Global TAC Film Market By Thickness Type (30-40M, and 80M-270M), By Application (Liquid Crystal Display (LCD),and Ion Sensing & Separation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 29483

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

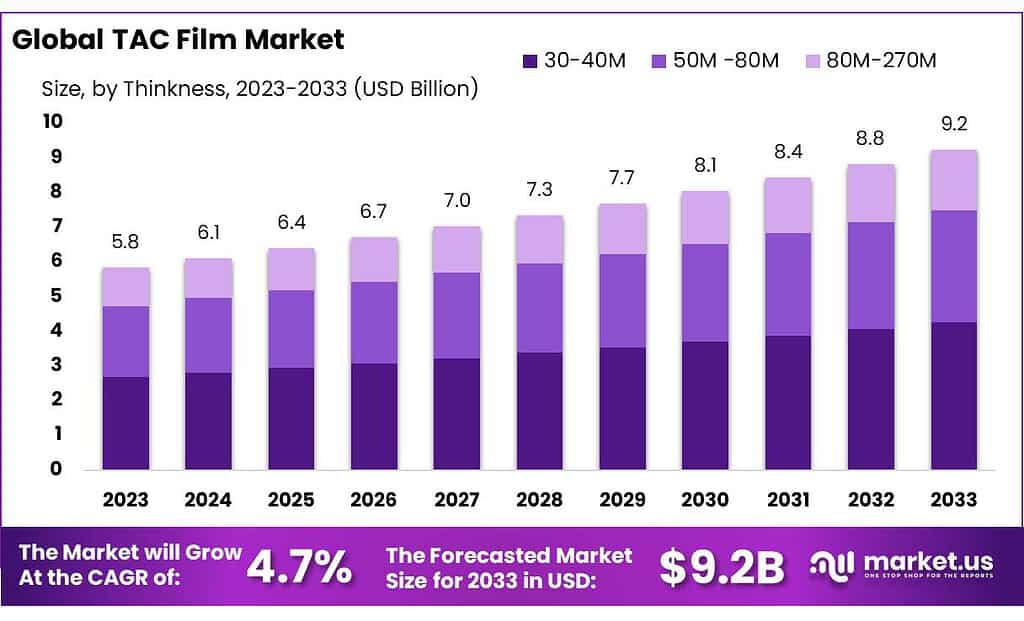

The TAC Film Market size is expected to be worth around USD 9.2 billion by 2033, from USD 5.8 Bn in 2023, growing at a CAGR of 4.7% during the forecast period from 2023 to 2033.

The TAC film is used in several electronic product applications, enhancing market demand. TAC (Triacetate Cellulose) is a biochemical element prepared from acetic anhydride and cellulose. It has exceptional transparency, good mechanical strength, low birefringence, highly enhanced UV cutting performance, and moisture reabsorption properties.

Due to its high light transmittance, great curling characteristic, low birefringence, homogeneity, and high moisture permeability TAC is also used as a polarizing plate protective film and photographic film. Because of this, it is repeatedly used as an optical compensating film for liquid crystal displays (LCD).

The TAC film plays an active part in polarizer protection and optical adjustment of LCDs by using regulated birefringence. By stretching, the in-plane birefringence can be reformed, while the TAC film’s out-of-plane birefringence can be organized with the help of additives. The TAC film can be coated with a discotic substance adding an optical correction layer.

Key Takeaways

- Market Growth: TAC Film Market targets USD 9.2 billion by 2033, with a 4.7% CAGR from 2023 to 2033, indicating substantial expansion.

- Versatile Material: Triacetate Cellulose-based TAC film sees rising demand for its transparency, strength, and applications across electronics, photography, and LCDs.

- Thickness Preference: Type 30-40M dominates in 2023, holding a notable 44% market share, reflecting broad acceptance and utility.

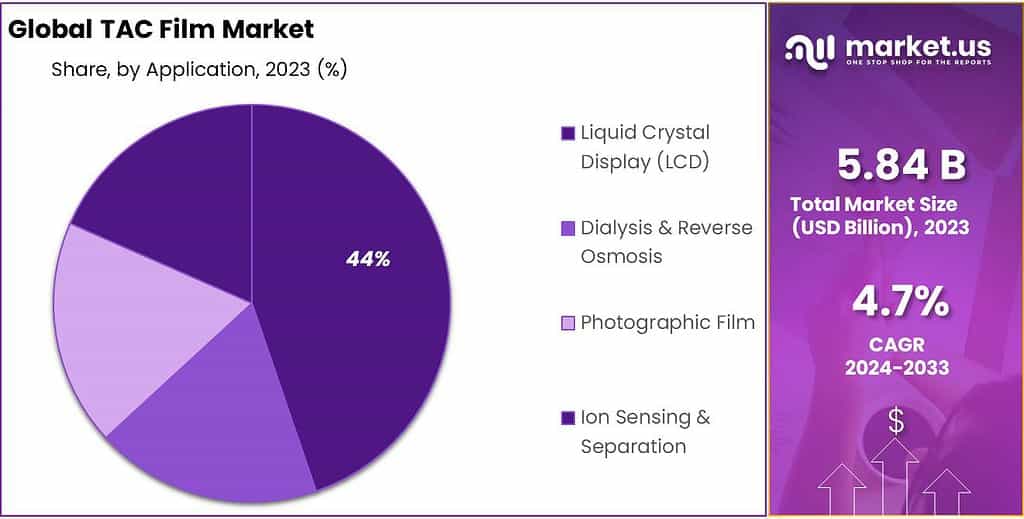

- LCD Dominance: TAC films claim a significant 42.5% market share in Liquid Crystal Display (LCD) applications in 2023, driven by sleek and high-performance display demands.

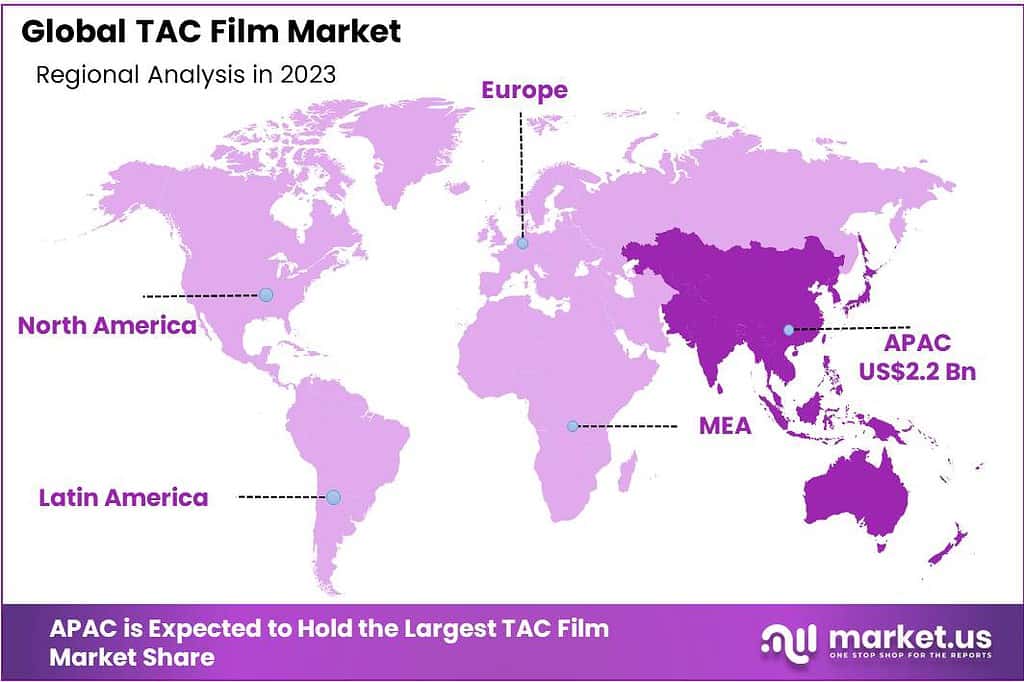

- Global Leadership: Asia Pacific commands over 39% revenue share in 2023, driven by electronic device manufacturing hubs and increased TAC film utilization.

Thickness Type Analysis

In the dynamic landscape of the TAC Film market, the year 2023 marked the supremacy of Type 30-40M, claiming a significant market share exceeding 44%. This particular thickness type emerged as the frontrunner, showcasing its widespread acceptance and utility across various applications.

The dominance of Type 30-40M suggests that consumers and industries found merit in its performance attributes, making it the preferred choice during that period. The versatility of TAC films in the 30-40 micrometer thickness range likely contributed to their leading market position. These films, known for their balanced performance, could have found applications in diverse industries, ranging from electronics to packaging.

The favorable characteristics of Type 30-40M may include aspects such as flexibility, durability, or optical properties, aligning with the multifaceted requirements of different sectors. As industries evolve and technological innovations continue to shape the market, the preferences for TAC film thickness may change.

Manufacturers and businesses keen on staying competitive in the TAC Film market will need to adapt to these shifts, considering the factors that led to the dominance of Type 30-40M in 2023 as valuable insights for future product development and market strategies.

Application Analysis

In the dynamic landscape of the TAC Film market, the year 2023 witnessed the remarkable dominance of Liquid Crystal Display (LCD) applications, capturing an impressive market share exceeding 42.5%. This substantial market position indicates the widespread utilization and preference for TAC films specifically engineered for LCD technologies during that timeframe.

The significant foothold of TAC films in LCD applications can be attributed to the pervasive adoption of LCD technology across a spectrum of electronic devices. The surge in demand for sleek, lightweight, and high-performance displays in devices such as smartphones, televisions, and computer monitors likely fueled the preference for TAC films designed to enhance LCD functionality.

The optical clarity and protective attributes offered by TAC films align with the stringent requirements of LCD screens, contributing to their dominance in this segment. As technology keeps getting better in the electronics world, the TAC Film market might see changes in what people prefer to use it for.

To stay in the game, companies making TAC films should keep an eye on what customers want and the latest trends in the industry. They should be ready to change their products to meet new demands. Knowing why Liquid Crystal Display (LCD) applications were so popular in 2023 can help these companies make smart decisions in the fast-paced and competitive TAC Film market.

Key Industry Segments

By Thickness Type

- 30-40M

- 50M -80M

- 80M-270M

By Application

- Liquid Crystal Display (LCD)

- Dialysis & Reverse Osmosis

- Photographic Film

- Ion Sensing & Separation

Drivers

The TAC Film market is driven by several key factors that influence its growth and prominence in various industries. A big reason for the TAC Film market doing well is because many people are using advanced displays, especially in things like phones and tablets. People want screens that are clear, respond to touch, and can last a long time. That’s where TAC films come in – they are used in things like Liquid Crystal Displays (LCDs) and touchscreens to make sure the screens look good and work well.

As more folks look for fancier and better-looking electronic devices, the demand for TAC films goes up, making the market grow. Additionally, the growth of industries requiring specialized films contributes to the expansion of the TAC Film market. Sectors like medical devices, where films are used in applications such as dialysis and reverse osmosis, create new opportunities for TAC film manufacturers. The versatility of TAC films to meet specific needs, such as ion sensing and separation in various industrial processes, further propels market growth.

Advancements in film technologies and materials enhance the performance characteristics of TAC films, making them more attractive to industries seeking innovative solutions. Continuous research and development efforts result in films with improved optical properties, flexibility, and protective features, driving their adoption in diverse applications.

In summary, the TAC Film market is driven by the demand for advanced displays in consumer electronics, expansion into specialized industries, and ongoing innovations in film technologies. These drivers collectively contribute to the market’s growth and its role in meeting the evolving needs of various sectors.

Restraints

While the TAC Film market is on the rise, it faces certain restraints that can slow down its widespread adoption and growth. One notable challenge comes from the increasing competition among different types of films and materials used in electronic devices. As new materials emerge and industries explore alternatives, TAC films must compete to maintain their market share. The availability of substitutes and the need for continuous innovation pose challenges for the sustained dominance of TAC films.

Another restraint stems from the cost implications associated with producing high-quality TAC films. As consumers and industries demand advanced features, manufacturers need to invest in research and development to enhance film properties. Making TAC films better and fancier can cost a lot of money.

This might make TAC films more expensive, and it could be harder for many people and industries to use them in different things. Companies making TAC films need to find the right balance between making their films better and keeping the costs low. This is a big challenge they face – figuring out how to be innovative and make cool stuff without making it too expensive for everyone to use.

The TAC Film market is influenced by fluctuations in the electronics industry. Changes in consumer preferences, economic conditions, or global events can impact the demand for electronic devices and, consequently, the demand for TAC films.

The market’s dependency on the overall health of the electronics sector introduces an element of uncertainty and requires adaptability from TAC film manufacturers. In summary, the TAC Film market faces restraints related to competition, production costs, and external factors affecting the electronics industry. Overcoming these challenges will be essential for sustained growth and continued relevance in the dynamic market landscape.

Opportunities

The TAC Film market has some exciting chances due to how industries are changing and what people want. One big opportunity comes from the increased use of touchscreens in things other than just phones and tablets. Companies are exploring touchscreens in smart appliances, car displays, and interactive kiosks. This means more demand for TAC films, as they help make touchscreens stronger and more responsive.

This is a chance for TAC films to grow in new and emerging areas. Another opportunity comes from the growing trend of electric vehicles (EVs). In electric cars, touchscreens are becoming important on dashboards and control panels. TAC films are essential here because they make the screens clear and perform better. As more people around the world start using electric cars, the need for TAC films in cars is expected to go up.

As more people look for ways to make their homes smarter and more energy-efficient, TAC films have a chance to play a big role. TAC films can be used in things like smart windows and displays that help save energy. This makes TAC films important in the fast-growing market for smart and sustainable living solutions.

In short, the TAC Film market can make the most of chances in growing touchscreen use, the rise of electric vehicles, and the need for smart and energy-saving technologies. Companies need to adapt to these trends and find new uses for TAC films to fully benefit from these opportunities and make sure they keep growing.

Challenges

While the TAC Film market is full of opportunities, it also faces certain challenges that can make things a bit tricky. One notable challenge is the increasing competition from other types of films and materials used in electronic devices. As new materials come into play, TAC films need to fight to keep their place in the market. The availability of alternatives and the need for continuous innovation can make it tough for TAC films to stay on top.

Another challenge comes from the cost of making high-quality TAC films. As people want more advanced features on their screens, companies need to invest a lot in research and development to make better films. This can increase production costs, making it harder for TAC films to be affordable and widely used. Striking the right balance between innovation and cost-effectiveness becomes a big challenge for companies making TAC films.

The TAC Film market is influenced by changes in the electronics industry. Things like shifts in what consumers like, changes in the economy, or global events can affect how much people want electronic devices, and that, in turn, affects the demand for TAC films.

Depending on the overall health of the electronics sector introduces an element of uncertainty and requires companies to adapt to changes. In summary, the TAC Film market faces challenges related to competition, production costs, and external factors affecting the electronics industry. Overcoming these challenges will be crucial for the sustainable growth and continued success of TAC films in the ever-changing market landscape.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 39% in 2023. This can be attributed to the existence of key manufacturers of electronic devices, with the wide range of increasing use of TAC films in electronic products such as laptops, LCD televisions, navigation systems, and cell phones, in automobiles. During the forecast period, among regional markets, it is projected that North America will contribute to revenue growth in 2022.

This is due to the technological developments in products and production systems and increasing market demand for TAC films from several end-use industries operating in countries in the region. In Europe, the TAC Film Market intelligence is likely to record a vigorous revenue growth rate during the forecast period due to the existence of key players in countries in the region and the increasing need to purify water for drinking and to treat wastewater from industries.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

- Fujifilm Global Graphic Systems Co., Ltd.

- SK Innovation Global Technology

- Island Polymer Industries GmbH

- Catalina Graphic Films, Incorporated

- Hyosung Corporation

- TacBright Optronics Corp

- Zeon Corp.

- Konica Minolta, Inc.

- Cayman Chemical

- China Lucky Film Group Corporation

- Lucky Group Corporation

- Other Key Players

Recent Developments

Report Scope

Report Features Description Market Value (2022) US$ 5.8 Bn Forecast Revenue (2032) US$ 9.2 Bn CAGR (2023-2032) 4.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Thickness Type (30-40M, and 80M-270M), By Application (Liquid Crystal Display (LCD),and Ion Sensing & Separation) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape Fujifilm Global Graphic Systems Co., Ltd., SK Innovation Global Technology, Island Polymer Industries GmbH, Catalina Graphic Films, Incorporated, Hyosung Corporation, TacBright Optronics Corp, Zeon Corp., Konica Minolta, Inc., Cayman Chemical, China Lucky Film Group Corporation, Lucky Group Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of TAC Film Market?TAC Film Market size is expected to be worth around USD 9.2 billion by 2033, from USD 5.8 Bn in 2023

What is the TAC Film Market growth?The global TAC Film Market is expected to grow at a compound annual growth rate of 4.7%.Who are the key companies/players in the TAC Film Market?Fujifilm Global Graphic Systems Co., Ltd., SK Innovation Global Technology, Island Polymer Industries GmbH, Catalina Graphic Films, Incorporated, Hyosung Corporation, TacBright Optronics Corp, Zeon Corp., Konica Minolta, Inc., Cayman Chemical, China Lucky Film Group Corporation, Lucky Group Corporation, Other Key Players

-

-

- Fujifilm Global Graphic Systems Co., Ltd.

- SK Innovation Global Technology

- Island Polymer Industries GmbH

- Catalina Graphic Films, Incorporated

- Hyosung Corporation

- TacBright Optronics Corp

- Zeon Corp.

- Konica Minolta, Inc.

- Cayman Chemical

- China Lucky Film Group Corporation

- Lucky Group Corporation

- Other Key Players