Global Supply Chain Digital Twin Market By Component (Software, Services), By Deployment Mode (On-premise, Cloud), By Technology (Internet of Things (IoT), Big Data Analytics, Artificial Intelligence (AI), Blockchain, Other Technologies), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By End-User Industry (Manufacturing, Retail, Healthcare, Automotive, Food and Beverage, Consumer Goods, Other End-User Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 107564

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

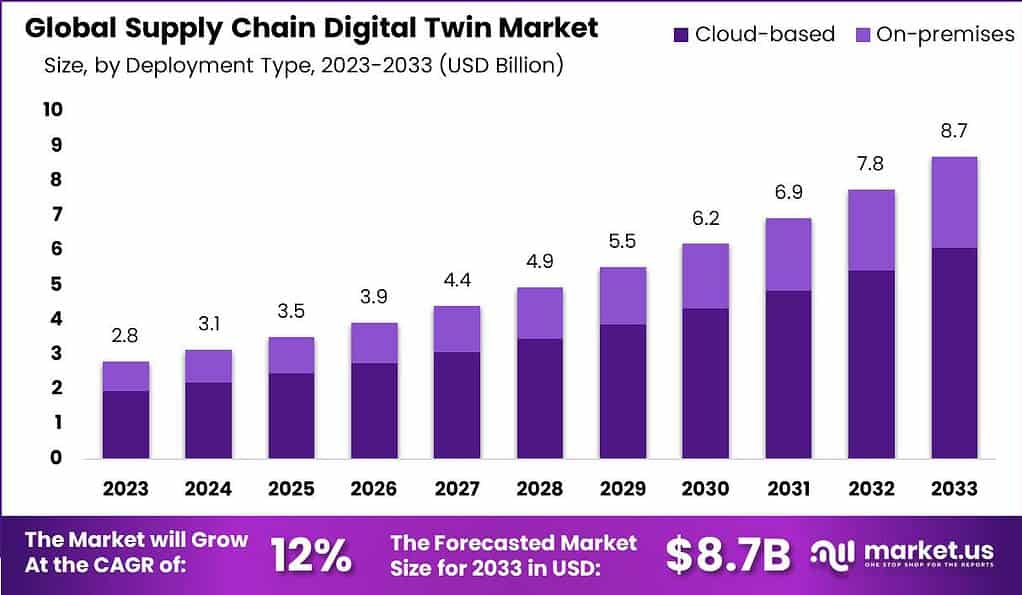

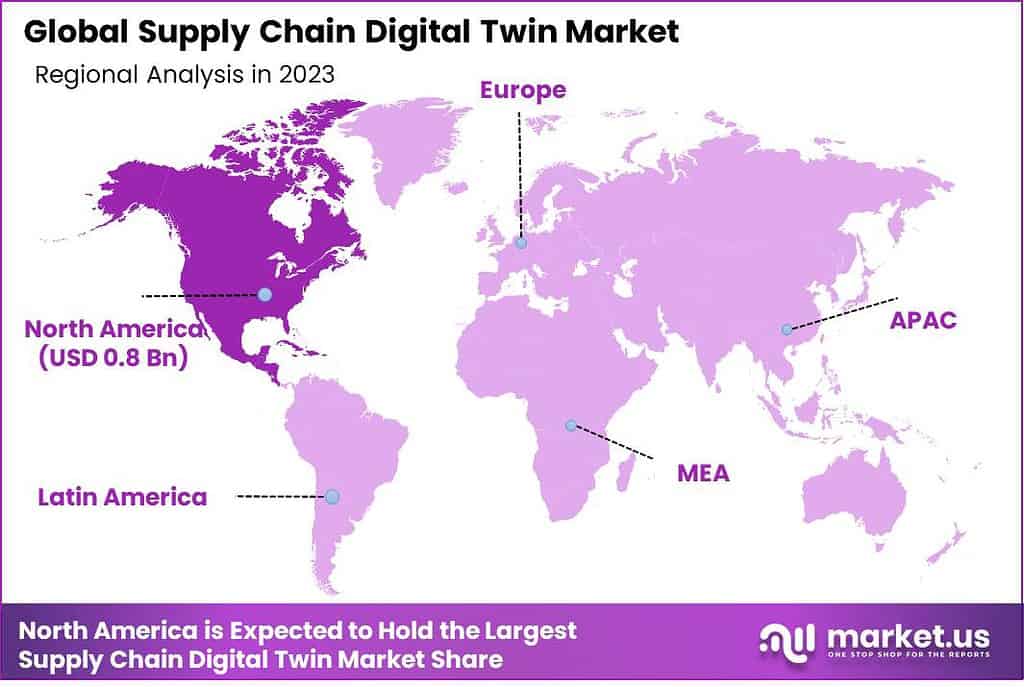

The Global Supply Chain Digital Twin Market size is projected to surpass USD 2.8 Billion in 2023 and is likely to attain a valuation of USD 8.7 Billion by 2033, growing at a CAGR of 12.0% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 32.0% share, holding USD 0.8 Billion revenue.

A Supply Chain Digital Twin is an advanced virtual model that replicates the physical attributes of a supply chain. It integrates data visualization, technology, and analytics to support decision-making processes across supply chain operations. This technology is distinguished from traditional simulation models by its ability to utilize real-time data, which is continually updated from both internal and external sources.

The development of intelligent digital twins, which leverage artificial intelligence to enhance decision-making and create new knowledge, marks a significant evolution in this field. The Supply Chain Digital Twin market is experiencing robust growth due to its ability to enhance visibility, efficiency, and responsiveness within logistics operations. This market benefits from the increasing integration of IoT, artificial intelligence, and machine learning technologies, which facilitate more dynamic and interconnected supply chain operations.

Companies are adopting digital twins at various levels – from basic models that provide visual representations to more advanced systems capable of predictive and prescriptive analytics. The growth of the Supply Chain Digital Twin market is propelled by the need for greater supply chain resilience and efficiency. Digital twins enable companies to predict disruptions, optimize operations, and improve supply chain planning.

This technology is especially critical in sectors like pharmaceuticals, where it can ensure robust manufacturing processes and quality control, and in e-commerce, where it helps manage complex inventory and delivery logistics. Demand for Supply Chain Digital Twins is driven by the need for enhanced supply chain transparency and real-time decision-making. As global supply chains become more complex and susceptible to disruptions, the ability to simulate and analyze various scenarios in real-time becomes invaluable.

This demand is further supported by industries that require stringent compliance with safety and quality standards, such as food and beverage, pharmaceuticals, and automotive. The integration of Supply Chain Digital Twins with emerging technologies like blockchain and advanced analytics presents significant opportunities for market expansion. These integrations can offer unprecedented levels of traceability, predictive maintenance, and operational efficiency, opening new avenues for innovation in supply chain management.

From an analyst’s viewpoint, the recent investments in the Supply Chain Digital Twin (SCTD) market signal a robust growth trajectory. Siemens’ commitment of €2 billion earmarked for R&D in digital twins and related technologies indicates a significant push towards innovation in this space. Similarly, Morgan Stanley Expansion Capital’s $34 million investment in Vortexa underscores the growing investor confidence in analytics platforms for supply chain monitoring.

Additionally, as the technology matures and becomes more accessible, smaller companies will also be able to leverage digital twins to compete with larger corporations on a more level playing field. Technological advancements are continuously shaping the Supply Chain Digital Twin market. The incorporation of AI and machine learning has transformed digital twins from static models to dynamic systems that can learn and adapt. These advancements not only improve the accuracy of the simulations but also enhance their capability to conduct complex predictive and prescriptive analyses.

Key Takeaways

- The Supply Chain Digital Twin Market is projected to be valued at USD 8.7 billion in 2033, with a remarkable CAGR of 12.0% expected from 2024 to 2033.

- In 2023, the Software segment held a dominant market position in the Supply Chain Digital Twin market, capturing more than a 65% share.

- In 2023, the cloud-based deployment mode emerged as the dominant player in the supply chain digital twin market, capturing a significant market share of over 70%.

- In 2023, Large Enterprises held a dominant market position in the Supply Chain Digital Twin market, capturing more than a 65% share.

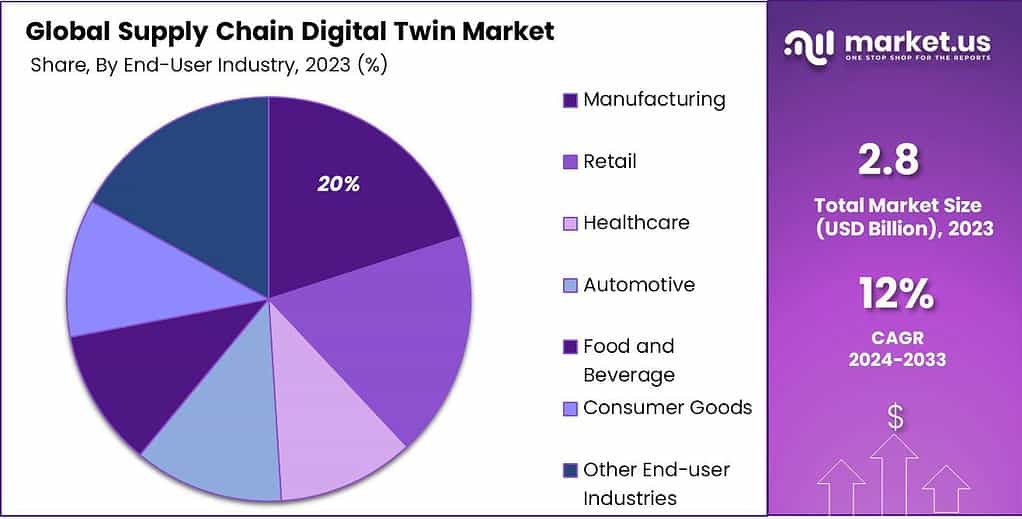

- In 2023, the manufacturing sector emerged as the dominant end-user industry in the supply chain digital twin market, capturing a significant market share of over 20%.

- In 2023, North America emerged as the dominant region in the supply chain digital twin market, capturing a significant market share of over 32%.

- Some of the key players in the Supply Chain Digital Twin market include IBM, Oracle, SAP, Dassault Systèmes, AVEVA, Siemens Digital Industries Software, Kinaxis, The AnyLogic Company, Simio, and Logivations.

Component Analysis

In 2023, the Software segment held a dominant market position in the Supply Chain Digital Twin market, capturing more than a 65% share. This dominance is primarily attributed to the pivotal role software plays in the creation and functioning of digital twins. As the core component, it forms the backbone of any digital twin solution, providing the necessary infrastructure for data integration, analysis, and visualization.

Software in the context of digital twins is sophisticated, integrating various functionalities such as real-time data processing, simulation, predictive analytics, and machine learning. These features enable businesses to create accurate and dynamic models of their supply chains, facilitating improved decision-making and operational efficiency. The ability of the software to process vast amounts of data from diverse sources, including IoT devices and enterprise systems, is crucial for the accuracy and effectiveness of a digital twin.

Moreover, ongoing advancements in software technology, such as the integration of AI and advanced analytics, are continuously enhancing the capabilities of supply chain digital twins. This leads to more precise predictions, better risk management, and optimized supply chain strategies.

The growth in the software segment is also propelled by the increasing adoption of digital twins across various industries seeking to improve their supply chain resilience and efficiency. Industries like manufacturing, logistics, healthcare, and retail are heavily investing in digital twin software to gain a competitive edge through enhanced supply chain visibility and agility.

Deployment Mode Analysis

In 2023, the cloud-based deployment mode emerged as the dominant player in the supply chain digital twin market, capturing a significant market share of over 70%. This segment’s dominant position can be attributed to several factors that have propelled its growth and adoption within the industry.

One key reason for the dominance of the cloud-based segment is the scalability and flexibility it offers to organizations. Cloud-based deployment allows companies to easily scale their supply chain digital twin solutions based on their changing needs, without the need for significant infrastructure investments. This flexibility is particularly valuable in the dynamic and evolving supply chain landscape, where organizations need to quickly adapt to market fluctuations, changing customer demands, and emerging trends. Cloud-based solutions enable businesses to access the required computing power and storage resources on-demand, ensuring they have the necessary capabilities to effectively manage their supply chain operations.

Another factor contributing to the dominance of the cloud-based segment is the increasing adoption of Software-as-a-Service (SaaS) models in the supply chain domain. Cloud-based supply chain digital twin solutions are often offered as SaaS platforms, which provide organizations with a cost-effective and hassle-free approach to implementing and managing their digital twin infrastructure. With a cloud-based SaaS model, companies can avoid the complexities of on-premise deployments, such as hardware procurement, maintenance, and software updates. This ease of implementation and maintenance, coupled with the pay-as-you-go pricing model, has made cloud-based solutions highly attractive to organizations across various industries.

By Technology

In 2023, the Internet of Things (IoT) segment held a dominant market position in the Supply Chain Digital Twin market, capturing more than a 30% share. The significant market dominance of IoT can be attributed to several key factors. Firstly, IoT technologies play a crucial role in collecting real-time data from various sensors and devices embedded throughout the supply chain. These sensors enable organizations to monitor and track assets, inventory levels, environmental conditions, and other relevant parameters. The abundance of IoT-enabled devices and the seamless connectivity they provide contribute to the extensive data collection necessary for building accurate and dynamic digital twins.

Secondly, IoT facilitates the integration of physical and digital supply chain systems, enabling the seamless flow of information across different stages and entities. By connecting and sharing data among stakeholders, IoT technologies enhance visibility and transparency in the supply chain, allowing for better collaboration and coordination. This interconnectedness is vital for creating a comprehensive digital replica of the supply chain, enhancing its effectiveness and enabling real-time simulation and optimization.

Additionally, the scalability and affordability of IoT solutions have contributed to their market dominance. The decreasing cost of IoT devices and the availability of scalable IoT platforms have made it feasible for organizations of various sizes to implement IoT technologies in their supply chain operations. This has resulted in widespread adoption across industries, driving the growth of the IoT segment in the Supply Chain Digital Twin market.

Moreover, IoT’s ability to enable predictive and prescriptive analytics is a significant factor in its dominance. By analyzing the vast amount of data collected from IoT devices, organizations can gain valuable insights into supply chain performance, identify patterns, detect anomalies, and make data-driven decisions. These analytics capabilities are essential for optimizing supply chain operations, improving efficiency, and mitigating risks.

Furthermore, the increasing focus on supply chain visibility, traceability, and sustainability has further propelled the adoption of IoT in the Supply Chain Digital Twin market. IoT technologies enable real-time monitoring of supply chain processes, facilitating accurate tracking of products, environmental conditions, and compliance with regulatory standards. This transparency and traceability are vital for enhancing operational efficiency, ensuring product quality, and meeting sustainability goals.

Organization Size

In 2023, the Large Enterprises segment held a dominant market position in the Supply Chain Digital Twin market, capturing more than a 65% share. This substantial market control can be attributed to several factors inherent to large enterprises.

Primarily, their significant financial resources enable them to invest in advanced digital twin technologies, which are often cost-intensive. These organizations typically manage complex and extensive supply chains, necessitating sophisticated tools for efficient operation and risk management. The deployment of digital twins in such environments allows for real-time monitoring, simulation, and optimization of supply chain operations, leading to enhanced decision-making and operational efficiency.

Moreover, large enterprises are often at the forefront of adopting innovative technologies to maintain competitive advantages, driving the demand for supply chain digital twins. Their capacity to undertake large-scale integration of digital twins across various nodes of the supply chain further strengthens their market position. The data analytics capabilities embedded within digital twin technology align well with the data-driven decision-making processes prevalent in large enterprises. This technology enables them to analyze vast amounts of data, predict future trends, and make proactive adjustments to their supply chain strategies.

End-User Industry

In 2023, the manufacturing sector emerged as the dominant end-user industry in the supply chain digital twin market, capturing a significant market share of over 20%. This segment’s dominant position can be attributed to several factors that have propelled its growth and adoption within the industry.

One key reason for the dominance of the manufacturing segment is the complexity and scale of supply chain operations within the manufacturing industry. Manufacturing companies typically have intricate and extensive supply chain networks with multiple suppliers, production facilities, distribution centers, and transportation routes. Managing such complex operations requires robust visibility, coordination, and optimization capabilities, which can be effectively addressed through supply chain digital twin solutions.

Supply chain digital twins provide manufacturing companies with real-time visibility into their entire supply chain, enabling them to monitor and analyze critical performance indicators such as inventory levels, production throughput, demand patterns, and supplier performance. By leveraging data-driven insights and predictive analytics, manufacturers can optimize their production schedules, reduce lead times, manage inventory efficiently, and identify areas for process improvement. This level of operational optimization is crucial for manufacturers to enhance productivity, reduce costs, and maintain a competitive edge in the market.

Additionally, the manufacturing industry has been at the forefront of technology adoption and digital transformation initiatives. With the increasing integration of automation, robotics, and Internet of Things (IoT) devices in manufacturing processes, there is a growing need for advanced supply chain management capabilities.

Supply chain digital twin solutions enable manufacturers to align their physical operations with their digital counterparts, facilitating seamless coordination and synchronization across the entire manufacturing supply chain. This integration helps manufacturers achieve higher levels of efficiency, quality control, and operational agility.

Key Market Segments

By Component

- Software

- Services

Deployment Mode

- On-premise

- Cloud

By Organization Size

- Large Enterprises

- Small and Medium Size Enterprises (SMEs)

By Technology

- Internet of Things (IoT)

- Big Data Analytics

- Artificial Intelligence (AI)

- Blockchain

- Other Technologies

By End-User Industry

- Manufacturing

- Automotive

- Aerospace and Defense

- Retail

- Pharmaceuticals

- Consumer Goods

- Others

Driver

Advancements in IoT and AI Technologies

The advancements in Internet of Things (IoT) and artificial intelligence (AI) technologies serve as a significant driver for the supply chain digital twin market. IoT devices, such as sensors and smart devices, enable the collection of real-time data from various points within the supply chain. This data, when combined with AI algorithms and analytics, provides valuable insights into supply chain operations, allowing organizations to optimize their processes, improve efficiency, and make data-driven decisions. The increasing maturity and availability of IoT and AI technologies have expanded the capabilities of supply chain digital twins, making them more robust and effective in managing complex supply chain networks.

Restraint

High Implementation Costs

One of the key restraints in the adoption of supply chain digital twin solutions is the high implementation costs associated with deploying and integrating these systems. Developing a comprehensive digital twin model requires significant investments in technology infrastructure, software licenses, data integration, and customization.

Additionally, organizations need to allocate resources for training employees and ensuring a smooth transition to the digital twin environment. The upfront costs and ongoing maintenance expenses can pose challenges, particularly for small and medium-sized enterprises (SMEs) with limited budgets. The high implementation costs act as a restraint for widespread adoption, and organizations need to carefully evaluate the return on investment and long-term benefits before committing to supply chain digital twin implementations.

Opportunity

Growing Demand for Supply Chain Resilience

The growing demand for supply chain resilience presents a significant opportunity for the supply chain digital twin market. Organizations have realized the importance of building resilient supply chains that can effectively respond to disruptions and uncertainties, such as natural disasters, geopolitical events, and global pandemics.

Supply chain digital twins offer real-time visibility, scenario modeling, and predictive analytics capabilities that enable organizations to assess and enhance the resilience of their supply chain networks. By simulating different scenarios and identifying potential risks and vulnerabilities, organizations can proactively implement mitigation strategies, optimize inventory levels, and establish alternative sourcing options. The increasing focus on supply chain resilience creates a favorable environment for the adoption and expansion of supply chain digital twin solutions.

Challenge

Complexity in Integration and Scalability

One of the significant challenges in implementing supply chain digital twin solutions is the complexity of integration and scalability. Supply chains involve multiple stakeholders, systems, and data sources, making the integration of diverse data streams a complex task.

Ensuring seamless connectivity and data synchronization across the entire supply chain network requires careful planning, robust integration frameworks, and interoperability between different software systems. Additionally, as organizations expand their operations or undergo changes, scaling the digital twin models to accommodate the evolving supply chain landscape can be challenging. Managing the increased data volume and complexity while maintaining performance and accuracy is an ongoing challenge that organizations need to address to fully leverage the benefits of supply chain digital twins.

Regional Analysis

In 2023, North America emerged as the dominant region in the supply chain digital twin market, capturing a significant market share of over 32%. This regional dominance can be attributed to several factors that have contributed to the growth and adoption of supply chain digital twin solutions within North America. The demand for Supply Chain Digital Twin in North America was valued at US$ 0.8 billion in 2023 and is anticipated to grow significantly in the forecast period.

One key reason for North America’s dominant position is the presence of technologically advanced economies and a strong emphasis on innovation. The region is home to several prominent technology companies and research institutions that are at the forefront of developing and implementing cutting-edge technologies. This technological prowess has facilitated the adoption of supply chain digital twin solutions, as organizations in North America leverage these advanced technologies to optimize their supply chain operations, enhance efficiency, and gain a competitive advantage.

Furthermore, North America has a mature and well-established logistics and manufacturing sector, which has been early adopters of digital transformation initiatives. These industries recognize the potential of supply chain digital twins in improving operational visibility, streamlining processes, and enhancing supply chain resilience. The high concentration of manufacturing hubs, distribution centers, and transportation networks in North America creates a conducive environment for the adoption of supply chain digital twin solutions, as organizations seek to optimize their supply chain operations and improve overall performance.

Moreover, North America benefits from a conducive regulatory environment and favorable government initiatives supporting technology adoption and digital transformation. Policies promoting innovation, investment in research and development, and collaboration between public and private sectors have encouraged organizations in North America to embrace emerging technologies, including supply chain digital twin solutions. This supportive ecosystem has accelerated the growth and adoption of supply chain digital twins in the region.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Supply Chain Digital Twin market, a comprehensive Key Players Analysis reveals a landscape defined by leading companies at the forefront of innovation and technological advancements. Prominent entities such as Siemens AG, IBM Corporation, SAP SE, and Oracle Corporation have established their dominance in this dynamic sector. Their robust presence is a testament to their commitment to pioneering solutions in digital twin technology, facilitating real-time simulation, and enhancing supply chain efficiency.

Top Key Players

- Siemens AG

- IBM Corporation

- SAP SE

- Oracle Corporation

- General Electric Company

- PTC Inc.

- Ansys Inc.

- Accenture plc

- Dassault Systèmes

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- PTC Inc.

- Other Key Players

Report Scope

Report Features Description Market Value (2023) US$ 2.8 Bn Forecast Revenue (2033) US$ 8.7 Bn CAGR (2024-2033) 12.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment Mode (On-premise, Cloud), By Technology (Internet of Things (IoT), Big Data Analytics, Artificial Intelligence (AI), Blockchain, Other Technologies), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By End-User Industry (Manufacturing, Retail, Healthcare, Automotive, Food and Beverage, Consumer Goods, Other End-User Industries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Siemens AG, IBM Corporation, SAP SE, Oracle Corporation, General Electric Company, PTC Inc., Ansys Inc., Accenture plc, Dassault Systèmes, Cisco Systems Inc., Huawei Technologies Co. Ltd., PTC Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Supply Chain Digital Twin?A Supply Chain Digital Twin is a virtual representation of a physical supply chain, leveraging real-time data and simulations to mirror and optimize end-to-end processes.

How big is the supply chain digital twin market?The Global Supply Chain Digital Twin Market size is projected to surpass USD 2.8 Billion in 2023 and is likely to attain a valuation of USD 8.7 Billion by 2033, growing at a CAGR of 12.0% during the forecast period from 2024 to 2033.

Who are the key players in the supply chain digital twin market?Some of the key player include Siemens AG, IBM Corporation, SAP SE, Oracle Corporation, General Electric Company, PTC Inc., Ansys Inc., Accenture plc, Dassault Systèmes, Cisco Systems Inc., Huawei Technologies Co. Ltd., PTC Inc., Other Key Players

What industries can benefit from implementing a Supply Chain Digital Twin?Various industries, including manufacturing, logistics, retail, and healthcare, can benefit from a Supply Chain Digital Twin. Its adaptability and versatility make it applicable across diverse sectors, helping organizations optimize processes and enhance overall supply chain performance.

Which region is leading in Supply Chain Digital Twin Market?In 2023, North America emerged as the dominant region in the supply chain digital twin market, capturing a significant market share of over 32%.

Supply Chain Digital Twin MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Supply Chain Digital Twin MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- IBM Corporation

- SAP SE

- Oracle Corporation

- General Electric Company

- PTC Inc.

- Ansys Inc.

- Accenture plc

- Dassault Systèmes

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- PTC Inc.

- Other Key Players