Global Synthetic Paper Market By Product Type (HDPE, BOPP, PET, and Other Product Type), By Distribution Channel (Label and Non-Label), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Dec. 2024

- Report ID: 20420

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

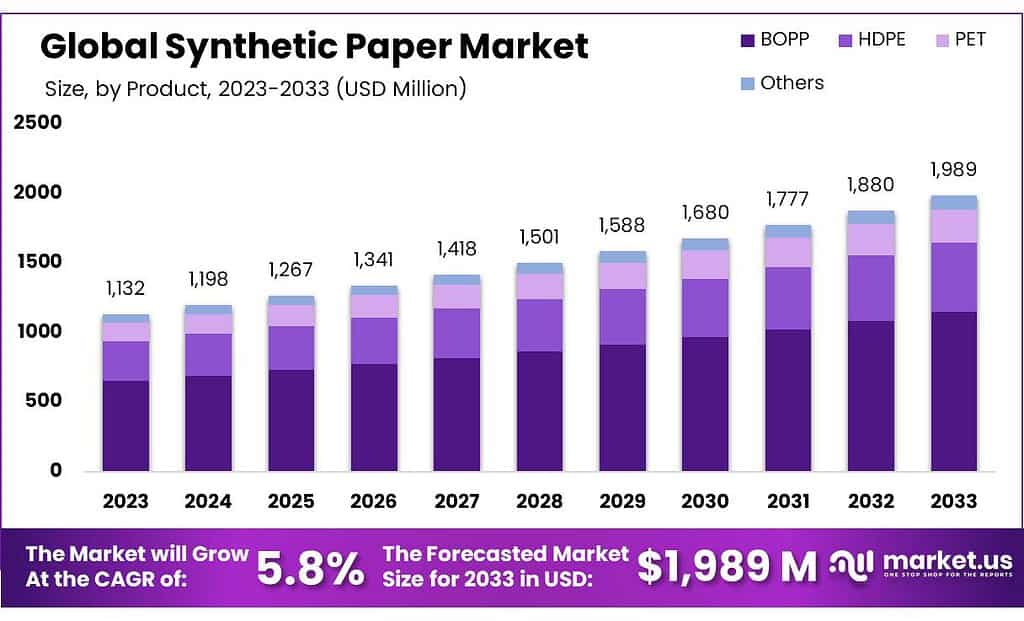

The global Synthetic Paper market size is expected to be worth around USD 1989 Million by 2033, from USD 1132 Million in 2023, growing at a CAGR of 5.8% during the forecast period from 2023 to 2033.

Due to consumers’ preference for eco-friendly packaging and recycled paper, the market is expected to expand significantly.

Synthetic resins are petroleum-derived and make synthetic paper. The material has exceptional properties such as being resistant to tears, chemicals, water, and oil. It also offers better heat seal ability and printability than conventional paper. It is used extensively in many industries such as packaging, food, beverages, transport, and pharma.

Note: Actual Numbers Might Vary In Final Report

Key Takeaways

- Market Size and Growth: The Synthetic Paper market is projected to grow significantly, reaching around USD 1989 million by 2033 from USD 1132 million in 2023, at a CAGR of 5.8%.

- Material and Properties: Synthetic paper, derived from petroleum-based synthetic resins, offers exceptional properties like tear, chemical, water, and oil resistance. It also boasts better heat seal ability and printability compared to conventional paper.

- Product Types and Growth Trends: BOPP dominates the market, especially in packaging perishable products, and is expected to grow at a 5.6% CAGR. HDPE-based synthetic paper, ideal for packaging various items, is forecasted to be the fastest-growing category at 6.1%.

- Thickness Segmentation: Different thickness ranges cater to diverse needs. Papers below 200 microns suit applications requiring high print quality and durability. The 200 to 400 microns range finds use in outdoor signage, while papers above 400 microns are preferred for heavy-duty applications like book covers.

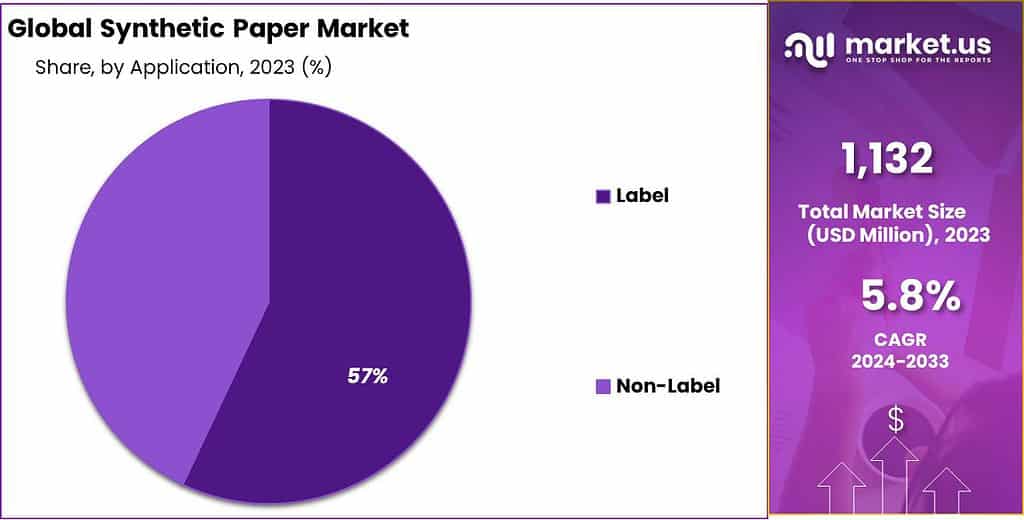

- Application and End-Use Analysis: Non-labeling applications account for a majority share due to synthetic paper’s suitability for packaging, driven by its durability, strength, and resistance to heat and moisture. The healthcare industry drives the growth of labeling applications, especially in medical tags.

- Market Drivers: The market is propelled by the eco-friendly nature of synthetic paper, its recyclability, and its ideal physical properties. Companies emphasize promoting 100% recycled synthetic paper to align with sustainability goals.

- Market Restraints: Fluctuations in raw material prices, particularly polybutylene, polypropylene, and polyethylene, pose challenges. Price fluctuations linked to crude oil prices impact production costs, potentially restraining market growth.

- Opportunities: Stringent government regulations favor recyclable and reusable papers, reducing reliance on wood-based papers and supporting the adoption of eco-friendly alternatives like synthetic paper.

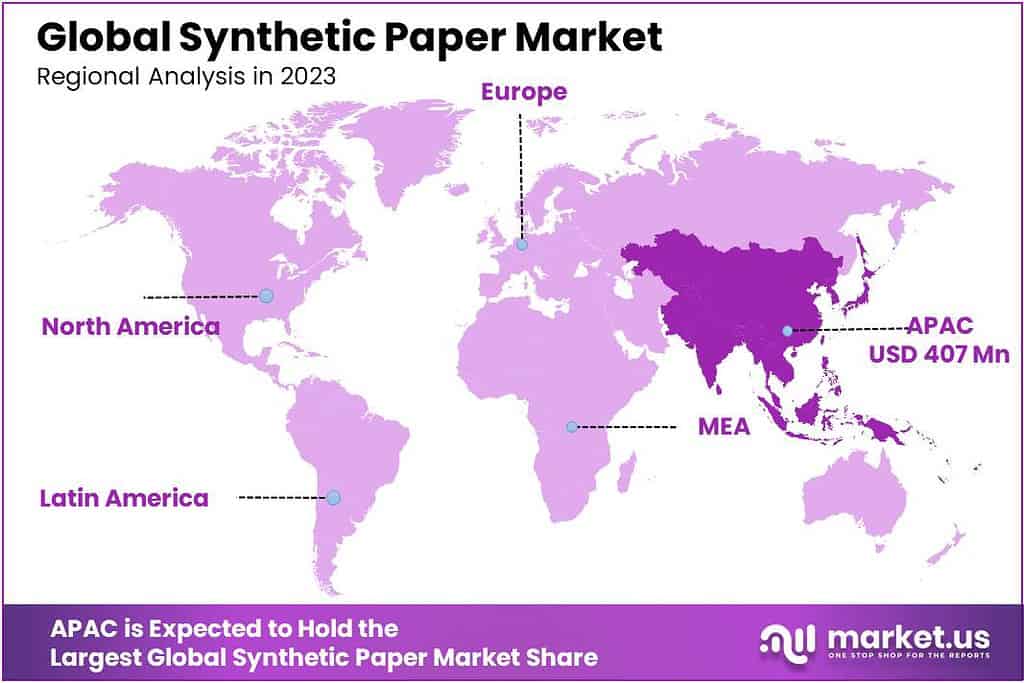

- Regional Analysis: Asia Pacific dominates the market, driven by increasing demand in packaging, pharmaceuticals, and printing. Europe and North America also hold significant market shares.

- Key Players and Developments: Major players are employing strategies like new product development and mergers to strengthen their market position. Recent developments, such as acquisitions and product launches, contribute to market expansion.

Product Type Analysis

BOPP accounted for 57.3% of global revenue in 2023. The material’s superior strength makes it suitable for packaging perishable products such as fruits, vegetables, snacks, fast food, fruits, and confectionery. This is expected to lead to a 5.6% CAGR from 2023 to 2032.

BOPP’s superior properties have led to its widespread use in packaging chemicals, textiles, food, and beverages. Over the forecast period, BOPP film will be in high demand in the Asia Pacific due to the growth of these application industries in emerging countries like India and China.

HDPE-based synthetic paper, which is used in the packaging and storage of powder, cheese, frozen foods, and electronic parts, will be the fastest-growing product category over the forecast period. It is expected to grow at 6.1% between 2023-2032. These papers have high moisture resistance and temperature resistance, as well as being non-abrasive and scratch-resistant.

HDPE will be a popular choice in emerging countries like Brazil, China, and India over the next few years due to its low price and wide application range. HDPE films can also be used as interleaving sheets, foam-in-place, box liners, and release liners.

By Thickness

Below 200 Microns: Synthetic papers with thicknesses below 200 microns offer a lightweight and flexible solution suitable for applications requiring high print quality, such as labels, tags, and packaging. This segment is characterized by its versatility, offering durability, moisture resistance, and tear resistance despite its thin structure.

The demand for synthetic papers in this range is driven by industries like packaging, where the need for eco-friendly, tear-resistant, and printable materials is growing. Key players in this segment focus on developing ultra-thin yet robust synthetic paper formulations to cater to various printing and packaging needs.

200 to 400 Microns: In the range of 200 to 400 microns, synthetic papers find applications in more durable and demanding uses, including outdoor signage, cards, maps, and manuals. This segment’s thickness provides enhanced stiffness and durability while retaining printability and resistance to water, chemicals, and tearing.

The demand for synthetic papers within this range is propelled by sectors requiring longer-lasting and rugged materials for outdoor or heavy-use applications. Manufacturers concentrate on optimizing material composition and coating technologies to meet the stringent performance requirements of these applications.

Above 400 Microns: Synthetic papers exceeding 400 microns in thickness are typically used for applications demanding heavy-duty performance, such as book covers, calendars, and menus. This thicker segment offers robustness, rigidity, and resilience against frequent handling, making it suitable for products requiring extended longevity.

Industries seeking durable, tear-resistant, and reusable materials opt for synthetic papers in this range. Manufacturers in this segment focus on developing thicker synthetic papers that maintain printability while meeting stringent durability standards.

Application Analysis

Market share for non-labeling applications was 63%, Synthetic paper is a good material for packaging and other non-labeling purposes. It has exceptional durability and the strength to hold heavy objects. The material’s superior resistance to extreme heat and moisture will also drive its growth in packaging applications.

Its ease of fine printing on synthetic paper with inks and adhesives is a major reason for its high demand. Synthetic papers are easy to print on, making them ideal for printing over-packaged items. They are also stained- and scratch-resistant, which makes them ideal for delicate materials packaging.

Over the forecast period, the CAGR for labeling applications is expected to be 6%. From 2023 to 2032, the CAGR for medical tags in this segment is expected to be more than 7.5%. Medical tags can be used for applications like blood bags, first aid, testing in pathological labs, tubes, pharmaceuticals, medical equipment, bottles, and medical devices. The Healthcare industry is the fastest-growing sector globally.

This will increase the demand for medical tags. Because of their reliability in extreme temperatures and tampering, synthetic papers are used to make medical tags.

By End-use

Industrial End-Use: Synthetic papers in the industrial segment cater to a diverse array of applications such as manufacturing labels, tags, and documentation used in industrial settings. These papers are known for their durability, and resistance to harsh chemicals, moisture, and abrasion.

Institutional End-Use: Institutional applications encompass various uses such as educational materials, manuals, menus, and signage used in educational institutions, hospitals, government offices, and public facilities. Synthetic papers in this segment are valued for their printability, tear resistance, and longevity.

Commercial End-Use: The commercial sector includes applications like packaging, advertising, retail tags, and outdoor signage, where synthetic papers provide versatility, printability, and durability. These papers are sought after for their water resistance, tear strength, and ability to withstand varying environmental conditions.

Note: Actual Numbers Might Vary In Final Report

Маrkеt Ѕеgmеntѕ

By Product Type

- HDPE

- BOPP

- PET

- Other Product Type

By Thickness

- Below 200 microns

- 200 to 400 microns

- Above 400 micron

By Application

- Label

- Hand Tags

- Medical Tags

- Others

- Non-Label

- Packaging

- Documents

- Others

By End-use

- Industrial

- Institutional

- Commercial

Drivers

Synthetic papers are eco-friendly and possess ideal physical properties

Synthetic papers, unlike traditional paper derived from trees or wood, are manufactured using various types of plastics like polyolefin resin or polypropylene. These plastics undergo a melting process and are shaped via controlled extrusion techniques, minimizing waste and potential hazards.

Notably, synthetic papers can be recycled and repurposed as plastic resins for various applications, bolstering their eco-friendly attributes. This environmentally conscious approach is propelling the global growth of the synthetic paper market.

Key players in this market emphasize promoting 100% recycled synthetic paper to uphold sustainability goals. For instance, Polyart adheres to a ‘4 Rs’ policy—Recycle, Reuse, Respect, and Reduce.

Nan Ya Plastics, through its patented PEPA product, employs an eco-friendly manufacturing process using biaxial-oriented polypropylene synthetic paper. Yupo Corporation follows the ‘3 Rs’—Reuse, Recycle, and Repurpose—to create environmentally friendly synthetic paper.

The durable nature of synthetic paper allows it to endure substantial tension without tearing, resulting in a prolonged lifespan. Its composition lacking wood fibers renders it waterproof and resistant to disintegration when exposed to water.

Additionally, synthetic paper exhibits easy foldability without the risk of cracking. These characteristics not only enhance its durability but also contribute to its versatility and widespread adoption across various industries.

Restraints

Fluctuation in the price of raw materials and crude oil

Fluctuations in the prices of fundamental raw materials like polybutylene, polypropylene, and polyethylene have the potential to restrain the synthetic paper market. The inherent volatility in raw material prices could amplify production costs, impacting overall expenses within the industry.

The limited availability of plastic materials required for synthetic paper production further exacerbates these market constraints. Additionally, synthetic paper prices are directly influenced by fluctuations in crude oil prices, a significant factor contributing to the industry’s challenges.

The anticipated fluctuations in crude oil prices are expected to impact the prices of polypropylene (PP) and polyethylene (PE), thereby impacting synthetic paper pricing.

The market anticipates an increase in polymer prices in the upcoming years, exerting additional pressure on the industry. These price fluctuations are closely tied to both the growth in application demands and the availability of raw materials.

The industry’s continued growth trajectory is likely to be impacted by the persistent influence of fluctuating prices, which are contingent on the expansion of applications and the accessibility of raw materials.

Opportunity

Stringent government regulations and increasing concerns of pulp paper for environment pollution

The global paper industry, comprising approximately 400 million tons, predominantly relies on pulp or wood-based paper production. These conventional papers, derived from wood, are cost-effective but contribute significantly to deforestation and environmental concerns.

In contrast, synthetic papers offer an eco-friendly alternative by reducing reliance on natural resources, contributing to environmental preservation. Manufacturers are actively engaged in research and development endeavors aimed at reducing the production costs of synthetic paper, which would bolster its market share within the paper industry and encourage increased adoption.

Governments worldwide are increasingly prioritizing recyclable and reusable papers to mitigate waste. For instance, in 2019, India’s environmental ministry drafted the “National Resource Efficiency Policy 2019,” proposing measures for enhanced waste management.

This policy aimed to minimize landfill use and improve the management of various waste categories, including construction waste, electronic waste, and waste from rapidly expanding sectors.

Such initiatives underscore a global shift towards sustainable practices and support the adoption of eco-friendly alternatives like synthetic paper to address environmental concerns within the paper industry.

Challenges

Exorbitant prices of synthetic papers

The primary challenge faced by synthetic paper lies in its higher production cost compared to traditional paper and generic plastics like PVC vinyl and polystyrene. Due to its plastic composition, synthetic paper can be up to twice as expensive as fine offset paper.

Consequently, it’s typically recommended for long-term applications, such as durable menus, seasonal point-of-purchase displays, banners, and manuals that endure harsh environments.

Its longevity is advantageous in scenarios where durability surpasses that of standard paper. As a result of its relatively higher cost, synthetic paper finds optimal use in prolonged applications rather than short-term needs.

Regional Analysis

The market was dominated by the Asia Pacific region, which accounted for 48.3% of global revenue in 2023. Due to the increasing demand in the packaging, pharmaceutical, and printing industries, the Asia Pacific market was worth US$ 478 million in 2021.

The region’s rapid growth in e-commerce will be another major driver for synthetic paper growth over the forecast period. The Asia Pacific region’s growth can be attributed in part to the increasing disposable incomes and a better standard of living in developing countries like India and China.

In 2021, Europe was responsible for a large revenue share at 28.8%. Due to the growing use of synthetic paper in the pet food and food labeling industries, the U.K. will likely see the greatest growth in label application.

Harrier Packaging is one of many companies that use synthetic paper to package pet food. The North American market was responsible for more than 23.2% of the total revenue in 2021.

Wrap-around labels are becoming more common in beverage packaging, including fruit juices, and functional drinks. This will drive North American growth in the label industry, which is expected positively to impact the growth of this market.

Note: Actual Numbers Might Vary In Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

To gain market dominance, major market players are implementing growth strategies. Companies are using a variety of strategies to increase their market presence in order to satisfy the increasing demand for synthetic papers from emerging countries.

These include new product development, mergers and acquisitions, expansion, and expansion. The key players in the synthetic paper market are focused on long-haul supply agreements with select business partners to gain an aggressive edge.

Many companies such as Cosmo, Fresco, and Profil have emerged to strengthen their market position. These companies have a long history in the market and offer a broad range of products. The following are some of the most prominent players in synthetic paper markets:

Маrkеt Кеу Рlауеrѕ

- Formosa Plastics Group

- SIHL Group

- B&F Plastics, Inc.

- Jindal Poly Films Ltd.

- Cosmo Films Ltd.

- Granwell Products, Inc.

- Transcendia, Inc.

- Valéron Strength Films

- Toyobo Co., Ltd.

- TechNova

- Other Key Players

Recent Development

In 2020, Arjobex SAS acquired 100% shares of the MDV Group—a niche manufacturer and coater of specialty papers and films for the print, packaging, medical, sign/display and building industries. MDV is the European market leader of fluorescent papers under the brand Fluolux and a major player in the films and synthetic paper market with brands like Robuskin and Satinex. This acquisition has greatly expanded Arjobex’s footprint in Europe, making it the leading European specialty coatings solutions provider for paper and films.

In September 2020, Yupo Corporation launched “SUPERYUPO Double” (grade: FRBW) grade for oil-based offset printing suitable for double-sided printing using oil-based ink for paper. “SUPERYUPO Double” is an innovative synthetic paper that retains YUPO’s core characteristics, such as outstanding durability, water resistance, and suitability for printing, while allowing double-sided printing using oil-based ink for paper without having to use special synthetic paper ink. The product is part of the YUPO GREEN Series which is blended partially with plant-derived biomass resin, which helps reduce CO2 emissions.

Report Scope

Report Features Description Market Value (2023) USD 1132 Billion Forecast Revenue (2033) USD 1989 Billion CAGR (2023-2032) 5.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (HDPE, BOPP, PET, Others), By Thickness (Below 200 microns, 200 to 400 micron, Above 400 microns), By Application (Label(Hand Tags, Medical Tags, Others), Non-Label(Packaging, Documents, Others)), By End-use(Industrial, Institutional, Commercial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Formosa Plastics Group, SIHL Group, B&F Plastics, Inc., Jindal Poly Films Ltd., Cosmo Films Ltd., Granwell Products, Inc., Transcendia, Inc., Valéron Strength Films, Toyobo Co., Ltd., TechNova, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is synthetic paper?Synthetic paper is a durable and versatile material manufactured from various plastic resins like polypropylene or polyethylene. It mimics the properties of traditional paper but offers enhanced durability and resistance to water, tearing, and harsh environmental conditions.

How does synthetic paper differ from traditional paper?Synthetic paper is made from plastic resins, making it more durable and resistant to tearing, moisture, and other environmental factors compared to traditional wood-based paper. It offers superior longevity and performance in challenging conditions.

What factors influence the growth of the synthetic paper market?Factors such as increasing demand for durable and weather-resistant materials, advancements in printing technologies, sustainability initiatives, and the need for long-lasting products drive the growth of the synthetic paper market.

-

-

- Formosa Plastics Group

- SIHL Group

- B&F Plastics, Inc.

- Jindal Poly Films Ltd.

- Cosmo Films Ltd.

- Granwell Products, Inc.

- Transcendia, Inc.

- Valéron Strength Films

- Toyobo Co., Ltd.

- TechNova

- Other Key Players