US Car Rental Market Size, Share, Growth Analysis By Booking Mode (Online, Offline), By Vehicle (Economy cars, Luxury cars, Executive cars, SUVs, MUVs), By Application (Local usage, Airport transport, Outstation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146352

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

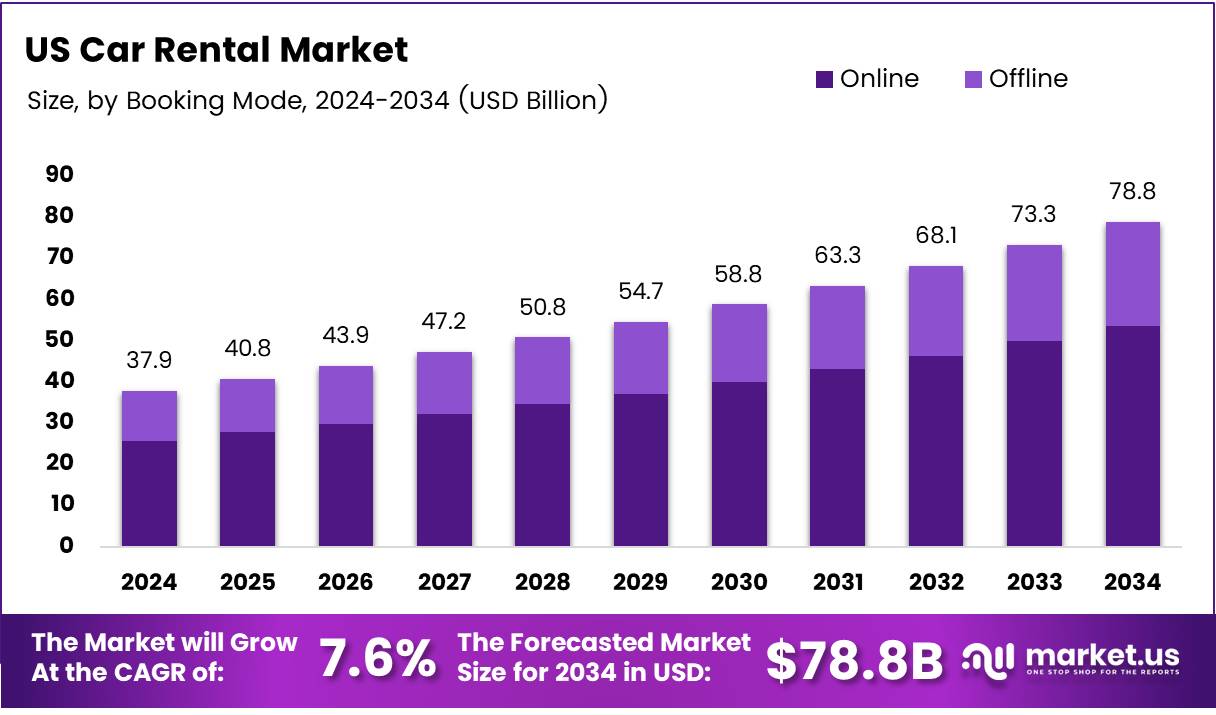

The US Car Rental Market size is expected to be worth around USD 78.8 Billion by 2034, from USD 37.9 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

The U.S. car rental market has experienced consistent growth due to factors such as increasing travel demand, the need for flexible transportation options, and the rise in tourism. The market is characterized by a variety of rental companies, from global brands to local agencies, offering services ranging from economy to luxury vehicles.

According to Bankrate, the daily rental cost for a car can range from under $50 to over $100, depending on factors like vehicle type and rental location. As of February 2025, there are 309 National Car Rental locations across the United States, according to Scrapehero, underscoring the significant footprint of car rental services in the country. Moreover, nearly 45% of Americans have no access to public transportation, as noted by ITDP, which further boosts the demand for car rentals, especially in underserved areas.

The U.S. car rental market is expected to continue evolving with significant opportunities driven by consumer preference for short-term vehicle access over long-term ownership. Increased air travel, business trips, and tourism are key factors that will fuel demand for car rentals.

Additionally, the rise in remote work and the need for occasional travel during off-peak times can contribute to sustained market growth. However, fluctuations in fuel prices and insurance costs remain potential risks to the overall profitability of rental agencies.

The growth trajectory for the U.S. car rental market looks promising, especially with the expansion of electric vehicle (EV) fleets and the potential for partnerships with ride-sharing companies. Car rental companies are increasingly investing in more sustainable vehicles, responding to growing consumer demand for greener transportation options.

Government initiatives that support the adoption of EVs and provide tax incentives for clean energy vehicles are also expected to play a role in the market’s evolution. The rise of autonomous vehicle technology could further influence market dynamics, although regulations around such technologies remain in early stages of development.

As the U.S. car rental industry adapts to consumer preferences, such as demand for flexible leasing and digital booking platforms, opportunities for growth are poised to continue, ensuring a robust future for this sector.

Key Takeaways

- US Car Rental Market is projected to reach USD 78.8 Billion by 2034, from USD 37.9 Billion in 2024, growing at a CAGR of 7.6%.

- Online bookings dominated the US car rental market in 2024, holding a 70.3% share in the Booking Mode Analysis segment.

- Economy cars led the market with a 29.8% share in the Vehicle Analysis segment, favored for their affordability and fuel efficiency.

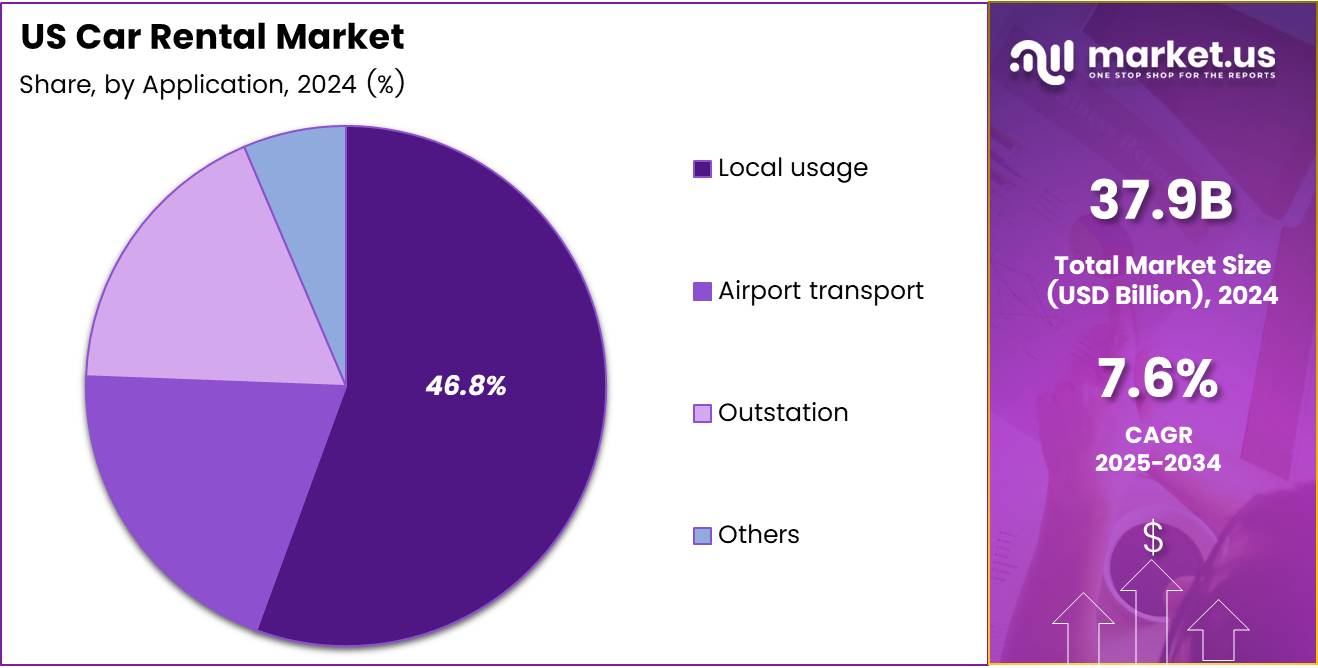

- Local usage accounted for 46.8% of the market share in the Application Analysis segment, driven by demand for short-term, in-city rentals.

Booking Mode Analysis

In 2024, Online held a dominant market position in By Booking Mode Analysis segment of US Car Rental Market, with a 70.3% share

In 2024, the online segment of the US car rental market held a commanding share of 70.3% in the By Booking Mode Analysis segment. The dominance of online bookings can be attributed to the increasing consumer preference for digital platforms due to convenience and ease of access. Online booking offers customers the ability to compare prices, check availability, and secure vehicles from anywhere, leading to its widespread adoption.

In contrast, the offline segment saw a decline in market share as traditional methods such as walk-ins and phone bookings have lost their appeal. This shift is largely driven by technological advancements and the growing comfort with online transactions. Although offline bookings still cater to a specific demographic, they represent a much smaller portion of the market, with a much lower share in comparison to online channels.

The strong performance of online platforms in the car rental market is expected to continue in the coming years as more customers turn to the convenience of mobile applications and websites to meet their rental needs.

Vehicle Analysis

In 2024, Economy cars held a dominant market position in By Vehicle Analysis segment of US Car Rental Market, with a 29.8% share

In 2024, economy cars dominated the US car rental market with a substantial share of 29.8% in the By Vehicle Analysis segment. The popularity of economy cars can be attributed to their affordability, fuel efficiency, and practicality for both short-term and budget-conscious travelers. They are commonly chosen for local rentals and are ideal for customers who prioritize cost-effective solutions.

Luxury cars, while representing a smaller share of the market, are gaining traction among high-end travelers seeking comfort, performance, and prestige. However, they are less accessible for everyday consumers, making economy vehicles a preferred option for the majority.

Executive cars also hold a moderate share, attracting business travelers who require premium yet practical vehicles for professional purposes. SUVs and MUVs are experiencing steady growth as consumer demand for versatile and spacious vehicles increases, especially for family trips and road vacations.

Despite the growing appeal of other vehicle types, economy cars are projected to maintain their leadership position in the market due to their widespread affordability and the large pool of consumers seeking budget-friendly options.

Application Analysis

In 2024, Local usage held a dominant market position in By Application Analysis segment of US Car Rental Market, with a 46.8% share

In 2024, the local usage segment took the lead in the US car rental market with an impressive 46.8% share in the By Application Analysis segment. Local usage, including daily rentals and in-city driving, is a key driver of the car rental industry, as more consumers prefer renting vehicles for short-term, local trips, including commuting, errands, or temporary needs.

Airport transport, while crucial, holds a secondary position in the market due to its reliance on tourism and business travel, which can be more volatile. Despite a strong presence at major airports, it does not capture as large a segment as local usage, which is more consistent throughout the year.

Outstation travel, where customers rent vehicles for longer trips, also has a notable share but is more seasonal. It peaks during holidays and vacation periods when families and tourists rent cars for road trips and vacations. The Others category represents niche use cases, including corporate rentals, but it does not have the same widespread adoption as the core segments.

Key Market Segments

By Booking Mode

- Online

- Offline

By Vehicle

- Economy cars

- Luxury cars

- Executive cars

- SUVs

- MUVs

By Application

- Local usage

- Airport transport

- Outstation

- Others

Drivers

Increasing Domestic and International Travel Boosts Car Rental Demand

The U.S. car rental market has seen significant growth in recent years, driven by increasing domestic and international travel. The post-pandemic recovery in tourism and business travel has played a pivotal role in boosting demand for rental cars.

Many travelers, both from within the U.S. and abroad, prefer renting cars as it offers flexibility and convenience, especially for trips where public transportation may not be as accessible or reliable. Car rentals provide an essential mode of transportation for tourists who wish to explore different parts of the country, whether for leisure or business purposes.

International visitors, particularly those from countries with lower availability of rental vehicles or different driving conditions, often turn to car rentals as a more familiar and comfortable transportation option during their stay.

Additionally, the rise of short-term travel and weekend getaways has increased the need for rental cars, as people are looking for temporary and affordable alternatives to owning a vehicle. This ongoing trend is expected to continue, as both domestic and international travel is likely to remain strong, ensuring that car rental agencies see sustained demand in the coming years.

Restraints

Rising Fuel Prices Impact Car Rental Demand

Rising fuel prices have become a significant challenge for the U.S. car rental market. As fuel costs continue to rise, rental agencies face increased operational expenses, which are often passed on to customers in the form of higher rental prices.

For consumers, this added cost may make car rentals less appealing, particularly during times of economic uncertainty when people are more budget-conscious. Fuel costs represent a substantial part of the total cost of renting a car, especially for long trips, and high fuel prices may deter some customers from choosing rental cars altogether.

In response to this issue, rental companies may begin offering more fuel-efficient or hybrid vehicles to attract customers looking to save on fuel. However, despite these efforts, the overall impact of higher fuel prices can still discourage rental car demand.

Consumers may consider alternative transportation options, such as ride-hailing services, public transit, or even flying instead of renting a car for long-distance travel. Additionally, rising fuel prices can also lead to reduced demand for larger, less fuel-efficient vehicles like SUVs and trucks. The combination of higher fuel costs and changing consumer preferences could influence how rental agencies manage their fleets and pricing strategies in the future.

Growth Factors

Electric Vehicle (EV) Rentals Provide New Growth Potential

Electric vehicle (EV) rentals offer a promising growth opportunity in the U.S. car rental market. As the demand for sustainable and eco-friendly transportation options increases, many consumers are seeking ways to reduce their carbon footprint.

Car rental companies are recognizing this shift in consumer preferences and are increasingly adding electric vehicles to their fleets to meet the demand for greener travel options. Offering EVs for rent not only aligns with growing environmental concerns but also provides a competitive advantage for rental agencies.

The U.S. government’s push for electric vehicle adoption, through tax incentives and infrastructure investments like EV charging stations, further supports the transition to electric fleets. EV rentals are particularly attractive to eco-conscious travelers who may not have access to electric vehicles at home but wish to experience them during their travels.

Additionally, some cities have introduced policies to encourage electric vehicle usage, such as reduced tolls and access to high-occupancy vehicle lanes, further enhancing the appeal of renting an EV. As consumers continue to prioritize sustainability, the demand for EV rentals is expected to rise, presenting a significant growth opportunity for rental agencies.

By diversifying their fleet to include electric vehicles, car rental companies can stay ahead of the curve and attract a broader customer base interested in eco-friendly transportation solutions.

Emerging Trends

The Rise of Autonomous Vehicles Could Shape Future Rentals

The rise of autonomous vehicles (AVs) presents a fascinating development in the car rental industry. As the technology behind self-driving cars continues to evolve, car rental companies are beginning to explore the potential of offering autonomous vehicles to customers.

Autonomous vehicles have the potential to revolutionize the rental experience by allowing passengers to sit back and relax, eliminating the need for a driver to control the vehicle. This could be particularly appealing for customers who want a more convenient and hands-free transportation option, whether for long road trips or commuting in urban areas.

The development of autonomous vehicles could also streamline the rental process, with customers being able to easily book and access self-driving cars without the need to interact with rental staff.

Although AV technology is still in its early stages, car rental agencies are closely monitoring its progress and exploring how it could be integrated into their fleets in the future. The rise of autonomous vehicles could also lead to the creation of new services, such as “driverless car rentals” for corporate clients or tourists who want an innovative and futuristic travel experience.

As autonomous vehicles become more widespread and the technology matures, the car rental market could undergo a dramatic transformation, offering more personalized, efficient, and seamless transportation options for consumers.

Key Players Analysis

In 2024, the U.S. car rental market continues to evolve, with several key players shaping its trajectory. Among these, Hertz Corporation stands out as a dominant force, maintaining a stronghold in the traditional car rental space. Known for its extensive fleet and nationwide presence, Hertz continues to cater to a diverse clientele, ranging from business travelers to vacationers.

Avis Budget Group remains a significant player in the market, with its strong portfolio of brands like Avis, Budget, and Zipcar. While it has faced pressures such as higher operational costs and increased vehicle depreciation, the company has been working to refine its customer experience and introduce innovative pricing models.

Europcar, with its international roots, has been making inroads into the U.S. market by focusing on offering a range of vehicles that appeal to different customer needs. Its recent expansion into key U.S. cities signals its intention to capture a larger share of the rental market, especially as it seeks to attract international travelers.

Turo, a disruptor in the market, has continued its rapid growth by enabling car owners to rent out their personal vehicles through its platform. Turo’s innovative business model appeals to customers seeking more personalized and flexible rental options, particularly in urban areas.

Sixt has focused on premium service offerings and expanding its U.S. footprint, particularly in high-demand urban centers. Its reputation for high-quality vehicles and superior customer service has helped it grow in a competitive environment. As the market increasingly values both luxury and convenience, Sixt’s ability to offer tailored experiences positions it well for continued success.

Midway Car Rental, while smaller than the giants like Hertz and Avis, has carved out a niche by catering to customers who are looking for more exotic and luxury vehicles. This focus on premium rentals allows Midway to target a high-end market segment that is willing to pay a premium for an upscale experience.

Getaround, though a key player in the car-sharing space, has faced challenges in 2024 due to liquidity issues. Despite its innovative approach to peer-to-peer car rentals, Getaround has struggled to maintain its U.S. Operations.

Top Key Players in the Market

- Fox Rent A Car

- Europcar

- Turo

- Hertz Corporation

- Dollar

- Avis Budget Group

- Getaround

- Midway Car Rental

- Sixt

Recent Developments

- In February 2025, a car rental firm’s funding exceeds £1 million after experiencing a remarkable threefold growth in its revenue, demonstrating strong market demand and financial potential.

- In February 2025, Finalrentals secures a six-figure pre-series A funding round to accelerate the development of its AI-powered car rental platform, aiming to enhance customer experience and operational efficiency.

- In January 2026, SIXT and Stellantis reach a strategic agreement for the purchase of up to 250,000 vehicles, a move designed to fuel SIXT’s global expansion plans and increase its fleet capacity across multiple markets.

Report Scope

Report Features Description Market Value (2024) USD 37.9 Billion Forecast Revenue (2034) USD 78.8 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Booking Mode (Online, Offline), By Vehicle (Economy cars, Luxury cars, Executive cars, SUVs, MUVs), By Application (Local usage, Airport transport, Outstation, Others) Competitive Landscape Fox Rent A Car, Europcar, Turo, Hertz Corporation, Dollar, Avis Budget Group, Getaround, Midway Car Rental, Sixt Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Fox Rent A Car

- Europcar

- Turo

- Hertz Corporation

- Dollar

- Avis Budget Group

- Getaround

- Midway Car Rental

- Sixt