Global Boutique Hotel Market By Type (Luxury, Mid-Scale, Budget), By Traveler Type (Leisure Travelers, Business Travelers, Others), By Booking Mode (Direct Booking, Travel Agents, Online Travel Agencies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139434

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Boutique Hotel Market size is expected to be worth around USD 50.5 Billion by 2034, from USD 25.2 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

Boutique hotels are characterized by their unique, stylish design, personalized services, and smaller-scale operations, typically offering an intimate, high-end experience. Unlike larger chain hotels, boutique establishments often focus on providing an individualized guest experience, with a strong emphasis on aesthetics, local culture, and luxury.

The market for boutique hotels has evolved rapidly over the last decade as both business and leisure travelers seek unique, personalized accommodations. As consumer preferences have shifted toward experiences over standardized offerings, boutique hotels are positioned as a desirable alternative to conventional large hotels. This segment is particularly popular in urban locations, high-tourism areas, and luxury resorts.

According to a report by Tandfonline, the majority of boutique hotel stays are driven by leisure and vacation purposes (88.9%), which speaks to the growing demand for personalized and immersive experiences. In addition, the rising disposable income of the middle and upper-class demographic, along with a shift in travel behavior toward experiential tourism, provides a solid foundation for the expansion of the boutique hotel market.

The boutique hotel market is currently experiencing strong growth driven by changing consumer preferences and the desire for differentiated, high-quality experiences. As of 2023, boutique hotels have become a strong competitor to traditional large hotel chains, with notable growth particularly in emerging markets. In India, for example, the branded and organized hotel sector saw a nationwide occupancy rate of 67.5% in 2023-2024, marking the highest level in a decade, according to USDA.

In the U.S., approximately 72% of hotel rooms were brand-affiliated in 2023, according to the SEC, showing a high penetration of organized hotels in the market. While this is indicative of the established dominance of larger hotel chains, boutique hotels are capitalizing on the demand for more individualized travel experiences.

Government support in the form of infrastructure investment and tourism promotion is also critical to the sector’s growth. Many countries are actively investing in their tourism sectors, creating favorable environments for boutique hotels to thrive.

The continued growth of the boutique hotel market hinges on maintaining high standards of service, adapting to regulatory changes, and leveraging consumer trends toward authenticity and uniqueness. As the market matures, boutique hotels are poised to capitalize on these factors to further solidify their presence in the global hospitality landscape.

Key Takeaways

- The global boutique hotel market is projected to reach USD 50.5 billion by 2034, growing at a 7.2% CAGR from 2025 to 2034.

- The luxury segment will continue to dominate the boutique hotel market, holding 53.2% of the market share in 2024.

- Leisure travelers make up 70.2% of the boutique hotel market by traveler type, reflecting demand for unique, personalized experiences.

- Direct booking accounts for 41.2% of the boutique hotel market, driven by traveler preference for personalized services and better rates.

- North America leads the boutique hotel market with a 37.2% share, generating USD 9.3 billion in revenue in 2024.

Type Analysis

Luxury Segment Leads Boutique Hotel Market with 53.2% Share in 2024, Driven by Premium Experience Demand

In 2024, the luxury segment commanded a dominant position in the Boutique Hotel Market, capturing a substantial 53.2% share of the total market. This growth is attributed to the increasing demand for personalized, high-end experiences, with affluent travelers seeking exclusive accommodations, unparalleled services, and premium amenities.

Luxury boutique hotels continue to thrive by offering bespoke services, unique architectural styles, and curated guest experiences that resonate with their high-net-worth clientele.

The mid-scale segment, holding a notable share of the market, benefits from the growing number of travelers seeking high-quality but more affordable alternatives. These hotels offer a balanced blend of comfort, style, and value, appealing to both business and leisure travelers looking for an upscale experience without the premium price tag.

Meanwhile, the budget segment remains significant, appealing to cost-conscious consumers who prioritize affordability while still seeking the charm and individuality often associated with boutique properties. Though smaller in share compared to luxury and mid-scale, budget boutique hotels cater to a large volume of guests, capitalizing on the growing trend of value-driven, experiential travel.

The distribution of market share across these segments underscores the diverse consumer preferences shaping the boutique hotel industry.

Traveler Type Analysis

Leisure Travelers Drive Boutique Hotel Market with 70.2% Share in 2024, Reflecting Shift Toward Experiential Travel

In 2024, leisure travelers accounted for a dominant 70.2% share in the By Traveler Type segment of the Boutique Hotel Market, highlighting the growing preference for unique and personalized travel experiences.

As consumers increasingly seek off-the-beaten-path destinations and accommodations that offer distinctive, immersive stays, boutique hotels have become the top choice for vacationers. These properties cater to leisure travelers by offering intimate atmospheres, custom-tailored services, and local cultural experiences that larger hotel chains often lack, driving the surge in demand.

Business travelers, while a significant market, hold a smaller share in comparison, as their priorities lean more toward convenience, amenities, and location rather than the boutique experience. However, boutique hotels catering to business needs are focusing on offering flexible workspaces, high-speed internet, and seamless service, appealing to this group by blending professional efficiency with personalized touches.

The Others category, comprising a mix of various niche traveler types, contributes to a smaller portion of the market. This includes group travelers, special-interest tourists, and those seeking specific themes or activities. While not as large as leisure and business segments, the diverse demands from this group continue to influence the broader boutique hotel market, promoting innovation in services and offerings.

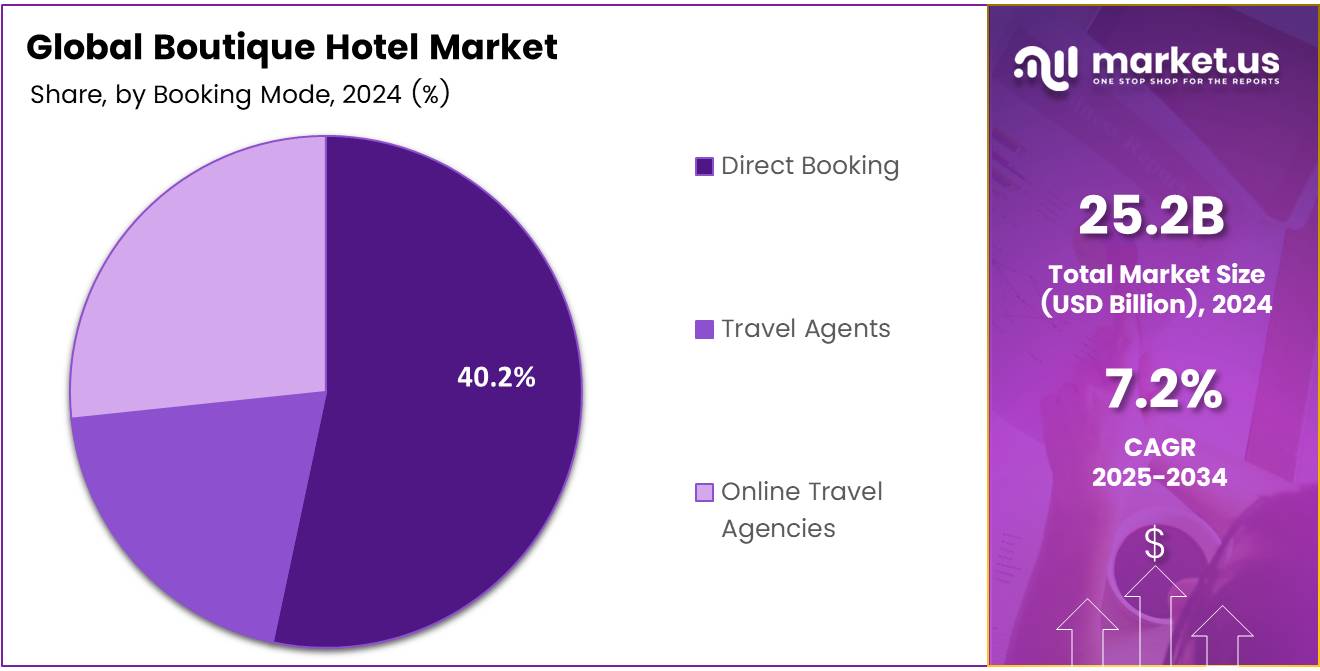

Booking Mode Analysis

Direct Booking Dominates Boutique Hotel Market with 41.2% Share in 2024, Reflecting Consumer Preference for Control and Personalization

In 2024, direct booking held a dominant 41.2% share in the By Booking Mode segment of the Boutique Hotel Market, underscoring the increasing preference among travelers for booking directly with hotels. This trend is driven by the desire for personalized experiences, better rates, and exclusive offers that are often available only through direct channels.

Boutique hotels, with their focus on delivering unique and tailored services, benefit from the direct interaction with guests, fostering stronger customer relationships and loyalty.

Travel agents, while still relevant in the market, account for a smaller share compared to direct bookings and online travel agencies (OTAs). Although travel agents provide convenience and expert recommendations, particularly for high-end or complex itineraries, the rise of online platforms and digital resources has shifted some of the demand away from traditional booking methods.

Online Travel Agencies (OTAs) also play a crucial role, holding a significant portion of the market. OTAs provide a convenient platform for travelers to compare prices and find deals across a wide range of boutique hotel options. However, the growing trend of direct booking is slowly eroding OTA dominance, as more travelers seek to bypass intermediaries in favor of more direct, personalized interactions.

This distribution highlights the evolving dynamics of the boutique hotel booking process, with consumers increasingly valuing direct engagement and exclusive benefits.

Key Market Segments

By Type

- Luxury

- Mid-Scale

- Budget

By Traveler Type

- Leisure Travelers

- Business Travelers

- Others

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

Drivers

Rising Demand for Unique Travel Experiences Drives Growth in Boutique Hotel Market

The boutique hotel market is experiencing significant growth, fueled by the increasing demand for unique, personalized travel experiences. As travelers seek to explore off-the-beaten-path destinations, boutique hotels are well-positioned to cater to these preferences, offering one-of-a-kind stays that reflect the local culture and environment.

The rise of Millennial and Gen Z travelers further drives this trend, as younger generations gravitate toward hotels with distinctive designs, vibrant atmospheres, and Instagram-worthy aesthetics. Additionally, the ongoing growth in luxury travel is contributing to the market’s expansion, with high-end boutique hotels offering a more exclusive and tailored alternative to larger, impersonal luxury chains.

Many boutique hotels are also gaining favor for their commitment to sustainability and eco-friendly practices, attracting environmentally conscious guests. From energy-efficient technologies to the use of locally sourced materials, these green initiatives not only align with travelers’ values but also enhance the appeal of boutique hotels.

Restraints

Competition from Alternative Accommodation Providers Poses Challenges to Boutique Hotels

Despite the growth of the boutique hotel market, several factors are acting as restraints, limiting its potential. One major challenge is the rising competition from alternative accommodation providers like Airbnb and VRBO.

These platforms allow travelers to book unique, personalized stays in private homes or apartments, often at lower prices compared to boutique hotels. As these platforms continue to grow in popularity, they offer more flexible, cost-effective options for travelers, which can draw attention away from boutique hotels.

Another significant restraint comes from economic downturns, which can directly impact the travel industry. During periods of financial uncertainty or economic slowdowns, consumers tend to cut back on discretionary spending, including travel.

This reduces the number of travelers willing to invest in the premium pricing typically associated with boutique hotels. While boutique hotels often offer superior service and unique experiences, their higher costs compared to mainstream accommodations can be a barrier during times when people are more cautious with their spending.

As a result, boutique hotel owners and operators need to continuously find ways to differentiate themselves and maintain appeal in an increasingly competitive and price-sensitive market. These challenges, along with the unpredictability of the global economy, could impact the growth trajectory of the boutique hotel market moving forward.

Growth Factors

Expansion into Emerging Markets Creates Growth Opportunities for Boutique Hotels

The boutique hotel market holds significant growth opportunities, particularly through expansion into emerging markets. Regions such as Southeast Asia, Latin America, and Eastern Europe are seeing an increase in both international and local tourism, which is driving demand for unique, personalized accommodations. As these regions continue to grow in popularity among travelers, boutique hotels can capitalize on this trend by offering distinctive and locally-inspired experiences.

Another key growth area is the rise of wellness tourism, where boutique hotels can attract health-conscious travelers by offering wellness-focused services like yoga retreats, saunas, and organic dining options. This trend reflects a broader shift towards self-care and mindfulness, making it an ideal opportunity for boutique hotels to diversify their offerings.

Additionally, the integration of smart technology presents an exciting opportunity to enhance the guest experience and appeal to the tech-savvy traveler. Features like voice-activated assistants, app-based check-ins, and in-room automation can create a more seamless and convenient stay, further differentiating boutique hotels from traditional options.

Finally, a focus on sustainable design and eco-tourism presents a chance for boutique hotels to appeal to environmentally-conscious tourists. By incorporating sustainable materials, renewable energy sources, and zero-waste policies, these hotels can align with growing consumer preferences for eco-friendly travel. Together, these opportunities offer avenues for boutique hotels to expand their market presence and meet the evolving demands of modern travelers.

Emerging Trends

Instagrammable Design Becomes Key Trend in the Boutique Hotel Market

The boutique hotel market is seeing a surge in popularity due to several key trends that appeal to modern travelers. One of the most significant is the focus on Instagrammable design, where the aesthetic appeal of a hotel plays a central role in attracting guests.

With social media platforms like Instagram driving travel decisions, travelers are increasingly seeking hotels that are visually stunning and provide photo-worthy moments. This trend has led many boutique hotels to invest in unique, stylish designs that stand out and offer the perfect backdrop for social media content.

Another trend gaining traction is the integration of art and culture into the hotel experience. Many boutique hotels are showcasing local art, incorporating cultural elements, and using themed décor to provide guests with an immersive experience that connects them to the destination’s heritage.

Additionally, there is a growing focus on wellness and self-care, with services like spas, meditation rooms, and fitness centers becoming standard offerings in boutique hotels to cater to the health-conscious traveler. Finally, today’s travelers are prioritizing experience over traditional hotel amenities.

Instead of simply looking for basic services like pools and gyms, guests are seeking out more personalized and culturally rich experiences such as local food, community interactions, and tailored services. These trends reflect a broader shift in travel preferences, with guests valuing unique and memorable experiences more than traditional hotel comforts.

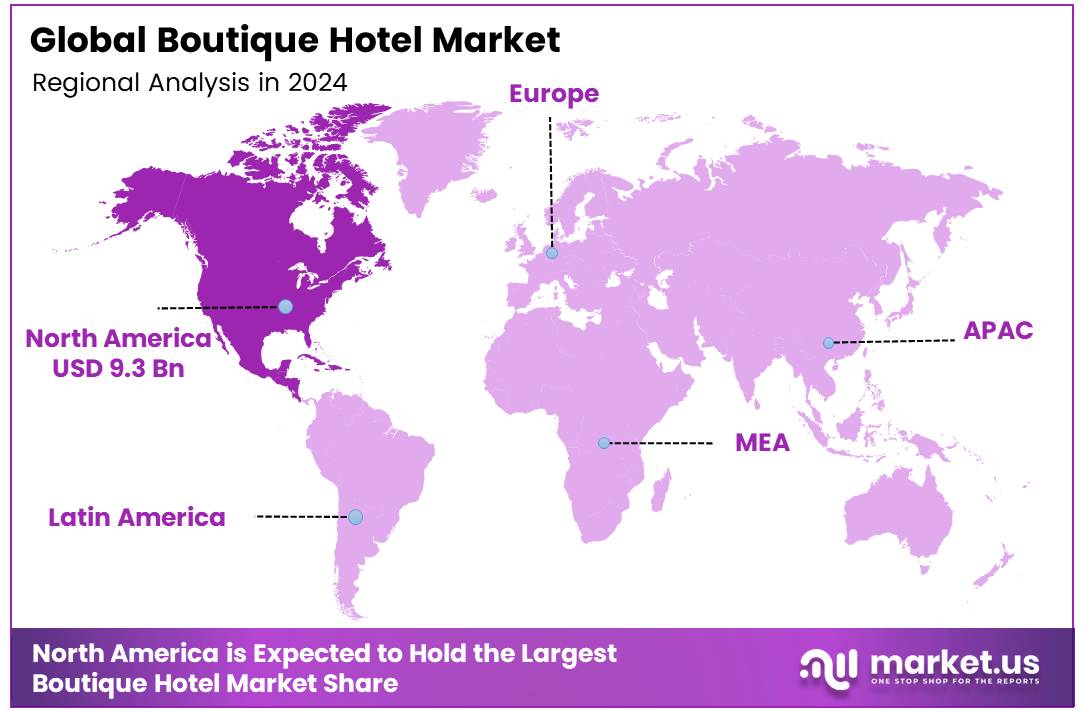

Regional Analysis

North America Leads Boutique Hotel Market with USD 9.3 Billion and 37.2% Share Driven by Rising Demand for Unique and Personalized Travel Experiences

The boutique hotel market is experiencing diverse growth across different regions, with North America leading the charge. Dominating the market with a 37.2% share, North America generates USD 9.3 billion in revenue.

This region benefits from high demand in cities such as New York, Los Angeles, and Miami, where boutique hotels cater to travelers seeking unique, personalized experiences. The growing preference for distinct, luxury accommodations combined with an increasing number of millennial travelers is propelling growth.

Regional Mentions:

In Europe, the market is characterized by steady demand, with countries like France, Italy, and the UK capitalizing on their cultural heritage and strong tourism sectors. The European boutique hotel market benefits from the region’s rich history and evolving consumer demand for immersive, locally inspired stays, which appeal to both regional and international visitors.

The Asia Pacific region is witnessing rapid expansion, driven by the increasing wealth of consumers in countries such as China, India, and Japan. With growing tourism and shifting preferences toward luxury and experiential travel, Asia Pacific is poised for significant growth in the boutique hotel sector.

In the Middle East & Africa, the market is gradually developing as both domestic and international travelers seek distinctive accommodations. The region’s increasing focus on tourism infrastructure and its appeal to luxury travelers contribute to this positive trend. Lastly, Latin America is experiencing a gradual rise in boutique hotel demand, particularly in key markets like Brazil and Mexico, where both international tourists and locals seek more authentic travel experiences.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global boutique hotel market in 2024 is poised for significant growth, driven by a rising demand for unique, personalized, and authentic travel experiences. Key players in this sector, such as Marriott International, The Standard Hotels, and Accor, continue to dominate the market with a blend of luxury, design, and bespoke guest experiences that cater to affluent and millennial travelers.

Marriott International leverages its extensive brand portfolio, integrating boutique-style hotels under brands like Autograph Collection and Tribute Portfolio, providing access to its vast global network while maintaining the individuality of boutique properties. Similarly, Accor enhances its footprint with brands like MGallery and 25hours, offering travelers a mix of locally inspired design and contemporary amenities, cementing its position in the growing boutique segment.

Innovative and niche brands such as The Hoxton, Soho Boutique Hoteles, and Joie de Vivre continue to focus on creating distinctive atmospheres, prioritizing art, design, and community-driven experiences, which appeal to the modern traveler. These brands are pivotal in shaping the perception of boutique hotels as spaces for immersive experiences rather than just accommodations.

Rosewood Hotel Group and Kimpton Hotels & Restaurants maintain a strong focus on luxury and exceptional service, ensuring high standards in design while promoting local culture, wellness, and culinary offerings to attract high-net-worth individuals.

With the rise of experiential tourism, these players are likely to continue innovating, enhancing their appeal by blending local authenticity with global standards, ensuring they remain at the forefront of the boutique hotel market in 2024.

Top Key Players in the Market

- Marriott International, Inc.

- The Standard Hotels

- Hotel Indigo

- Accor

- Rosewood Hotel Group

- Kimpton Hotels & Restaurants

- The Hoxton

- Soho Boutique Hoteles

- Ace Hotel

- Joie de Vivre

Recent Developments

- In March 2024, Brij Hotels successfully raised approximately USD 4 million in a Series-A funding round to expand its portfolio of luxury boutique properties. The investment aims to enhance its technology infrastructure and scale its brand presence globally.

- In July 2024, Hyatt was reportedly in advanced talks to acquire boutique hotel brand Standard International, signaling its strategic shift towards expanding its portfolio of lifestyle properties. This move reflects Hyatt’s ongoing focus on capturing the growing demand for upscale, experiential travel.

- In August 2024, Hyatt confirmed its acquisition of boutique hotel specialist Standard International, a deal that will add unique and stylish properties to its luxury collection. The acquisition aligns with Hyatt’s vision of diversifying its offerings to cater to changing consumer preferences in the hospitality market.

Report Scope

Report Features Description Market Value (2024) USD 25.2 Billion Forecast Revenue (2034) USD 50.5 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Luxury, Mid-Scale, Budget), By Traveler Type (Leisure Travelers, Business Travelers, Others), By Booking Mode (Direct Booking, Travel Agents, Online Travel Agencies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Marriott International, Inc., The Standard Hotels, Hotel Indigo, Accor, Rosewood Hotel Group, Kimpton Hotels & Restaurants, The Hoxton, Soho Boutique Hoteles, Ace Hotel, Joie de Vivre Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Marriott International, Inc.

- The Standard Hotels

- Hotel Indigo

- Accor

- Rosewood Hotel Group

- Kimpton Hotels & Restaurants

- The Hoxton

- Soho Boutique Hoteles

- Ace Hotel

- Joie de Vivre