UK Serviced Apartment Market Size, Share, Growth Analysis By Lease Duration (Long-Term (More Than 30 Nights), Short-Term (Less Than 30 Nights)), By Booking Mode (Online Travel Agencies, Direct Booking, Corporate Contracts), By End Use (Corporate/Business Traveler, Leisure Travelers, Expats and Relocators), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159721

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

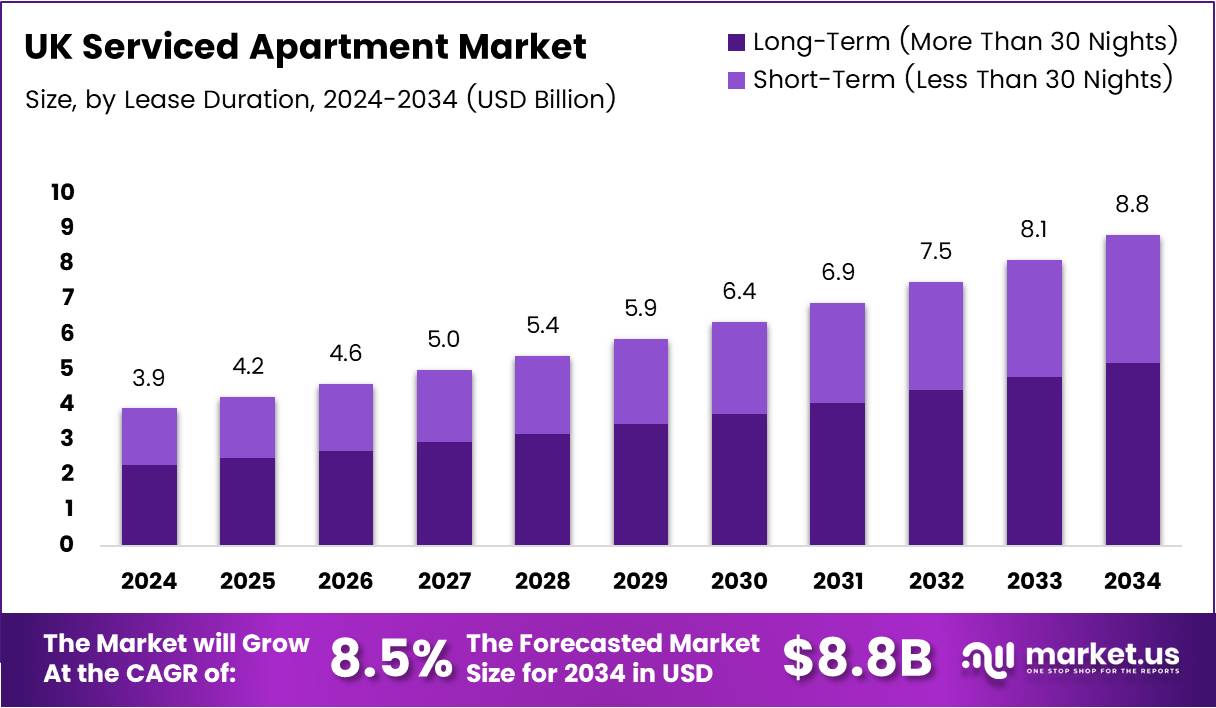

The UK Serviced Apartment Market size is expected to be worth around USD 8.8 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 8.5% during the forecast period from 2025 to 2034.

The UK serviced apartment market has witnessed substantial growth over the past few years, driven by increasing demand for flexible accommodation solutions. These apartments cater to both short-term and long-term stays, making them ideal for business travelers, tourists, and relocating professionals. As preferences shift toward more homely environments, serviced apartments are becoming the preferred choice.

The market is expected to grow further due to the rising demand from corporate travelers and the flourishing tourism sector. Business travel continues to be a significant driver, with serviced apartments offering an alternative to traditional hotels, providing both comfort and convenience. Moreover, relocating professionals seek flexible living options, contributing to the growing popularity of serviced apartments.

Government investments in the hospitality sector are expected to boost market growth. Initiatives to promote tourism and business travel are likely to increase demand for serviced apartments in urban centers. Moreover, regulatory changes may positively impact the market by introducing frameworks that ensure higher standards and greater consistency across serviced apartment providers.

According to industry reports, the average daily rate of serviced apartments in the UK is £208.80, reflecting their value in the market. Business travel represents a significant portion of the customer base, accounting for 45% of serviced apartment guests. Additionally, tourists and relocating professionals represent 27% and 23%, respectively, contributing to the overall demand for these services.

Key Takeaways

- The UK Serviced Apartment Market is expected to reach USD 8.8 Billion by 2034, growing at a CAGR of 8.5% from USD 3.9 Billion in 2024.

- In 2024, Long-Term (More Than 30 Nights) dominated the By Lease Duration segment with a 58.9% share.

- Online Travel Agencies held the largest share in the By Booking Mode segment, with a 45.8% share in 2024.

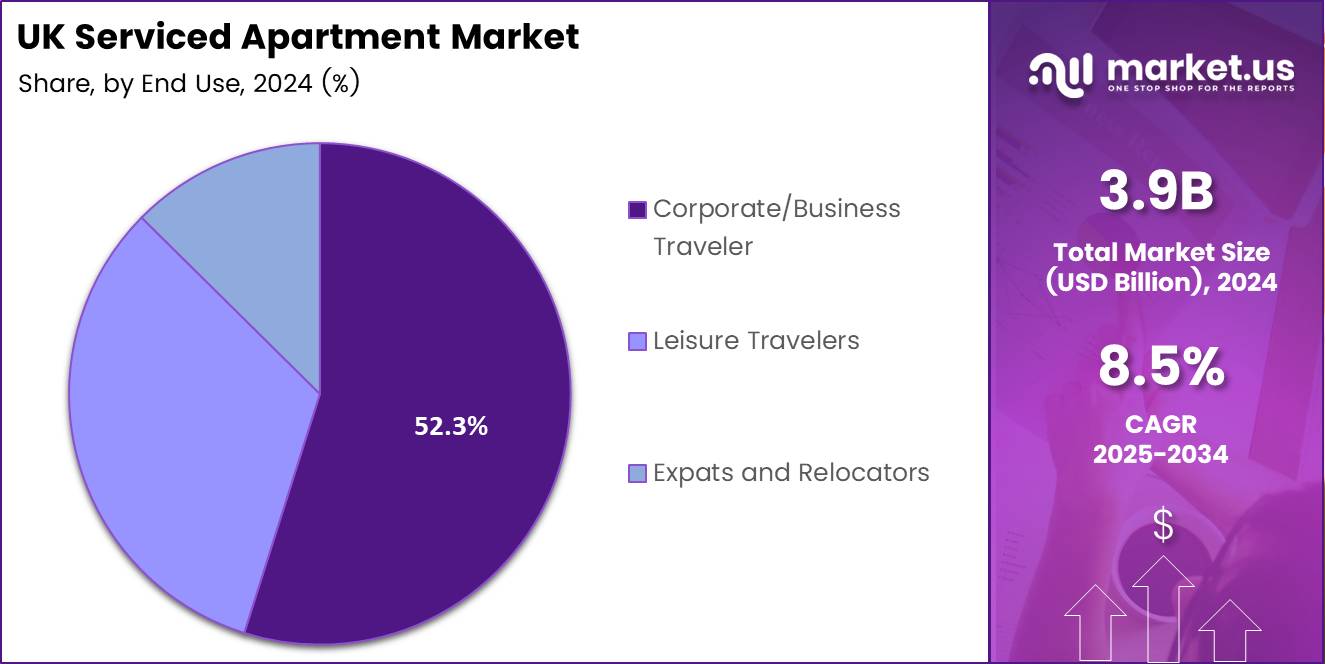

- Corporate/Business Travelers accounted for 52.3% of the market share in the By End Use segment in 2024.

By Lease Duration Analysis

Long-Term Dominates with a Market Share of 58.9%

In 2024, Long-Term (More Than 30 Nights) held a dominant market position in the By Lease Duration Analysis segment of UK Serviced Apartment Market, with a 58.9% share. The long-term stay segment is experiencing significant demand, as it caters to business travelers and relocating professionals. These stays often provide more flexibility and cost savings, contributing to their growing share.

Short-Term (Less Than 30 Nights) remains a competitive sub-segment, though it holds a smaller market share. Short-term stays are primarily popular among leisure travelers and those looking for temporary accommodation. Despite the growth in long-term stays, short-term options remain essential for business and tourist trips.

By Booking Mode Analysis

Online Travel Agencies Dominates with a Market Share of 45.8%

In 2024, Online Travel Agencies held a dominant market position in the By Booking Mode Analysis segment of UK Serviced Apartment Market, with a 45.8% share. The convenience and reach of online travel platforms contribute significantly to their leadership in bookings. They offer a broad range of serviced apartments, with easy comparison and booking options, making them a top choice for travelers.

Direct Booking through service providers offers more personalized experiences and often better rates. Many travelers prefer booking directly, as it can provide additional benefits such as flexible cancellation policies and loyalty rewards, further enhancing customer satisfaction.

Corporate Contracts have been growing steadily, particularly with companies seeking extended stays for employees on projects. While this sub-segment remains smaller than the others, its growth is supported by the rising demand for corporate housing solutions, ensuring business continuity during long-term assignments.

By End Use Analysis

Online Travel Agencies Dominates with a Market Share of 45.8%

In 2024, Corporate/Business Traveler held a dominant market position in the By End Use Analysis segment of UK Serviced Apartment Market, with a 52.3% share. The increasing demand for flexible, long-term accommodation for business professionals contributes to the growth of this segment. Corporate travelers often choose serviced apartments for their home-like comforts, making them ideal for extended stays.

Leisure Travelers remain a significant portion of the serviced apartment market, with families and individuals preferring these accommodations for their spaciousness and affordability. This sub-segment continues to grow, supported by the increasing trend of staycations and the desire for comfortable, independent travel experiences.

Expats and Relocators make up a smaller, but still important, market segment. The demand for serviced apartments from expatriates and professionals on assignment continues to rise, as they require flexible and fully furnished housing options. Many individuals relocating for work prefer serviced apartments for their convenience and comprehensive services.

Key Market Segments

By Lease Duration

- Long-Term (More Than 30 Nights)

- Short-Term (Less Than 30 Nights)

By Booking Mode

- Online Travel Agencies

- Direct Booking

- Corporate Contracts

By End Use

- Corporate/Business Traveler

- Leisure Travelers

- Expats and Relocators

Drivers

Increasing Demand for Flexible Accommodation Options Drives UK Serviced Apartment Market Growth

The UK serviced apartment market is experiencing strong growth due to rising demand for flexible living solutions. Modern travelers and business professionals prefer accommodations that offer home-like comfort with hotel-style services. This trend reflects changing lifestyle preferences where people value space, privacy, and convenience.

Business and leisure travel continues to expand across the UK, creating steady demand for serviced apartments. Corporate travelers especially appreciate the additional space and amenities compared to traditional hotels. These properties offer meeting areas, kitchens, and separate living spaces that enhance productivity and comfort during extended stays.

Long-term stay preferences are becoming more popular among various customer segments. Professionals on temporary assignments, students, and individuals relocating for work find serviced apartments more suitable than hotels for extended periods. The cost-effectiveness and homely environment make them attractive for stays lasting weeks or months.

The growing trend of relocation and project-based work significantly boosts market demand. Companies increasingly deploy employees to different locations for specific projects, creating consistent need for temporary housing solutions. Serviced apartments provide the perfect balance of professional amenities and personal comfort for these work arrangements.

Restraints

Stringent Regulations in the Hospitality Industry Create Challenges for Market Growth

The UK serviced apartment market faces significant challenges from strict hospitality industry regulations. Operators must comply with complex licensing requirements, safety standards, and local planning permissions. These regulatory hurdles increase operational costs and create barriers for new market entrants seeking to establish serviced apartment businesses.

Competition from alternative accommodation providers like Airbnb presents ongoing challenges for traditional serviced apartment operators. These platforms offer similar flexibility and often at lower prices, attracting cost-conscious travelers. The ease of booking and variety of options available through these platforms creates pressure on established serviced apartment providers to differentiate their offerings.

Economic uncertainty significantly impacts business travel budgets, affecting demand for serviced apartments. During economic downturns, companies reduce travel expenses and opt for cheaper accommodation alternatives. This creates revenue volatility for operators who depend heavily on corporate clients for sustained bookings and long-term contracts.

Market operators also face challenges from changing consumer expectations and increased competition within the hospitality sector. The need to constantly upgrade facilities, maintain competitive pricing, and provide exceptional service levels requires substantial investment. These factors combine to create operational pressures that can limit market growth and profitability for serviced apartment providers.

Growth Factors

Expansion in Key Metropolitan Areas Presents Significant Growth Opportunities

The UK serviced apartment market offers substantial growth potential through expansion in major metropolitan areas. Cities like London, Manchester, Birmingham, and Edinburgh show strong demand for flexible accommodation solutions. These urban centers attract business travelers, international visitors, and professionals requiring temporary housing, creating consistent market opportunities for operators.

Rising demand from international travelers creates excellent growth prospects for the serviced apartment sector. Post-pandemic recovery in international tourism and business travel drives increased bookings. Foreign visitors often prefer serviced apartments for longer stays, appreciating the additional space and local living experience compared to traditional hotels.

The corporate housing sector presents significant expansion opportunities as companies increasingly adopt flexible working arrangements. Organizations require accommodation solutions for relocated employees, project teams, and temporary assignments. This growing corporate demand provides stable revenue streams and long-term partnership opportunities for serviced apartment providers.

Increasing partnerships with online travel agencies (OTAs) open new distribution channels and customer reach. These collaborations help operators access broader markets and compete effectively with alternative accommodation providers. OTA partnerships also provide valuable booking data and marketing insights that help optimize pricing strategies and improve occupancy rates across serviced apartment portfolios.

Emerging Trends

Integration of Smart Technologies in Serviced Apartments Shapes Market Trends

Smart technology integration is transforming the UK serviced apartment market, with operators adopting advanced systems to enhance guest experiences. Properties now feature keyless entry, automated check-in processes, and smartphone-controlled room amenities. These technological improvements streamline operations while providing guests with convenient, modern accommodation experiences that meet contemporary expectations.

Sustainability practices are gaining significant traction among serviced apartment providers as environmental consciousness grows. Operators implement energy-efficient systems, renewable energy sources, and eco-friendly amenities to attract environmentally aware travelers. These green initiatives not only reduce operational costs but also appeal to corporate clients with sustainability mandates and environmentally conscious individual guests.

Service customization for niche customer segments represents a growing trend in the market. Operators develop specialized offerings for specific groups such as business travelers, families, digital nomads, and healthcare professionals. This targeted approach allows providers to command premium pricing while meeting unique customer needs through tailored amenities and services.

The increasing focus on wellness and health-conscious accommodations reflects changing traveler priorities. Serviced apartments now incorporate fitness facilities, healthy dining options, air purification systems, and wellness programs. This trend responds to growing awareness of health and wellbeing, particularly following the pandemic, as guests seek accommodations that support their physical and mental wellness during stays.

Key UK Serviced Apartment Company Insights

In 2024, SACO – The Serviced Apartment Company continues to be a prominent player in the UK serviced apartment market. With a strong focus on providing high-quality accommodation for both short and long stays, SACO has maintained its competitive edge by expanding its portfolio in key UK cities, ensuring high occupancy rates and consistent demand from business and leisure travelers.

Staycity Ltd has carved a niche by combining hotel-like amenities with the flexibility of serviced apartments. It is focusing on strategic expansion, particularly in London and other major UK cities, attracting both international tourists and corporate clients looking for cost-effective, high-quality alternatives to traditional hotels.

Marlin Apartments is recognized for its focus on offering stylish and spacious apartments for both short and long stays. The company’s diverse offerings in central London cater to tourists, business travelers, and relocating professionals. Marlin’s commitment to customer satisfaction and luxury makes it a strong competitor in the serviced apartment space.

The Ascott Limited has built a significant presence in the UK market by offering an extensive range of serviced apartments under multiple brands, including Citadines and Somerset. The company’s strong brand recognition and its focus on providing excellent service continue to drive its growth, particularly in high-demand urban locations in the UK.

Top Key Players in the Market

- SACO – The Serviced Apartment Company

- Staycity Ltd

- Marlin Apartments

- The Ascott Limited

- Supercity Aparthotels

- SilverDoor Apartments

- Fraser Suites

- Cheval Collection

- Staybridge Suites

- Clarendon Serviced Apartments

Recent Developments

- In July 2024, NUMA Group acquired Native Places, a UK-based serviced apartment operator, significantly expanding its portfolio to over 7,300 units across Europe, marking a strategic move to strengthen its position in the European market.

- In July 2024, the 75-unit Native Bankside property in London was sold to Jastar Capital for €46.7 million, underscoring the growing investor confidence in the serviced apartment sector amid robust demand for flexible accommodation options.

- In May 2024, the 106-unit Aparthotel Adagio in Stratford was sold to Stratford 42 Celebration Avenue Ltd for €37.7 million, reflecting the strong interest and healthy investment activity in the serviced apartment market, particularly in London.

- In April 2024, Radisson announced plans for its first UK serviced apartment in Glasgow, featuring luxury studios and one-bedroom apartments, with the property set to open in 2027, contributing to the expanding serviced apartment offerings in the UK.

- In February 2024, Ascott Limited launched ‘Cubby’, a generative AI-powered chatbot, at properties in the UK to enhance customer service and operational efficiency, positioning the company at the forefront of innovation in the serviced apartment sector.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 8.8 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Lease Duration (Long-Term (More Than 30 Nights), Short-Term (Less Than 30 Nights)), By Booking Mode (Online Travel Agencies, Direct Booking, Corporate Contracts), By End Use (Corporate/Business Traveler, Leisure Travelers, Expats and Relocators) Competitive Landscape SACO – The Serviced Apartment Company, Staycity Ltd, Marlin Apartments, The Ascott Limited, Supercity Aparthotels, SilverDoor Apartments, Fraser Suites, Cheval Collection, Staybridge Suites, Clarendon Serviced Apartments Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  UK Serviced Apartment MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

UK Serviced Apartment MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SACO - The Serviced Apartment Company

- Staycity Ltd

- Marlin Apartments

- The Ascott Limited

- Supercity Aparthotels

- SilverDoor Apartments

- Fraser Suites

- Cheval Collection

- Staybridge Suites

- Clarendon Serviced Apartments