Global eSIM Market Size, Share, Upcoming Investments Report By Solution (Hardware, and Connectivity Services), By Vertical (Automotive, Consumer Electronics, and Other Verticals), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Dec. 2024

- Report ID: 55068

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

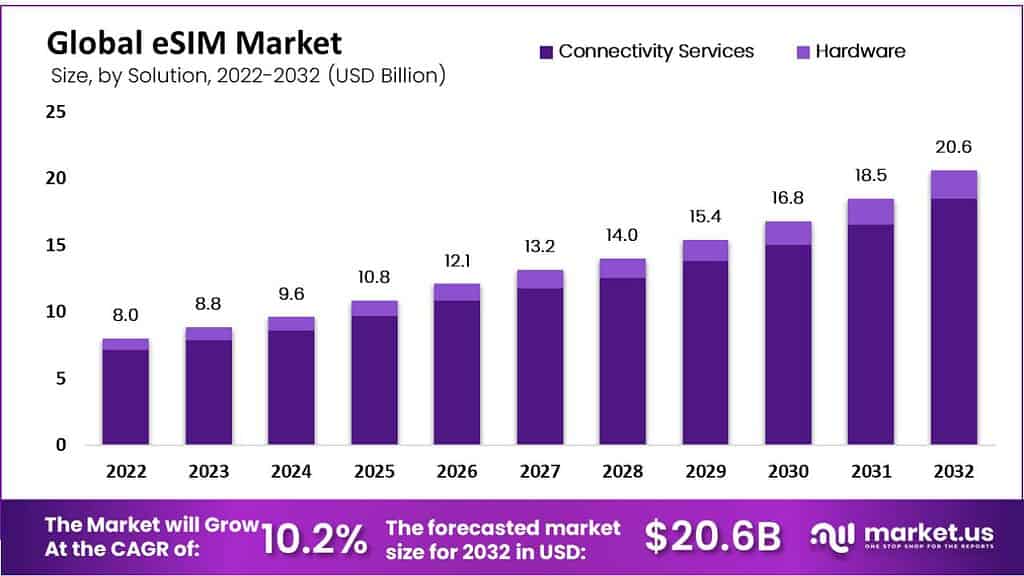

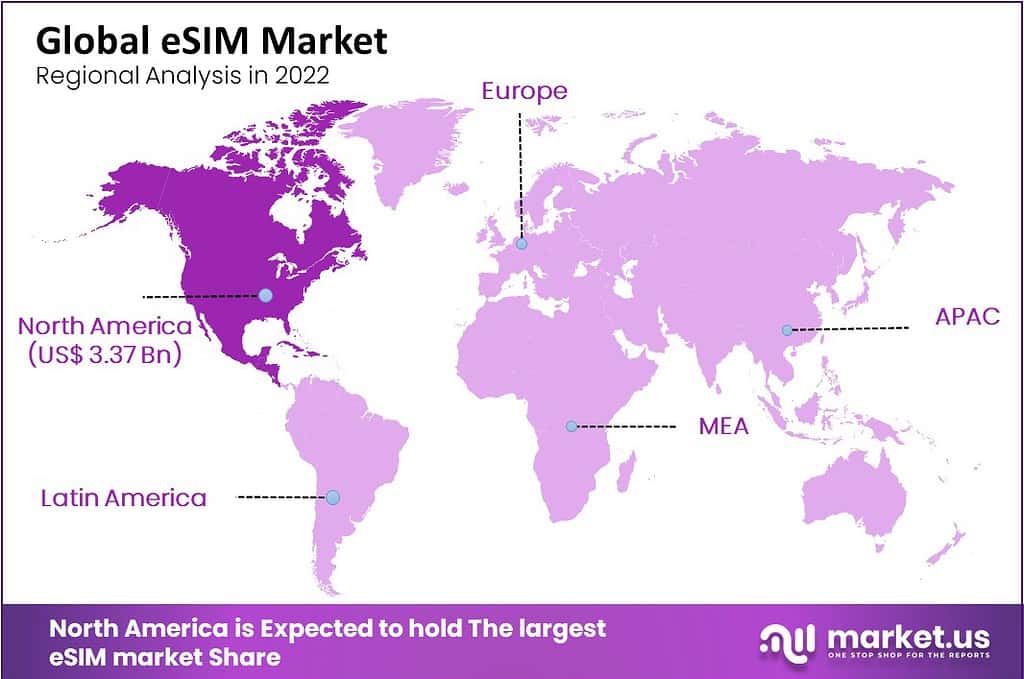

The Global eSIM Market size is expected to be worth around USD 20.6 Billion By 2032, from USD 8.8 billion in 2023, growing at a CAGR of 10.2% during the forecast period from 2023 to 2032. In 2022, North America held a dominant market position, capturing more than a 42.24% share, holding USD 3.37 Billion revenue.

An embedded SIM (eSIM) is a digital SIM that allows users to activate a cellular plan from a carrier without using a physical nano-SIM. eSIMs are embedded directly into devices, enabling easier and quicker switching between network providers without the need for physical SIM cards. This technology is increasingly being integrated across a variety of devices, including smartphones, tablets, and wearables, enhancing connectivity and providing flexibility in managing mobile services.

The primary factors propelling the eSIM market include the rising number of IoT devices and the growing demand for smart and connected devices, which require reliable and efficient connectivity solutions. Moreover, the shift towards digital transformation across various industries, coupled with regulatory support in numerous regions, is further boosting the adoption of eSIM technology. These drivers ensure a robust environment for the growth of the eSIM market by enhancing device connectivity and user convenience.

The demand for eSIMs is particularly high in the consumer electronics sector, especially in smartphones, due to the space-saving benefits and enhanced functionality they offer. This is complemented by opportunities in automotive applications, where eSIMs are used for in-car connectivity, telematics, and remote vehicle management. The ability of eSIMs to support seamless network switching is also creating significant opportunities in sectors such as healthcare, logistics, and smart cities, where uninterrupted connectivity is crucial.

The eSIM market is set to capitalize on expanding applications in telematics, smart city projects, and cross-border communications, which can greatly benefit from the versatility of eSIM technology. Additionally, there is a growing trend towards sustainability, with eSIM technology supporting green initiatives by reducing the waste associated with physical SIM cards.

Technological innovations are central to the expansion of the eSIM market. Advances such as the integration of 5G technology, improved remote provisioning capabilities, and enhanced security features are making eSIMs more appealing to both consumers and industrial users. Companies are continually investing in R&D to refine and expand the functionalities of eSIM technology, aiming to capitalize on new applications and increase market penetration.

Key Takeaways

- The market for electronic SIMs (eSIMs) is projected to reach approximately 20.6 billion by 2032, growing at an estimated compound annual growth rate between 2023-2032 of 10.2% compound annual growth rate.

- The global eSIM (embedded Subscriber Identity Module) market is being driven by an increase in connected devices, particularly IoT applications such as cars, laptops, M2M systems, smartphones, tablets and wearables.

- Major factors driving growth include Apple and Samsung utilizing eSIMs in their flagship smartphones as well as increased adoption for smartwatches due to their cost-effective and secure data storage properties.

- Though its market growth is impressive, eSIMs face various obstacles due to their non-standardized solutions for various devices and networks as well as higher initial investments compared with traditional SIM cards.

- Connectivity services dominate the market (89.48%), with mobile network operators offering various voice and data plans, IoT connectivity solutions, and remote management of eSIM profiles for devices equipped with an eSIM chip.

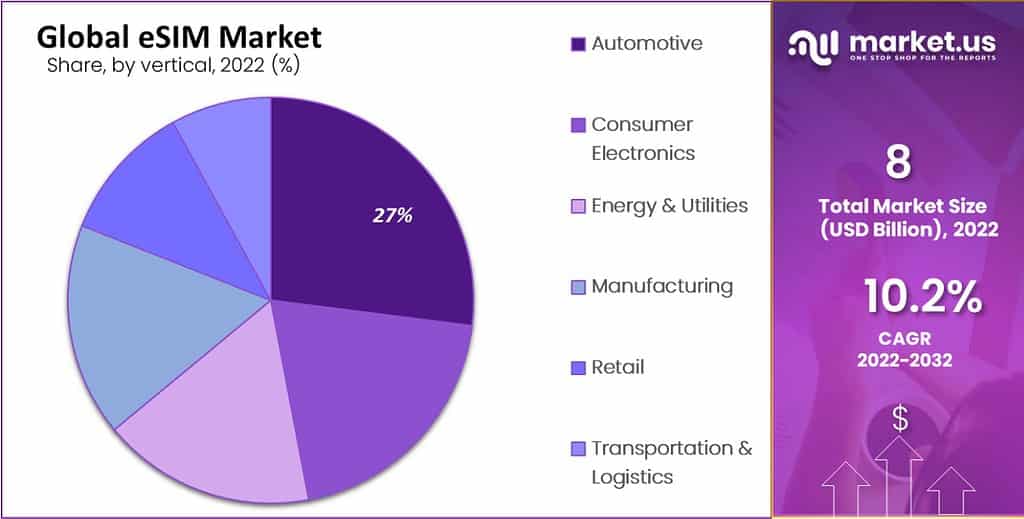

- Consumer electronics dominate the market, while automotive is projected to experience exponential growth due to an increasing need for connected cars.

- North America, Europe, Asia-Pacific, Latin America and MEA are key regions in the eSIM market. North America currently accounts for 42.24% of eSIM sales followed by Europe, Asia-Pacific Latin America and MEA.

- At present, key players in the eSIM market include Gemalto N V, Giesecke+Devrient GmbH, STMicroelectronics N V, Infineon Technologies AG, Valid S A, Kigen Ltd. Deutsche Telekom AG KORE Wireless NXP Semiconductors N V Sierra Wireless Thales Group Workz Group are among others that operate within this space.

eSIM Statistics

- The revenue generated from smartphones was reported to reach USD 411.89 billion by the end of 2023. This figure highlights the continuing robust market demand and innovation within the smartphone industry.

- It is projected that by 2030, the annual revenue from the Internet of Things (IoT) will ascend to USD 621.6 billion. This anticipated growth underscores the expanding integration of IoT technology in various sectors and its potential economic impact.

- Cost reduction is deemed extremely important by 50% of mobile network operators, as evidenced by their support for eSIM technology. This technology is seen as a key strategy to decrease operational expenses.

- Awareness of eSIM technology among consumers in the US, UK, and Australia stands at 58%. This level of awareness indicates a significant market penetration and familiarity with this emerging technology.

- In terms of environmental impact, eSIM technology is far superior to traditional SIM cards, producing only 1g of CO2 emissions compared to 136g from physical SIM cards. This stark contrast highlights the potential environmental benefits of adopting eSIM technology.

- Projections for eSIM adoption are optimistic. By 2025, the number of eSIM connections is estimated to grow to 3.4 billion, with adoption rates expected to range from 25% (low adoption) to 40% (high adoption) of all smartphone connections globally.

- Over its lifetime, eSIM technology is expected to reduce costs by an average of 15%. This reduction is anticipated due to lower physical production needs and easier distribution and management of telecom services.

- By early 2023, eSIM technology was supported in 102 countries, representing more than half of all countries worldwide. This marked a significant increase, by 325%, from the number of countries supporting this technology in 2018.

- North America is poised to lead in eSIM adoption, with forecasts suggesting that up to 98% of smartphone connections in the region could utilize eSIM technology by 2030.

- By the same year, it is expected that 14 billion eSIM-capable devices will be shipped, significantly increasing the accessibility and use of this technology.

- Furthermore, by 2030, eSIMs are projected to account for 76% of the total number of smartphone connections, totaling 6.7 billion.

- Drones and smartwatches are expected to achieve 100% eSIM penetration by 2030, indicating a complete transition to eSIM technology in these device categories.

Solution Analysis

In 2022, the Connectivity Services segment held a dominant position in the eSIM market, capturing more than 89.48% of the market share. This substantial share can be attributed to several pivotal factors that underscore the critical role of connectivity services in the telecommunications sector.

Firstly, the surge in demand for seamless and flexible mobile connectivity has significantly propelled the growth of the Connectivity Services segment. With the increasing proliferation of smart devices, including smartphones, IoT devices, and wearables, consumers and businesses are seeking more efficient ways to manage multiple network operators without the need for physical SIM cards. eSIM technology provides this flexibility, enabling users to switch operators remotely without physical exchanges, which enhances user convenience and operational efficiency.

Moreover, the ongoing expansion in global mobile network coverage and the rollout of 5G networks have further fueled the demand for eSIM connectivity services. These advancements allow for higher data throughput and more reliable network connections, making eSIMs highly attractive for new technological deployments in smart cities, industrial automation, and connected vehicles.

The ability to remotely manage connectivity on a global scale without the need to replace SIM cards manually supports scalability and security, which are crucial for enterprises operating internationally. Lastly, regulatory changes and initiatives promoting the adoption of eSIM technology have also supported the growth of this segment.

For example, several governments and industry regulators are advocating for the adoption of eSIM technologies to enhance competition and consumer choice, as well as to reduce electronic waste associated with plastic SIM cards.

Vertical Analysis

In 2022, the Automotive segment held a dominant market position in the eSIM industry, capturing more than a 27% share. This notable market share is underpinned by several key factors that highlight the importance of eSIM technology in the automotive sector.

The integration of eSIMs in vehicles has been driven primarily by the advancement and increased adoption of connected car technologies. As automakers continue to enhance vehicle functionality through internet connectivity, eSIMs provide a robust and scalable solution to manage wireless communications efficiently. eSIM technology allows vehicles to maintain constant connectivity for navigation, infotainment systems, telematics, and remote vehicle diagnostics, all of which are essential for modern, smart vehicles.

Furthermore, eSIMs facilitate the implementation of global LTE connectivity, which is critical for international fleet management and automotive manufacturers. This capability enables automakers to streamline logistics and production processes by using a single global solution that avoids the complexities of dealing with multiple local network operators and varying compliance standards in different regions.

The push towards autonomous driving and the need for continuous data exchange between vehicles and traffic management systems also bolster the demand for eSIM solutions in the automotive industry. As vehicles become more autonomous, the reliability and security provided by eSIM technology, with its remote provisioning and management capabilities, become increasingly crucial.

Application Analysis

In 2022, the Connected Cars segment held a dominant market position in the eSIM industry, reflecting its pivotal role in driving forward modern automotive technologies. This segment captured a significant market share due to several influential factors that demonstrate the indispensable nature of eSIMs in this application.

The rise in demand for connected cars equipped with eSIM technology stems from the automotive industry’s shift towards more integrated, autonomous, and user-centric vehicles. eSIMs enable seamless and continuous internet connectivity, which is essential for navigation systems, real-time traffic updates, on-demand entertainment, and cloud-based services such as voice assistance and emergency responses.

This connectivity is not just an enhancement but a core feature in increasing the safety, efficiency, and user experience offered by modern vehicles. Moreover, the push for global standardization and the ability to switch network providers remotely without physical SIM swaps make eSIMs particularly attractive for the automotive sector.

This capability allows manufacturers to produce vehicles that are suitable for various markets without needing specific configurations for each country, simplifying logistics and reducing manufacturing complexity. Additionally, the legislative environment in several key markets is encouraging the adoption of eSIM technology to boost safety and environmental sustainability.

Regulations that promote vehicle-to-everything (V2X) communication for safety, and initiatives aimed at reducing the carbon footprint of automotive manufacturing, further support the expansion of the Connected Cars segment.

Key Market Segments

Based on Solution

- Hardware

- Connectivity Services

Based on Vertical

- Automotive

- Consumer Electronics

- Energy & Utilities

- Manufacturing

- Retail

- Transportation & Logistics

- Other Verticals

Based on Application

- Connected Cars

- Laptops

- M2M

- Smartphones

- Tablets

- Wearables

- Other Applications

Driver

Increasing Demand for IoT and M2M Applications

The global eSIM market is experiencing substantial growth, driven by the escalating demand for Internet of Things (IoT) and Machine-to-Machine (M2M) communication technologies. As industries and consumers increasingly adopt smart devices that require reliable and continuous connectivity, eSIM technology offers a flexible and scalable solution.

The ability of eSIMs to be managed remotely enhances the operational efficiency of IoT devices, which are often deployed in remote or hard-to-access locations, making them ideal for a wide range of applications including smart grids, automotive telematics, and healthcare monitoring systems. This trend is supported by advancements in 5G technology, which provide the high-speed connectivity needed to maximize the potential of IoT and M2M applications, thereby propelling the eSIM market forward.

Restraint

Regulatory and Standardization Challenges

The growth of the eSIM market is hampered by significant regulatory and standardization challenges. Different regions and countries have varied requirements and regulations that can complicate the deployment and integration of eSIM technology.

The lack of universal standards can lead to interoperability issues, making it difficult for device manufacturers and network providers to support a seamless global service. These regulatory and standardization issues not only slow down the market expansion but also affect the user experience by complicating the process of switching between networks and services on a global scale.

Opportunity

Expansion into Consumer Electronics and Automotive Industries

eSIM technology presents significant opportunities in the consumer electronics and automotive industries. In consumer electronics, manufacturers are increasingly integrating eSIMs into products such as smartphones, smartwatches, and tablets to save space and enhance device design.

In the automotive sector, eSIMs are being utilized to enable connected car features such as on-the-go entertainment, real-time navigation updates, and enhanced telematics services. These applications of eSIM technology are expected to drive its adoption across both sectors, with manufacturers leveraging eSIM capabilities to offer added value to consumers and gain a competitive edge in the market.

Challenge

Technological Complexity and Integration Issues

One of the major challenges facing the eSIM market is the technological complexity associated with its integration and deployment. The eSIM ecosystem involves a wide array of stakeholders, including device manufacturers, network operators, and service providers, each of which must collaborate closely to ensure seamless functionality across different platforms and devices.

The need for specialized technical knowledge to manage these integrations can pose barriers to entry for new market players and slow down the adoption rate among consumers and industries unfamiliar with the technology. Additionally, maintaining the security and privacy of eSIMs in an increasingly connected world remains a critical challenge that stakeholders must address to foster wider acceptance and utilization of eSIM technology.

Growth Factors

The eSIM market is propelled by a convergence of technological advancements and increasing global connectivity needs. Key drivers include the widespread adoption of IoT and M2M technologies across various industries such as healthcare, automotive, and logistics. These technologies rely heavily on seamless and continuous connectivity, for which eSIMs are ideally suited due to their remote provisioning and management capabilities.

The rollout of 5G networks further enhances the functionality of eSIMs, offering higher bandwidth and enabling more reliable and faster communications. This is crucial for supporting the vast data transfers required by modern IoT applications, driving further integration of eSIM technology across consumer and industrial devices.

Emerging Trends

Emerging trends in the eSIM market indicate a significant shift towards digital SIM technologies, particularly in the automotive and consumer electronics sectors. The ability of eSIMs to support connected car functionalities and smart consumer devices without the need for physical SIM cards is becoming increasingly important.

Additionally, there is a noticeable trend towards the integration of eSIMs with 5G technology, which is expected to revolutionize mobile connectivity by offering enhanced speeds and connectivity reliability. This integration is especially relevant in the automotive industry where eSIMs facilitate new innovations in telematics and vehicle management systems.

Business Benefits

The adoption of eSIM technology offers substantial business benefits, including cost reduction, enhanced operational efficiency, and improved customer experience. For businesses, eSIMs reduce logistical challenges associated with handling physical SIM cards, such as distribution and inventory management.

They also simplify the process of switching service providers and plans, providing flexibility and ease for consumers and businesses alike. Furthermore, eSIM technology enables businesses to deploy connected devices more rapidly and at a lower cost, particularly in international markets, simplifying global operations and allowing companies to quickly adapt to new regulatory environments and market conditions.

Regional Analysis

Based on geographic segmentation, the global eSIM market can be examined. These regions include North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa (MEA). Given its prevalence of connected devices and access to top eSIM providers, North America currently holds the highest market share for eSIMs at 42.2%. North America’s three major markets for eSIMs are: USA, Canada, and Mexico whereas Europe features three key marketplaces for these eSIMs: UK Germany France

Asia-Pacific is an attractive market for eSIMs due to the rise in Internet of Things device adoption and rising demand in emerging economies such as India and China. China holds the highest eSIM penetration rate among this region’s countries followed by Japan and India.

Latin America and MEA are expected to experience significant growth in the eSIM market, due to the increasing adoption of connected devices and rising demand for secure and convenient connectivity solutions in these regions. Brazil, Mexico, and Argentina are leading markets in Latin America while UAE, Saudi Arabia, and South Africa lead MEA’s eSIM landscape.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Over the past several years, the eSIM (Embedded Subscriber Identity Module) industry has experienced steady expansion. Users can remotely provision and manage cellular connectivity because of this technology without physically changing their SIM card on a device.

A number of new competitors in this market are seeking out opportunities in developing and provisioning eSIM technology and developing related solutions such as SIM provisioning, remote SIM management, or any related service related to eSIM technology development and provisioning – each working towards providing these services in some form or another.

Market Key Players:

- Gemalto N V

- Giesecke+Devrient GmbH

- STMicroelectronics N V

- Infineon Technologies AG

- Valid S A

- Kigen Ltd

- Deutsche Telekom AG

- KORE Wireless

- NXP Semiconductors N V

- Sierra Wireless

- Thales Group

- Workz Group

- Other Key Players

Recent Developments

- May 2023: Lonestar Cell MTN brings eSIM to Liberia: Lonestar Cell MTN, a leading South African telecom player, rolled out eSIM technology in Liberia. This new feature lets customers use eSIM-compatible devices without juggling physical SIM cards. Subscribers can easily switch by scanning a QR code provided at any Lonestar Cell MTN service center. This is a game-changer for convenience and device compatibility.

- March 2023: Gcore launches Zero-Trust 5G eSIM Cloud: Gcore introduced its cutting-edge Zero-Trust 5G eSIM Cloud platform. This technology provides companies worldwide with secure and reliable high-speed connectivity. By using Gcore’s software-defined eSIM, businesses can securely connect remote devices, access corporate resources, or link to Gcore’s cloud through regional 5G carriers. This innovation boosts security and efficiency for global enterprises.

- February 2023: Amdocs and Drei Austria redefine eSIM experience: Amdocs partnered with Drei Austria to launch a revolutionary eSIM solution. The “up” app delivers a fully digital SIM experience, eliminating the need for physical cards or store visits. Customers can activate and manage their eSIMs effortlessly through this app. Amdocs’ advanced technology makes the process simple, fast, and entirely app-based, reshaping customer convenience.

Report Scope

Report Features Description Market Value (2023) USD 8.8 Bn Forecast Revenue (2032) USD 20.6 Bn CAGR (2023-2032) 10.2 % Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution-Hardware, and Connectivity Services; By Vertical-Automotive, Consumer Electronics, Energy & Utilities, Manufacturing, Retail, Transportation & Logistics, and Other Verticals; By Application-Connected Cars, Laptops, M2M, Smartphones, Tablets, Wearables, and Other Applications Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Gemalto N V, Giesecke+Devrient GmbH, STMicroelectronics N V, Infineon Technologies AG, Valid S A, Kigen Ltd, Deutsche Telekom AG, KORE Wireless, NXP Semiconductors N V, Sierra Wireless, Thales Group, Workz Group, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the eSIM Market in 2022?The eSIM Market size was estimated to be USD 8 billion in 2022.

What is the projected CAGR at which the eSIM Market is expected to grow at?The eSIM Market is expected to grow at a CAGR of 10.2% (2023-2032).

List the key industry players of the eSIM Market?Gemalto N V, Giesecke+Devrient GmbH, STMicroelectronics N V, Infineon Technologies AG, Valid S A, Kigen Ltd, Deutsche Telekom AG, KORE Wireless, NXP Semiconductors N V, Sierra Wireless, Thales Group, Workz Group, and Other Key Playersengaged in the eSIM Market.

Which region is more appealing for vendors employed in the eSIM Market?Given its prevalence of connected devices and access to top eSIM providers, North America currently holds the highest market share for eSIMs at 42.2%.

-

-

- Gemalto N V

- Giesecke+Devrient GmbH

- STMicroelectronics N V

- Infineon Technologies AG

- Valid S A

- Kigen Ltd

- Deutsche Telekom AG

- KORE Wireless

- NXP Semiconductors N V

- Sierra Wireless

- Thales Group

- Workz Group

- Other Key Players