Veterinary Telehealth Market By Product Type (Teleradiology, Telemonitoring, Teleconsulting, and Others), By Technology (On-premise and Cloud/App-based), By Application (Canine, Bovine, Equine, Feline, and Others), By End-user (Providers and Patients), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149741

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

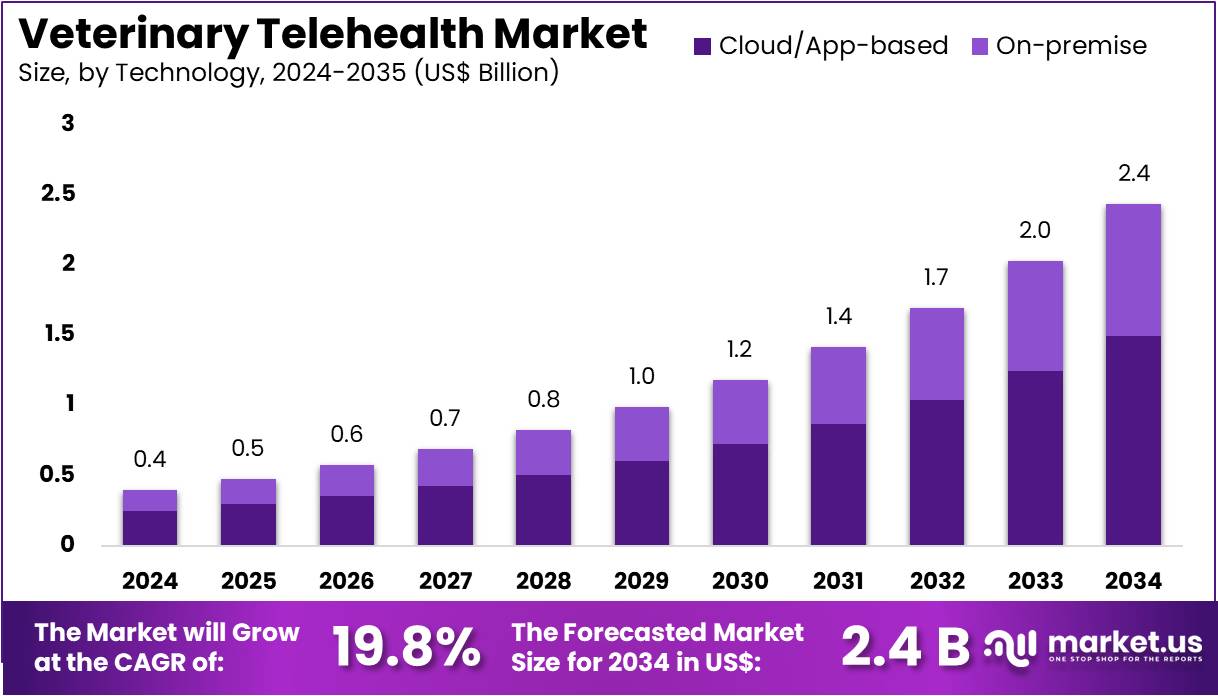

The Veterinary Telehealth Market Size is expected to be worth around US$ 2.4 billion by 2034 from US$ 0.4 billion in 2024, growing at a CAGR of 19.8% during the forecast period 2025 to 2034.

Rising demand for accessible and convenient veterinary care propels the growth of the veterinary telehealth market. Telehealth solutions enable remote consultations, diagnostics, and follow-ups for companion animals, livestock, and exotic species, improving healthcare reach and efficiency. Expanding pet ownership and increasing awareness of preventive care further drive adoption. Innovations in digital platforms, mobile applications, and wearable monitoring devices enhance real-time health tracking and communication between veterinarians and pet owners.

In October 2024, Dial A Vet expanded its global footprint by acquiring SpeakToAVet.com, aiming to provide cost-effective and timely pet healthcare services worldwide. This strategic move strengthens the company’s position in the market and broadens access to remote veterinary expertise. Telehealth offers opportunities to reduce treatment delays, lower healthcare costs, and improve patient outcomes, particularly in underserved areas.

Regulatory frameworks evolving to support virtual veterinary care promote broader acceptance. Integration of artificial intelligence and machine learning facilitates more accurate diagnostics and personalized treatment plans. The market witnesses increasing partnerships between telehealth providers and traditional veterinary clinics to offer hybrid care models. Consumer preference for digital health solutions accelerates market growth.

The veterinary telehealth market also benefits from rising demand for urgent care and behavioral consultations conducted remotely. Advances in secure data management bolster client trust and compliance. These factors collectively position veterinary telehealth as a critical component in modern animal healthcare delivery, presenting substantial growth potential.

Key Takeaways

- In 2024, the market for veterinary telehealth generated a revenue of US$ 0.4 billion, with a CAGR of 19.8%, and is expected to reach US$ 2.4 billion by the year 2034.

- The product type segment is divided into teleradiology, telemonitoring, teleconsulting, and others, with teleconsulting taking the lead in 2024 with a market share of 43.9%.

- Considering technology, the market is divided into on-premise and cloud/app-based. Among these, cloud/app-based held a significant share of 61.4%.

- Furthermore, concerning the application segment, the market is segregated into canine, bovine, equine, feline, and others. The canine sector stands out as the dominant player, holding the largest revenue share of 38.7% in the veterinary telehealth market.

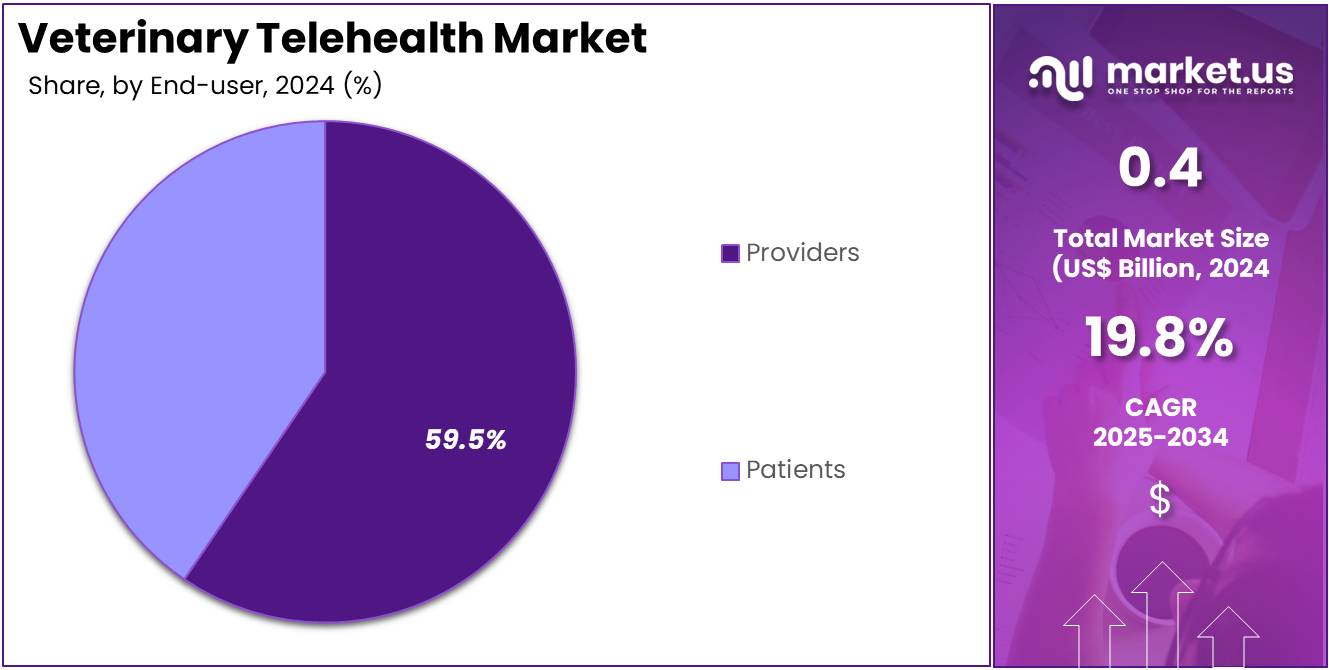

- The end-user segment is segregated into providers and patients, with the patients segment leading the market, holding a revenue share of 59.5%.

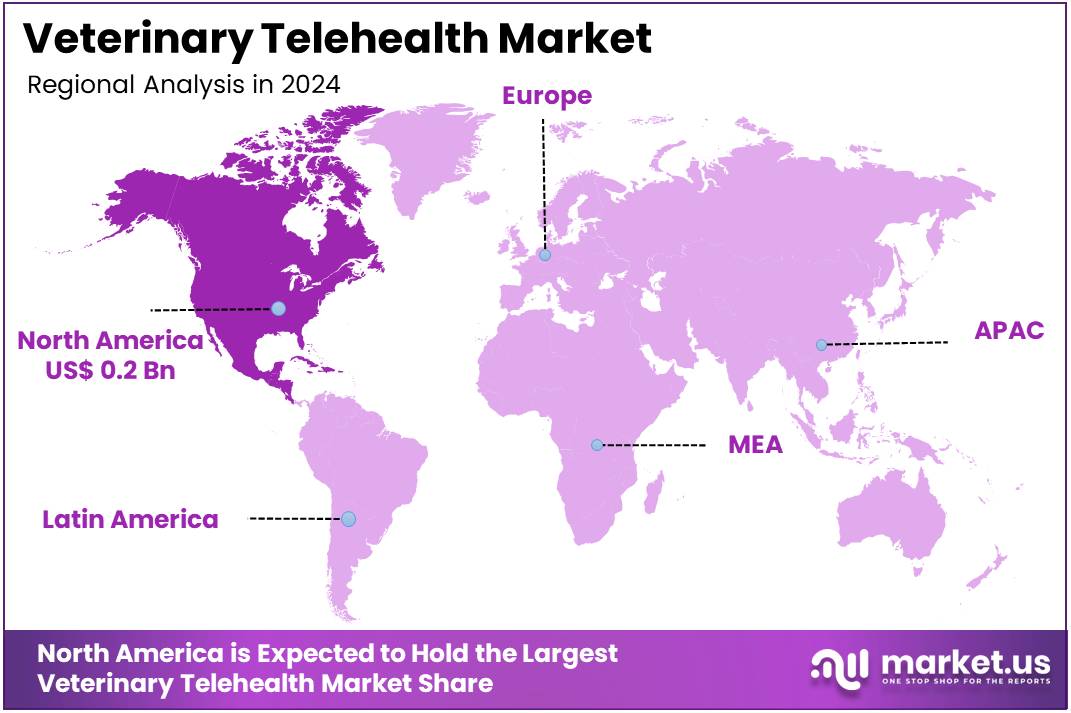

- North America led the market by securing a market share of 43.1% in 2024.

Product Type Analysis

The teleconsulting segment claimed a market share of 43.9% owing to increasing demand for remote veterinary consultations. This growth is driven by expanding pet ownership and the need for timely expert advice without geographical constraints. Advancements in digital communication technologies enable seamless interaction between veterinarians and pet owners, further supporting expansion.

Teleconsulting offers cost-effective, convenient solutions for routine checkups and follow-ups, enhancing client satisfaction. Moreover, rising awareness about telehealth benefits among veterinary professionals fuels adoption. The segment also benefits from growing investments in telehealth infrastructure and supportive regulatory frameworks, making teleconsulting a critical service in veterinary care.

Technology Analysis

The cloud/app-based held a significant share of 61.4% due to its flexibility and scalability in delivering telehealth solutions. This growth is driven by the increasing shift toward cloud computing to reduce IT infrastructure costs and improve data accessibility. Cloud-based platforms allow real-time monitoring and data sharing, enhancing clinical decision-making and patient care.

Mobile app integration boosts user engagement among veterinarians and pet owners, driving adoption further. Additionally, the segment benefits from enhanced cybersecurity measures and compliance with data privacy regulations, encouraging trust. The ease of software updates and interoperability with other veterinary systems also supports expansion in this segment.

Application Analysis

The canine segment had a tremendous growth rate, with a revenue share of 38.7% owing to the large population of companion dogs and their rising healthcare needs. Growth is driven by increasing pet humanization trends, where owners seek advanced medical care for their dogs. Canine telehealth services facilitate early diagnosis and continuous monitoring of chronic conditions such as arthritis and heart disease.

Additionally, advancements in wearable devices and remote monitoring tools improve health tracking, further expanding the segment. The segment also benefits from increased veterinary specialization in canine health and rising demand for behavioral consultations. Owners’ willingness to invest in preventive care accelerates the segment’s growth significantly.

End-user Analysis

The patients segment grew at a substantial rate, generating a revenue portion of 59.5% due to increasing acceptance of telehealth services among pet owners. This growth is driven by the convenience and accessibility telehealth provides, especially for remote or underserved areas. Patients benefit from reduced travel time, lower consultation costs, and timely access to veterinary expertise.

The rising awareness about animal health and wellness also encourages owners to utilize telehealth platforms more frequently. Furthermore, technological advancements in mobile devices and high-speed internet penetration enhance user experience. The segment gains additional momentum from pet owners’ preference for virtual care post-pandemic, which is likely to sustain long-term growth.

Key Market Segments

By Product Type

- Teleradiology

- Telemonitoring

- Teleconsulting

- Others

By Technology

- On-premise

- Cloud/App-based

By Application

- Canine

- Bovine

- Equine

- Feline

- Others

By End-user

- Providers

- Patients

Drivers

Increased Convenience and Accessibility is Driving the Market

The rising demand for convenient and accessible veterinary care is a major factor driving growth in the veterinary telehealth market. Telehealth services allow pet owners to consult veterinarians without traveling to a clinic, saving time and reducing stress for both pets and owners. This convenience is especially valuable for those living in rural areas or facing mobility challenges. According to a 2024 survey by the American Veterinary Medical Association (AVMA), a significant portion of pet owners showed interest in using telehealth for certain aspects of pet care.

The ease of access to veterinary advice from home encourages more pet owners to adopt these services. Telehealth platforms also enable timely care, which can prevent minor issues from becoming serious. Additionally, the flexibility to schedule appointments outside of regular clinic hours further appeals to consumers. As a result, the demand for veterinary telehealth continues to rise steadily.

Restraints

Regulatory and Legal Challenges are Restraining the Market

The veterinary telehealth market faces challenges due to complex and varying regulations across different regions. Many licensing requirements mandate that veterinarians be licensed in the same state or area where the animal patient is located, which complicates cross-border service provision. The American Veterinary Medical Association (AVMA) actively participates in discussions to establish clearer and more consistent guidelines for veterinary telehealth practices.

The lack of uniform regulations limits the ability of providers to scale their services and expand reach. This regulatory uncertainty slows broader adoption despite growing consumer demand for remote care. Moreover, compliance with diverse legal frameworks increases operational complexity for telehealth companies. Restrictions also hinder innovation and partnerships that could enhance service offerings. Until clearer policies are implemented, regulatory challenges will continue to restrain market growth.

Opportunities

Advancements in Telecommunications Technology are Creating Growth Opportunities

Ongoing improvements in telecommunications technology are opening new opportunities for the veterinary telehealth market. Faster internet speeds, better video conferencing tools, and intuitive mobile applications enable veterinarians to conduct more effective remote consultations. Wearable devices allow continuous monitoring of animal health, providing valuable data during virtual visits.

The Telecom Regulatory Authority of India reported in March 2024 that mobile internet penetration reached 95%, up from 78% in 2020, greatly expanding the potential user base. Improved connectivity makes telehealth services more reliable and accessible across different regions. Enhanced platforms streamline information exchange between veterinarians and pet owners. These technological advancements support more accurate diagnoses and better treatment outcomes. As a result, telehealth becomes a practical and efficient solution for veterinary care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the rate at which veterinary telehealth services are adopted. During economic downturns, pet owners may look for more affordable care options, increasing the appeal of telehealth for certain consultations. Conversely, economic growth often leads to higher spending on pet health, including innovative telehealth solutions.

Geopolitical factors such as trade disruptions may affect the availability of technology and software essential for telehealth platforms. Supply chain interruptions can delay equipment delivery or increase costs for providers. Despite these challenges, the growing importance of pet health and the convenience of remote care make the market relatively resilient. Demand for veterinary telehealth tends to remain steady even amid broader economic or political fluctuations. The need for accessible and efficient pet care services supports ongoing market expansion.

Current US tariffs may have varied effects on the veterinary telehealth market. If tariffs apply to imported technology or software needed for remote veterinary services, operational costs for providers could rise. These increased costs might result in higher service fees for pet owners. However, tariffs could also encourage domestic development of telehealth technologies and platforms within the US.

This shift could foster innovation and promote locally produced solutions for remote veterinary care. Short-term cost increases present challenges, but they may incentivize investment in the domestic market. The strong demand for convenient and accessible pet healthcare is likely to drive continued growth despite tariff-related pressures. Overall, tariffs may reshape the market landscape but are unlikely to halt its expansion.

Latest Trends

Integration of Artificial Intelligence (AI) is a Recent Trend

Artificial intelligence (AI) is increasingly integrated into veterinary telehealth to improve service quality and efficiency. AI-powered tools assist veterinarians by providing preliminary diagnoses based on symptoms and behavior observed during video consultations. In February 2024, VetNOW launched an AI-driven real-time consultation platform that analyzes pet behavior and symptoms to enhance diagnostic accuracy.

This technology helps veterinarians make faster, more informed decisions during remote appointments. AI also streamlines workflows by automating routine tasks and prioritizing urgent cases. It enables personalized care plans tailored to each animal’s specific needs. By improving diagnostic confidence, AI enhances overall patient outcomes. This growing use of AI represents a significant and promising trend within the veterinary telehealth market.

Regional Analysis

North America is leading the Veterinary Telehealth Market

North America dominated the market with the highest revenue share of 43.1% owing to the increasing acceptance and guidelines provided by professional organizations. The American Veterinary Medical Association (AVMA) has released comprehensive guidelines for the use of telehealth in veterinary practice, promoting its integration to improve access to services and enhance patient care.

A 2023 survey by the AVMA indicated that 65% of pet owners were interested in using telehealth services for their pets, a significant increase from 40% in 2020, signaling a growing demand from consumers. Furthermore, a separate AVMA survey in early 2024 found that 70% of veterinary practices using telehealth had adopted integrated platforms, up from 40% in 2022, highlighting the increasing adoption by veterinary professionals.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing pet ownership and the expansion of digital infrastructure. According to a March 2024 report by the Asia-Pacific Veterinary Federation, the region’s veterinary telehealth market experienced substantial growth in 2023. The Telecom Regulatory Authority of India reported in March 2024 that mobile internet penetration had reached 95% of the population, up from 78% in 2020, significantly expanding the potential user base for remote veterinary services. This increasing connectivity, coupled with a rising awareness of the convenience and accessibility of virtual veterinary care, suggests a positive growth trajectory for the market in the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the veterinary telehealth market drive growth by integrating advanced technologies, expanding service offerings, and enhancing accessibility. They develop user-friendly platforms that facilitate real-time consultations, diagnostics, and follow-up care, catering to the increasing demand for convenient pet healthcare solutions. Strategic partnerships with pet insurance providers and online pharmacies enable these companies to offer comprehensive care packages, improving customer retention and satisfaction.

Additionally, they focus on expanding their geographic reach, particularly in underserved and rural areas, to ensure broader access to veterinary services. Investments in artificial intelligence (AI) and machine learning enhance diagnostic accuracy and operational efficiency, positioning these companies at the forefront of the evolving veterinary care landscape.

Vetster Inc., a prominent player in this domain, offers a comprehensive online platform that connects pet owners with licensed veterinarians for virtual consultations. Founded in 2020 and headquartered in Toronto, Canada, Vetster allows users to schedule appointments with veterinary professionals at their convenience, providing services such as video, text, and voice consultations. The platform also offers VetsterRx, an online pet pharmacy service, enabling users to obtain prescriptions directly through the platform.

Top Key Players in the Veterinary Telehealth Market

- Vetster

- VetSon

- TeleVet

- Pets at Home Group Plc

- PetCoach

- GuardianVets

- AirVet

- Pawp

Recent Developments

- In August 2024, Vetster was recognized as “Pet App of the Year” for the third year running, underscoring its rapid growth as a leading platform in pet telemedicine and its influence on shaping the digital veterinary landscape.

- In July 2024, VetSon, based in Ontario, broadened its telehealth platform by adding new animal care features, enhancing its ability to meet diverse veterinary needs and contributing to the evolution of telehealth services for pets.

- In May 2024, Walmart partnered with Pawp to launch continuous telehealth services for pets, offering unlimited access to expert veterinarians. This collaboration advances the pet telehealth sector by making expert care more accessible to pet owners at all times.

Report Scope

Report Features Description Market Value (2024) US$ 0.4 billion Forecast Revenue (2034) US$ 2.4 billion CAGR (2025-2034) 19.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Teleradiology, Telemonitoring, Teleconsulting, and Others), By Technology (On-premise and Cloud/App-based), By Application (Canine, Bovine, Equine, Feline, and Others), By End-user (Providers and Patients) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vetster, VetSon, TeleVet, Pets at Home Group Plc, PetCoach, GuardianVets, AirVet, Pawp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Telehealth MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Telehealth MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vetster

- VetSon

- TeleVet

- Pets at Home Group Plc

- PetCoach

- GuardianVets

- AirVet

- Pawp