US Storm Water Cleaning Services Market Size, Share, Growth Analysis By Service Type (Root Cutting, Hydro-Excavation, Vacuum Loading, Water Jetting, Others), By Application (Surface Stormwater Systems, Underground Stormwater Systems, Retention Ponds and Basins, Rainwater Harvesting Systems, Others), By End-User (Municipal, Industrial, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 73680

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

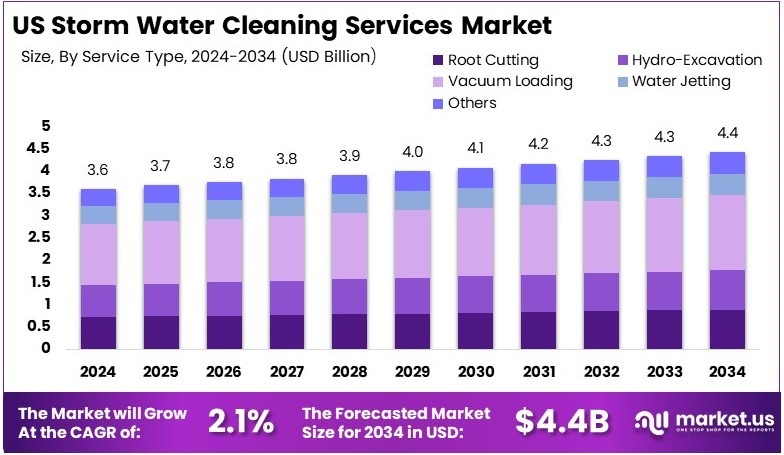

The US Storm Water Cleaning Services Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 3.6 Billion in 2024, growing at a CAGR of 2.1% during the forecast period from 2025 to 2034.

US Storm Water Cleaning Services involve the maintenance and cleaning of drainage systems to prevent flooding and pollution. These services ensure that stormwater systems function efficiently, protecting urban areas and ecosystems from water-related damage.

The US Storm Water Cleaning Services Market refers to the economic sector focused on providing these essential services. It encompasses the businesses and organizations that specialize in stormwater system maintenance, addressing the needs of both public and private sectors across the United States.

The U.S. storm water cleaning services market is experiencing a significant uptick in demand, driven by increasing urban development and more frequent severe weather conditions. Furthermore, market competitiveness remains moderately high, allowing room for new companies to establish a foothold.

Moreover, the importance of these services extends beyond basic infrastructure maintenance. They are essential for preventing water pollution and minimizing soil erosion across urban areas. Additionally, on a local scale, storm water cleaning supports the structural integrity of cities and enhances overall urban livability.

Conversely, the role of government investment is pivotal. For instance, Philadelphia’s green infrastructure plan, which involves an investment of $1.2 billion over 25 years, with $800 million directed towards green infrastructure projects, underscores the significant governmental commitment to sustainable urban development. Hence, this investment not only supports current environmental initiatives but also sets a precedent for future projects aimed at enhancing storm water management systems.

Ultimately, this strategic focus on improving storm water cleaning services and infrastructure reflects a broader commitment to environmental sustainability and urban quality of life, making it a key area of interest for stakeholders in the environmental management sector.

Key Takeaways

- The US Storm Water Cleaning Services Market was valued at USD 3.6 billion in 2024 and is expected to reach USD 4.4 billion by 2034, with a CAGR of 2.1%.

- In 2024, Vacuum Loading dominated the Service Type segment with 37.4%, driven by its efficiency in removing debris from stormwater systems.

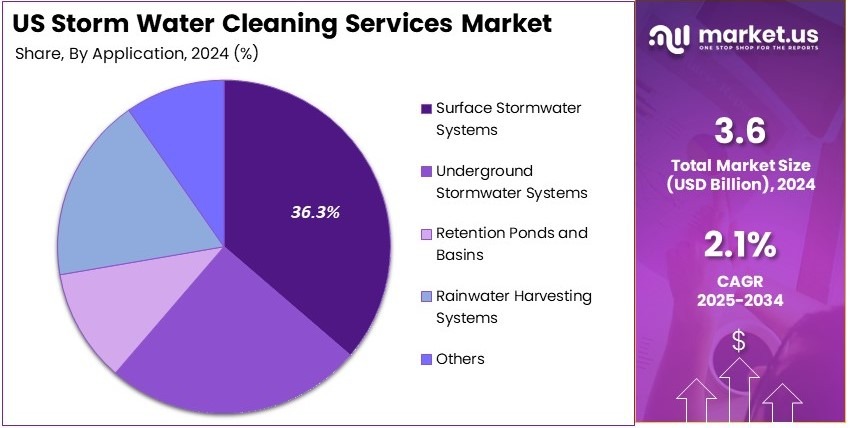

- In 2024, Surface Stormwater Systems led the Application segment with 36.3%, owing to the extensive use in urban water drainage.

- In 2024, Municipal was the leading End-User segment with 53.4%, due to high investments in infrastructure maintenance and water management.

Service Type Analysis

Vacuum Loading dominates with 37.4% due to its high efficiency in stormwater removal.

The vacuum loading segment leads the U.S. stormwater cleaning services market with a share of 37.4%. This dominance is largely attributed to the growing need for effective and efficient removal of debris, sediments, and contaminants from stormwater systems.

Vacuum loading technology is known for its ability to collect large volumes of water and debris quickly, making it particularly useful in urban environments with high water runoff. Its high efficiency and minimal environmental impact have contributed to its widespread adoption, especially in municipalities focused on maintaining clean and safe water systems.

On the other hand, root cutting, which involves the removal of tree roots obstructing stormwater systems, plays a smaller role in the market. It is important but is limited by the seasonal nature of the service and the need for highly specialized equipment.

Hydro-excavation, which utilizes high-pressure water to excavate soil, serves a niche role in sensitive environments where traditional digging may cause damage. Water jetting, another key technique, is used to clean pipes and drains by forcing high-pressure water through them, though it sees less frequent use compared to vacuum loading. The “others” category includes less common methods such as manual cleaning or chemical treatments, contributing minimally to the overall market share.

Application Analysis

Surface Stormwater Systems dominate with 36.3% due to increasing urbanization and surface water runoff.

Surface stormwater systems account for the largest share in the U.S. stormwater cleaning services market at 36.3%. This is due to the increasing urbanization that leads to higher surface runoff, which often exceeds the capacity of underground systems. As cities expand, the need to manage surface stormwater through effective cleaning solutions becomes critical to preventing flooding and environmental damage.

Surface systems are also more accessible, making them easier to clean and maintain compared to underground systems. Additionally, the growing concern about water quality in urban settings further propels the demand for regular cleaning of surface stormwater systems.

In contrast, underground stormwater systems also play a vital role in managing water, especially in urban areas with limited surface space. Although they are crucial, the maintenance cost and complexity of cleaning them are higher.

Retention ponds and basins, designed to collect and temporarily store stormwater, make up another important segment. These systems are essential in flood-prone areas but require less frequent cleaning. Rainwater harvesting systems, while valuable, are niche and typically serve specific regions focused on sustainable practices. The “others” category includes smaller applications that have specialized uses, contributing less to the overall market.

End-User Analysis

Municipal segment dominates with 53.4% due to government focus on infrastructure maintenance.

The municipal sector dominates the stormwater cleaning services market, accounting for 53.4% of the total market share. This dominance is driven by government regulations and policies aimed at maintaining public infrastructure and ensuring environmental safety. Municipalities are responsible for maintaining extensive stormwater systems, which require regular cleaning to prevent blockages, flooding, and pollution.

As urban populations grow, the pressure on local governments to manage stormwater systems effectively increases, resulting in a strong demand for stormwater cleaning services. The municipal focus on maintaining public health, as well as compliance with environmental regulations, further supports this trend.

Industrial users, while significant, contribute less to the overall market due to the highly specialized needs of industrial stormwater management. Industrial sectors generally focus on managing water runoff from manufacturing plants, which involves different cleaning processes and equipment.

The commercial segment, though growing, has a smaller share compared to municipal users. Commercial establishments like shopping malls or office buildings need stormwater cleaning services, but these are typically limited to smaller areas and less complex systems. As a result, commercial demand is more localized and intermittent.

Key Market Segments

By Service Type

- Root Cutting

- Hydro-Excavation

- Vacuum Loading

- Water Jetting

- Others

By Application

- Surface Stormwater Systems

- Underground Stormwater Systems

- Retention Ponds and Basins

- Rainwater Harvesting Systems

- Others

By End-User

- Municipal

- Industrial

- Commercial

Driving Factors

Increasing Regulatory Requirements Drives Market Growth

Growing regulatory pressure on stormwater management is a key factor driving the US stormwater cleaning services market. As environmental policies become stricter, local governments are implementing stronger regulations to control pollution and manage stormwater runoff. This trend has led to increased demand for efficient stormwater cleaning services.

Urbanization and infrastructure development further amplify this need. As cities grow and expand, more complex stormwater management systems are required. This creates a need for cleaning services to ensure these systems operate efficiently.

Additionally, advancements in stormwater treatment technology have made it easier to manage runoff water more effectively. New filtration systems, advanced pumps, and other innovations contribute to the improvement of stormwater management.

Lastly, the rising public awareness about environmental sustainability plays a significant role. More people are recognizing the importance of clean water and the environmental impacts of stormwater, pushing governments and private sectors to prioritize this issue. Combined, these factors create a robust market for stormwater cleaning services in the US.

Restraining Factors

High Costs and Skilled Labor Shortages Restrain Market Growth

The US stormwater cleaning services market faces challenges due to high operational and maintenance costs. Maintaining and operating stormwater cleaning systems can be expensive, which limits market growth, especially for smaller municipalities or businesses with fewer resources.

Furthermore, there is a limited availability of skilled labor in the water treatment industry. This shortage of qualified professionals can slow down the adoption of new cleaning technologies and hinder system maintenance, creating a bottleneck in the market.

Inefficient public-private partnership models also contribute to market constraints. When private companies and public agencies fail to collaborate effectively, it can result in project delays and less-efficient stormwater management solutions.

Inconsistent regulatory standards across regions further complicate the situation. Without standardized practices, service providers must navigate varying local rules, leading to confusion and inefficiencies. These factors combined create substantial barriers to market growth, hindering the full potential of stormwater cleaning services.

Growth Opportunities

AI, Eco-Friendly Solutions, and Rural Expansion Provides Opportunities

The US stormwater cleaning services market presents several growth opportunities. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into stormwater management systems is a significant opportunity. Real-time monitoring and data analytics can optimize the cleaning process, making it more efficient and cost-effective.

Moreover, expanding stormwater cleaning services to rural areas offers a large untapped market. Many rural regions face challenges in managing stormwater, creating demand for effective cleaning solutions.

The development of eco-friendly and sustainable cleaning technologies is another growing opportunity. As demand for environmentally friendly products and services rises, companies can capitalize on this trend by adopting green solutions.

Additionally, the emergence of advanced filtration and purification technologies presents opportunities for companies to improve system efficiency and tackle stormwater contamination more effectively. These innovations pave the way for a more sustainable and profitable market.

Emerging Trends

Advanced Filtration and Biofiltration Techniques Is Latest Trending Factor

Several trends are currently shaping the stormwater cleaning services market in the US. The rising adoption of biofiltration techniques is one of the most notable trends. These natural filtration methods, such as rain gardens and green roofs, are gaining popularity as effective solutions for stormwater treatment. They provide sustainable alternatives to traditional mechanical systems, reducing environmental impacts.

Another trend is the increased use of modular stormwater management systems. These systems are becoming more popular due to their flexibility and cost-effectiveness, allowing for easy expansion or reconfiguration based on changing needs.

The deployment of drones for stormwater system inspections and monitoring is also gaining traction. Drones allow for more efficient, safer, and cost-effective monitoring of large stormwater systems, making it easier to identify and address issues.

Finally, the growth of public-private collaboration in water management projects is a significant trend. By working together, the public and private sectors can better manage stormwater and share the costs and responsibilities. These trends indicate that the market is evolving, with more sustainable and efficient solutions being prioritized.

Competitive Landscape

The US Storm Water Cleaning Services Market is highly competitive, with several key players offering comprehensive solutions for stormwater management. Among these, Advanced Drainage Systems, Inc., Aquam Corporation, AquaShield, Inc., and Contech Engineered Solutions LLC stand out as dominant players.

Advanced Drainage Systems, Inc. (ADS) is a leading player known for its innovative stormwater management solutions, particularly in the design and manufacture of drainage products. ADS offers a range of stormwater cleaning services that cater to both residential and industrial clients, with a strong focus on sustainability. The company’s extensive distribution network and robust product portfolio, including pipes and water filtration systems, have helped it maintain a strong position in the market.

Aquam Corporation, through its specialized pipe technologies, plays a critical role in stormwater cleaning and management. The company offers tailored solutions, including high-quality drainage pipes that help prevent water accumulation and flooding in urban areas. Aquam’s strong reputation for customer service and product reliability allows it to serve a wide array of clients, including municipalities and industrial sites.

AquaShield, Inc. provides advanced stormwater treatment and filtration systems. The company focuses on designing innovative, environmentally friendly solutions that meet regulatory standards. AquaShield’s services cater to both public infrastructure and private sector projects, positioning them as a key player in addressing stormwater runoff and water quality challenges.

Contech Engineered Solutions LLC specializes in stormwater management systems, including detention, infiltration, and filtration products. Contech is well-regarded for its engineering expertise and wide range of customizable solutions. The company’s emphasis on efficient product designs that meet sustainability goals has made it a trusted partner in stormwater cleaning projects nationwide.

These companies, along with others in the market, contribute to the ongoing efforts to manage stormwater more effectively, addressing both environmental concerns and regulatory requirements. Their extensive service offerings and commitment to innovation solidify their positions as leaders in the US market.

Major Companies in the Market

- Advanced Drainage Systems, Inc.

- Aquam Corporation (Specialized Pipe Technologies)

- AquaShield, Inc.

- Contech Engineered Solutions LLC

- DBi Services

- Forterra, Inc.

- Hydro International

- John’s Sewer & Drain Cleaning

- McVac Environmental Inc.

- Oldcastle Infrastructure, Inc.

- RC Northwest Inc. (Clean Creek)

- Resource Environmental Solutions, LLC

- Rinker Materials, Inc.

- River City Environmental Inc.

- SR&R Environmental Inc.

- StormTrap LLC

- Thompson Pipe Group

- Water Worx Services Inc.

Recent Developments

- Apex Companies, LLC: On June 2024, Apex Companies, LLC announced the acquisition of Storm Water Inspection & Maintenance Services, Inc. (SWIMS), a California-based firm specializing in stormwater services. Established nearly 30 years ago, SWIMS employs over 100 professionals with expertise in stormwater inspection, management, erosion control, dewatering, and compliance services.

- Pennsylvania American Water: On October 2024, Pennsylvania American Water reminded customers about the importance of keeping storm drains clear of leaves during the fall season. Blocked storm drains can lead to excess stormwater, resulting in flooded roadways and sewer backups. The company recommends proper disposal of leaves and yard waste to maintain water quality and prevent infrastructure issues.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 4.4 Billion CAGR (2025-2034) 2.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Root Cutting, Hydro-Excavation, Vacuum Loading, Water Jetting, Others), By Application (Surface Stormwater Systems, Underground Stormwater Systems, Retention Ponds and Basins, Rainwater Harvesting Systems, Others), By End-User (Municipal, Industrial, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Advanced Drainage Systems, Inc., Aquam Corporation (Specialized Pipe Technologies), AquaShield, Inc., Contech Engineered Solutions LLC, DBi Services, Forterra, Inc., Hydro International, John’s Sewer & Drain Cleaning, McVac Environmental Inc., Oldcastle Infrastructure, Inc., RC Northwest Inc. (Clean Creek), Resource Environmental Solutions, LLC, Rinker Materials, Inc., River City Environmental Inc., SR&R Environmental Inc., StormTrap LLC, Thompson Pipe Group, Water Worx Services Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Storm Water Cleaning Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

US Storm Water Cleaning Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Drainage Systems, Inc.

- Aquam Corporation (Specialized Pipe Technologies)

- AquaShield, Inc.

- Contech Engineered Solutions LLC

- DBi Services

- Forterra, Inc.

- Hydro International

- John’s Sewer & Drain Cleaning

- McVac Environmental Inc.

- Oldcastle Infrastructure, Inc.

- RC Northwest Inc. (Clean Creek)

- Resource Environmental Solutions, LLC

- Rinker Materials, Inc.

- River City Environmental Inc.

- SR&R Environmental Inc.

- StormTrap LLC

- Thompson Pipe Group

- Water Worx Services Inc.