US Fashion Accessories Market Size, Share, Growth Analysis By Product (Jewelry, Handbags & Purses, Watches, Belts & Wallets, Sunglasses, Others), By Distribution Channel (Online Retail, Hypermarkets & Supermarkets, Specialty Stores, Others), By End User (Women, Men, Unisex, Children) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148470

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

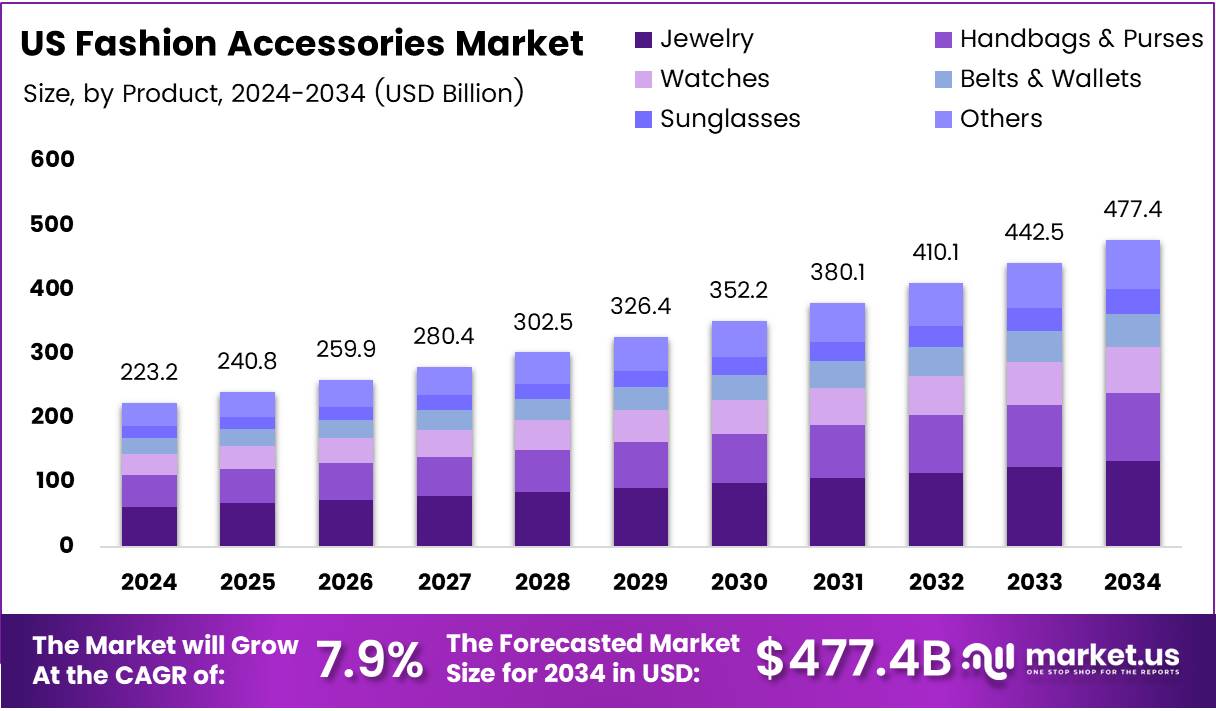

The US Fashion Accessories Market size is expected to be worth around USD 477.4 Billion by 2034, from USD 223.2 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The US Fashion Accessories Market encompasses a broad range of items such as bags, belts, jewelry, hats, scarves, sunglasses, and watches. These items complement clothing and enhance personal style. This segment continues to evolve rapidly with shifting consumer preferences, seasonal trends, and digital influence playing a key role in purchase behavior.

Driven by personalization trends and rapid online expansion, the US fashion accessories market is witnessing dynamic growth. According to Justuno, 29.5% of all e-commerce sales in the US are from apparel & accessories, reflecting strong digital traction. This surge is pushing brands to innovate with virtual try-ons and curated digital experiences.

Opportunities are expanding through influencer marketing, sustainable fashion, and customization. Brands are now exploring biodegradable materials, recycled components, and transparent sourcing to cater to ethical consumers. Additionally, according to BuckleMyBelt, 60% of consumers now purchase belts primarily as a fashion statement, highlighting the rise of aesthetics over function.

Transitioning to consumer behavior, accessory sales are gaining share in the broader retail mix. According to ASDOnline, accessories will account for 12.3% of consumer purchases, while jewelry will represent 20.9%, underlining a shift toward personal style investments. Minimalist designs and bold statement pieces are gaining popularity across age groups.

Government support is subtle yet impactful. While there are no direct investments into fashion accessories, initiatives promoting domestic manufacturing and small business funding are indirectly fueling growth. The push for “Made in USA” labeling adds brand value and builds consumer trust in local products.

Regulatory frameworks primarily focus on product safety, labeling, and sustainable practices. Policies from the Consumer Product Safety Commission (CPSC) and Federal Trade Commission (FTC) govern material disclosures, especially for children’s accessories and imported goods. This ensures market transparency and mitigates environmental and health risks.

Technological integration is accelerating innovation. From 3D printing of jewelry to AI-driven personalization in handbags, the market is capitalizing on cross-industry advancements. Retailers are leveraging augmented reality and smart mirrors to boost both engagement and conversions.

Moreover, the rise of digital native brands and D2C models is transforming distribution strategies. Emerging labels are tapping into niche audiences through platforms like Instagram and Etsy, bypassing traditional retail overhead and boosting margins through direct online channels.

Key Takeaways

- US Fashion Accessories Market is projected to reach USD 477.4 Billion by 2034, up from USD 223.2 Billion in 2024, growing at a CAGR of 7.9% from 2025 to 2034.

- Jewelry accounted for 52.4% of the market share in 2024 under the product segment, driven by its cultural and personal identity significance.

- Online Retail dominated distribution channels in 2024, reflecting a shift toward digital shopping due to variety, personalization, and seasonal deals.

- Women were the leading end-user segment in 2024, driven by trend sensitivity, social media influence, and frequent fashion purchases.

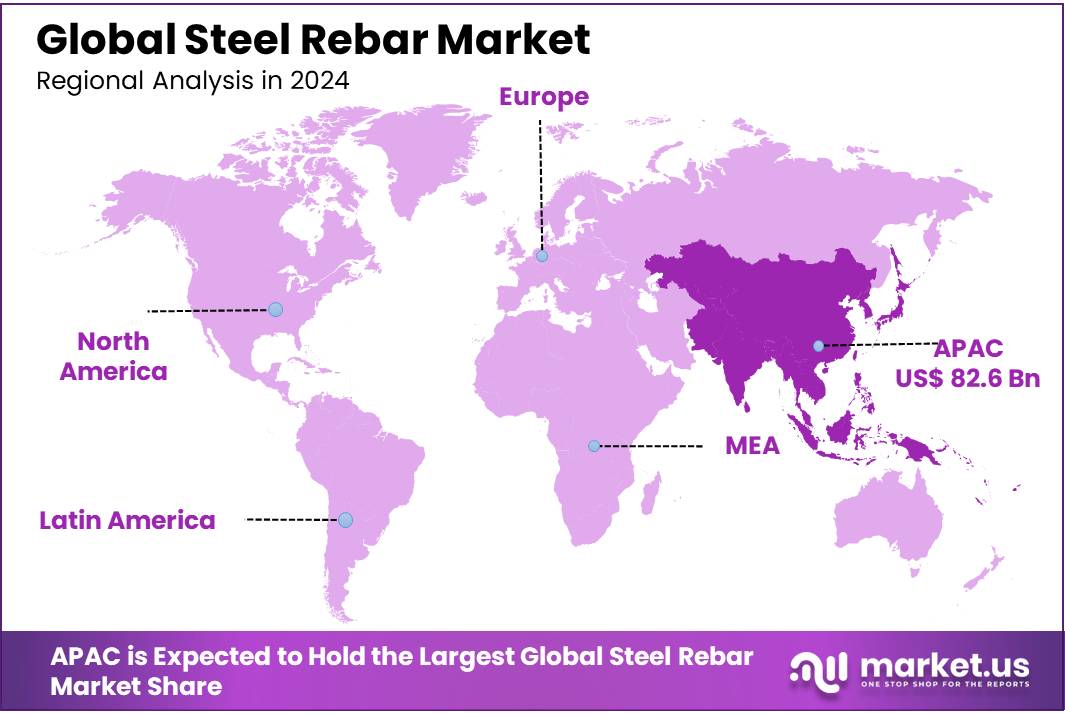

- North America captured a 35.2% market share valued at USD 21.8 Billion, fueled by high consumer spending, fashion hubs, and e-commerce maturity.

Product Analysis

Jewelry leads with 52.4% share as consumers opt for statement pieces and timeless elegance.

In 2024, Jewelry held a dominant market position in the By Product Analysis segment of the US Fashion Accessories Market, with a 52.4% share. This leadership can be attributed to the enduring cultural appeal of jewelry as both a fashion statement and a symbol of personal identity.

Gold, silver, and diamond accessories remain highly favored, especially among women and millennials seeking quality investment pieces. The rise of influencer-driven fashion and celebrity endorsements further amplified consumer engagement, particularly in online platforms.

Handbags & Purses followed as the second-largest category, driven by premium leather brands and crossbody styles gaining traction among urban shoppers. Watches retained relevance as a luxury symbol, though smartwatches impacted traditional watch demand.

Belts & Wallets captured modest share due to functionality and affordability, particularly in the men’s segment. Sunglasses continued to attract seasonal demand, fueled by fashion trends and UV protection awareness. The ‘Others’ category, including items like scarves and hair accessories, is experiencing rising demand from Gen Z consumers prioritizing expressive, low-cost items.

Overall, the product mix reflects a dynamic blend of classic essentials and trend-driven accessories, positioning jewelry at the forefront of both high-value and emotionally resonant fashion purchases.

Distribution Channel Analysis

Online Retail captures top spot due to digital-first consumer behavior and convenience.

In 2024, Online Retail held a dominant market position in the By Distribution Channel Analysis segment of the US Fashion Accessories Market. This shift highlights the transformation in consumer buying patterns, with a marked preference for digital shopping platforms offering wider assortments, personalized recommendations, and seasonal discounts.

Direct-to-consumer (DTC) brands and e-commerce giants have heavily invested in social commerce and influencer collaborations, especially on platforms like Instagram and TikTok, effectively driving fashion accessory sales.

Hypermarkets & Supermarkets retained a notable share due to their bundled offerings and discounted pricing, especially during festive and back-to-school seasons. These retail giants continue to serve a price-sensitive demographic, offering convenience through omnichannel presence.

Specialty Stores, known for curated selections and high-end brands, performed well in urban and premium segments, benefiting from in-store experiences and exclusivity. The ‘Others’ category, including department stores and small boutiques, still holds value in suburban markets and among consumers preferring tactile shopping experiences.

The overall distribution landscape in the US fashion accessories market is increasingly skewed towards online channels, as convenience, faster delivery, and expanding digital infrastructure redefine the path to purchase.

End User Analysis

Women dominate as style, self-expression, and seasonal trends drive frequent purchases.

In 2024, Women held a dominant market position in the By End User Analysis segment of the US Fashion Accessories Market. This commanding lead reflects the long-standing association of accessories with women’s fashion and the high frequency of purchases influenced by trends, social media, and seasonal updates. From statement jewelry and designer handbags to fashion sunglasses and elegant watches, women’s demand continues to drive both volume and value across retail channels.

Men represented the second-largest share, showing rising interest in premium wallets, minimalist watches, and leather belts, especially among urban professionals. Unisex accessories are gaining ground, propelled by the rise in gender-neutral fashion and brands offering inclusive collections.

This segment appeals particularly to Gen Z consumers seeking versatility and identity expression. The Children’s segment, while smaller, is expanding steadily as parents increasingly seek fashionable and themed accessories for kids, particularly in categories like backpacks, hair accessories, and novelty watches.

Overall, gender-targeted marketing and product innovation remain critical, with the women’s segment setting the pace for trends and influencing the broader dynamics of the US fashion accessories market.

Key Market Segments

By Product

- Jewelry

- Handbags & Purses

- Watches

- Belts & Wallets

- Sunglasses

- Others

By Distribution Channel

- Online Retail

- Hypermarkets & Supermarkets

- Specialty Stores

- Others

By End User

- Women

- Men

- Unisex

- Children

Drivers

Growing Demand for Sustainable and Eco-friendly Fashion Accessories Drives Market Growth

The growing interest in eco-friendly fashion accessories is changing the U.S. market. More consumers now want products made from recycled, organic, or cruelty-free materials. This is not just a trend; it reflects a deeper concern for the environment. Brands that promote sustainability are gaining more trust and loyalty from eco-conscious shoppers.

Social media plays a big role in shaping consumer tastes. Influencers and celebrities often showcase sustainable fashion items, encouraging followers to choose similar accessories. Their reach boosts awareness and drives demand for stylish yet environmentally responsible items, especially among younger consumers.

Rising disposable income across various age groups allows people to spend more on accessories that match their lifestyle values. Consumers are more willing to pay a little extra for fashion items that are both trendy and eco-friendly. This shift in spending behavior is helping premium sustainable brands grow faster in the U.S. market.

E-commerce platforms also support this growth. Many online stores now feature filters for sustainable or eco-certified products, making it easier for customers to shop consciously. This accessibility has opened new revenue streams for brands that prioritize sustainability in their designs and packaging.

Restraints

Intense Competition from Counterfeit and Low-Cost Alternatives Hampers Market Stability

One major challenge in the U.S. fashion accessories market is the rise of counterfeit and low-cost alternatives. Many consumers, especially those on tight budgets, turn to cheaper, unbranded accessories. While these items are affordable, they often lack quality and durability. This undercuts premium and authentic brands trying to maintain higher standards.

Raw material costs are also unpredictable. Fluctuations in prices of leather, metals, and textiles affect production expenses, forcing brands to either raise prices or cut margins. On top of that, supply chain disruptions—especially due to global events or shipping delays—can slow down product availability and customer satisfaction.

Economic downturns further impact the market. In times of financial uncertainty, consumers usually cut back on luxury or non-essential spending, including high-end accessories. This makes it harder for premium fashion brands to maintain sales and grow revenue, particularly in the luxury segment.

Additionally, many consumers now prefer minimalist styles, which reduces the frequency of accessory purchases. They may opt for fewer items with timeless appeal, rather than frequently buying new trendy pieces. This shift in taste challenges brands that rely on fast-changing styles and large product volumes.

Growth Factors

Innovation in Smart and Tech-Integrated Fashion Accessories Offers New Growth Pathways

Technology is opening exciting new doors for the U.S. fashion accessories market. Brands are now introducing smart accessories, such as watches with health tracking features, handbags with built-in charging ports, and even jewelry that connects with smartphones. These tech-integrated products meet modern lifestyle needs and offer more than just style.

Developing economies are also becoming important growth zones. U.S.-based brands are starting to reach out to global markets, especially in Asia and Latin America, where young consumers are eager to explore Western fashion. This creates new sales opportunities for American companies offering trendy or innovative accessories.

Customization is another rising trend. Many consumers want to express their personality through their fashion choices. Brands offering personalized accessories—like engraved jewelry, custom-fit watches, or monogrammed bags—are gaining popularity. This makes products feel more special and boosts customer satisfaction.

Men’s fashion accessories are also on the rise. Traditionally, the market was focused on women, but now men are increasingly shopping for items like belts, bags, watches, and sunglasses. Brands that create stylish and functional products for men are tapping into a growing customer base that was previously underserved.

Emerging Trends

Shift Towards Gender-Neutral and Inclusive Fashion Accessories Shapes Market Trends

There is a growing shift in the U.S. toward gender-neutral and inclusive fashion accessories. Consumers are moving away from traditional labels and embracing products that can be worn by anyone, regardless of gender. Brands responding to this trend with unisex designs are connecting better with modern, open-minded buyers.

Sustainability is another major influence. Accessories made from recycled plastic, plant-based leather, and biodegradable materials are becoming mainstream. Many consumers now choose products that are stylish but also environmentally friendly. This trend is not just ethical—it’s fashionable.

In urban areas, minimalist and functional accessories are in high demand. City dwellers prefer items that are sleek, lightweight, and useful in their daily lives, like compact bags, versatile jewelry, and simple sunglasses. This trend is helping to define the modern urban fashion style.

Digital fashion is also gaining traction. Virtual accessories used in gaming, social media avatars, and online platforms are opening new ways for consumers to express themselves. Some brands now offer digital-only collections or NFTs, blending fashion with technology to appeal to the younger, tech-savvy audience.

Key Players Analysis

The US Fashion Accessories Market in 2024 continues to be shaped by the strategic movements and brand influence of luxury and premium players.

LVMH Moët Hennessy Louis Vuitton SE maintains a dominant position through its expansive portfolio of luxury brands and consistent innovation in design, leveraging strong heritage and a loyal consumer base to drive high-margin sales in accessories.

Kering S.A. strengthens its foothold by pushing iconic labels like Gucci and Saint Laurent, with a clear focus on sustainability and youth-oriented luxury trends that resonate well in the US market.

Richemont International SA leverages its strength in jewelry and watches through brands like Cartier, benefiting from the rising demand for premium accessories among affluent consumers, while also exploring digital avenues to enhance customer engagement.

Chanel S.A. continues to lead in timeless fashion with its classic accessories line, emphasizing exclusivity, craftsmanship, and a selective distribution strategy that enhances brand prestige and consumer aspiration.

These companies collectively shape the premium and luxury segments of the US fashion accessories landscape. Their emphasis on innovation, brand storytelling, and alignment with evolving consumer values—such as sustainability and digital convenience—enables them to maintain relevance and expand market share. While legacy remains a core strength, their agility in responding to younger demographics and e-commerce trends further fuels their competitive edge in 2024.

Top Key Players in the Market

- LVMH Moët Hennessy Louis Vuitton SE

- Kering S.A.

- Richemont International SA

- Chanel S.A.

- Hermès International S.A.

- Tapestry, Inc.

- Michael Kors

- Prada S.p.A.

- Tiffany & Co.

- Burberry Group plc

- Nike Inc.

- Adidas AG

- Guess Inc.

- Tory Burch LLC

Recent Developments

- In June 2024, Julie Bornstein secured US$50 million in funding to launch an AI-powered fashion search startup aimed at enhancing product discovery and personalization in online retail. The investment highlights growing interest in AI-driven solutions within the fashion e-commerce landscape.

- In February 2024, fashion jewellery brand Kushal’s raised ₹284 crore from Lighthouse to accelerate retail expansion and strengthen its omnichannel presence. The funding will also support brand development and operational scalability across India.

- In November 2024, True Diamond raised US$1 million in seed funding to scale its lab-grown diamond venture. The capital will be utilized for production capacity enhancement, technology upgrades, and marketing initiatives.

- In January 2025, Trimco Group acquired US-based Nexgen Packaging to boost its global packaging and labeling capabilities. The acquisition enhances Trimco’s customer base and strengthens its presence in North America.

- In February 2025, Tamasq acquired accessories brand NakhreWaali as part of its strategy to diversify its product portfolio. The company also announced plans to expand NakhreWaali’s reach across urban and tier-2 markets.

- In September 2024, Toniq Retail Brands completed the acquisition of Ayesha Accessories to consolidate its position in the affordable fashion accessories market. The deal aims to integrate design synergies and strengthen retail distribution across India.

Report Scope

Report Features Description Market Value (2024) USD 223.2 Billion Forecast Revenue (2034) USD 477.4 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Jewelry, Handbags & Purses, Watches, Belts & Wallets, Sunglasses, Others), By Distribution Channel (Online Retail, Hypermarkets & Supermarkets, Specialty Stores, Others), By End User (Women, Men, Unisex, Children) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LVMH Moët Hennessy Louis Vuitton SE, Kering S.A., Richemont International SA, Chanel S.A., Hermès International S.A., Tapestry, Inc., Michael Kors, Prada S.p.A., Tiffany & Co., Burberry Group plc, Nike Inc., Adidas AG, Guess Inc., Tory Burch LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Fashion Accessories MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

US Fashion Accessories MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LVMH Moët Hennessy Louis Vuitton SE

- Kering S.A.

- Richemont International SA

- Chanel S.A.

- Hermès International S.A.

- Tapestry, Inc.

- Michael Kors

- Prada S.p.A.

- Tiffany & Co.

- Burberry Group plc

- Nike Inc.

- Adidas AG

- Guess Inc.

- Tory Burch LLC