Global Vehicle Surveillance System Market Vehicle Type (Commercial, Passenger), By Product (Blindspot detection system, Autonomous Cruise Control system, Parking assist system, Lane departure warning system, Heads-up display device, Global positioning system), By Under vehicle surveillance (Static Under Vehicle Surveillance system, Mobile Under Vehicle Surveillance system), By Out Vehicle Surveillance (Hardware, Software, Services), By End User (Military and defense, Government, Energy and Power, Automobile), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 85049

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

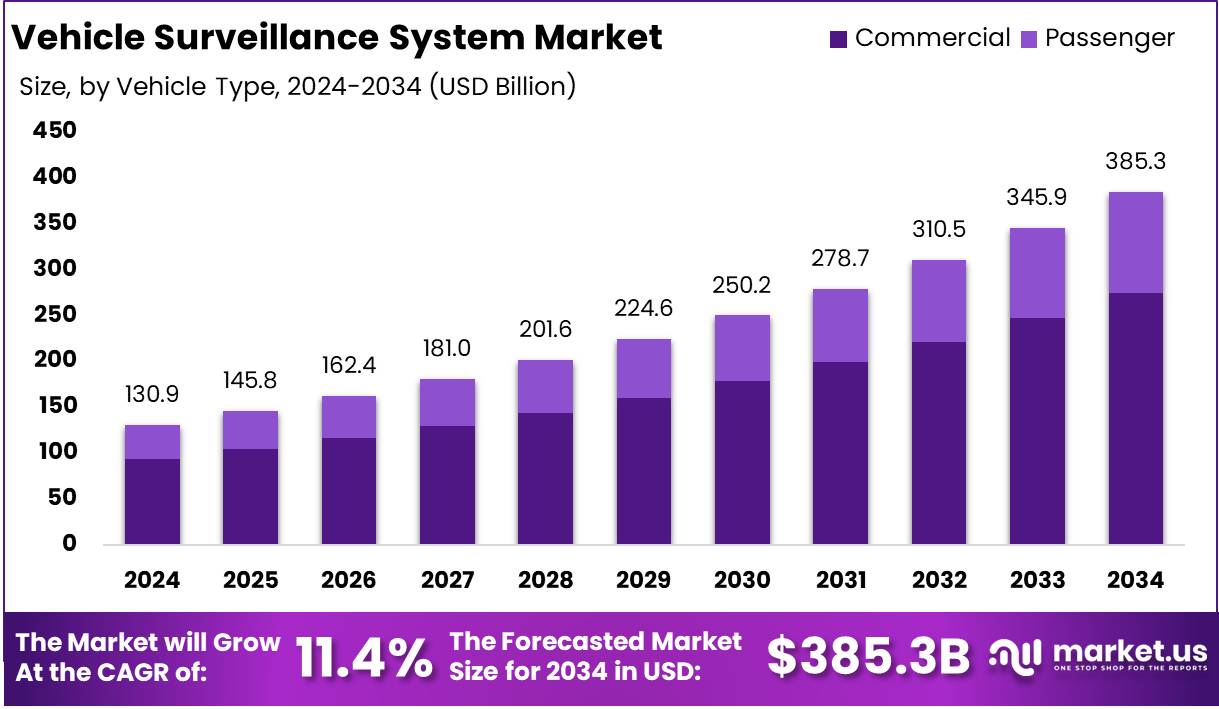

The Global Vehicle Surveillance System Market size is expected to be worth around USD 385.3 Billion by 2034 from USD 130.9 Billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034.

A Vehicle Surveillance System refers to an integrated set of technologies designed to monitor, record, and analyze vehicular activities both internally and externally. These systems utilize a combination of cameras, sensors, GPS, and software algorithms to enhance vehicle security, improve operational efficiency, and ensure driver and passenger safety.

Common features include real-time video monitoring, automated number plate recognition (ANPR), collision detection, driver behavior analytics, and incident recording. Such systems are deployed across a range of vehicle types including private cars, commercial fleets, and public transportation units to deter theft, monitor usage, and provide actionable insights through data analytics.

The Vehicle Surveillance System Market encompasses the global ecosystem of products, technologies, services, and solutions associated with the design, development, and deployment of surveillance systems within vehicles. This includes both hardware components such as cameras, sensors, control units and software solutions including AI-based analytics platforms and cloud-based data storage.

The market spans across multiple end-use industries such as logistics, law enforcement, ride-hailing services, and personal automobiles. It is driven by the growing demand for intelligent transportation systems, rising concerns around vehicular safety and theft, and the proliferation of connected vehicle technologies. Market players range from established automotive electronics manufacturers to emerging tech startups providing AI-driven surveillance solutions.

The growth of the vehicle surveillance system market can be attributed to the increasing emphasis on road safety regulations and the rising adoption of smart mobility technologies. Governments across several regions are enforcing stricter safety standards, prompting OEMs and fleet operators to integrate advanced surveillance systems into their vehicles.

Demand for vehicle surveillance systems is witnessing a consistent rise, particularly within commercial fleet operations, public transport systems, and law enforcement agencies. Fleet managers are increasingly investing in these systems to enhance route monitoring, reduce liabilities, and ensure compliance with safety norms.

In parallel, the growing penetration of shared mobility services and autonomous vehicles has amplified the requirement for continuous, real-time monitoring. Furthermore, consumer preferences are shifting towards vehicles equipped with built-in surveillance features, driven by heightened awareness of personal security and asset protection.

Significant growth opportunities exist in the integration of AI and machine learning within vehicle surveillance platforms, enabling more intelligent threat detection and behavior prediction. The expansion of 5G connectivity is expected to further unlock real-time video streaming and low-latency communication capabilities, creating new possibilities in remote vehicle monitoring.

According to Seeking Alpha, the Vehicle Surveillance System Market is gaining momentum due to developments such as BYD’s 2025 announcement to integrate self-driving features in all 21 models, starting at $9,500. This competitive pricing strategy is expected to disrupt China’s EV segment.

According to PJ Auto Tech, the Vehicle Surveillance System market is gaining significant traction due to its proven impact on road safety. Blind spot detection systems, a key component, have been shown to reduce all lane-change crashes by 14% and related injuries by 23%. Notably, if adopted across all vehicles in the U.S., nearly 50,000 crashes and approximately 16,000 injuries could be avoided annually.

Furthermore, insurance claims have decreased by 14% for vehicle damage and by 11% for injuries to others. Around 80% of drivers reported finding blind spot detection technology highly beneficial. These statistics underscore a growing demand trajectory for advanced surveillance solutions in automotive safety.

Key Takeaways

- The global vehicle surveillance system market is projected to grow significantly, reaching approximately USD 385.3 billion by 2034, up from USD 130.9 billion in 2024, registering a CAGR of 11.4% during the forecast period (2025–2034).

- In 2024, commercial vehicles dominated the market by vehicle type, accounting for a 71.4% share, driven by rising fleet management demands and security mandates across logistics and transportation sectors.

- Blindspot detection systems held the largest share within the product segment in 2024, capturing over 36.2% of the market, attributed to increasing emphasis on driver safety and accident prevention.

- The static under vehicle surveillance systems segment led the market in 2024, securing more than 63% share, fueled by growing installations at security checkpoints and critical infrastructure facilities.

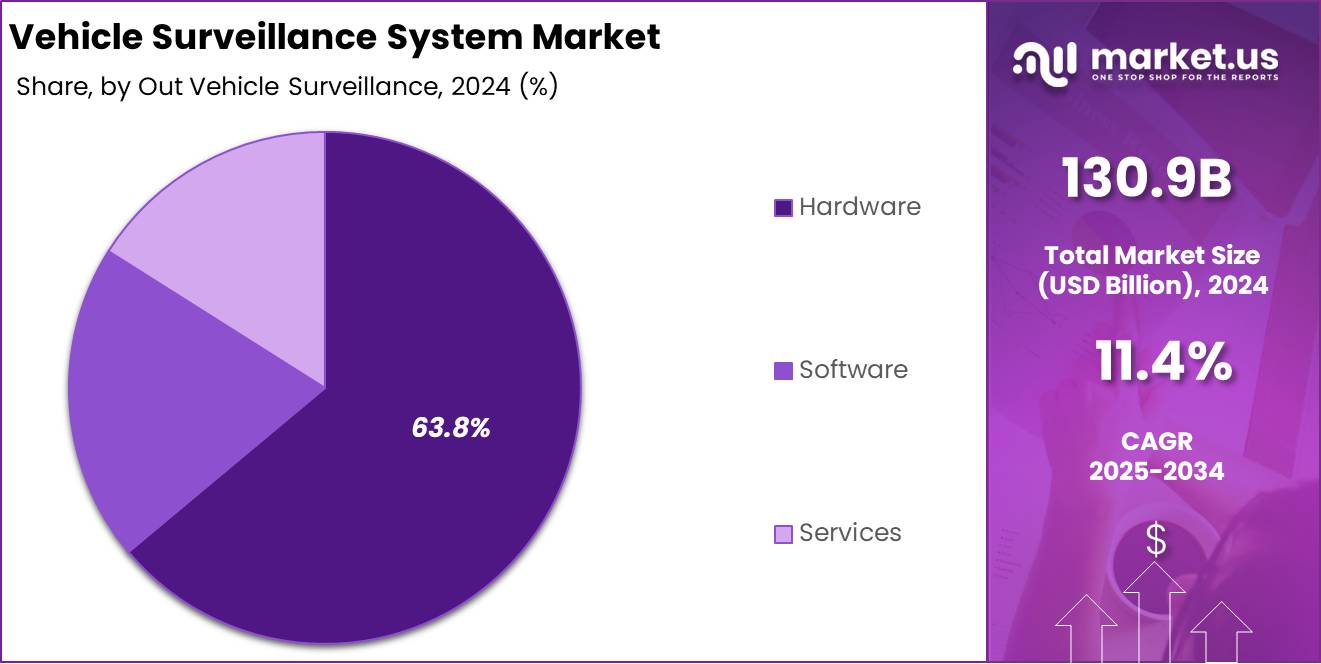

- Hardware components dominated the out vehicle surveillance category in 2024, accounting for over 63.8% of the market share, due to the widespread deployment of sensors, cameras, and detection devices.

- The military and defense sector emerged as the dominant end user in 2024, representing more than 71.4% of the total market, supported by heightened demand for high-security vehicle monitoring systems.

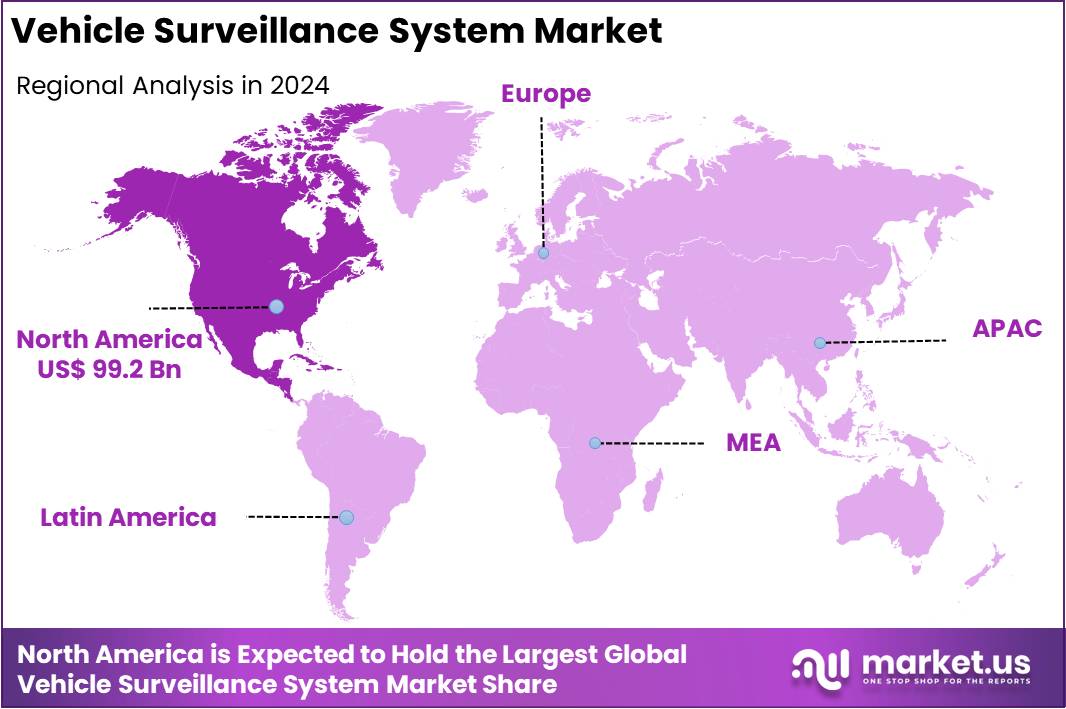

- North America led the global market in 2024 with a commanding 75.8% share, equivalent to a market valuation of USD 99.2 billion, driven by strong defense spending, infrastructure security needs, and technological advancements.

Vehicle Type Analysis

Commercial Vehicles Segment Dominates the Vehicle Surveillance System Market with 71.4% Share in 2024

In 2024, Commercial vehicles held a dominant market position in the Vehicle Surveillance System Market by Vehicle Type, capturing more than a 71.4% share. This substantial dominance can be attributed to the rising adoption of advanced surveillance technologies across logistics, public transport, freight, and fleet management industries.

The growing need for real-time vehicle monitoring, driver behavior analysis, and cargo security has significantly accelerated the deployment of surveillance systems in commercial fleets. Furthermore, regulatory mandates in several regions requiring onboard camera systems and GPS-based tracking for commercial transport vehicles have supported strong market penetration.

Additionally, commercial operators are increasingly investing in vehicle surveillance systems to minimize operational risks, prevent theft, ensure compliance with safety norms, and improve route efficiency. The integration of AI-enabled video analytics, cloud-based data storage, and telematics in commercial vehicles has also contributed to enhancing fleet visibility and decision-making.

As commercial fleets typically operate across longer routes and for extended durations, the need for robust monitoring systems is greater compared to passenger vehicles. This ongoing shift towards smart fleet management is expected to continue driving the market growth in the commercial segment.

In 2024, passenger vehicles held a moderate share in the Vehicle Surveillance System Market by Vehicle Type. Although this segment remains smaller compared to its commercial counterpart, the integration of surveillance technologies in passenger vehicles has shown a consistent upward trend.

Increasing concerns around vehicle theft, road safety, and demand for driver assistance features have played a vital role in encouraging the adoption of solutions such as dashboard cameras, parking sensors, and interior monitoring systems.

Furthermore, the expanding consumer base for premium and connected vehicles—especially in urban centers and technologically advanced regions—is significantly supporting the market’s progression. Original equipment manufacturers (OEMs) are increasingly incorporating surveillance systems into their standard safety offerings.

Features such as real-time alerts, remote access, night vision capabilities, and cloud-based video storage are becoming more prevalent. While the commercial segment currently dominates the market, the passenger vehicle segment is expected to gain traction through continued advancements in smart vehicle technologies and consumer preference for enhanced in-car safety and security features.

By Product Analysis

Blindspot Detection Systems Segment Dominates the Vehicle Surveillance System Market with 36.2% Share in 2024

In 2024, Blindspot detection systems held a dominant market position in the Vehicle Surveillance System Market by Product Analysis, capturing more than a 36.2% share. This dominance can be attributed to the increasing demand for enhanced driver safety and accident prevention technologies. Blindspot detection systems assist in monitoring areas that are difficult for the driver to see, thereby reducing collision risks during lane changes and turns. The adoption of these systems has been further fueled by rising consumer awareness and regulatory encouragement in favor of vehicle safety features.

In 2024, autonomous cruise control systems secured a significant share in the Vehicle Surveillance System Market by Product Analysis. These systems gained traction due to their capability to maintain safe distances between vehicles, thereby reducing driver fatigue and improving road safety. The growing integration of these systems into advanced driver-assistance systems (ADAS) has played a pivotal role in expanding their presence across various vehicle categories.

In 2024, parking assist systems represented a notable portion of the Vehicle Surveillance System Market by Product Analysis. Their adoption has been driven by the increasing challenges of parking in densely populated urban areas. These systems utilize proximity sensors, rear-view cameras, and automated steering functionalities to support drivers in parking safely and accurately.

The evolution of smart city environments and consumer demand for convenience-enhancing vehicle technologies have further supported the uptake of parking assist features. Advanced variants, including self-parking and automated valet systems, are being integrated into newer vehicle models, particularly in the premium segment. As urbanization accelerates and space constraints grow, this segment is projected to experience consistent growth fueled by innovation and demand for user-centric solutions.

In 2024, lane departure warning systems accounted for a considerable share of the Vehicle Surveillance System Market by Product Analysis. Designed to alert drivers when a vehicle unintentionally veers out of its lane, these systems have become critical in preventing accidents caused by distraction or drowsiness. Legislative initiatives and safety rating systems in key regions have contributed to the segment’s broader adoption.

Advancements in artificial intelligence, computer vision, and onboard sensor technologies have significantly improved the effectiveness and responsiveness of lane departure warning systems. These features are increasingly included in ADAS suites across both mass-market and high-end vehicles. With regulatory support and ongoing technological refinement, this segment is expected to witness growing penetration in the years ahead.

In 2024, heads-up display (HUD) devices occupied a smaller but growing share in the Vehicle Surveillance System Market by Product Analysis. These systems enhance driver awareness by projecting essential information—such as speed, navigation, and system alerts—onto the windshield or a transparent display, allowing drivers to maintain attention on the road.

In 2024, global positioning systems (GPS) continued to play a foundational role in the Vehicle Surveillance System Market by Product Analysis. These systems are essential for vehicle navigation, real-time tracking, and fleet monitoring. GPS technologies are widely used across both commercial and passenger vehicles for route optimization, theft recovery, and logistics management.

Under Vehicle Surveillance Analysis

Static Under Vehicle Surveillance Systems Segment Dominates the Vehicle Surveillance System Market with 63% Share in 2024

In 2024, Static Under Vehicle Surveillance Systems secured a dominant position in the Vehicle Surveillance System Market by Under Vehicle Surveillance, capturing more than 63% of the market share. These systems are primarily used in fixed locations, such as checkpoints, entrances, and security facilities, to inspect vehicles for potential threats. Their widespread adoption can be attributed to their effectiveness in providing high-resolution images and detailed analysis of vehicle undercarriages, which helps in detecting explosives, contraband, and other security risks.

The primary advantage of static systems lies in their ability to offer continuous, high-performance surveillance with a consistent focus on high-risk locations. These systems typically use high-definition cameras, X-ray technologies, or other imaging systems to scan vehicles as they pass through the checkpoint. Given the increasing focus on security in public spaces, commercial facilities, and transportation hubs, the static under vehicle surveillance segment is expected to maintain its strong market position moving forward.

In 2024, Mobile Under Vehicle Surveillance systems held a growing share in the Vehicle Surveillance System Market by Under Vehicle Surveillance. These systems are designed for flexible, on-the-go vehicle inspection and are commonly used by law enforcement, military, and security agencies for temporary security checks at events, border crossings, or on-the-move checkpoints. Their portability and ease of deployment have made them increasingly popular in dynamic environments where fixed installations are not feasible.

Mobile under vehicle surveillance systems are typically equipped with imaging technologies such as X-ray or automated cameras, which can be mounted on vehicles or deployed quickly to inspect suspicious vehicles. The increasing need for security in high-mobility environments such as in military operations, large public gatherings, and emergency response situations is driving the demand for these mobile solutions. As security concerns continue to rise globally, the mobile under vehicle surveillance segment is poised to expand as a flexible and adaptable solution.

Out Vehicle Surveillance Analysis

Hardware Segment Dominates the Vehicle Surveillance System Market with 63.8% Share in 2024

In 2024, Hardware secured a dominant market position in the Vehicle Surveillance System Market by Out Vehicle Surveillance, capturing more than 63.8% of the market share. Hardware in vehicle surveillance systems includes components such as cameras, sensors, scanners, and display systems, which are essential for monitoring and analyzing vehicle movements and identifying potential security threats. These hardware systems are critical for providing real-time data and high-quality imaging necessary for effective surveillance.

The significant market share of hardware can be attributed to its foundational role in vehicle surveillance systems. As security concerns around transportation, infrastructure, and high-risk facilities continue to grow, the demand for hardware solutions that enable advanced surveillance capabilities is increasing.

In 2024, Software accounted for a growing share in the Vehicle Surveillance System Market by Out Vehicle Surveillance. Software solutions are integral to the management, analysis, and interpretation of data collected by surveillance hardware. These solutions include features such as image processing, threat detection algorithms, vehicle tracking, and reporting, enabling users to gain actionable insights from the data collected in real-time.

As vehicle surveillance systems become more sophisticated, the role of software in integrating and analyzing data becomes increasingly critical. The need for advanced analytics, cloud storage, and AI-based decision-making tools in modern surveillance systems is driving growth in this segment.

In 2024, Services accounted for a smaller yet important portion of the Vehicle Surveillance System Market by Out Vehicle Surveillance. The services segment includes installation, maintenance, and support services for hardware and software components of vehicle surveillance systems. These services are crucial for ensuring that surveillance systems are properly set up, calibrated, and maintained over their lifecycle.

The demand for services is primarily driven by the growing installation of vehicle surveillance systems across various sectors. As organizations seek to optimize the performance of their surveillance systems, the need for professional installation and ongoing maintenance services has increased.

End User Analysis

Military and Defense Segment Dominates the Vehicle Surveillance System Market with 71.4% Share in 2024

In 2024, Military and Defense held a dominant position in the Vehicle Surveillance System Market by End User, capturing more than 71.4% of the market share. This significant share is driven by the critical need for enhanced security and surveillance in military and defense operations.

Vehicle surveillance systems are increasingly being used by defense agencies to monitor military vehicles, ensure operational safety, and detect threats in real-time during operations. These systems support the monitoring of both ground vehicles and convoys in complex and hostile environments, providing real-time data for strategic decision-making.

The growth in this segment is fueled by the ongoing modernization of defense infrastructure, with vehicle surveillance systems playing a vital role in increasing the efficiency of military operations. As defense agencies seek to improve their surveillance capabilities, the demand for advanced technologies such as infrared cameras, automated recognition systems, and GPS tracking solutions is expected to continue expanding.

The emphasis on enhancing border security, monitoring military logistics, and providing situational awareness for defense operations will contribute to the continued dominance of this segment in the vehicle surveillance market.

In 2024, Government accounted for a significant share in the Vehicle Surveillance System Market by End User. Government agencies utilize vehicle surveillance systems for a range of applications, including traffic monitoring, law enforcement, and urban security. These systems help manage traffic flow, ensure compliance with regulations, and enhance safety in urban areas. The use of vehicle surveillance technologies in public safety operations has become a crucial part of government efforts to maintain order and security.

In 2024, Energy and Power represented an emerging but important segment in the Vehicle Surveillance System Market by End User. Within the energy sector, vehicle surveillance systems are used to secure transportation and operations in industries such as oil and gas, utilities, and renewable energy. These systems help ensure the safety of vehicles involved in critical supply chains, including the transportation of energy resources and equipment maintenance.

In 2024, the Automobile segment accounted for a substantial portion of the Vehicle Surveillance System Market by End User. Vehicle surveillance systems in the automobile sector are primarily used to improve driver safety, enhance fleet management, and mitigate operational risks. These systems are increasingly integrated into passenger vehicles and commercial fleets to provide features such as driver assistance, behavior monitoring, and accident prevention.

Key Market Segments

By Vehicle Type

- Commercial

- Passenger

By Product

- Blindspot detection system

- Autonomous Cruise Control system

- Parking assist system

- Lane departure warning system

- Heads-up display device

- Global positioning system

By Under vehicle surveillance

- Static Under Vehicle Surveillance system

- Mobile Under Vehicle Surveillance system

By Out Vehicle Surveillance

- Hardware

- Software

- Services

By End User

- Military and defense

- Government

- Energy and Power

- Automobile

Driver

Rising Demand for Enhanced Fleet Safety and Security Solutions

The primary driver accelerating the growth of the global vehicle surveillance system market in 2024 is the increasing emphasis on fleet safety and security across commercial and logistics sectors. With road transportation accounting for a significant share of global freight movement, the need to safeguard assets, reduce operational risks, and ensure driver accountability has become paramount.

Surveillance systems, such as in-vehicle cameras, real-time tracking modules, and behavior monitoring solutions, are being widely adopted by fleet operators to improve visibility and deter unauthorized activities.

The integration of surveillance systems with fleet management software enables automated alerts, evidence collection, and analytics, all of which contribute to proactive safety measures. Governments and transport agencies in developed and emerging markets are also enforcing regulations mandating safety technologies, further accelerating adoption.

Moreover, the rapid expansion of the e-commerce and last-mile delivery ecosystem has heightened concerns over package security and vehicle misuse. As businesses aim to maintain service reliability and reduce liabilities, investment in intelligent surveillance systems has increased. These technologies allow for real-time location sharing, geofencing, and driver behavior tracking, ensuring goods are delivered securely and on time.

In addition, insurers are offering premium benefits to fleet operators equipped with surveillance systems, thereby strengthening the economic incentive for adoption. This growing alignment between operational efficiency, compliance, and risk mitigation is expected to remain a key growth catalyst for the vehicle surveillance system market throughout 2024.

Restraint

High Cost of Advanced Surveillance System Integration

A key restraint hindering the widespread adoption of vehicle surveillance systems in 2024 is the high upfront and operational cost associated with advanced system integration, particularly for small and medium enterprises (SMEs) and individual vehicle owners. Sophisticated systems featuring multi-channel video recording, facial recognition, AI-based behavior analytics, and cloud storage capabilities require significant capital investment in hardware, software, and network infrastructure.

Furthermore, ongoing maintenance, data management, and system updates impose recurring expenses. These financial burdens can be particularly prohibitive in cost-sensitive markets, where vehicle owners may prioritize basic functionality over advanced surveillance features.

Additionally, the cost-to-benefit ratio remains a major concern for fleet operators in developing economies, where margins are thin and technology investment decisions are closely scrutinized. Although vehicle surveillance systems offer long-term benefits in terms of safety and operational efficiency, the initial investment may be perceived as excessive without immediate tangible returns.

Moreover, system compatibility issues with older vehicle models further escalate the cost of retrofitting, acting as a deterrent to adoption. Limited digital infrastructure in rural and semi-urban regions also hampers cloud-based surveillance implementations. Consequently, despite the growing awareness and proven utility of surveillance technologies, the high cost of deployment continues to act as a substantial barrier to mass adoption, particularly in price-sensitive market segments.

Opportunity

Integration of AI and Edge Computing for Real-Time Analysis

One of the most promising opportunities shaping the global vehicle surveillance system market in 2024 is the integration of artificial intelligence (AI) and edge computing technologies. This development enables real-time data processing and decision-making directly within the vehicle, eliminating latency and dependence on cloud infrastructure for critical safety actions.

AI-powered surveillance systems can now detect driver fatigue, identify hazardous behavior, and recognize external threats with improved accuracy, allowing for instant alerts and preventive actions. Such systems significantly enhance the operational intelligence of both commercial and personal vehicles, meeting the rising expectations for predictive safety features.

Furthermore, the adoption of edge computing allows continuous system operation even in areas with limited or no internet connectivity. This is particularly advantageous for long-haul transport and rural logistics routes, where uninterrupted surveillance is essential. The ability to process and store data locally also reduces bandwidth usage and associated costs, making advanced surveillance solutions more economically viable.

As AI and edge technologies continue to evolve, their integration into surveillance systems opens up new avenues for customization, scalability, and autonomous intervention. This advancement is poised to unlock considerable growth in markets seeking robust, self-reliant, and intelligent safety infrastructures, offering manufacturers and service providers a strong platform to develop differentiated offerings with enhanced value propositions.

Trends

Rising Adoption of Cloud-Based and IoT-Connected Surveillance Systems

A significant trend influencing the vehicle surveillance system market in 2024 is the increasing shift toward cloud-based and Internet of Things (IoT) -enabled surveillance architectures. As the demand for real-time monitoring, remote diagnostics, and data-driven decision-making continues to grow, cloud connectivity has become an essential component of modern vehicle surveillance solutions.

These systems allow data from multiple vehicles to be stored, accessed, and analyzed centrally, offering a scalable and flexible infrastructure for fleet managers and service providers. The integration of IoT sensors with video surveillance equipment enables vehicles to communicate operational metrics, environmental conditions, and safety events, contributing to a more intelligent and responsive ecosystem.

This trend is also driven by advancements in 4G/5G connectivity, which have significantly enhanced the transmission speed and reliability of video and sensor data. As a result, surveillance systems can now support high-definition video streaming, real-time alerts, and automated system updates without substantial latency. Cloud-based platforms offer added benefits such as remote configuration, seamless integration with enterprise systems, and robust cybersecurity features.

In 2024, the preference for subscription-based models over traditional ownership is gaining traction, allowing smaller businesses to adopt advanced surveillance systems without heavy upfront investments. This trend is expected to redefine how surveillance data is utilized, transforming vehicles into dynamic data hubs and paving the way for more connected, secure, and efficient transportation networks.

Regional Analysis

North America Leads the Vehicle Surveillance System Market with the Largest Market Share of 75.8% in 2024

In 2024, North America has emerged as the leading region in the global vehicle surveillance system market, commanding the largest market share of 75.8%, which translates to a substantial market valuation of USD 99.2 billion. This dominant position can be attributed to the widespread integration of advanced surveillance technologies across both commercial and personal vehicles, driven by heightened concerns over road safety, vehicle theft, and regulatory mandates for fleet monitoring.

The increasing penetration of connected and autonomous vehicles, combined with strong consumer demand for technologically equipped automobiles, has further accelerated the adoption of vehicle surveillance systems across the region. The region’s advanced automotive infrastructure and a high degree of digital transformation in transportation have also contributed significantly to its market leadership.

Europe represents a mature market for vehicle surveillance systems, driven by stringent vehicular safety regulations and a growing focus on reducing traffic-related incidents. Countries such as Germany, the United Kingdom, and France are witnessing a steady rise in the deployment of surveillance technologies in both private and public transport fleets.

The emphasis on integrating intelligent transport systems (ITS) and rising adoption of electric and connected vehicles are further supporting market expansion in the region. The trend toward smart city development and enhanced law enforcement initiatives is anticipated to sustain market demand in the near term.

Asia Pacific is experiencing rapid growth in the vehicle surveillance system market, fueled by urbanization, rising disposable income, and increased vehicle ownership in emerging economies such as China and India. The growing awareness of vehicle safety, along with government initiatives to improve road infrastructure and reduce accident rates, is encouraging the adoption of advanced in-vehicle monitoring technologies. Furthermore, the expansion of ride-sharing services and commercial transport is propelling demand for fleet surveillance solutions across the region.

The Middle East & Africa region is gradually adopting vehicle surveillance systems, particularly in Gulf Cooperation Council (GCC) countries where smart transportation initiatives and safety regulations are gaining prominence. Increasing investments in smart mobility and infrastructure development are laying the foundation for future market growth.

Latin America is showing moderate growth, driven by increasing concerns over vehicle theft and operational efficiency in the transportation and logistics sector. Countries such as Brazil and Mexico are expected to witness incremental growth through investments in intelligent transportation systems and growing automotive production.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global vehicle surveillance system market continues to witness active participation from key industry players that are strategically leveraging technological capabilities, product innovation, and regional expansion to strengthen their market presence. Magna International remains a leading contributor, driven by its robust automotive electronics segment and investments in advanced driver assistance systems (ADAS).

Continental AG has focused on integrating AI-powered surveillance functionalities within its sensor modules, enhancing its value proposition for OEMs targeting smart mobility solutions. Robert Bosch GmbH sustains its dominance through a comprehensive product portfolio, coupled with its established partnerships across the automotive ecosystem, which reinforces its role in providing integrated safety and monitoring solutions.

Advantech Co., Ltd and IEI Integration Group are positioning themselves as critical enablers in vehicle digital infrastructure by offering ruggedized, AI-enabled edge computing platforms suitable for real-time surveillance. These companies are capitalizing on demand from fleet operators and smart transportation authorities. Innotech Solutions Pte Ltd and Shyam Networks are contributing to the market through niche specialization, particularly in customized surveillance systems for commercial and defense vehicles in the Asia-Pacific region. W.W. Grainger, Inc, although primarily known for distribution, plays an indirect role by enabling widespread access to surveillance system components through its extensive supply chain network.

Lanner Electronics Incorporated has demonstrated notable growth through its vehicle-grade network video recorders (NVRs) and communication gateways, which support scalable and interoperable surveillance architectures. Lastly, Eyeride continues to build a competitive edge by focusing on connected vehicle monitoring, with real-time telematics, live video streaming, and driver behavior analytics—making it a preferred vendor in public transportation and logistics.

Top Key Players in the Market

- Magna International

- Continental AG

- Robert Bosch GmbH

- Advantech Co., ltd

- IEI Integration group

- Innotech Solutions pte ltd

- Shyam Networks

- W.W. Grainger, Inc

- Lanner Electronics Incorporated

- Eyeride

Recent Developments

- In 2025, Motorola Solutions announced the acquisition of RapidDeploy, a cloud-based public safety technology company based in Austin, Texas. This move strengthens Motorola’s emergency response capabilities by adding advanced location and analytics tools to its portfolio. RapidDeploy’s tools help emergency teams respond faster using real-time mapping and mobile apps for better communication and faster coordination during 911 calls.

- In 2023, DENSO CORPORATION introduced its first inverter built with silicon carbide (SiC) technology. The innovation is part of the eAxle electric driving system created with BluE Nexus and will power the new Lexus RZ. This technology helps improve efficiency and reduce energy loss in electric vehicles, marking a key step forward in EV development.

- In 2025, BYD held a launch event showcasing its new autonomous driving platform. The company announced plans to include self-driving features in all 21 of its car models, even starting at a price of just $9,500. This move is set to increase competition in China’s EV market and challenge existing players with more affordable autonomous vehicles.

- In 2025, Nissan confirmed a new partnership with UK-based AI company Wayve to improve its ProPILOT driver assistance system. The updated system will launch by 2027 and will include lidar sensors and advanced perception technology. It marks the first time Wayve’s AI software will be used in a passenger car available for the general market.

- In 2024, Huawei introduced a new software brand called Qiankun focused on intelligent driving. The brand will develop systems that manage vehicle control, cabin features, and automated driving functions. This launch is part of Huawei’s strategy to expand its presence in the electric vehicle sector and offer complete smart driving solutions.

- In 2023, AddSecure acquired the DigiComm Group to expand its presence in the DACH region and strengthen its secure IoT solutions. The acquisition included DigiComm GmbH, Temeno GmbH, and Insert IT GmbH, all of which specialize in critical infrastructure services. This strategic move allowed AddSecure to enhance its offerings in digital connectivity and enter new areas such as smart waste management, while also broadening its customer base and expertise in essential service sectors across Central Europe.

Report Scope

Report Features Description Market Value (2024) USD 130.9 Billion Forecast Revenue (2034) USD 385.3 Billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Vehicle type(Commercial, Passenger), Product(Blindspot detection system, Autonomous Cruise Control system, Parking assist system, Lane departure warning system, Heads-up display device, Global positioning system) , Under vehicle surveillance(Static Under Vehicle Surveillance system, Mobile Under Vehicle Surveillance system), Out Vehicle Surveillance(Hardware, Software, Services), End User(Military and defense, Government, Energy and Power, Automobile) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Magna International, Continental AG, Robert Bosch Gmbh, Advantech Co., ltd, IEI Integration group, Innotech Solutions pte ltd, Shyam Networks, W.W. Grainger, Inc, Lanner Electronics Incorporated, Eyeride Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vehicle Surveillance System MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Vehicle Surveillance System MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Magna International

- Continental AG

- Robert Bosch GmbH

- Advantech Co., ltd

- IEI Integration group

- Innotech Solutions pte ltd

- Shyam Networks

- W.W. Grainger, Inc

- Lanner Electronics Incorporated

- Eyeride