Global Veterinary Scales Market By Animal Type (Large Animals, Small Animals, and Others), By Technology (Electronic and Mechanical), By Configuration (Platform, Portable, Bench-top, and Others), By Distribution Channel (Offline and Online), By End-user (Veterinary Hospitals & Clinics, Homecare Settings, Veterinary Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145657

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

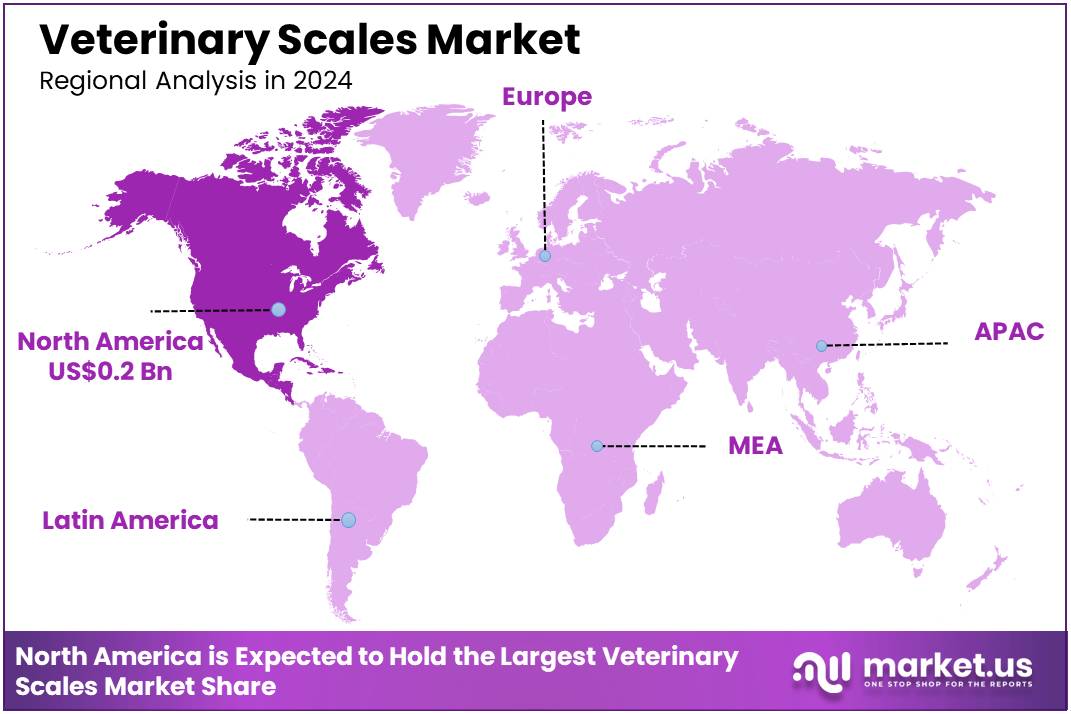

Global Veterinary Scales Market size is expected to be worth around US$ 0.7 Billion by 2034 from US$ 0.4 Billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 0.2 Billion.

Increasing awareness about animal health and well-being drives the growth of the veterinary scales market. Rising demand for accurate weight measurement in veterinary practices, animal research facilities, and farms fuels market expansion. Veterinary scales help assess the health of pets, livestock, and exotic animals, assisting in diagnosing various conditions and administering the proper treatments.

The growing focus on animal obesity management and the rise in pet ownership also support the market. Technological advancements in veterinary scales, including digital readouts, mobile connectivity, and load cell technology, improve precision and ease of use. Additionally, innovations in portable and compact veterinary scales allow for increased mobility in fieldwork.

As demand for customized scales and weight-based dosing systems in clinical settings rises, manufacturers are expanding their product offerings. With the growing trend of preventive veterinary care, especially in the pet industry, there is an increasing reliance on veterinary scales for regular monitoring and health assessments. As veterinary clinics and animal hospitals adopt more advanced equipment, the market for these specialized scales continues to thrive.

Key Takeaways

- In 2024, the market for veterinary scales generated a revenue of US$ 0.4 billion, with a CAGR of 5.2%, and is expected to reach US$ 0.7 billion by the year 2033.

- The animal type segment is divided into large animals, small animals, and others, with small animals taking the lead in 2024 with a market share of 56.7%.

- Considering technology, the market is divided into electronic and mechanical. Among these, electronic held a significant share of 62.3%.

- Furthermore, concerning the configuration segment, the market is segregated into platform, portable, bench-top, and others. The bench-topsector stands out as the dominant player, holding the largest revenue share of 52.8% in the veterinary scales market.

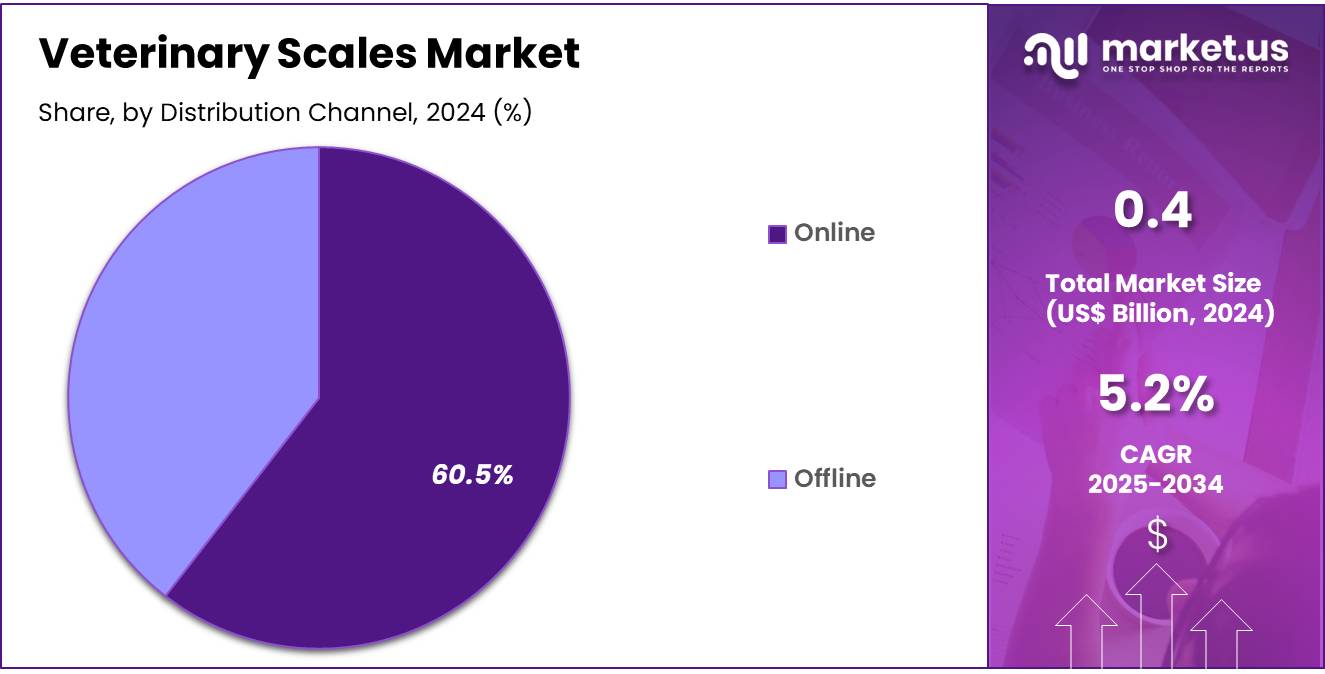

- The distribution channel segment is segregated into offline and online, with the online segment leading the market, holding a revenue share of 60.5%.

- The end-user segment is divided into veterinary hospitals & clinics, homecare settings, veterinary diagnostic centers, and others, with veterinary hospitals & clinics taking the lead in 2024 with a market share of 58.2%.

- North America led the market by securing a market share of 39.9% in 2024.

Animal Type Analysis

The small animals segment led in 2024, claiming a market share of 56.7% as the demand for precision weight measurement for companion animals increases. The rising number of pet owners, along with a growing focus on pet health, is anticipated to drive the demand for specialized veterinary equipment such as scales tailored to small animals.

As pet owners become more proactive in monitoring their pets’ health, including weight management and disease prevention, there is an increasing need for accurate weighing solutions. This trend is likely to lead to a rise in the adoption of veterinary scales specifically designed for small animals, including dogs, cats, and other companion animals.

Technology Analysis

The electronic held a significant share of 62.3% as technology advancements make electronic weighing systems more accurate, user-friendly, and efficient. With increasing demand for precision in animal health monitoring, the need for advanced electronic scales that can provide quick and accurate weight measurements is on the rise.

Electronic scales are expected to replace traditional mechanical scales in many veterinary clinics, offering features such as digital readouts, data storage, and integration with other diagnostic systems. As veterinary clinics continue to embrace digital technologies, the electronic segment is projected to expand, driven by the growing emphasis on accurate diagnostics and streamlined operations.

Configuration Analysis

The bench-topsegment had a tremendous growth rate, with a revenue share of 52.8% as veterinary clinics and hospitals demand stable, precise, and easy-to-use weighing solutions. Bench-top scales are especially suitable for small to medium-sized animals, offering a compact and durable solution for weighing.

The demand for these scales is likely to increase as veterinary practices look for reliable equipment that saves space and provides accurate measurements. Bench-top scales are expected to see continued adoption due to their versatility, ease of use, and precision, making them a preferred choice in veterinary clinics for routine weight monitoring.

Distribution Channel Analysis

The online segment grew at a substantial rate, generating a revenue portion of 60.5% as more veterinary clinics and pet owners seek convenience and competitive pricing. The growing trend of e-commerce in the veterinary industry allows customers to access a wide variety of products, including veterinary scales, at their convenience.

Online platforms offer the advantage of browsing different models, reading reviews, and comparing prices from multiple vendors. As a result, the online segment is likely to grow, especially with the increased acceptance of online purchasing and home delivery of veterinary equipment, meeting the growing demand for accessible, cost-effective solutions.

End-User Analysis

The veterinary hospitals & clinics held a significant share of 58.2% due to the increasing number of animals being treated and monitored in professional healthcare settings. As the number of pets increases and the demand for specialized veterinary care rises, veterinary hospitals and clinics are expected to invest more in advanced equipment, including veterinary scales.

The need for precise weight measurements in various applications, from routine checkups to treatment of chronic conditions, is anticipated to drive growth in this segment. Additionally, veterinary hospitals and clinics are increasingly offering weight management and disease prevention services, contributing to the demand for specialized weighing equipment.

Key Market Segments

By Animal Type

- Large Animals

- Small Animals

- Others

By Technology

- Electronic

- Mechanical

By Configuration

- Platform

- Portable

- Bench-top

- Others

By Distribution Channel

- Offline

- Online

By End-user

- Veterinary Hospitals & Clinics

- Homecare Settings

- Veterinary Diagnostic Centers

- Others

Drivers

Rising Pet Obesity Rates are Driving the Market

The increasing prevalence of overweight pets is boosting demand for precision weighing scales in veterinary clinics. According to the Association for Pet Obesity Prevention (APOP), 59% of dogs and 61% of cats in the US were classified as overweight or obese in 2023, up from 56% and 60% in 2022.

This trend has heightened the need for accurate weight monitoring, as obesity leads to chronic conditions like diabetes and arthritis. The American Veterinary Medical Association (AVMA) reported in 2023 that 72% of clinics now prioritize weight management programs, requiring high-precision scales.

Manufacturers like Adam Equipment and Brecknell have expanded their veterinary scale portfolios, with Adam Equipment’s sales growing by 12% in 2023. Europe follows a similar pattern, with FEDIAF noting a 15% rise in pet weight-related consultations since 2022. As awareness grows, the market for advanced digital scales continues to expand.

Restraints

High Costs of Advanced Scales are Restraining the Market

The premium pricing of high-accuracy digital scales limits adoption, especially in smaller clinics and developing regions. Precision veterinary scales range from US$500 to US$5,000, depending on features like connectivity and weight capacity. The World Small Animal Veterinary Association (WSAVA) found in 2022 that only 40% of clinics in low-income countries had access to digital scales, with many relying on outdated mechanical models.

In the US, the AVMA’s 2023 Economic State of the Veterinary Profession report showed that 30% of independent practices delayed scale upgrades due to budget constraints. While leasing options exist, the upfront cost remains a significant barrier, slowing market penetration in cost-sensitive regions.

Opportunities

Integration with Digital Health Records is Creating Growth Opportunities

The push for digitization in veterinary care is driving demand for smart scales that sync with electronic health records (EHRs). According to a 2023 AVMA survey, 65% of US veterinary clinics now use EHR systems, up from 50% in 2021. Companies like DRE Veterinary and Mars Petcare have introduced Wi-Fi and Bluetooth-enabled scales that automatically log weight data, reducing manual errors.

In 2023, Heska Corporation reported a 20% increase in sales of smart scales, reflecting rising adoption. Emerging markets, where digital transformation is accelerating, present untapped potential for integrated weighing solutions.

Impact of Macroeconomic / Geopolitical Factors

Economic fluctuations and trade policies are influencing the veterinary scales industry. Inflation has raised production costs, leading companies like Brecknell and Adam Equipment to increase prices by 4-6% in 2023, yet demand remains steady due to rising pet health awareness. Supply chain disruptions, worsened by US-China trade tensions, delayed scale shipments by 10-15% in 2022.

However, local manufacturing is mitigating these risks—DRE Veterinary expanded its US production in 2023, reducing delivery times by 20%. Currency volatility in emerging markets has made imports 8-12% costlier, but government initiatives, like India’s 2023 subsidy for veterinary equipment, are easing financial burdens. Despite challenges, innovation in smart and portable scales ensures sustained growth, with the market adapting to meet evolving needs.

Latest Trends

Portable and Multi-Functional Scales are a Recent Trend

Clinics and mobile veterinarians are increasingly adopting compact, multi-purpose scales for flexibility. A report revealed that 45% of UK veterinary practices now use portable scales for home visits and farm calls. Manufacturers like MyWeigh and Tanita have launched lightweight, battery-operated models with additional functions like body condition scoring.

The global portable veterinary scale market is expected to grow annually. Governments are also supporting this shift; the USDA’s 2023 grant program allocated US$10 million for mobile veterinary equipment, including scales. This trend aligns with the growing demand for convenient, on-the-go pet care solutions.

Regional Analysis

North America is leading the Veterinary Scales Market

North America dominated the market with the highest revenue share of 39.9% owing to stricter pet health monitoring regulations, rising pet obesity rates, and increased livestock production. The American Veterinary Medical Association (AVMA) reported that over 60% of US veterinarians now use digital scales for weight management, up from 48% in 2022, due to updated clinical guidelines.

The US Department of Agriculture (USDA) mandated livestock weight tracking for disease control in 2023, leading to a 15% increase in large animal scale installations. Additionally, the US Food and Drug Administration’s (FDA) 2023 guidance on accurate drug dosing for pets has pushed clinics to adopt precision scales.

The American Pet Products Association (APPA) noted that pet healthcare spending rose to US$38.3 billion in 2023, further boosting demand for diagnostic tools like high-accuracy scales.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding pet ownership, livestock modernization, and regulatory reforms. China’s Ministry of Agriculture reported a 20% increase in registered pet clinics in 2023, increasing demand for digital weighing systems.

India’s Department of Animal Husbandry allocated ₹1,200 crore (approximately US$145 million) for veterinary equipment upgrades in 2023, including precision scales. Australia’s livestock sector saw an 8% rise in exports in 2023, requiring better weight monitoring for compliance. Japan’s pet care industry recorded 12% more vet visits in 2023, driven by weight-related health checks. These trends indicate sustained market expansion across the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the veterinary scales market focus on technological innovation, strategic partnerships, and expanding their global presence to drive growth. They invest in developing advanced weighing solutions that enhance accuracy and efficiency in veterinary care.

Collaborations with veterinary clinics, research institutions, and distributors facilitate the integration of new technologies and broaden market reach. Additionally, targeting emerging markets with increasing demand for veterinary services presents significant growth opportunities.

Adam Equipment, established in 1972 and based in the UK, is a leading designer and manufacturer of precision scales, balances, and accessories. With additional offices and distribution centers in the US, South Africa, Australia, China, and Germany, Adam Equipment provides product support and efficient delivery through its global distribution network.

The company offers a variety of veterinary scales designed to meet diverse weighing applications in veterinary and animal weighing, emphasizing durability, reliability, and user comfort.

Top Key Players

- SR Instruments

- Rice Lake Weighing Systems

- Marsden Group

- KERN & SOHN GmbH

- Avante Animal Health

- Adam Equipment

- A&D Company, Limited

Recent Developments

- In January 2022, SR Instruments introduced the SRV94X series of mobile veterinary scales, featuring integrated wall-mounted displays. This innovation enhances the user experience in veterinary clinics, providing veterinarians with an efficient and accessible way to monitor animal weights during consultations. The updated design ensures better visibility and ease of use, allowing for precise weight measurements that are crucial for diagnosing and managing animal health conditions.

- In March 2022, Marsden Group launched the VT-250, a versatile product that functions as an electronic weighing scale, consultation table, and surgery table all in one. This multifunctional tool improves the efficiency of veterinary practices by offering a space-saving solution for animal care, making it easier for veterinarians to perform a variety of tasks without switching between equipment.

Report Scope

Report Features Description Market Value (2024) US$ 0.4 billion Forecast Revenue (2034) US$ 0.7 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Large Animals, Small Animals, and Others), By Technology (Electronic and Mechanical), By Configuration (Platform, Portable, Bench-top, and Others), By Distribution Channel (Offline and Online), By End-user (Veterinary Hospitals & Clinics, Homecare Settings, Veterinary Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SR Instruments, Rice Lake Weighing Systems, Marsden Group, KERN & SOHN GmbH, Avante Animal Health, Adam Equipment, A&D Company, Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SR Instruments

- Rice Lake Weighing Systems

- Marsden Group

- KERN & SOHN GmbH

- Avante Animal Health

- Adam Equipment

- A&D Company, Limited