Global Tactical Communication Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Communication (Radio communication, Satellite communication, Encryption and cybersecurity solutions, Mobile communication systems, Others), By Platform (Ground, Airborne, Naval), By Application (Intelligence, surveillance & reconnaissance, Command & control, Combat operations, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 163978

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Communication Analysis

- Platform Analysis

- Application Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

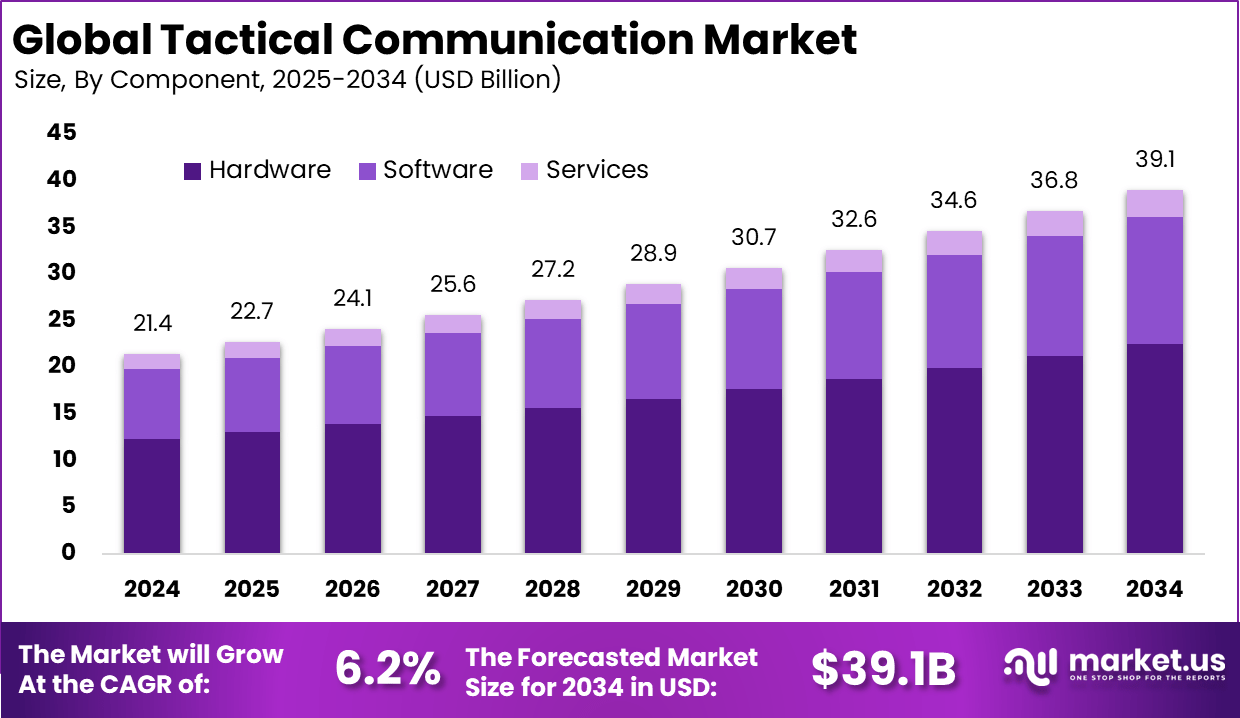

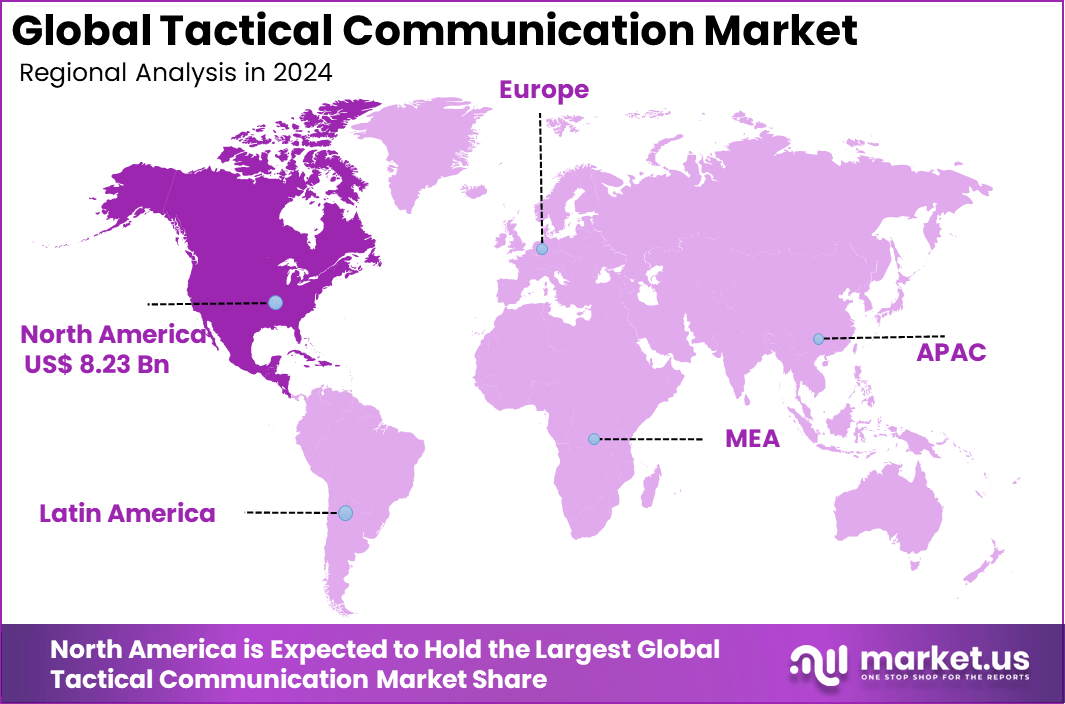

The Global Tactical Communication Market size is expected to be worth around USD 39.1 billion by 2034, from USD 21.4 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38.5% share, holding USD 8.23 billion in revenue.

The Tactical Communication Market is centered on advanced military communication devices that enable secure, real-time information exchange on battlefields and other defense environments. These systems transmit crucial commands, military intelligence, and situational data in verbal, written, visual, or audio forms. They operate across land, air, and naval platforms, often in harsh, hostile conditions where reliability and security are paramount.

Top driving factors include the significant increase in global defense expenditures and the ongoing modernization of military networks. The transition from analog to digital radio communications enhances spectrum efficiency and communication reliability, with digital radio standards like DMR, TETRA, and P25 gaining preference.

The growing adoption of 5G-enabled networks and AI-powered cognitive radios facilitates higher bandwidth, better spectrum management, and adaptive communication in complex and contested environments. Defensive needs against cybersecurity threats and electronic jamming also push for higher investment in secure, resilient communication systems.

Demand analysis highlights strategic requirements for seamless connectivity in joint and hybrid warfare scenarios. Ground forces represent the largest user base, accounting for an estimated 36% share of tactical communication deployments due to their operational scale and mobility needs. Combat applications comprise about 27.5% of usage, reflecting the critical role of communication in delivering timely, accurate intelligence and orders during combat.

For instance, In February 2025, KSSL and L3Harris Technologies signed an MoU to co-develop tactical communication networks for the Indian Armed Forces. The collaboration focuses on integrating advanced communication technologies to enhance network reliability, security, and operational efficiency by combining KSSL’s local expertise with L3Harris’ global experience.

Key Takeaway

- The Hardware segment dominated with 57.6%, reflecting extensive use of advanced communication systems, transceivers, and secure networking devices across defense operations.

- Radio Communication held 49.2%, driven by its critical role in ensuring real-time battlefield connectivity and secure information exchange.

- The Ground segment led with 61.5%, supported by large-scale deployment of tactical communication networks in land-based missions and command operations.

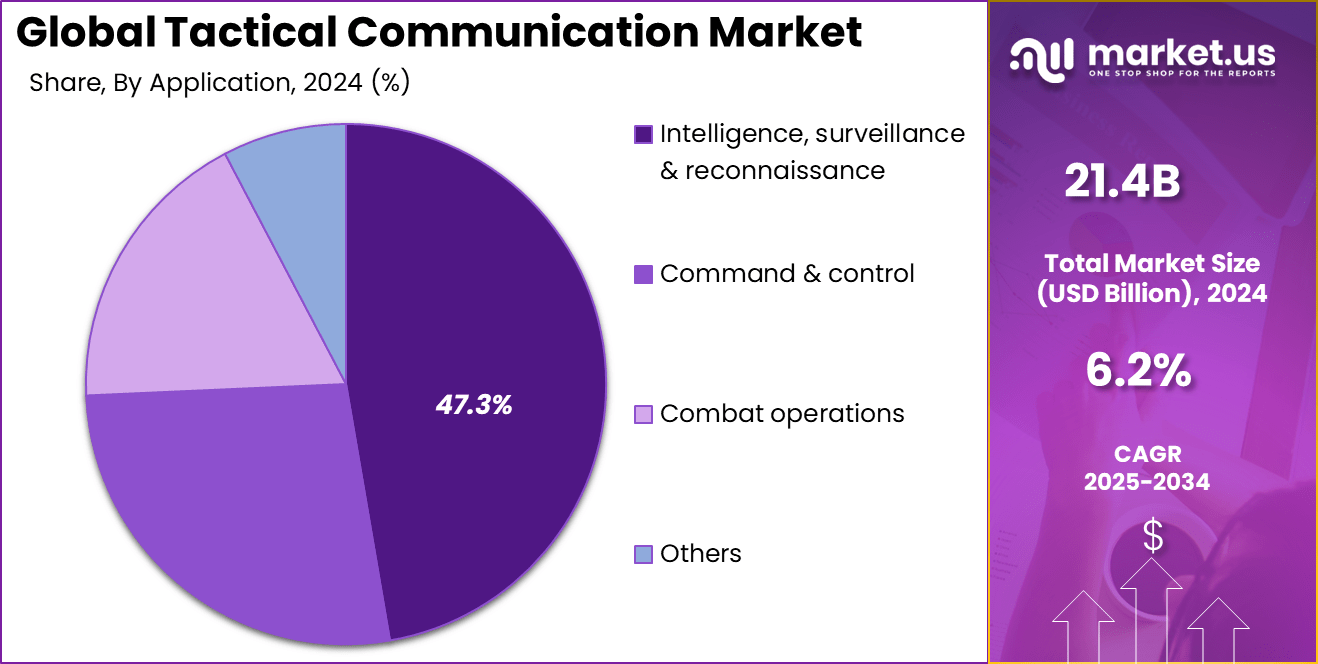

- Intelligence, Surveillance & Reconnaissance (ISR) accounted for 47.3%, emphasizing the growing integration of tactical communication in data-driven defense intelligence systems.

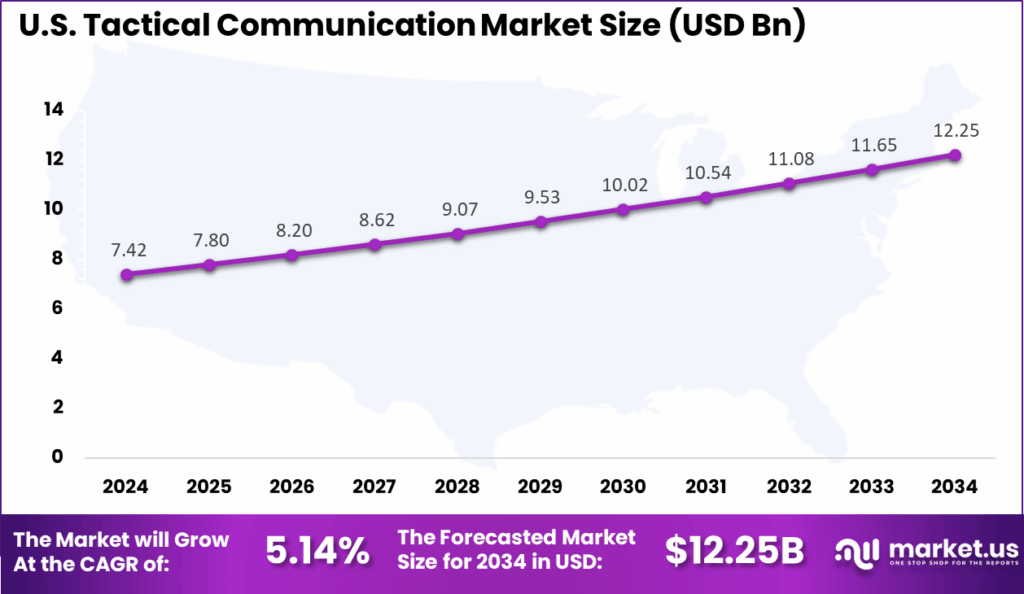

- The US market reached USD 7.42 Billion in 2024, recording a steady 5.14% CAGR, supported by modernization programs and increased defense spending on secure communication technologies.

- North America maintained leadership with 38.5% of the global market, driven by strong military infrastructure, advanced R&D capabilities, and adoption of next-generation tactical communication networks.

Role of Generative AI

Generative AI plays a central role in modern tactical communication by improving the speed and accuracy of data processing. Around 40% of recent improvements in tactical communication systems come from applying AI tools that manage and optimize bandwidth and secure information sharing.

This technology is transforming communication into an adaptive system, ensuring military units can respond swiftly and effectively in mission-critical situations. Besides enhancing data handling, generative AI supports advanced techniques such as predictive analytics and cognitive radios.

These technologies help increase situational awareness by processing complex data from multiple sources quickly. The use of generative AI reduces decision-making time by about 30%, making communication systems smarter and more reliable on the battlefield.

Investment and Business Benefits

Investment opportunities abound in AI-enabled systems that optimize spectrum allocation and enable cognitive radio functions, which dynamically adjust frequencies to avoid interference and jamming. The rise of 5G and private LTE networks in defense communication unlocks high throughput and ultra-low latency connectivity, a critical asset for real-time video and data sharing.

Miniaturization and wearable communication device development also attract funding, addressing the need for hands-free, lightweight, and multi-functional tactical kits. Public-private partnerships and indigenous production incentives in emerging defense markets further stimulate investment by fostering innovation and reducing dependency on imports.

Business benefits of advanced tactical communication systems include improved mission success rates stemming from faster and more accurate decision-making enabled by real-time information exchange. Enhanced interoperability across branches and coalition forces reduces operational silos and streamlines command structures.

Scalability and modular design lower upgrade costs and shorten deployment times, enabling quicker adaptation to evolving threats. Resilience against electronic warfare and cyberattacks safeguards operational continuity, a valuable asset in modern asymmetric and multi-theater conflicts. These advantages translate into operational efficiency, cost savings, and strategic superiority.

U.S. Market Size

The market for Tactical Communication within the U.S. is growing tremendously and is currently valued at USD 7.42 billion, the market has a projected CAGR of 5.14%. This growth is largely driven by ongoing defense modernization initiatives that emphasize network-centric warfare, integrating advanced communication technologies across military branches. Increasing defense budgets support the procurement and deployment of secure, reliable, and high-throughput tactical communication systems that are vital in complex combat environments.

Additionally, technological advancements such as software-defined radios, 5G networks, and satellite communications are expanding capabilities for real-time data transfer and intelligence sharing. The growing demand for interoperability, encryption, and jamming resistance further fuels the market, making tactical communication a cornerstone for enhancing situational awareness and command effectiveness on the battlefield.

For instance, in January 2025, L3Harris Technologies secured nearly $300 million in full-rate production orders for its resilient Manpack and Leader radios from the U.S. Army under the Handheld, Manpack & Small Form Fit (HMS) program. These radios provide secure, battle-proven communication supporting modern battlefield demands, including electronic warfare resistance and coalition interoperability.

In 2024, North America held a dominant market position in the Global Tactical Communication Market, capturing more than a 38.5% share, holding USD 8.23 billion in revenue. This dominance is due to the substantial defense budgets and a strong focus on modernization. The region’s military invests heavily in advanced communication technologies such as secure, interoperable radio networks and satellite communication systems that enhance command and control capabilities.

Additionally, North America benefits from the presence of leading defense contractors driving innovation in software-defined radios, mesh networking, and encrypted communication. These factors create a dynamic environment fostering rapid adoption and integration of state-of-the-art tactical communication solutions across land, air, and sea platforms. This ecosystem supports continued market leadership and expansion.

For instance, in October 2025, Northrop Grumman advanced the U.S. Army’s Improved Threat Detection System (ITDS) to Phase II, accelerating aircraft survivability tech development to counter missile and drone threats. This reflects strong U.S. investment in protecting frontline aviation with next-gen tactical communication and sensor systems.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 57.6% share of the Global Tactical Communication Market. This dominance is due to its essential role in enabling critical communication on the battlefield. This segment includes physical devices like radios and networking gear that ensure secure and reliable data transmission in challenging environments.

The preference for hardware reflects the importance of durable and high-performance equipment to maintain uninterrupted communication during military operations. The reliance on hardware showcased the military’s need for tangible, rugged solutions that can operate in harsh conditions. Continued innovation focuses on improving device resilience, connectivity, and real-time data transfer capabilities, which are vital for effective command and control in combat situations.

For Instance, in March 2025, Curtiss-Wright Corporation secured an $18 million contract to supply its PacStar 400-Series tactical communication hardware to the U.S. Marine Corps. Their rugged, compact communication systems provide efficient computation and switching capabilities at the tactical edge, emphasizing hardware solutions designed to enhance mobility and transmission speed in ground-based combat scenarios.

Communication Analysis

In 2024, the Radio communication segment held a dominant market position, capturing a 49.2% share of the Global Tactical Communication Market. The preference for radios comes from their proven reliability, ease of use, and adaptability to various combat environments. Radios enable real-time voice and data exchange critical for operational command and control, maintaining seamless contact between units.

The prominence of radio communication highlights its foundational role in battlefield connectivity, where secure, low-latency interactions often dictate mission success. Advances in radio technologies, including software-defined radios and frequency hopping, enhance performance and resistance to jamming, making radios indispensable in tactical communication networks.

For instance, in July 2025, ASELSAN introduced the T-LINK tactical data link system featuring advanced V/UHF radio communication capabilities, designed to deliver secure voice and data links across air, naval, and land forces. This modular radio communication system supports enhanced situational awareness and coordination, exemplifying innovation in radio technology for tactical communication networks.

Platform Analysis

In 2024, The Ground segment held a dominant market position, capturing a 61.5% share of the Global Tactical Communication Market. This dominance is attributed to the extensive deployment of land forces requiring uninterrupted communication among personnel, vehicles, and command centers. Ground tactical communication supports coordination in reconnaissance, surveillance, and direct combat activities where mobility and encryption are vital.

The preference for ground platforms reflects ongoing modernization efforts to equip land forces with advanced communication tools. It ensures enhanced situational awareness through reliable connectivity on the battlefield, accommodating increasing demands for bandwidth and network integration within ground operations.

For Instance, in August 2025, Collins Aerospace announced successful NSA Type-1 secure verification for its SCISR software-defined radio designed specifically for intelligence, surveillance, and reconnaissance missions. This compact system supports Beyond Line-of-Sight and dynamic mesh communications, emphasizing ground platforms’ need for secure, resilient connectivity in tactical environments.

Application Analysis

In 2024, The Intelligence, surveillance & reconnaissance segment held a dominant market position, capturing a 47.3% share of the Global Tactical Communication Market. Intelligence, surveillance & reconnaissance capabilities enhance commanders’ situational awareness by providing timely, accurate information essential for decision-making during military operations.

The growth of Intelligence, surveillance & reconnaissance-focused communication solutions aligns with rising requirements for data-intensive tasks like target tracking, threat assessment, and battlefield monitoring. These systems facilitate effective information gathering and dissemination, which are critical for operational efficiency and mission success.

For Instance, in October 2025, L3Harris integrated advanced long-range, low-light sensor technology with tactical networking systems to support ISR operations, enhancing battlefield data collection and command capabilities. This integration underlines the increasing reliance on communication solutions tailored for ISR applications with high data throughput and situational awareness.

Emerging trends

Emerging trends in tactical communication highlight the integration of 5G networks and AI-driven cognitive radios to support high-bandwidth intelligence, surveillance, and reconnaissance applications. By 2025, 5G and non-terrestrial networks (NTN) technologies are projected to contribute roughly 1.2% to annual market growth, reflecting their growing importance in enabling secure, reliable, and low-latency battlefield communications.

Another trend is the miniaturization of soldier-worn devices, improving mobility and network capabilities in combat zones. This segment has been estimated to add about 0.3% to overall market growth in the medium term. Together, these trends are transforming tactical communication into highly integrated, technology-rich ecosystems that support modern warfare demands.

Growth Factors

The growth of tactical communication markets is primarily fueled by rising defense budgets worldwide, with global military spending increasing by 6.8% in 2023, directly benefiting investments in communication technology upgrades. Furthermore, over 50% of new procurement projects focus on secure, resilient communication systems capable of operating in harsh or electronically contested environments.

Technology advancements such as digital signal processing, compression, and frequency hopping have boosted system reliability and privacy, attracting more defense agencies to adopt modern tactical communication solutions. The global focus on modernizing battlefield networks towards integrated IP-based and mesh communication technologies supports steady annual growth of around 5-7% in the sector.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Communication

- Radio communication

- Satellite communication

- Encryption and cybersecurity solutions

- Mobile communication systems

- Others

By Platform

- Ground

- Airborne

- Naval

By Application

- Intelligence, surveillance & reconnaissance

- Command & control

- Combat operations

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Defense Modernization and Network-Centric Warfare

Defense forces worldwide are shifting their focus to modernize military operations by adopting network-centric warfare concepts. This involves deploying advanced tactical communication systems that ensure secure and timely sharing of information among troops on the battlefield. Such modernization efforts create a strong demand for reliable and flexible communication solutions.

This trend towards integrated communication networks enhances coordination and situational awareness during operations. It requires advanced hardware and software that can support seamless connectivity in complex environments. The continuous push for operational efficiency drives the tactical communication market forward steadily.

For instance, in June 2025, L3Harris Technologies strengthened its communication network modernization efforts by providing solutions that simplify planning and rapid information flow for integrated communication networks. This ease of use is critical for armed forces needing reliable and coordinated communications in the field.

Restraint

High Cost and Operational Complexity

The adoption of tactical communication systems is hindered by their high cost, which is a major concern for many defense organizations. Building and maintaining sophisticated communication solutions requires extensive investment in cutting-edge technology, training, and system integration. This financial burden limits the accessibility of these systems for some militaries.

Operational complexity also presents significant challenges. Tactical communications need to perform reliably under harsh and rapidly changing battlefield conditions. Managing intricate networks while ensuring security demands specialized skills and continual support, which can complicate deployment and upkeep.

For instance, in August 2024, Motorola Solutions acquired Barrett Communications, a provider of specialized tactical radios used in security, peacekeeping, and humanitarian operations. The acquisition emphasized that while tactical communication offerings are expanding, their market penetration is still restrained by challenges related to infrastructure costs and niche deployment needs, especially for specialized radios that operate without infrastructure support.

Opportunities

Integration of AI and 5G Technology

The integration of artificial intelligence and 5G connectivity offers promising opportunities for enhancing tactical communications. AI technology can optimize network performance by managing spectrum and bandwidth efficiently, adapting communication channels in real time to changing conditions on the ground.

Meanwhile, 5G networks provide faster, more stable data transmission, which is critical for high-demand applications such as surveillance and real-time intelligence sharing. These technological advancements enable tactical systems to be more adaptive and capable, opening up new possibilities for defense communication solutions.

For instance, in August 2025, at the IDEF defense exhibition, Aselsan unveiled the Turan 100 BR-OM, a mobile tactical cloud system installed on a utility vehicle. This innovation integrates multiple radio links and communication standards, offering secure, real-time connectivity across air, naval, and land platforms with support for emerging LTE and 5G technologies.

Challenges

Security Risks and Electronic Warfare

The new generative AI has been creating more advanced threats, namely prompt injection attacks. By exploiting the AI models incorporated in the APIs, the hackers manipulate the input to the model to cause malicious actions.

By writing certain prompts, intruders will determine the AI behavior to retrieve sensitive, confidential data, respectively modify the output, or ultimately affect the weaknesses of the organization. Potential risks include data breaches and intellectual property theft. With more integration into company activities, securing AI-centric APIs against these threats would save business assets and credibility.

For instance, in November 2025, BAE Systems began fielding the AN/ARC-231A Multi-mode Aviation Radio Set (MARS) in US Army rotary-wing aircraft. Although this radio system provides secure and flexible communication with software-defined upgrades, BAE’s experience illustrates the challenge of continuously evolving cybersecurity and electronic warfare threats.

Key Players Analysis

The Tactical Communication Market is led by major defense and communication technology companies such as L3Harris Technologies, BAE Systems, Thales Group, and General Dynamics Corporation. These firms specialize in secure, interoperable communication systems used across land, air, and naval defense operations. Their technologies integrate encrypted radios, satellite links, and AI-enhanced networks that ensure reliable command and control during complex military missions.

Prominent participants including Collins Aerospace, Northrop Grumman Corporation, Lockheed Martin Corporation, Leonardo S.p.A., and Elbit Systems Ltd. focus on developing advanced tactical data links and real-time information-sharing platforms. Their solutions enhance situational awareness and battlefield coordination, supporting both manned and unmanned defense systems through high-speed, low-latency connectivity.

Additional contributors such as Aselsan A.S., Rafael Advanced Defense Systems Ltd., Saab AB, Ultra, Rohde & Schwarz, Cobham Advanced Electronic Solutions Inc., Honeywell International Inc., Viasat Inc., and Rolta India Limited, along with other market participants, are expanding the ecosystem with next-generation software-defined radios, sensor integration, and cyber-secure tactical networks. Their innovations are transforming modern defense communications toward greater automation, resilience, and global interoperability.

Top Key Players in the Market

- L3Harris Technologies

- Aselsan A.S.

- BAE Systems

- Barrett Communications

- Bharat Electronics Ltd.

- Cobham Advanced Electronic Solutions Inc.

- Collins Aerospace

- Curtiss-Wright Corporation

- Data Link Solutions

- Elbit Systems Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Rohde & Schwarz

- Rolta India Limited

- Saab AB

- Thales Group

- Ultra

- Viasat Inc.

- Others

Recent Developments

- In August 2025, Aselsan revealed the Turan 100 BR-OM, a mobile tactical cloud solution integrated on a Toyota Hilux utility vehicle. This modular system supports multiple radio links, including VHF, UHF, SATCOM, and 4G/5G LTE, creating a versatile and secure tactical network adaptable to battlefield needs. This solution emphasizes seamless connectivity and network resilience across diverse operational theatres.

- In November 2025, BAE Systems began fielding its advanced AN/ARC-231A Multi-mode Aviation Radio Set (MARS) across selected U.S. Army helicopters. The new radio enhances fast, secure, and multi-band airborne communications with modernized encryption and software-defined upgrades, replacing legacy systems to boost tactical aviation mission readiness.

Report Scope

Report Features Description Market Value (2024) USD 8.1 Bn Forecast Revenue (2034) USD 30.7 Bn CAGR(2025-2034) 14.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Communication (Radio communication, Satellite communication, Encryption and cybersecurity solutions, Mobile communication systems, Others), By Platform (Ground, Airborne, Naval), By Application (Intelligence, surveillance & reconnaissance, Command & control, Combat operations, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L3Harris Technologies, Aselsan A.S., BAE Systems, Barrett Communications, Bharat Electronics Ltd., Cobham Advanced Electronic Solutions Inc., Collins Aerospace, Curtiss-Wright Corporation, Data Link Solutions, Elbit Systems Ltd., General Dynamics Corporation, Honeywell International Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Rafael Advanced Defense Systems Ltd., Rohde & Schwarz, Rolta India Limited, Saab AB, Thales Group, Ultra, Viasat Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tactical Communication MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Tactical Communication MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- L3Harris Technologies

- Aselsan A.S.

- BAE Systems

- Barrett Communications

- Bharat Electronics Ltd.

- Cobham Advanced Electronic Solutions Inc.

- Collins Aerospace

- Curtiss-Wright Corporation

- Data Link Solutions

- Elbit Systems Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Rohde & Schwarz

- Rolta India Limited

- Saab AB

- Thales Group

- Ultra

- Viasat Inc.

- Others