Global Vehicle Roadside Assistance Market Size, Share, Growth Analysis By Service Type (Towing Service, Battery Jump Start, Flat Tire Assistance, Fuel Delivery Service, Lockout Service, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers), By Provider (Auto Manufacturers, Insurance Providers, Independent Service Providers), By End-User (Individual Customers, Fleet Operators), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138566

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

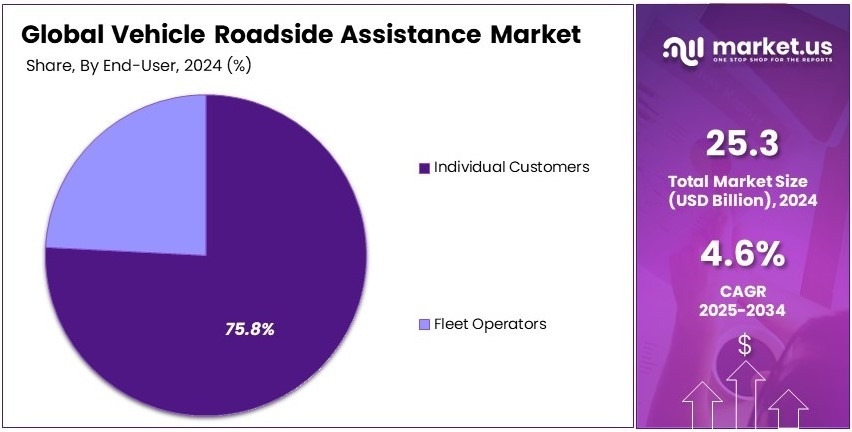

The Global Vehicle Roadside Assistance Market size is anticipated to achieve USD 39.7 Billion by 2034, up from USD 25.3 Billion in 2024, expanding at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Vehicle roadside assistance is a service that helps drivers when their vehicles break down or encounter problems on the road. It includes services like towing, jump-starting batteries, tire replacement, and fuel delivery, ensuring drivers can continue their journey or reach help.

The vehicle roadside assistance market includes companies providing emergency repair and support services for vehicles. It serves individual drivers, fleet owners, and commercial businesses, ensuring reliability and safety during unexpected situations on the road.

The vehicle roadside assistance sector is increasingly indispensable, supporting drivers through innovations aimed at enhancing service responsiveness and efficiency. A notable example of such innovation occurred in September 2023 when AAA collaborated with Apple.

This partnership launched a groundbreaking feature for iPhone 14 and 15 users, offering two years of complimentary emergency SOS and roadside assistance, leveraging satellite IoT to ensure reliability and extensive coverage. This adaptation highlights the industry’s shift towards integrating advanced technology to provide critical services more effectively.

The vehicle roadside assistance market is witnessing significant growth, driven by strategic partnerships and technological enhancements aimed at improving service delivery and operational efficiency. For example, in December 2024, Motive teamed up with the National Automobile Club to introduce a comprehensive 24/7 roadside support service, which connects commercial drivers with a vast network of over 75,000 roadside assistance providers across the U.S. and Canada.

This service is particularly valuable during peak accident seasons, enhancing driver safety and support. In another strategic move, Canoo Inc. partnered with The AA in October 2024 to offer specialized roadside assistance services to commercial fleet and government customers throughout the United Kingdom.

These initiatives not only boost the market’s capacity but also demonstrate a keen focus on enhancing customer experience and safety across different regions, reflecting strong market demand and the high competitiveness of this evolving sector.

Key Takeaways

- Vehicle Roadside Assistance Market was valued at USD 25.3 Billion in 2024, and is expected to reach USD 39.7 Billion by 2034, with a CAGR of 4.6%.

- In 2024, Towing Service dominates the service type segment with 40.2% due to high demand for emergency recovery.

- In 2024, Passenger Vehicles lead the vehicle type segment with 58.9% owing to the largest vehicle population.

- In 2024, Auto Manufacturers dominate the provider segment with 34.7% because of integrated service offerings.

- In 2024, Individual Customers dominate the end-user segment with 75.8% due to personal vehicle ownership.

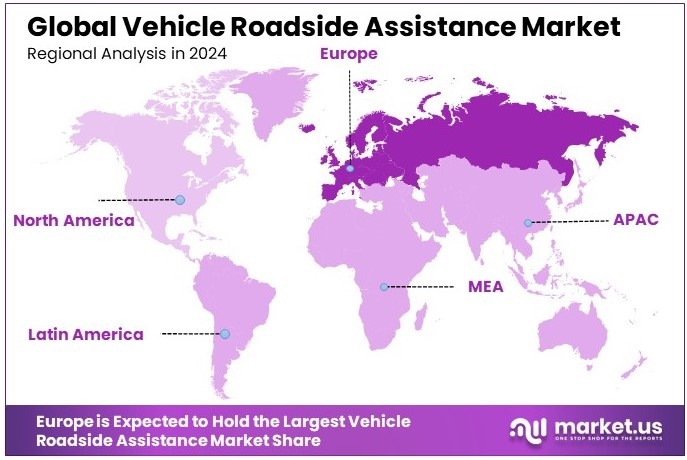

- In 2024, Europe holds the dominant region, driving market growth with advanced infrastructure and services.

Service Type Analysis

Towing Service dominates with 40.2% due to high demand for vehicle recovery.

Towing services are currently the most sought-after in the Vehicle Roadside Assistance Market, holding a dominant 40.2% share. This sub-segment’s popularity stems primarily from the essential need for vehicle recovery following breakdowns or accidents.

Towing is often the first service called upon when a vehicle cannot be repaired on the spot, making it a critical component of roadside assistance offerings. The demand for towing equipment and services is particularly high in urban areas and on busy highways where the risk of vehicle breakdowns and incidents is more significant.

The efficiency and speed of towing services are vital for clearing traffic and ensuring road safety, which enhances its importance in the roadside assistance market. Providers are increasingly integrating GPS technology and mobile apps to improve service responsiveness and customer satisfaction.

Other segments such as Battery Jump Start and Flat Tire Assistance are also integral to roadside assistance but do not command as large a market share as Towing Service. Battery jump starts are crucial, especially in cold weather, when battery performance issues are more frequent.

Flat tire assistance remains a steady demand service, essential for those who are unable or unprepared to change a tire themselves. Both services are fundamental to the roadside assistance industry and contribute significantly to its overall growth, ensuring drivers are supported in various common breakdown scenarios.

Vehicle Type Analysis

Passenger Vehicles dominate with 58.9% due to their high usage in daily commutes.

Passenger vehicles are the primary users of Vehicle Roadside Assistance services, dominating the market with a 58.9% share. This high percentage is largely due to the sheer number of passenger vehicles on the road, coupled with their frequent use for daily commutes and long-distance travel.

The dependency on passenger vehicles for routine travel increases the likelihood of roadside incidents, thereby boosting the demand for roadside assistance services specifically tailored to this segment.

The services provided for passenger vehicles typically include towing, tire changes, lockout service, and emergency fuel delivery, among others. The growth in passenger vehicle sales globally also propels the demand for roadside assistance services, as newer drivers often seek the security of having support in the event of a vehicle malfunction or emergency.

Commercial vehicles and two-wheelers also represent significant segments within the market. Commercial vehicles require robust assistance services due to the high costs associated with delays and breakdowns, impacting business operations.

Two-wheelers, which are prevalent in regions with dense urban populations, increasingly benefit from customized assistance services tailored to their specific needs, though their overall market share remains smaller compared to passenger vehicles.

Provider Analysis

Auto Manufacturers dominate with 34.7% due to integrated service offerings.

Auto manufacturers are the leading providers of Vehicle Roadside Assistance, holding a 34.7% market share. This dominance is due to manufacturers increasingly bundling roadside assistance as part of the vehicle purchase package, offering it as a value-added service to enhance customer satisfaction and brand loyalty.

Providing roadside assistance helps auto manufacturers ensure that their customers receive timely and effective help in the event of a breakdown, directly affecting customer satisfaction and brand perception. For instance, many manufacturers offer comprehensive packages that cover everything from towing to emergency fuel delivery, appealing to consumers who value a high level of support.

Insurance providers and independent service providers also play critical roles in the market. Insurance companies offer roadside assistance as part of their auto insurance packages, often at a competitive rate, which includes additional coverage options.

Independent service providers, meanwhile, compete by offering flexible and often more affordable roadside assistance packages without the need for insurance or vehicle purchase ties, catering to a segment of consumers who prefer standalone services.

End User Analysis

Individual Customers dominate with 75.8% due to the personal ownership of vehicles.

Individual customers are the largest end-user group in the Vehicle Roadside Assistance Market, dominating with a share of 75.8%. The predominance of individual customers is driven by the high number of personal vehicle owners who seek security and convenience through roadside assistance services.

Roadside assistance is a critical service for individuals, especially those who frequently travel or who have limited mechanical knowledge. The assurance that help is readily available in the event of a vehicle issue is a significant factor in many individuals’ decision to subscribe to a roadside assistance service.

Fleet operators also utilize roadside assistance services, though to a lesser extent compared to individual customers. These services are vital for managing large vehicle fleets, especially for companies that depend on vehicle reliability for business operations such as logistics, taxi services, and car rentals.

Fleet operators value roadside assistance as it helps minimize downtime and maintain operational efficiency, which is crucial for profitability and service reliability.

Key Market Segments

By Service Type

- Towing Service

- Battery Jump Start

- Flat Tire Assistance

- Fuel Delivery Service

- Lockout Service

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

By Provider

- Auto Manufacturers

- Insurance Providers

- Independent Service Providers

By End-User

- Individual Customers

- Fleet Operators

Driving Factors

Rising Vehicle Ownership and Technological Advancements Drive Market Growth

The Vehicle Roadside Assistance Market is growing significantly due to several interconnected factors. One of the primary drivers is the increase in vehicle ownership and the expanding automotive fleet. As personal and commercial vehicle usage rises, the likelihood of breakdowns and mechanical failures also increases, leading to higher demand for roadside assistance services.

Another key factor is the rising incidence of vehicle breakdowns and mechanical failures. Aging vehicle fleets in many regions contribute to more frequent mechanical issues, creating a consistent need for reliable roadside assistance. This demand extends to commercial vehicles, where downtime due to breakdowns can significantly impact business operations.

The growth in long-distance travel and changing commuting patterns is also contributing to market expansion. As people travel more for work or leisure, they seek the security of knowing that help is available in case of emergencies. Roadside assistance services provide peace of mind, especially for drivers undertaking long trips in unfamiliar areas.

Technological advancements further bolster market growth. On-demand roadside services powered by mobile apps and GPS technology enable quicker response times and improved efficiency. These platforms allow customers to request assistance, track service providers in real-time, and receive updates, enhancing the overall experience and increasing customer satisfaction.

Restraining Factors

Accessibility and Cost Challenges Restrain Market Growth

Despite its growth potential, the Vehicle Roadside Assistance Market faces significant challenges that limit its expansion. One major obstacle is the limited accessibility of services in remote and rural areas. In these regions, infrastructure is often inadequate, making it difficult for service providers to deliver timely assistance. This gap in coverage leaves rural drivers underserved, reducing the market’s overall reach.

High operational costs present another challenge for companies in this space. Maintaining a fleet of service vehicles requires substantial investment in maintenance, fuel, staffing, and training. These costs can strain smaller providers, forcing them to limit their service areas or reduce the quality of their offerings to remain profitable.

Meeting consumer expectations for fast response times is an additional hurdle. In today’s fast-paced world, customers expect assistance within minutes. Delays caused by traffic, poor infrastructure, or inadequate staffing can lead to dissatisfaction and damage a company’s reputation. Consistently meeting these expectations requires significant investment in technology and workforce.

Dependence on third-party vendors for service delivery further complicates operations. Many roadside assistance providers outsource services to local vendors, which can lead to inconsistencies in service quality.

Growth Opportunities

Mobile Innovations and Strategic Partnerships Provide Growth Opportunities

The Vehicle Roadside Assistance Market has ample opportunities to grow through innovation and collaboration. The development of mobile apps for real-time service requests and tracking is one such opportunity. These apps allow users to request help, monitor the location of service vehicles, and receive updates on estimated arrival times. This convenience strengthens customer trust and engagement.

Vehicle subscription-based models are another avenue for growth. By offering customers the option to subscribe to monthly or annual plans, companies can build a loyal customer base while ensuring steady revenue streams. These models also allow service providers to bundle value-added services, such as maintenance reminders or insurance tie-ins, enhancing their appeal.

Collaborations with electric vehicle (EV) manufacturers open new possibilities. As EV adoption grows, roadside assistance providers can develop specialized services such as mobile charging stations or assistance for battery-related issues. Partnering with automakers allows companies to integrate their services into EV ecosystems, tapping into a rapidly expanding market.

Integration of advanced diagnostics tools is also a promising opportunity. Modern roadside assistance vehicles equipped with diagnostic technology can quickly identify mechanical issues, enabling faster and more accurate repairs. This capability not only improves efficiency but also reduces downtime for customers, strengthening the market’s value proposition.

Emerging Trends

Smart Technologies and Sustainable Practices Are Latest Trending Factors

Several emerging trends are transforming the Vehicle Roadside Assistance Market. One notable trend is the increasing popularity of pay-per-use assistance models. These models provide flexibility by allowing customers to pay only when they require assistance, making roadside services accessible to occasional users who may not want to commit to a subscription.

The incorporation of AI and predictive analytics is revolutionizing the market by enabling proactive support. Predictive tools analyze vehicle data to anticipate potential issues, allowing drivers to address problems before they lead to breakdowns. This technology reduces the frequency of roadside emergencies and enhances customer satisfaction.

Environmental sustainability is also shaping the market. Companies are adopting green practices, such as deploying electric or hybrid service vehicles and optimizing service routes to minimize fuel consumption. These initiatives align with global sustainability goals and appeal to eco-conscious consumers.

Finally, the rise of EV-specific services, such as mobile charging solutions, is addressing the unique needs of electric vehicle owners. With the growing number of EVs on the road, offering services tailored to their requirements ensures that roadside assistance remains relevant.

Regional Analysis

Europe Dominates with 42.7% Market Share

Europe leads the Vehicle Roadside Assistance Market with a 42.7% market share. This dominance is driven by a robust network of service providers, stringent vehicle safety regulations, and widespread adoption of roadside assistance services. The high density of vehicles, particularly in urban areas, increases the demand for timely and reliable roadside support.

Key factors include Europe’s focus on safety and compliance with strict automotive standards. Many European countries mandate comprehensive insurance coverage, which often includes roadside assistance. Leading providers like Allianz and AXA dominate the market, offering seamless service integration and innovative digital tools to enhance user experiences.

Market dynamics in Europe highlight the importance of quick response times and user-friendly solutions. Countries like Germany, France, and the UK experience high demand due to heavy traffic and increased vehicle usage.

Roadside assistance is particularly critical during extreme weather conditions, such as snowy winters, which can cause frequent breakdowns. Digital tools like GPS-enabled apps and 24/7 call centers have further strengthened the industry’s growth by providing convenience and reliability.

Regional Mentions:

- North America: North America holds a strong position in the market, driven by advanced infrastructure and high vehicle ownership. The region’s reliance on personal vehicles and extensive highway networks supports steady demand.

- Asia Pacific: Asia Pacific is experiencing rapid growth in this market, fueled by rising car ownership and expanding urbanization. Countries like China and India are adopting digital roadside assistance services to meet growing demand.

- Middle East & Africa: The market in the Middle East and Africa is growing as tourism and infrastructure projects increase. Roadside assistance providers cater to expanding highway systems and remote travel needs.

- Latin America: Latin America sees gradual market expansion, with rising vehicle sales and improving infrastructure. Countries like Brazil and Mexico show growing demand for affordable and efficient roadside services.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Vehicle Roadside Assistance Market is dominated by Allianz Global Assistance, GEICO, Allstate Insurance, and Agero. These companies lead the industry through comprehensive service offerings, extensive networks, and advanced technological integration.

Allianz Global Assistance is a global leader providing roadside services as part of its insurance solutions. Its strong presence across multiple regions and innovative digital tools ensure quick and reliable support for stranded motorists. Allianz’s reputation for quality and dependability helps maintain its dominant market position.

GEICO, known for its large customer base, offers seamless roadside assistance as part of its auto insurance policies. Its competitive pricing and coverage options make it a preferred choice for customers. GEICO also leverages technology through mobile apps, enabling users to access services quickly and efficiently.

Allstate Insurance is a prominent player offering a wide range of roadside assistance plans, catering to different customer needs. Known for its “Good Hands” promise, Allstate ensures prompt and dependable service. The company’s focus on innovation, such as its usage of real-time tracking systems, enhances the customer experience.

Agero stands out as a technology-driven provider specializing in roadside assistance for automakers and insurers. With advanced solutions like AI-powered dispatch and telematics integration, Agero improves operational efficiency and response times. Its partnerships with major brands further solidify its market leadership.

These key players invest heavily in digital transformation and service quality to meet customer expectations. Their emphasis on innovation, reliability, and tailored offerings ensures they remain leaders in the growing roadside assistance market. As vehicle ownership increases and electric vehicle adoption rises, these companies are well-positioned to capitalize on emerging opportunities.

Major Companies in the Market

- Allianz Global Assistance

- GEICO

- Allstate Insurance

- Agero

- AutoVantage

- Paragon Motor Club

- Falck

- ARC Europe

- Viking Assistance Group

- SOS International

- RAC Group

- AA plc

- Green Flag

- National General Insurance

- Better World Club

Recent Developments

- The Shyft Group: On October 2023, The Shyft Group announced a merger with the Aebi Schmidt Group to create a leader in specialty vehicles. The combined entity is expected to achieve pro forma 2024 estimated revenue of $1.95 billion and adjusted EBITDA of over $200 million, including synergies from the merger.

- Urgent.ly: On October 2023, Urgent.ly, a leading roadside assistance technology company, completed a merger with Israel-based Otonomo Technologies. The newly combined entity began public trading on NASDAQ under the ticker symbol ULY, aiming to enhance its connected vehicle services and expand its market reach.

Report Scope

Report Features Description Market Value (2024) USD 25.3 Billion Forecast Revenue (2034) USD 39.7 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Towing Service, Battery Jump Start, Flat Tire Assistance, Fuel Delivery Service, Lockout Service, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers), By Provider (Auto Manufacturers, Insurance Providers, Independent Service Providers), By End-User (Individual Customers, Fleet Operators) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz Global Assistance, GEICO, Allstate Insurance, Agero, AutoVantage, Paragon Motor Club, Falck, ARC Europe, Viking Assistance Group, SOS International, RAC Group, AA plc, Green Flag, National General Insurance, Better World Club Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vehicle Roadside Assistance MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Vehicle Roadside Assistance MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz Global Assistance

- GEICO

- Allstate Insurance

- Agero

- AutoVantage

- Paragon Motor Club

- Falck

- ARC Europe

- Viking Assistance Group

- SOS International

- RAC Group

- AA plc

- Green Flag

- National General Insurance

- Better World Club