Global Tennis Equipment Market Size, Share, Growth Analysis By Product Type (Apparel, Tennis Balls, Strings, Rackets, Others), By Sales Channel (Specialty Sports & Fitness Stores, Supermarkets & Hypermarkets, Electronics & Sports Stores, Online Retailers, Direct Sales, Others), By Application (Amateur Usage, Professional), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153669

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

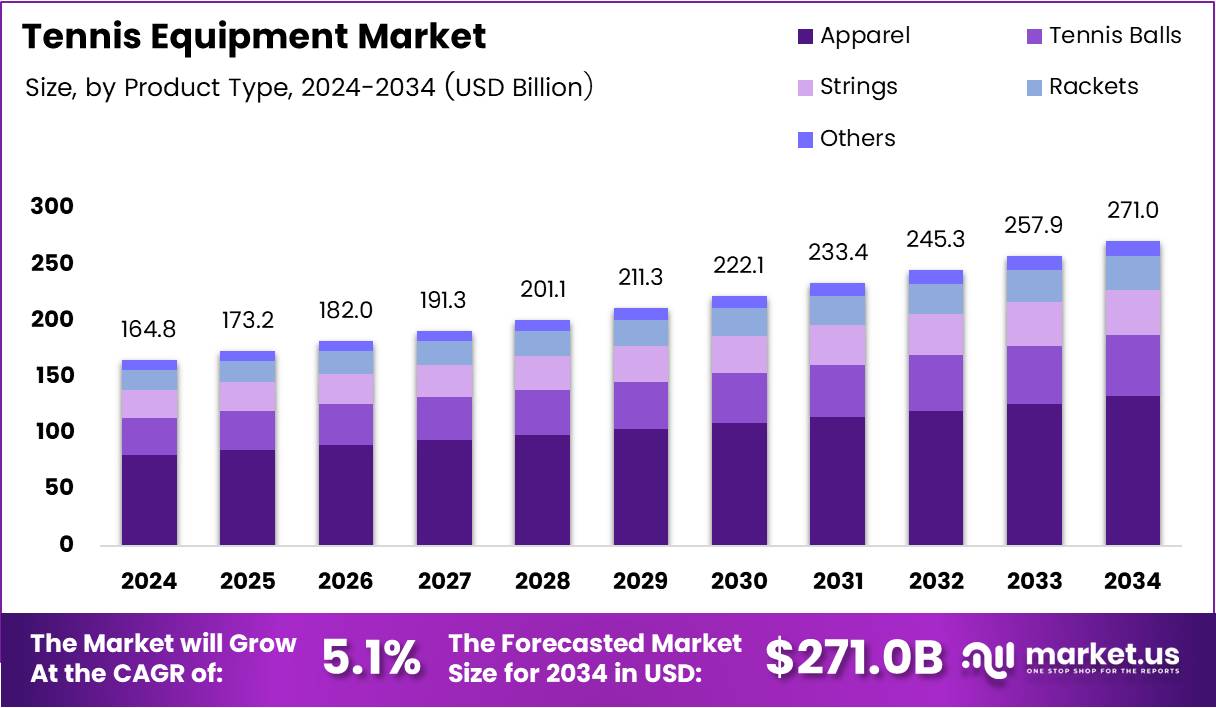

The Global Tennis Equipment Market size is expected to be worth around USD 271.0 Billion by 2034, from USD 164.8 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The Tennis Equipment Market refers to the ecosystem of products and gear essential for playing tennis—this includes racquets, balls, apparel, footwear, accessories, and maintenance tools. It is closely linked to player participation rates, seasonal sports trends, and innovations in product performance and sustainability. As tennis grows in recreational and competitive popularity, the demand for advanced equipment continues to rise.

The tennis equipment market is experiencing notable growth, driven by increased participation in tennis across all age groups. In particular, youth and women’s segments are showing strong momentum. Government funding for public courts and fitness initiatives are boosting accessibility, expanding market reach, and supporting retail performance.

Meanwhile, product innovation remains a key growth driver. According to Tennisnerd, adding tennis string to a racquet shifts its balance point by one centimeter and adds an average weight of 20g, showing how product customization affects playability. Such enhancements create new revenue streams for equipment makers targeting performance-conscious consumers.

Sustainability has become a concern. As per VOA News, of the 330 million tennis balls produced annually, almost all are discarded, often ending up in landfills where they may take up to 400 years to decompose. This raises opportunities for eco-friendly alternatives and circular recycling models in tennis gear manufacturing.

The U.S. market is also benefiting from fashion-driven sales in tennis apparel. According to Tennis.com, women’s tennis apparel grew 22% from early 2024 to August, while men’s apparel followed with a 19% rise. This indicates growing consumer interest in lifestyle-based tennis wear, not just performance gear.

Regulatory standards also influence product development. As per Azbil, the International Tennis Federation (ITF) mandates tennis ball sizes between 6.54 and 6.86 cm, with weights from 56.0 to 59.4g, ensuring brand compliance and consistency across competitive products.

Furthermore, rising interest in personalized tennis gear—like customized racquets and grip technologies—has opened niche segments. This shift aligns with consumer expectations for quality, innovation, and personalization in premium sports equipment.

Retailers and manufacturers are responding with omnichannel strategies, blending e-commerce with in-store experiences. As consumers seek convenience and detailed product education, digital platforms are key in influencing purchases and engagement.

Government-backed sport development programs and school-level tennis initiatives continue to fuel the base of active players, sustaining long-term equipment demand. These efforts not only support participation but also stimulate tennis equipment sales at the grassroots level.

Emerging technologies, such as smart racquets and connected wearables, are reshaping the competitive edge. These innovations drive both performance improvement and differentiation, keeping the U.S. Tennis Equipment Market dynamic and innovation-focused.

Key Takeaways

- Global Tennis Equipment Market is projected to reach USD 271.0 Billion by 2034, up from USD 164.8 Billion in 2024, growing at a CAGR of 5.1% from 2025 to 2034.

- In 2024, Apparel led the product type segment with a 32.6% share, driven by demand for performance-enhancing and fashionable sportswear.

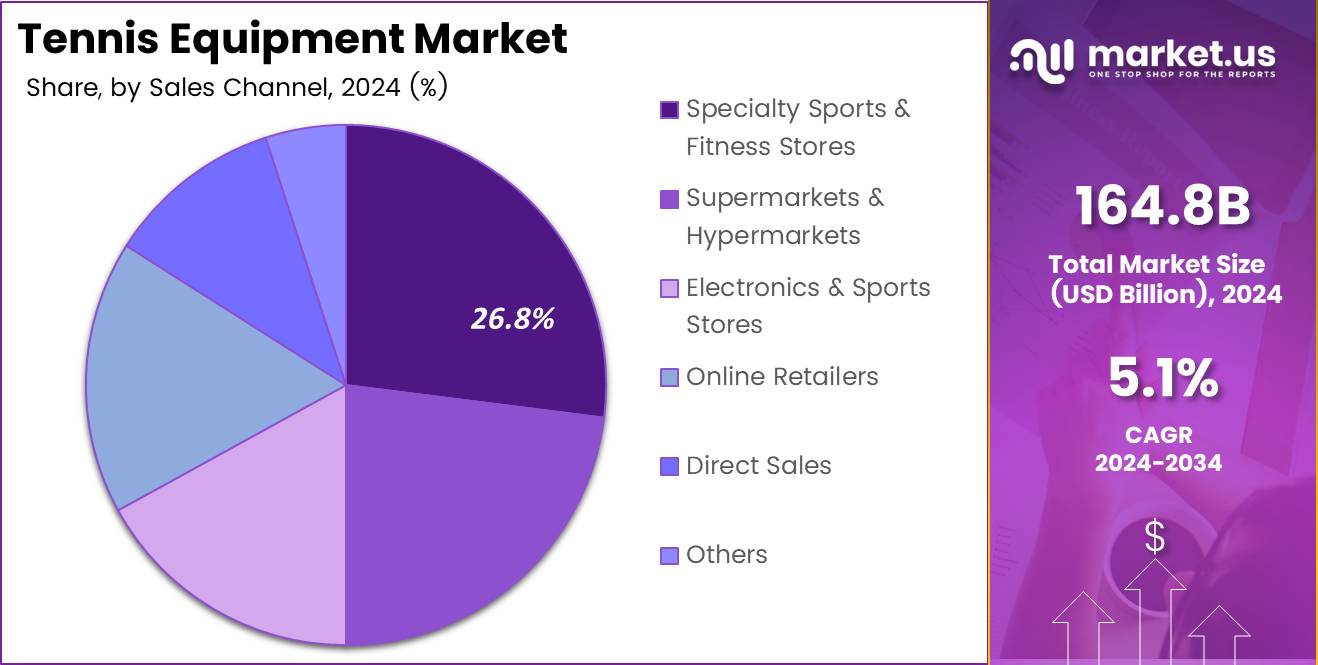

- Specialty Sports & Fitness Stores dominated the sales channel segment in 2024, holding a 26.8% share due to expert service and premium product offerings.

- Amateur Usage accounted for the largest application share in 2024 at 60.3%, fueled by rising recreational tennis interest and health awareness.

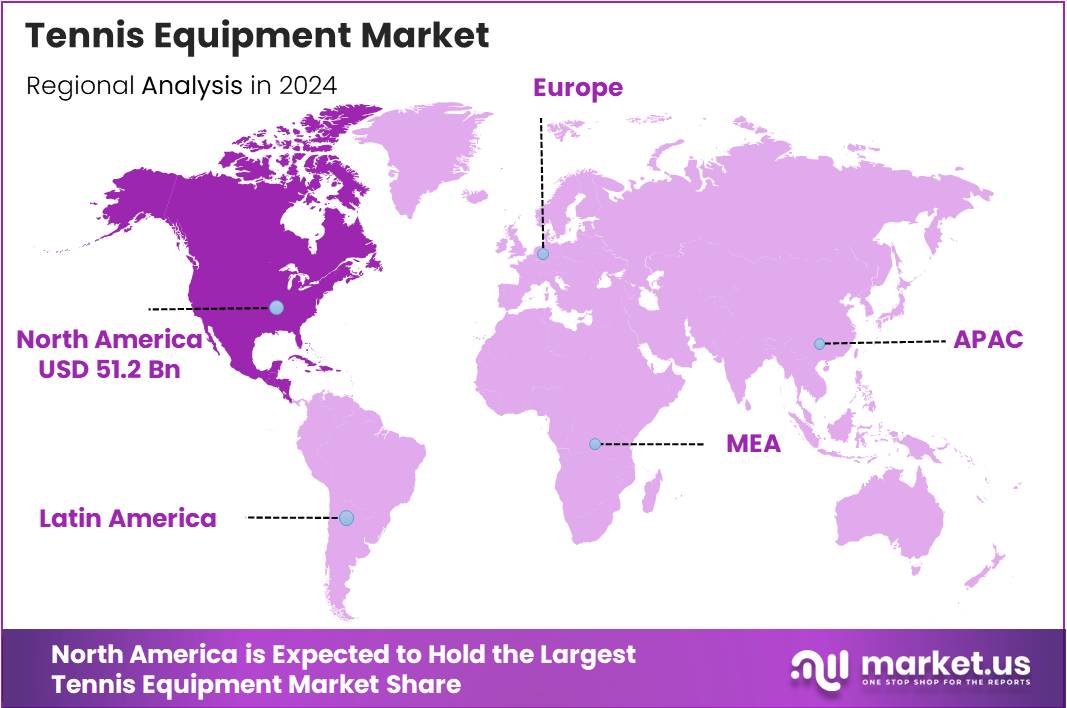

- North America held the top regional position with a 30.9% market share and USD 51.2 Billion valuation, supported by strong tennis culture and infrastructure.

Product Type Analysis

Apparel leads with 32.6% share, driven by rising fashion trends and comfort preferences in tennis.

In 2024, Apparel held a dominant market position in the By Product Type Analysis segment of the Tennis Equipment Market, with a 32.6% share. The growing emphasis on performance-enhancing, stylish, and breathable sportswear has significantly contributed to this lead. Tennis players, both amateur and professional, are increasingly prioritizing functional and fashionable clothing, boosting apparel demand.

Following apparel, Tennis Balls emerged as a crucial segment, supporting consistent player training and match requirements. With regular replacements due to wear and quality concerns, this segment maintains a steady demand curve.

Strings have also carved a notable position in the market. Frequent restringing practices among players, aimed at optimizing racket performance, have contributed to its consistent growth.

Rackets, the core tool of the sport, continue to drive substantial revenue. Technological advancements and ergonomic designs are attracting a wide range of players.

The Others category encompasses accessories such as grips, dampeners, and bags. While individually less significant, collectively they form a support segment enhancing overall tennis gear usage.

Sales Channel Analysis

Specialty Sports & Fitness Stores take the lead with 26.8%, thanks to tailored product ranges and expert service.

In 2024, Specialty Sports & Fitness Stores held a dominant market position in the By Sales Channel Analysis segment of the Tennis Equipment Market, with a 26.8% share. These stores cater specifically to tennis enthusiasts, offering expert advice and a wide selection of premium gear, which has fueled customer loyalty and trust.

Supermarkets & Hypermarkets follow closely, driven by their wide geographical presence and convenience factor. Although their assortments are often limited, affordability and accessibility attract casual players.

Electronics & Sports Stores serve a mixed clientele. Their integrated offerings and seasonal promotions make them a secondary yet competitive option.

Online Retailers are steadily gaining ground, offering extensive selections and doorstep delivery. Their growing popularity among tech-savvy consumers is reshaping purchasing habits in urban regions.

Direct Sales continue to maintain relevance, particularly among tennis academies and clubs procuring bulk equipment. Personalized services and brand-driven promotions enhance their appeal.

The Others channel consists of emerging retail methods, including pop-up shops and collaborative brand outlets, adding a niche but growing presence in the market.

Application Analysis

Amateur Usage dominates with 60.3% share as casual players fuel mass-market demand.

In 2024, Amateur Usage held a dominant market position in the By Application Analysis segment of the Tennis Equipment Market, with a 60.3% share. The surge in recreational tennis participation, driven by increased health awareness and community programs, is the primary contributor to this segment’s dominance.

Casual players, school students, and adult beginners are key demographics supporting consistent demand. Their focus on affordability, durability, and general-purpose products ensures steady sales across various product categories.

In contrast, the Professional segment remains highly specialized, catering to elite athletes and competitive players. Although smaller in share, this segment commands premium pricing and brand endorsement value.

The distinct gap in share between the two highlights how the broader population’s interest in tennis plays a vital role in shaping the overall market landscape. Grassroots development programs and recreational leagues will likely sustain the amateur segment’s leading role in coming years.

Key Market Segments

By Product Type

- Apparel

- Tennis Balls

- Strings

- Rackets

- Others

By Sales Channel

- Specialty Sports & Fitness Stores

- Supermarkets & Hypermarkets

- Electronics & Sports Stores

- Online Retailers

- Direct Sales

- Others

By Application

- Amateur Usage

- Professional

Drivers

Rise in Professional Tennis Tournaments and Global Viewership Boosts Market Expansion

The global rise in professional tennis tournaments has increased demand for quality tennis equipment. With more international competitions being held and televised, audiences are growing, creating more interest in tennis among viewers. This trend directly supports the sales of rackets, balls, shoes, and apparel.

The expansion of e-commerce platforms has also contributed to the growth of the tennis equipment market. Consumers now have easier access to a wide variety of gear online, often at competitive prices. This has made it simpler for both amateur and professional players to purchase high-quality equipment conveniently.

Furthermore, schools and colleges are increasingly introducing tennis into their sports programs. This early exposure to the sport encourages participation among young athletes, driving steady demand for affordable and durable tennis gear suitable for students and beginners.

Governments in several countries are investing in the development of sports infrastructure, including tennis courts and training centers. This has created a stronger foundation for the sport at the grassroots level, supporting market growth for equipment manufacturers and retailers.

Restraints

High Cost of Premium Tennis Equipment and Accessories Limits Market Accessibility

Premium tennis equipment often comes with a high price tag, which can discourage entry-level players from purchasing. This creates a barrier, especially in developing regions, where affordability is a key factor in sports adoption.

In many rural and underserved areas, access to proper tennis courts and facilities is very limited. Without places to play, interest in the sport naturally declines, reducing the need for equipment in these regions.

Outdoor tennis is also highly dependent on season and weather. In areas with extreme weather conditions, the sport becomes less practical year-round, causing fluctuations in equipment sales and participation rates.

The rise of other sports and fitness trends, such as running, cycling, and indoor gym workouts, also competes with tennis. These alternatives are often more accessible and require less specialized gear, drawing potential players away from tennis.

Growth Factors

Integration of Smart Technology and Wearables in Tennis Gear Creates New Growth Opportunities

Smart technology is becoming a key factor in tennis gear development. Products like sensor-enabled rackets and wearable performance trackers help players improve their game, making smart equipment more desirable for tech-savvy consumers.

Emerging markets in Asia-Pacific and Latin America offer significant potential for market expansion. Growing middle-class populations and rising interest in tennis are fueling demand for equipment in these regions, especially when supported by localized marketing.

Sustainability trends are shaping product design. Many brands are now focusing on creating eco-friendly tennis products using recycled materials and sustainable production methods, appealing to environmentally conscious consumers.

Fitness influencers and professional tennis ambassadors are partnering with brands to promote products. These strategic collaborations help companies reach wider audiences and build trust among potential buyers through authentic engagement and content.

Emerging Trends

Customization and Personalization of Tennis Rackets and Apparel Fuel Market Trends

Consumers are increasingly seeking personalized tennis equipment. From custom racket grips to apparel tailored to personal style, brands offering customization options are seeing higher engagement and loyalty.

Online coaching and virtual tennis training platforms are gaining popularity, especially among beginners and casual players. These digital tools support skill development at home, which in turn drives sales of equipment tailored for training use.

Urban fashion is being influenced by tennis styles, with tennis-inspired clothing becoming trendy beyond the court. This crossover into lifestyle fashion contributes to higher demand for tennis-branded shoes and apparel.

Augmented Reality (AR) is being adopted by retailers to enhance shopping experiences. By allowing users to virtually test tennis rackets or shoes before buying, AR increases consumer confidence and supports higher conversion rates in online stores.

Regional Analysis

North America Dominates the Tennis Equipment Market with a Market Share of 30.9%, Valued at USD 51.2 Billion

North America leads the global tennis equipment market, capturing a substantial 30.9% market share and reaching a valuation of USD 51.2 Billion. The region’s dominance is attributed to the widespread popularity of tennis, well-established sports infrastructure, and higher disposable income levels. Consistent participation across all age groups further propels demand for tennis gear, apparel, and accessories.

Europe Tennis Equipment Market Trends

Europe follows closely, with a robust sports culture and significant investments in recreational sports activities. Countries such as Germany, France, and the UK exhibit strong demand for tennis equipment due to a growing health-conscious population and active tennis communities. Seasonal tournaments and grassroots-level participation continue to drive market growth.

Asia Pacific Tennis Equipment Market Trends

Asia Pacific is witnessing rapid growth, fueled by increasing sports participation and rising disposable incomes in emerging economies like China, India, and Japan. Government initiatives promoting physical activity and the expanding middle-class demographic are key factors stimulating the regional market. Urbanization and the development of sports clubs also contribute to the surge in demand.

Middle East and Africa Tennis Equipment Market Trends

The Middle East and Africa region shows moderate growth in the tennis equipment market. The presence of international sports events and increasing awareness about fitness contribute to demand. While tennis remains a niche sport, rising investments in sports infrastructure are expected to support gradual market development.

Latin America Tennis Equipment Market Trends

Latin America demonstrates steady expansion in the tennis equipment market, supported by a growing interest in tennis and increasing youth engagement. Countries like Brazil and Argentina are seeing improvements in sports participation rates. Continued investment in training facilities and sports programs fosters a favorable environment for market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tennis Equipment Company Insights

North America Dominates the Tennis Equipment Market with a Market Share of 30.9%, Valued at USD 51.2 Billion

North America leads the global tennis equipment market, capturing a substantial 30.9% market share and reaching a valuation of USD 51.2 Billion. The region’s dominance is attributed to the widespread popularity of tennis, well-established sports infrastructure, and higher disposable income levels. Consistent participation across all age groups further propels demand for tennis gear, apparel, and accessories.

Europe Tennis Equipment Market Trends

Europe follows closely, with a robust sports culture and significant investments in recreational sports activities. Countries such as Germany, France, and the UK exhibit strong demand for tennis equipment due to a growing health-conscious population and active tennis communities. Seasonal tournaments and grassroots-level participation continue to drive market growth.

Asia Pacific Tennis Equipment Market Trends

Asia Pacific is witnessing rapid growth, fueled by increasing sports participation and rising disposable incomes in emerging economies like China, India, and Japan. Government initiatives promoting physical activity and the expanding middle-class demographic are key factors stimulating the regional market. Urbanization and the development of sports clubs also contribute to the surge in demand.

Middle East and Africa Tennis Equipment Market Trends

The Middle East and Africa region shows moderate growth in the tennis equipment market. The presence of international sports events and increasing awareness about fitness contribute to demand. While tennis remains a niche sport, rising investments in sports infrastructure are expected to support gradual market development.

Latin America Tennis Equipment Market Trends

Latin America demonstrates steady expansion in the tennis equipment market, supported by a growing interest in tennis and increasing youth engagement. Countries like Brazil and Argentina are seeing improvements in sports participation rates. Continued investment in training facilities and sports programs fosters a favorable environment for market growth.

Top Key Players in the Market

- YONEX Co., Ltd.

- Wilson Sporting Goods

- Nike, Inc.

- Adidas AG

- BABOLAT VS S.A.

- Solinco Inc.

- Amer Sports

- Head N.V.

- Dunlop Sports

- Technifibre

- ASICS Corporation

- Geau Sport

- Prince Tennis

- Volkltennis

- Ame & Lulu

Recent Developments

- In February 2024, Amer Sports, maker of Wilson tennis rackets, saw its shares rise 3% during its NYSE debut. The IPO was priced at a discount, helping the stock gain in an otherwise tepid market.

- In August 2023, the USTA announced that five additional tennis organizations have joined its growing platform, USTA Connect. This expansion aims to foster collaboration across the tennis community and strengthen network ties.

- In June 2025, the USTA launched a new micro-grant program with a $5 million pledge to support grassroots tennis over five years. This initiative reinforces the USTA’s long-term commitment to making tennis more accessible and community-driven.

Report Scope

Report Features Description Market Value (2024) USD 164.8 Billion Forecast Revenue (2034) USD 271.0 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apparel, Tennis Balls, Strings, Rackets, Others), By Sales Channel (Specialty Sports & Fitness Stores, Supermarkets & Hypermarkets, Electronics & Sports Stores, Online Retailers, Direct Sales, Others), By Application (Amateur Usage, Professional) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape YONEX Co., Ltd., Wilson Sporting Goods, Nike, Inc., Adidas AG, BABOLAT VS S.A., Solinco Inc., Amer Sports, Head N.V., Dunlop Sports, Technifibre, ASICS Corporation, Geau Sport, Prince Tennis, Volkltennis, Ame & Lulu Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- YONEX Co., Ltd.

- Wilson Sporting Goods

- Nike, Inc.

- Adidas AG

- BABOLAT VS S.A.

- Solinco Inc.

- Amer Sports

- Head N.V.

- Dunlop Sports

- Technifibre

- ASICS Corporation

- Geau Sport

- Prince Tennis

- Volkltennis

- Ame & Lulu