Global Table Linen Market Material Type (Artificial Fibers, Cotton, Linen Silk, Other Material Types), Application (Commercial, Residential), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 22581

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

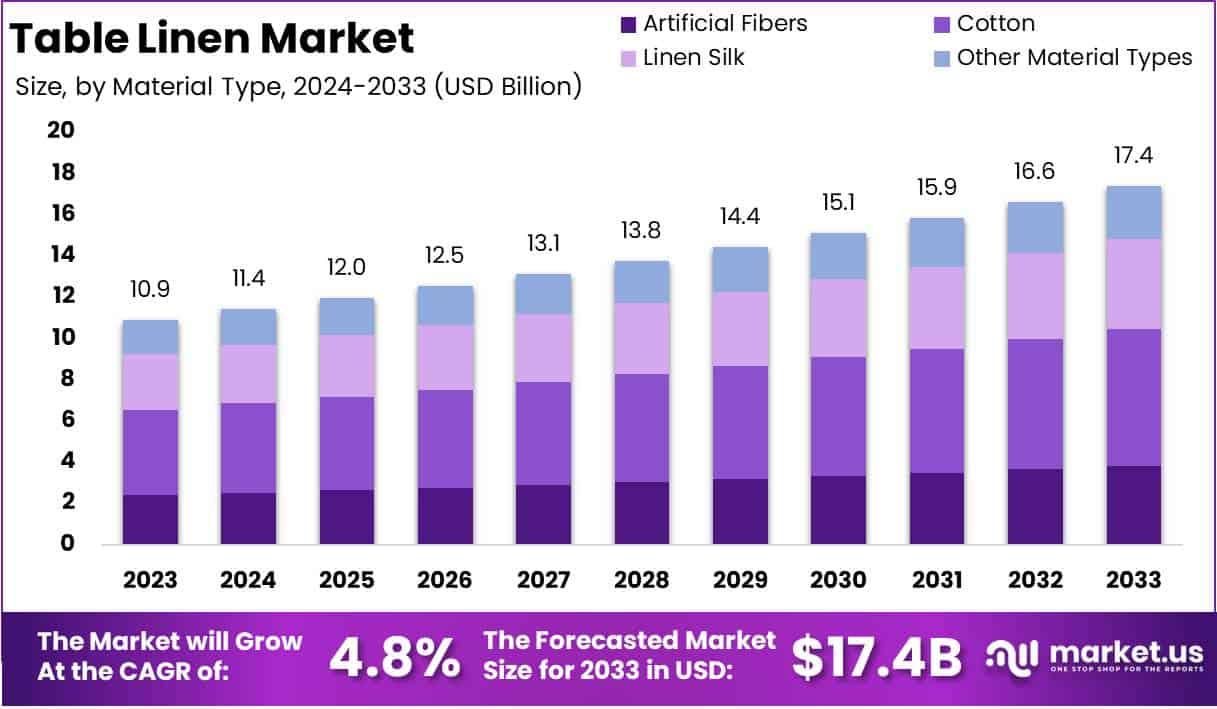

The Global Table Linen Market size is expected to be worth around USD 17.4 Billion by 2033, from USD 10.9 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Table linens encompass a range of fabric-based coverings and accessories designed to enhance both the aesthetic appeal and functionality of dining spaces. This category includes tablecloths, placemats, napkins, table runners, and overlays, which are typically made from materials like cotton, linen, polyester, and blends of natural and synthetic fibers.

Table linens play a key role in both residential and commercial settings, offering protection to dining surfaces while adding style, elegance, and customization to the overall decor.

The table linen market is an industry segment focused on the production, distribution, and sale of table linens for various consumer and institutional needs. This market serves a diverse clientele ranging from households to hospitality sectors, including restaurants, hotels, and event venues.

The market is characterized by a variety of products across different price points, styles, materials, and functionalities, catering to both everyday and upscale use.

Market participants include large-scale manufacturers, boutique designers, and emerging eco-friendly brands, all responding to evolving consumer preferences and trends in interior décor, sustainability, and textile innovation.

Several factors are driving growth in the table linen market. Firstly, the rise of the hospitality and tourism industry has significantly increased demand for high-quality table linens as hotels and restaurants strive to enhance customer experience through improved décor and ambiance.

Additionally, a growing trend toward home decor and interior design among consumers has elevated table linens from a purely functional item to a style statement, leading to higher demand for premium, aesthetically pleasing options.

Moreover, increased awareness and preference for sustainable and eco-friendly products are encouraging the adoption of reusable table linens made from organic and recycled materials, further expanding market reach and engagement.

Demand for table linens is robust across both residential and commercial sectors, fueled by trends in home improvement, lifestyle upgrades, and increased interest in high-quality dining experiences. The resurgence of in-home gatherings and events, particularly after the pandemic period, has also contributed to rising demand for stylish and customizable table linens.

In commercial settings, demand is supported by the hospitality sector’s focus on branding and atmosphere creation, where table linens serve as an important décor element. Furthermore, consumers are increasingly seeking convenience-oriented options, such as stain-resistant and machine-washable table linens, which align with modern lifestyle preferences.

Opportunities in the table linen market are plentiful, especially in the domains of sustainability, innovation, and customization. Sustainable table linen products, such as those made from organic cotton or recycled materials, are gaining traction as consumers and businesses prioritize environmentally responsible choices.

Additionally, digital and e-commerce channels are creating new avenues for market growth by enabling brands to reach global audiences with minimal logistical constraints.

Innovations in textile technology, such as wrinkle-resistant fabrics, antimicrobial treatments, and customization options, are also areas where companies can differentiate their offerings. By focusing on these trends, market players can capitalize on the growing demand for versatile, high-quality, and eco-friendly table linens that align with consumer values and lifestyle trends.

According to IKEA Global, the fiscal year 2023 saw IKEA retail sales hit EUR 47.6 billion, marking a 6.6% increase, or 7.3% adjusted for currency effects. Despite lower sales volumes, strategic management enabled robust financial performance amid economic fluctuations, reflecting strong consumer demand for home furnishings, including table linens.

According to Texmin, India produces about 24% of the world’s cotton, supporting 6 million farmers and 40-50 million related workers. India’s textile industry favors a 60:40 cotton to non-cotton fiber usage ratio, distinct from the global 30:70 ratio.

According to Wrightresearch, India’s home textiles market, valued at USD 10 billion, is projected to grow at a 7% CAGR to reach USD 16 billion by FY31, representing nearly 10% of the global market and making India a key supplier to the US.

Key Takeaways

- The Global Table Linen Market is anticipated to expand from USD 10.9 billion in 2023 to USD 17.4 billion by 2033, growing at a 4.8% CAGR, fueled by rising consumer demand for premium home décor and heightened hospitality sector activity.

- Cotton leads the table linen market by material, capturing a 38.1% share in 2023, driven by consumer preference for sustainable, durable, and easy-maintenance fabrics.

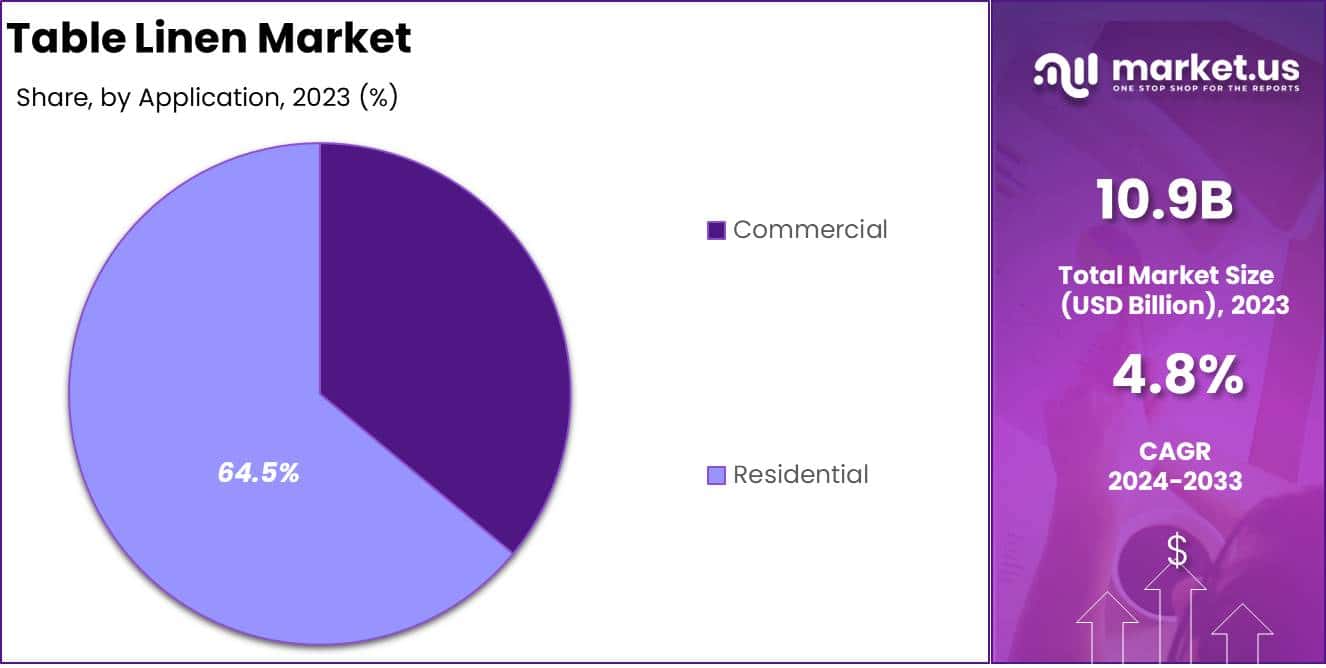

- The Residential segment dominates the table linen market with a 64.5% share, reflecting increased investment in home décor and dining aesthetics, especially in post-pandemic settings.

- Supermarkets/Hypermarkets hold a leading 45.0% share in distribution, attributed to convenience and product accessibility, appealing to a wide consumer base.

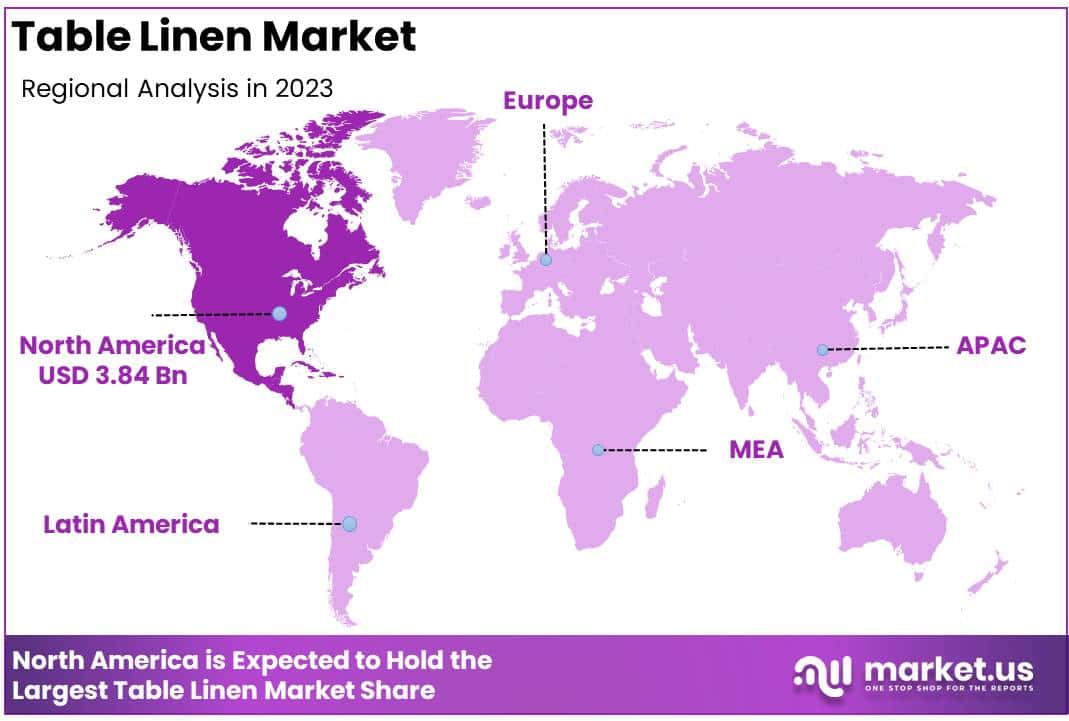

- North America is the largest regional market, accounting for 35.3% of global table linen sales in 2023, driven by high disposable incomes and robust demand from both home and hospitality sectors.

By Material Analysis

Cotton Dominating Segment in Table Linen Market with 38.1% Share

In 2023, Cotton held a dominant market position by material type in the Table Linen Market, capturing more than a 38.1% share. Its widespread popularity is due to its durability, softness, and ease of maintenance, making it a preferred choice among both residential and commercial buyers.

Cotton table linens appeal to a broad consumer base, particularly as sustainable and natural fiber options become increasingly desirable. This segment continues to benefit from the trend toward eco-friendly materials, positioning cotton as a staple material within the industry.

Artificial fibers represent a growing segment in the Table Linen Market, driven by their durability, affordability, and resistance to stains and wrinkling. While currently holding a smaller market share relative to natural fibers, the demand for artificial materials is on the rise, particularly within the hospitality sector where cost-efficiency and ease of maintenance are key factors.

Innovations in synthetic fiber technology are expected to further support segment growth as these materials increasingly mimic the look and feel of natural fibers while offering superior performance.

Linen occupies a premium segment within the Table Linen Market, valued for its luxurious texture, natural luster, and cooling properties. Though it commands a smaller market share, linen is particularly favored in upscale restaurants and boutique hotels that prioritize high-quality aesthetics.

The segment is projected to grow steadily as consumer interest in natural and high-end home textiles expands. Linen’s strong association with sustainability and its biodegradable nature further support its appeal among environmentally conscious consumers.

Silk remains a niche yet impactful segment in the Table Linen Market, known for its elegance and high-end appeal. Although it holds a small share compared to other materials, silk table linens are often used for specialty settings, events, and luxury dining establishments.

Silk’s delicate nature and premium price limit its adoption for everyday use, but its association with exclusivity makes it a sought-after choice for select customers who prioritize sophistication and opulence.

Other material types, including blended fabrics and alternative natural fibers, comprise a small yet diverse segment within the Table Linen Market. This segment caters to a range of consumer preferences, from sustainable materials like hemp to budget-friendly blends that combine durability with cost efficiency.

As experimentation with alternative textiles grows, this segment is anticipated to attract interest from niche markets looking for unique aesthetic and functional qualities.

By Application Analysis

Residential Dominating Segment in Table Linen Market with 64.5% Share

In 2023, the Residential sector held a dominant market position by application in the Table Linen Market, capturing more than a 64.5% share. This segment’s strength is driven by a growing consumer focus on home aesthetics and the rise in dining and entertaining at home, particularly post-pandemic.

Homeowners are increasingly investing in quality table linens to elevate their dining spaces, with seasonal and themed linens also contributing to steady demand. Residential demand is expected to remain strong as consumers continue to prioritize home decor and seek high-quality, stylish table linens for personal use.

The Commercial segment, while holding a smaller share relative to Residential, is a significant and steadily expanding application area within the Table Linen Market. Demand in this segment is largely driven by restaurants, hotels, and event venues that require durable, cost-effective linens capable of withstanding frequent use and washing.

The trend toward elevating guest experience in the hospitality industry further bolsters commercial demand, as table linens are a key element in enhancing the dining atmosphere. Continued growth is anticipated in this segment as the global hospitality and events industry recovers and expands, driving further adoption of quality table linens.

By Distribution Channel Analysis

Supermarkets/Hypermarkets: Dominating Segment in Table Linen Market with 45.0% Share

In 2023, Supermarkets/Hypermarkets held a dominant market position by distribution channel in the Table Linen Market, capturing more than a 45.0% share. These outlets are favored for their convenience and accessibility, offering consumers a wide selection of table linen options in one location.

Shoppers benefit from the ability to inspect the quality and design of products directly, driving significant foot traffic to these stores for home textile purchases. The segment’s strong position is expected to remain steady as supermarkets and hypermarkets continue to expand their home décor sections to meet consumer demand.

Specialty Stores represent a growing distribution channel within the Table Linen Market, appealing to consumers seeking premium and unique table linens. These stores offer a curated selection, often emphasizing quality, craftsmanship, and design, which is particularly appealing to discerning customers.

As consumer interest in specialty and artisanal home goods rises, this segment is likely to gain traction, especially in urban areas where there is a higher concentration of boutique retailers focusing on niche and high-end products.

Online Platforms are an expanding distribution channel in the Table Linen Market, fueled by the convenience of home shopping and the vast variety of products available. E-commerce enables consumers to explore a broad range of brands, styles, and price points, often with customer reviews that aid in decision-making.

The online segment’s growth is further supported by the rise in digital-savvy shoppers and improvements in logistics and delivery services. As e-commerce continues to gain momentum, the online distribution channel is expected to grow rapidly, becoming an increasingly significant contributor to overall market revenue.

Key Market Segments

By Material Type

- Artificial Fibers

- Cotton

- Linen Silk

- Other Material Types

By Application

- Commercial

- Residential

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Platforms

Driver

Rising Consumer Demand for Premium Home Decor and Hospitality Sectors

The demand for premium and aesthetically appealing table linen products is steadily rising, propelled by shifting consumer preferences toward upscale home décor and a desire for refined hospitality experiences. As consumers place greater emphasis on elevating home and dining aesthetics, table linens have become a focal point, providing both functionality and style.

This trend has been reinforced by an increasing interest in home improvement, especially post-pandemic, as individuals and families have spent more time at home and have sought to enhance their living spaces. Aesthetic considerations now heavily influence purchasing decisions, as consumers look for table linens that complement their interior themes.

The preference for unique, high-quality materials like linen and organic cotton further amplifies this trend, with consumers ready to pay premium prices for products that reflect craftsmanship and luxury.

The hospitality industry, including hotels, restaurants, and event management sectors, is another significant driver for the global table linen market. With the sector witnessing a resurgence after global lockdowns, there is a renewed emphasis on providing memorable dining experiences, which table linens play a central role in delivering. Table linens serve not only a functional purpose but also contribute to the ambiance, enhancing customer experience and brand image.

As a result, table linen manufacturers are innovating their product lines to meet this demand, offering a diverse range of textures, colors, and customizable designs.

The expanding hospitality industry, particularly in regions where tourism is recovering quickly, is anticipated to continue supporting market growth, creating a robust demand for high-quality table linen. Together, these factors underscore how premium consumer demand and the hospitality sector’s revival are shaping the future of the table linen market.

Restraint

High Production Costs and Raw Material Price Volatility

One of the primary restraints on the global table linen market is the volatility in raw material prices, particularly for natural fibers such as cotton, linen, and silk, which are preferred in high-quality table linen manufacturing.

The price of cotton, for instance, has seen fluctuations due to climate impacts on agriculture, geopolitical tensions affecting trade, and economic shifts that alter supply and demand balances.

As raw material costs surge, production expenses for manufacturers rise correspondingly, often squeezing profit margins. This cost challenge is especially pronounced for smaller players and new entrants, who may struggle to absorb these variations in material expenses or pass the costs onto consumers without impacting demand.

Larger manufacturers, though often better positioned to navigate these price fluctuations, still face hurdles in maintaining consistent pricing structures while meeting profitability targets.

Beyond raw material prices, labor costs and production expenses add further pressure. Crafting table linen involves labor-intensive processes, especially when producing premium, handcrafted items that demand precision and quality. In many developing economies where table linen manufacturing is common, rising wages and increased regulatory compliance also add to production costs.

Moreover, fluctuations in transportation and shipping costs, further exacerbated by global supply chain disruptions, present additional expenses, affecting the market’s growth trajectory.

Collectively, these factors hinder market expansion, forcing manufacturers to prioritize cost-control strategies, which can sometimes compromise quality or limit innovation. Addressing these production and cost challenges will be essential for the market to grow sustainably while delivering value to consumers.

Opportunity

Expansion into Sustainable and Eco-friendly Product Lines

As environmental concerns become increasingly important, the global table linen market has a significant opportunity to capitalize on the rising demand for sustainable and eco-friendly products. Consumers today are more conscious of their environmental impact and often prefer products made from organic, biodegradable, or recycled materials.

This shift towards eco-conscious purchasing has seen manufacturers adopting sustainable practices and using environmentally friendly raw materials, such as organic cotton, hemp, and bamboo fibers, which offer both durability and a reduced carbon footprint.

In response, companies are positioning these sustainable product lines as premium offerings, appealing to a segment of the market willing to invest in environmentally responsible choices. With sustainability poised as a defining value among consumers, especially in North America and Europe, this trend presents a lucrative growth opportunity for market players.

Additionally, innovations in production, such as using plant-based dyes and water-efficient processes, align with this eco-friendly demand, further bolstering the appeal of sustainable table linen. Brands that proactively adopt these practices not only strengthen their market positioning but also enhance their brand image, capturing the loyalty of environmentally minded consumers.

There is an increasing interest in certifications, such as GOTS (Global Organic Textile Standard) and Fair Trade, which assure buyers of a product’s sustainability credentials. These certifications have become a marketing asset, differentiating products in a competitive landscape and allowing manufacturers to command higher price points.

As environmental regulations tighten globally, companies investing in sustainability now will be well-prepared for future compliance, potentially offering a competitive advantage in markets with stringent environmental standards.

Trends

Rise of E-commerce Platforms Broadening Market Reach and Customer Base

E-commerce has revolutionized the global table linen market, providing unparalleled access to a broad and diverse consumer base. The shift to online shopping has been a significant trend, enabling consumers worldwide to access various table linen products from different brands and suppliers with ease.

E-commerce platforms have particularly bolstered the visibility of small and medium-sized enterprises (SMEs), allowing them to compete alongside established brands and expand their reach to international markets.

With the increasing penetration of smartphones and internet connectivity, particularly in developing regions, more consumers are discovering and purchasing table linen online. This digital marketplace has also facilitated price comparison, product reviews, and quick access to the latest trends, which are critical factors influencing purchasing decisions today.

The rise of e-commerce has also fostered product innovation, as online platforms encourage market players to adapt their offerings to meet the preferences of digital consumers.

Brands are increasingly utilizing data analytics to understand purchasing patterns, optimize their marketing strategies, and offer personalized recommendations. Additionally, the surge in social media and influencer marketing has helped popularize table linen as an essential lifestyle product, driving further consumer interest.

Special online sales events and discounts exclusive to e-commerce platforms create additional purchase incentives, further stimulating market demand. Together, these factors position e-commerce as a crucial channel driving growth in the table linen market, allowing brands to engage directly with consumers, enhance customer loyalty, and streamline distribution networks for greater efficiency.

Regional Analysis

North America Leads Table Linen Market with Largest Market Share of 35.3% in 2023

The global table linen market demonstrates significant regional variation, with North America leading as the dominant region, capturing a 35.3% share in 2023, translating to approximately USD 3.84 billion. This leading position can be attributed to the region’s robust demand driven by the hospitality and home décor sectors, which prioritize high-quality, aesthetically pleasing table linens.

North America’s high disposable incomes, established retail networks, and strong consumer preference for premium and customizable home furnishings contribute significantly to its leadership in the market. Additionally, evolving lifestyle trends favoring home aesthetics and the high rate of renovations in the U.S. and Canada continue to fuel demand.

Europe holds the second-largest share in the table linen market, propelled by a culturally ingrained appreciation for quality table settings, particularly in countries like Germany, France, and Italy.

The region’s tourism and hospitality industry is an important consumer, as luxury hotels and restaurants emphasize premium linen for guest experience enhancement. Regulatory focus on sustainable materials also benefits the European market, where eco-friendly linens are increasingly preferred.

In Asia Pacific, growing urbanization and rising income levels are expanding the table linen market, particularly in China, Japan, and India. The increasing popularity of Western dining practices, coupled with a rise in premium home furnishing adoption, is supporting steady market growth in this region.

The proliferation of e-commerce platforms has further facilitated access to quality table linens, driving regional sales.

In Latin America, the market growth is modest but supported by increasing hospitality investments and tourism activity, particularly in Brazil and Mexico.

The Middle East & Africa region exhibits a burgeoning demand for table linen, primarily due to an expanding hospitality sector and rising infrastructural developments in countries like the UAE and Saudi Arabia, which promote upscale dining and table aesthetics.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In the Global Table Linen Market, several key players distinguish themselves through their strategic positioning, product diversity, and brand recognition. Williams-Sonoma Inc. leads with a strong focus on high-quality, stylish table linens that cater to mid- and high-end consumers, leveraging its extensive retail network to build a loyal customer base.

Inter IKEA Holding B.V., with its affordability and minimalist design, effectively captures a broad consumer segment globally by integrating table linens within its wider home decor product offerings, ensuring accessibility in various markets.

AB Siulas leverages its European heritage and expertise in linen production to deliver premium and eco-friendly products, appealing to a growing segment of environmentally conscious consumers.

Prestige Linens and Frette hold strong positions in the luxury segment, where Frette’s legacy in Italian craftsmanship continues to set it apart.

SFERRA similarly taps into the luxury market, known for its high-quality materials and design sophistication, while Milliken & Company stands out with its innovative, stain-resistant fabrics, appealing to both residential and commercial buyers looking for durability and ease of maintenance. The Venus Group and Benson Mills cater to mid-market consumers, offering a balance between quality and price, particularly in North America.

Ameritex Industries and other key players add depth to the competitive landscape by offering versatile designs and materials that meet both functional and aesthetic needs.

Collectively, these companies contribute to a robust market by continuously addressing consumer demand for sustainable, high-quality, and aesthetically pleasing table linens, while responding to the increasing emphasis on home decor as a lifestyle extension.

Top Key Players in the Market

- Williams-Sonoma Inc.

- Inter IKEA Holding B.V.

- AB SIULAS

- Prestige Linens

- Frette

- SFERRA

- Milliken & Company

- Venus Group

- Benson Mills

- Ameritex Industries

- Other Key Players

Recent Developments

- In 2023, the Inter IKEA Group declared its annual financial outcomes, recording IKEA retail sales totaling EUR 47.6 billion for the fiscal year (FY23). This marked a 6.6% increase, which further adjusts to a 7.3% rise with currency considerations, compared to the previous fiscal year (FY22). These figures were achieved despite encountering challenges like decreased sales volumes, showcasing the group’s effective strategic management in a fluctuating economic landscape.

- In January 2024, a strategic partnership was forged between International Jet Interiors and Sferra, leading to the creation of the Jet Essentials collection. This new line features bespoke luxury table linens, including placemats, napkins, and tablecloths, designed exclusively for the private aviation sector. This initiative targets affluent consumers, expanding the companies’ reach into the high-end market.

- In 2023, Williams-Sonoma, Inc. introduced GreenRow, a brand that epitomizes commitment to sustainability and quality craftsmanship. GreenRow produces vintage-inspired products with a focus on sustainability, using low-impact materials like responsibly sourced linen, cotton, and recycled elements. Each item supports the company’s social and environmental goals, emphasizing GreenRow’s pledge to innovative and eco-friendly manufacturing processes.

Report Scope

Report Features Description Market Value (2023) US$ 10.9 Bn Forecast Revenue (2033) US$ 17.4 Bn CAGR (2023-2033) 4.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Material Type (Artificial Fibers, Cotton, Linen Silk, Other Material Types), Application (Commercial, Residential), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online Platforms) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America, Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa Competitive Landscape Williams-Sonoma Inc., Inter IKEA Holding B.V., AB SIULAS, Prestige Linens, Frette, SFERRA, Milliken & Company, Venus Group, Benson Mills, Ameritex Industries, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Williams-Sonoma Inc.

- Inter IKEA Holding B.V.

- AB SIULAS

- Prestige Linens

- Frette

- SFERRA

- Milliken & Company

- Venus Group

- Benson Mills

- Ameritex Industries

- Other Key Players