Global Synthetic Biology Market By Technology (NGS Technology, PCR Technology, Genome Editing Technology, Bioprocessing Technology and Other Technologies) By Product Type (Oligonucleotide/Oligo Pools and Synthetic DNA, Enzymes, Cloning Technologies Kits, Xeno-Nucleic Acids and Chassis Organism) By Application (Healthcare, Clinical, Non-Clinical, Non-healthcare, Biotech Crops, Specialty Chemicals, Bio-fuels and Others) By End-use (Biotechnology and Pharmaceutical Companies, Academic and Government Research Institutes and Other End-Uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 31004

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

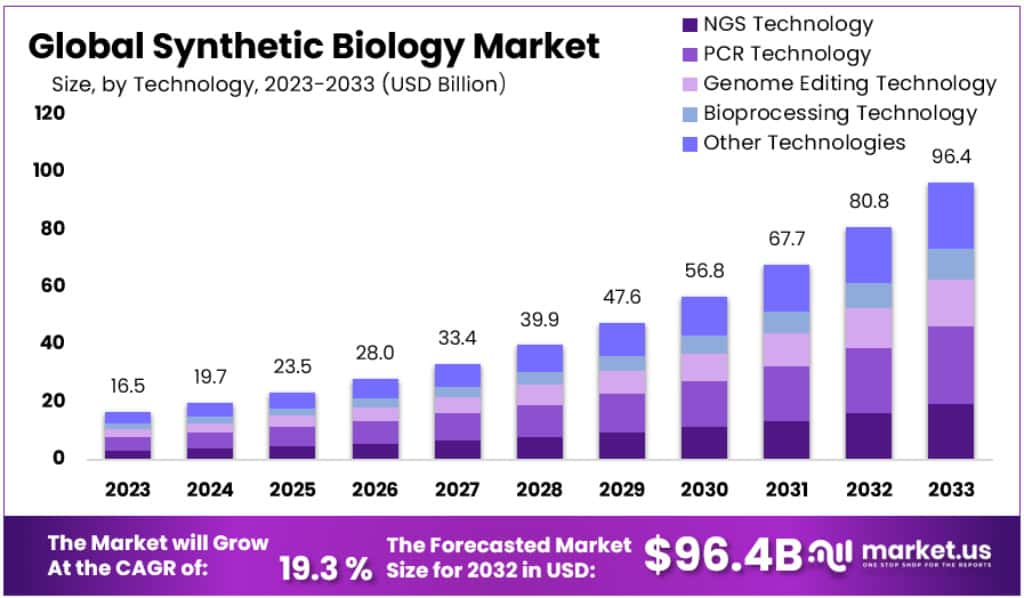

The Global Synthetic Biology Market Size is expected to be worth around US$ 96.4 Billion by 2033, from US$ 16.5 Billion in 2023, growing at a CAGR of 19.3% during the forecast period from 2024 to 2033.

Synthetic biology is a science field where researchers modify or create living things to have new abilities or features. It’s like giving nature a little upgrade to help in areas such as medicine, product creation, and agriculture. Think of it as a mix of biology and engineering!

Synthetic biology has achieved strides that have enabled it to change technology in a variety of fields, including living things, biocomputing, and therapeutic genome editing. The development of synthetic biology products has been made possible by the areas of gene editing and gene circuit design, metagenomics discoveries, automated strain engineering, and directed evolution. These compounds, which are created by altered cells and enzymes like CAR-Ts and genome-edited soy, include sitagliptin, diamines, and leghemoglobin.

Key Takeaways

- In 2023, the Synthetic Biology Market was valued at USD 16.5 Billion.

- It is expected to grow at a CAGR of 19.3% from 2023 to 2033.

- The global Synthetic Biology market is anticipated to reach approximately USD 96.4 Billion by 2033.

- Synthetic biology involves modifying or creating living organisms to give them new abilities, impacting areas like medicine, product development, and agriculture. It’s like nature’s upgrade with a mix of biology and engineering.

- Synthetic biology has made significant advancements in areas like gene editing, therapeutic genome editing, and biocomputing. It has led to the creation of various compounds, including CAR-Ts, genome-edited soy, sitagliptin, diamines, and leghemoglobin.

- PCR technology accounted for 28.1% of total revenue in 2023, due to its speed, simplicity, and precision, making it highly useful in synthetic biology operations.

- NGS (Next-Generation Sequencing) technology is expected to experience the fastest CAGR in the coming years, allowing the synthesis of DNA sequences and targeted DNA introductions into living cells.

- In 2023, the healthcare segment contributed to 18.7% of all revenue, improving biopharmaceutical drug discovery by addressing gene design, expression optimization, and yield stability.

- Biotechnology and pharmaceutical companies dominate the Synthetic Biology market, holding a 52.3% market share in 2023, using synthetic biology to create new drugs for chronic conditions and more efficient in-vitro drug manufacturing.

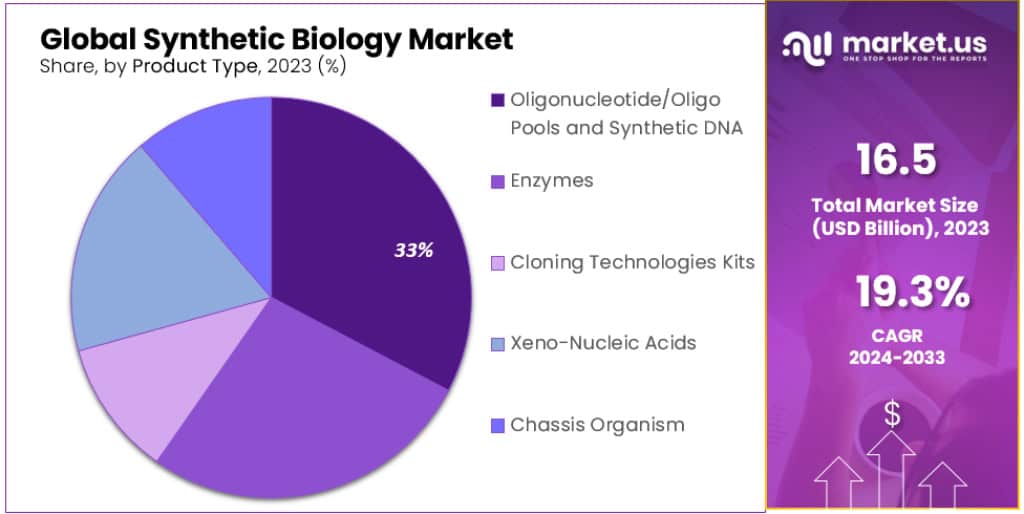

- The category generating the most revenue in 2023 was oligonucleotide/oligo pools and synthetic DNA, expected to continue growing at the fastest CAGR.

- In 2023, the United States led the global Synthetic Biology market, accounting for 42.1% of total revenue, driven by supportive laws, financing, and government backing.

Technology analysis

In 2023, PCR technology accounted for more than 28.1% of the total revenue. This is due to its high use, which is quick, simple, reproducible, highly specific, and sensitive.

PCR cloning can be used for gene cloning and DNA recombination. Gene quantification is also possible in synthetic biology operations. The Sony 2.0 technology from Synbio Technologies can successfully clone target gene targets without the requirement for restriction enzyme sites. These platforms are cost-effective and increase the efficiency of PCR in synthetic biology applications.

The Synthetic Biology market’s segment growth is also driven by an increase in R&D to develop and launch reagents. A group of researchers from the U.S. and U.K. developed cellular agents in 2021. These reagents can replace enzymes in molecular biology and diagnostic reactions. They also have common synthetic biology processes such as qPCR or PCR. These technologies can be used to increase production in order to meet the rising diagnostic demand.

NGS technology is expected to experience the fastest CAGR over the forecast period. NGS’s ability to synthesize DNA sequences right from the beginning, as well as new technologies such as CRISPR/Cas9, are enabling targeted introductions of DNA sequences in living cells.

Application analysis

In 2023, the healthcare segment was responsible for 18.7% of all revenue. The scope and scale of biopharmaceutical drug discovery have been greatly improved by synthetic biology. This technology provides practical solutions to the problems associated with biopharmaceutical production, including gene design, expression optimization, and yield stability.

Synthetic biology diagnostics are a noninvasive, real-time, sensitive, and specific method of detecting cancer cells and infectious agents. Researchers use rational engineering to create biosensing systems dynamically composed of a sensor processor and reporter. Glympse Bio developed an activity-based biosensor that can detect early signs of Non-Alcoholic Steatohepatitis, predict the disease stage, and support drug development.

The largest non-healthcare revenue-generating application is bio-fuels. The fourth generation of biofuels is possible thanks to synthetic biology. Research is underway to develop alternative biofuel molecules. These are expected to help reduce Greenhouse Gas (GHG), emissions. GenScript offers GenPlus, a high-throughput gene synthesizer, combinatorial assembly library, and CRISPR/Cas9 genetic editing for biofuel production.

End-use analysis

With a Synthetic Biology market share of over 52.3%, the biotechnology and pharmaceuticals segment dominated in 2023. Biotechnology and pharmaceutical companies have used synthetic biology to create new drugs that can be used for chronic conditions. Merck, for example, has used synthetic biology to create Januvia (sitagliptin), a treatment for diabetics. Novartis also developed Kymriah, or Tisagenlecleucel, to treat B-cell acute Lymphoblastic Leukemia.

Several companies also use synthetic biology to create pathways that allow microorganisms produce relevant medicines. Amyris Inc. created yeast strains for the development of Artemenisin, an antimalarial drug. Synthetic biology can also be used to improve in-vitro drug manufacturing. Codexis uses synthetic biology to create a more efficient enzyme that can be used in the synthesis of small-molecule drugs. This Synthetic Biology market is further supported by technological advancements.

Computational protein design is a method of creating proteins from scratch. It also calculates variants of protein structure and protein design. Scientists can develop enzymes that are unique to the natural world. Ginkgo Bioworks, for example, uses computer automation to create new organisms. Arzeda also manufactures enzymes from scratch to produce rare sugars and natural sweeteners.

Product Type Analysis

The product category that will generate the most revenue in 2023, with a revenue share of more than 32.7%, was oligonucleotide/oligo pools and synthetic DNA. During the projection period, this category is anticipated to increase at the quickest CAGR.

The capacity to design unique DNA oligos is one of several possibilities in molecular and synthetic biology. Custom primer services are provided by organizations like Integrated DNA Technologies and Life Technologies. Falling synthesis costs and increased need for synthetic RNA, DNA, and genes that may be used in a number of ways are driving the segment’s growth.

The Synthetic Biology market for enzymes is anticipated to see a sizable CAGR during the projected period. The manufacturing of enzymes with efficiency, economy, and the environment in mind is currently a priority for businesses. Many businesses are switching from the current phosphoramidite chemical for gene synthesis to enzyme-based chemistry. The potential use of enzymatic synthesizing to produce longer genes with a quicker turnaround time will promote industry growth.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- Enzymes

- Oligonucleotide/Oligo pools and Synthetic DNA

- Xeno-nucleic Acids

- Cloning Technologies Kits

- Chassis Organism

By Technology

- PCR

- NGS

- Bioprocessing Technology

- Genome Editing

- Other Technologies

By Application

- Healthcare

- Non-Clinical/Research

- Clinical

- Non-Healthcare

- Specialty Chemicals

- Biotech Crops

- Bio-Fuels

- Other Non-Healthcare

By End-Use

- Academic & Government Research Institutes

- Biotechnology & Pharmaceutical Companies

- Other End-uses

Driver

Increased Funding for Research

Growing investments in synthetic biology research and development are boosting market growth. Both government agencies and private investors are providing substantial funding, enabling the advancement of innovative projects. For instance, in 2022, SynbiCITE in the UK received a significant funding commitment of $5.7 million to support synthetic biology startups, promoting bioeconomy growth.

Restraint

Biosecurity and Ethical Concerns

Biosecurity and ethical issues present challenges to the market. Concerns center around potential risks from the release of synthetic organisms into the environment. There are worries about unintended interactions, mutations, and the potential formation of antibiotic-resistant superbugs. These concerns, coupled with regulatory actions, could limit market expansion.

Opportunity

Machine Learning Integration

The integration of artificial intelligence and machine learning into synthetic biology offers significant opportunities. These technologies can enhance analysis and decision-making in research and development. Industry players are increasingly focusing on leveraging AI/ML, supported by substantial government support. For example, collaborations like BigHat Biosciences and Merck’s AI-enabled platform for protein engineering are poised to drive growth.

Challenge

Biosafety Regulations

Stringent biosafety regulations pose a challenge to the market. The unintentional or planned release of synthetic organisms can have unknown environmental and health consequences. Recent global events have heightened concerns about biosecurity in synthetic biology, potentially leading to stricter regulations and inhibiting market growth.

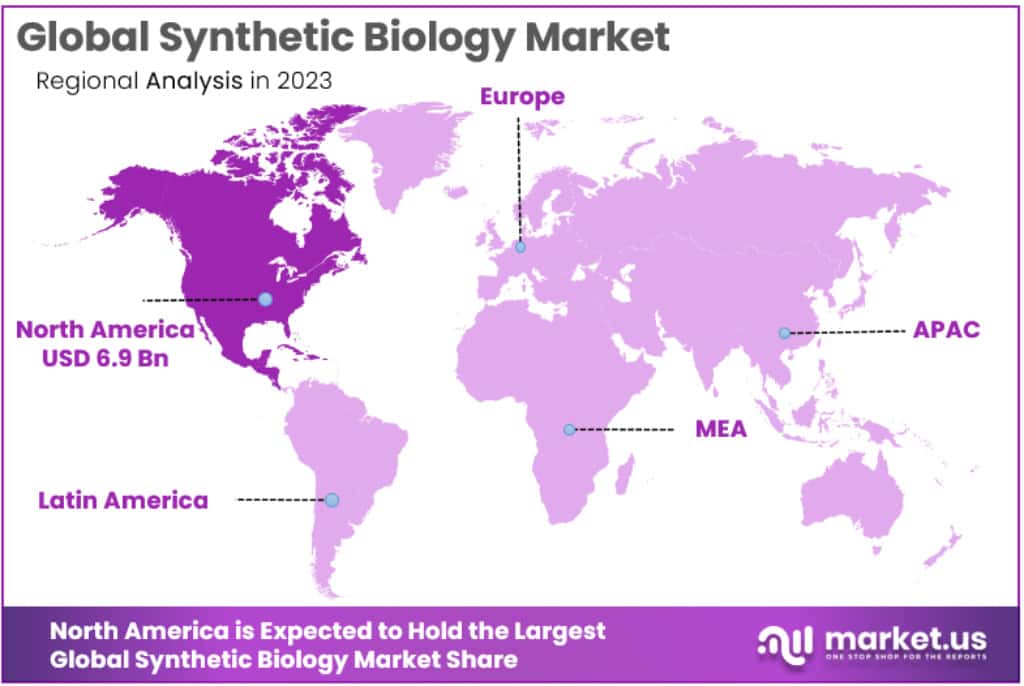

Regional Analysis

In 2023, the United States led the global Synthetic Biology Market, accounting for a dominant 42.1% of the total revenue, reaching USD 6.9 billion. This was a result of better laws, improved financing for the development of synthetic biology products, and government support. Modern Therapeutics and Sana Biotechnology, Poseida Therapeutics, and Greenlight Biosciences are just a few of the startups in this area. They raised more than US$ 3000 million in 2020’s first half.

The U.S. focuses primarily on research in drug discovery, genomics structure prediction, and proteomics. This has helped to propel the growth of the synthetic biology industry. Moreover, the National Institutes of Health (NIH) and private organizations like the Gates and Melinda Foundation are funding research and development in synthetic biology, which could increase the country’s Synthetic Biology market prospects.

Germany will see a rise in synthetic biology sales over the forecast period. This is due to the presence of many synthetic biology hubs, which are driving advances in this field. In order to develop minimum cells, MaxSynBio, a member of the Max Planck Society and the Ministry of Education and Research, seeks to understand fundamental cellular processes. Leaps by Bayer is a Bayer AG-owned initiative that invests in life sciences advances, including synthetic biology. The Synthetic Biology market growth in Germany is expected to be fueled by the presence of such institutions.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Despite COVID-19’s impact, the Synthetic Biology market saw strong investments from both private and public partners. According to Synbiobeta data, the industry received a record $7.8 million investment in 2020. Join Bio is currently developing an engineering microbe to support sustainable agriculture.

Companies like Bolt Threads and Spiber have seen a rapid rise in consumer biotechnology. These companies create sustainable synthetic biomaterials that look natural but are still durable. These biomaterial-based products can be marketed as sustainable fashion clothes.

Spiber, a Japanese firm, grows spider silk using precision-engineered microbes. In 2021, the company raised $240 million. The textile sector is experiencing a biotechnological revolution that uses biology to make clothing more durable and better. Modern Meadow and VitroLabs are pioneering the production of genuine leather using a bioengineering process. Modern Meadow is a pioneer in the leather industry, making leather from yeast.

Маrkеt Кеу Рlауеrѕ

- Bota Biosciences Inc.

- Codexis, Inc.

- Creative Biogene.

- Creative Enzymes.

- Enbiotix, Inc.

- Illumina, Inc.

- Merck Kgaa (Sigma-Aldrich Co. Llc)

- New England Biolabs

- Euro fins Scientific

- Novozymes

- Pareto Bio, Inc.

- Scarab Genomics, Llc

- Synthego

- Synthetic Genomics Inc.

- Thermo Fisher Scientific, Inc.

- Other Key Players

Recent Developments

- In August 2024: New Product Launch, Illumina launched an expanded oncology menu for its NovaSeq X Series customers. The update includes TruSight Oncology 500 High Throughput (TSO 500 HT) and TruSight Oncology 500 ctDNA version 2 (TSO 500 ctDNA v2). These assays improve the economic efficiency of sequencing and enhance the ability of laboratories to perform comprehensive genomic profiling from blood and tissue samples. This development is significant for advancing research and applications in clinical oncology, which is closely related to synthetic biology in its techniques and applications.

- In December 2023: Codexis entered into a purchase agreement with Nestlé Health Science for CDX-7108, a therapy potentially treating exocrine pancreatic insufficiency (EPI). Under the agreement, Codexis will receive up to $45 million in milestone payments, including a $5 million upfront payment, and royalties on net sales. This deal allows Codexis to focus its resources more on advancing its ECO Synthesis™ platform and its pharmaceutical manufacturing business.

Report Scope

Report Features Description Market Value (2023) US$ 16.5 Billion Forecast Revenue (2033) US$ 96.4 Billion CAGR (2024-2033) 19.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (NGS Technology, PCR Technology, Genome Editing Technology, Bioprocessing Technology and Other Technologies) By Product Type (Oligonucleotide/Oligo Pools and Synthetic DNA, Enzymes, Cloning Technologies Kits, Xeno-Nucleic Acids and Chassis Organism) By Application (Healthcare, Clinical, Non-Clinical, Non-healthcare, Biotech Crops, Specialty Chemicals, Bio-fuels and Others) By End-use (Biotechnology and Pharmaceutical Companies, Academic and Government Research Institutes and Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bota Biosciences Inc., Codexis, Inc., Creative Biogene., Creative Enzymes., Enbiotix, Inc., Illumina, Inc., Merck Kgaa (Sigma-Aldrich Co. Llc), New England Biolabs, Euro fins Scientific, Novozymes, Pareto Bio, Inc., Scarab Genomics, Llc, Synthego, Synthetic Genomics Inc., and Thermo Fisher Scientific, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bota Biosciences Inc.

- Codexis, Inc.

- Creative Biogene.

- Creative Enzymes.

- Enbiotix, Inc.

- Illumina, Inc.

- Merck Kgaa (Sigma-Aldrich Co. Llc)

- New England Biolabs

- Euro fins Scientific

- Novozymes

- Pareto Bio, Inc.

- Scarab Genomics, Llc

- Synthego

- Synthetic Genomics Inc.

- Thermo Fisher Scientific, Inc.

- Other Key Players