Global Veterinary Pregnancy Test Kit Market By Product Type (Pregnancy Test Kit Cassettes, Pregnancy Test Kit Strips and ELISA Test Kits), By Sample Type (Urine, Whole Blood, Serum, Plasma and Others), By Application (Companion Animals and Livestock Animals), By Distribution Channel (Veterinary Hospitals and Clinics, E-commerce and Retail Stores), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171035

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

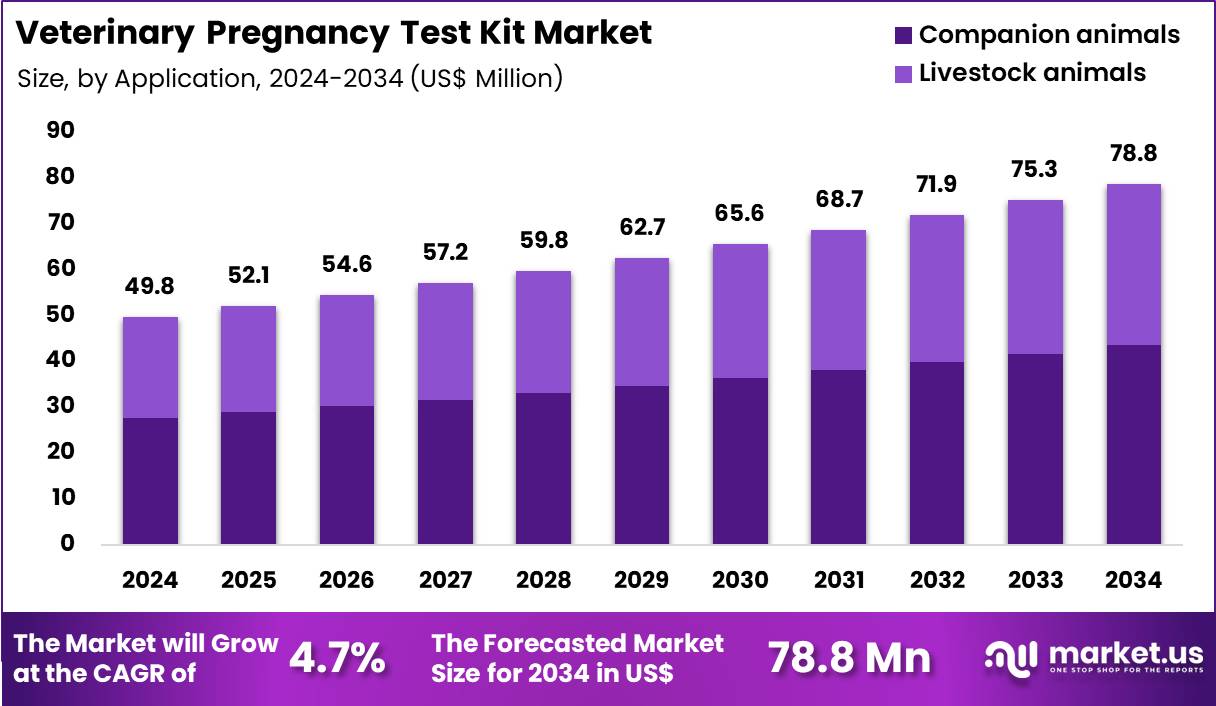

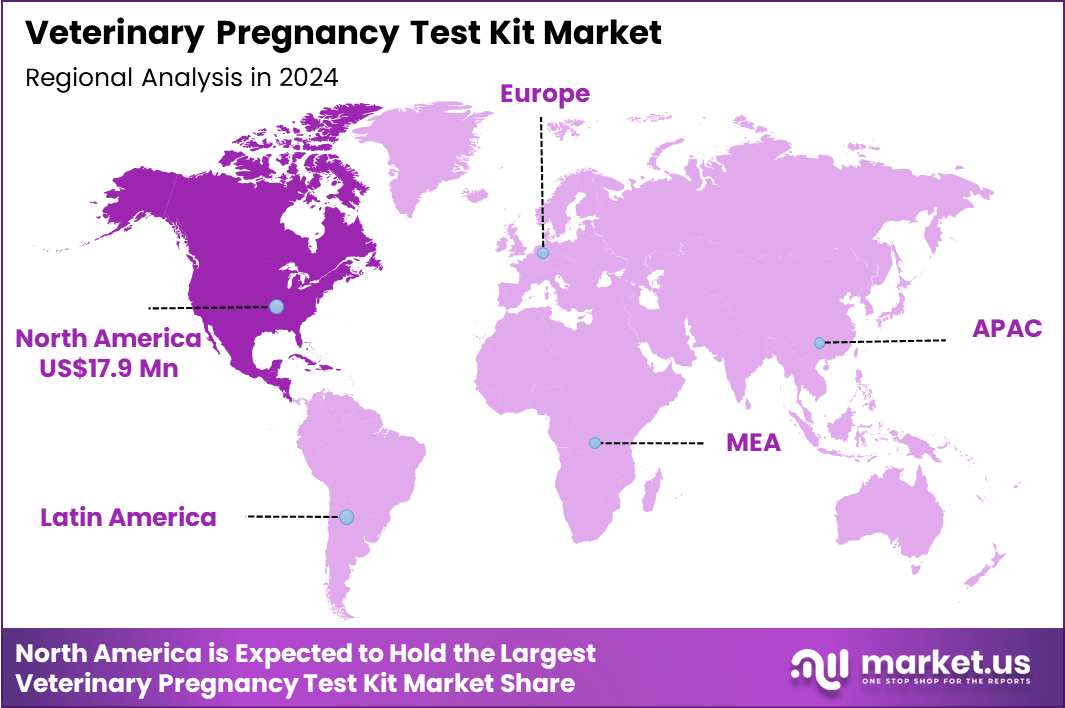

The Global Veterinary Pregnancy Test Kit Market size is expected to be worth around US$ 78.8 Million by 2034 from US$ 49.8 Million in 2024, growing at a CAGR of 4.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 35.9% share with a revenue of US$ 17.9 Million.

Increasing demand for efficient reproductive management in livestock operations propels the Veterinary Pregnancy Test Kit market, as farmers prioritize tools that confirm pregnancies early to optimize breeding cycles and minimize economic losses from false assumptions. Manufacturers innovate with rapid lateral flow assays and ELISA kits that detect progesterone or pregnancy-specific proteins from blood, milk, or urine samples with over 98% accuracy.

These kits apply in bovine herd synchronization programs to schedule artificial insemination, porcine farrowing planning to allocate housing resources, ovine flock monitoring for timely nutritional adjustments, and equine breeding confirmation to support valuable stallion rotations. Emerging opportunities include non-invasive formats that reduce animal stress and integrate with digital farm management software for data-driven decisions.

In September 2025, Nanaji Deshmukh Veterinary University in Madhya Pradesh announced an initiative to develop a wildlife pregnancy testing kit, focusing on non-invasive diagnostics to enhance reproductive monitoring in endangered species like tigers and elephants. This effort highlights the market’s expansion into conservation biology, fostering cross-sector innovations that benefit both agriculture and biodiversity preservation.

Growing adoption of point-of-care testing accelerates the Veterinary Pregnancy Test Kit market, as veterinarians and breeders seek on-site solutions that deliver results in minutes without laboratory dependency. Diagnostic developers refine user-friendly strip-based kits that require minimal training, ensuring broad accessibility in field conditions.

Applications encompass canine companion animal confirmation for responsible pet ownership and spay/neuter planning, caprine dairy goat assessments to boost milk production forecasts, poultry layer hen evaluations for flock productivity, and camelid herd management in arid farming systems.

Portable designs open avenues for mobile veterinary services that serve remote operations and integrate with telemedicine for expert consultations. Biotechnology firms increasingly explore multiplex kits that combine pregnancy detection with health markers like progesterone levels, enhancing overall animal welfare monitoring. This trend supports sustainable farming by enabling precise resource allocation and reducing overbreeding risks.

Rising focus on precision breeding technologies invigorates the Veterinary Pregnancy Test Kit market, as agribusinesses leverage advanced assays to align genetic selection with confirmed gestations for superior offspring outcomes. Companies launch digital-enabled kits that sync results via apps for automated record-keeping and AI-assisted trend analysis.

These tools facilitate alpaca fiber production planning through early twin detection, rabbit colony management for meat yield optimization, deer farm antler crop forecasting, and bison ranch synchronization for herd expansion. High-accuracy innovations create opportunities for subscription-based testing ecosystems that pair kits with genomic profiling for trait-enhanced breeding.

Research collaborations actively validate these systems against ultrasound standards, paving the way for regulatory endorsements in emerging livestock sectors. This technological synergy positions the market as a vital enabler of data-informed, resilient animal agriculture.

Key Takeaways

- In 2024, the market generated a revenue of US$ 49.8 Million, with a CAGR of 4.7%, and is expected to reach US$ 78.8 Million by the year 2034.

- The product type segment is divided into pregnancy test kit cassettes, pregnancy test kit strips and elisa test kits, with pregnancy test kit cassettes taking the lead in 2024 with a market share of 46.7%.

- Considering sample type, the market is divided into urine, whole blood, serum, plasma and others. Among these, urine held a significant share of 51.3%.

- Furthermore, concerning the application segment, the market is segregated into companion animals and livestock animals. The companion animals sector stands out as the dominant player, holding the largest revenue share of 55.4% in the market.

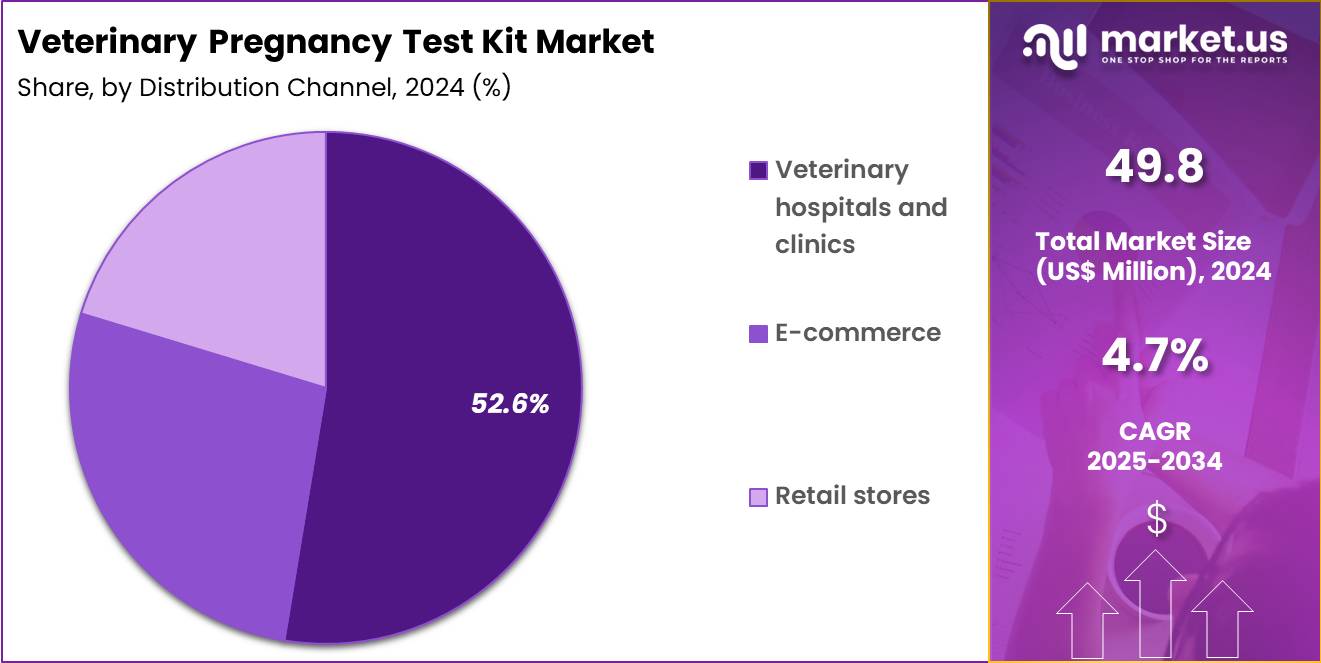

- The distribution channel segment is segregated into veterinary hospitals and clinics, e-commerce and retail stores, with the veterinary hospitals and clinics segment leading the market, holding a revenue share of 52.6%.

- North America led the market by securing a market share of 35.9% in 2024.

Product Type Analysis

Pregnancy test kit cassettes, holding 46.7%, are expected to dominate because they provide easy-to-use and highly interpretable results across multiple veterinary care environments. Veterinarians strongly prefer cassette-based kits due to their better handling convenience and contamination resistance compared with strips. Increasing demand for rapid reproductive assessment in both companion and farm animals strengthens reliance on these cassettes.

Improved assay sensitivity supports earlier pregnancy confirmation, enhancing breeding efficiency and reducing financial losses associated with unsuccessful pregnancy cycles. Disposable cassette formats also reduce workflow errors in busy veterinary settings. Their expanding availability through professional channels keeps adoption rising. These factors keep pregnancy test kit cassettes anticipated to remain the leading product type.

Sample Type Analysis

Urine, holding 51.3%, is projected to dominate because urine-based testing provides a non-invasive approach that minimizes stress on animals during pregnancy diagnosis. Urine allows early detection of specific pregnancy-associated proteins or hormones, improving breeding program outcomes. Pet owners increasingly opt for urine testing due to its convenience for at-home or clinic sample collection.

Livestock breeders also prefer this method to avoid the specialized handling required for blood-based testing. As interest in home-based veterinary diagnostics rises, urine sampling becomes more integrated into consumer-friendly test kits. Growing product innovation enhances the stability and accuracy of urine tests across species. These drivers keep urine expected to remain the most widely used sample type.

Application Analysis

Companion animals, holding 55.4%, are expected to dominate due to rising pet ownership and stronger focus on early reproductive care among dog and cat owners. The growing popularity of selective breeding programs drives demand for reliable and timely pregnancy confirmation.

Veterinarians emphasize early diagnosis to support proactive prenatal care and reduce pregnancy-associated health risks. Expanding animal health expenditure encourages frequent testing throughout the breeding cycle. Pet owners increasingly rely on quick diagnostics to manage pregnancies effectively in home settings. These factors keep companion animals anticipated to remain the dominant application segment in this market.

Distribution Channel Analysis

Veterinary hospitals and clinics, holding 52.6%, are projected to dominate because most pregnancy verifications occur during professional veterinary consultations for reproductive care and breeding guidance. Clinics maintain trained staff and proper diagnostic infrastructure, ensuring accurate testing outcomes. Growing veterinary service availability increases access to structured reproductive screening.

Hospitals also provide follow-up care in high-risk pregnancies, strengthening ongoing diagnostic demand. Pet owners and breeders seek clinical validation of test results to support responsible breeding decisions. As prenatal monitoring practices expand, veterinary hospitals and clinics are expected to remain the primary distribution and testing centers for pregnancy kits in animals.

Key Market Segments

By Product Type

- Pregnancy Test Kit Cassettes

- Pregnancy Test Kit Strips

- ELISA Test Kits

By Sample Type

- Urine

- Whole Blood

- Serum

- Plasma

- Others

By Application

- Companion Animals

- Livestock Animals

By Distribution Channel

- Veterinary Hospitals and Clinics

- E-commerce

- Retail Stores

Drivers

Expansion in global meat production is driving the market

The steady increase in global meat production has elevated the importance of efficient reproductive management in livestock, thereby boosting demand for veterinary pregnancy test kits to optimize breeding cycles. This growth necessitates reliable diagnostics to confirm pregnancies early, reducing economic losses from open days and improving herd productivity. Producers are increasingly adopting these kits to align with intensified farming practices aimed at meeting rising protein demands.

International agricultural policies encourage such tools to enhance food security through sustainable animal husbandry. The scalability of test kits supports large-scale operations, enabling batch testing in commercial herds. Advancements in kit design, including user-friendly formats, facilitate integration into routine farm protocols. Collaborative programs between governments and industry promote awareness of these diagnostics for better reproductive outcomes.

Economic analyses highlight cost savings from accurate testing, influencing procurement decisions in agribusiness. As production scales, the need for non-invasive, rapid results becomes paramount for operational efficiency. Overall, this driver positions veterinary pregnancy test kits as essential components in modern livestock management strategies.

Restraints

Physiological variability affecting test sensitivity is restraining the market

Differences in animal physiology, such as milk yield, influence the detectability of pregnancy-associated glycoproteins in blood samples, leading to potential false negatives in high-producing dairy cows. This variability complicates on-farm reliability, prompting reliance on confirmatory methods that extend diagnostic timelines. Sample type preferences emerge, with plasma outperforming whole blood in sensitivity, yet requiring additional processing steps.

Such inconsistencies erode user confidence, particularly in time-sensitive breeding decisions. Environmental factors like stress during sampling can further skew results, exacerbating accuracy concerns. The need for specialized handling in variable conditions strains resource-limited operations.

Standardization efforts lag behind physiological diversity across breeds and regions. These limitations result in cautious adoption, favoring established ultrasound over emerging kits. Ongoing validation studies underscore persistent challenges in universal applicability. Consequently, this restraint moderates market expansion by necessitating supplementary technologies.

Opportunities

Point-of-care testing reducing veterinary workload is creating growth opportunities

Point-of-care veterinary pregnancy test kits enable on-site evaluations, significantly alleviating the burden on veterinarians by streamlining pregnancy checks in remote or large-scale settings. This efficiency allows practitioners to focus on complex cases, enhancing overall herd health management. The portability of these kits extends diagnostic access to underserved rural areas, promoting equitable reproductive care.

Integration with digital tracking systems facilitates data-driven breeding programs, optimizing genetic selection. Cost reductions from minimized travel and labor encourage investment in kit inventories. Training initiatives for farm personnel democratize usage, fostering self-reliant operations. Regulatory support for validated point-of-care devices accelerates market entry for innovative products.

Synergies with precision agriculture tools amplify predictive capabilities for calving schedules. As adoption grows, these kits unlock potential for integrated health monitoring platforms. In summary, this opportunity transforms diagnostics into proactive tools for sustainable livestock enterprises.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic pressures like rising inflation and fluctuating disposable incomes challenge the Veterinary Pregnancy Test Kit market by curbing farmers’ and pet owners’ budgets for non-essential diagnostics, while economic recoveries in key regions spur higher livestock investments that boost demand for efficient breeding tools.

Geopolitical tensions, including ongoing trade disputes between major exporters like China and the U.S., disrupt global supply chains for raw materials and components, leading to delays and higher procurement costs for manufacturers. These factors create volatility, as sudden outbreaks of zoonotic diseases heighten urgency for rapid testing kits, yet currency fluctuations erode profit margins for international suppliers.

The current U.S. tariffs, imposing up to 25% on imported diagnostic supplies and test kit components from China and Mexico as of April 2025, inflate operational expenses and force distributors to pass costs to end-users, potentially slowing adoption in cost-sensitive rural markets. On the flip side, these tariffs encourage domestic innovation, prompting U.S. firms to ramp up local production of affordable, high-accuracy kits that meet stringent FDA standards.

Geopolitical awareness also fosters stronger regulatory collaborations, accelerating approvals for next-generation biosensors that enhance early detection accuracy. Macroeconomic tailwinds from pet humanization trends further amplify opportunities, as urban consumers prioritize premium at-home testing solutions. Ultimately, the market demonstrates resilience, positioning savvy players for sustained growth through diversified sourcing and technological leaps that safeguard animal health worldwide.

Latest Trends

Launch of species-specific progesterone ELISA for camels is a recent trend

In June 2025, Demeditec Diagnostics introduced the Progesterone Camel ELISA kit, a quantitative assay tailored for early pregnancy detection in dromedary camels using serum or plasma samples. This development addresses a critical gap in camelid reproductive diagnostics, offering results within two hours without sample extraction. The kit’s calibrator range of 0.25–20 ng/ml and analytical sensitivity of 0.13 ng/ml ensure precise progesterone quantification for species-specific application.

Accompanying quality controls enhance reliability in arid-region veterinary practices. This innovation supports camel farming in the Middle East and Africa, where pregnancy confirmation impacts milk and breeding yields. The ELISA format aligns with laboratory workflows, enabling scalable testing in emerging markets. Industry feedback highlights its role in reducing diagnostic delays for nomadic herders.

Regulatory validations confirm compliance with international standards for animal health assays. Early implementations demonstrate improved accuracy over traditional methods. This 2025 launch exemplifies targeted advancements in niche veterinary diagnostics, broadening the scope of pregnancy testing solutions.

Regional Analysis

North America is leading the Veterinary Pregnancy Test Kit Market

In 2024, North America accounted for 35.9% of the global veterinary pregnancy test kit market, propelled by robust livestock management practices and advancements in rapid diagnostic technologies. Dairy and beef producers increasingly deploy on-site immunoassay kits to optimize breeding cycles, minimizing economic losses from false pregnancies in herds strained by supply chain disruptions.

Federal subsidies through the U.S. Department of Agriculture incentivize precision farming tools, including portable ultrasound-integrated test strips that enhance accuracy for bovine and equine applications. Veterinary clinics expand services with multiplex panels detecting hormone markers like progesterone, aligning with regulatory pushes for animal welfare standards in commercial operations. Rising pet ownership trends among urban households drive demand for user-friendly canine and feline kits, supported by e-commerce platforms for direct-to-consumer sales.

Collaborative initiatives between agribusinesses and research institutions refine biosensors for field use, reducing diagnostic turnaround times amid labor shortages. Export regulations for semen and embryos further mandate verified gestation confirmations, bolstering kit adoption in cross-border trade. These elements collectively fortify the sector’s expansion, underpinning sustainable animal agriculture. The U.S. Department of Agriculture’s National Agricultural Statistics Service reported a total U.S. cattle inventory of 88.8 million head on January 1, 2022, reflecting the scale of breeding diagnostics needs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project strong momentum in the veterinary pregnancy test kit sector throughout Asia Pacific in the coming years, as intensifying meat demands reshape farming paradigms. Governments in Thailand and the Philippines invest in subsidized distribution networks, equipping cooperatives with lateral flow assays to confirm swine gestations and curb overfeeding costs. Biotech enterprises develop low-cost ELISA variants suited to tropical climates, enabling small-scale water buffalo breeders to integrate testing into seasonal calving schedules.

Regional forums promote knowledge exchange on genomic-enhanced kits, helping herders in Mongolia identify twin pregnancies in sheep flocks vulnerable to nutritional deficits. Urban veterinary chains stock digital reader-compatible devices for companion animals, capitalizing on affluent millennials’ focus on pet family planning. Supply chain optimizations via ASEAN partnerships reduce import dependencies, fostering local assembly of hormone-detection strips for poultry layers.

Educational campaigns by extension officers train rural women on kit usage, empowering gender-inclusive livestock enterprises against climate-induced fertility fluctuations. These strategies harness regional synergies, ensuring scalable solutions for burgeoning herds. The Food and Agriculture Organization documented 1.7% annual population growth in Asia as of 2022, driving parallel surges in livestock numbers and diagnostic requirements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the veterinary pregnancy testing space strengthen growth by developing rapid, species-specific kits that improve breeding efficiency for livestock producers and companion-animal clinics, reducing costly false negatives. They expand market access by collaborating with veterinary distributors and large farm networks to ensure broad product availability in high-breeding regions.

Automation-friendly formats and easy field-use designs support adoption in rural and resource-limited environments where laboratory access remains limited. Companies invest in educational campaigns for breeders and livestock cooperatives to reinforce the economic value of early pregnancy confirmation and regular herd monitoring.

They broaden portfolios with biomarkers such as pregnancy-associated glycoproteins and relaxin to cover bovine, porcine, equine, and canine testing, enabling recurring demand across multiple animal groups. IDEXX Laboratories demonstrates this strategy through its global diagnostic footprint, extensive veterinary customer relationships, and continuous innovation in reproductive testing solutions that enhance productivity for farms and veterinary practices worldwide.

Top Key Players

- IDEXX Laboratories, Inc.

- Zoetis Services LLC

- BioNote, Inc.

- BioTracking, Inc.

- Fassisi GmbH

- J & G Biotech Ltd

- Randox Laboratories Ltd.

- Heska Corporation

Recent Developments

- In June 2025, IDEXX Laboratories in the United States expanded its reproductive diagnostics portfolio by acquiring the Alerts On Farm pregnancy testing solution, which allows early pregnancy confirmation as soon as 28 days after breeding.

- In 2025, Ring Biotechnology Co. Ltd. in Beijing introduced a new early-stage bovine pregnancy diagnostic tool capable of detecting pregnancy between 28 and 30 days without requiring trained personnel for operation, simplifying usage for livestock producers.

Report Scope

Report Features Description Market Value (2024) US$ 49.8 Million Forecast Revenue (2034) US$ 78.8 Million CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pregnancy Test Kit Cassettes, Pregnancy Test Kit Strips and ELISA Test Kits), By Sample Type (Urine, Whole Blood, Serum, Plasma and Others), By Application (Companion Animals and Livestock Animals), By Distribution Channel (Veterinary Hospitals and Clinics, E-commerce and Retail Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IDEXX Laboratories, Inc., Zoetis Services LLC, BioNote, Inc., BioTracking, Inc., Fassisi GmbH, J & G Biotech Ltd, Randox Laboratories Ltd., Heska Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Pregnancy Test Kit MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Pregnancy Test Kit MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IDEXX Laboratories, Inc.

- Zoetis Services LLC

- BioNote, Inc.

- BioTracking, Inc.

- Fassisi GmbH

- J & G Biotech Ltd

- Randox Laboratories Ltd.

- Heska Corporation