Thrombopoietin Receptor Agonists Market By Product Type (Injectable and Oral), By Application (Acute Myeloid Leukemia, Myelodysplastic Syndromes, Immune Thrombocytopenia, and Aplastic Anemia), By End-user (Hospitals, Clinics, and Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152929

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

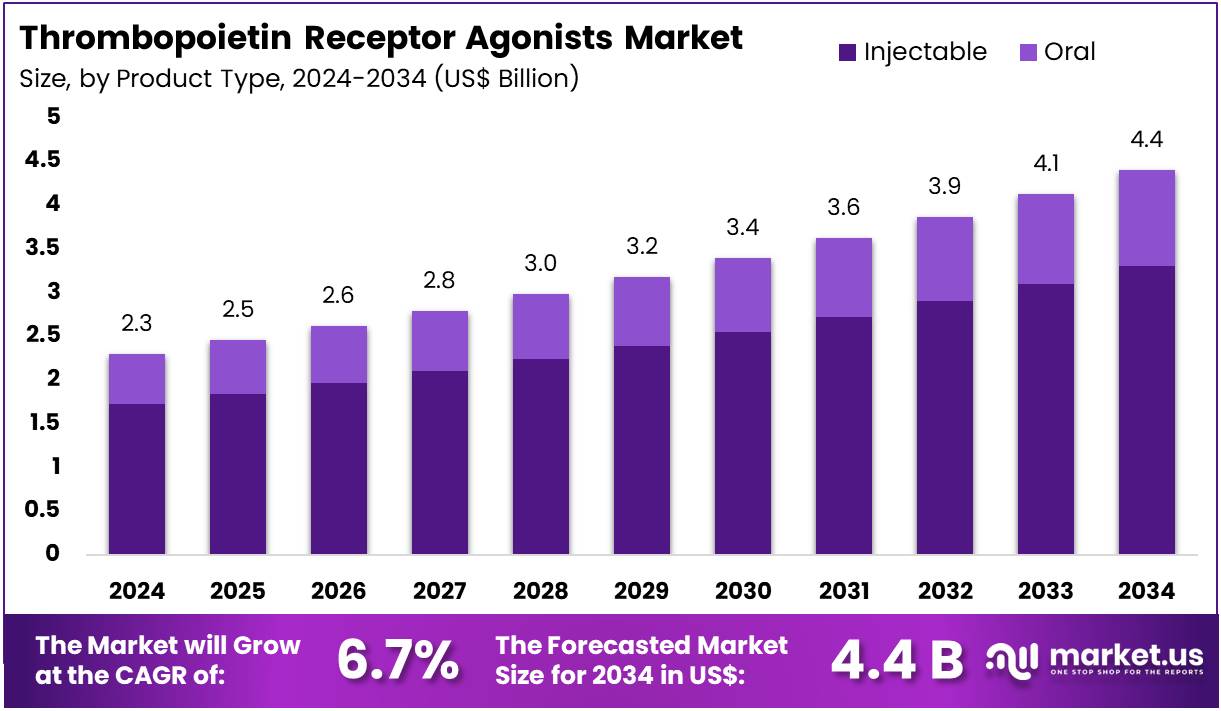

The Thrombopoietin Receptor Agonists Market Size is expected to be worth around US$ 4.4 billion by 2034 from US$ 2.3 billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034.

Increasing demand for targeted therapies and the growing prevalence of thrombocytopenia are driving the expansion of the thrombopoietin receptor agonists market. Thrombopoietin receptor agonists, such as romiplostim and eltrombopag, stimulate platelet production by activating the thrombopoietin receptor, offering an effective solution for patients with conditions like immune thrombocytopenia (ITP) and chemotherapy-induced thrombocytopenia.

Rising awareness of these therapies’ ability to prevent bleeding complications and reduce the need for platelet transfusions has led to greater adoption among healthcare providers. The market also benefits from the increasing focus on personalized medicine, where treatments are tailored based on the patient’s specific condition and response to therapy, improving outcomes.

In January 2023, Intas Pharmaceuticals launched its biosimilar romiplostim in India, expanding access to these life-saving therapies. A retrospective study published in the Indian Journal of Pathology & Microbiology demonstrated the effectiveness of the biosimilar in treating adult Indian patients with ITP, reinforcing its potential in addressing unmet medical needs. Recent trends in the thrombopoietin receptor agonists market include the development of more cost-effective biosimilars, making these treatments more accessible to patients worldwide.

Additionally, ongoing research into novel agonists and combination therapies offers further opportunities to enhance efficacy and safety profiles. As the number of patients with thrombocytopenia continues to rise, the market is set to experience sustained growth, driven by innovations in both drug development and treatment approaches.

Key Takeaways

- In 2024, the market for thrombopoietin receptor agonists generated a revenue of US$ 2.3 billion, with a CAGR of 6.7%, and is expected to reach US$ 4.4 billion by the year 2034.

- The product type segment is divided into injectable and oral, with injectable taking the lead in 2023 with a market share of 75.2%.

- Considering application, the market is divided into acute myeloid leukemia, myelodysplastic syndromes, immune thrombocytopenia, and aplastic anemia. Among these, acute myeloid leukemia held a significant share of 58.3%.

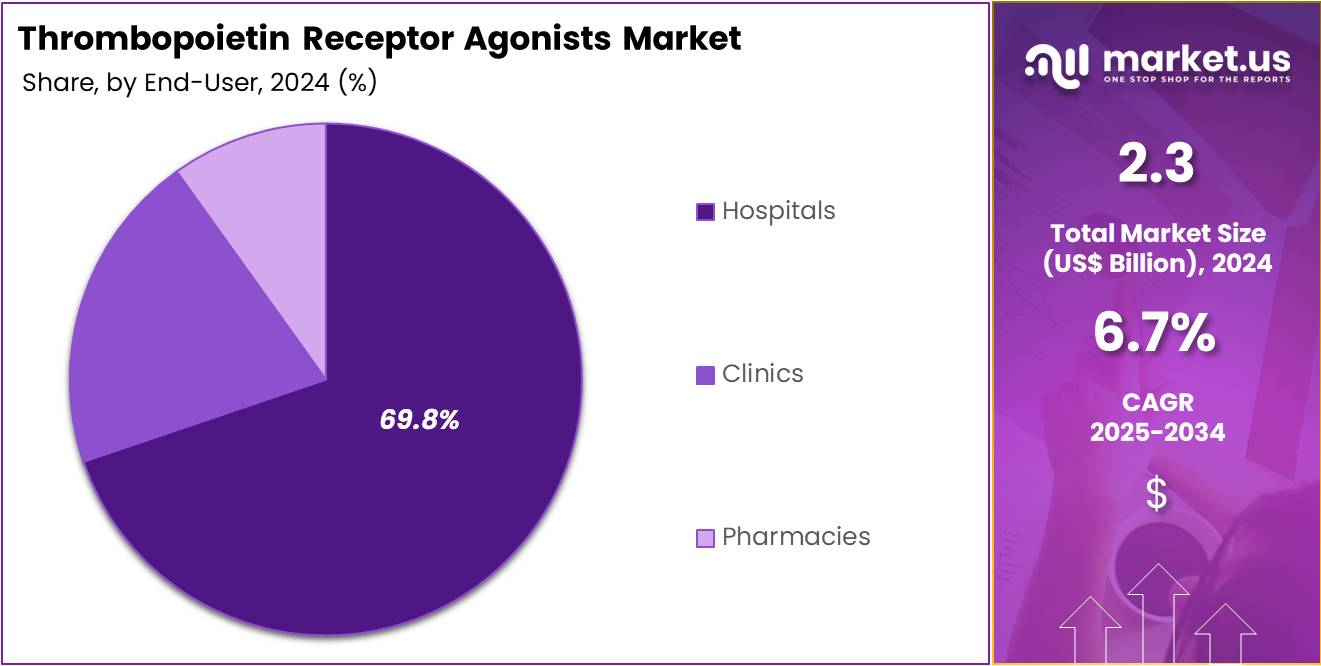

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, and pharmacies. The hospitals sector stands out as the dominant player, holding the largest revenue share of 69.8% in the thrombopoietin receptor agonists market.

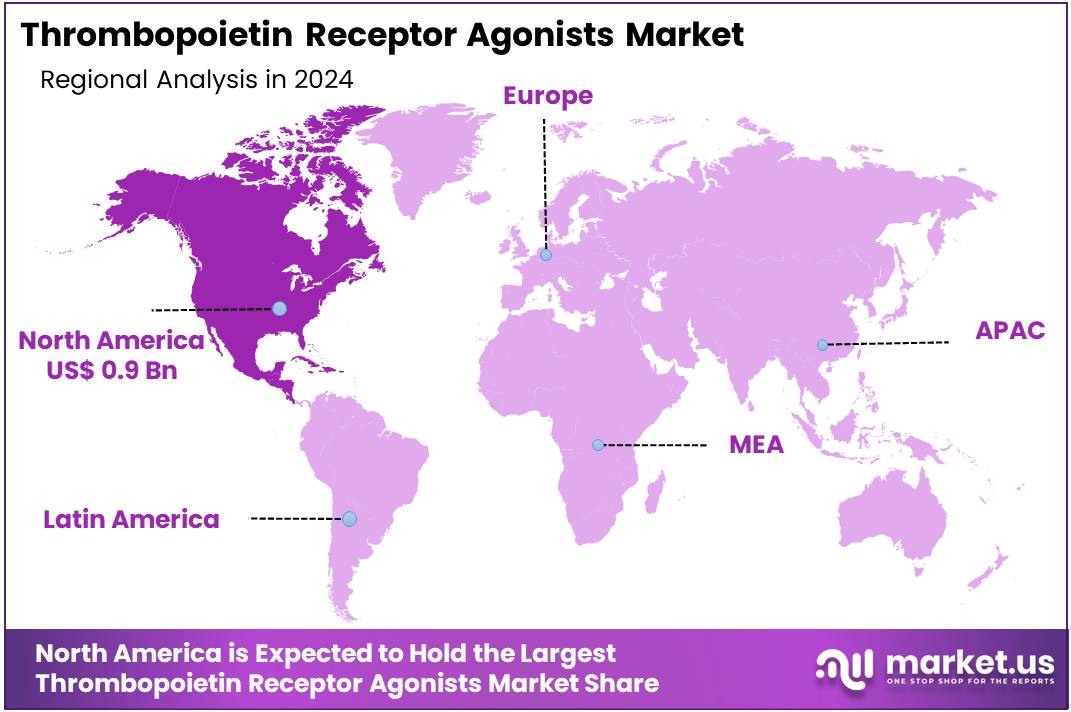

- North America led the market by securing a market share of 39.3% in 2023.

Product Type Analysis

Injectables dominate the thrombopoietin receptor agonists market, holding a significant share of 75.2%. This growth is expected to continue as injectables offer faster and more reliable absorption, especially in conditions like immune thrombocytopenia and acute myeloid leukemia, where rapid platelet production is required. The increasing adoption of injectable treatments in hospital settings, especially for patients who need quick responses, is projected to sustain this dominance.

Additionally, injectable formulations are anticipated to remain the preferred option due to their higher bioavailability and effectiveness in managing platelet count during severe conditions. As more advanced injectable therapies become available, particularly those with longer dosing intervals, their convenience and efficacy will likely drive further growth in the segment.

The increasing prevalence of diseases like immune thrombocytopenia and acute myeloid leukemia is expected to bolster demand for injectable thrombopoietin receptor agonists. Furthermore, the approval of new injectable products by regulatory bodies will likely facilitate wider adoption and distribution in global markets, especially in regions with higher medical needs.

Application Analysis

Acute myeloid leukemia (AML) holds a dominant share of 58.3% in the thrombopoietin receptor agonists market. This segment’s growth is expected to be driven by the increasing incidence of AML, particularly in older populations who are more prone to hematological cancers. The development of new thrombopoietin receptor agonists that are specifically designed to manage thrombocytopenia in AML patients is projected to accelerate this market segment’s expansion.

Additionally, ongoing research into the combination of thrombopoietin receptor agonists with chemotherapy treatments is anticipated to improve patient outcomes, which will likely increase their adoption. As the survival rates for AML improve with advancements in treatment, the demand for platelet-regulating drugs is expected to rise significantly.

The growing awareness of the role of thrombopoietin receptor agonists in improving the quality of life for AML patients is also expected to contribute to the market’s expansion. Furthermore, the increasing focus on targeted therapies in cancer treatment is likely to drive more specialized use of thrombopoietin receptor agonists in AML treatment regimens.

End-User Analysis

Hospitals are the dominant end-user segment, holding 69.8% of the thrombopoietin receptor agonists market. This growth is expected to continue as hospitals remain the primary setting for the administration of thrombopoietin receptor agonists due to their clinical infrastructure, specialized staff, and access to emergency care. The rising incidence of hematological disorders like AML, myelodysplastic syndromes, and immune thrombocytopenia is anticipated to increase the demand for thrombopoietin receptor agonists in hospitals.

Additionally, hospitals offer a comprehensive setting for the delivery of injectable treatments, which are often preferred for their rapid onset of action. The growing availability of specialized medical centers and the increasing focus on improving patient outcomes for severe diseases are expected to drive further growth in hospital demand.

With hospitals at the forefront of advanced medical care, including novel thrombopoietin receptor agonists, this segment is likely to remain the largest contributor to the market. Moreover, government healthcare policies focusing on improving hospital care and patient access to novel therapies are projected to further boost hospital utilization of thrombopoietin receptor agonists.

Key Market Segments

By Product Type

- Injectable

- Oral

By Application

- Acute Myeloid Leukemia

- Myelodysplastic Syndromes

- Immune Thrombocytopenia

- Aplastic Anemia

By End-user

- Hospitals

- Clinics

- Pharmacies

Drivers

Increasing Incidence and Diagnosis of Immune Thrombocytopenia (ITP) is Driving the Market

The increasing incidence and improved diagnosis of immune thrombocytopenia (ITP) and other related thrombocytopenic conditions are a significant driver propelling the thrombopoietin receptor agonists (TPO-RAs) market. ITP is an autoimmune bleeding disorder characterized by a low platelet count, leading to an increased risk of bleeding.

TPO-RAs stimulate the bone marrow to produce more platelets, offering a crucial treatment option for patients who do not respond adequately to corticosteroids or intravenous immunoglobulin (IVIG), or for those requiring long-term management to maintain a safe platelet count. The rising awareness among healthcare professionals and the availability of more accurate diagnostic tools contribute to the earlier and more frequent identification of ITP cases.

The US Centers for Medicare & Medicaid Services (CMS) coverage criteria for Immune Thrombocytopenia (ITP) Therapy, updated in 2023, note that the incidence of ITP ranges from 1 to 5 cases per 100,000 adults annually, with a higher prevalence due to the chronic nature of the disorder. These consistent figures highlight the continuous stream of new diagnoses. This persistent and critical medical need for effective platelet-boosting therapies drives the sustained demand for TPO-RAs, as they represent a vital component of the therapeutic arsenal for managing these chronic bleeding disorders.

Restraints

High Cost of Treatment and Reimbursement Challenges are Restraining the Market

The inherently high cost associated with thrombopoietin receptor agonists, combined with significant challenges in securing adequate reimbursement, notably restrains the market’s broader expansion. TPO-RAs are specialty pharmaceuticals, often requiring long-term administration, making their overall treatment cost substantial for patients and healthcare systems.

The complex research, development, and manufacturing processes for these advanced biologics contribute directly to their high price tags. This elevated cost can lead to hurdles in gaining comprehensive insurance coverage and favorable reimbursement policies from government health programs in various countries. According to a May 2025 report by the American Society of Health-System Pharmacists (ASHP), US prescription drug spending reached US$ 805.9 billion in 2024, representing a 10.2% year-over-year increase, significantly driven by specialty drugs.

This broader trend indicates the ongoing financial burden these medications place on healthcare systems. Payer scrutiny over treatment duration, patient eligibility criteria, and the requirement for prior authorizations often create access barriers for patients who could benefit from these therapies. Such financial constraints and administrative complexities limit the uptake of TPO-RAs, particularly in regions with cost-sensitive healthcare environments or less robust reimbursement frameworks.

Opportunities

Expanding Indications and Addressing Unmet Needs in Rare Platelet Disorders is Creating Growth Opportunities

The continuous expansion of approved indications for existing thrombopoietin receptor agonists and the strategic pursuit of addressing unmet medical needs in other rare platelet disorders are creating significant growth opportunities in the market. While TPO-RAs are primarily known for their use in ITP, pharmaceutical companies are investing in clinical trials to explore their efficacy in other conditions characterized by low platelet counts, such as chemotherapy-induced thrombocytopenia, aplastic anemia, or myelodysplastic syndromes.

Gaining regulatory approvals for these new indications broadens the patient base and extends the therapeutic utility of these drugs. Furthermore, the focus on developing TPO-RAs for specific patient populations, like pediatric patients or those who have failed multiple prior therapies, highlights an ongoing commitment to precision medicine.

For example, in May 2025, the US FDA announced the commercial availability of generic, AB-rated formulations of eltrombopag for the treatment of patients at least one year of age with persistent or chronic immune thrombocytopenia who have had an insufficient response to prior treatment, improving accessibility. This specific approval exemplifies how expanding age-group specific uses and increasing accessibility drives market opportunity. This strategic expansion into diverse patient populations and new therapeutic areas ensures sustained demand for TPO-RAs, leveraging their proven mechanism of action to address a wider spectrum of thrombocytopenic conditions.

Impact of Macroeconomic / Geopolitical Factors

Global economic shifts, including persistent inflation and fluctuating interest rates, influence the thrombopoietin receptor agonists market, impacting both operational costs for manufacturers and healthcare spending capabilities worldwide. The sophisticated manufacturing processes required for TPO-RAs, which involve specialized equipment, highly purified raw materials, and skilled labor, are susceptible to rising input costs.

For example, the US Producer Price Index for Pharmaceutical Preparation and Medicament Manufacturing showed a consistent increase over the past year, reflecting these escalating operational expenses for drug production. This directly translates to higher manufacturing expenditures for TPO-RAs, which companies must manage, potentially affecting their profitability or leading to price adjustments for healthcare systems.

Furthermore, geopolitical uncertainty, encompassing regional conflicts and unstable trade relations, introduces considerable risk to the global supply chains crucial for pharmaceutical components. Such instability can disrupt the reliable flow of raw materials or finished products, causing delays and increasing logistical complexities and costs.

However, these challenges also spur innovation, driving pharmaceutical companies to enhance supply chain resilience by diversifying sourcing and investing in more geographically distributed manufacturing capabilities. This ultimately contributes to a more robust and adaptable market for TPO-RAs, ensuring greater access to essential treatments even amidst global volatility.

Evolving US tariff policies are directly shaping the thrombopoietin receptor agonists market, impacting import costs, influencing supply chain decisions, and incentivizing a shift towards domestic pharmaceutical manufacturing. While finished TPO-RAs may not always face direct, high tariffs, duties on critical imported precursors, specialized analytical equipment, or advanced chemical reagents used in their complex production processes can significantly increase manufacturing costs for pharmaceutical companies operating in the US.

Data from the US Census Bureau for 2023 shows the total value of imported medicinal and pharmaceutical products into the US reached US$ 90.2 billion, demonstrating the vast volume of international trade in this sector where tariff implications on inputs can accumulate. This rise in input costs directly affects the profitability of TPO-RA manufacturers, potentially impacting their capacity for research and development or compelling them to adjust product pricing, which can burden patients and healthcare providers.

Conversely, the strategic application of tariffs, coupled with other governmental incentives, is actively encouraging pharmaceutical companies to enhance and expand their manufacturing footprint within the United States. This drive towards domestic production aims to create a more resilient and secure supply chain for essential medications like TPO-RAs, reducing vulnerability to geopolitical disruptions and fostering greater self-sufficiency in the US pharmaceutical landscape.

Latest Trends

Development of Next-Generation Oral and Extended Half-Life TPO-RAs is a Recent Trend

A prominent recent trend significantly impacting the thrombopoietin receptor agonists market in 2024 and continuing into 2025 is the accelerated development of next-generation oral formulations and extended half-life TPO-RAs. While existing TPO-RAs like eltrombopag (oral) and romiplostim (injectable) have transformed ITP treatment, pharmaceutical companies are focusing on innovation to further enhance convenience, patient adherence, and efficacy.

The development of new oral TPO-RAs aims to reduce the burden of injections for patients, offering a more patient-friendly administration route for chronic conditions. Simultaneously, research into extended half-life versions, whether oral or subcutaneous, seeks to decrease dosing frequency, which can improve patient compliance and simplify long-term management. This also includes efforts to develop TPO-RAs with different binding sites or mechanisms to potentially overcome resistance in patients who do not respond to current therapies.

A 2025 analysis in Blood Vessels, Thrombosis & Hemostasis, based on Japanese real-world data, indicated that early TPO-RA initiation can reduce corticosteroid dose and treatment duration in ITP patients, supporting the push for optimized and convenient regimens. The ongoing research and investment by key players in developing these advanced formulations signal a clear trend towards improving the patient experience and expanding the clinical utility of these essential platelet-stimulating therapies.

Regional Analysis

North America is leading the Thrombopoietin Receptor Agonists Market

North America dominated the market with the highest revenue share of 39.3% owing to the increasing diagnosis of chronic immune thrombocytopenia (ITP) and aplastic anemia, as well as expanded indications and strong commercial performance of existing therapies. ITP, a disorder characterized by low platelet counts, affects a considerable number of individuals across the United States and Canada, with an estimated prevalence of 12.1 per 100,000 adults in the US, as per NIH-supported research.

Aplastic anemia, another condition benefiting from TPO-RAs, sees between 600 and 900 new diagnoses annually in the US These patient populations represent a consistent demand for effective treatments that stimulate platelet production. Leading pharmaceutical companies have actively contributed to this growth through their established TPO-RA products. For example, Amgen reported that Nplate (romiplostim) sales increased by 12% year-over-year to US$ 346 million in the second quarter of 2024, reflecting continued strong demand in the region.

Novartis’s Promacta/Revolade (eltrombopag) also remains a significant contributor to its oncology portfolio, with global sales reaching US$ 2,216 million in 2024, demonstrating sustained uptake in key markets, including North America. Additionally, Rigel Pharmaceuticals reported that TAVALISSE (fostamatinib) net product sales reached US$ 104.8 million for the full year 2024, an increase of 12% compared to 2023, further solidifying the market’s expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to improving healthcare infrastructure, increasing diagnosis rates for relevant conditions, and a growing emphasis on rare blood disorder management by regional governments. Many countries across Asia Pacific are actively enhancing their diagnostic capabilities and awareness programs, leading to earlier identification of conditions like ITP and aplastic anemia, which often require long-term treatment with these therapies.

The incidence rates of aplastic anemia in Asia are observed to be two to three times higher than in North America, indicating a larger patient pool that will increasingly require effective treatments as healthcare access improves. China’s National Health Commission continues to refine its policies related to blood products and rare disease treatments, aiming to improve accessibility for patients. Japan’s Ministry of Health, Labour and Welfare consistently supports the development and provision of orphan drugs, which often include these platelet-stimulating therapies, to its population.

Leading global manufacturers with a significant presence in Asia Pacific are likely to increase their investment and expand their offerings. For instance, CSL Behring reported strong performance across its portfolio, particularly immunoglobulins, which are often used in conjunction with or for conditions similar to those treated by platelet-stimulating agents, indicating robust demand for specialized hematological treatments in the region. This sustained commitment by pharmaceutical companies, coupled with governmental efforts to improve rare disease care, is projected to significantly accelerate the adoption and growth of these essential medicines across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the thrombopoietin receptor agonists market employ a variety of strategies to drive growth. They focus on expanding their product pipelines by developing innovative therapies to treat disorders like thrombocytopenia. Companies invest in research and clinical trials to enhance the efficacy and safety profiles of their treatments.

Strategic partnerships with healthcare providers and research institutions help them accelerate product development and regulatory approval processes. They also prioritize geographical expansion, particularly targeting regions with unmet medical needs. Furthermore, increasing patient access programs and collaborations with patient advocacy groups play a significant role in ensuring widespread adoption.

One key player, Novartis, is a global healthcare company with a strong portfolio in hematology. The company’s thrombopoietin receptor agonist, Revolade, is used to treat thrombocytopenia in patients with chronic immune thrombocytopenic purpura. Novartis focuses on expanding its offerings in rare and serious diseases through ongoing research and partnerships. The company’s commitment to innovation and patient support ensures its leadership in the market.

Top Key Players in the Thrombopoietin Receptor Agonists Market

- Teva Pharmaceuticals

- Kyowa Kirin

- Hetero

- Gyre Pharmaceuticals

- Grand Pharmaceutical

- Chugai Pharmace

- Asahi Kasei Pharma

- Amgen

Recent Developments

- In July 2024: Gyre Pharmaceuticals, a subsidiary of Gyre Therapeutics, received approval from the National Medical Products Administration of China for avatrombopag maleate tablets. These tablets are intended for the treatment of thrombocytopenia associated with chronic liver disease in adults undergoing planned diagnostic procedures or treatments.

- In March 2024: Asahi Kasei Pharma and Swedish Orphan Biovitrum Japan Co., Ltd. reached an agreement granting exclusive distribution rights for Doptelet, an avatrombopag maleate-based thrombopoietin receptor agonist, in Japan. The medication is also approved for patients with immune-related platelet deficiencies.

Report Scope

Report Features Description Market Value (2024) US$ 2.3 billion Forecast Revenue (2034) US$ 4.4 billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Injectable and Oral), By Application (Acute Myeloid Leukemia, Myelodysplastic Syndromes, Immune Thrombocytopenia, and Aplastic Anemia), By End-user (Hospitals, Clinics, and Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teva Pharmaceuticals, Kyowa Kirin, Hetero, Gyre Pharmaceuticals, Grand Pharmaceutical, Chugai Pharmace, Asahi Kasei Pharma, Amgen. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Thrombopoietin Receptor Agonists MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Thrombopoietin Receptor Agonists MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Teva Pharmaceuticals

- Kyowa Kirin

- Hetero

- Gyre Pharmaceuticals

- Grand Pharmaceutical

- Chugai Pharmace

- Asahi Kasei Pharma

- Amgen