Global Veterinary Molecular Diagnostics Market Analysis By Product (Instruments, Test Kits & Reagents, Software & Services), By Technology (PCR (including real-time PCR, multiplex PCR), DNA Sequencing, Microarrays, Other molecular technologies), By Animal Type (Companion Animals, Livestock Animals), By Application (Infectious Diseases, Genetic/Hereditary Disorders, Other Applications), By End-User (Veterinary Hospitals & Clinics, Diagnostic Laboratories, Veterinary Research Institutes & Universities, Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163676

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

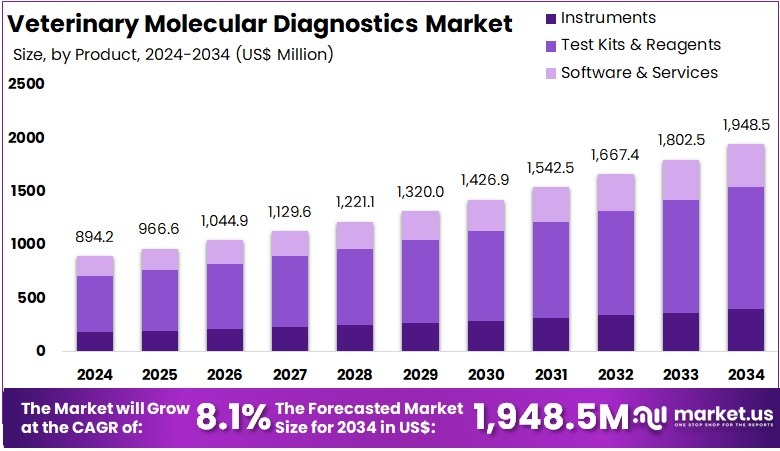

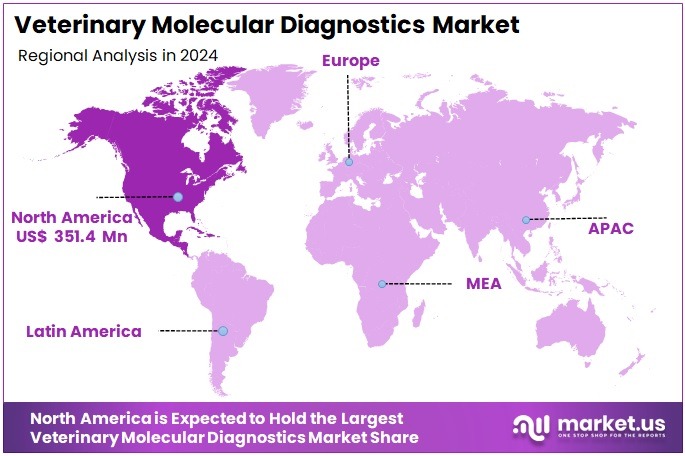

The Global Veterinary Molecular Diagnostics Market Size is expected to be worth around US$ 1948.5 Million by 2034, from US$ 894.2 Million in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.3% share and holds US$ 351.4 Million market value for the year.

Veterinary molecular diagnostics refers to laboratory techniques such as PCR, real-time PCR, sequencing, and microarrays used to detect DNA, RNA, and proteins in animals. These tools enable early and precise disease identification. According to the U.S. CDC, more than 60% of known infectious diseases in humans are zoonotic. It is also estimated that about 75% of new or emerging human infections originate in animals. This epidemiological link strengthens demand for accurate animal testing.

Strong adoption is observed across livestock, companion animals, and wildlife. Public health agencies emphasize rapid detection of spillover events. For example, ongoing avian influenza activity has required sensitive molecular assays. Study by WOAH shows recurrent HPAI waves in 2024–2025, resulting in millions of birds culled during peak months. The FAO and WOAH 2024–2033 global strategy prioritizes early detection and lab confirmation. This policy focus promotes sustained investment in validated PCR kits and sequencing workflows.

Growth is supported by increasing pet ownership and higher spending on animal care. Livestock producers are also adopting molecular tests to protect herd productivity and export access. According to FAO, global meat production in 2024 is estimated to have grown by 1.3% to approximately 365 million tonnes, led by poultry and beef. Larger herds and dense production systems heighten outbreak risks, making fast diagnostics essential. Export markets often require proof of disease-free status, driving laboratory testing volumes.

Antimicrobial resistance is another structural driver. WHO’s GLASS reports continued pressure to monitor resistant pathogens in animals. According to WOAH data, antimicrobial agents intended for animal use fell from 102 mg/kg biomass in 2020 to 97 mg/kg in 2022, reflecting a ~5% decline. Participation in surveillance improved, with 71% of global animal biomass covered in one survey cycle. These stewardship measures require routine pathogen and resistance gene testing, reinforcing molecular diagnostics adoption.

Regulation and Technology Trends

Regulatory standards and laboratory frameworks are expanding. The European Union’s Animal Health Law mandates disease notification and diagnostic method requirements. In the United States, USDA-APHIS coordinates the National Animal Health Laboratory Network. These programs institutionalize molecular tools as routine. For instance, SARS-CoV-2 monitoring in animals has been integrated into national dashboards. Such initiatives ensure procurement of consumables, instruments, and reference materials, strengthening market stability.

Accreditation and performance validation guide technology selection. WOAH specifies that veterinary assays must demonstrate defined analytical and diagnostic performance for each species and sample type. Guidelines for wildlife surveillance further emphasize validated logistics and lab capacity. This clarity reduces technology risk for veterinary authorities and large producers. Study by the Global Burden of Animal Diseases programme notes that only 16-plus animal diseases have DALY estimates, highlighting data gaps. Better diagnostics support improved burden estimation and health planning.

Declining sequencing costs broaden advanced molecular testing. According to NIH’s NHGRI tracking, sequencing expenses have fallen significantly since the Human Genome Project. This enables veterinary labs to use whole-genome and targeted sequencing for outbreak tracing and AMR characterization. For example, genomic data are used to classify avian influenza variants and monitor spillover. Data availability is growing; FAO agriculture statistics cover more than 245 countries and territories, supporting evidence-based disease management.

Global land use trends and One Health coordination contribute to sustained demand. According to Our World in Data, about 80% of agricultural land supports livestock grazing and feed crops, while livestock supply roughly 17% of calories and 38% of protein. This scale increases biosecurity importance. In 2023, the European Centre for Disease Prevention and Control reported rising cases of campylobacteriosis and salmonellosis in humans. Coordinated surveillance, including the WOAH ANIMUSE platform and reports from 152 participating countries, continues to push veterinary systems toward reliable molecular testing.

Key Takeaways

- The global veterinary molecular diagnostics market is forecast to reach USD 1948.5 million by 2034, increasing from USD 894.2 million in 2024 at 8.1% CAGR.

- Test kits and reagents accounted for over 58.7% of the product segment in 2024, indicating strong reliance on ready-to-use molecular testing components.

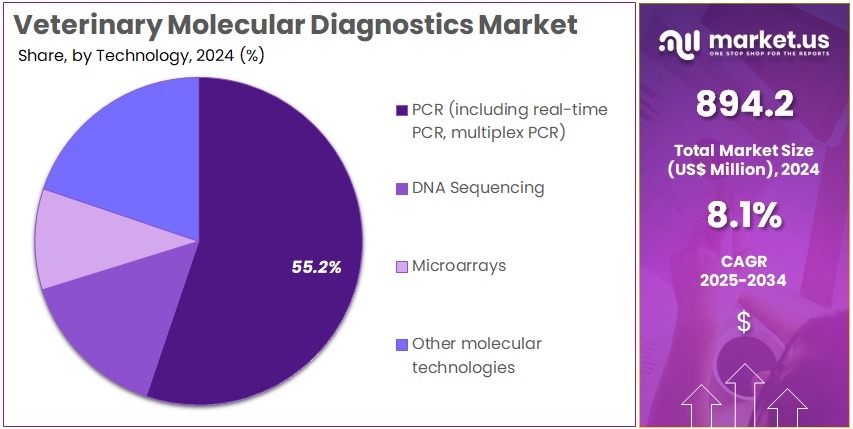

- PCR technologies, including real-time and multiplex PCR, dominated the technology segment in 2024, holding more than 55.2% market share globally in the sector.

- Companion animals represented over 66.8% of the animal type segment in 2024, reflecting increased demand for advanced diagnostics in household pet health management.

- Infectious diseases accounted for more than 70.8% of application share in 2024, driven by rising prevalence of zoonotic pathogens and routine disease surveillance.

- Veterinary hospitals and clinics captured over 52.3% of end-user market share in 2024, supported by greater access to diagnostic infrastructure and trained professionals.

- North America led the global market in 2024 with more than 39.3% share, reaching USD 351.4 million due to advanced veterinary healthcare systems.

Product Analysis

In 2024, the Test Kits & Reagents Section held a dominant market position in the Product Segment of Veterinary Molecular Diagnostics Market, and captured more than a 58.7% share. The demand for quick and precise disease detection in animals supported this dominance. Increasing livestock disease outbreaks and rising pet healthcare spending also contributed. Consumable usage in routine diagnostic processes further strengthened this segment. Continuous product launches, improved assay sensitivity, and expanding availability in point-of-care settings additionally boosted adoption.

The Instruments segment accounted for a notable share. It was driven by growing adoption of advanced PCR platforms, automated analyzers, and portable devices. Higher precision needs in veterinary laboratories supported the use of advanced instruments. Investments in diagnostic infrastructure and modernization of veterinary reference labs led to growing installation rates. However, higher equipment costs and service requirements limited faster adoption in small clinics and low-resource areas.

The Software & Services segment demonstrated steady growth. Cloud-based analysis systems and digital reporting tools improved workflow efficiency. Increasing use of bioinformatics platforms for genetic sequencing and pathogen identification supported expansion. Service-based models for laboratory testing, training, and data interpretation increased reliance on professional support solutions. Continuous improvement in data accuracy and remote diagnostic capabilities strengthened market presence. The segment is expected to gain traction as digital veterinary health systems and tele-diagnostics adoption expands globally.

Technology Analysis

In 2024, the PCR (including real-time PCR, multiplex PCR) Section held a dominant market position in the Technology Segment of Veterinary Molecular Diagnostics Market, and captured more than a 55.2% share. This segment was described as the most widely applied technology due to high accuracy and rapid pathogen detection. Its adoption was supported by strong use in routine diagnostics and livestock disease monitoring. Expanded testing in veterinary laboratories further strengthened growth. Broad assay availability also enhanced demand across companion and farm animals.

DNA sequencing was reported as a fast-growing technology in the veterinary molecular diagnostics industry. It benefited from advances in next-generation sequencing systems. The technology allowed precise pathogen identification and detailed genomic analysis. Cost reductions improved accessibility in research and specialized diagnostic centers. Demand increased as precision animal health solutions and surveillance programs expanded. Further adoption is expected as sequencing platforms become faster, more automated, and more suitable for clinical veterinary workflows.

Microarrays held a moderate position, driven by uses in multiplex pathogen screening and epidemiology research. Their high-throughput capacity supported university and government programs. However, PCR and DNA sequencing remained preferred in routine practice, which limited market penetration. Other molecular technologies, including CRISPR-based tools and isothermal amplification methods, were observed as emerging solutions. These platforms showed promise for rapid and portable applications. Growing interest in field-based diagnostics and point-of-care testing is expected to support future adoption.

Animal Type Analysis

In 2024, the Companion Animals Section held a dominant market position in the Animal Type Segment of the Veterinary Molecular Diagnostics Market, and captured more than a 66.8% share. This leadership position was supported by rising pet ownership and higher veterinary care spending. Strong focus on preventive testing also played a key role. Demand for PCR tests and rapid molecular panels increased in clinics. Pet owners actively sought early disease detection. Growing cancer and genetic testing in dogs and cats further strengthened segment expansion.

Companion animals benefited from improved veterinary awareness. The adoption of point-of-care molecular systems expanded testing access in hospitals and practices. Insurance coverage for pets supported diagnostic affordability. Human-like treatment standards continued to influence the veterinary field. As a result, the companion animal segment was projected to maintain strong demand. Ongoing technology improvements were expected to enhance diagnostic accuracy. Rising interest in wellness and routine testing also contributed to sustained growth momentum.

Livestock animals represented the remaining share of the market. Steady adoption was assisted by rising concerns about zoonotic infections. Farmers placed greater emphasis on herd health. Molecular testing for avian influenza, foot-and-mouth disease, and bovine infections became more common. Government disease monitoring initiatives supported adoption. However, budget constraints in small farms slowed uptake. Limited access to advanced labs in rural areas also restrained penetration. Continued automation and lower testing costs were anticipated to boost demand in the livestock segment.

Application Analysis

In 2024, the Infectious Diseases Section held a dominant market position in the Application Segment of Veterinary Molecular Diagnostics Market, and captured more than a 70.8% share. This leadership was driven by the rising incidence of zoonotic infections and livestock-related disease outbreaks. Increased animal movement, global trade, and intensified commercial farming have also supported demand. The need for rapid and accurate diagnosis for conditions such as avian influenza, foot-and-mouth disease, and bovine respiratory infections strengthened the adoption of molecular diagnostic tools. The market growth can be attributed to strong awareness regarding early disease detection and improved veterinary healthcare infrastructure.

The Genetic/Hereditary Disorders segment accounted for a notable share. Demand has been supported by advancements in genomic testing technologies and increased focus on breeding optimization. Elevated awareness among pet owners regarding hereditary disease screening contributed to uptake in companion animal clinics. Growth was also assisted by expanding research initiatives in animal genetics. Testing adoption increased across equine, canine, and bovine categories for conditions such as progressive retinal atrophy and hip dysplasia. The segment is expected to witness sustained growth as precision breeding and advanced genomic programs gain traction.

The Other Applications segment represented a smaller but emerging share. It includes oncology testing, metabolic disorders, and parasitic disease diagnostics. Steady progress was recorded due to improvements in laboratory automation and biomarker-based testing. Growing interest in companion animal oncology and supportive veterinary diagnostic guidelines contributed to segment expansion. Demand for preventive care and routine screening in urban pet populations has also risen. The segment is expected to observe gradual acceleration, driven by innovations in multi-panel test kits and increased veterinary spending.

End-User Analysis

In 2024, the Veterinary Hospitals & Clinics Section held a dominant market position in the End-User Segment of Veterinary Molecular Diagnostics Market, and captured more than a 52.3% share. This leading position was supported by strong demand for point-of-care testing. A high volume of companion animal visits also contributed. Rising pet ownership encouraged early diagnosis. Clinics adopted advanced technologies for fast and reliable results. Increased awareness of infectious and genetic diseases further boosted usage. Growing preference for accurate molecular tests improved market traction.

Diagnostic Laboratories accounted for a notable share and continued to expand. Centralized testing allowed high throughput and standardized results. These facilities handled complex test panels, including PCR and sequencing. Smaller clinics often outsourced such tests. This trend supported stable demand. A rise in zoonotic disease screening created additional growth opportunities. Laboratories benefited from investments in automation and advanced instruments. Strict quality protocols further improved test reliability and adoption across the market.

Veterinary Research Institutes and Universities showed steady growth. Research programs focused on infectious disease control and genetic studies. Increased government and academic funding supported molecular tool adoption. Institutions used advanced methods for surveillance and vaccine development. Field studies and epidemiology programs boosted test demand. Other End-Users, including livestock farms and field research units, adopted diagnostics at a gradual pace. Their growth was linked to herd health monitoring and biosecurity needs. Limited access to advanced equipment in rural zones moderated expansion.

Key Market Segments

By Product

- Instruments

- Test Kits & Reagents

- Software & Services

By Technology

- PCR (including real-time PCR, multiplex PCR)

- DNA Sequencing

- Microarrays

- Other molecular technologies

By Animal Type

- Companion Animals

- Livestock Animals

By Application

- Infectious Diseases

- Genetic/Hereditary Disorders

- Other Applications

By End-User

- Veterinary Hospitals & Clinics

- Diagnostic Laboratories

- Veterinary Research Institutes & Universities

- Other End-Users

Drivers

Increasing Companion Animal Ownership and Preventive Healthcare Adoption

The rising ownership of companion animals has been driving strong demand for veterinary molecular diagnostics. A larger pet population increases the requirement for routine health management and diagnostic services. Pet owners have been prioritizing wellness and disease prevention, rather than reactive treatments. As a result, molecular tools for early and precise diagnosis are being adopted. The trend has been strengthening across both developed and emerging economies, where awareness of advanced veterinary healthcare has been improving consistently.

Increased spending on pet health has been a major factor supporting this trend. Households have been allocating higher budgets to veterinary services, advanced testing, and preventive care solutions. This spending pattern reflects a growing perception of pets as family members. Consequently, investment in timely disease detection and genetic screening has expanded. Favorable economic conditions in several markets, along with rising disposable income among pet owners, have reinforced the adoption of molecular diagnostics for improved clinical outcomes.

Greater awareness of early-stage disease management has played a critical role. Pet owners and veterinarians have been focusing on proactive monitoring to detect infections and hereditary conditions before symptoms progress. Molecular diagnostic platforms provide accurate identification of pathogens and genetic markers, enabling targeted treatment strategies. This shift toward preventive veterinary medicine has reduced disease burden and improved pet survival rates. Training programs and information campaigns by veterinary organizations have further accelerated knowledge regarding the benefits of molecular diagnostic technologies.

Restraints

High Equipment And Testing Costs

High equipment and testing costs are limiting the broader adoption of veterinary molecular diagnostics. Advanced PCR systems, sequencing platforms, and automated analyzers require significant capital investment. This cost burden is difficult for small veterinary clinics and animal health centers in low- and middle-income economies. High consumable costs and maintenance expenses add further financial strain. As a result, many facilities continue to rely on traditional diagnostic methods. This cost pressure slows market penetration and delays technology modernization across emerging regions.

Limited availability of trained personnel further constrains growth in this market. Molecular diagnostic systems require expertise in sample preparation, assay execution, and data interpretation. Many veterinary clinics lack access to professionals with molecular biology training. Due to this skills gap, even installed systems remain underutilized. Continuous training programs and workforce development efforts are needed. Without skilled operators, market expansion faces operational challenges. This workforce shortage restricts adoption, particularly in developing economies and independent veterinary practices.

Operational complexity also impacts widespread implementation. Molecular diagnostic procedures involve standardized workflows, biosafety measures, and strict quality controls. Smaller practices often lack supporting infrastructure for advanced molecular testing. Limited laboratory space, inadequate cold-chain supplies, and insufficient quality assurance systems pose barriers. Compliance with regulatory protocols demands additional resources and planning. These operational demands discourage smaller veterinary facilities from investing in such technologies. As a result, adoption remains concentrated among reference laboratories and large institutions, limiting broader availability of molecular diagnostic services.

Opportunities

Rising Adoption of Portable Point-of-Care Molecular Testing in Veterinary Diagnostics

Significant opportunity has been identified in the growth of point-of-care molecular testing solutions within the veterinary field. Rising demand for rapid decision-making in animal health diagnostics is expected to support adoption of portable PCR systems. Greater emphasis on early disease identification in livestock, companion animals, and wildlife is also driving this trend. As veterinary professionals seek efficient, on-site testing, the uptake of compact and user-friendly molecular platforms is projected to rise across both developed and emerging markets.

The development of portable PCR-based devices is anticipated to enhance diagnostic accessibility for veterinarians operating in remote or rural settings. Traditional laboratory infrastructure is limited in many livestock regions, leading to delays in disease detection. Compact molecular systems are expected to shorten turnaround times, reduce disease transmission, and optimize treatment decisions. Field-ready diagnostics have been designed to withstand challenging environments. Their use can support improved animal productivity and better monitoring of herd health.

Workflow efficiency within veterinary practices is likely to experience improvement through streamlined testing procedures. Portable molecular diagnostics reduce sample transport time and decrease reliance on centralized laboratories. This shift can enable veterinarians to conduct immediate testing during farm visits or clinical consultations. The economic value created through faster treatment responses and reduced disease impact is anticipated to strengthen market adoption. As awareness grows among practitioners, manufacturers are expected to expand product pipelines and focus on user-centric innovation for veterinary molecular diagnostics.

Trends

Adoption of Advanced Genomic Technologies in Veterinary Diagnostics

A prominent trend in the veterinary molecular diagnostics market is the growing adoption of next-generation sequencing and real-time PCR platforms. These technologies are being incorporated to enhance pathogen detection accuracy and accelerate diagnosis. A shift toward rapid molecular techniques is being observed due to rising concerns about emerging animal diseases and zoonotic threats. As a result, the demand for highly sensitive and precise diagnostic tools is increasing across veterinary laboratories, academic institutes, and animal healthcare centers.

The market is experiencing increased emphasis on genomic-driven disease surveillance in veterinary practice. The integration of sequencing techniques enables detailed pathogen profiling and early identification of disease outbreaks in livestock, companion animals, and wildlife. Real-time molecular surveillance supports timely intervention and helps control disease spread. The growing importance of biosecurity in agriculture, along with stricter regulatory frameworks, is strengthening the use of advanced molecular platforms for early detection, monitoring, and prevention of infectious diseases in animals.

The trend toward personalized veterinary treatment plans is gaining momentum in this market. Genomic data is being used to tailor therapies and monitor treatment responses, especially in oncology, infectious diseases, and genetic disorders. Antimicrobial resistance detection through precise molecular tools is also becoming a priority to guide appropriate therapeutic decisions. This rising focus on individualized care reflects advancements in veterinary precision medicine. Consequently, the integration of genomics and targeted molecular testing is expected to support improved clinical outcomes and enhance overall animal health management.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 39.3% share and holds US$ 351.4 Million market value for the year. This leadership was supported by strong veterinary healthcare systems and wide access to modern diagnostic facilities. High levels of pet ownership in the United States and Canada encouraged routine testing for animal diseases. Spending on pet health continued to rise, which increased adoption of advanced molecular tools. Early disease detection also gained focus across clinics and hospitals.

The region benefited from established veterinary laboratories and well-developed research centers. These facilities played a significant role in disease surveillance and diagnostics. Growing awareness of zoonotic diseases also encouraged testing. Livestock producers continued to face infectious disease challenges. This drove the need for precise and rapid diagnosis. Clear regulatory standards guided testing practices. As a result, reliable and consistent diagnostic protocols became common across veterinary settings.

Continuous investment in biotechnology supported steady innovation in diagnostic solutions. Companies introduced more accurate and faster tests for clinical use. Preventive animal healthcare gained momentum, with veterinarians recommending routine screenings. Strong collaboration between research institutions, diagnostic providers, and veterinary clinics enhanced test development. The region also benefited from rising consumer willingness to spend on premium animal care. These conditions strengthened the region’s position in the veterinary molecular diagnostics landscape and ensured sustained market dominance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The veterinary molecular diagnostics market is shaped by rising demand for fast and accurate animal disease detection. Growth is supported by advanced PCR, sequencing, and panel-based testing. Major participants such as IDEXX Laboratories Inc. and Zoetis Services LLC hold strong positions due to their integrated diagnostic platforms and global veterinary networks. Thermo Fisher Scientific Inc. also plays a large role by supplying high-performance molecular instruments and reagents to veterinary laboratories. Their strong distribution channels and continuous innovation have strengthened market penetration across companion-animal and livestock applications.

Reference-laboratory systems have increased their influence by offering broad molecular test menus and fast turnaround times. Companies including Antech Diagnostics Inc. and Heska Corporation leverage centralized testing models and digital connectivity. bioMérieux S.A. and Virbac focus on specialized veterinary diagnostic solutions and service support. Their strategies include technology partnerships, service expansion, and focused investment in molecular workflows. These companies contribute significantly to disease surveillance, preventive care, and clinical decision support in veterinary settings.

Technology providers remain important in enabling scalable molecular workflows and laboratory automation. Firms like QIAGEN N.V., INDICAL Bioscience GmbH, and Neogen Corporation supply extraction systems, PCR kits, and genetic testing solutions. Roche Diagnostics, Bio-Rad Laboratories Inc., and Agilent Technologies Inc. enhance market capability through next-generation sequencing, digital PCR, and genomic analysis tools. Their products support research and clinical laboratories and standardize testing accuracy and reproducibility. Adoption is driven by rising awareness of pathogen monitoring, herd health improvement, and genetic screening.

The competitive landscape further includes companies such as Abaxis Inc. and other specialized providers. They support point-of-care integration and test menu expansion. Strategic initiatives across the industry include automation upgrades, software connectivity, and validation of multiplex molecular panels. Investments in oncology testing, antimicrobial stewardship, and rapid pathogen identification are expected to continue. Market growth is encouraged by rising pet ownership, increasing livestock productivity needs, and global emphasis on zoonotic disease control, supporting long-term demand for precise molecular diagnostics.

Market Key Players

- IDEXX Laboratories Inc.

- Zoetis Services LLC

- Thermo Fisher Scientific Inc.

- bioMérieux S.A.

- Virbac

- Antech Diagnostics Inc.

- Neogen Corporation

- INDICAL Bioscience GmbH

- QIAGEN N.V.

- Heska Corporation

- Roche Diagnostics

- Abaxis Inc.

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- Other key players

Recent Developments

- In February 2024: Antech launched the Nu.Q® Canine Cancer Test, operating on the Element i+ immunodiagnostic analyzer, enabling veterinarians to obtain rapid (~6 minutes) screening results from a 50 µL plasma sample. This represents an in-clinic molecular/epigenetic cancer screening innovation.

- In October 2023: BioMérieux announced a strategic investment of £70 million in Oxford Nanopore Technologies, which develops nanopore-based molecular sensing technology. Although this investment is targeted primarily at human/infectious-disease diagnostics, the capability expansion in molecular sequencing has potential indirect relevance to veterinary molecular diagnostics as platforms bridge human and animal health surveillance.

- In May 2023: Thermo Fisher launched the SureCount Salmonella Species, Typhimurium and Enteritidis Multiplex PCR Kit for animal-health food-safety applications (poultry, beef, pork). The test enables simultaneous quantification and differentiation of Salmonella species, S. Typhimurium and S. Enteritidis in a single PCR run, and is undergoing AOAC Performance Tested Methods validation. The kit addresses molecular detection of pathogens in food-animal matrices, an important sub-segment of veterinary molecular diagnostics. Demonstrates Thermo Fisher’s innovation in multiplex molecular assays for animal health/food-animal diagnostics.

Report Scope

Report Features Description Market Value (2024) US$ 894.2 Million Forecast Revenue (2034) US$ 1948.5 Million CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Instruments, Test Kits & Reagents, Software & Services), By Technology (PCR (including real-time PCR, multiplex PCR), DNA Sequencing, Microarrays, Other molecular technologies), By Animal Type (Companion Animals, Livestock Animals), By Application (Infectious Diseases, Genetic/Hereditary Disorders, Other Applications), By End-User (Veterinary Hospitals & Clinics, Diagnostic Laboratories, Veterinary Research Institutes & Universities, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IDEXX Laboratories Inc., Zoetis Services LLC, Thermo Fisher Scientific Inc., bioMérieux S.A., Virbac, Antech Diagnostics Inc., Neogen Corporation, INDICAL Bioscience GmbH, QIAGEN N.V., Heska Corporation, Roche Diagnostics, Abaxis Inc., Bio-Rad Laboratories Inc., Agilent Technologies Inc., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Molecular Diagnostics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Molecular Diagnostics MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IDEXX Laboratories Inc.

- Zoetis Services LLC

- Thermo Fisher Scientific Inc.

- bioMérieux S.A.

- Virbac

- Antech Diagnostics Inc.

- Neogen Corporation

- INDICAL Bioscience GmbH

- QIAGEN N.V.

- Heska Corporation

- Roche Diagnostics

- Abaxis Inc.

- Bio-Rad Laboratories Inc.

- Agilent Technologies Inc.

- Other key players