms and virtual goods marketplaces globally. Its Steam platform enables peer-to-peer trading of in-game items, a model that has significantly shaped consumer expectations around virtual goods ownership. Furthermore, Valve’s marketplace infrastructure demonstrates the commercial viability of user-driven virtual goods economies within a centralized but open trading environment.

Key Players

- Tencent Holdings Ltd.

- Meta Platforms Inc.

- Epic Games Inc.

- Valve Corporation

- Unity Technologies Inc.

- Activision Blizzard Inc.

- Electronic Arts Inc.

- NetEase Inc.

- Decentraland Foundation

- Animoca Brands Corporation Ltd.

- Dapper Labs Inc.

Recent Developments

- February 2026 – Mattel announced its decision to acquire full ownership of Mattel163, its mobile games studio, to strengthen its digital games business. This move signals Mattel’s intent to deepen its presence in the virtual goods and digital gaming market.

- January 2026 – Animoca Brands acquired gaming and digital collectibles company Somo, expanding its portfolio of blockchain-enabled virtual goods platforms. This acquisition aligns with Animoca’s strategy to grow its footprint across the digital collectibles and NFT-based assets ecosystem.

- November 2025 – Epic Games announced a strategic partnership with Unity Technologies to enhance interoperability, allowing Unity-developed games to appear within Fortnite. The collaboration also links commerce tools across Unreal and Unity ecosystems, creating broader virtual goods distribution opportunities for developers.

- June 2025 – Rembrand acquired Mirriad’s U.S. business and formed a joint venture to expand its AI-powered virtual product placement capabilities. The deal is focused on scaling branded virtual goods integration across premium TV and video content channels.

Report Scope

Report Features Description Market Value (2025) USD 101.4 Billion Forecast Revenue (2035) USD 443.5 Billion CAGR (2026-2035) 15.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (In-Game Virtual Goods, Digital Collectibles (Non-NFT), Non-Fungible Tokens (NFT-Based Collectibles), Virtual Currency (Coins, Gems, Tokens), Virtual Land and Property, Virtual Services (Avatar Styling, Event Tickets, etc.)), By Platform (Mobile Games and Apps, PC/Console Games, Metaverse Platforms and Virtual Worlds, Social-Media Networks, Crypto-Native Marketplaces), By Device (Smartphones and Tablets, PCs and Consoles, VR/AR Head-Mounted Displays), By Technology (Blockchain-Enabled, Non-Blockchain (Centralized)), By Payment Model (Micro-transactions and Loot Boxes, Subscription / Season Pass, Pay-to-Own (One-Time Purchase)), By Application (Online Games, Metaverse and Virtual Events, Social-Media Gifting and Tipping, Digital Commerce and Advertising) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tencent Holdings Ltd., Meta Platforms Inc., Epic Games Inc., Valve Corporation, Unity Technologies Inc., Activision Blizzard Inc., Electronic Arts Inc., NetEase Inc., Decentraland Foundation, Animoca Brands Corporation Ltd., Dapper Labs Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tencent Holdings Ltd.

- Meta Platforms Inc.

- Epic Games Inc.

- Valve Corporation

- Unity Technologies Inc.

- Activision Blizzard Inc.

- Electronic Arts Inc.

- NetEase Inc.

- Decentraland Foundation

- Animoca Brands Corporation Ltd.

- Dapper Labs Inc.