Global Veterinary Electrosurgery Market by Product Type (Bipolar Electrosurgery Instruments, Monopolar Electrosurgery Instruments, Consumables & Accessories), By Animal Type (Small Animal, Large Animal), By Indication, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 102648

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factors

- Restraining Factors

- By Product Type Analysis

- By Animal Type Analysis

- By Indication Analysis

- By End-user Analysis

- Market Segmentations

- Opportunity

- Trends

- Regional Analysis

- Key Regions

- Key Players Analysis

- Recent developments in the Veterinary Electrosurgery Market

- Report Scope

Report Overview

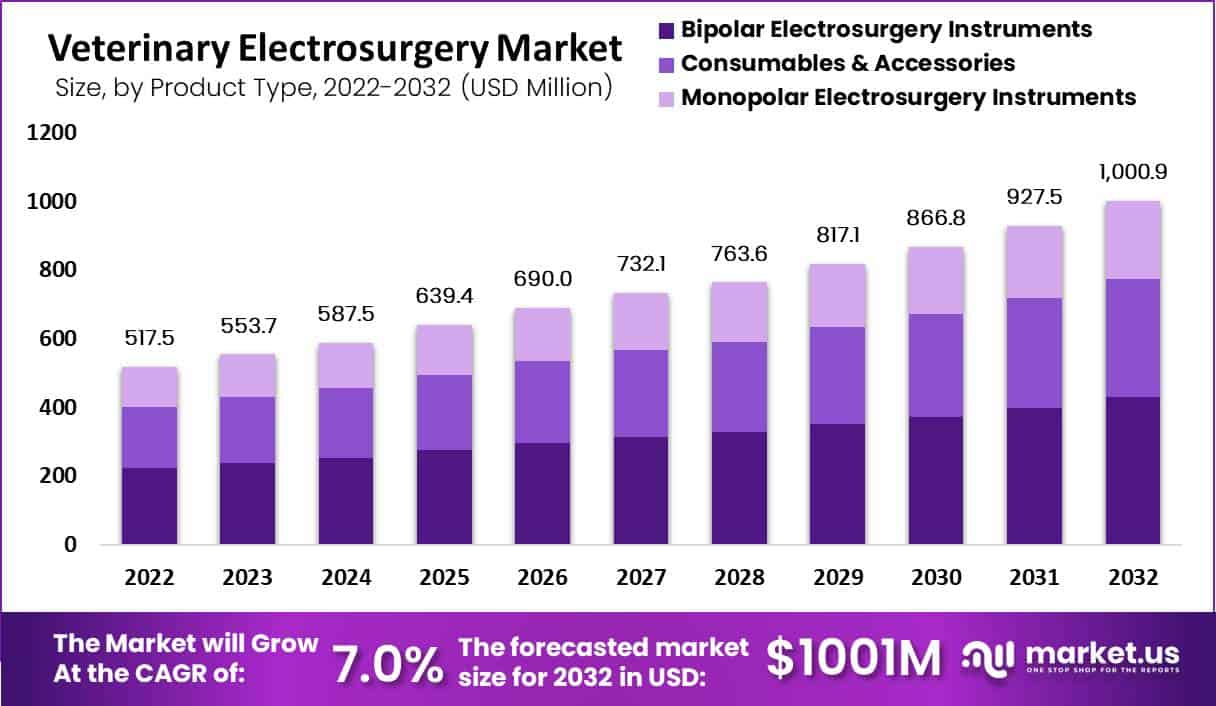

In 2022, the Global Veterinary Electrosurgery Market was worth USD 517.5 Million and is projected to reach USD 1,001 Million by 2032. It is estimated to register the highest CAGR of 7.0% between 2023-2032.

The use of electric current going from a device through the patient and back to the generator is referred to as electrosurgery. The result could be tissue cutting, vascular coagulation, or tissue destruction (fulguration). Veterinary electrosurgery devices are used in surgical operations to cut tissue and reduce bleeding.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Rising Demand: The market for veterinary electrosurgery has seen sustained expansion due to an upsurge in demand for minimally invasive surgical procedures within animal medicine.

- Technological Advancements: Innovations in electrosurgical devices such as improved power settings and precision are fueling market expansion, creating safer procedures with greater efficiency. These advances allow more cost-efficient procedures.

- Animal Population Growth: With pet population numbers skyrocketing around the globe and an emphasis placed on providing superior healthcare services for pets, electrosurgery has become more widely employed within veterinary practices worldwide.

- Electrosurgery’s utilization in treating large animals such as horses and livestock for various surgical procedures represents an impressive market revenue source.

- Electrosurgical devices have become an indispensable asset in small animal clinics for spaying, neutering and other common procedures.

- Veterinary Hospitals and Clinics: The market is predominantly driven by animal hospitals and clinics who adopt electrosurgery devices to expand their surgical capabilities.

Today’s electrosurgery generators enable a veterinarian to be considerably more efficient, whether it’s removing a tumor or doing advanced surgical operations. Because of the benefits connected with the use of electrosurgical devices, more and more animal health specialists throughout the world are adopting these devices.

Electrosurgery generators and accessories are time-saving instruments that can improve the efficiency of any veterinary professional facility. These surgical devices are very popular because they allow for faster and more efficient operations and provide Veterinarians with some unique capabilities. These features include the capacity to cut, coagulate, ablate, and dissect tissue with a single device, which can reduce operative timeframes, blood loss, and time under anesthesia both intra- and post-operatively.

The market’s growth is positively impacted by several factors, such as rising demand for pet health insurance, an increase in the number of veterinary practitioners, an increase in the number of animal procedures, and an increase in the companion animal population. Furthermore, increased knowledge of animal treatment choices is projected to stimulate the growth of the market during the forecast period.

Driving Factors

Rising pet adoption

Over 3.3 million dogs entered shelters in 2018, according to the ASPCA. A dog is owned by 37% to 47% of families. Around 78 million dogs are kept as pets in the United States. Every year, around 3.3 million dogs enter shelters, with approximately 670,000 being euthanized. At least 65% of owners acquire a free rescue dog.

In the United States, 51.3% of dog owners have mixed-breed pets. Purebred dogs currently account for up to 25% of canines in shelters. Dog ownership has surged by 39% in the last ten years. It was estimated that there were 74.1 million pet cats in America in 2012. The United States is noted for having the most dogs and cats in its households. This figure currently comprises 76 million dogs and more than 95 million cats.

China comes in second in all categories, with 27.4 million dogs and 53.1 million cats, while Russia comes in third with 12.5 million dogs and 17.8 million cats. Thus, rising pet adoption is likely to drive the demand for veterinary electrosurgery devices during the forecast period.

Increasing demand for pet health insurance

According to highlights of the 2023 NAPHIA’s State of the Industry Report, in the U.S., the total pet insurance volume was valued at around $3.2 billion. By the end of 2022, about 4.8 million pets in the country were insured, which amounted to an increase of 22% from the year 2021.

For dogs, the average illness and accident premium insurance coverage was $53 per month or $640 per year. Cats’ average illness and accident premium was $32 per month or $387 per year. Dogs accounted for the majority of insured pets (80% against 20% for cats).

Trupanion reported in 2020 that over 800,000 pets were covered under the company’s plans in significant areas such as the United States, Canada, and Australia. Thus, a rise in demand for pet health insurance is anticipated to boost the market growth during the projected time period.

Rise in the number of veterinarians

The increasing number of veterinary practitioners across the world is positively impacting the growth of the market. According to the Canadian Veterinary Medical Association, in 2022, there will be around 15,322 veterinarians in Canada, with 3,825 active in clinical practice.

According to the American Veterinary Medical Association (AVMA), in 2020, the overall number of veterinarians in the United States was 126,138, which represents a rise of 4% since the year 2018. According to the Bureau of Labour Statistics (BLS), veterinary occupations are forecasted to add around 51,700 new jobs and increase at a rate of 19% between the time frame of 2016 and 2026.

It is about three times faster than the estimated 7% for other occupations. Thus, a rise in the number of veterinarians around the globe is projected to fuel the growth of the veterinary electrosurgery market during the projection period.

Restraining Factors

The rising cost of pet care

Over the years, there has been a significant increase in pet care costs all over the globe. According to a 2022 LendingTree survey on pet expenses, more than 75% of pet owners believe inflation is increasing the cost of pet keeping, and around 26% are struggling to keep up with escalating costs.

Millennials (32%) are the most likely demographic to claim they are having difficulty paying pet bills due to inflation. While prices for necessities are rising, pet expenditure is decreasing. Overall, around 87% of pet owners have noticed price increases on major expenses, including pet food (74%) and veterinary care (33%). Meanwhile, owners now report spending an average of $984 per year on their dogs, down from $1,163 reported in 2021.

Prices for veterinary services increased by 10%, the largest increase in the last 20 years, according to official data. Thus, the rising cost of pet care services is anticipated to have a negative impact on the market growth during the forecast period.

Risks involved in veterinary electrosurgery

There are some hazards involved with using electrosurgery. Tissue death frequently happens at the surgical site, albeit it is usually minor. Problems with the equipment or mistakes in operation can result in burns on the dog. It is critical that all safety precautions are followed at all times.

The combination of electronic currents and anesthetic gases has the potential to start a fire in the operating room. Alcohol should not be used to sterilize the surgical region prior to the surgery because of this danger. Delayed hemorrhage is also possible following electrosurgery. Thus, certain risks associated with veterinary electrosurgery may limit the growth of the market during the estimated time period.

High cost of veterinary electrosurgery

The cost of electrosurgery varies substantially based on the treatment employed and the condition being treated. Because the equipment might cost several thousand dollars, most electrosurgical procedures cost more than standard operations to cover tool expenses.

Simple operations can cost as little as $100, whilst more sophisticated tumor removals or emergency surgery can cost thousands of dollars. Therefore, the high cost of veterinary electrosurgery is expected to restrain market growth during the projected time period.

By Product Type Analysis

Bipolar electrosurgery leads to the highest growth

The ability to employ isotonic saline during surgery, lower blood loss, and less heat damage to surrounding tissue are all advantages of bipolar electrosurgery. Bipolar electrosurgery delivers concentrated energy to a smaller area of tissue. As a result, offers a significant reduction in the danger of patient burns. Thus, due to the key benefits offered by bipolar electrosurgery, it is highly preferred by veterinarians.

Also, consumables and accessories are expected to grow at a significant rate during the forecast period. Increasing demand for monopolar and bipolar electrosurgical devices has led to high utilization of consumables and accessories, thereby driving the growth of the segment. Moreover, the presence of key players like GVP Pty Ltd., DLC Vet Pty Ltd., and Jorgensen that offer quality consumables and accessories are likely to positively impact the growth of the segment.

By Animal Type Analysis

Small animals are witnessing high demand

Factors such as increased pet adoption and disease prevalence among them are expected to drive the segment growth. According to Cooper Pet Care figures, there were around 140 million pet animals in the European Union (including Norway and Switzerland) in January 2022.

There were around 64 million dogs and 76 million cats among such pets. It also stated that Estonia and Lithuania have a healthy mix of cat and dog populations, whereas Spain has a considerably stronger preference for dogs, with their population outnumbering the cat population by 3 million people. This demonstrates that cats are widely adopted in countries all around the world. This is expected to contribute to segment growth throughout the projection period.

Moreover, large animals are projected to witness high growth during the estimated time period. Large animals’ anatomical and body size features necessitate an exceptionally specialized product range. Symmetry Surgical, DRE Veterinary, and others are among the companies that cater to such product needs. The use of electrosurgical procedures in veterinary practice can increase practice efficiency and minimize treatment times, lowering facility cost-to-serve and thereby increasing the adoption of electrosurgery devices.

By Indication Analysis

General surgery indication leads to the highest growth

The increased prevalence of chronic diseases in animals, as well as the increasing number of procedures performed on animals, are driving segment expansion. Pet obesity has become an epidemic in the United States, according to Banfield Pet Hospital’s 2020 report on Veterinary Emerging Topics.

Obesity causes concomitant illnesses such as osteoarthritis, which frequently necessitate surgical intervention. Thus, the high demand for veterinary electrosurgery in general surgery is fuelled by the increasing number of procedures performed on animals.

Also, the orthopedic surgery segment is anticipated to witness high growth during the forecast period. The growth of the segment is driven by a rise in the number of veterinary orthopedic surgeries. According to Banfield Pet Hospital, the most frequent osteoarthritis disorders affecting dogs and cats in 2017 were arthritis/DJD, ligament/tendon conditions, and hip/pelvis conditions. This increased the number of orthopedic procedures performed on canine pets. Therefore, the rising number of orthopedic surgeries is anticipated to boost the demand for veterinary electrosurgery.

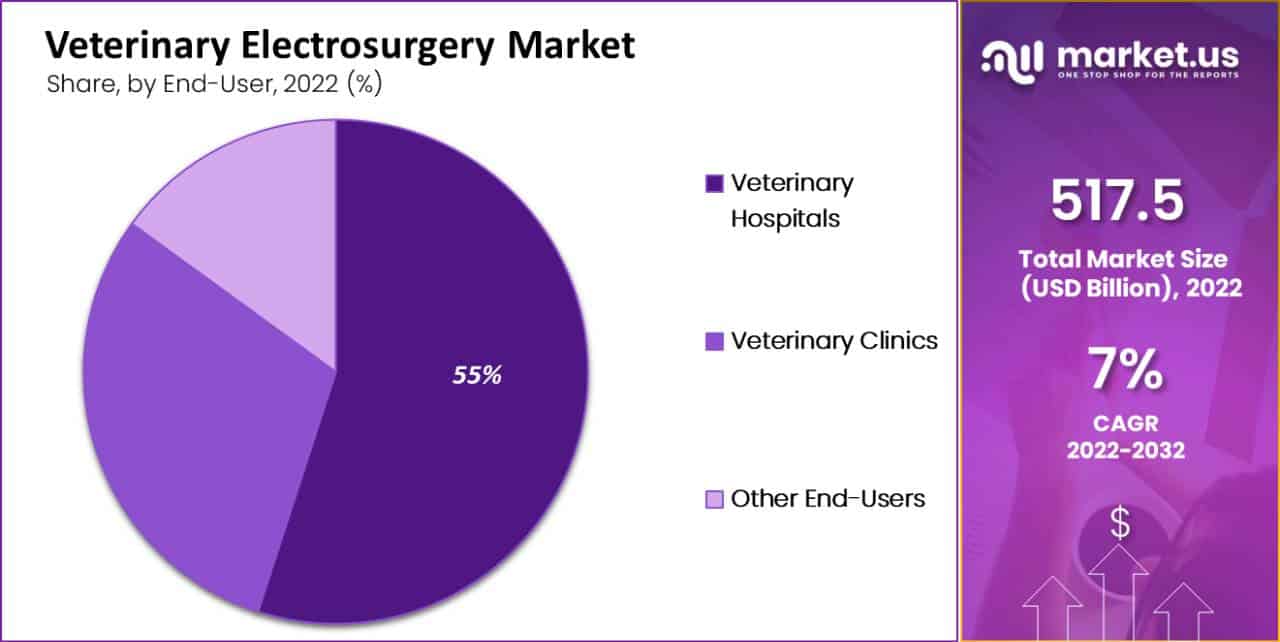

By End-user Analysis

Veterinary Hospitals are the major end-users

The availability of several treatment options at veterinary hospitals over the globe is a major factor driving the growth of the segment. Furthermore, the expansion and adoption of modern and advanced diagnostic equipment and devices in veterinary hospitals is another key factor that is likely to contribute to the overall growth of the segment.

On the other hand, veterinary clinics are anticipated to grow at a high rate during the estimated time period. The high growth of the segment can be attributed to increasing pet adoption, which has felled the demand for veterinary surgical procedures in clinics.

Market Segmentations

Application

Bipolar Electrosurgery Instruments

Monopolar Electrosurgery Instruments

Consumables & AccessoriesType

Small Animal

Large AnimalEnd-Users

Veterinary Hospitals

Veterinary Clinics

Other End-UsersOpportunity

High pet adoption in developing nations

Pet adoption has skyrocketed in developing regions of the world, like Asia Pacific, Latin America, and others. According to Rakuten Insight’s 2021 Survey, around 59% of adults in Asia have a pet at home, although there are noticeable variances.

In Hong Kong, 16% of the population owns a dog, while 47% in Thailand and 67% in the Philippines own a dog. Dogs have been confirmed as man’s closest friend in one-third (32%) of the population in the twelve Asian nations. Cats were second in pet ownership (26%)

Pet ownership in China is increasing, with 6.6% of families already having a dog, according to Euromonitor. Due to rising pet adoption, the spending on animal health in these nations has also increased significantly in recent years. It is likely to provide lucrative growth opportunities for key players operating in the market.

Trends

Technological advancements and new product launches

In the previous few decades, the veterinary surgery sector has progressed tremendously, resulting in significant technological improvements and new product launches. For instance, in April 2022, in the United States, Vimian Group announced the purchase of two product portfolios of orthopedic implants and veterinary surgical equipment.

Through this purchase, Vimian expanded its line of high-quality orthopedic implants for companion animals and also developed a new product category in veterinary surgical devices with this acquisition. Also, in July 2020, in the United Kingdom, a new type of electrosurgical device named Onemytis was introduced.

A huge shift to digital technologies from analog techniques can be indicated through the launch of this device. It is currently used widely throughout Europe, mostly in ENT, ophthalmology, dermatology, and other surgical procedures. European veterinary surgeons largely prefer this device over the past few years. Therefore, such key technological advancements and innovative product launches can be considered a positive trend that is expected to fuel the growth of the market in the upcoming years.

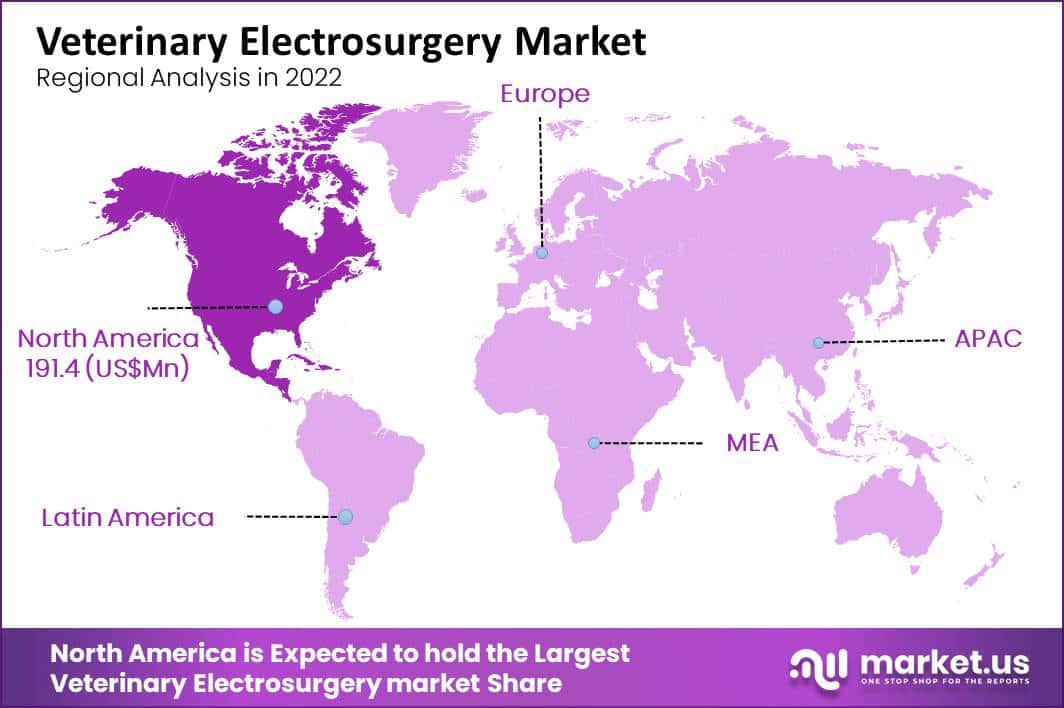

Regional Analysis

The North American region is expected to hold the highest share of the market, 37%, during the forecast period. Pet adoption, as well as pet insurance, is on the rise, which is expected to drive market growth in the region.

According to the North American Pet Health Insurance Association (NAPHIA), in 2021, 4.41 million pets will be insured in North America. Furthermore, the average monthly cost of pet insurance for cats is USD 28, and for dogs is USD 50 for policies that cover both accidents and illnesses.

Furthermore, according to the American Pet Products Association, USD 123.6 billion was spent on pets in the United States in 2021, up from roughly USD 99.0 billion in 2020. Pet owners’ spending is increasing the demand for procedures for pet treatment. This is also expected to open up the potential for veterinary electrosurgery. As a result, the market in North America is growing at the highest rate.

The Asia Pacific market is projected to witness high growth over the forecast period. Increased disposable income, an increase in middle-class households, and acceptance of companion animals are some of the primary drivers projected to drive growth in the region’s veterinary electrosurgery market.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Veterinary Electrosurgery market is regarded as moderately competitive. Major players in the market are focusing on technological advancements and new product launches to gain market share.

Also, several players are emphasizing joint ventures and strategic initiatives such as mergers and acquisitions in order to expand their product line and geographical footprint. It is likely to positively contribute to the growth of the market in the upcoming years.

Top Key Players in the Market

- Medtronic

- Symmetry Surgical Inc.

- DRE Veterinary

- B. Braun Melsungen AG

- Eickemeyer Veterinary Equipment Ltd

- Kwanza Veterinary

- Burtons Medical Equipment Ltd.

- KARL STORZ

- Macan Manufacturing

- Summit Hill Laboratories

- Other Key Players

Recent developments in the Veterinary Electrosurgery Market

- May ’22: SynDaver, a cutting-edge biotechnology firm specializing in synthetic educational human and animal simulators, has introduced a new synthetic feline surgical training model. This novel instrument is intended to teach veterinary students how to execute feline spay procedures without endangering a living patient.

- August ’18: With the intention of expanding and improvement of its veterinary electrosurgical equipment portfolio, Symmetry Surgical Inc. formally announced the acquisition of Bovie Medical.

Report Scope

Report Features Description Market Value (2022) USD 517.5 Mn Forecast Revenue (2032) USD 1001 Mn CAGR (2023-2032) 7.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Bipolar Electrosurgery Instruments, Monopolar Electrosurgery Instruments, Consumables & Accessories, By Animal Type – Small Animal, Large Animal, By Indication- General Surgery, Dental Surgery, Gynaecological & Urological Surgery, Orthopaedic Surgery, Ophthalmic Surgery, and Other Indications, and by End-user- Veterinary Hospitals, Veterinary Clinics, and Other End-users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, Symmetry Surgical Inc., DRE Veterinary, B. Braun Melsungen AG, Eickemeyer Veterinary Equipment Ltd, Kwanza Veterinary, Burtons Medical Equipment Ltd., KARL STORZ, Macan Manufacturing, Summit Hill Laboratories, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the global Veterinary Electrosurgery Market?In 2022, the global Veterinary Electrosurgery market was valued at US$ 517.5 million and will be valued US$ 1001 million by 2032.

What is electrosurgery and how is it used in veterinary medicine?Electrosurgery is the use of electric current to perform surgical procedures in veterinary medicine. It involves passing electric current from a device through the patient to achieve tissue cutting, vascular coagulation, or tissue destruction.

What factors are driving the growth of the Veterinary Electrosurgery market?Rising pet adoption, increasing demand for pet health insurance, and a rise in the number of veterinarians are the key driving factors for the growth of the Veterinary Electrosurgery market.

Why is the increasing demand for pet health insurance expected to boost the Veterinary Electrosurgery market?With the rise in pet health insurance coverage, pet owners are more likely to opt for advanced surgical procedures, including those that require veterinary electrosurgery devices. This increased demand for veterinary procedures contributes to the growth of the market.

Which product type is expected to witness the highest growth in the Veterinary Electrosurgery market?Bipolar electrosurgery is projected to experience the highest.

What are the different product types in the Veterinary Electrosurgery market?The Veterinary Electrosurgery market offers various product types, including Bipolar Electrosurgery Instruments, Monopolar Electrosurgery Instruments, and Consumables & Accessories.

Which animal types are considered in the Veterinary Electrosurgery market?The Veterinary Electrosurgery market caters to both Small Animals and Large Animals.

Which region holds the largest share of the Veterinary Electrosurgery market?North America is expected to dominate the Veterinary Electrosurgery market, holding the highest share of 37% during the forecast period.

What are some key players in the Veterinary Electrosurgery market?Prominent players in the market include Medtronic, Symmetry Surgical Inc., Kwanza Veterinary, Burtons Medical Equipment Ltd., KARL STORZ, Macan Manufacturing, Summit Hill Laboratories, and other key players.

Veterinary Electrosurgery MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Veterinary Electrosurgery MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic

- Symmetry Surgical Inc.

- DRE Veterinary

- B. Braun Melsungen AG

- Eickemeyer Veterinary Equipment Ltd

- Kwanza Veterinary

- Burtons Medical Equipment Ltd.

- KARL STORZ

- Macan Manufacturing

- Summit Hill Laboratories