Surgical Equipment Market By Product (Surgical Sutures & Staplers, Electrosurgical Devices, Handheld Surgical Devices, and Other Surgical Equipments), By Category (Disposable Surgical Equipment and Reusable Surgical Equipment), By Applications, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Aug 2024

- Report ID: 43826

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

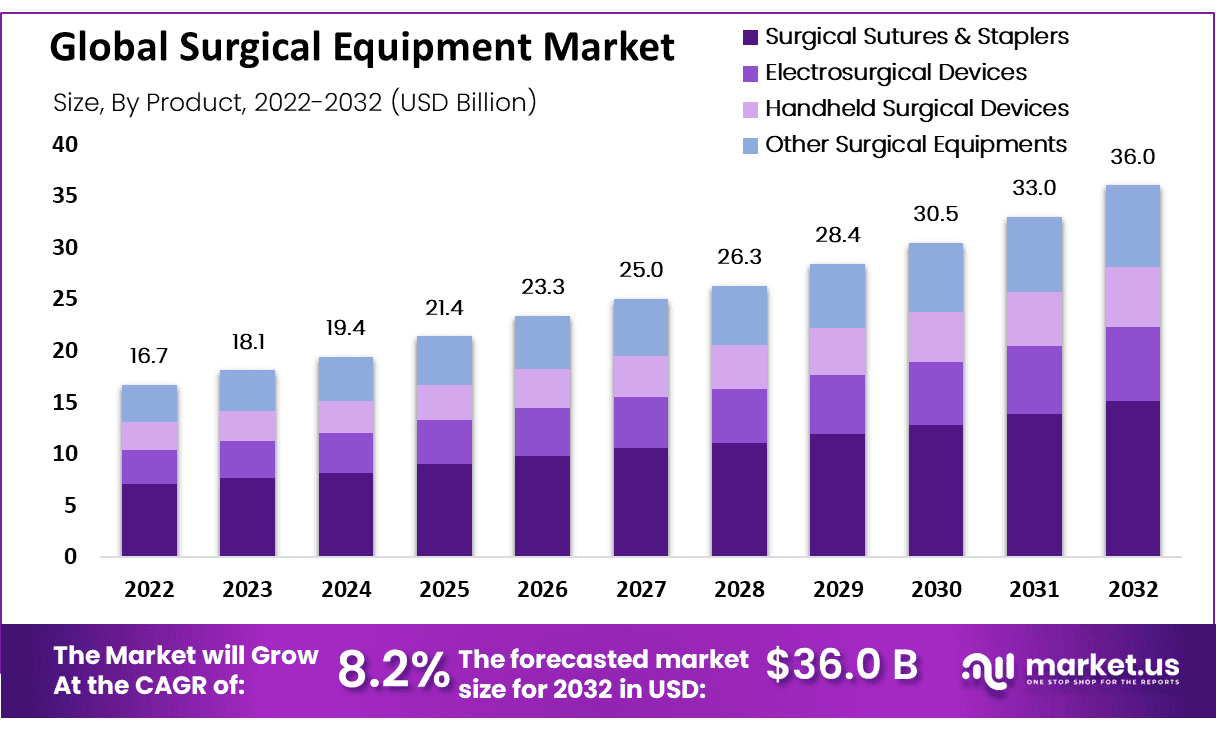

The Global Surgical Equipment Market size is expected to be worth around USD 36 Billion by 2032 from USD 16.7 Billion in 2022, growing at a CAGR of 8.2% during the forecast period from 2023 to 2032.

Surgical equipment is described as devices or tools that perform functions such as cutting, grasping, dissecting, holding, suturing, or retracting. Most surgical instruments are made from stainless steel. The surgical equipment devices market is expanding rapidly owing to factors such as increasing incidence of lifestyle diseases that eventually require surgery, the rising geriatric population, growing healthcare costs, as well as large unmet surgical needs.

Moreover, an increase in the advancement of technology in minimally invasive surgeries, reduced post-surgery hospital stays, and a growing number of ambulatory surgical centers are anticipated to surge the growth of the surgical equipment market during the forecast period.

Key Takeaways

- Market Growth: The surgical equipment market to reach USD 36 billion by 2032, growing at 8.2% CAGR from USD 16.7 billion in 2022.

- Product Analysis: Surgical sutures & staplers dominate with 42% market share.

- Category Analysis: Disposable surgical equipment leads, to a growing CAGR.

- Application Analysis: Diverse surgical applications drive the market, with obstetrics & gynecology on the rise.

- End-User Analysis: Hospitals take the largest share, thanks to advanced technology and disease prevalence.

- In 2022, North America dominated the market with the highest revenue share of 38%.

- Asia-Pacific will likely grow at a significant CAGR from 2023-2032.

Driving Factors

Increasing chronic illness and a rising geriatric population drive market growth

Increasing incidence of chronic illness, a rising geriatric population, and an increase in road accidents are all the major drivers propelling the growth of the surgical equipment market. Increased frequency of chronic disorders like arthritis, cancer, and cardiovascular disease in aged individuals results in a growing number of surgical procedures.

As people are becoming more aware and knowledgeable about minimally invasive procedures, the share of the global surgical equipment market is expected to grow at a faster rate. Furthermore, the awareness regarding the financial benefits associated with early surgical intervention is a key reason for the increasing demand for surgical procedures.

Rising government investments to boost market growth

An increase in government spending in regulations that encourage (FDI) foreign direct investment in developing countries and healthcare infrastructure is propelling the expansion of the surgical equipment market. Furthermore, the increasing incidence of injuries, such as road accidents, sports injuries, and heart procedures, is positively driving the demand for surgical equipment.

Developments of surgery equipment and growing investments in the industry are also predicted to support the growth prospects in the coming years. Moreover, healthcare providers are looking to purchase surgical equipment with advanced technologies.

Restraining Factors

Contamination of surgical equipment hampers market growth

For the surgical equipment market, the major drawback is the contamination of surgical instruments. Having numerous bacteria on surgical equipment can lead to a higher rate of infectious diseases. Without proper sterilization, the instruments used in surgery have a higher chance of becoming infected. Surgical site infections may result from such exposure.

Moreover, the second restraining factor to the expansion of the surgical equipment market is the sale of counterfeit surgical instruments. Additionally, during the lockdowns, there were no running vehicles on the road, which resulted in less number of accidents, and thus there was a decreased rate of surgery, which also caused disruptions in the supply chain.

Growth Opportunities

Growing aesthetic awareness and high demand for powered surgical tools

The minimally invasive procedures gained huge popularity has resulted in the increase in demand for new powered surgical devices, and it is predicted to offer significant business scope for well-established and upcoming surgical equipment manufacturers during the forecast period. Growing awareness about the benefits that are associated with powered portable surgical devices among medical professionals and surgeons is also expected to create new opportunities in the upcoming period.

Owing to the rising influence of celebrities and social media influencers, the awareness of aesthetics among the general population is on the rise. A gradual increase in the number of individuals opting for cosmetic and plastic surgeries, such as lip fillers, breast reconstruction, butt implants, etc., is also anticipated to surge the demand for novel surgical equipment.

Trending Factors

Increasing Need for Surgical Staples and Sutures in A Variety of Surgical Procedures

The growing need for surgical sutures & staples creates numerous opportunities for original equipment manufacturers (OEMs) and medical technology in the surgical equipment industry across the globe. To sell the products, leading corporations implement a competitive pricing approach combined with advanced technology.

There is a rising trend among healthcare facilities, especially hospitals, for the usage of handheld tools. As a result, a significant increase in revenue is experienced by the surgical equipment industry from the development of new dilators and retractors.

Additionally, the global surgical equipment market is expected to benefit largely from the development of better goods used in imaging for surgical opportunities.

Product Analysis

The surgical sutures & staplers held the largest revenue share in 2022

Based on Product, the market for surgical equipment is segmented into surgical sutures & staplers, electrosurgical devices, handheld surgical devices, and other surgical equipment. Among these types, the surgical sutures & staplers segment held the largest market share of 42% in 2022 and dominated the global market.

This is due to the high adoption of sutures & staplers because of their growing use in wound closure procedures. The staplers segment is anticipated to be the most lucrative segment due to the greater advantages it provides over the sutures. This includes a low risk of infection and rapid wound healing.

However, government initiatives and technological advancements will likely boost the suture segment’s growth over the forecast period. The electrosurgical devices segment is accounted to grow at the fastest CAGR over the forecast period. This growth is subjected to the rising demand for electrosurgical devices in minimally invasive surgeries. The major players in this market are involved in the development of advanced electrosurgical devices.

Category Analysis

Disposable surgical equipment dominated the global market

Based on Category, the market is further divided into disposable surgical equipment and reusable surgical equipment. Out of these categories, the disposable surgical equipment segment dominated the market and is anticipated to reach the highest CAGR during the forecast period.

This can be attributed to their increased adoption in various surgeries such as wound closure, plastic & reconstructive surgeries, laparoscopic surgeries, orthopedic surgery, and other surgeries. Thus significant traction has been witnessed by disposable surgical equipment over the past few years.

Application Analysis

The others segment accounted for dominating a market with significant shareholding

Based on application, the global market for surgical equipment is bifurcated into neurosurgery, orthopedic, obstetrics & gynecology, plastic & reconstructive surgery, cardiovascular, wound closure, and other applications. Among these applications, the others segment accounted for the highest revenue share of 28.0% in 2022.

Owing to the frequent rise in the prevalence of disorders associated with female reproductive organs and the increase in the number of childbirths across the globe, the obstetrics & gynecology segment held the second-largest revenue share and has resulted in the rise in the number of gynecological surgeries.

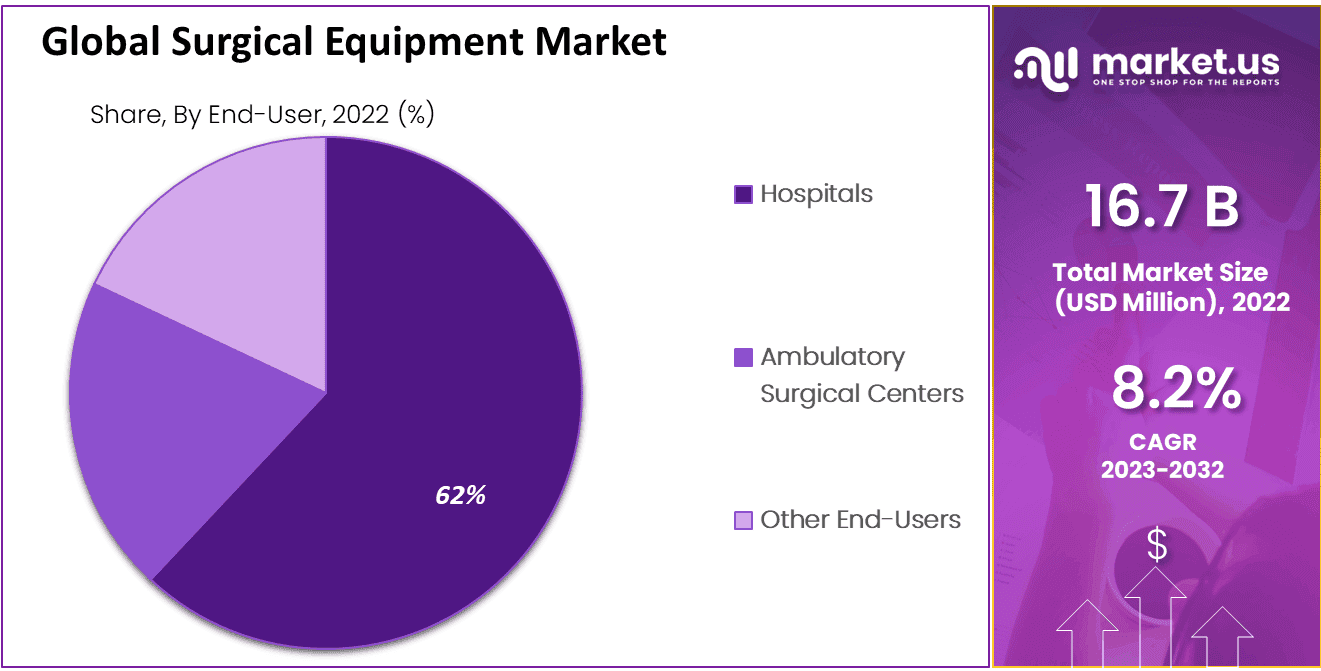

End-User Analysis

Hospitals accounted for the largest market share

Based on end-users, the market is classified into ambulatory surgical centers, hospitals, and other end-users. Among these end-users, the hospitals dominated the market in 2022 with the largest revenue share and are anticipated to remain dominant in the years to come.

Generally, the surgeries are performed at hospitals. Owing to the rising diseases across the globe and growth in surgeries due to certain factors like trauma, chronic wounds, disabilities, chronic diseases, and cancer. Additionally, the rising healthcare infrastructure, availability of advanced technologies, qualified surgeons, and higher success rates of surgeries across the globe are propelling the market growth of surgical equipment.

Key Market Segments

Based on Product

- Surgical Sutures & Staplers

- Electrosurgical Devices

- Handheld Surgical Devices

- Other Surgical Equipment

Based on Category

- Disposable Surgical Equipment

- Reusable Surgical Equipment

Based on Applications

- Neurosurgery

- Orthopedic

- Obstetrics & Gynecology

- Plastic & Reconstructive Surgery

- Cardiovascular

- Wound Closure

- Other Applications

Based on End-User

- Ambulatory Surgical Centers

- Hospitals

- Other End-Users

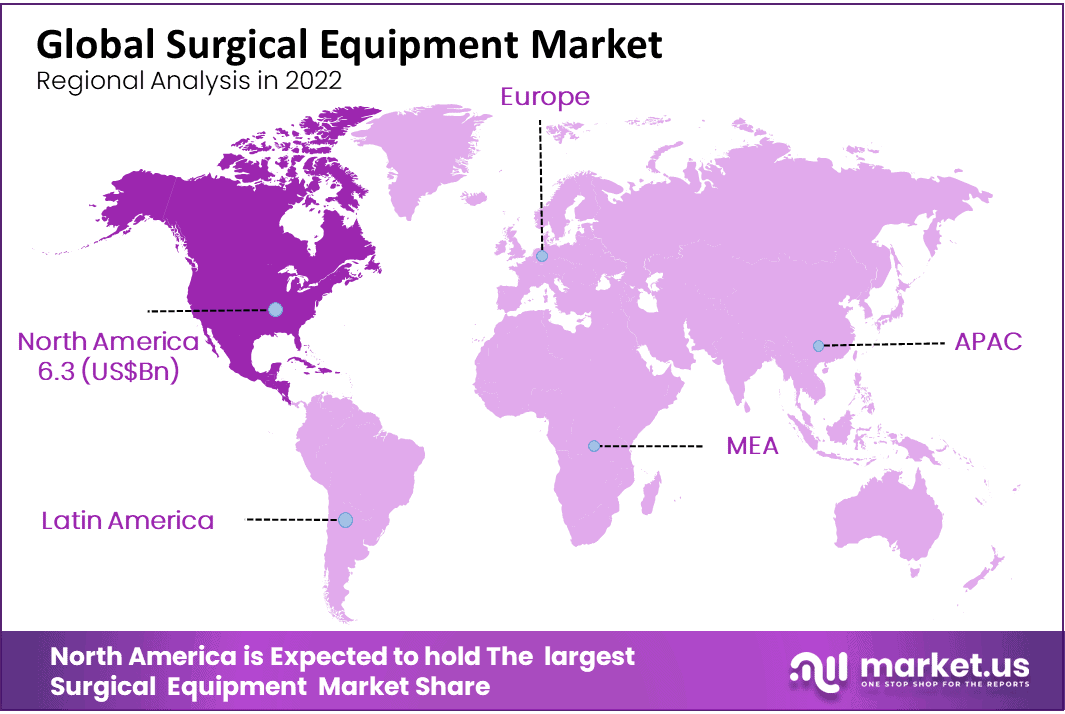

Regional Analysis

North America dominated the global market with the highest revenue share

Based on regions, the global market for surgical equipment is classified into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Among these regions, North America dominated the global market with a market share of 38.0% in 2022.

The existence of well-established hospitals, high healthcare expenditure, and the presence of major key players in the United States are the major factors contributing to the expansion of the surgical equipment market in this region. Additionally, the rising demand for minimally invasive surgeries as well as technological advancements are expected to positively drive the growth of the regional market during the forecast period.

Asia Pacific is estimated to be the fastest-expanding regional market for surgical equipment over the forecast period. The rising demand for plastic and reconstructive surgeries in regions like China and India is anticipated to boost due to the rising disposable income, thereby contributing to the growth of the regional market. Moreover, the increasing number of aged individuals in the Asia Pacific region is predicted to result in a rise in the number of cardiovascular and orthopedic procedures.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The major players in the global surgical equipment market are involved in the manufacturing of perfusion systems and are highly focused on different strategic initiatives to surge their market presence. They are also involved in strengthening their product portfolios through the acquisition of companies that represent partnerships & collaborations, great potential, and increasing focus on R&D activities for the development of technologically advanced products.

Listed below are some of the most prominent surgical equipment industry players.

Market Key Players

- B Braun Melsungen AG

- Cadence Design Systems, Inc.

- Olympus Corporation

- CONMED Corporation

- Ethicon, Inc.

- Stryker Corporation

- Smith & Nephew plc

- Becton, Dickinson, and Company

- Zimmer Biomet

- Medtronic plc

- Aspen Surgical, Inc.

- Other Key Players

Recent Developments

- In June 2024: Cadence completed its acquisition of BETA CAE Systems International AG. This acquisition enhances Cadence’s Intelligent System Design strategy by incorporating BETA CAE’s advanced engineering simulation solutions. This move aims to expand Cadence’s multiphysics system analysis suite and strengthen its position in markets such as automotive, aerospace, industrial, and healthcare. The acquisition is expected to add approximately $40 million to Cadence’s revenue for the year.

- In May 2024: Ethicon launched the ECHELON LINEAR™ Cutter, a novel surgical stapler designed to significantly reduce leaks at the staple line by 47%. This product is intended to enhance surgical safety and efficiency, marking a significant innovation in surgical stapling technology.

- In January 2024: Olympus completed the acquisition of Taewoong Medical, a South Korean company known for its gastrointestinal metallic stents. This $370 million acquisition strengthens Olympus’s GI EndoTherapy portfolio and is expected to enhance the company’s capabilities in providing minimally invasive treatments for gastrointestinal conditions.

- In August 2022: CONMED Corporation completed its acquisition of Biorez, Inc., a medical device startup focused on the development of the BioBrace Implant, an innovative bioinductive scaffold designed to reinforce soft tissue and promote healing. This acquisition, valued at approximately $250 million, was funded through a combination of cash on hand and long-term borrowings.

Report Scope

Report Features Description Market Value (2022) US$ 16.7 Bn Forecast Revenue (2032) US$ 36.0 Bn CAGR (2023-2032) 8.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product – Surgical Sutures & Staplers, Electrosurgical Devices, Handheld Surgical Devices, and Other Surgical Equipment; By Category – Disposable Surgical Equipment and Reusable Surgical Equipment; By Applications; By End-User Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape B Braun Melsungen AG, Cadence Design Systems, Inc., Olympus Corporation, CONMED Corporation, Ethicon, Inc., Stryker Corporation, Smith & Nephew plc, Becton, Dickinson and Company, Zimmer Biomet, Medtronic plc, Aspen Surgical, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What was the Surgical Equipment Market Size in the Year 2022?The Global Surgical Equipment Market size was USD 16.7 Billion in 2022, growing at a CAGR of 8.20% during the forecast period from 2023 to 2032.

What is the Surgical Equipment Market Size During the Forecast Period 2023-2032?The Global Surgical Equipment Market size is expected to be worth around USD 36 Billion by 2032, growing at a CAGR of 8.20% during the forecast period from 2023 to 2032.

What is the Surgical Equipment Market CAGR During the Forecast Period?The Global Surgical Equipment Market Cagr is growing at a CAGR of 8.20% during the forecast period from 2023 to 2032.

-

-

- B Braun Melsungen AG

- Cadence Design Systems, Inc.

- Olympus Corporation

- CONMED Corporation

- Ethicon, Inc.

- Stryker Corporation

- Smith & Nephew plc

- Becton, Dickinson, and Company

- Zimmer Biomet

- Medtronic plc

- Aspen Surgical, Inc.

- Other Key Players