Global Large Language Models (LLMs) in Cybersecurity Market By Offering (Solutions (Threat Detection and Prevention, Vulnerability Management, Security Automation, Data Security, Identity and Access Management, Others), Services (Professional Services (Implementation & Integration Services, Consulting & Training, Support & Maintenance)), Managed Services), By Deployment Model (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Network Security, Endpoint Security, Application Security, Cloud Security, Others), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), Healthcare, IT & Telecom, Government and Defense, Retail, Manufacturing, Others (Aerospace, & Energy and Utilities, etc.)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb. 2025

- Report ID: 141460

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- U.S. Market Size

- Analysts’ Viewpoint

- Offering Analysis

- Deployment Model Analysis

- Organization Size Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Business Benefits

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

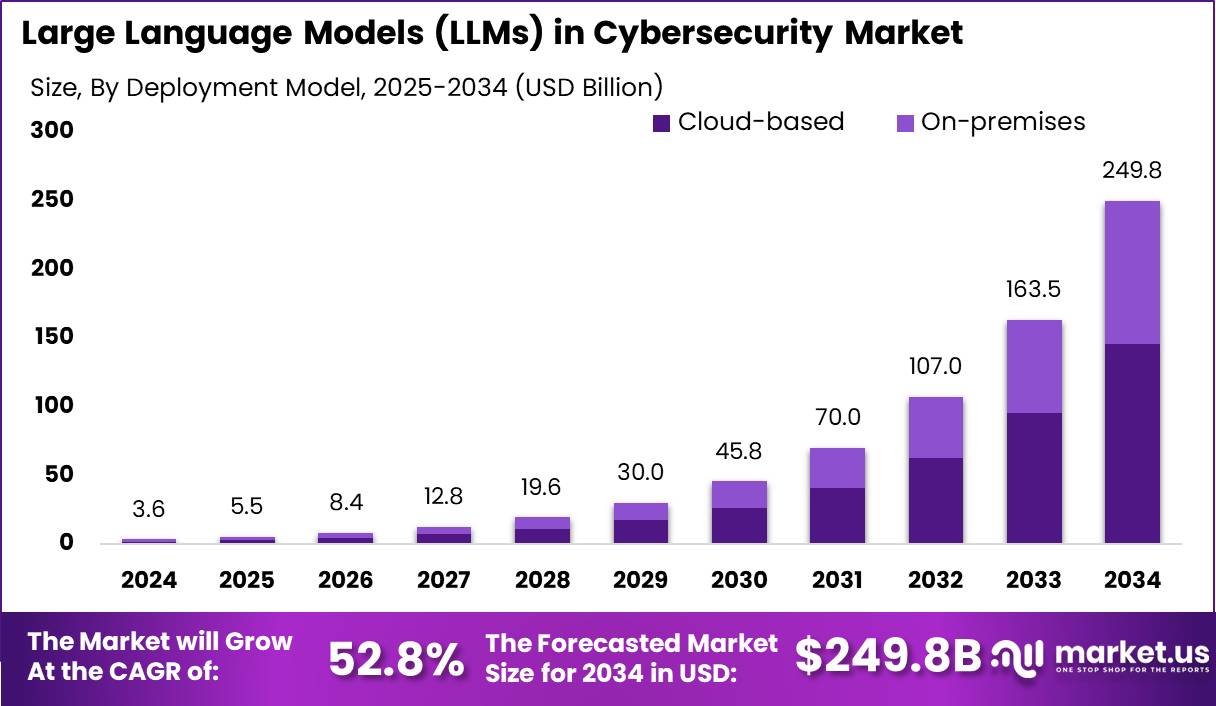

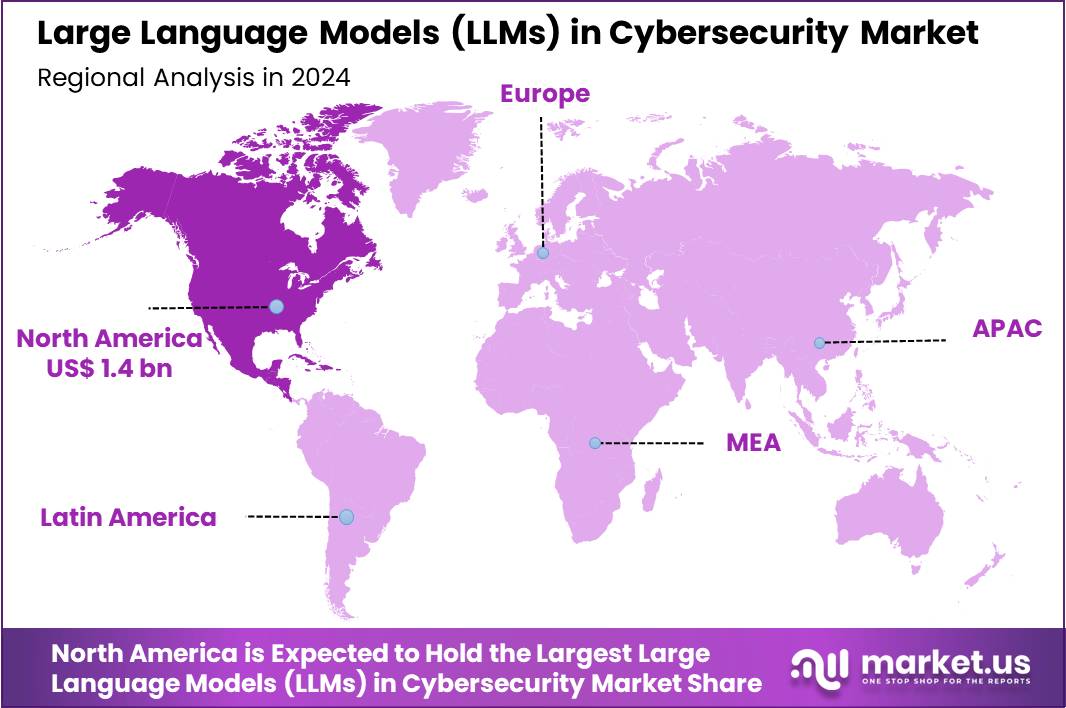

The LLMs in Cybersecurity Market size is expected to be worth around USD 249.8 Billion By 2034, from USD 3.6 billion in 2024, growing at a CAGR of 52.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40.7% share, holding USD 1.4 Billion revenue.

Large Language Models (LLMs) are increasingly being integrated into cybersecurity frameworks due to their ability to process vast amounts of data and identify suspicious patterns effectively. These models are pivotal in real-time threat detection, anomaly analysis, and automating routine security tasks, such as phishing and social engineering detection.

The cybersecurity market is witnessing rapid growth, driven by the escalating need to protect against increasingly sophisticated cyber threats. Investments in AI and cybersecurity technologies are surging, as organizations seek to leverage advanced analytics and machine learning to enhance their defensive capabilities.

The market is also seeing a rise in spending on cybersecurity infrastructures, driven by the greater integration of AI technologies which are predicted to increase security spending significantly by 2025. Key drivers of the cybersecurity market include the integration of AI and machine learning technologies, which provide enhanced capabilities for threat detection and response.

The growing complexity of cyber threats and the increasing frequency of cyberattacks necessitate more robust and sophisticated cybersecurity solutions. Additionally, the expansion of IoT and the proliferation of digital devices have broadened attack surfaces, further driving demand for advanced cybersecurity measures.

Based on data from Springs, in 2023, the world’s top five LLM developers accounted for approximately 88.22% of total market revenue. This reflects the dominance of a few key players in the industry, driving advancements in AI-powered solutions. By 2025, it is projected that 750 million apps will incorporate LLM technology, highlighting the rapid integration of these models across industries.

Furthermore, it is estimated that 50% of digital work will be automated through applications powered by LLMs, significantly transforming workplace efficiency and productivity. However, real-world performance challenges remain. When tested with actual business data used by insurance companies, LLM products demonstrated an accuracy rate of only 22%, raising concerns about reliability in critical applications.

According to Market.us, the Global Large Language Model (LLM) Market is expected to grow from USD 4.5 billion in 2023 to approximately USD 82.1 billion by 2033, reflecting a strong CAGR of 33.7% between 2024 and 2033. This growth is driven by increasing adoption across industries, advancements in AI capabilities, and expanding enterprise applications.

In 2023, North America held the largest market share at 32.7%, benefiting from a well-established AI research ecosystem, substantial investments, and a strong technology infrastructure. As businesses continue to integrate LLMs, the market is set for significant expansion in the coming years.

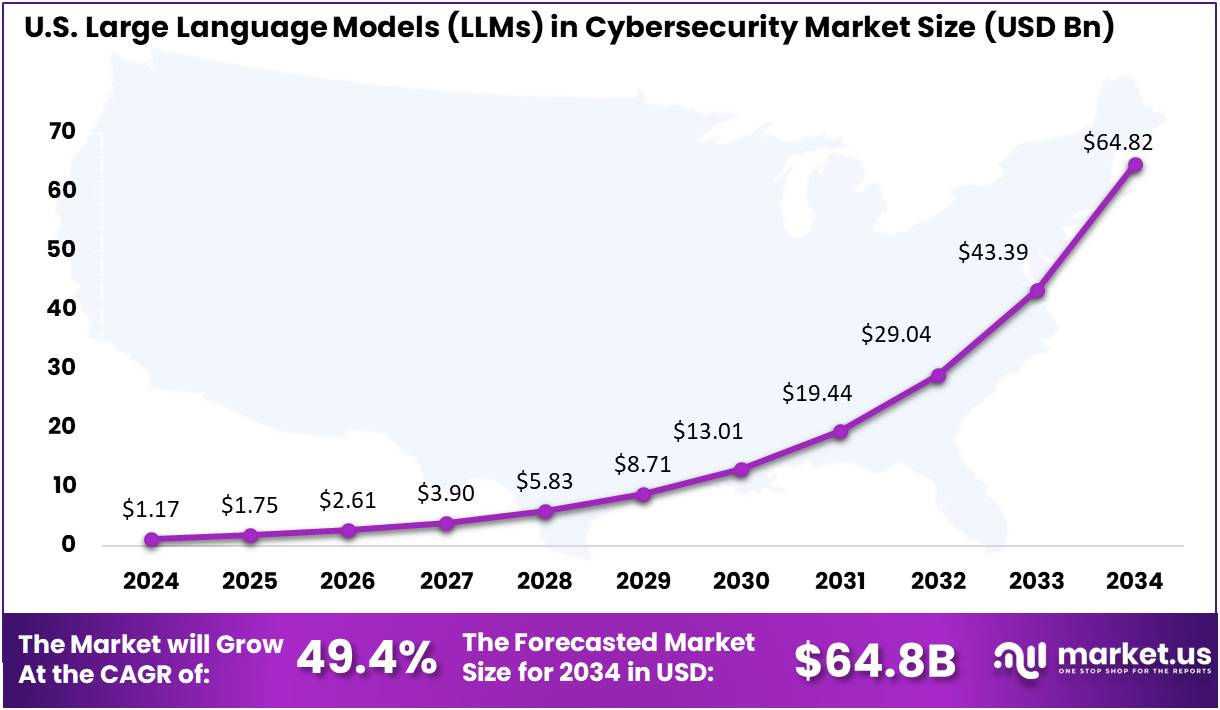

U.S. Market Size

The US LLMs in Cybersecurity market size itself was exhibited at USD 1.17 billion in 2024, with a Compound Annual Growth Rate (CAGR) of 49.4%. This rapid growth is indicative of the escalating demand for AI-powered security solutions that can offer enhanced protection against increasingly sophisticated cyber-attacks, which are becoming more frequent and complex.

The adoption of LLMs in cybersecurity practices in the U.S. is being driven by these factors, combined with a growing awareness of the potential benefits these technologies can offer in terms of efficiency and effectiveness in threat detection and response.

Additionally, the concentration of major tech companies in the United States that are pioneering AI and cybersecurity solutions has contributed to the growth of this market. These companies are not only significant consumers of cybersecurity solutions but also lead in the development of advanced technologies that incorporate LLMs. This has spurred innovation and investment in the region, further solidifying its lead in the global market.

In 2024, North America held a dominant market position in the LLMs in Cybersecurity sector, capturing more than a 40.7% share, with revenues reaching USD 1.4 billion. This significant market share is primarily due to the advanced technological infrastructure and the early adoption of AI technologies across various industries in the region.

North American businesses have been at the forefront in integrating AI into their cybersecurity strategies, seeking to enhance their ability to detect and respond to threats more efficiently. The prominence of North America in the LLMs in Cybersecurity market can also be attributed to the robust regulatory framework that governs data protection and cybersecurity.

U.S. regulations, such as the California Consumer Privacy Act (CCPA) and the New York SHIELD Act, have pushed organizations to adopt more sophisticated cybersecurity measures, including the use of LLMs to manage the increasing complexity of cyber threats.

Analysts’ Viewpoint

The cybersecurity sector presents numerous investment opportunities, particularly in areas like AI-driven security, cloud security, and cybersecurity services. As organizations continue to digitize their operations, the need for comprehensive cybersecurity solutions that can preemptively identify and mitigate threats is becoming paramount.

Investors are particularly interested in startups and technologies that offer innovative solutions to these evolving challenges. Technological advancements in cybersecurity include the development of AI and machine learning models that can predict and neutralize threats before they manifest. Innovations in encryption technology, threat detection algorithms, and automated security protocols are key areas of focus.

The use of AI to automate routine tasks and support cybersecurity professionals allows them to concentrate on more strategic, high-impact work areas. The regulatory landscape for cybersecurity is becoming stricter, with new laws and regulations being implemented to protect personal and organizational data.

The EU’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are examples of regulations that have a significant impact on how organizations manage cybersecurity. Compliance with these regulations is a major driver for the adoption of advanced cybersecurity solutions.

Offering Analysis

In 2024, the Solutions segment held a dominant market position in the LLMs in Cybersecurity sector, capturing more than a 72.8% share. This leadership can be attributed to the comprehensive range of functionalities that solutions in cybersecurity offer, including threat detection and prevention, vulnerability management, and security automation, among others.

As organizations increasingly recognize the necessity of robust cybersecurity measures to safeguard against sophisticated cyber threats, the demand for integrated solutions that offer end-to-end capabilities has surged. The solutions segment’s prominence is bolstered by its ability to provide organizations with the tools necessary for proactive security measures.

For instance, threat detection and prevention solutions utilize advanced AI algorithms to monitor and analyze data for potential threats, effectively reducing the risk of security breaches. Similarly, security automation tools help streamline various security processes, enhancing the efficiency and effectiveness of cybersecurity operations.

Moreover, the rising complexities of cyber threats and the expanding attack surfaces due to digital transformation efforts across industries necessitate a more integrated approach to cybersecurity. This trend has led to an increased adoption of comprehensive solutions that can offer extensive protection against diverse types of cyber threats.

Consequently, the high market share of the solutions segment is also driven by the growing need for data security and identity and access management solutions, which are critical in protecting sensitive information and managing access controls within organizations.

Overall, the solutions segment’s dominance is a reflection of its critical role in providing necessary security capabilities that enable organizations to defend themselves against an ever-evolving threat landscape. This segment’s growth is expected to continue as cybersecurity remains a top priority for businesses globally

Deployment Model Analysis

In 2024, the Cloud-based segment held a dominant market position in the LLMs in Cybersecurity market, capturing more than a 58.5% share. This leading position can primarily be attributed to the flexibility, scalability, and cost-effectiveness that cloud-based solutions offer.

Organizations, ranging from small enterprises to large corporations, increasingly favor cloud deployments because they eliminate the need for significant upfront investments in hardware and reduce the ongoing operational costs associated with maintaining physical infrastructure.

Furthermore, the cloud-based model supports a faster implementation of cybersecurity defenses, crucial for adapting to the rapidly evolving threat landscape. This agility enables organizations to deploy the latest security measures and updates much more swiftly than traditional on-premises setups.

Additionally, the ability to scale resources on demand allows businesses to handle varying levels of threat detection and response, which is particularly beneficial in handling spike demands during cyber-attack incidents. The growth of the cloud-based segment is also driven by its ability to facilitate remote access securely.

As workforces have become more distributed, particularly in the aftermath of the global shifts towards remote working, maintaining cybersecurity across geographically dispersed teams has become a challenge that cloud-based solutions address effectively. This deployment model ensures that teams can access security tools and data securely from any location, enhancing overall business continuity and resilience against cyber threats.

The prominence of cloud-based solutions in the LLMs in Cybersecurity market underscores the critical need for flexible, scalable, and cost-efficient cybersecurity measures that cater to the dynamic needs of modern organizations, ensuring they can swiftly adapt to new security challenges as they arise

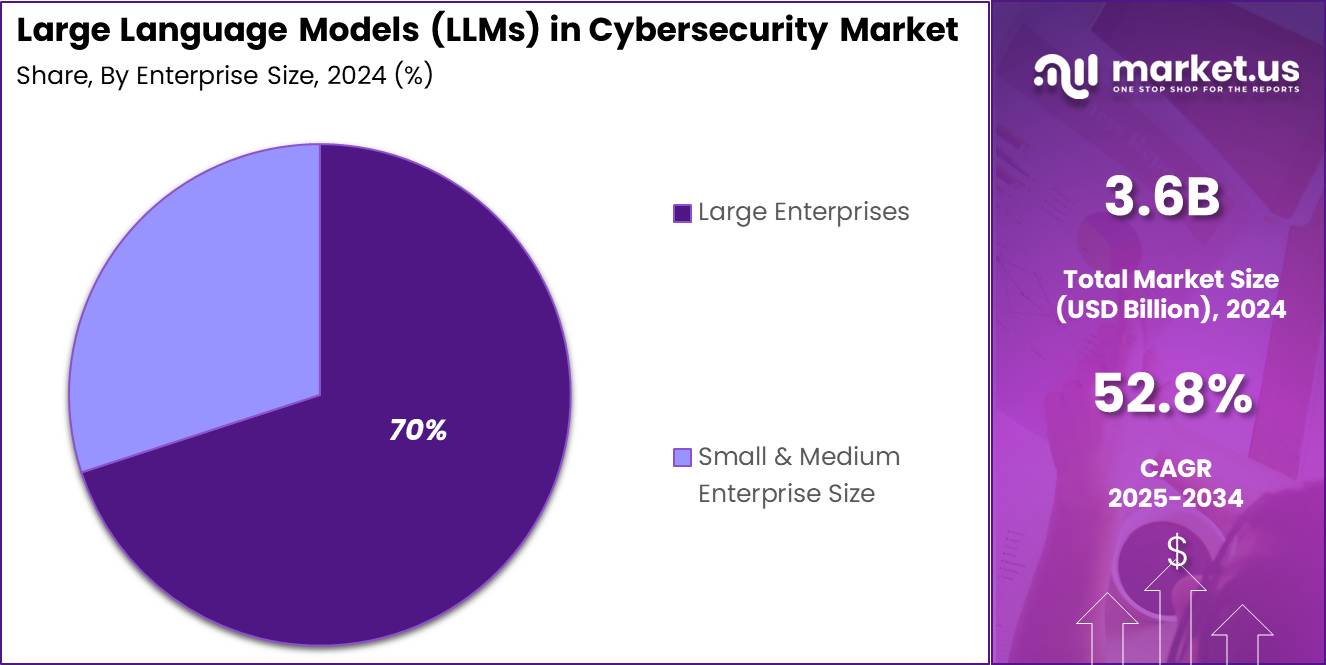

Organization Size Analysis

In 2024, the Large Enterprises segment held a dominant market position in the LLMs in Cybersecurity market, capturing more than a 70% share. This dominance is largely due to the substantial resources that large enterprises can allocate towards advanced cybersecurity solutions, including LLMs.

These organizations typically possess the financial capability to invest in comprehensive, state-of-the-art cybersecurity infrastructures that leverage the power of large language models for enhanced threat detection, prevention, and response. Additionally, large enterprises often face more complex and frequent cybersecurity threats due to their size and the valuable data they hold, which necessitates robust cybersecurity measures.

The integration of LLMs into their cybersecurity strategies allows these organizations to analyze vast amounts of data for anomalies and potential threats at scale, significantly improving their ability to safeguard sensitive information against sophisticated cyberattacks.

Moreover, large enterprises are usually more regulated than smaller businesses, especially in industries such as finance, healthcare, and government, where data breaches can have severe legal and financial repercussions. Compliance with stringent regulatory requirements further drives the adoption of advanced cybersecurity technologies like LLMs, reinforcing their market dominance in this segment.

Application Analysis

In 2024, the Network Security segment held a dominant market position in the LLMs in Cybersecurity market, capturing more than a 35.4% share. This prominence is primarily attributed to the escalating complexities and frequencies of network-based cyber threats which demand robust defenses.

Large language models (LLMs) are increasingly employed in network security applications due to their ability to process and analyze large datasets swiftly, identify patterns, and predict potential breaches before they occur.

Network security remains a critical concern for organizations as the first line of defense against cyber threats. The adoption of LLMs enhances the capability to detect anomalies in network traffic and potential threats in real-time, thereby allowing for immediate and effective responses. This is crucial in environments where the cost of breaches can be extraordinarily high, both in terms of financial impact and damage to reputation.

Furthermore, the continuous evolution of network infrastructure, including the adoption of cloud technologies and the expansion of IoT devices, has expanded the attack surface that organizations need to protect. LLMs provide advanced solutions in network security by enabling more sophisticated monitoring and analysis capabilities that can adapt to new threats as they emerge.

The significant share held by the Network Security segment reflects the ongoing prioritization of investments in technologies that can deliver comprehensive and preemptive security measures. This approach is essential to maintaining the integrity and confidentiality of organizational data across increasingly complex and interconnected network environments.

End-User Analysis

In 2024, the Banking, Financial Services, and Insurance (BFSI) segment held a dominant market position in the LLMs in Cybersecurity market, capturing more than a 32.6% share. This leadership is largely due to the critical need for robust cybersecurity measures within the sector, which handles sensitive financial data and is highly regulated.

LLMs are particularly valuable in BFSI for their ability to detect fraud and identify anomalies by analyzing vast quantities of transactions and customer interactions in real time. The high adoption rate in the BFSI sector is also driven by the increasing sophistication of cyber threats targeted at financial institutions, which often involve complex phishing schemes and ransomware attacks.

The deployment of LLMs helps these institutions enhance their security postures by improving threat detection capabilities and response strategies, thereby reducing potential financial losses and reputational damage.

Moreover, as regulatory requirements continue to evolve, financial institutions are increasingly relying on advanced technologies like LLMs to ensure compliance. These models assist in meeting stringent compliance standards by automating the monitoring and reporting processes, which are essential for regulatory audits and ensuring data integrity.

The significant share of the BFSI segment in the LLMs in Cybersecurity market underscores the sector’s urgent need to adopt cutting-edge solutions to protect against and mitigate the impacts of cyber threats, while also ensuring regulatory compliance and safeguarding customer trust.

Key Market Segments

By Offering

- Solutions

- Threat Detection and Prevention

- Vulnerability Management

- Security Automation

- Data Security

- Identity and Access Management

- Others

- Services

- Professional Services

- Implementation & Integration Services

- Consulting & Training

- Support & Maintenance

- Managed Services

- Professional Services

By Deployment Model

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- IT & Telecom

- Government and Defense

- Retail

- Manufacturing

- Others (Aerospace, & Energy and Utilities, etc.)

Driver

Enhancing Proactive Cybersecurity Measures

One significant driver for the adoption of Large Language Models (LLMs) in cybersecurity is their capability to enhance proactive security measures. LLMs can analyze vast amounts of data quickly, identifying potential threats before they manifest into actual breaches.

This preemptive approach is crucial as it shifts the cybersecurity paradigm from reactive to proactive, helping organizations stay ahead of cybercriminals who continuously evolve their tactics. The ability of LLMs to understand and process natural language can also be leveraged to monitor and analyze the dark web and hacker forums for emerging threats, providing cybersecurity teams with early warnings of potential vulnerabilities and breaches.

Restraint

High Complexity and Resource Intensity

Despite their advantages, LLMs also present significant restraints, primarily due to their complexity and resource intensity. The training of LLMs requires substantial computational power and a large corpus of training data, which can be both costly and technically demanding.

This complexity may limit their use to organizations with significant resources or advanced AI capabilities. Additionally, the sophisticated nature of these models means that they require continuous updates and maintenance to stay effective against new threats, adding to the operational overhead.

Opportunity

Advancement in Customizable and Domain-Specific Models

LLMs offer substantial opportunities in cybersecurity through the advancement of customizable and domain-specific models. These specialized models can be tailored to specific organizational needs or particular types of cyber threats, enhancing their effectiveness.

For instance, LLMs can be trained to recognize and respond to industry-specific jargon and threat patterns, making them incredibly valuable for sectors like finance, healthcare, or government that often face targeted attacks. The flexibility of LLMs to adapt to various cybersecurity contexts supports better defense mechanisms tailored to the unique challenges of different industries.

Challenge

Ensuring Ethical Use and Bias Mitigation

A critical challenge in deploying LLMs in cybersecurity is ensuring their ethical use and mitigating any inherent biases. Since LLMs learn from large datasets, there is a risk that these datasets contain biases, which can lead to skewed threat assessments or unfair targeting. This not only affects the model’s effectiveness but also raises ethical concerns regarding privacy and discrimination.

Ensuring the fairness, transparency, and accountability of LLMs is essential to prevent these issues. Cybersecurity teams must implement robust data governance and continuous monitoring to ensure that LLMs operate within ethical boundaries and maintain public trust.

Growth Factors

The rapid evolution of artificial intelligence and the increasing sophistication of cyber threats have significantly propelled the growth of Large Language Models (LLMs) in cybersecurity. These models, like GPT-3 and BERT, are revolutionizing the field by enabling sophisticated natural language processing tasks that enhance threat detection and incident response capabilities.

One of the primary growth factors for LLMs in cybersecurity is their ability to process and analyze vast amounts of unstructured data, which is pivotal in identifying and mitigating cyber threats. This capability allows LLMs to detect anomalies, phishing attempts, and malicious software behaviors, significantly enhancing the accuracy and speed of threat detection.

Emerging trends highlight the integration of LLMs with other AI technologies, such as machine learning and computer vision, to create more robust security solutions. Moreover, there is a growing emphasis on real-time threat intelligence and the ethical considerations surrounding data privacy and bias in model training and application.

Business Benefits

LLMs offer numerous business benefits by automating complex cybersecurity tasks, which reduces the workload on human analysts and increases operational efficiency. By automating threat detection and incident response, organizations can respond more swiftly to threats, significantly reducing the time and resources spent on manual interventions.

Furthermore, LLMs enhance the accuracy of cybersecurity measures. They are continuously learning from new data, which helps in reducing false positives and ensuring that genuine threats are promptly addressed. This not only improves the security posture of organizations but also contributes to substantial cost savings, particularly in reducing breach costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The integration of Large Language Models (LLMs) into cybersecurity has led to the emergence of key players leveraging artificial intelligence to enhance threat detection and response capabilities. These companies utilize LLMs to process extensive data, identify patterns, and predict potential security threats.

In September 2023, Cisco announced its intent to acquire Splunk, a leader in data analytics and security, for $28 billion. This acquisition, finalized in March 2024, represents Cisco’s largest to date and aims to bolster its cybersecurity capabilities by integrating Splunk’s data analytics with Cisco’s security portfolio.

In April 2024, Darktrace, a UK-based cybersecurity firm specializing in AI-driven threat detection, was acquired by the American private equity firm Thoma Bravo for approximately $5.3 billion. This acquisition underscores Darktrace’s commitment to leveraging artificial intelligence in cybersecurity.

In September 2024, Mastercard announced its agreement to acquire Recorded Future, a prominent threat intelligence company, for $2.65 billion. Recorded Future employs artificial intelligence to analyze vast amounts of data, providing real-time threat intelligence to its clients.

Top Key Players in the Market

- Palo Alto Networks, Inc.

- CyberArk Software Ltd.

- Darktrace Holdings Ltd

- Lasso.security

- International Business Machines Corporation (IBM)

- Zscaler, Inc.

- CrowdStrike

- Vectra AI, Inc.

- Fortinet, Inc.

- Broadcom

- Cisco Systems, Inc.

- Splunk Inc.

- Others

Recent Developments

- AMD bought Silo AI for $665 million in late 2024. Silo AI specializes in creating large language models (LLMs) that work in many languages and handle big tasks. This deal helps AMD build smarter AI tools for cybersecurity, like spotting threats in real-time across different languages.

- In September 2024, Nvidia acquired OctoAI for $250 million. OctoAI’s tech makes AI models faster and cheaper to run, which is great for cybersecurity. Nvidia plans to use this to improve AI tools for businesses, like better security monitoring and threat detection.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 249.8 Bn CAGR (2025-2034) 52.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Solutions (Threat Detection and Prevention, Vulnerability Management, Security Automation, Data Security, Identity and Access Management, Others), Services (Professional Services (Implementation & Integration Services, Consulting & Training, Support & Maintenance)), Managed Services), By Deployment Model (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Network Security, Endpoint Security, Application Security, Cloud Security, Others), By End-User Industry (Banking, Financial Services, and Insurance (BFSI), Healthcare, IT & Telecom, Government and Defense, Retail, Manufacturing, Others (Aerospace, & Energy and Utilities, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Palo Alto Networks Inc., CyberArk Software Ltd., Darktrace Holdings Ltd, Lasso.security, International Business Machines Corporation (IBM), Zscaler Inc., CrowdStrike, Vectra AI Inc., Fortinet Inc. , Broadcom, Cisco Systems Inc. , Splunk Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  LLMs in Cybersecurity MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample

LLMs in Cybersecurity MarketPublished date: Feb. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Palo Alto Networks, Inc.

- CyberArk Software Ltd.

- Darktrace Holdings Ltd

- Lasso.security

- International Business Machines Corporation (IBM)

- Zscaler, Inc.

- CrowdStrike

- Vectra AI, Inc.

- Fortinet, Inc.

- Broadcom

- Cisco Systems, Inc.

- Splunk Inc.

- Others