Global Traffic Signal Recognition Market Size, Share, Growth Analysis By Component (Software [Image Processing Algorithms, Machine Learning Models, Object Detection Software, Neural Network Solutions, Cloud-Based Platforms], Hardware [Cameras & Image Sensors, LIDAR Sensors, Radar Sensors, By Processing Units/ECUs, Display Units, GPS Receivers]), By Vehicle Type (Passenger Vehicles, Commercial Vehicles [Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)], Special Purpose Vehicles), By Technology (Computer Vision, Image Processing, Deep Learning, Machine Learning, Pattern Recognition, Sensor Fusion), By Application (Speed Limit Detection, Traffic Light Detection, Stop Sign Recognition, Warning Sign Recognition, Lane Marking Detection, Pedestrian Crossing Recognition, Railroad Crossing Detection, Yield Sign Recognition), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177392

- Number of Pages: 213

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

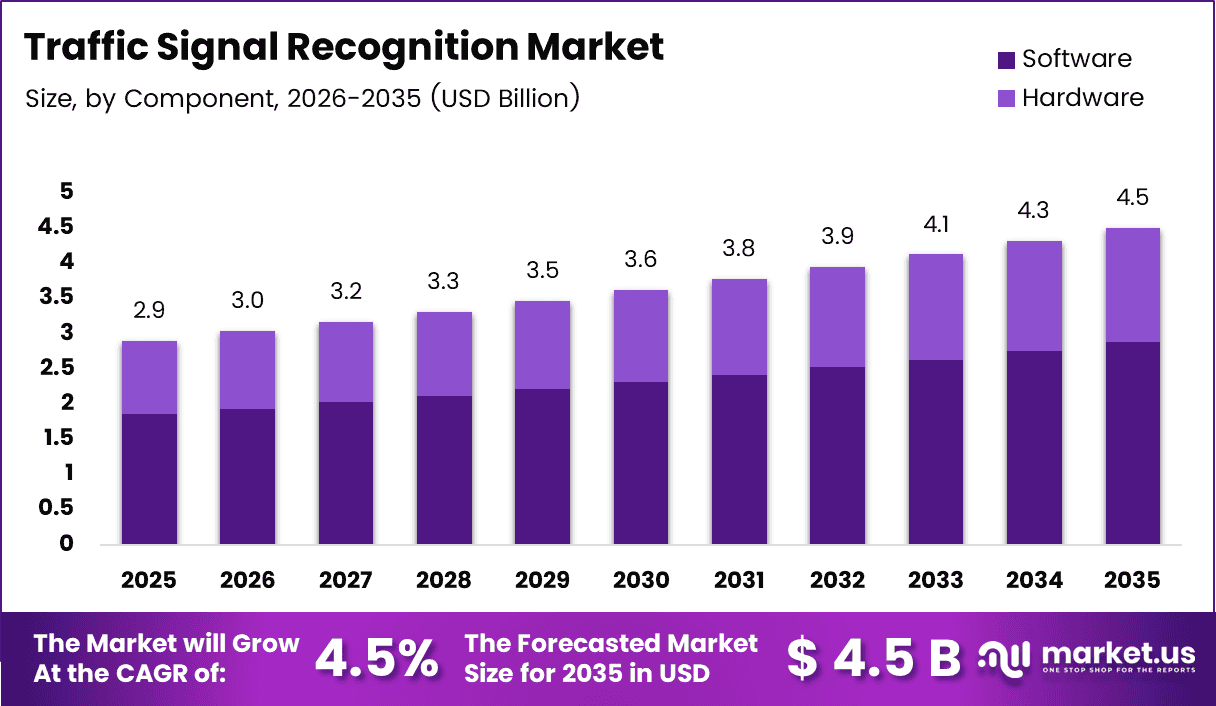

Global Traffic Signal Recognition Market size is expected to be worth around USD 4.5 Billion by 2035 from USD 2.9 Billion in 2025, growing at a CAGR of 4.5% during the forecast period 2026 to 2035.

Traffic signal recognition represents an advanced automotive technology that enables vehicles to automatically detect and interpret road signs, traffic lights, and regulatory markers. This system uses cameras, sensors, and artificial intelligence to process visual information in real-time. Consequently, drivers receive immediate alerts about speed limits, stop signs, and traffic signal changes.

The market experiences robust growth driven by increasing vehicle safety standards and autonomous driving development. Moreover, governments worldwide mandate intelligent traffic management systems to reduce accidents and improve road efficiency. Therefore, automotive manufacturers integrate these recognition systems into advanced driver assistance platforms across vehicle segments.

Urban areas face mounting traffic congestion challenges requiring sophisticated signal interpretation technologies. Additionally, the rise of electric vehicles and connected car ecosystems accelerates demand for smart recognition solutions. However, system deployment remains focused on premium vehicle segments due to technology complexity and implementation costs.

Recent technological advancements enhance recognition accuracy and processing speed significantly. Deep learning algorithms and neural networks enable systems to function effectively under diverse environmental conditions. Furthermore, integration with vehicle-to-everything communication creates opportunities for predictive traffic management and enhanced safety protocols.

According to NCBI research, the proposed CViT achieved an overall accuracy of 99.87%, with a Micro Precision of 99.07%. Additionally, IEEE studies reveal noteworthy enhancements improving vehicle detection with a map50 of 80.5% for various vehicle types in Indian traffic using Yolo V8.

Government investments in smart city infrastructure and connected traffic networks support market expansion. Regulatory bodies implement stringent safety standards requiring advanced recognition capabilities in new vehicles. Consequently, manufacturers prioritize research and development to meet compliance requirements and consumer safety expectations.

The market benefits from ongoing collaboration between technology providers and automotive manufacturers. Cloud-based platforms enable continuous model learning and system updates across vehicle fleets. Therefore, traffic signal recognition systems evolve rapidly, incorporating real-time data annotation and improved detection algorithms for better performance.

Key Takeaways

- Global Traffic Signal Recognition Market valued at USD 2.9 Billion in 2025, projected to reach USD 4.5 Billion by 2035 at 4.5% CAGR

- Software component dominates the market with 63.8% share, driven by AI-based algorithms and cloud platforms

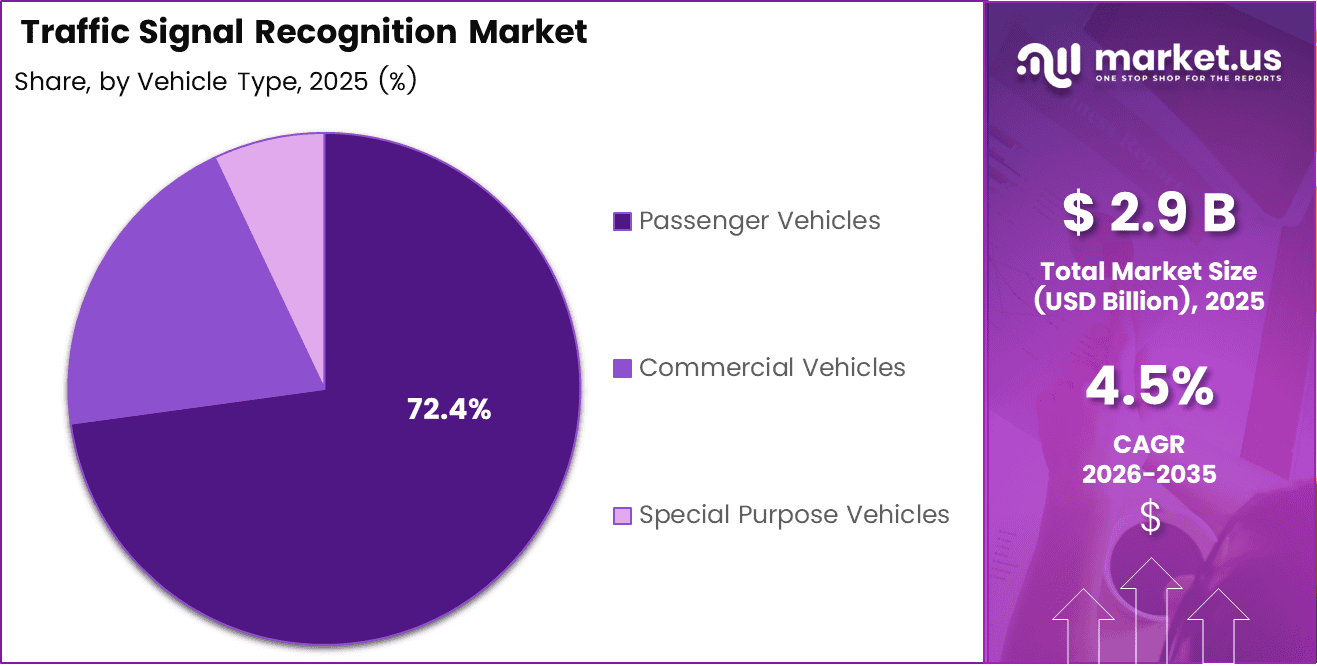

- Passenger vehicles account for 72.4% of vehicle type segment due to high ADAS adoption rates

- Computer vision technology holds 28.5% share, leading technological innovation in signal recognition systems

- Speed limit detection application captures 27.1% market share as primary use case

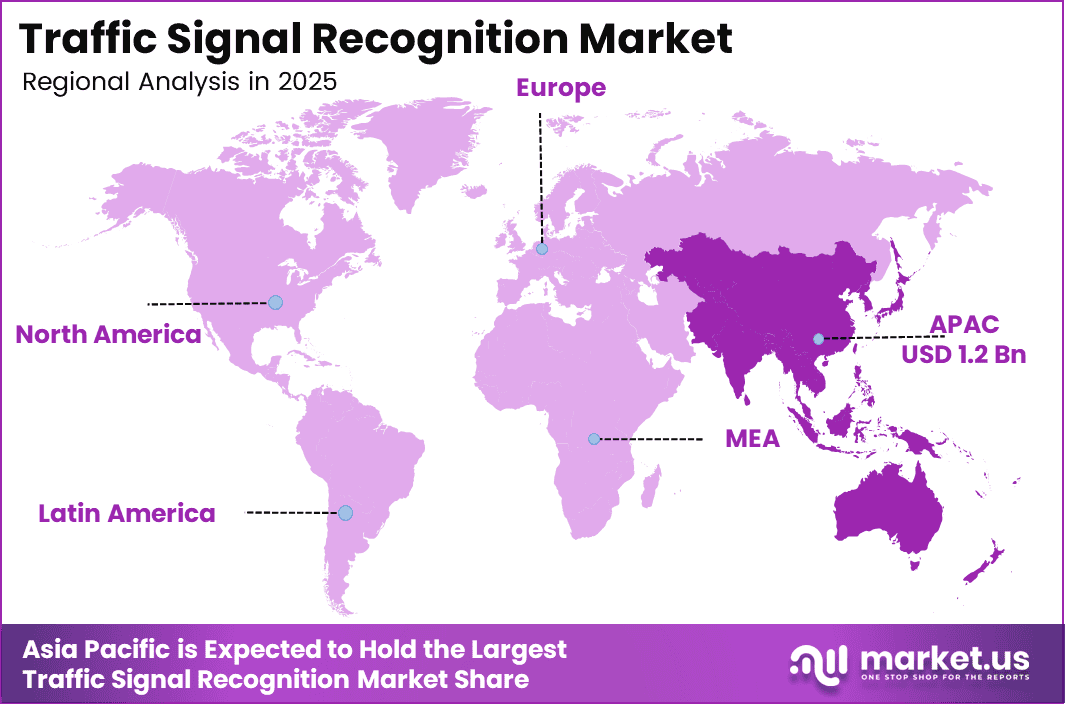

- Asia Pacific region dominates with 42.70% market share, valued at USD 1.2 Billion

Component Analysis

Software dominates with 63.8% due to advanced AI algorithms and cloud-based processing capabilities.

In 2025, Software held a dominant market position in the Component segment of Traffic Signal Recognition Market, with a 63.8% share. This segment includes Image Processing Algorithms, Machine Learning Models, Object Detection Software, Neural Network Solutions, and Cloud-Based Platforms that enable accurate signal detection. Moreover, software solutions provide continuous updates and improvements through over-the-air capabilities, reducing long-term maintenance costs.

Hardware components provide the physical infrastructure necessary for traffic signal recognition system functionality across vehicle platforms. This subsegment encompasses Cameras & Image Sensors, LIDAR Sensors, Radar Sensors, Processing Units/ECUs, Display Units, and GPS Receivers that capture and process environmental data. However, hardware represents higher initial investment costs compared to software, limiting adoption in budget vehicle segments.

Vehicle Type Analysis

Passenger Vehicles dominate with 72.4% due to widespread ADAS integration and consumer safety demand.

In 2025, Passenger Vehicles held a dominant market position in the Vehicle Type segment of Traffic Signal Recognition Market, with a 72.4% share. This segment benefits from increasing consumer awareness about vehicle safety features and regulatory requirements for advanced driver assistance systems. Consequently, automakers prioritize traffic signal recognition technology in passenger car models across different price segments to meet market demands.

Commercial Vehicles adopt traffic signal recognition systems to enhance fleet safety, operational efficiency, & driver performance monitoring capabilities. This subsegment includes Light Commercial Vehicles and Heavy Commercial Vehicles operating in diverse urban and highway environments. Additionally, fleet operators invest in intelligent systems to reduce accidents and comply with stringent commercial vehicle safety regulations.

Special Purpose Vehicles represent an emerging subsegment incorporating traffic signal recognition for specialized applications including emergency response and public transport. These vehicles require advanced recognition capabilities to navigate complex traffic scenarios while maintaining operational safety standards. Therefore, recognition systems enhance their ability to respond quickly to changing traffic conditions during critical missions.

Technology Analysis

Computer Vision dominates with 28.5% due to superior image processing and real-time detection capabilities.

In 2025, ‘Computer Vision‘ held a dominant market position in the ‘Technology’ segment of Traffic Signal Recognition Market, with a 28.5% share. This technology enables vehicles to interpret visual information from cameras with high accuracy and minimal processing latency for enhanced safety. Additionally, computer vision systems integrate seamlessly with existing automotive sensor architectures and advanced driver assistance platforms across vehicle segments.

Image Processing technology analyzes visual data from cameras to identify traffic signals, signs, and road markings with precision and reliability. This approach forms the foundation for converting raw camera feeds into actionable information that drivers can understand and respond to effectively. Moreover, image processing algorithms continuously filter noise and enhance image quality to improve recognition accuracy under challenging lighting conditions.

Deep Learning utilizes neural networks that learn from vast datasets to recognize traffic signals across diverse scenarios and geographical regions. This technology enables systems to adapt to different traffic control designs, sign variations, and regional differences automatically. Furthermore, deep learning models improve over time through exposure to real-world driving data collected from connected vehicle fleets.

Machine Learning algorithms analyze patterns in traffic signal data to predict signal changes and optimize vehicle responses accordingly. These systems process historical and real-time information to enhance detection accuracy and reduce false positive alerts. Additionally, machine learning enables continuous performance improvement without requiring manual software updates or system recalibration.

Pattern Recognition technology identifies recurring visual patterns in traffic signals and signs to enhance detection accuracy under varying environmental conditions. This approach recognizes specific shapes, colors, and symbol combinations that indicate different traffic control devices and regulatory requirements. Therefore, pattern recognition systems maintain reliable performance even when signals are partially obscured or damaged.

Sensor Fusion combines data from multiple sources including cameras, radar, and LiDAR to create comprehensive traffic environment understanding. This technology overcomes individual sensor limitations by cross-validating information from different detection modalities for enhanced reliability. Consequently, sensor fusion delivers robust performance across challenging weather conditions including rain, fog, and snow.

Application Analysis

Speed Limit Detection dominates with 27.1% due to critical safety importance and regulatory compliance requirements.

In 2025, ‘Speed Limit Detection‘ held a dominant market position in the ‘Application’ segment of Traffic Signal Recognition Market, with a 27.1% share. This application directly impacts driver behavior and accident prevention by providing real-time speed limit information across different road types. Moreover, insurance companies increasingly value speed limit detection systems for risk assessment, premium calculation, and fleet management purposes.

Traffic Light Detection enhances intersection safety by alerting drivers to signal changes and preventing red-light violations in urban environments. This application monitors traffic signal status in real-time and provides visual or audible warnings to drivers approaching intersections. Additionally, traffic light detection integrates with adaptive cruise control systems to automatically adjust vehicle speed based on signal timing.

Stop Sign Recognition identifies stop signs at intersections and alerts drivers to complete stops before proceeding through controlled areas. This technology prevents accidents at four-way stops and uncontrolled intersections where driver attention often lapses during routine driving. Furthermore, stop sign recognition systems work effectively in both urban and rural environments with varying sign designs.

Warning Sign Recognition interprets hazard indicators, construction zones, and temporary traffic control measures to enhance driver awareness and safety. This application detects various warning signs including curve warnings, pedestrian crossings, school zones, and road work alerts. Therefore, warning sign recognition enables drivers to anticipate potential hazards and adjust driving behavior proactively.

Lane Marking Detection helps vehicles maintain proper lane positioning and assists with lane-keeping functions in advanced driver assistance systems. This technology analyzes road surface markings to determine lane boundaries and provide steering corrections when vehicles drift unintentionally. Moreover, lane marking detection supports autonomous driving features by enabling precise lateral vehicle control.

Pedestrian Crossing Recognition identifies crosswalks and alerts drivers to the presence of pedestrians in or near crossing areas. This application enhances safety in urban environments where pedestrian-vehicle interactions occur frequently at marked crossing locations. Additionally, pedestrian crossing recognition integrates with automatic emergency braking systems to prevent collisions.

Railroad Crossing Detection recognizes railway crossings and alerts drivers to approaching trains or active crossing signals for enhanced safety. This technology prevents accidents at grade crossings by providing early warnings and ensuring drivers maintain appropriate caution. Furthermore, railroad crossing detection systems identify both marked and unmarked crossings in rural areas.

Yield Sign Recognition detects yield signs and alerts drivers to slow down and give right-of-way to other vehicles or pedestrians. This application ensures compliance with traffic regulations at merge points, roundabouts, and uncontrolled intersections requiring yield protocols. Therefore, yield sign recognition reduces collision risks in areas where traffic flow prioritization is critical for safe operations.

Key Market Segments

By Component

- Software

- Image Processing Algorithms

- Machine Learning Models

- Object Detection Software

- Neural Network Solutions

- Cloud-Based Platforms

- Hardware

- Cameras & Image Sensors

- LIDAR Sensors

- Radar Sensors

- Processing Units/ECUs

- Display Units

- GPS Receivers

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Special Purpose Vehicles

By Technology

- Computer Vision

- Image Processing

- Deep Learning

- Machine Learning

- Pattern Recognition

- Sensor Fusion

By Application

- Speed Limit Detection

- Traffic Light Detection

- Stop Sign Recognition

- Warning Sign Recognition

- Lane Marking Detection

- Pedestrian Crossing Recognition

- Railroad Crossing Detection

- Yield Sign Recognition

Drivers

Rising Integration of ADAS and Autonomous Driving Technologies Drives Market Growth

Advanced driver assistance systems increasingly incorporate traffic signal recognition as a core safety feature across vehicle segments. Automotive manufacturers integrate these technologies to meet consumer demand for intelligent driving solutions and enhanced road safety. Consequently, ADAS-equipped vehicles demonstrate superior accident avoidance capabilities compared to conventional systems, driving widespread adoption.

Autonomous vehicle development requires robust traffic signal recognition for safe navigation without human intervention. Self-driving systems rely on accurate signal interpretation to comply with traffic regulations and maintain operational safety. Moreover, regulatory frameworks increasingly mandate autonomous vehicles to demonstrate reliable recognition capabilities before receiving commercial deployment approval.

Government regulations worldwide enforce stringent safety standards requiring intelligent traffic management system integration in new vehicles. These mandates accelerate manufacturer adoption of recognition technologies to ensure regulatory compliance and avoid market penalties. Therefore, the combination of regulatory pressure and technological advancement creates strong momentum for market expansion across global automotive industries.

Restraints

High System Costs and Complex Sensor Calibration Requirements Limit Market Adoption

Traffic signal recognition systems require significant investment in hardware components including high-resolution cameras, processing units, and sensor arrays. These costs substantially increase vehicle manufacturing expenses, particularly impacting budget and mid-range segments. Additionally, installation complexity demands specialized technical expertise, raising implementation barriers for smaller automotive manufacturers and aftermarket providers.

System calibration presents ongoing challenges requiring precise alignment of multiple sensors and cameras for optimal performance. Environmental factors including vibration, temperature fluctuations, and physical impacts necessitate frequent recalibration to maintain accuracy. Furthermore, calibration procedures demand specialized equipment and trained technicians, increasing long-term ownership costs for vehicle operators and fleet managers.

Performance limitations under adverse weather conditions including heavy rain, fog, and snow significantly reduce system reliability and detection accuracy. Low-visibility scenarios compromise camera-based recognition systems, creating potential safety risks when drivers depend on automated alerts. Therefore, manufacturers face substantial research and development expenses to overcome environmental limitations and deliver consistent performance across diverse operating conditions.

Growth Factors

Expansion of Smart City Infrastructure and Connected Traffic Networks Accelerates Market Growth

Global smart city initiatives drive substantial investments in intelligent transportation infrastructure including connected traffic signals and digital road networks. These developments create opportunities for vehicle-to-infrastructure communication systems that enhance traffic signal recognition accuracy. Moreover, cities implement standardized digital signage that improves machine readability and reduces recognition errors across urban environments.

Electric and autonomous vehicle manufacturers increasingly demand advanced traffic signal recognition systems as standard safety equipment. The transition toward electric mobility accelerates technology adoption as manufacturers differentiate products through intelligent driving features. Additionally, autonomous vehicle testing programs require sophisticated recognition capabilities to demonstrate safe operation in real-world traffic conditions.

Driver training institutions and simulation system providers adopt traffic signal recognition technology to enhance educational programs and assessment capabilities. These systems enable realistic scenario training without physical road exposure, improving driver preparation and safety awareness. Furthermore, integration with vehicle-to-everything communication enables predictive traffic management by anticipating signal changes and optimizing route planning for improved traffic flow.

Emerging Trends

Shift Toward Deep Learning-Based Traffic Signal Detection Models Reshapes Market Landscape

Automotive technology providers increasingly deploy deep learning algorithms that significantly improve traffic signal recognition accuracy and processing speed. These neural network models learn from vast datasets encompassing diverse traffic scenarios, weather conditions, and geographical variations. Consequently, systems achieve superior performance compared to traditional rule-based approaches, particularly in complex urban environments with multiple simultaneous signals.

Edge artificial intelligence processing enables real-time signal recognition directly within vehicle computing units without cloud connectivity requirements. This approach reduces latency, enhances data privacy, and ensures system functionality in areas with limited network coverage. Moreover, edge processing capabilities allow continuous operation during communication network disruptions, maintaining critical safety functions.

Manufacturers integrate camera, LiDAR, and radar data through sensor fusion techniques to create comprehensive traffic environment understanding. This multi-modal approach overcomes individual sensor limitations and delivers robust performance across varying environmental conditions. Therefore, cloud-based data annotation platforms enable continuous model learning by collecting real-world recognition data from vehicle fleets for ongoing algorithm improvement.

Regional Analysis

Asia Pacific Dominates the Traffic Signal Recognition Market with a Market Share of 42.70%, Valued at USD 1.2 Billion

Asia Pacific leads the global market due to rapid urbanization, increasing vehicle production, and growing adoption of advanced driver assistance systems. Countries including China, Japan, and South Korea invest heavily in smart city infrastructure and connected vehicle technologies. Moreover, the region’s 42.70% market share reflects strong government support for automotive innovation and traffic safety improvement initiatives valued at USD 1.2 Billion.

North America Traffic Signal Recognition Market Trends

North America demonstrates strong market growth driven by stringent vehicle safety regulations and high consumer demand for advanced automotive technologies. The United States and Canada lead in autonomous vehicle development, requiring sophisticated traffic signal recognition capabilities. Additionally, established automotive manufacturers and technology companies collaborate to develop next-generation intelligent transportation systems across the region.

Europe Traffic Signal Recognition Market Trends

Europe maintains significant market presence through comprehensive vehicle safety standards and robust automotive manufacturing infrastructure. Germany, France, and the United Kingdom drive innovation in ADAS technologies and traffic signal recognition systems. Furthermore, European regulations mandate advanced safety features in new vehicles, accelerating technology adoption across passenger and commercial vehicle segments.

Latin America Traffic Signal Recognition Market Trends

Latin America experiences gradual market growth as automotive manufacturers introduce advanced safety features in premium vehicle segments. Brazil and Mexico lead regional adoption through increasing urbanization and government investments in transportation infrastructure. However, cost sensitivity and economic constraints limit widespread deployment across budget vehicle categories in developing markets.

Middle East & Africa Traffic Signal Recognition Market Trends

Middle East and Africa region shows emerging market potential driven by smart city projects and luxury vehicle imports in Gulf Cooperation Council countries. South Africa demonstrates growing interest in advanced vehicle safety technologies among commercial fleet operators. Therefore, infrastructure development and increasing road safety awareness create future growth opportunities despite current market size limitations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Audi leads premium automotive innovation through comprehensive integration of traffic signal recognition in its advanced driver assistance systems. The company develops proprietary algorithms that combine camera and sensor data for superior detection accuracy across European and global markets. Moreover, Audi collaborates with technology providers to enhance system performance in autonomous driving applications and connected vehicle platforms.

Bosch maintains a dominant position as a leading automotive technology supplier providing traffic signal recognition solutions to manufacturers worldwide. The company offers complete system packages including cameras, processing units, and software algorithms for diverse vehicle applications. Additionally, Bosch invests significantly in artificial intelligence research to improve recognition accuracy and expand functional capabilities across different traffic environments.

Continental delivers integrated traffic signal recognition systems as part of comprehensive advanced driver assistance platform offerings to global automotive manufacturers. The company focuses on sensor fusion technologies combining camera, radar, and LiDAR inputs for robust signal detection capabilities. Furthermore, Continental develops cloud-connected solutions enabling continuous system updates and performance improvements through over-the-air software enhancements.

Denso specializes in advanced automotive electronics and sensor technologies supporting traffic signal recognition system development for Asian and global markets. The company manufactures high-resolution cameras and image processing units optimized for traffic signal detection applications. Therefore, Denso collaborates with vehicle manufacturers to integrate recognition capabilities into next-generation electric and autonomous vehicle platforms across multiple market segments.

Key Players

- Audi

- Bosch

- Continental

- Denso

- Ford

- General Motors

- HERE Technologies

- Hitachi Automotive Systems

- Hyundai

Recent Developments

- March 2025 – Qualcomm Technologies, Inc. announced an agreement to acquire EdgeImpulse Inc., enhancing its offering for developers and expanding leadership in AI capabilities to power AI-enabled products and services across IoT applications.

- October 2025 – Mitsubishi Electric announced collaboration with ITRI in Taiwan on large capacity power-conversion systems using power semiconductors, advancing automotive electronics and intelligent system development capabilities.

- July 2025 – Nature published research analyzing acquisition systems for electronic traffic signals in smart cities based on internet of things technology, demonstrating improved signal management and vehicle communication efficiency.

Report Scope

Report Features Description Market Value (2025) USD 2.9 Billion Forecast Revenue (2035) USD 4.5 Billion CAGR (2026-2035) 4.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software [Image Processing Algorithms, Machine Learning Models, Object Detection Software, Neural Network Solutions, Cloud-Based Platforms], Hardware [Cameras & Image Sensors, LIDAR Sensors, Radar Sensors, By Processing Units/ECUs, Display Units, GPS Receivers]), By Vehicle Type (Passenger Vehicles, Commercial Vehicles [Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV)], Special Purpose Vehicles), By Technology (Computer Vision, Image Processing, Deep Learning, Machine Learning, Pattern Recognition, Sensor Fusion), By Application (Speed Limit Detection, Traffic Light Detection, Stop Sign Recognition, Warning Sign Recognition, Lane Marking Detection, Pedestrian Crossing Recognition, Railroad Crossing Detection, Yield Sign Recognition) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Audi, Bosch, Continental, Denso, Ford, General Motors, HERE Technologies, Hitachi Automotive Systems, Hyundai Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Traffic Signal Recognition MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Traffic Signal Recognition MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Audi

- Bosch

- Continental

- Denso

- Ford

- General Motors

- HERE Technologies

- Hitachi Automotive Systems

- Hyundai