Global Tethered Drone Market Size, Industry Analysis Report By Type (Stationary tethered drones, Mobile tethered drones, and Hybrid tethered drones), By Range (Mid-range (100 – 300 meters), Short-range (100 meters), and Long-range (> 300 meters)), By Deployment Mode (Vehicle-mounted systems, Portable/man-portable systems, Fixed ground station-based systems, and Maritime), By Technology Integration (AI-enabled tethered drones, Computer vision-enhanced systems, Automated launch & recovery, Real-time edge computing systems, Encrypted communication & cybersecurity features, and Others), By Application (Defense & security, Public safety & emergency response, Commercial & industrial, Environmental monitoring, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155982

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

- Tethered Drone Market size

- Key Insight Summary

- Market Overview

- Impact of U.S. Tariffs

- Top Growth Factors

- Key Trends and Innovations

- By Type Segment

- By Range Segment

- By Deployment Mode

- By Technology Integration

- By Application

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Tethered Drone Market size

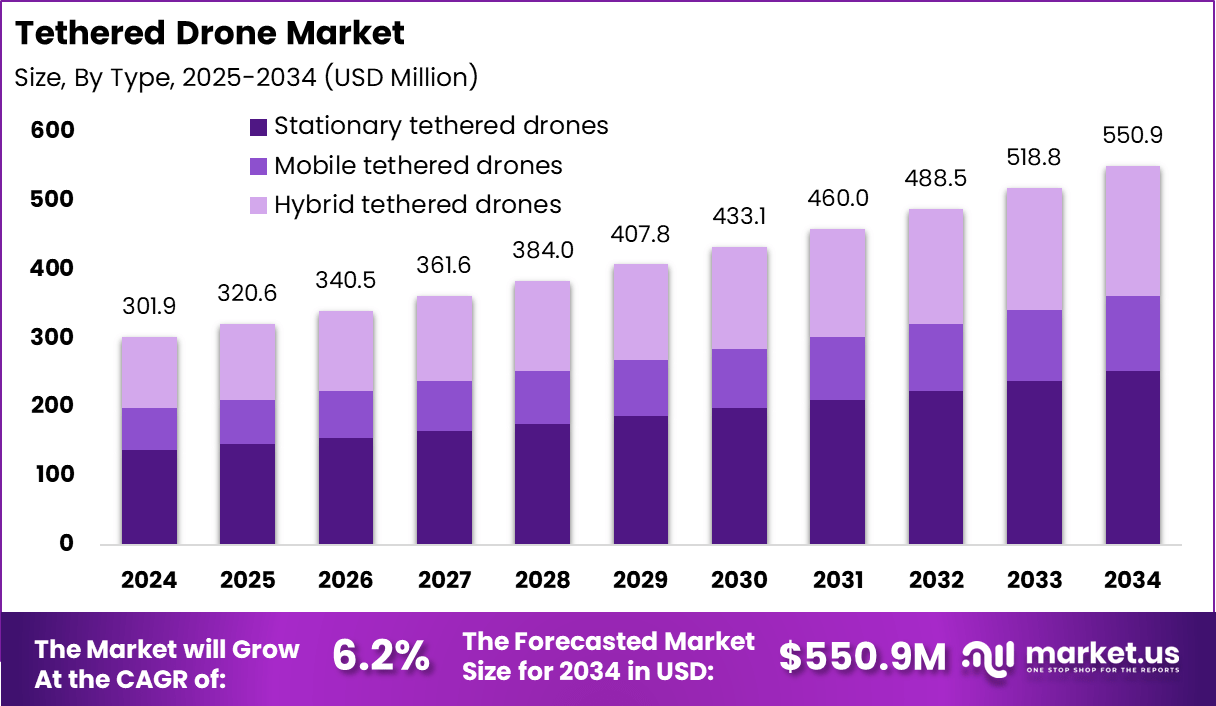

The Global Tethered Drone Market size is expected to be worth around USD 550.9 Million By 2034, from USD 301.9 Million in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 55.1% share, holding USD 166.4 Million revenue.

The Tethered Drone Market focuses on drones that are physically connected to a ground-based power source, enabling continuous operation for extended periods compared to battery-powered drones. These drones are primarily used in applications where sustained aerial presence is critical, including defense, border surveillance, event security, emergency response, infrastructure inspection, and industrial site monitoring.

Based on data from Federal Aviation Administration, As of July 2025, the drone sector has reached a significant milestone with 822,039 total registrations. Within this, 433,407 drones are tied to commercial purposes, indicating the growing reliance on drones for professional services such as delivery, agriculture, and infrastructure monitoring.

Recreational use also remains strong with 377,484 registrations, while 11,148 paper-based filings highlight that traditional processes still exist, though digital compliance is clearly becoming dominant. On the workforce side, the presence of 460,375 certificated remote pilots demonstrates a well-trained operator base, ensuring safe and regulated use of drones across industries.

Key Insight Summary

- Type Segment, Stationary tethered drones led with 45.8%, showing strong use for stable surveillance.

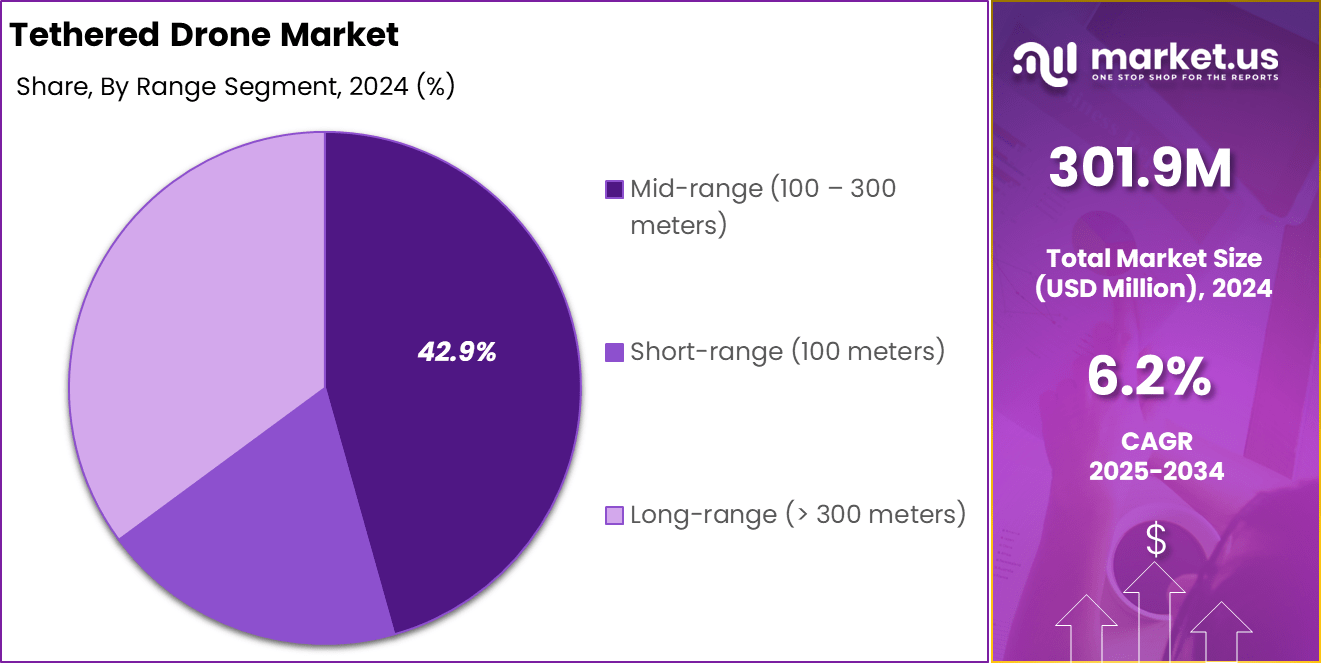

- Range Segment, Mid-range (100-300 meters) accounted for 42.9%, reflecting balanced coverage and flexibility.

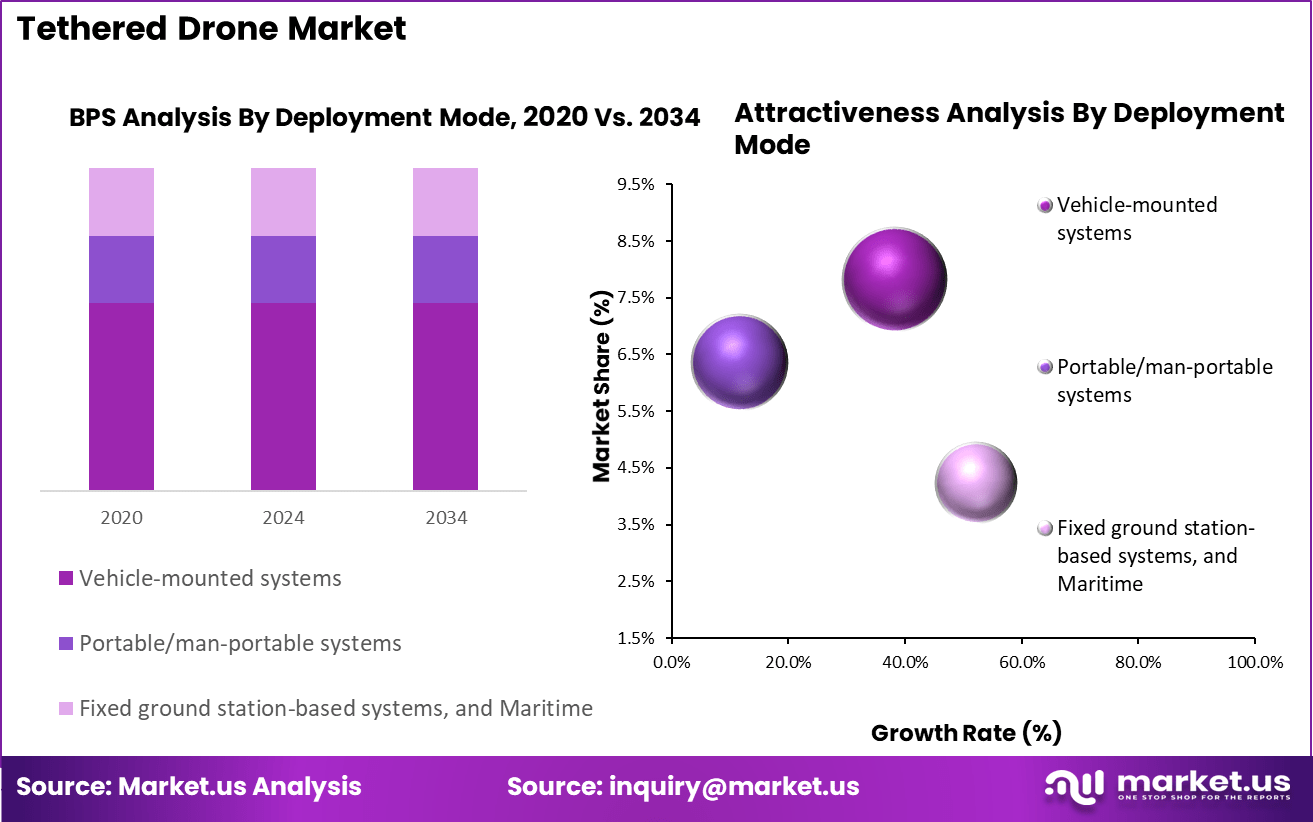

- Deployment Mode, Vehicle-mounted systems captured 40.7%, preferred for mobile and on-field operations.

- Technology Integration, AI-enabled tethered drones captured 12.2%, increasingly adopted for real-time analytics and automation.

- Application, Defense & security dominated with 40%, highlighting their role in military monitoring and border protection.

Market Overview

Top driving factors in this market include the increasing need for uninterrupted, real-time monitoring by defense, public safety, and disaster management agencies. Tethered drones are valued for their long endurance and reduced operational risk, as the tether enables both a constant power supply and a secure data connection – addressing limitations of conventional drones constrained by battery life or wireless signal reliability.

Investment opportunities are emerging alongside expanding industry use cases. Companies innovating in tethered drone technology, such as AI-integrated control systems, edge computing capabilities, and enhanced safety features, are capturing attention from both the public and private sectors. Growth is particularly notable in regions investing in border security, large-scale infrastructure monitoring, and government digitization programs.

For businesses, tethered drones deliver tangible benefits: they reduce manpower needs for routine inspections, enable rapid deployment for emergency events, and offer stable, high-bandwidth connections for secure video and data transfer. Their autonomy allows teams to focus on mission requirements rather than piloting logistics, while integration with advanced sensors supports real-time analytics and efficient resource allocation.

Impact of U.S. Tariffs

The Trump administration’s tariffs on Chinese technological components have profoundly impacted the tethered drone supply chain in several ways:

- Increased Costs: Tariffs of up to 25% on Chinese imports raised costs for drone components such as cameras, GPS modules, batteries, sensors, and circuit boards. This made Chinese-made drones and parts more expensive for U.S. manufacturers and consumers, impacting major Chinese drone makers like DJI and others.

- Supply Chain Disruptions: Many U.S. and European drone manufacturers rely on Chinese-made electronic components. Tariffs disrupted these supply chains, causing shortages, delays, and increased lead times for items like lithium-polymer batteries, electronic speed controllers, and brushless motors. Companies had to scramble for alternate suppliers in Taiwan, Japan, South Korea, and domestically, affecting production timelines.

- Shift in Manufacturing: Due to tariffs increasing costs from China, manufacturers began relocating production to other regions such as Southeast Asia (Vietnam, Malaysia, Indonesia), Mexico (nearshoring for U.S. companies), and India. However, moving manufacturing hubs involves high cost, infrastructure, and regulatory challenges, resulting in short-term surges in costs and slower transition.

- Impact on Defense and Government Use: The U.S. government banned Chinese-made drones in federal agencies over security concerns. This caused many agencies to ground Chinese drones, retrofit fleets, or invest in domestic alternatives, simultaneously creating a gap in availability and pushing for domestic innovation.

- Broader Tech Industry Ripple Effects: Tariffs caused global supply chain uncertainties affecting not only drones but also semiconductors, electronics, and hardware manufacturing, leading companies like Apple, Microsoft, and Nvidia to diversify manufacturing locations and invest more in domestic capacity.

Top Growth Factors

Growth Factor Description Persistent Aerial Surveillance Continuous monitoring for defense, homeland security, events, and border patrol Continuous Power & Long Flight Time Tethering enables extended missions, critical for long-duration aerial presence Growing Public Safety & Event Use Law enforcement, disaster response, emergency monitoring, and crowd safety Industrial/Infrastructure Monitoring Use in utilities, construction, broadcast, and infrastructure inspection Regulatory Advantages Fewer restrictions compared to untethered UAVs; easier compliance with safety rules Technology Advancements High-endurance materials, AI-enabled controls, fiber optic/data tethers Key Trends and Innovations

Trend / Innovation Description Modular, Cost-Effective Designs Flexible, scale-out platforms from startups for commercial and industrial use AI & Computer Vision Integration Real-time analytics, threat detection, and automated tracking Improved Tether Durability Lighter, stronger tethers for longer missions and faster deployment Encrypted Communication Secure, real-time video and telemetry for defense/police and critical infrastructure Automated Launch & Recovery Self-deploying/Mobile tethered systems for rapid response and flexible positioning Maritime & Vehicle-mounted Systems New deployment modes for naval, border, and mobile command applications By Type Segment

In 2024, Stationary tethered drones hold a substantial 45.8% share within the Tethered Drone Market, highlighting their widespread adoption for applications requiring prolonged hovering and stable operations. These drones maintain a fixed position while tethered, providing continuous power supply and robust communication links without the limitations of battery life.

Their ability to stay airborne for extended periods makes them ideal for surveillance, monitoring, and communication relay tasks. The appeal of stationary tethered drones is amplified in environments where persistent aerial presence is critical, such as border security, event surveillance, and infrastructure inspection. Their reliability and endurance offer a cost-effective alternative to conventional drones that suffer from limited flight times.

By Range Segment

In 2024, The mid-range category, covering distances between 100 to 300 meters, dominates with a 42.9% market share within tethered drone operations. This range effectively balances operational flexibility and control, enabling drones to cover significant ground while maintaining strong tethered connections.

It is perfectly suited for tasks that require more coverage than short-range drones but do not necessitate extreme distances. Mid-range drones are favored for their ability to provide detailed situational awareness in applications such as infrastructure monitoring, emergency response, and surveillance. Their moderate operational radius suits many commercial and defense use cases by ensuring high data fidelity and real-time responsiveness.

By Deployment Mode

In 2024, Vehicle-mounted tethered drone systems capture a 40.7% share, reflecting their strategic integration with mobile platforms. This deployment mode enhances operational flexibility, allowing drones to be quickly moved and deployed across diverse environments, including remote or rugged terrains.

Mounted on vehicles, tethered drones provide continuous surveillance, communication, or data collection capabilities while on the move or stationary. Such systems are particularly valuable for defense, law enforcement, and disaster response teams that require rapid deployment and extended aerial coverage without dependence on fixed installations. The mobility of vehicle-mounted drones significantly expands their tactical and operational utility.

By Technology Integration

In 2024, AI-enabled tethered drones enhance the market by incorporating advanced autonomous capabilities, including real-time data processing, object detection, and decision-making. The integration of AI supports functions like automated tracking, threat detection, and optimized flight paths, reducing operator workload and improving mission accuracy.

By leveraging AI, tethered drones can deliver smarter, more adaptive performance across applications, especially where rapid analysis and response are critical. This technology integration is driving adoption in sectors such as defense and security, where precision and operational efficiency are paramount.

By Application

In 2024, the defense and security sector leads the tethered drone market with a 40% share, driven by the need for persistent aerial surveillance, border security, and tactical communication support. Tethered drones provide continuous intelligence, surveillance, and reconnaissance (ISR) capabilities with advantages such as extended flight endurance and secure data transmission.

Their applications include monitoring sensitive areas, supporting military operations, and enhancing public safety during large events or emergencies. The high strategic value of tethered drones in defense and security solidifies this sector’s dominant role in market growth and innovation.

Key Market Segments

Type Segment

- Stationary tethered drones

- Mobile tethered drones

- Hybrid tethered drones

Range Segment

- Mid-range (100 – 300 meters)

- Short-range (100 meters)

- Long-range (> 300 meters)

Deployment Mode

- Vehicle-mounted systems

- Portable/man-portable systems

- Fixed ground station-based systems, and Maritime

Technology Integration

- AI-enabled tethered drones

- Computer vision-enhanced systems

- Automated launch & recovery

- Real-time edge computing systems

- Encrypted communication & cybersecurity features

- Others

Application

- Defense & security

- Public safety & emergency response

- Commercial & industrial

- Environmental monitoring

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Demand for Continuous Surveillance and Reliable Communications

A critical driver of the tethered drone market is the increasing need for long-term, uninterrupted surveillance in sensitive areas such as borders, critical infrastructure, and public events. Unlike standard drones restricted by battery life, tethered drones can remain airborne for hours or days by drawing power from the ground, ensuring constant situational awareness.

This makes them indispensable for real-time monitoring and data transmission. Moreover, their secure and stable communication links are highly valued in both governmental and commercial sectors. These drones provide reliable high-definition video feeds and telemetry without the risk of frequent signal loss or data interruptions common to wireless drone systems.

Restraint Analysis

Mobility Constraints and Regulatory Ambiguity

Despite their advantages, tethered drones are limited by the physical length and nature of their tether cables. This restricts the operational range and makes them less suitable for missions requiring wide-area coverage or fast repositioning. Such mobility constraints limit their use in scenarios involving large-scale or rapidly changing environments.

In addition, regulatory frameworks for tethered drones are still evolving and vary widely by region. The cable and stationary deployment bring unique legal considerations distinct from traditional drones, especially regarding airspace use and privacy protections. These regulatory uncertainties can postpone adoption, particularly in urban or densely populated areas, complicating operational planning for users.

Opportunity Analysis

Expanding Roles in Civil and Industrial Sectors

Tethered drones are increasingly being adopted in civil and industrial applications beyond their traditional defense roots. Their ability to provide persistent overhead monitoring benefits sectors like construction, utilities, and large-scale events where constant observation improves safety and operational management.

They can serve as temporary communication towers and broadcast platforms during emergencies and concerts, signaling growing versatility. As improvements continue in sensor technology and AI integration, tethered drones are poised to play a more central role in smart city initiatives and critical infrastructure inspection.

Challenge Analysis

Physical Tether Vulnerabilities and Complex Deployment

The tether cable, while a source of extended power and data link stability, introduces vulnerability to weather, environmental obstacles, and physical damage. High winds, storms, or accidental snags can sever the tether or destabilize the drone, risking mission failure. Maintaining the integrity of the tether is a continuous challenge for operators.

Furthermore, setting up tethered drone systems can be complex and labor-intensive, requiring specialized equipment such as ground stations and secure power sources. Deployments may be less feasible in difficult terrain or constrained urban environments where space for equipment setup is limited. Streamlining these operational challenges is crucial to making tethered drones more accessible and efficient in various real-world scenarios.

Competitive Analysis

In the tethered drone market, Bharat Electronics and Acecore Technologies are recognized for strengthening military and surveillance applications. Bharat Electronics focuses on defense-grade tethered systems with strong emphasis on reliability and secure communication. Acecore Technologies, on the other hand, emphasizes versatile platforms that are suited for law enforcement and public safety.

Aerial IQ and Easy Aerial are expanding the market presence by targeting commercial and security applications. Aerial IQ provides specialized tethered solutions designed for long-duration monitoring tasks, offering flexibility in urban and industrial use cases. Easy Aerial builds autonomous tethered systems that combine mobility with rapid deployment, making them suitable for emergency response and infrastructure monitoring.

Elistair, FlyFocus, and Fotokite are emerging as innovation leaders in this segment. Elistair has developed advanced tethered drone stations that focus on scalability and field adaptability, making them attractive for large-scale events and defense operations. FlyFocus positions its tethered drones as solutions for broadcasting and security, highlighting ease of operation.

Tethered Drone Market Companies

Some of the prominent market participants operating in the sector include:

- Bharat Electronics

- Acecore Technologies

- Aerial IQ

- Easy Aerial

- Elistair

- FlyFocus

- Fotokite

Recent Developments

- In February 2025, Elistair, in partnership with Milrem Robotics, secured a defense contract to provide its Khronos small tethered unmanned aerial systems (UAS) to an allied military force. The agreement covers more than the delivery of the systems, extending to first-line spare parts, operator training, and ongoing support, ensuring long-term operational readiness.

Report Scope

Report Features Description Market Value (2024) USD 301.9 Mn Forecast Revenue (2034) USD 550.9 Mn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Stationary tethered drones, Mobile tethered drones, and Hybrid tethered drones), By Range (Mid-range (100 – 300 meters), Short-range (100 meters), and Long-range (> 300 meters)), By Deployment Mode (Vehicle-mounted systems, Portable/man-portable systems, Fixed ground station-based systems, and Maritime), By Technology Integration (AI-enabled tethered drones, Computer vision-enhanced systems, Automated launch & recovery, Real-time edge computing systems, Encrypted communication & cybersecurity features, and Others), By Application (Defense & security, Public safety & emergency response, Commercial & industrial, Environmental monitoring, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bharat Electronics, Acecore Technologies, Aerial IQ, Easy Aerial, Elistair, FlyFocus, Fotokite Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bharat Electronics

- Acecore Technologies

- Aerial IQ

- Easy Aerial

- Elistair

- FlyFocus

- Fotokite