Surface Roughness Measurement (SRM) Market By Component (Probes, Lighting Equipment, Frame Grabbers, Cameras, Imaging Technology, Other Components), By Surface Type (2D, 3D), By Technique (Contact, Noncontact), By Industry Vertical (Semiconductor, Automobile, Aerospace & Defense, Optics and Metal Bearing, Medical & Pharmaceuticals, Other Industry Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 73331

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

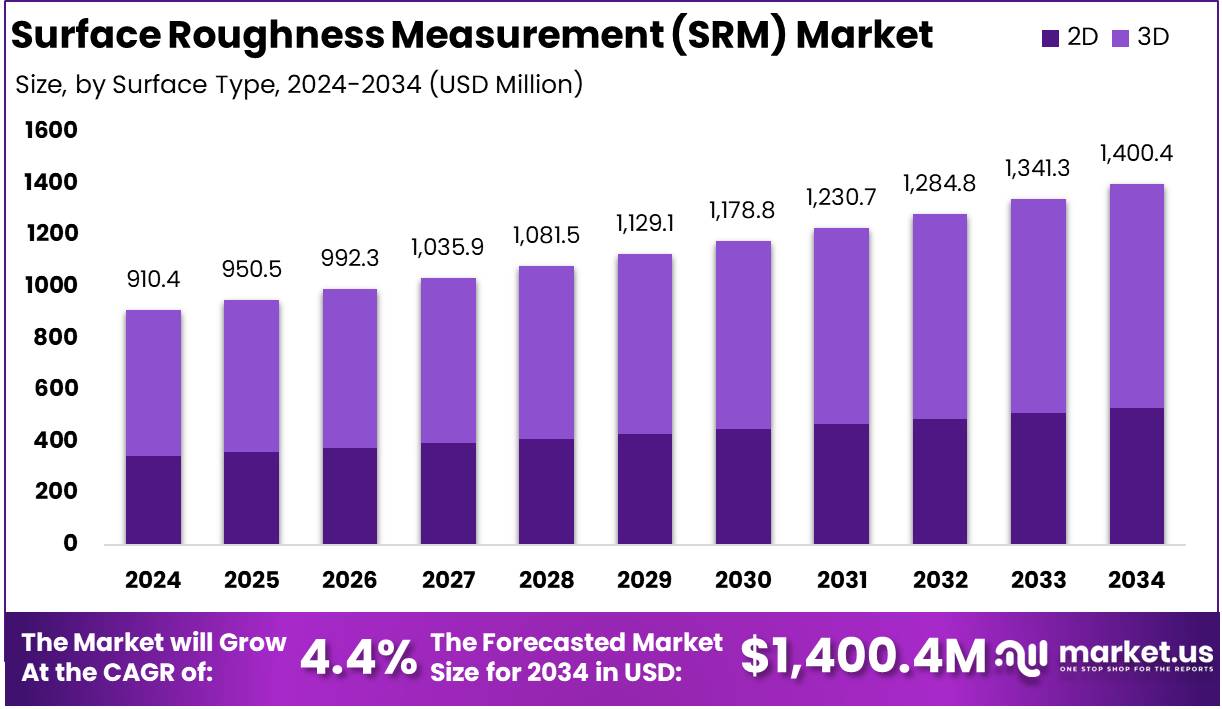

The Global Surface Roughness Measurement (SRM) Market size is expected to be worth around USD 1,400.4 Million by 2034 from USD 910.4 Million in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Surface Roughness Measurement (SRM) refers to the process of quantifying the microscopic variations and deviations found on a material’s surface. These irregularities are critical indicators of a material’s quality, performance, and functional characteristics such as friction, wear resistance, and adhesion properties. SRM techniques utilize contact and non-contact instruments including profilometers, atomic force microscopes, and optical interferometers to accurately assess surface texture parameters like Ra (average roughness), Rz (mean peak-to-valley height), and Rt (total height of the profile).

Surface roughness measurements are essential across a wide array of industries, including automotive, aerospace, semiconductor manufacturing, medical devices, and precision engineering, where strict adherence to surface specifications directly impacts product reliability and performance.

The Surface Roughness Measurement (SRM) Market encompasses the global ecosystem of technologies, instruments, software solutions, and services dedicated to the analysis and quantification of surface textures. It includes hardware components such as stylus-based profilometers, optical profilers, and 3D metrology systems, as well as software platforms that process and interpret complex surface data.

This market serves a diverse range of sectors particularly those where microstructural surface characteristics are crucial for product safety, durability, and regulatory compliance. The SRM market is characterized by technological advancements, increased precision demands, integration with smart manufacturing systems, and the growing adoption of Industry 4.0 practices. It plays a pivotal role in ensuring product excellence, operational efficiency, and innovation across multiple industrial domains.

The growth of the Surface Roughness Measurement (SRM) market can be attributed to the escalating demand for high-precision manufacturing processes and tighter quality control standards across critical industries. The rising complexity of components in aerospace, automotive, and semiconductor sectors necessitates meticulous surface characterization to enhance performance and prolong product life cycles.

Significant opportunities exist within the Surface Roughness Measurement (SRM) market, particularly through the integration of advanced digital technologies and next-generation analytical tools. The convergence of metrology with artificial intelligence, machine learning, and big data analytics presents a transformative potential for the industry, allowing for predictive insights, automated anomaly detection, and optimization of manufacturing processes. Companies that innovate by offering smart, connected, and highly automated SRM solutions are well-positioned to capture a larger share of the evolving market landscape.

According to data from Oh My Facts, a single bolt of lightning can reach temperatures of 30,000 Kelvin, five times hotter than the sun’s surface, and can travel at speeds of up to 220,000 miles per hour. The average lightning bolt carries 30,000 amperes of current, equivalent to powering a 100-watt light bulb for over three months. Despite the extreme conditions, the odds of being struck by lightning are about 1 in 15,300. This data illustrates the growing importance of precision and safety in various markets, including SRM, where high-precision measurement technologies play a critical role.

According to CGI, the SRM market is experiencing growth due to increasing demand for precision in sectors like aerospace and manufacturing. The use of 3D content has led to a 94% increase in conversion rates, with 82% of viewers interacting with 3D assets.

Additionally, 66% of shoppers report increased buying confidence, while 34% engage with 3D content for over 30 seconds. Furthermore, 57% of retailers use 3D content to enhance customer experience, and 89% agree it reduces returns by 40%, contributing to the rising demand for SRM solutions.

Key Takeaways

- The global Surface Roughness Measurement (SRM) Market is projected to grow from USD 910.4 Million in 2024 to USD 1,400.4 Million by 2034, expanding at a CAGR of 4.4% during the forecast period (2025-2034).

- Probes emerged as the dominant segment within the market in 2024, holding a significant share of more than 34%.

- 3D Surface Roughness Measurement (SRM) commanded the largest share in 2024, accounting for over 62% of the market.

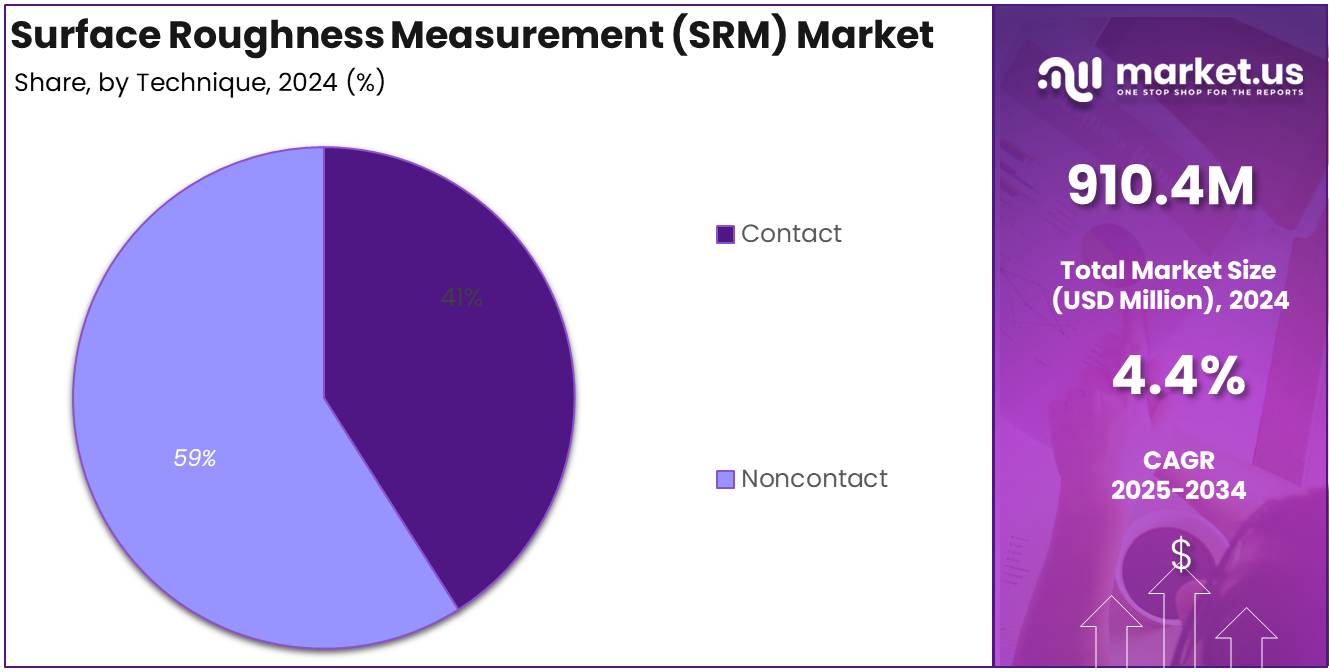

- The Noncontact Surface Roughness Measurement (SRM) techniques led the Technique segment in 2024, capturing more than 59% of the market share.

- The Semiconductor industry was the largest end-user of SRM technology in 2024, holding more than 31% of the total market share.

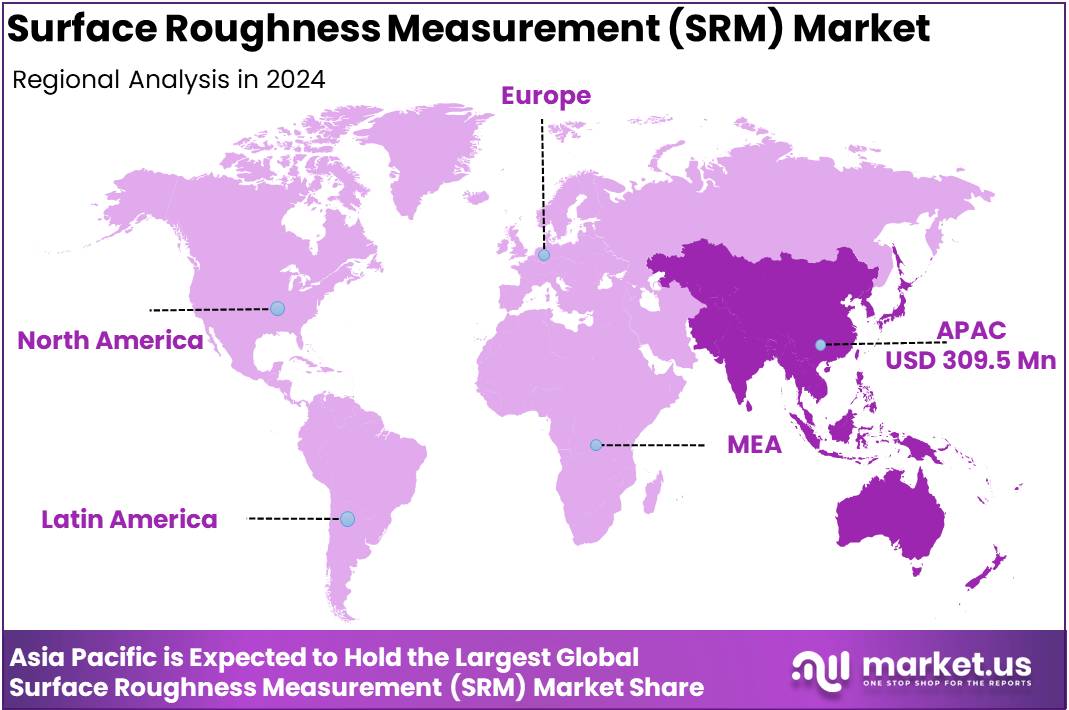

- The Asia Pacific region dominated the Surface Roughness Measurement (SRM) Market in 2024, contributing to 34% of the global market share, valued at USD 309.5 Million.

By Component Analysis

Probes held a leading position in the Surface Roughness Measurement (SRM) Market, securing over 34% of the share.

In 2024, Probes secured a dominant market position within the Surface Roughness Measurement (SRM) Market, capturing more than 34% share. The high demand for precision in quality control processes across industries such as automotive, aerospace, and manufacturing has significantly driven the adoption of probes. Their ability to deliver accurate, contact-based surface measurements has made them the most preferred component in SRM systems. The growth of automated production lines and strict regulatory standards for product quality have further contributed to the increasing use of probes, strengthening their leading position in the market.

The reliability, repeatability, and ease of integration with other measurement equipment have ensured that probes remain the component of choice among manufacturers. Continuous technological advancements, such as the development of multi-functional and high-resolution probes, are expected to sustain this segment’s stronghold over the forecast period. Additionally, rising investments in smart factories and Industry 4.0 initiatives have created an optimistic outlook for the probes segment within the SRM market.

In 2024, the Lighting Equipment segment played a crucial role in the Surface Roughness Measurement (SRM) Market, enhancing image clarity and contrast during surface inspections. Specialized lighting solutions are essential for non-contact surface roughness evaluations, ensuring accurate and consistent measurements. Technological advancements in adaptive lighting and structured illumination are further broadening its application across industries like electronics and medical devices, supporting steady growth in this segment.

Frame Grabbers have become vital in SRM systems by enabling high-speed, high-resolution data transfer between cameras and processing units. The demand for real-time data acquisition and rapid analysis in automated systems is driving the growth of this segment, particularly in industries like semiconductor manufacturing and aerospace, where high precision is critical.

Cameras are integral to SRM systems, offering non-contact optical measurement capabilities for fast and accurate surface inspections. Innovations in digital imaging, such as 3D vision systems and high-frame-rate cameras, are improving measurement efficiency. The continued trend toward automation and traceable measurements ensures the sustained growth of this segment across various industrial applications.

Imaging Technology, including confocal microscopy and laser scanning, remains essential for precise surface profiling in SRM systems. With a focus on micro and nano-scale measurements, particularly in electronics and medical devices, this segment is expected to grow as advancements in optical systems and data processing enhance SRM capabilities.

Other Components, including calibration tools and analysis software, support the functionality and reliability of SRM systems. As SRM applications grow more complex with IoT integration and cloud-based analysis, the demand for these supplementary components is expected to increase, ensuring comprehensive surface measurement solutions.

By Surface Type Analysis

3D held a leading position in the Surface Roughness Measurement (SRM) Market, securing over 62% of the share.

In 2024, 3D Surface Roughness Measurement (SRM) held a dominant market position within the Surface Type segment, capturing more than 62% of the market share. This trend reflects the increasing preference for 3D measurement techniques, which offer enhanced precision and the ability to capture intricate surface details that are often missed by 2D methods. The 3D SRM systems are highly valued across various industries such as automotive, aerospace, and manufacturing, where high-precision measurements are critical for ensuring product quality and performance.

The 2D Surface Roughness Measurement segment, though holding a smaller share of the market compared to its 3D counterpart, continues to play a vital role in specific applications that require less complex surface analysis. This segment is particularly relevant in industries where a basic understanding of surface texture is sufficient for operational needs. Its enduring significance stems from its ability to provide reliable results for simpler roughness measurements, making it a preferred choice for many applications where advanced techniques are not necessary.

2D methods are widely employed in industries such as automotive, manufacturing, and metalworking, where surface irregularities and roughness need to be assessed, but the level of precision offered by 3D measurements is not always critical. These techniques remain cost-effective and user-friendly, offering a straightforward approach to surface analysis without the complexity and higher investment associated with 3D methods.

While the demand for 2D surface roughness measurement may be overshadowed by the more advanced 3D technologies in certain high-precision applications, its affordability and simplicity ensure it continues to be a reliable tool for numerous sectors. The segment’s resilience can be attributed to its balance of performance, ease of use, and lower operational costs.

By Technique Analysis

Noncontact held a leading position in the Surface Roughness Measurement (SRM) Market, securing over 59% of the share.

In 2024, Noncontact Surface Roughness Measurement (SRM) techniques held a dominant market position within the Technique segment, capturing more than 59% of the market share. The growing adoption of noncontact methods is attributed to their ability to provide highly accurate measurements without physically touching the surface, making them ideal for delicate or small components. Industries such as semiconductor manufacturing, automotive, and electronics benefit from the precision and non-intrusiveness of these techniques, ensuring that product quality is maintained without the risk of damaging sensitive surfaces.

The Contact Surface Roughness Measurement segment, while holding a smaller share, continues to be a crucial method for specific applications where direct interaction with the surface is necessary. Contact-based techniques, such as stylus profilometers, offer reliable and straightforward measurements, particularly in industries like metalworking and heavy manufacturing, where physical interaction with the surface is more feasible. These techniques remain valuable for applications that require tactile measurements and are often preferred when noncontact methods are less practical or cost-effective.

By Industry Vertical Analysis

Semiconductor held a leading position in the Surface Roughness Measurement (SRM) Market, securing over 31% of the share.

In 2024, the Semiconductor industry holds a dominant market position in the Surface Roughness Measurement (SRM) market, capturing over 31% of the total market share. This significant share is primarily driven by the increasing demand for precision measurements in semiconductor manufacturing processes, where surface roughness plays a crucial role in ensuring the quality and performance of microchips and electronic components. As technological advancements in semiconductor devices continue to evolve, the need for accurate and consistent SRM technologies becomes even more critical to maintain product quality.

The Automobile sector also holds a notable share in the Surface Roughness Measurement (SRM) market. With the growing emphasis on automotive manufacturing quality, especially in engine components, suspension systems, and precision machining, SRM plays a pivotal role. The market for SRM solutions in the automotive industry is expanding as manufacturers look to meet stringent quality standards and reduce manufacturing defects. As a result, the sector is witnessing an increasing adoption of surface measurement technologies.

The Aerospace & Defense sector is another key contributor to the Surface Roughness Measurement (SRM) market. High-precision manufacturing is crucial in aerospace components, where even minute variations in surface roughness can significantly affect the performance, safety, and reliability of parts. As aerospace technology continues to advance, the need for accurate and reliable SRM tools is expected to rise, securing a solid share for this industry vertical in the overall market.

In the Optics and Metal Bearing sector, the importance of surface roughness measurement is increasing due to the critical role that smooth surfaces play in optical clarity and bearing efficiency. The growing demand for high-precision optical devices, coupled with advancements in metal-bearing technologies, is driving the need for advanced SRM solutions. This sector is projected to maintain a steady contribution to the market as both industries prioritize quality control and performance in their manufacturing processes.

The Medical & Pharmaceuticals sector is witnessing an increased focus on precision manufacturing for medical devices, implants, and pharmaceutical equipment. Surface roughness is a critical factor in ensuring the functionality, safety, and longevity of these products. With the growing trend of customized medical devices and implants, the demand for Surface Roughness Measurement (SRM) technologies is expected to rise significantly, adding to the market’s expansion within this vertical.

The Other Industry Verticals” category includes a diverse range of sectors where surface roughness measurement plays a role, such as electronics, manufacturing, and energy. While these industries may not individually dominate the market, collectively they contribute to a substantial portion of the market share. As industrial applications grow more sophisticated, the need for SRM tools in these areas continues to increase, supporting overall market growth and diversification.

Key Market Segments

By Component

- Probes

- Lighting Equipment

- Frame Grabbers

- Cameras

- Imaging Technology

- Other Components

By Surface Type

- 2D

- 3D

By Technique

- Contact

- Noncontact

By Industry Vertical

- Semiconductor

- Automobile

- Aerospace & Defense

- Optics and Metal Bearing

- Medical & Pharmaceuticals

- Other Industry Verticals

Driver

Rising Demand for Precision in Manufacturing Processes

The global Surface Roughness Measurement (SRM) market in 2024 is being significantly driven by the rising emphasis on precision and quality control across advanced manufacturing industries. As sectors such as aerospace, automotive, electronics, and medical devices continue to demand higher levels of product reliability and durability, the critical role of surface texture analysis has been accentuated.

The push for minimizing manufacturing defects and achieving exact surface specifications is enhancing the adoption of SRM technologies. It has been observed that manufacturers increasingly incorporate non-contact and contact-based SRM devices into production lines to ensure real-time quality assurance, directly influencing market expansion.

Moreover, as industries transition towards Industry 4.0 frameworks, the integration of SRM solutions with automated and smart production systems is becoming more prevalent. The need for faster, more accurate, and inline roughness measurements that align with digital manufacturing environments has led to significant technological advancements within the SRM space.

Enhanced metrology capabilities not only improve product aesthetics but also optimize functionality, particularly in industries where microscopic surface defects can lead to performance failures. Therefore, the heightened focus on achieving micro-level precision through advanced surface roughness measurement techniques stands as a substantial driver accelerating the global SRM market’s growth trajectory in 2024.

Restraint

High Cost of Advanced SRM Equipment Limits Widespread Adoption

Despite the promising growth potential, the global Surface Roughness Measurement (SRM) market faces a significant restraint in the form of the high cost associated with advanced measurement equipment. State-of-the-art SRM systems, especially those employing laser, optical, and non-contact technologies, require considerable investment not only in acquisition but also in maintenance and calibration.

Small and medium-sized enterprises (SMEs), which constitute a large portion of the manufacturing sector globally, often find it financially challenging to integrate such high-cost solutions into their production processes. This cost barrier restricts the adoption of SRM technologies primarily to large corporations, thereby slowing the market’s overall penetration rate.

Furthermore, the complexities involved in the operation of sophisticated SRM devices necessitate additional investment in skilled labor and specialized training. In many developing economies, the lack of trained professionals and limited technical know-how further exacerbates the problem, resulting in a slower uptake of these technologies.

Although the long-term benefits of SRM systems in enhancing product quality and reducing operational inefficiencies are well-recognized, the immediate capital expenditure required acts as a deterrent, particularly in cost-sensitive markets. Consequently, the high price point of advanced surface roughness measurement instruments remains a prominent challenge that continues to hinder the broader expansion of the global SRM market in 2024.

Opportunity

Expansion of Electric Vehicle (EV) Manufacturing Offers New Avenues

The surge in electric vehicle (EV) manufacturing presents a considerable opportunity for the global Surface Roughness Measurement (SRM) market in 2024. EV production demands exceptional levels of precision, particularly in the manufacturing of battery systems, drive units, and lightweight chassis components. Surface integrity plays a crucial role in ensuring the safety, performance, and longevity of these critical EV parts.

As EV manufacturers increasingly emphasize tight surface tolerances to optimize electrical conductivity, thermal management, and mechanical fit, the requirement for advanced SRM solutions is expected to witness a sharp rise.

Moreover, the trend towards lightweight and composite materials in EV manufacturing, such as carbon fiber and advanced polymers, requires sophisticated surface measurement techniques that traditional tools cannot provide. SRM technologies capable of evaluating complex, delicate surfaces without causing material damage are highly sought after.

This evolution in material usage within the EV sector underscores the strategic importance of high-precision surface roughness measurement solutions. As governments worldwide push for greener transportation solutions, thereby expanding EV production capabilities, the SRM market stands well-positioned to capitalize on the emerging needs of this fast-growing sector, establishing a dynamic opportunity landscape throughout 2024 and beyond.

Trends

Integration of Non-Contact Optical Technologies Accelerates Market Innovation

A prominent trend shaping the global Surface Roughness Measurement (SRM) market in 2024 is the increasing integration of non-contact optical technologies into measurement systems. Traditional contact-based profilometers, while still widely used, are gradually being complemented or replaced by optical methods such as laser scanning, white light interferometry, and confocal microscopy.

These non-contact technologies offer significant advantages including faster measurement speeds, the ability to measure delicate or soft surfaces without physical damage, and higher precision at micro- and nano-scales. This technological shift aligns strongly with the growing demand for inspection of complex geometries and miniature components across industries like semiconductor manufacturing, aerospace, and biomedical devices.

In addition, the integration of optical technologies with advanced data analytics and machine learning algorithms has led to the development of intelligent SRM systems capable of predictive analysis and automated defect detection. Optical SRM devices are also increasingly being designed for inline integration, supporting real-time process monitoring in smart factories.

As manufacturers aim to achieve higher throughput while maintaining strict quality control standards, the demand for these next-generation non-contact SRM solutions continues to rise. This trend not only enhances the functional scope of surface metrology but also redefines the competitive landscape by pushing companies towards continuous innovation, thereby reinforcing the growth momentum of the SRM market in 2024.

Regional Analysis

Asia Pacific Surface Roughness Measurement (SRM) Market with Largest Market Share 34%.

The Surface Roughness Measurement (SRM) Market is witnessing substantial growth across various regions, with Asia Pacific leading the market in 2024, accounting for 34% of the global market share. Valued at USD 309.5 million, Asia Pacific is the dominating region in this market, driven by rapid industrialization and a significant presence of manufacturing industries. The region is characterized by an increasing demand for precision measurement tools in automotive, electronics, and aerospace sectors. Moreover, the growth of emerging economies such as China and India, along with the advancements in smart manufacturing technologies, is expected to propel the market further in this region.

North America holds a significant share of the Surface Roughness Measurement Market, driven by its advanced manufacturing sector and strong emphasis on technological innovation. The market in North America is expected to grow steadily due to the presence of well-established industries such as automotive, aerospace, and semiconductor, where precision measurement plays a crucial role. Furthermore, the increasing adoption of automation and the Internet of Things (IoT) in manufacturing processes are contributing to the growth of the SRM market in the region.

Europe is also witnessing notable growth in the SRM market, owing to its strong industrial base, particularly in countries such as Germany, France, and the United Kingdom. Europe has a well-developed automotive and aerospace sector, which is a key consumer of surface roughness measurement tools. The emphasis on product quality and precision in manufacturing processes in this region is expected to continue driving demand for SRM technologies. Additionally, the growing trend of Industry 4.0, which focuses on the integration of smart technologies in manufacturing, is further augmenting the demand for surface roughness measurement instruments in Europe.

The Middle East & Africa (MEA) region is experiencing moderate growth in the Surface Roughness Measurement Market, driven by increasing investments in infrastructure development and industrialization, particularly in the Gulf Cooperation Council (GCC) countries. Although the market share in this region remains smaller compared to Asia Pacific, North America, and Europe, the MEA region’s industrial diversification and adoption of advanced technologies are expected to contribute to gradual market expansion.

Latin America represents a smaller segment of the SRM market but is anticipated to experience steady growth as industrial sectors in countries like Brazil and Mexico continue to modernize. Increasing industrial activities, particularly in automotive and manufacturing, are expected to drive demand for precise measurement instruments in the region. As the focus on quality and efficiency in manufacturing processes intensifies, the SRM market in Latin America is projected to witness steady progress in the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Surface Roughness Measurement (SRM) Market in 2024 is significantly shaped by the strategic activities and technological advancements of several key players, each contributing uniquely to market dynamics. Keyence Corporation is recognized for its advanced non-contact measurement technologies, continuously introducing innovative solutions that enhance speed, precision, and ease of use. Mahr GmbH, a prominent player, is strengthening its market position through continuous product innovation and expanding its service network, thereby addressing a broad range of industrial requirements.

Kosaka Laboratory Ltd. is leveraging its extensive research expertise to develop high-precision systems, particularly for critical applications in automotive and semiconductor industries. Meanwhile, The Sempre Group Ltd. is focusing on customized metrology solutions, aligning with the trend toward tailored measurement systems for complex industrial processes.

HORIBA Ltd. has been investing heavily in R&D, aiming to integrate advanced software capabilities into its surface metrology products, which is expected to enhance data analysis precision. Mitutoyo Corporation, with its strong global distribution network and wide product portfolio, is capitalizing on increasing automation trends by integrating SRM technologies into smart manufacturing environments. Hexagon AB is advancing digital metrology through strategic acquisitions and software integration, positioning itself strongly in Industry 4.0 initiatives.

Carl Zeiss AG continues to focus on the high-end segment, offering premium SRM solutions that are widely adopted in aerospace, electronics, and automotive sectors. AMETEK Inc. is expanding its global footprint through acquisitions and innovations, offering diversified solutions to meet varying end-user demands. Additionally, several Other Key Players are adopting strategies such as product innovation, strategic collaborations, and geographic expansion to maintain competitiveness in the evolving global SRM market landscape.

Top Key Players in the Market

- Keyence Corporation

- Mahr GmbH

- Kosaka Laboratory Ltd.

- The Sempre Group Ltd.

- HORIBA Ltd.

- Mitutoyo Corporation

- Hexagon AB

- Carl Zeiss AG

- AMETEK Inc.

- Mahr GmbH

- Other Key Players

Recent Developments

- In 2023, Hexagon announced a collaboration with Sony Semiconductor Solutions to advance its reality capture technologies. Hexagon, a global leader in digital solutions, will now use Sony’s advanced Time-of-Flight image sensors to improve the speed and precision of its Leica BLK series. The partnership is expected to strengthen Hexagon’s position by offering faster and more accurate reality capture devices for professional use.

- In 2024, Mitutoyo America Corporation introduced the new Surftest® SJ-310 surface roughness tester, designed for high accuracy and flexibility. With a resolution of 0.002µm and a quick measurement speed of 0.75 mm/s, the device includes 11 different detector tips and features like gear tooth surface measurement. The SJ-310 provides an efficient and cost-effective solution for industries needing precise surface testing.

- In 2023, Nikon presented its latest MM-400N and MM-800N series of industrial measuring microscopes, revealing them at the Control 2023 exhibition in Stuttgart. This new generation of microscopes now includes an aperture diaphragm on the diascopic illuminator, allowing better control of contrast and resolution. Operators can also customize lighting for improved measurement of cylindrical and complex products.

- In 2024, TCI Precision Metals announced the addition of the Keyence XM-5000 handheld probe Coordinate Measuring Machine to its facility. This new equipment enables fast and highly accurate measurements across large surfaces, supporting the company’s growing production of Machine-Ready Blanks. The investment aims to meet the increasing customer demand by reducing verification times and improving overall production speed.

Report Scope

Report Features Description Market Value (2024) USD 910.4 Million Forecast Revenue (2034) USD 1,400.4 Million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Probes, Lighting Equipment, Frame Grabbers, Cameras, Imaging Technology, Other Components), By Surface Type (2D, 3D), By Technique (Contact, Noncontact), By Industry Vertical (Semiconductor, Automobile, Aerospace & Defense, Optics and Metal Bearing, Medical & Pharmaceuticals, Other Industry Verticals) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Keyence Corporation, Mahr GmbH, Kosaka Laboratory Ltd., The Sempre Group Ltd., HORIBA Ltd., Mitutoyo Corporation, Hexagon AB, Carl Zeiss AG, AMETEK Inc., Mahr GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Surface Roughness Measurement (SRM) MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Surface Roughness Measurement (SRM) MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Keyence Corporation

- Mahr GmbH

- Kosaka Laboratory Ltd.

- The Sempre Group Ltd.

- HORIBA Ltd.

- Mitutoyo Corporation

- Hexagon AB

- Carl Zeiss AG

- AMETEK Inc.

- Mahr GmbH

- Other Key Players