US Household Kitchen Appliances Market Size, Share, Growth Analysis By Product (Cooking Appliances, Dishwasher, Refrigerator, Range Hood, Others), By Technology (Conventional, Smart Appliances) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153593

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

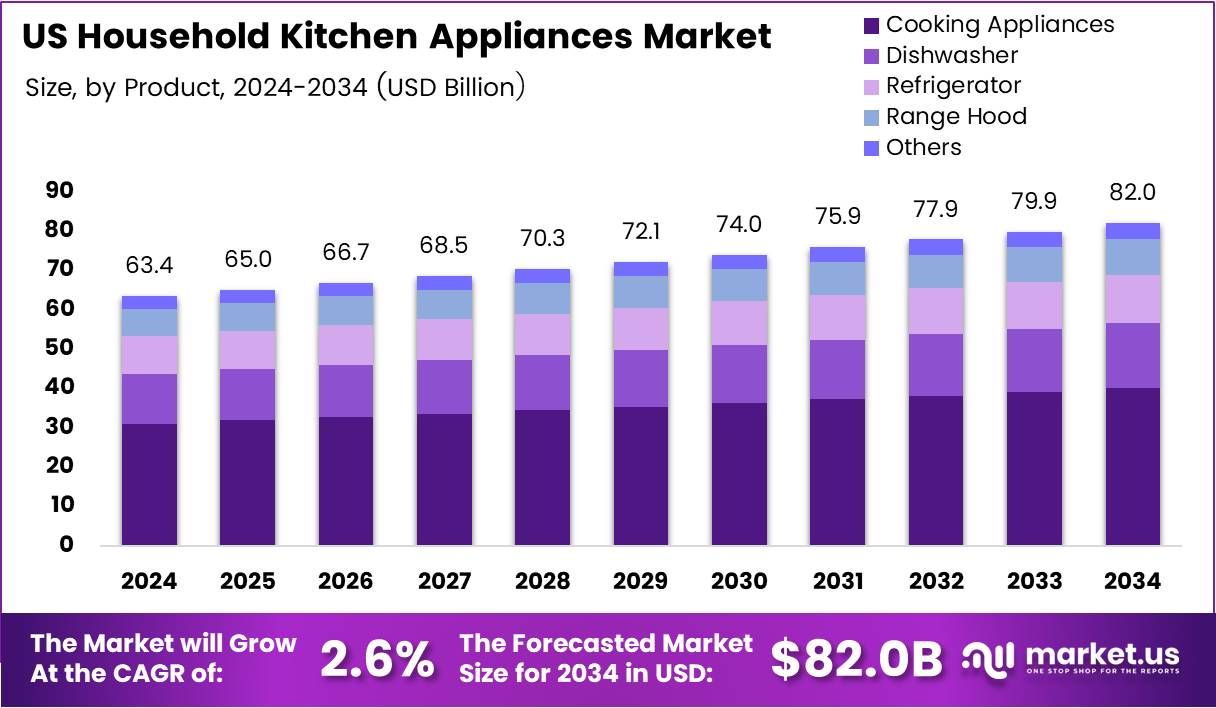

The US Household Kitchen Appliances Market size is expected to be worth around USD 82.0 Billion by 2034, from USD 63.4 Billion in 2024, growing at a CAGR of 2.6% during the forecast period from 2025 to 2034.

The US Household Kitchen Appliances market includes products like refrigerators, ovens, dishwashers, and microwaves, serving everyday cooking, food storage, and cleaning needs. These appliances are integral to modern homes, offering convenience and energy-saving capabilities. Increasing consumer demand, technological upgrades, and sustainability trends are driving significant industry momentum.

The market is experiencing consistent growth, driven by rising home renovation activities and demand for energy-efficient products. According to Greenmatch, kitchen appliances account for approximately 17% of the average household’s electricity bill. This growing focus on energy consumption is steering consumers toward sustainable appliances.

In addition, US households are showing increasing willingness to invest. According to MorningBrew, households spent 43% more on home appliances in 2023 compared to a decade ago. Interestingly, while spending rose, appliance prices declined by 12%, making high-end models more accessible to broader demographics.

Shifting consumer preferences are also reshaping the market landscape. American Home Shield reports that 49% of homeowners are planning to purchase new appliances. Of these, 64% aim to upgrade, while 39% are targeting energy-efficient replacements. This signals strong transactional intent tied to technological and environmental factors.

Moreover, smart kitchen appliances are becoming a preferred choice. According to the same source, 57% of those planning purchases are inclined toward smart appliances. This demonstrates a shift towards IoT integration and digital convenience, which manufacturers are rapidly adopting to maintain market competitiveness.

Rising urbanization and millennial homeownership are also fueling demand for modular kitchen setups and compact appliance designs. These preferences are encouraging brands to innovate with space-saving and multi-functionality in mind, broadening their product appeal across segments.

From a regulatory standpoint, energy efficiency mandates from the Department of Energy and ENERGY STAR certifications are pushing manufacturers to prioritize eco-friendly innovations. These government initiatives are aligning with consumer sentiment, encouraging sustainable growth across the kitchen appliance market.

Simultaneously, federal and state-level incentives for energy-efficient appliances—such as rebates and tax credits—are enhancing consumer adoption rates. These policy tools not only support environmental goals but also stimulate transactional movement in the mid- to high-end appliance segment.

As e-commerce channels grow and smart home integration expands, opportunities for market penetration are multiplying. The availability of financing options and digital retail experiences is making it easier for consumers to upgrade kitchens, further accelerating market dynamics.

Key Takeaways

- The US Household Kitchen Appliances Market is projected to reach USD 82.0 Billion by 2034, up from USD 63.4 Billion in 2024. The market is expected to grow at a CAGR of 2.6% from 2025 to 2034.

- In 2024, Cooking Appliances led the product segment with a 41.5% share, driven by demand for ovens, cooktops, and ranges. Growth in this segment is fueled by energy-efficient and multifunctional cooking units.

- The Conventional technology segment held a dominant 84.7% share in 2024, reflecting consumer preference for affordability and familiarity. Conventional appliances are especially popular among middle-income households and older demographics due to brand trust and simplicity.

Product Analysis

Cooking Appliances held a dominant market position with 41.5% in 2024.

In 2024, Cooking Appliances held a dominant market position in the By Product Analysis segment of the US Household Kitchen Appliances Market, with a 41.5% share. This leadership can be attributed to the consistent demand for essential cooking units such as ovens, cooktops, and ranges across American households. The segment has seen innovation in energy-efficient designs and multifunctional models, further boosting adoption.

Dishwashers also continued to remain a key component of modern kitchens, appealing to convenience-seeking consumers. While their adoption was not as high, their growth is driven by increasing preference for hygiene and time-saving solutions.

Refrigerators, a household necessity, maintained strong relevance across demographics. Consumer interest is gradually shifting toward compact and energy-efficient models, influenced by urban living and sustainability preferences.

The Range Hood segment played a supporting role in kitchen upgrades, especially in open-plan home layouts where aesthetics and ventilation are prioritized. Though niche, it contributes to an evolving kitchen ecosystem.

Other appliances, grouped under Others, captured a modest share of the market, comprising secondary tools that support but do not drive kitchen operations. While not dominant, this category remains vital in offering functional diversity.

Technology Analysis

Conventional technology led the market with 84.7% share in 2024.

In 2024, Conventional held a dominant market position in the By Technology Analysis segment of the US Household Kitchen Appliances Market, with a 84.7% share. This stronghold stems from affordability, widespread availability, and familiarity among the majority of consumers. Traditional appliances continue to appeal to a broad segment, especially among middle-income households and older demographics, where brand trust and simplicity are highly valued.

Smart Appliances, while still emerging, are gaining momentum with tech-savvy consumers. Integration with AI, remote operability, and energy monitoring are some of the key innovations attracting younger buyers. However, high upfront costs and compatibility concerns with existing home systems are slowing down mainstream adoption.

Despite the rise in smart technology trends, conventional appliances remain the backbone of the American kitchen. Their market dominance is reinforced by established infrastructure, repair networks, and user comfort with tried-and-tested systems.

As manufacturers continue to bridge the gap between traditional and smart features, the market may gradually evolve, but conventional units will likely retain a substantial footprint in the foreseeable future.

Key Market Segments

By Product

- Cooking Appliances

- Dishwasher

- Refrigerator

- Range Hood

- Others

By Technology

- Conventional

- Smart Appliances

Drivers

Rising Popularity of Smart Kitchens and IoT-Enabled Appliances

The U.S. household kitchen appliances market is witnessing strong momentum due to the increasing adoption of smart kitchens. Consumers are now embracing appliances that are connected through the Internet of Things (IoT), offering features like remote control, scheduling, and real-time monitoring. This shift is being driven by a growing preference for convenience and efficiency in everyday life.

As more households have both partners working full-time, there is a clear demand for time-saving and user-friendly solutions in the kitchen. Smart appliances help in reducing manual tasks and can be integrated with voice assistants like Alexa and Google Home, making them even more attractive to busy families.

Additionally, the rise of e-commerce platforms has made it easier for consumers to compare prices and access a wider range of smart appliances. Online marketplaces often provide competitive deals, contributing to the increased affordability and accessibility of high-tech kitchen products.

Urban living trends are also influencing this market shift. With smaller kitchen spaces in apartments and city homes, there is a greater need for compact, multi-functional appliances. Smart devices often come with space-saving designs, aligning perfectly with urban lifestyles.

Together, these factors highlight how technological innovation and changing consumer needs are propelling the U.S. kitchen appliance market forward. The appeal of connected, efficient, and compact appliances continues to grow, positioning smart kitchens as a central theme in the market’s expansion.

Restraints

High Initial Cost of Premium and Smart Appliances

Despite the increasing interest in smart kitchen appliances, one major roadblock for the U.S. market is the high upfront cost of these premium products. Many consumers are still price-sensitive and may hesitate to invest in appliances with advanced features, even if they offer long-term savings or convenience.

Another concern for the market is the frequent recalls of kitchen appliances due to safety or technical issues. These recalls can damage consumer trust and slow down market growth. Manufacturers must ensure higher quality control to avoid such setbacks and maintain brand reputation.

Privacy is also a growing concern, particularly with IoT-enabled appliances. Connected devices often collect data about user habits, raising fears about data misuse or hacking. This has led some consumers to be cautious about adopting smart appliances, especially those that are always online or voice-enabled.

Finally, the complex repair and maintenance needs of advanced appliances create additional challenges. Many smart kitchen devices require professional servicing or have costly replacement parts, making them less appealing to buyers who prioritize simplicity and durability.

Overall, while the U.S. household kitchen appliances market shows promise, these restraints highlight the importance of addressing affordability, safety, privacy, and after-sales support to unlock its full potential.

Growth Factors

Integration of AI for Predictive Maintenance and Personalized Use

The integration of artificial intelligence (AI) is creating new growth opportunities in the U.S. kitchen appliances market. AI-powered appliances can learn from user behavior, suggest settings, and even alert homeowners to maintenance needs before problems occur. This kind of smart assistance adds real value and enhances user experience.

Energy efficiency is another strong growth driver. More U.S. consumers are actively seeking appliances that carry energy certifications and eco-labels. These products not only reduce environmental impact but also help lower utility bills, making them increasingly attractive to environmentally conscious and budget-minded households.

There’s also a rise in interest in modular and customizable kitchen designs. Many consumers now prefer appliances that can be tailored to their kitchen layout or lifestyle. Manufacturers offering flexible, stylish, and functional products are tapping into this growing trend.

Additionally, rural and semi-urban regions in the U.S. represent an untapped market for kitchen appliances. As infrastructure and internet connectivity improve in these areas, demand for modern appliances is expected to grow, providing companies with new areas for expansion.

Together, these trends show that innovation in AI, sustainability, customization, and regional outreach are key areas of opportunity for brands aiming to strengthen their position in the U.S. household kitchen appliance market.

Emerging Trends

Surge in Voice-Controlled and Touchless Appliance Adoption

The U.S. kitchen appliances market is experiencing a strong trend toward voice-controlled and touchless technologies. Consumers are increasingly looking for appliances that offer hygienic, hands-free operation. This demand surged after the pandemic and remains strong, especially in health-conscious households.

Minimalist and space-saving kitchen designs are also shaping purchasing decisions. Homeowners are choosing appliances that blend seamlessly into modern, clean layouts. Sleek, built-in, or compact designs are favored, especially in urban homes with limited space.

Manufacturers are also embracing sustainability by using recycled and eco-friendly materials in appliance production. This practice not only reduces environmental impact but also appeals to consumers who prioritize sustainable living. Green manufacturing is becoming a brand differentiator in a competitive market.

Finally, social media platforms and influencers play a growing role in shaping consumer choices. Videos, reviews, and kitchen tours featuring stylish or innovative appliances often influence buying decisions. Brands that partner with influencers or showcase their products on social media are seeing stronger engagement and sales.

These factors collectively highlight the evolving lifestyle preferences and expectations of U.S. consumers, driving manufacturers to focus on design, sustainability, and digital marketing to stay competitive in the kitchen appliances space.

Key US Household Kitchen Appliances Company Insights

In 2024, the U.S. household kitchen appliances market is witnessing strong competition and innovation among major players, driven by consumer demand for smart technology and energy-efficient solutions.

Whirlpool Corporation continues to dominate through a combination of brand legacy, wide product range, and innovation in connectivity and sustainability. Its focus on smart appliances and user-friendly designs maintains its relevance across demographics.

General Electric remains a key player by leveraging its deep manufacturing roots and integration of AI-enabled appliances. Its Profile and Café lines appeal to tech-savvy consumers and those seeking premium aesthetics without sacrificing performance.

Samsung Electronics is strengthening its U.S. position with sleek, modern appliances that feature advanced connectivity and seamless integration with smart home systems. Its rapid product cycles and focus on innovation give it a competitive edge in the premium segment.

LG Electronics is increasingly favored for its blend of style and functionality. Known for quiet operation and intuitive features, LG’s kitchen appliances often lead in energy efficiency and design, catering to both modern and environmentally conscious households.

These companies are setting the tone for the evolving kitchen appliance landscape, where technological integration and consumer personalization are becoming essential. Their strategies in innovation and branding will continue to shape the market trajectory throughout 2024 and beyond.

Top Key Players in the Market

- Whirlpool Corporation

- General Electric

- Samsung Electronics

- LG Electronics

- Bosch Home Appliances

- Electrolux

- Miele & Cie. KG

- Haier

- Panasonic

- JennAir

Recent Developments

- In Nov 2023, the Department of Energy (DOE) released detailed guidelines for Tribal governments. These guidelines enable applications for $225 million in funding under the Home Electrification and Appliance Rebate program.

- In Jun 2025, former President Trump announced new 50% tariffs on steel and aluminum imports. This policy could significantly impact the cost of home appliances, raising concerns within the manufacturing sector.

- In Feb 2025, LG Electronics (LG) revealed the rebranding of its SIGNATURE KITCHEN SUITE to SKS. The announcement was made during the 2025 Kitchen and Bath Industry Show (KBIS) in Las Vegas, USA.

Report Scope

Report Features Description Market Value (2024) USD 63.4 Billion Forecast Revenue (2034) USD 82.0 Billion CAGR (2025-2034) 2.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cooking Appliances, Dishwasher, Refrigerator, Range Hood, Others), By Technology (Conventional, Smart Appliances) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Whirlpool Corporation, General Electric, Samsung Electronics, LG Electronics, Bosch Home Appliances, Electrolux, Miele & Cie. KG, Haier, Panasonic, JennAir Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Household Kitchen Appliances MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

US Household Kitchen Appliances MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Whirlpool Corporation

- General Electric

- Samsung Electronics

- LG Electronics

- Bosch Home Appliances

- Electrolux

- Miele & Cie. KG

- Haier

- Panasonic

- JennAir