Global Tableland Tourism Market Size, Share, Growth Analysis By Location Type (Hills, Lakes, Trails, Waterfalls, Parks, Farms, Museums), By Booking Channel (Online Booking, Phone Booking, Direct Booking), By Tour Type (Package Traveller, Independent Traveller, Tour Group), By Tourist Type (Domestic, International), By Consumer Orientation (Men, Women), By Age Group (15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, 66-75 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 153493

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

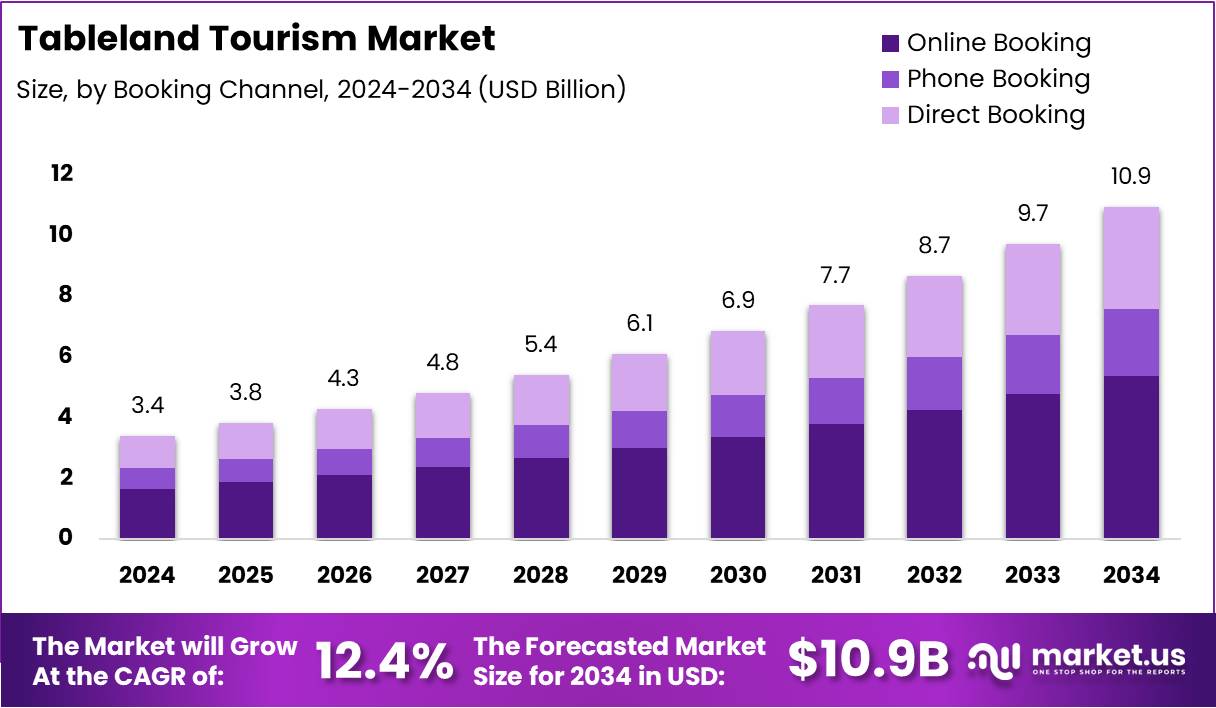

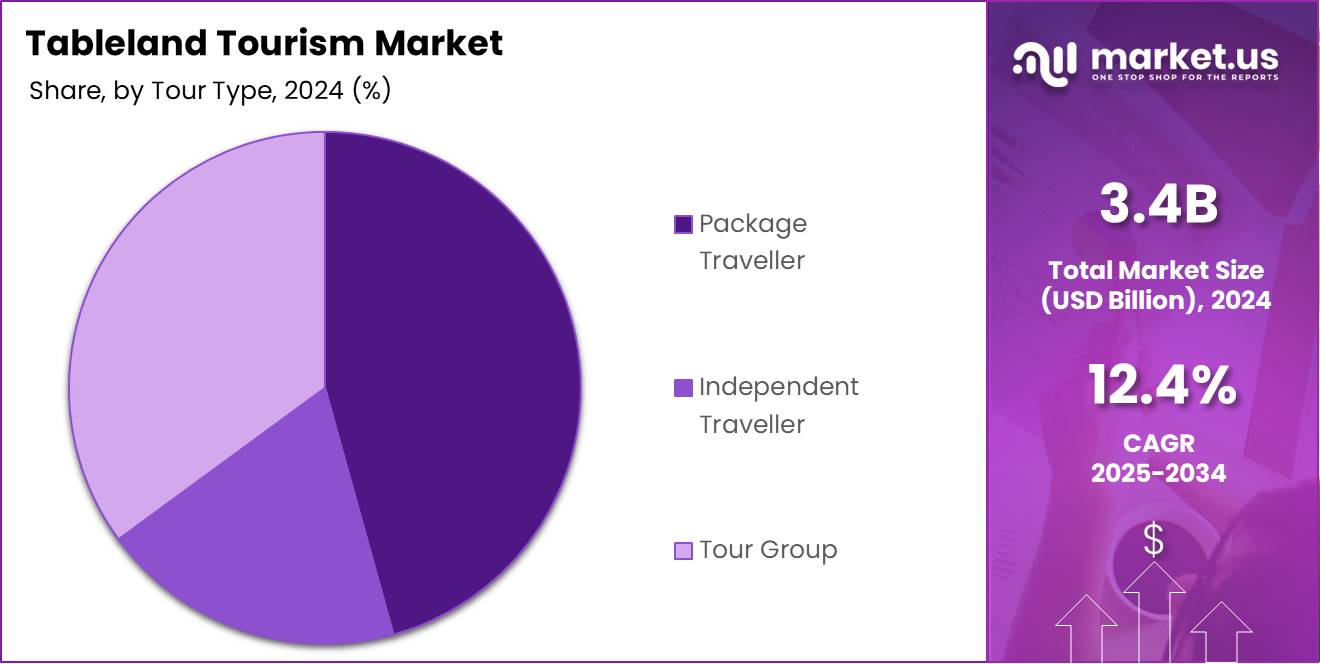

The Global Tableland Tourism Market size is expected to be worth around USD 10.9 Billion by 2034, from USD 3.4 Billion in 2024, growing at a CAGR of 12.4% during the forecast period from 2025 to 2034.

The Tableland Tourism Market is emerging as a niche yet dynamic segment within Asia-Pacific’s broader travel industry. Tablelands, characterized by elevated flat terrains offering panoramic views, rich biodiversity, and pleasant climates, are drawing the attention of experience-driven travelers. This form of tourism thrives on eco-adventures, agro-tourism, and scenic leisure, especially in regions like India’s Panchgani-Mahabaleshwar Tableland and Australia’s Atherton Tablelands.

Driven by changing preferences, Tableland Tourism is increasingly being shaped by travelers seeking unique, high-altitude destinations that promise sustainability and culture. According to Hindustan Times, more than 10.1 million foreign tourists visited Asia’s most loved country in first quarter of 2025 signaling renewed confidence in regional tourism hotspots, including scenic tablelands.

Moreover, eco-consciousness is influencing market dynamics. According to GSTC, 75% of global travelers in 2024 aimed to travel more sustainably in the next 12 months. This aligns perfectly with Tableland destinations that often emphasize low-impact tourism, conservation, and community engagement offering high potential for growth in eco-segment packages and curated nature stays.

Meanwhile, the overall regional market is rebounding strongly. According to Macao News, the Asia-Pacific region welcomed 316 million international visitors in 2024 a strong indicator of post-pandemic recovery. This uptrend is expected to spill over into lesser-explored submarkets like Tableland Tourism, creating fresh investment and revenue opportunities.

Additionally, governments are increasingly recognizing the economic and ecological value of tableland regions. Strategic investments in road connectivity, homestay schemes, and rural tourism initiatives are enhancing accessibility and visibility for these areas, particularly in India, Vietnam, and Sri Lanka where tableland ecosystems flourish.

Parallel to this, new regulations are promoting responsible tourism models. Policies focused on sustainable development, waste management, and eco-certification are helping tableland markets align with global standards, improving tourist satisfaction and destination longevity.

Local businesses and tourism boards are leveraging digital channels and experiential marketing to attract younger travelers and global explorers. With increased mobile penetration and social media influence, tableland experiences are being shared widely, spurring curiosity and demand.

Furthermore, seasonal promotions and bundled eco-tourism experiences are being introduced, enhancing profitability for small-scale operators. With a unique offering that blends nature, culture, and community, Tableland Tourism is becoming a strong contender in Asia-Pacific’s growing tourism landscape.

Key Takeaways

- The Global Tableland Tourism Market is projected to reach USD 10.9 Billion by 2034, up from USD 3.4 Billion in 2024, growing at a CAGR of 12.4%.

- In 2024, the Hills segment led the By Location Type Analysis with a 26.3% share, driven by scenic views and well-developed infrastructure.

- Online Booking dominated the By Booking Channel segment in 2024 with a 49.2% share, supported by mobile-first behavior and flexible options.

- The Package Traveller segment held the lead in the By Tour Type category in 2024, due to its convenience and all-inclusive travel planning.

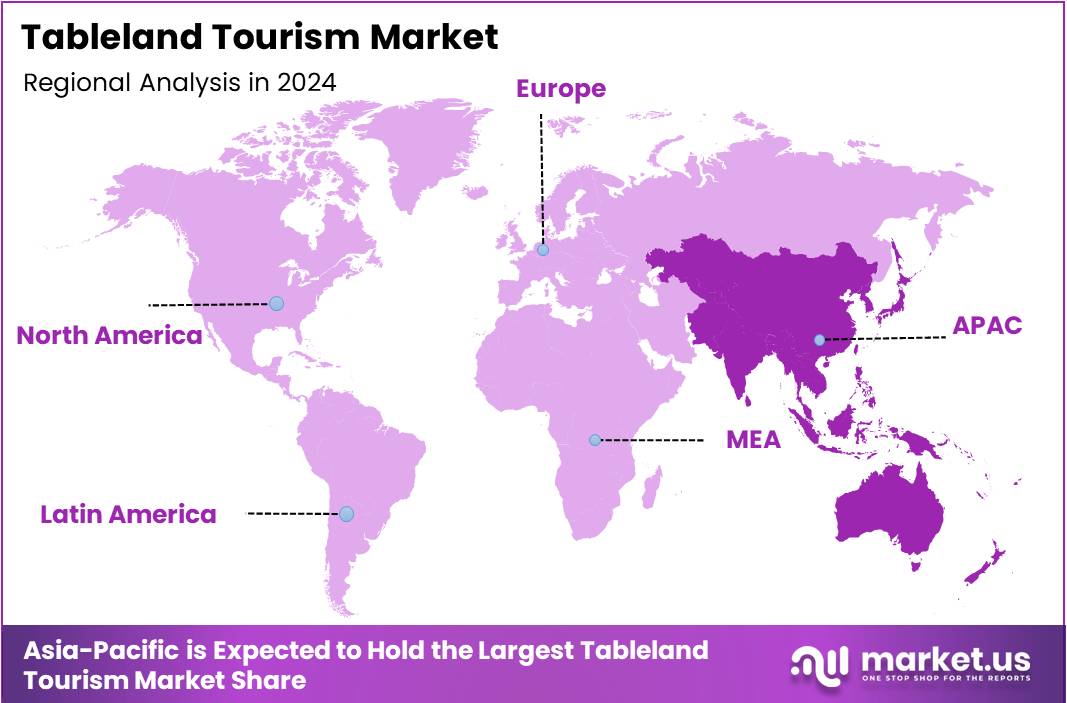

- The Asia Pacific region led the global market in 2024, fueled by investment in eco-tourism, rising domestic travel, and growing disposable incomes.

Location Type Analysis

Hills lead the way with 26.3% due to their scenic appeal and year-round accessibility.

In 2024, Hills held a dominant market position in the By Location Type Analysis segment of the Tableland Tourism Market, with a 26.3% share. The elevated demand stems from the breathtaking panoramic views, cooler climates, and increased infrastructure supporting hillside resorts and adventure trails.

Lakes followed closely, offering tranquil landscapes and water-based activities that attract nature lovers and families alike. Trails also maintained a robust presence, driven by rising interest in hiking, eco-tourism, and fitness travel experiences.

Waterfalls captivated a significant tourist segment with their visual grandeur and proximity to key parklands. Parks benefited from conservation awareness and accessible recreation options for all age groups.

Farms gained traction for their agri-tourism appeal, where experiential travel like fruit picking and farm stays drew domestic visitors. Museums, while lower in share, remained key for educational tourism and heritage-focused travelers, particularly in culturally rich areas.

Overall, the varied natural and cultural offerings of Tableland drive diverse tourist interest, with Hills maintaining a clear lead due to both natural beauty and accessibility.

Booking Channel Analysis

Online Booking dominates with 49.2% due to convenience and mobile accessibility.

In 2024, Online Booking held a dominant market position in the By Booking Channel Analysis segment of the Tableland Tourism Market, with a 49.2% share. The surge was primarily fueled by mobile-first behavior and instant access to customizable travel options.

Travelers increasingly preferred online platforms for their flexibility, ability to compare options, and integration with social media and reviews. This shift also empowered smaller operators in Tableland to reach a broader audience.

Phone Booking retained a moderate share, especially among older demographics and repeat travelers who preferred personalized service. It remains a trusted channel for making direct inquiries and arranging specific needs.

Direct Booking, though more limited, maintained relevance particularly for walk-in tourists and last-minute planners. Local promotions and partnerships with hotels and activity providers kept this channel active despite broader digitalization.

As the market grows increasingly tech-savvy, online platforms are expected to strengthen their role, streamlining the travel planning process for both domestic and international tourists.

Tour Type Analysis

Package Traveller leads the trend due to its hassle-free planning and bundled value.

In 2024, Package Traveller held a dominant market position in the By Tour Type Analysis segment of the Tableland Tourism Market, reflecting its convenience-driven popularity. Travelers favored pre-arranged itineraries that included accommodation, transport and guided experiences, reducing the stress of individual planning.

Independent Traveller emerged as the second-largest segment, especially among millennials and experienced tourists. Flexibility, control over schedules, and the freedom to explore unique paths made it attractive to adventure seekers and solo travelers.

Tour Group bookings catered to larger demographics, such as school trips, senior tours, and cultural exchanges. This segment benefited from economies of scale and professional coordination but remained smaller due to its fixed schedules and lower flexibility.

The dominance of Package Traveller reflects a consumer shift toward all-in-one offerings that simplify travel, especially in regions like Tableland where diverse attractions require coordination.

Key Market Segments

By Location Type

- Hills

- Lakes

- Trails

- Waterfalls

- Parks

- Farms

- Museums

By Booking Channel

- Online Booking

- Phone Booking

- Direct Booking

By Tour Type

- Package Traveller

- Independent Traveller

- Tour Group

By Tourist Type

- Domestic

- International

By Consumer Orientation

- Men

- Women

By Age Group

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

Drivers

Rise in Demand for Offbeat and Less Crowded Travel Destinations Drives Market Growth

Tableland tourism is gaining popularity as travelers seek peaceful alternatives to crowded tourist spots. Tourists now prefer exploring less commercialized, natural locations, and tablelands offer just that. These elevated landscapes provide wide open spaces and fewer crowds, making them ideal for solitude and personal exploration.

Governments and local authorities are expanding eco-tourism infrastructure in these regions. This includes setting up nature trails, eco-friendly accommodations, and informative centers that help tourists enjoy the tablelands without harming the environment. These improvements are attracting eco-conscious travelers who value sustainable tourism.

Improved road and air connectivity is also contributing to the market’s growth. Previously hard to reach tablelands are now accessible due to better transportation links. Tourists can now reach remote locations more quickly and safely, encouraging more frequent visits to these scenic destinations.

Overall, the tableland tourism market is benefiting from travelers’ desire for quiet, nature centric experiences, supported by better infrastructure and accessibility. As these trends continue, the demand for tableland tourism is expected to grow steadily.

Restraints

Seasonal Accessibility Issues Due to Harsh Weather Conditions Restrict Market Expansion

A major challenge for tableland tourism is limited accessibility during certain seasons. Harsh weather especially in winter can block roads and make travel unsafe, reducing the number of visitors. This seasonal nature limits consistent income for local businesses.

Another restraint is the lack of luxury or high end accommodation in remote tableland areas. Many tourists today expect premium facilities like spas, fine dining or Wi Fi. Without these, upscale travelers may choose alternative destinations, impacting the growth of the high spending tourist segment.

Healthcare and emergency services in these areas are often inadequate. Remote locations usually lack quick medical support, which can deter families, senior citizens or those with health concerns from visiting. Ensuring tourist safety remains a concern, especially in case of accidents or altitude related illnesses.

These limitations suggest that while the market has potential, investment in infrastructure and safety is necessary to support long term growth and attract a broader range of tourists.

Growth Factors

Development of Themed Adventure Tourism Packages Unlocks Growth Potential

One of the key growth opportunities in the tableland tourism market lies in themed adventure packages. Activities like trekking, paragliding, and rock climbing can be bundled into attractive experiences. These packages appeal to thrill seekers and young travelers looking for something unique.

Digital promotion also plays a crucial role. Virtual tours, interactive websites, and social media marketing can showcase tableland beauty to global audiences. This helps attract international tourists who may not have previously considered these destinations.

Combining agriculture with tourism known as agri tourism is another promising trend. Travelers can stay on local farms, participate in farming activities, and experience the rural lifestyle. This gives visitors a richer cultural experience and helps local farmers earn additional income.

By embracing adventure, technology, and agri tourism, the tableland tourism market has significant room to grow, especially among younger and international audiences.

Emerging Trends

Increased Use of Drone Photography in Scenic Marketing Boosts Visitor Interest

Drone photography is revolutionizing how tableland destinations are marketed. High quality aerial shots of scenic landscapes are capturing tourists’ attention online. These visuals are often used in social media campaigns, travel blogs, and promotional videos, increasing curiosity and footfall.

Another popular trend is glamping luxury camping in high altitude tablelands. Tourists want to enjoy nature without giving up comfort. Glamping options offer stylish tents with modern amenities, drawing more travelers who are new to outdoor experiences but still want to explore nature.

Wellness tourism is also on the rise. More travelers are choosing serene locations for yoga, meditation, and detox retreats. Tablelands, with their peaceful settings and fresh air, provide the perfect backdrop for these wellness focused trips.

Together, these trending factors are reshaping how tableland tourism is packaged and consumed. They appeal to a wide audience by blending nature, comfort, and wellness in unique ways.

Regional Analysis

Asia Pacific Dominates the Tableland Tourism Market

The Asia Pacific region holds a dominant position in the global Tableland Tourism Market, driven by its vast and diverse landscapes, cultural richness and a rapidly growing tourism infrastructure. Countries like China, India, and Southeast Asian nations are significantly investing in eco-tourism and adventure travel, which includes tableland destinations. Increasing domestic travel, government-led tourism initiatives, and rising disposable incomes further contribute to the region’s leading market share.

North America Tableland Tourism Market Trends

North America follows closely, supported by its well-developed travel and hospitality ecosystem. The U.S. and Canada, in particular, have a range of tableland sites known for hiking, photography, and nature experiences. High consumer spending on leisure and consistent efforts in sustainable tourism have strengthened the region’s appeal among both local and international tourists.

Europe Tableland Tourism Market Trends

Europe showcases a steady demand in the tableland tourism market, bolstered by its extensive network of protected natural parks and culturally significant highland destinations. Countries across the Alps, Pyrenees, and Scottish Highlands see considerable traction, especially among eco-conscious travelers and outdoor enthusiasts. The presence of efficient transportation and travel infrastructure further enhances accessibility to these destinations.

Middle East and Africa Tableland Tourism Market Trends

The Middle East and Africa are emerging players in the tableland tourism segment, supported by a rising focus on niche tourism and geographic diversity. Countries in East Africa, for instance, offer unique tableland experiences interlinked with wildlife safaris and eco-tourism. While infrastructural development is still progressing, growing regional tourism campaigns are fostering greater market interest.

Latin America Tableland Tourism Market Trends

Latin America offers untapped potential in the tableland tourism market, featuring iconic landscapes such as plateaus in the Andes and Brazil’s interior highlands. The region benefits from its natural diversity and cultural vibrancy, which appeal to adventure and experiential travelers. However, inconsistent infrastructure and political instability in some areas may moderate the pace of growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tableland Tourism Company Insights

In 2024, the global Tableland Tourism Market continues to be shaped significantly by the strategic movements of major players. Expedia Group remains a dominant force, leveraging its expansive digital infrastructure to offer tailored travel solutions. Its investment in AI-driven personalization has enhanced user engagement, particularly in remote and scenic destinations like tablelands.

Booking Holdings Inc. maintains a strong foothold through its robust platform portfolio, including Booking.com and Priceline. The company’s data-centric approach and deep localization strategies have allowed it to tap into emerging tableland travel hotspots, catering to diverse traveler preferences.

Airbnb, Inc. has effectively redefined accommodation in the tableland tourism space, capitalizing on the demand for experiential travel. Its focus on unique, nature-based stays has resonated with eco-conscious tourists, driving growth in rural and offbeat locations.

TripAdvisor, Inc. continues to influence traveler decisions through its review-driven ecosystem. The company has strengthened its role as a trip planning resource, with curated content and travel guides that highlight tableland regions as must-visit destinations.

Collectively, these companies are not only driving innovation and accessibility in the market but are also contributing to the diversification of global tourism offerings. Their focus on digital integration, customer experience, and sustainable tourism is likely to push tableland tourism into new growth phases in the coming years. While competition remains intense, strategic partnerships, advanced analytics, and consumer behavior insights will be key in determining long-term leadership in this evolving landscape.

Top Key Players in the Market

- Expedia Group

- Booking Holdings Inc.

- Airbnb, Inc.

- TripAdvisor, Inc.

- TUI Group

- Hilton Worldwide Holdings Inc.

- Marriott International, Inc.

- InterContinental Hotels Group PLC

- American Express Global Business Travel

- Virtuoso

Recent Developments

- In July 2025, MMGY Global, the world’s leading integrated marketing and communications firm specializing in travel, tourism, and hospitality, announced the acquisition of Think Strawberries (TS), a premier travel representation and marketing brand. This strategic move strengthens MMGY’s footprint in the Asia and Middle East markets, enhancing its global destination marketing capabilities.

- In June 2024, Yatra Online acquired an additional 4.5% stake in Adventure and Nature Network (ANN) to deepen its investment in the adventure tourism segment. This acquisition reflects Yatra’s focus on expanding curated outdoor experiences and niche travel offerings for its user base.

- In November 2024, MakeMyTrip announced the signing of a Business Transfer Agreement to acquire the Happay Expense Management Platform from CRED. The acquisition is aimed at strengthening MakeMyTrip’s corporate travel and expense management services under its growing B2B portfolio.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Billion Forecast Revenue (2034) USD 10.9 Billion CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Location Type (Hills, Lakes, Trails, Waterfalls, Parks, Farms, Museums), By Booking Channel (Online Booking, Phone Booking, Direct Booking), By Tour Type (Package Traveller, Independent Traveller, Tour Group), By Tourist Type (Domestic, International), By Consumer Orientation (Men, Women), By Age Group (15-25 Years, 26-35 Years, 36-45 Years, 46-55 Years, 66-75 Years) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Expedia Group, Booking Holdings Inc., Airbnb, Inc., TripAdvisor, Inc., TUI Group, Hilton Worldwide Holdings Inc., Marriott International, Inc., InterContinental Hotels Group PLC, American Express Global Business Travel, Virtuoso Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Expedia Group

- Booking Holdings Inc.

- Airbnb, Inc.

- TripAdvisor, Inc.

- TUI Group

- Hilton Worldwide Holdings Inc.

- Marriott International, Inc.

- InterContinental Hotels Group PLC

- American Express Global Business Travel

- Virtuoso