Global Belts and Wallets Market By Product (Belts, Wallets), By Material (Leather, Non-Leather), By End-user (Men, Women), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138940

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

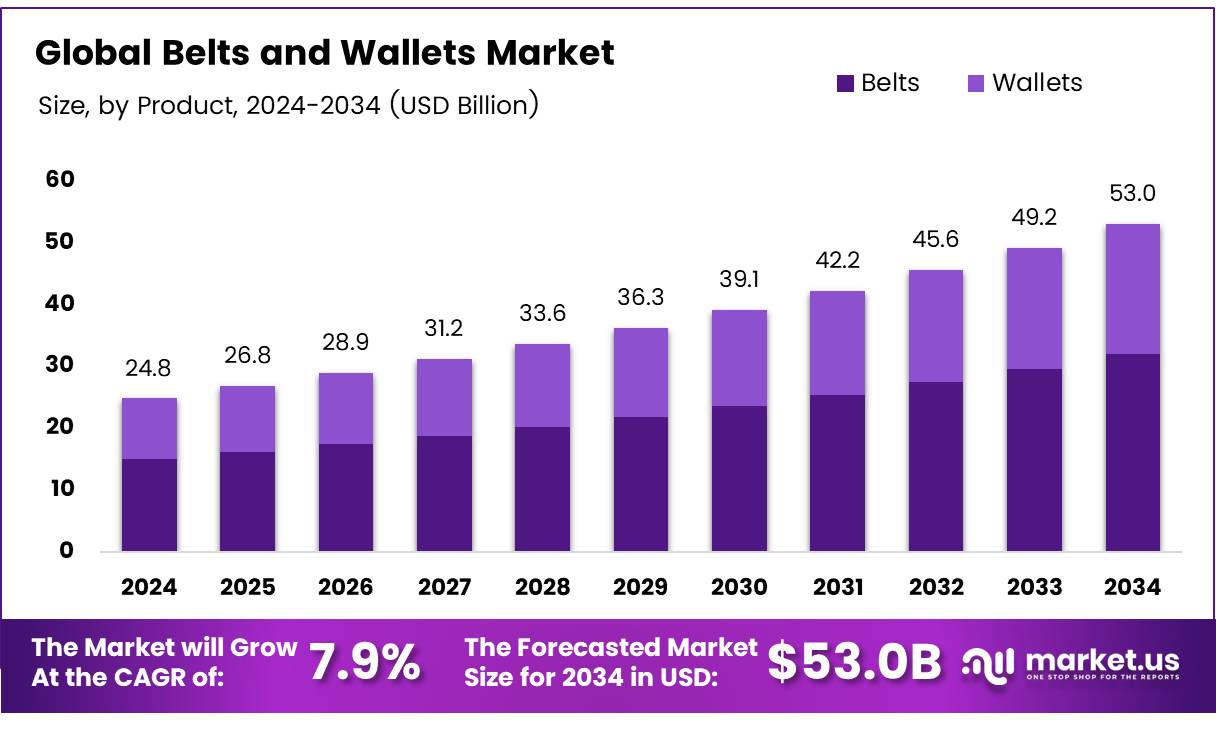

The Global Belts and Wallets Market size is expected to be worth around USD 53.0 Billion by 2034, from USD 24.8 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

Belts and wallets are essential fashion accessories that serve both functional and aesthetic purposes. Belts are primarily used to secure pants or skirts, while wallets are designed to hold cash, cards, and identification. These products are made from various materials, including leather, fabric, and synthetic materials.

The global belts and wallets market encompasses a wide range of products, including traditional leather belts, designer belts, eco-friendly options, and high-tech wallets with built-in RFID protection. The market has been characterized by evolving consumer preferences towards both luxury and sustainable goods.

In addition to traditional sales channels, e-commerce platforms have gained significant traction, making these accessories more accessible to a global audience. With a growing demand for customization, such as personalized belts and engraved wallet designs, this market has expanded to include bespoke offerings that appeal to consumers seeking individuality and style.

The belts and wallets market is poised for continued growth, driven by a combination of fashion trends, technological advancements, and a greater emphasis on sustainability. The demand for personalized and eco-friendly products is surging, as consumers seek products that reflect their identity and values.

According to Bucklemybelt, personalized belts now account for 15% of U.S. belt sales, with Western-style buckles leading this customization trend, growing at 25% annually. Furthermore, the use of recycled materials, vegan leathers, and biodegradable options has grown substantially, with brands adopting these sustainable practices seeing a 40% increase in demand over the past five years.

The online retail channel plays an increasingly significant role in driving market expansion. With virtual fitting tools and detailed customization options, online sales now account for 45% of all belt purchases, as reported by Bucklemybelt.

This shift in consumer purchasing behavior indicates a growing preference for convenience and tailored shopping experiences. As the market continues to evolve, both traditional and digital retail channels will need to align with shifting consumer demands to capture market share.

The belts and wallets market is experiencing strong growth, bolstered by both established and emerging market segments. According to Enterslice, the leather belt-making business is notably profitable, with a 20%-30% profit margin estimated. This indicates a favorable business environment for manufacturers looking to capitalize on both mass-market and premium product offerings.

Governments and organizations are increasingly focused on fostering sustainability, which has created a favorable environment for eco-friendly products. Investments in sustainable manufacturing practices, coupled with regulations aimed at reducing carbon footprints, offer brands a chance to align with these initiatives while capitalizing on growing demand.

Key Takeaways

- The global belts and wallets market is projected to grow from USD 24.8 billion in 2024 to USD 53.0 billion by 2034, with a CAGR of 7.9%.

- Belts are the leading product category in 2024, holding a 60.2% market share, driven by demand for functional, stylish accessories.

- Leather dominates the material segment with a 73.1% market share in 2024, valued for its durability and luxury appeal.

- Men are the main consumers, representing 64.2% of the market in 2024, due to high demand for essential fashion items.

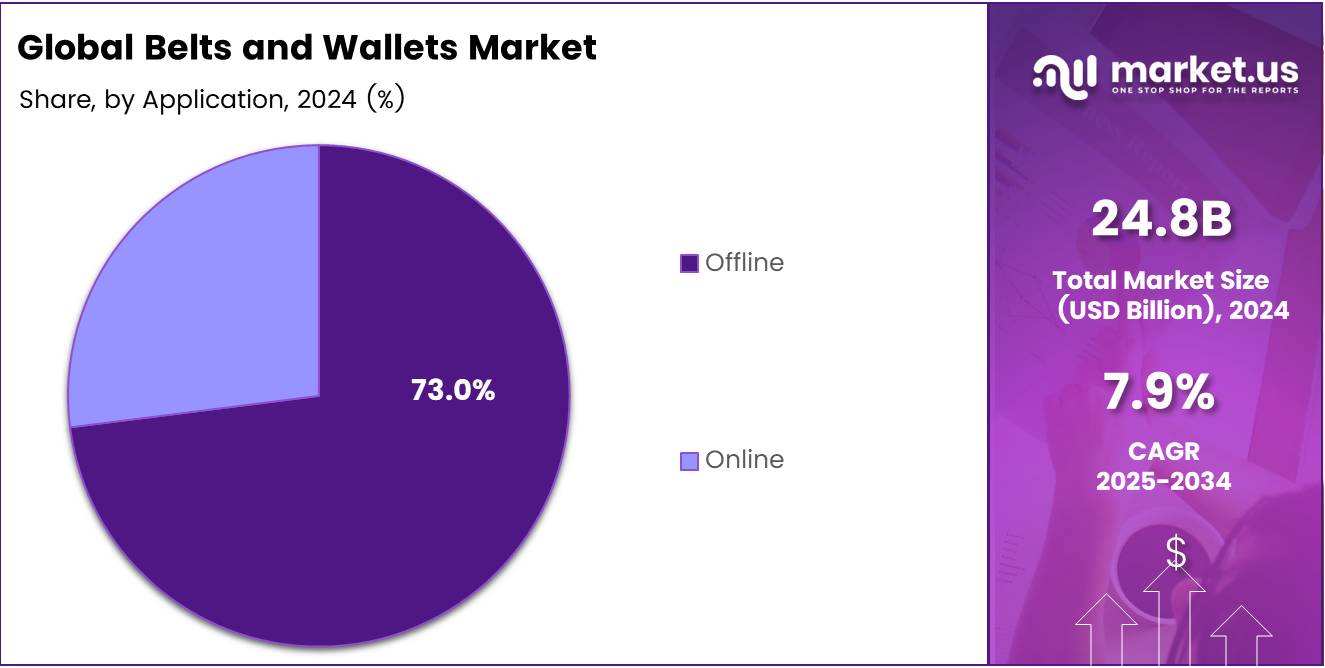

- The offline sales channel dominates with a 72.4% share in 2024, preferred for its tactile shopping experience.

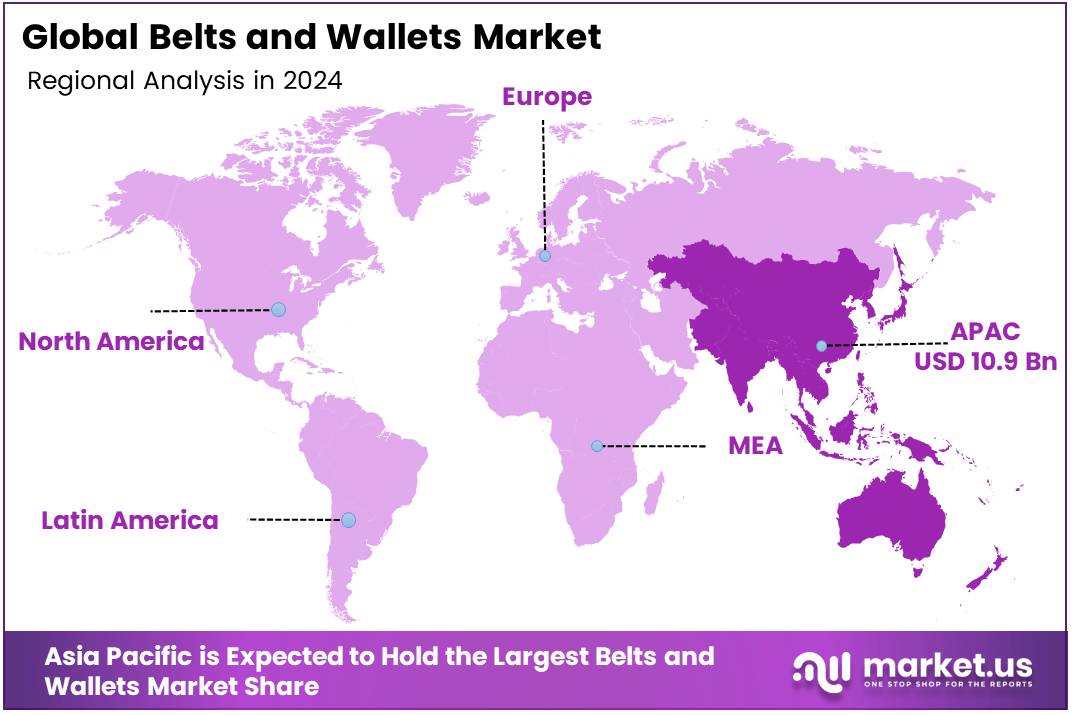

- Asia Pacific leads the market with a 44.6% share, driven by a growing middle class and fashion consciousness, particularly in China and India.

Product Analysis

Belts Lead the Belts and Wallets Market with 60.2% Share in 2024, Driven by Consumer Demand for Fashion and Functionality

In 2024, Belts held a dominant position in the By Product Analysis segment of the Belts and Wallets Market, commanding a significant 60.2% share. This growth can be attributed to the increasing demand for functional yet stylish accessories that cater to both men and women.

As belts are essential wardrobe staples, their popularity is sustained by ongoing trends in fashion and a growing emphasis on both aesthetics and practicality. Whether as part of business attire or casual outfits, belts continue to be a top choice for consumers, ensuring their substantial market share.

Wallets, while also a key player, capture a smaller portion of the market. In 2024, the Wallets segment contributes to the remaining share, driven by their function as essential accessories for carrying cash, cards, and IDs.

However, the competitive landscape in the wallets category is more fragmented, with numerous styles and designs targeting different consumer preferences. Despite this, wallets continue to see steady demand, with innovations in material quality and design appealing to a variety of customer segments.

Material Analysis

Leather Dominates Belts and Wallets Market with 73.1% Share in 2024, Fueled by Durability and Luxury Appeal

In 2024, Leather held a dominant position in the By Material Analysis segment of the Belts and Wallets Market, securing a 73.1% market share. This dominance is driven by leather’s reputation for durability, timeless appeal, and luxury status.

Leather products, particularly in belts and wallets, are favored for their long-lasting quality and premium feel, making them a preferred choice for both consumers and high-end fashion brands. The material’s ability to age gracefully, developing a unique patina over time, further solidifies its standing as the material of choice for those seeking both function and style.

The Non-Leather segment, while growing in popularity, accounted for the remaining market share. Non-leather options, such as synthetic materials, fabric, and eco-friendly alternatives, appeal to a segment of consumers prioritizing cost-effectiveness, sustainability, or cruelty-free products.

As demand for sustainable fashion grows, non-leather belts and wallets are seeing increased market penetration, especially among younger, environmentally-conscious consumers.

Despite the rise of alternatives, leather remains the dominant material in the Belts and Wallets Market due to its unmatched combination of quality, luxury, and timeless appeal, continuing to capture the largest share of consumer spending.

End-user Analysis

Men Lead Belts and Wallets Market with 64.2% Share in 2024, Driven by Consistent Demand for Classic Accessories

In 2024, Men held a dominant position in the By End-user Analysis segment of the Belts and Wallets Market, commanding a 64.2% market share. This dominance is largely due to the consistent and enduring demand for belts and wallets as essential components of men’s everyday attire.

These accessories serve both functional and style purposes, offering consumers a wide range of choices from formal to casual wear. Men’s belts, often viewed as a wardrobe necessity, along with wallets, remain staples in both the fashion and practical segments, contributing to their sustained market leadership.

The Women’s segment, while significant, accounted for the remaining 35.8% share of the market. Women’s belts and wallets are increasingly influenced by fashion trends, with a broader range of designs, colors, and materials offering diverse options.

Though demand for women’s accessories continues to rise, particularly with the growing interest in high-fashion and sustainable materials, the male demographic’s steady consumption of classic leather products has solidified its larger market share.

Distribution Channel Analysis

Offline Dominates Belts and Wallets Market with a 72.4% Share in 2024 Due to Traditional Shopping Preferences

In 2024, the Offline segment held a commanding position in the Belts and Wallets Market, capturing a significant 72.4% share. This dominance is largely attributed to the enduring preference for in-store shopping, where customers can physically inspect products for quality, fit, and style.

Physical retail stores provide a tactile experience that remains appealing, particularly for fashion items like belts and wallets, where material feel and design play crucial roles in purchasing decisions.

Offline shopping also benefits from established relationships with consumers, especially in markets with strong local retail networks. The availability of immediate purchase and the ability to take home the product the same day further solidifies its lead. Additionally, brick-and-mortar stores offer personalized customer service and the opportunity for on-the-spot recommendations, which continue to attract a loyal customer base.

On the other hand, the Online segment has gained momentum, driven by the growing shift towards e-commerce and convenience shopping. However, its share remains lower compared to offline, as many consumers still prioritize the in-person shopping experience when it comes to fashion accessories like belts and wallets. Despite this, the Online segment is expected to see incremental growth as digital shopping trends continue to evolve.

Key Market Segments

By Product

- Belts

- Wallets

By Material

- Leather

- Non-Leather

By End-user

- Men

- Women

By Distribution Channel

- Offline

- Online

Drivers

Rising Disposable Income Fuels Belt and Wallet Market Demand

As disposable incomes rise globally, consumers are increasingly able to afford premium and luxury belts and wallets, driving market growth. People are no longer limiting their spending to just essentials but are now willing to invest in high-quality, fashionable accessories that reflect their personal style and status.

This shift is particularly noticeable in emerging markets, where the middle class is expanding rapidly. With more disposable income at their disposal, consumers are opting for premium, durable, and branded products that promise long-lasting quality. As a result, both belts and wallets have become not just functional items but also symbols of social standing, pushing the demand for upscale and designer options.

The rising demand for luxury goods is intertwined with this trend, as more individuals prioritize high-end products. Consequently, manufacturers and retailers are focusing on providing a variety of premium options to cater to this growing market segment, capitalizing on the trend of increased purchasing power and evolving consumer preferences.

Restraints

Rising Raw Material Costs and Economic Uncertainty Impact Belt and Wallet Market

The belts and wallets market faces significant challenges due to fluctuating raw material prices, particularly for materials like leather, fabric, and metals. These price swings can increase production costs, leading manufacturers to either absorb the cost or pass it on to consumers, potentially reducing affordability and profitability. This uncertainty in pricing can make it difficult for companies to maintain consistent product prices, impacting their competitiveness.

Additionally, economic uncertainty poses a restraint on the market, as periods of inflation, financial recessions, or overall economic downturns tend to reduce consumer spending on luxury goods. During tough economic times, consumers are more cautious about spending on premium belts and wallets, prioritizing basic needs over discretionary purchases.

As a result, manufacturers may experience slower sales, reduced profit margins, or the need to adjust their strategies to cater to more budget-conscious consumers. These external factors create a challenging environment for companies in the market, forcing them to constantly adapt to fluctuating production costs and changing consumer behavior during uncertain times.

Growth Factors

Expansion into Emerging Markets Creates New Growth Opportunities for Belts and Wallets

The belts and wallets market holds significant growth potential in emerging markets like India, China, and Brazil, where increasing urbanization and rising disposable incomes are boosting demand for fashion accessories.

As more people in these regions enter the middle class, there is a growing appetite for both affordable and luxury items, providing new avenues for market expansion. Additionally, the luxury segment is witnessing a surge, with more consumers seeking high-end, branded products that symbolize status and quality.

Companies can tap into this trend by offering premium belts and wallets that cater to the evolving tastes of consumers. Another growth opportunity lies in the demand for custom and personalized products. Consumers are increasingly drawn to unique items, such as belts and wallets with personalized initials or exclusive designs, which allow them to express individuality.

By offering customization options, brands can appeal to a broader audience seeking distinct and meaningful products. Furthermore, strategic collaborations with renowned fashion designers or influencers can generate excitement and drive sales.

Limited-edition collections or co-branded products can create a sense of exclusivity, attracting both fashion-forward consumers and collectors. Overall, these opportunities present multiple pathways for companies to grow their market share, cater to evolving consumer preferences, and capitalize on emerging global trends.

Emerging Trends

Minimalistic Designs and Innovative Trends Shape the Belt and Wallet Market

The belts and wallets market is being shaped by several key trends that reflect changing consumer preferences and technological advancements. Minimalistic designs, characterized by sleek and simple aesthetics, are particularly popular among young, style-conscious consumers who prefer subtle elegance over bold, flashy accessories. This shift towards simplicity has also been accompanied by a growing demand for smart accessories.

RFID-blocking wallets and belts equipped with built-in tracking devices are gaining traction as consumers seek both style and functionality. These tech-infused items not only protect personal data but also offer added convenience for modern lifestyles. At the same time, sustainability is becoming a significant factor in purchasing decisions.

As consumers become more environmentally conscious, there is a notable shift towards eco-friendly products made from recycled leather or plant-based materials. This trend aligns with the broader movement toward ethical and sustainable fashion. Another emerging trend is the rise of gender-neutral accessories.

With the increasing popularity of gender fluidity in fashion, belts and wallets are now being marketed as unisex products, appealing to a broader and more inclusive customer base. These trends highlight the evolving nature of consumer desires in the fashion accessories sector, where functionality, sustainability, and simplicity are becoming key drivers for brands aiming to stay relevant and competitive.

Regional Analysis

Asia Pacific Leads Global Belts and Wallets Market with 44.6% Share, Valued at USD 10.9 Billion

The belts and wallets market demonstrates distinct characteristics and trends across various global regions, influenced by local consumer preferences and economic conditions.

Asia Pacific is the dominant region in the belts and wallets market, holding a 44.6% share and valued at USD 10.9 billion. This region’s growth is propelled by the expanding middle class, increasing urbanization, and growing fashion consciousness among consumers. China and India, in particular, offer substantial market opportunities due to their large populations and increasing disposable incomes.

Regional Mentions:

In North America, the market is driven by a strong demand for designer and premium products, reflecting the region’s high purchasing power and a preference for quality and branded goods. The trend towards ethical fashion and sustainable practices further shapes the market landscape, impacting consumer choices and brand strategies.

Europe’s market is sustained by its rich heritage in luxury craftsmanship, with well-established brands dominating the landscape. The region’s focus on high-quality materials and artisanal techniques continues to appeal to both local and international consumers, supporting steady market growth.

The Middle East & Africa region, while smaller in scale, is experiencing growth due to an increasing interest in luxury and fashion products, especially in the Gulf countries. The market is benefiting from the expansion of retail infrastructure and the presence of global brands.

Latin America’s market is evolving with a focus on increasing consumer expenditure on fashion and accessories. The growing influence of international fashion trends, coupled with rising economic stability, supports the market’s development in countries such as Brazil and Mexico.

Overall, the Asia Pacific region not only leads in terms of market share but also demonstrates significant growth potential, driven by economic advancements and a rapidly expanding consumer base keen on fashion products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global belts and wallets market is significantly shaped by key players who bring diverse strengths and strategies to the industry.

Among these, companies like Burberry PLC and Guccio Gucci S.p.A. (part of KERING) continue to dominate the luxury segment, leveraging their established brand prestige and strong design capabilities to command premium pricing and customer loyalty. These companies benefit from a global distribution network and a strong presence in both physical and digital retail spaces.

On the other hand, companies like Diesel Fashion India Reliance Pvt. Ltd and Tommy Hilfiger licensing, LLC (PVH) cater to a more diverse market by combining style with accessibility. These brands focus on trend-driven designs and collaborations to appeal to younger demographics, which helps in maintaining a dynamic market presence.

Innovation and sustainability are increasingly becoming important differentiators in the market. PUMA SE and LEVI STRAUSS & CO. are examples of companies investing heavily in sustainable practices and materials, responding to the growing consumer demand for environmentally friendly products. This not only enhances their brand image but also aligns with global regulatory trends towards sustainability.

Emerging markets are pivotal for growth, and companies like Aditya Birla Group and Titan Company leverage their deep local knowledge and extensive distribution networks in regions like India to capitalize on increasing consumer spending power.

Lastly, niche players such as Marshall Wallet (ABC INTERNATIONAL) focus on specific market segments, offering specialized products that cater to unique consumer needs, often emphasizing craftsmanship and personalized options.

Top Key Players in the Market

- Burberry PLC

- Diesel Fashion India Reliance Pvt.Ltd

- Ralph Lauren Corp.

- Tommy Hilfiger licensing, LLC (PVH)

- Aditya Birla Group

- PUMA SE

- Titan Company

- LEVI STRAUSS & CO.

- Guccio Gucci S.p.A. (KERING)

- Marshall Wallet (ABC INTERNATIONAL)

Recent Developments

- In December 2024, HVEG International Fashion completed the acquisition of W Fashion Group, further expanding its reach in the global fashion market. This strategic move followed the successful acquisition of RNF Group, enhancing HVEG’s portfolio.

- In June 2024, Marquee Brands announced its acquisition of totes Isotoner Corporation, in a strategic partnership with Randa Apparel & Accessories. This acquisition aims to leverage the strengths of both entities in the accessories market.

- In April 2023, the London-based urban clothing brand Nicce was acquired by Apparel Brands Ltd. This acquisition is part of Apparel Brands’ strategy to diversify its offerings and strengthen its presence in the urban lifestyle segment.

Report Scope

Report Features Description Market Value (2024) USD 24.8 Billion Forecast Revenue (2034) USD 53.0 Billion CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Belts, Wallets), By Material (Leather, Non-Leather), By End-user (Men, Women), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Burberry PLC, Diesel Fashion India Reliance Pvt.Ltd, Ralph Lauren Corp., Tommy Hilfiger licensing, LLC (PVH), Aditya Birla Group, PUMA SE, Titan Company, LEVI STRAUSS & CO., Guccio Gucci S.p.A. (KERING), Marshall Wallet (ABC INTERNATIONAL) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Burberry PLC

- Diesel Fashion India Reliance Pvt.Ltd

- Ralph Lauren Corp.

- Tommy Hilfiger licensing, LLC (PVH)

- Aditya Birla Group

- PUMA SE

- Titan Company

- LEVI STRAUSS & CO.

- Guccio Gucci S.p.A. (KERING)

- Marshall Wallet (ABC INTERNATIONAL)