Global Transdermal Patch Market By Type (Drug-in-Adhesive, Matrix and Other Types) By Application (Pain Relief, Smoking Reduction and Cessation Aid, Overactive Bladder, Hormonal Therapy and Other Applications) By End Use (Homecare Setting, Hospitals and Clinics) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Feb 2024

- Report ID: 15591

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

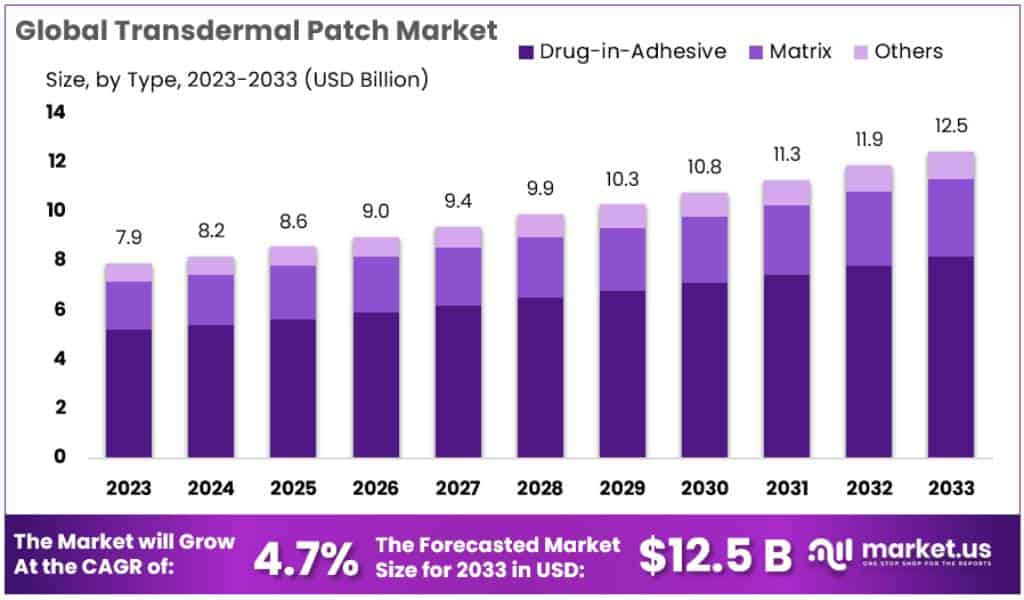

The Global Transdermal Patch Market size is expected to be worth around USD 12.5 Billion by 2033, from USD 7.9 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

A transdermal patch is a medicated adhesive patch that is placed on the skin to deliver a specific dose of medication through the skin and into the bloodstream. It provides a non-invasive and painless method of drug delivery, offering the benefit of a consistent therapeutic dosage over a predetermined time period.

Key Takeaways

- The Global Transdermal Patch Market is expected to reach approximately USD 12.5 Billion by the year 2033, a significant increase from its value of USD 7.9 Billion in 2023.

- This market is projected to experience a Compound Annual Growth Rate (CAGR) of 4.7% during the period from 2024 to 2033.

- In 2023, Drug-in-Adhesive patches held the majority of the market share, at over 65.9%, due to their simplicity and ease of use.

- The Pain Relief segment dominated the market, accounting for more than 65.9% of the share, in 2023.

- In 2023, the Homecare Setting was the leading end-use segment, with over 75.8% market share, driven by the preference for at-home treatments.

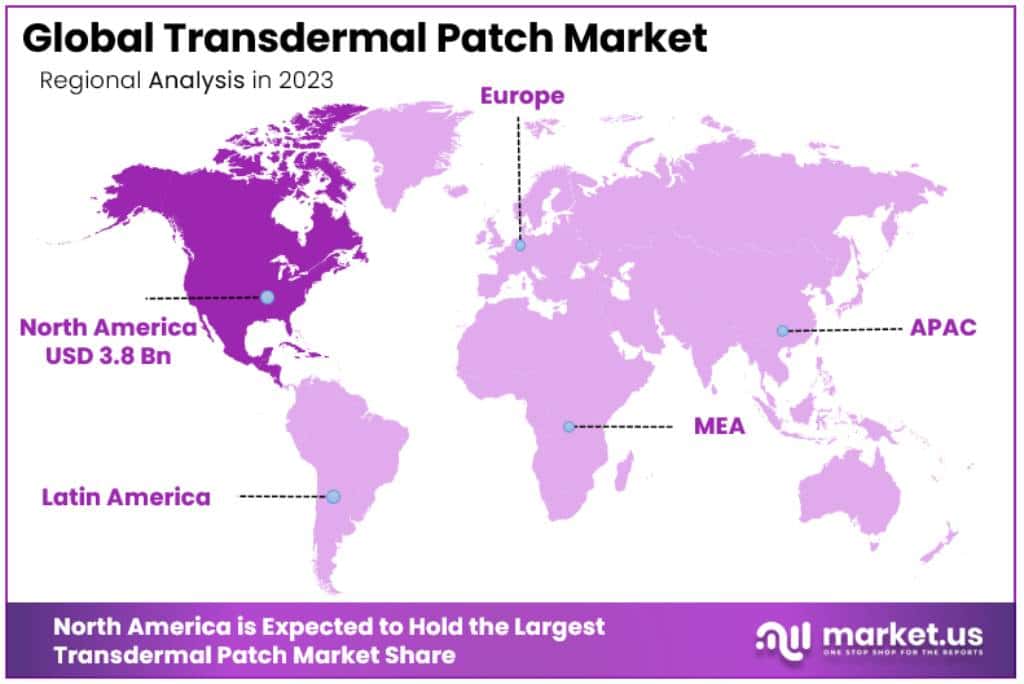

- North America led the market in 2023 with a 48.2% share, while the Asia-Pacific region showed rapid growth potential due to increasing chronic diseases and awareness of non-invasive treatments.

Type Analysis

In 2023, Drug-in-Adhesive held a dominant market position, capturing more than a 65.9% share. This segment’s strong performance is largely attributed to its straightforward design and ease of use. Drug-in-adhesive patches directly integrate the medication into the adhesive layer, simplifying the drug delivery system. This design minimizes complexities and enhances patient compliance, a crucial factor in the medical field.

The Matrix segment, while smaller in market share, presents significant growth potential. These patches employ a distinct approach where the drug is embedded in a polymer matrix. This design offers controlled release of medication, a key advantage for long-term treatments. The adaptability of this technology to various drugs broadens its applicability, potentially driving future market expansion.

Other types of transdermal patches, encompassing various innovative designs and mechanisms, collectively occupy a niche segment. This category includes reservoir patches and micro-needle patches, among others. While currently a smaller portion of the market, these types are gaining traction due to their advanced capabilities in drug delivery and targeted treatment. Continued innovation and technological advancements in this segment are expected to fuel its growth, catering to unmet medical needs and emerging therapeutic areas.

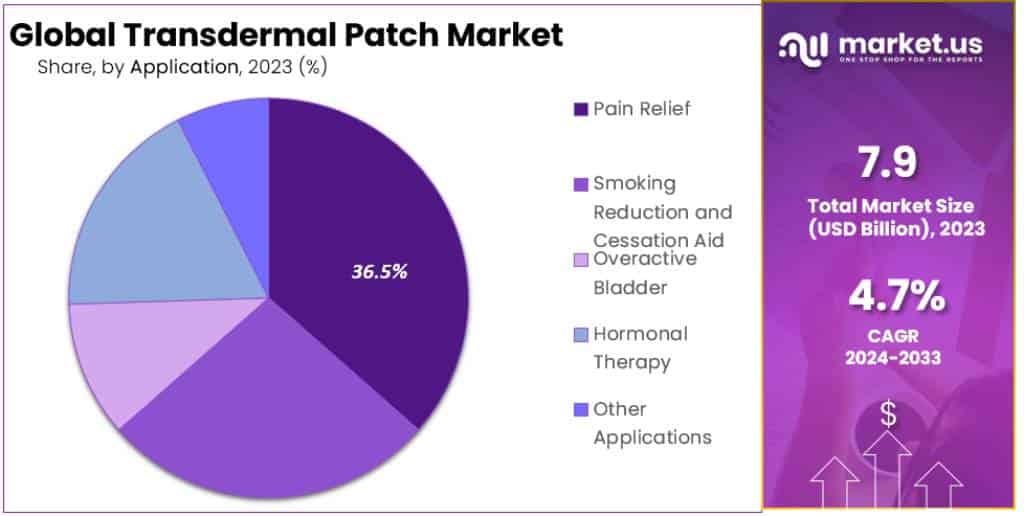

Application Analysis

In 2023, the Pain Relief segment held a dominant market position in the transdermal patch market, capturing more than a 65.9% share. This segment’s leading status is primarily driven by the increasing prevalence of chronic pain conditions and the growing preference for non-invasive pain management solutions. Transdermal patches in pain relief offer consistent, controlled drug delivery, providing extended pain management without the need for frequent dosing, which enhances patient convenience and compliance.

The Smoking Reduction and Cessation Aid segment also plays a crucial role in the market. These patches deliver nicotine in a controlled manner, helping individuals reduce their dependence on smoking. They are widely recognized for their effectiveness in managing withdrawal symptoms and are an integral tool in smoking cessation programs.

In the Overactive Bladder treatment category, transdermal patches provide a discreet and non-intrusive solution. They are particularly favored for their ability to administer medication efficiently, improving the quality of life for individuals dealing with bladder control issues.

Hormonal Therapy is another significant application for transdermal patches. These patches are used in various treatments, including contraception and menopause symptom management, offering a convenient and non-invasive method to administer hormones.

Other Applications of transdermal patches encompass a wide array of therapeutic areas. While they hold a smaller portion of the market share, these applications are crucial for their innovative approach to treating specific medical conditions, ranging from cardiovascular diseases to neurological disorders. The diversity of applications underlines the versatility and growing potential of the transdermal patch market.

End-Use Analysis

In 2023, the Homecare Setting segment held a dominant market position in the transdermal patch market, capturing more than a 75.8% share. This dominance is primarily driven by the growing preference for at-home medical treatments and the convenience of using transdermal patches in a non-clinical environment. The ease of application and the ability to manage various treatments without professional assistance have significantly contributed to the popularity of transdermal patches in homecare settings.

Hospitals and Clinics, as secondary end-users, account for a substantial portion of the market. In these settings, transdermal patches are widely utilized for controlled drug delivery in patients with chronic conditions. The professional oversight available in these facilities ensures precise and safe application, making them suitable for more complex or critical treatments. While the market share is smaller compared to homecare, the segment benefits from the expertise and infrastructure available in these medical facilities.

Key Market Segments

Type

- Drug-in-Adhesive

- Matrix

- Other Types

Application

- Pain Relief

- Smoking Reduction and Cessation Aid

- Overactive Bladder

- Hormonal Therapy

- Other Applications

End Use

- Homecare Setting

- Hospitals and Clinics

Driver

Rising Demand for Non-Invasive Pain Management

The increasing preference for non-invasive pain management is a significant driver of the transdermal patch market. Analgesic patches, offering controlled and prolonged pain relief, are gaining popularity. Their easy application and reduced side effects compared to oral painkillers make them particularly appealing for chronic pain sufferers. This trend is reinforced by a growing awareness of the risks associated with opioid use.

Restraint

Incidences of Drug Failure and Patch Recalls

Challenges in the transdermal patch market include occurrences of drug failure and product recalls. Inconsistencies in drug delivery and adverse skin reactions can result from formulation issues or patch design flaws. Such incidents highlight the need for rigorous quality control in manufacturing and development to ensure therapeutic effectiveness and patient safety.

Opportunity

Collaborative Innovations in Drug Delivery

Collaborations between pharmaceutical companies and drug delivery firms present significant opportunities. These partnerships are fostering innovations in transdermal patches, combining pharmaceutical expertise with advanced delivery technology. The result is more effective, patient-friendly patches with enhanced drug release profiles and minimal side effects, ultimately improving patient outcomes.

Challenge

Overcoming Skin Permeability and Irritation Issues

Technical challenges, especially related to skin permeability and irritation, pose significant hurdles. Achieving optimal drug absorption without causing skin damage or irritation requires careful formulation and design of patches. Balancing effective drug penetration with skin integrity is a key focus for ongoing research and innovation in this field.

Trends

Development of Patches for a Wider Range of Conditions

A notable trend is the development of patches for a broader spectrum of medical conditions. Innovations include rivastigmine patches for Alzheimer’s disease, docetaxel patches for cancer treatment, and insulin patches for diabetes management. These advancements offer simplified, continuous drug delivery, catering to specific needs and improving treatment efficacy.

Regional Analysis

North America’s Leading Position

In 2023, North America is dominating the transdermal patch market, holding a substantial 48.2% share, translating to USD 3.8 billion. This region’s leadership stems from its advanced healthcare infrastructure, high prevalence of chronic diseases, and stringent pharmaceutical regulations. The growing need for transdermal patches for ailments such as pain, hormone imbalances, and cardiovascular diseases is further amplified by an aging population and a rising preference for non-invasive drug delivery methods. In the United States and Canada, significant research and development activities, along with FDA guidelines, are shaping a positive landscape for the market. It is anticipated that North America will continue to see steady growth in this market due to these factors.

Asia-Pacific’s Rapid Growth

Asia-Pacific is witnessing the largest Compound Annual Growth Rate (CAGR) in the global transdermal patches industry. Factors fueling this growth include increasing chronic disease prevalence, greater awareness of non-invasive medication delivery, and improvements in healthcare infrastructure. The large and aging population in this region is also a key driver, necessitating cost-effective and patient-friendly healthcare solutions. Government initiatives to improve healthcare access and the adoption of advanced medical technologies further contribute to this growth. By 2030, the significant elderly population in this region, projected to reach 1.4 billion, is expected to notably influence the demand for transdermal patches.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The competitive landscape of the transdermal patch market offers a comprehensive overview of each key player in the field. This includes essential information such as company background, financial performance, revenue generation, and market influence. The report also delves into each company’s investment in research and development, highlighting their commitment to innovation and new market strategies.

Moreover, the analysis covers the global footprint of these companies, focusing on their production locations, capabilities, and the scale of operations. A critical aspect of this landscape is the evaluation of each company’s strengths and weaknesses, offering insights into their market positioning.

Additionally, the report examines the range and variety of products offered by these companies, along with their dominance in specific application areas. This detailed assessment provides a clear understanding of the competitive dynamics within the transdermal patch market, aiding stakeholders in making informed decisions.

Key Market Players

- Hisamitsu Pharmaceutical

- Novartis

- Johnson & Johnson

- Teikoku Pharma

- Mylan

- Actavis

- Mundipharma

- Henan Lingrui Pharmaceutical

- Changzhou Siyao

- Rfl Pharmaceutical

- AdhexPharma

- ProSolus, Inc

- Tapemark

- Tesa Tapes (India) Pvt. Ltd.

- Nitto Denko Corporation.

- Noven Pharmaceuticals, Inc

- LTS Lohmann Therapie-Systeme AG

- Medherant Limited

- Corium, Inc.

- Bayer AG

- Other Key Players

Recent Developments

Technological Advancements

- November 2023: Smart Patches: These patches incorporate sensors and microprocessors for real-time monitoring of drug delivery and vital signs like heart rate and blood glucose.

- October 2023: Dissolving/degradable Patches: These patches are designed to dissolve or degrade after delivering the medication, eliminating the need for removal.

- September 2023: 3D-printed patches: These patches offer personalized dosages and controlled drug release through precise design and fabrication.

- August 2023: Microneedle Patches: These patches use tiny needles to painlessly deliver drugs through the skin, improving penetration and bioavailability.

New Applications

- July 2023: Transdermal Vaccines: Researchers are developing patches that can deliver vaccines through the skin, potentially offering a more convenient and less painful alternative to injections.

- June 2023: Patches for Personalized Medicine: Personalized patches are being developed to deliver drugs based on individual genetic profiles and disease states.

- May 2023: Patches for Mental Health: Patches are being explored for delivering medication for conditions like anxiety and depression, offering continuous and controlled release.

Regulatory Landscape

- March 2023: The US FDA is streamlining the approval process for transdermal patches, encouraging innovation and development.

- March 2023: European regulations are also evolving to accommodate the latest advancements in transdermal technologies.

Mergers and Acquisitions

- February 2023: Several pharmaceutical companies are acquiring transdermal patch technology developers to expand their product portfolios and access innovative technologies.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Billion Forecast Revenue (2033) USD 12.5 Billion CAGR (2023-2032) 4.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Drug-in-Adhesive, Matrix and Other Types) By Application (Pain Relief, Smoking Reduction and Cessation Aid, Overactive Bladder, Hormonal Therapy and Other Applications) By End Use (Homecare Setting, Hospitals and Clinics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hisamitsu Pharmaceutical, Novartis, Johnson & Johnson, Teikoku Pharma, Mylan, Actavis, Mundipharma, Henan Lingrui Pharmaceutical, Changzhou Siyao, Rfl Pharmaceutical, AdhexPharma, ProSolus, Inc, Tapemark, tesa Tapes (India) Pvt. Ltd., Nitto Denko Corporation., Noven Pharmaceuticals, Inc, LTS Lohmann Therapie-Systeme AG, Medherant Limited, Corium, Inc., Bayer AG and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hisamitsu Pharmaceutical

- Novartis

- Johnson & Johnson

- Teikoku Pharma

- Mylan

- Actavis

- Mundipharma

- Henan Lingrui Pharmaceutical

- Changzhou Siyao

- Rfl Pharmaceutical

- AdhexPharma

- ProSolus, Inc

- Tapemark

- Tesa Tapes (India) Pvt. Ltd.

- Nitto Denko Corporation.

- Noven Pharmaceuticals, Inc

- LTS Lohmann Therapie-Systeme AG

- Medherant Limited

- Corium, Inc.

- Bayer AG

- Other Key Players