Global Vending Machine Market By Type(Food, Beverages, Ticket, Games/Amusement, Tobacco, Others), By Payment Mode(Cash, Cashless), By Application(Offices, Hotels & Restaurants, Public Places, Others), By Technology(Automatic Machine, Semi-Automatic Machine, Smart Machine), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 17600

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

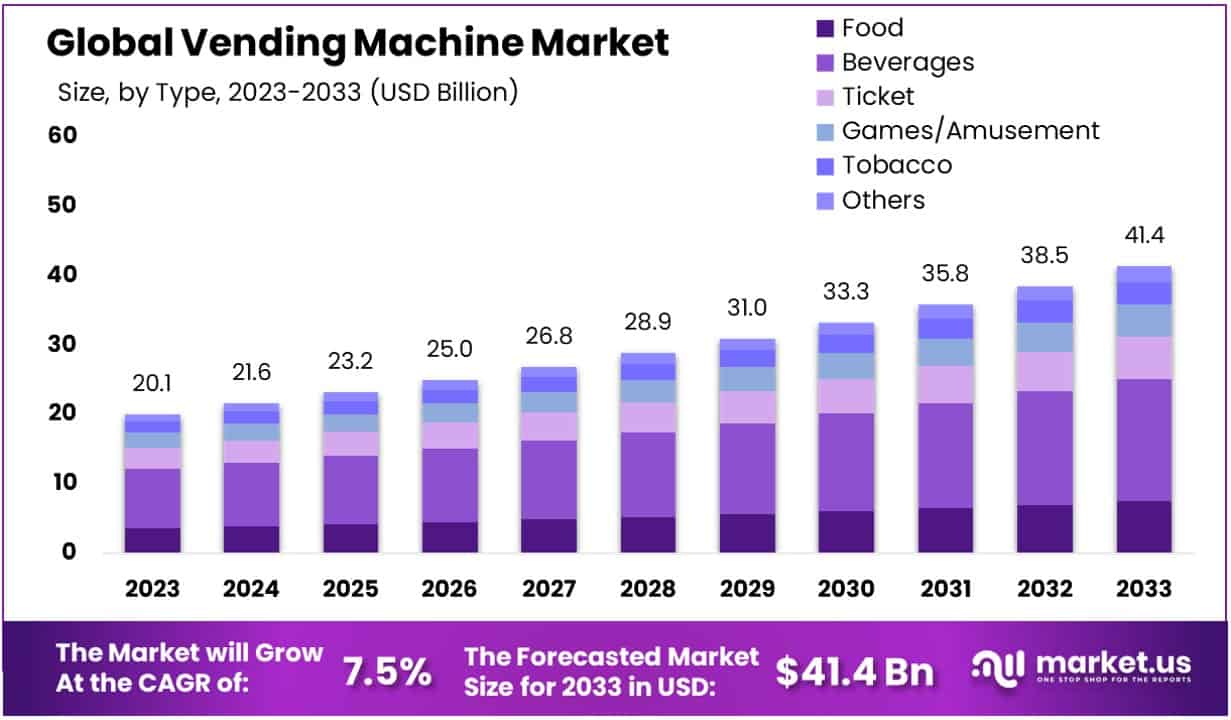

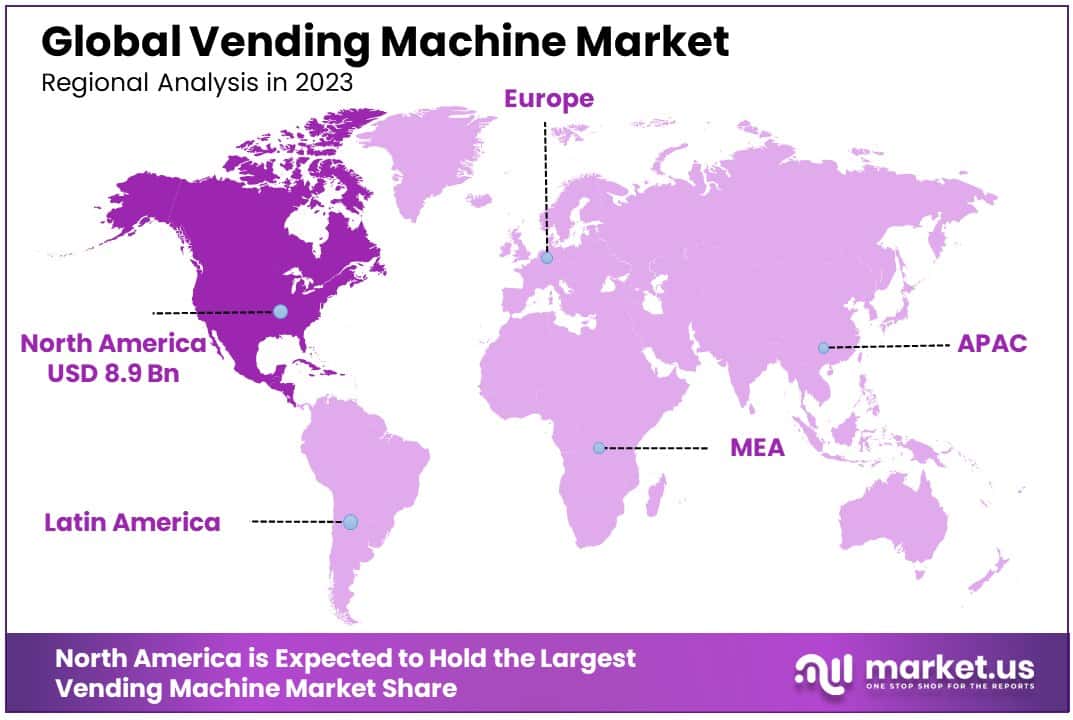

The Global Vending Machine Market is expected to be worth around USD 41.4 billion by 2033, up from USD 20.1 billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033. North America will dominate a 44.7% market share in 2023 and hold USD 8.98 Billion in revenue from the Vending Machine Market.

A vending machine is an automated device that dispenses items such as snacks, beverages, cigarettes, or lottery tickets to customers after money, a credit card, or a specially designed card is inserted into the machine. These machines offer a convenient and efficient solution for consumers to purchase products without human interaction.

The vending machine market refers to the industry centered around vending machines’ design, distribution, and operation. It encompasses a variety of machines dispensing a range of products and is influenced by technological advancements, evolving consumer preferences, and increasing demand for on-the-go products.

The expansion of the vending machine market can be attributed to the increasing integration of advanced technologies such as cashless payment systems, touchscreen interfaces, and smart dispensing mechanisms. These innovations enhance user experience and operational efficiency, driving the adoption of vending machines in diverse settings.

Demand in the vending machine market is driven by the growing need for fast and convenient access to food and beverages in high-traffic areas like schools, workplaces, and transportation hubs. The rise in consumer preference for self-service options and 24/7 availability also significantly boosts market growth.

The market presents opportunities for the customization and diversification of vending machine offerings. There is potential for expansion into non-traditional vending items such as electronics, health products, and even perishable foods, catering to a broader range of consumer needs and preferences. This versatility opens new avenues for market growth.

The Vending Machine Market has navigated a transformative phase, primarily marked by a significant contraction in operating revenues. According to data from ised-isde.canada.ca, in 2021, vending machine operators reported total operating revenues of $251.2 million, down from $303.5 million in the preceding year, representing a 17.2% decrease year-over-year.

This decline can be attributed to the disruptions caused by the global health crisis, which reduced foot traffic in key venues where vending machines are typically installed. Despite this setback, the industry’s ability to generate net revenue of $17.1 million in 2021—up from $15.5 million in 2020, showing a growth of 10.9%—underscores a resilient undercurrent.

Sales, constituting 91.5% of total operating revenues, indicate the core reliance on direct product dispensing, while other sources accounted for 8.5%, suggesting ancillary revenue streams remain marginal yet essential. This data reflects an industry adapting to new consumer behaviors and the altered economic landscape. Operators are increasingly turning to technology-enhanced models to regain momentum and cater to a market that values convenience, safety, and contactless interactions.

Looking ahead, the vending machine market is poised for rejuvenation with opportunities to integrate more personalized and digitally driven consumer experiences. These adaptations are not merely reactive but strategic, aligning with broader trends of digital transformation and consumer expectation shifts.

Key Takeaways

- The Global Vending Machine Market is expected to be worth around USD 41.4 billion by 2033, up from USD 20.1 billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

- In 2023, Beverages held a dominant market position in the By Type segment of the Vending Machine Market, with a 42.5% share.

- In 2023, Cash held a dominant market position in the By Payment Mode segment of the Vending Machine Market, with a 72.3% share.

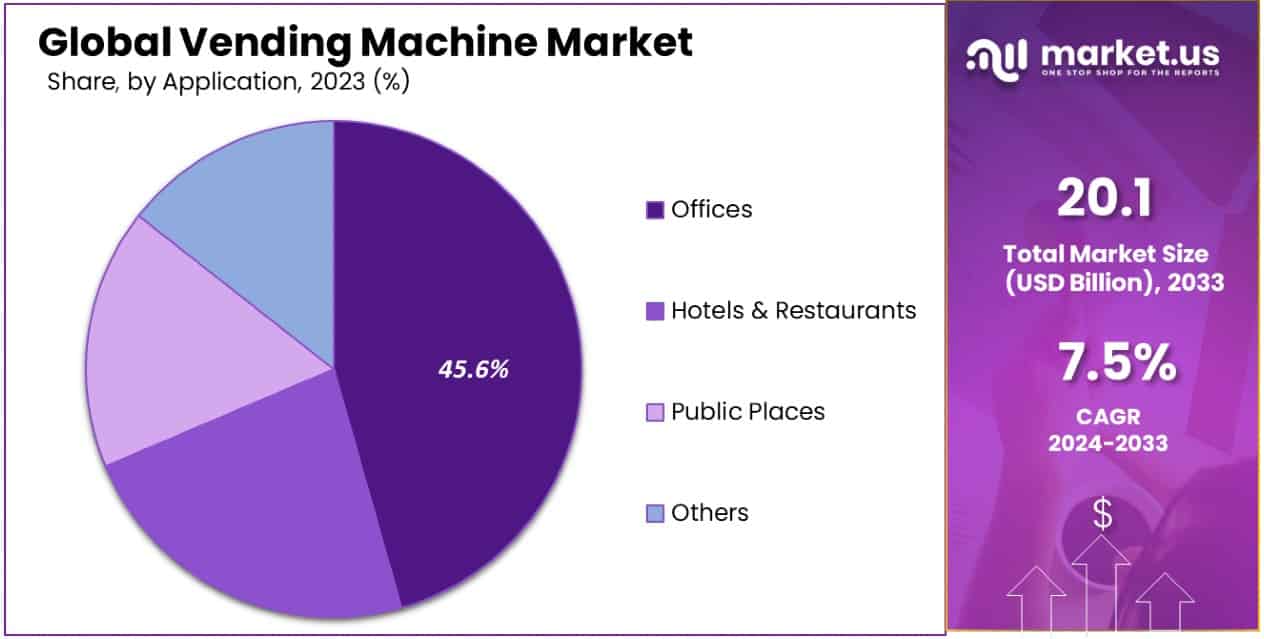

- In 2023, Offices held a dominant market position in the By Application segment of Vending Machine Market, with a 45.6% share.

- In 2023, Automatic Machines held a dominant market position in the By Technology segment of Vending Machine Market, with a 55.4% share.

- North America will dominate a 44.7% market share in 2023 and hold USD 8.98 Billion in revenue from the Vending Machine Market.

By Type Analysis

In 2023, the Vending Machine Market was categorized by various product types, including Food, Beverages, Tickets, Games/Amusement, Tobacco, and Others. Beverages emerged as the predominant category, commanding a significant 42.5% market share.

This dominance is primarily attributed to the increasing consumer demand for quick and convenient access to a variety of drink options, ranging from hot coffees to chilled soft drinks, which are ideal for on-the-go consumption. The rise in automated retail technology has further propelled the segment’s growth, enhancing the consumer experience through features like touchless operations and customized selections.

The Food segment also displayed substantial traction, reflecting evolving consumer preferences towards ready-to-eat snacks and meals due to busy lifestyles. Meanwhile, the Tickets segment benefited from automated ticketing solutions in the smart transportation and entertainment sectors, streamlining operations and reducing manpower costs. The Games/Amusement category capitalized on casual and impulse purchases in high foot traffic areas such as malls and airports.

Conversely, the Tobacco segment faced regulatory challenges, influencing its market positioning. The Others category, which includes various niche products, indicated moderate growth, driven by innovations in product offerings. Collectively, these segments highlight the diverse applications and adaptability of vending machines in meeting contemporary consumer demands and preferences.

By Payment Mode Analysis

In 2023, the Vending Machine Market was segmented by payment mode into Cash and Cashless options. Cash payment retained a dominant market position with a substantial 72.3% share. Despite the global push towards digital transactions, cash remains prevalent due to its universal accessibility and reliability, especially in regions with limited digital infrastructure or where consumer preferences lean towards traditional payment methods.

The Cashless segment, although smaller, showcased rapid growth, driven by advancements in technology and the increasing adoption of smart mobile payments, smart cards, and contactless transactions. This shift is supported by the consumer’s growing preference for convenience and speed, coupled with enhanced security features that reduce the risks associated with cash handling.

The contrast between the two segments highlights a significant divide in consumer adoption, with traditional practices firmly rooted but gradually yielding to digital innovations. The ongoing integration of more secure and versatile payment technologies in vending machines is likely to accelerate the expansion of cashless payments, suggesting a dynamic future for this market as consumer behaviors and technological landscapes evolve.

By Application Analysis

In 2023, Offices held a dominant market position in the By Application segment of the Vending Machine Market, securing a 45.6% share. This significant portion underscores the reliance of office environments on vending services for convenient access to food and beverages, thereby enhancing employee productivity and satisfaction. Following Offices, Hotels & Restaurants accounted for the market.

This segment benefits from the deployment of vending machines to offer guests quick service options around the clock, contributing to enhanced customer experiences and operational efficiencies. Public Places, including transportation hubs, malls, and leisure centers, represented, driven by high foot traffic and the need for quick, on-the-go access to refreshments. Other areas, encompassing educational institutions and healthcare facilities, held the remaining.

The diversified use across these sectors highlights the adaptive nature of vending solutions to various consumer needs and environments, suggesting continued growth and integration possibilities across multiple platforms. The sectoral adoption reflects strategic placements of vending machines, aiming to maximize accessibility and convenience for a broad user base.

By Technology Analysis

In 2023, Automatic Machines held a dominant market position in the By Technology segment of the Vending Machine Market, with a 55.4% share. These machines are favored for their ease of use and reliability, offering straightforward transactional processes without human intervention, which significantly enhances consumer convenience and operational efficiency.

Following closely, Smart Machines captured of the market. The adoption of these technologically advanced units is driven by their connectivity features, allowing for remote management, personalized customer interactions, and real-time inventory tracking, thereby aligning with the growing demand for smart and interactive retail solutions. Semi-automatic machines held the remaining of the market share.

While less prevalent than their fully automated and smart counterparts, these machines cater to settings where full automation is either impractical or unnecessary, offering a balance of manual control and automated mechanisms.

The segmentation within the market underscores a clear trend towards more automated and intelligent systems that cater to evolving consumer expectations and the increasing emphasis on contactless and efficient customer service solutions in various environments.

Key Market Segments

By Type

- Food

- Beverages

- Ticket

- Games/Amusement

- Tobacco

- Others

By Payment Mode

- Cash

- Cashless

By Application

- Offices

- Hotels & Restaurants

- Public Places

- Others

By Technology

- Automatic Machine

- Semi-Automatic Machine

- Smart Machine

Drivers

Vending Machine Market Growth Drivers

The expansion of the vending machine market is primarily driven by technological advancements and changing consumer preferences. Modern vending machines offer increased convenience, featuring cashless payment options, touch-screen interfaces, and the ability to provide a wider range of products, from electronics to freshly prepared foods.

This adaptability appeals to the fast-paced lifestyle of contemporary consumers who value quick and easy access to a variety of goods. Furthermore, the integration of smart technologies such as IoT has enabled real-time monitoring and inventory management, enhancing operational efficiency.

Businesses are also leveraging these machines to reduce labor costs and expand their sales channels. Additionally, the rising demand for on-the-go food options in urban settings further bolsters the market’s growth, meeting the needs of consumers seeking quick service and round-the-clock availability.

Restraint

Challenges Facing the Vending Machine Market

One significant restraint in the vending machine market is the high initial investment required for advanced machines. These costs can be prohibitive for small businesses and new entrants, as modern vending machines equipped with touch screens, cashless payment systems, and smart technology features are considerably more expensive than traditional models.

Additionally, the ongoing maintenance and regular updates needed to keep the machines functioning efficiently and securely add to the operational costs. The market also faces regulatory challenges, as governments may impose strict health and safety standards that require regular compliance checks.

Furthermore, consumer skepticism towards the freshness and quality of vended products, particularly food and beverages, can limit market growth. These factors combined make it difficult for vending machine operators to achieve rapid scalability and profitability.

Opportunities

Emerging Opportunities in Vending Markets

The vending machine market presents substantial opportunities, particularly through the customization and diversification of vending machine offerings. There is growing consumer interest in machines that offer unique products such as health foods, gourmet meals, and personal care items, beyond the traditional snacks and drinks.

This shift towards specialized vending machines creates a niche market for operators to explore. Moreover, integrating advanced technologies like biometric verification and AI-driven recommendations can enhance the user experience, making vending machines more interactive and personalized.

These innovations not only attract a broader customer base but also increase the potential for higher transaction values per user. Additionally, expanding into less saturated markets such as hospitals, schools, and corporate offices offers new venues for deployment, further driving market growth by reaching consumers directly in their daily environments.

Challenges

Navigating Challenges in Vending Machine Sector

The vending machine market faces several challenges that can hinder its growth. One of the primary issues is the vulnerability to vandalism and theft, particularly in machines located in less secure or unsupervised areas. This risk requires operators to invest in security measures, which can be costly.

Another challenge is the stringent health and safety regulations that govern the sale of perishable items through vending machines. Compliance with these regulations can be complex and expensive, potentially deterring operators from offering a broader range of food products.

Furthermore, the rapid pace of technological change means that vending machine technology can quickly become outdated, necessitating continuous upgrades and replacements. This can escalate operational costs and complicate the management of machine fleets. Additionally, consumer preferences are constantly evolving, and staying ahead of these trends to meet customer expectations can be difficult.

Growth Factors

Key Growth Factors in Vending

Several factors contribute to the growth of the vending machine market. The rise in consumer demand for convenience is a major driver, as vending machines provide easy access to products 24/7 without the need for retail staff.

Technological advancements are also propelling this market forward; modern vending machines are equipped with smart technology that offers cashless payments, touch screens, and customization options, enhancing the customer experience. Additionally, the expansion into non-traditional vending items such as electronics, cosmetics, and health products caters to a broader audience and creates new sales opportunities.

The integration of IoT technology improves operational efficiency through better inventory management and maintenance alerts, reducing downtime. Moreover, the strategic placement of vending machines in high-traffic areas like airports, schools, and business parks captures more consumers and increases sales potential.

Emerging Trends

Emerging Trends Shaping Vending Machines

Emerging trends in the vending machine market are significantly influenced by technological innovation and evolving consumer behaviors. Smart vending machines are becoming increasingly popular, equipped with features like facial recognition for personalized service, and real-time data analytics that help operators understand consumer preferences.

There’s also a shift towards eco-friendly machines that use energy-efficient technologies and materials, appealing to environmentally conscious consumers. The inclusion of healthier food options in vending machines reflects a growing consumer focus on wellness and nutrition.

Additionally, the integration of mobile Smart payment systems and QR codes has streamlined transactions, making vending machines more accessible and user-friendly. These machines are now being used in more diverse settings, including workplaces, universities, and transit stations, expanding their market reach and providing convenience in various aspects of daily life.

Regional Analysis

The global vending machine market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each displaying unique growth dynamics. North America dominates the market, holding a 44.7% share, valued at USD 8.98 billion, driven by high consumer demand for convenience and the rapid adoption of smart vending technologies.

In Europe, market growth is propelled by the increasing installation of vending machines in public and corporate sectors, coupled with stringent energy efficiency regulations that foster the deployment of greener machines.

Asia Pacific is witnessing the fastest growth due to urbanization, rising disposable incomes, and the expansion of retail infrastructure, making it a highly lucrative region for future investments. The market in the Middle East & Africa, and Latin America is still developing, with growth driven by gradual urbanization and increasing consumer awareness about the benefits of automated retail.

These regions are expected to experience higher growth rates in the coming years as they continue to adopt more technologically advanced vending solutions. Collectively, these trends underscore a diverse and expanding global marketplace, with North America maintaining its lead due to technological innovations and a robust consumer base.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global vending machine market will be significantly influenced by the activities and innovations of key players such as Crane Co., SandenVendo America, Inc., and Fastcorp Vending LLC. Each of these companies plays a crucial role in shaping the competitive landscape and driving market trends through their strategic initiatives and technological advancements.

Crane Co., known for its robust engineering and innovative payment solutions, continues to lead in the integration of digital technologies into vending operations. The company focuses on enhancing user experience through touchless transactions and advanced data analytics, positioning itself as a leader in smart vending solutions. This approach not only meets the increasing consumer demands for convenience and safety, especially relevant in the post-pandemic era but also helps in maintaining a strong market presence.

SandenVendo America, Inc., originally renowned for its beverage vending machines, has expanded its portfolio to include technologically advanced, energy-efficient models. The company has been pivotal in introducing eco-friendly refrigeration technologies and customizable vending options, catering to a growing segment of health-conscious consumers and those interested in minimizing their environmental footprint.

Fastcorp Vending LLC distinguishes itself with its innovative frozen and cold dispensing vending machines. By tapping into niche markets such as frozen foods and ice cream, Fastcorp has effectively captured a unique market segment. The company’s emphasis on versatility and reliability in its vending solutions allows it to cater to diverse consumer needs, from traditional snacks to gourmet frozen meals.

Collectively, these companies are not only enhancing their product offerings but are also strategically positioning themselves to leverage emerging market opportunities, thereby driving the global expansion and technological evolution of the vending machine industry.

Top Key Players in the Market

- Crane Co.

- SandenVendo America, Inc.

- Fastcorp Vending LLC

- Azkoyen S.A.

- Fuji Electric Co., Ltd.

- N&W Global Vending S.p.A.

- Royal Vendors, Inc.

- Selecta Group AG

- Evoca Group

- FAS International S.p.A.

- Bianchi Industry SpA

- Glory Limited

- Sielaff GmbH & Co. KG

- Groupe SEB

- Vendekin Technologies

Recent Developments

- In August 2023, Acquired a smaller competitor to expand its European market share, boosting its distribution network by 15%.

- In June 2023, Fuji Electric recently launched a new series of energy-efficient vending machines that reduce electricity usage by 30%.

- In May 2023, Introduced a line of solar-powered vending machines, aiming to increase installations in outdoor venues by 20% over the next year.

Report Scope

Report Features Description Market Value (2023) USD 20.1 Billion Forecast Revenue (2033) USD 41.4 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Food, Beverages, Ticket, Games/Amusement, Tobacco, Others), By Payment Mode(Cash, Cashless), By Application(Offices, Hotels & Restaurants, Public Places, Others), By Technology(Automatic Machine, Semi-Automatic Machine, Smart Machine) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Crane Co., SandenVendo America, Inc., Fastcorp Vending LLC, Azkoyen S.A., Fuji Electric Co., Ltd., N&W Global Vending S.p.A., Royal Vendors, Inc., Selecta Group AG, Evoca Group, FAS International S.p.A., Bianchi Industry SpA, Glory Limited, Sielaff GmbH & Co. KG, Groupe SEB, Vendekin Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vending Machine MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Vending Machine MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Crane Co.

- SandenVendo America, Inc.

- Fastcorp Vending LLC

- Azkoyen S.A.

- Fuji Electric Co., Ltd.

- N&W Global Vending S.p.A.

- Royal Vendors, Inc.

- Selecta Group AG

- Evoca Group

- FAS International S.p.A.

- Bianchi Industry SpA

- Glory Limited

- Sielaff GmbH & Co. KG

- Groupe SEB

- Vendekin Technologies