Global Super Generics Market By Product Type (Oral Solid Dosage Forms, Inhalable Dosage Forms, Injectables, Topical Dosage Forms and Others), By Route of Administration (Oral, Topical, Injectable and Others), By Application (Oncology, Chronic Pain, Central Nervous System (CNS) Disorders, Cardiovascular Diseases, Respiratory Disorders and Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies and Drug Stores), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173506

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Route of Administration Analysis

- Application Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

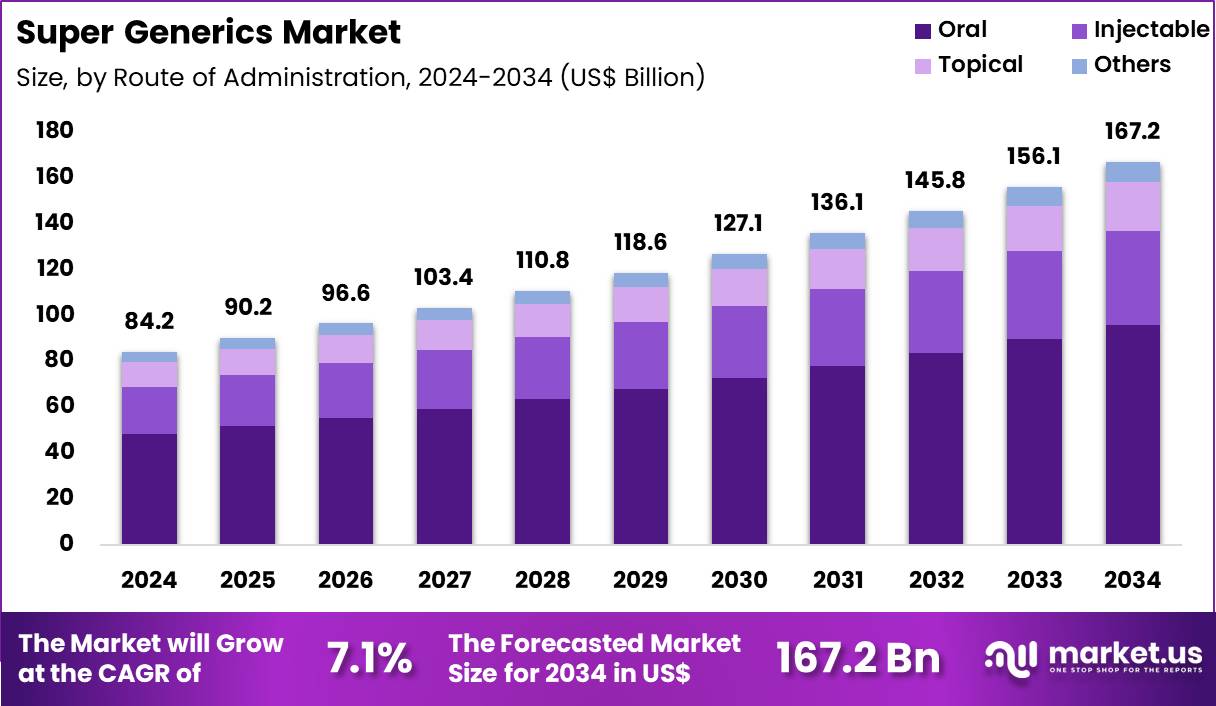

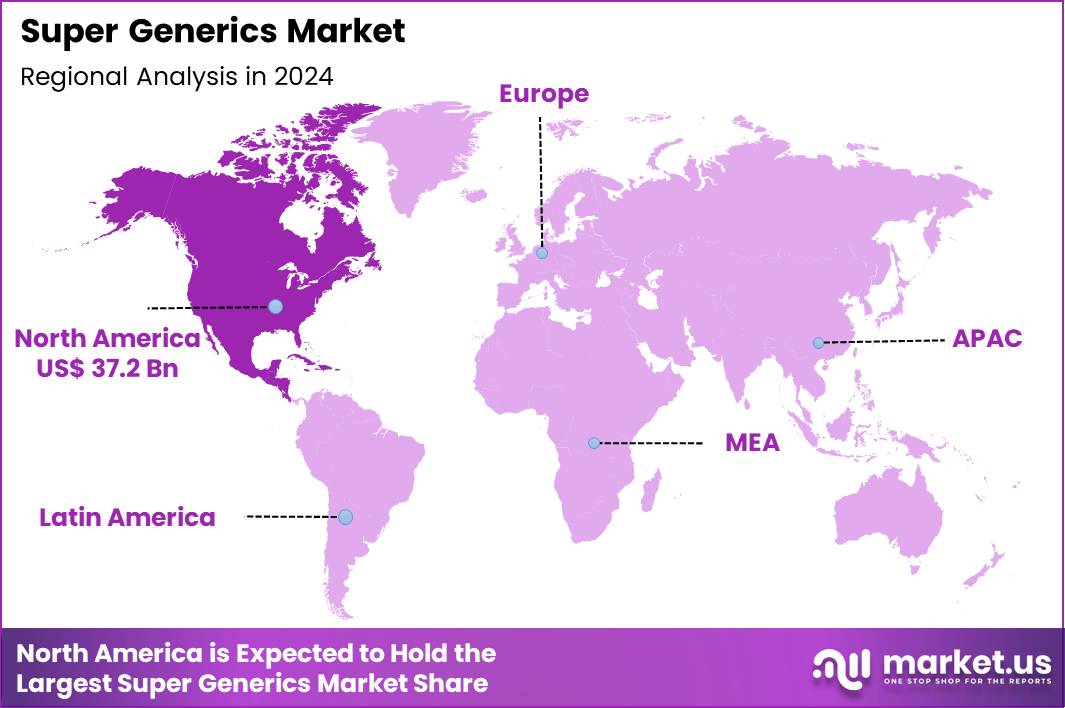

The Global Super Generics Market size is expected to be worth around US$ 167.2 Billion by 2034 from US$ 84.2 Billion in 2024, growing at a CAGR of 7.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.2% share with a revenue of US$ 37.2 Billion.

Rising competition in the pharmaceutical landscape compels companies to develop super generics that offer enhanced therapeutic value through improved formulations, delivery systems, or patient-friendly attributes compared to standard generics. Manufacturers increasingly reformulate off-patent molecules with advanced technologies such as nanoparticles or extended-release mechanisms to boost bioavailability and efficacy in chronic disease management.

These products address unmet needs in oncology by providing targeted delivery of chemotherapeutic agents, reducing systemic toxicity while maintaining affordability. Clinicians prescribe super generics for cardiovascular conditions, utilizing lipid-lowering agents with optimized absorption profiles to improve lipid control in high-risk patients. These therapies support diabetes management through combination formulations that simplify regimens and enhance glycemic stability.

In April 2025, Sun Pharmaceutical Industries launched Fexuclue for the treatment of erosive esophagitis in India, marking a move toward differentiated therapies within its generics portfolio. This was followed in November 2025 by a strategic partnership with AstraZeneca to promote and distribute sodium zirconium cyclosilicate for hyperkalaemia under the Gimliand brand in India.

Together, these developments demonstrate Sun Pharma’s shift toward specialty-branded and clinically differentiated products, directly supporting growth in the super generics market by expanding access to higher-value alternatives for chronic and specialty indications.

Pharmaceutical developers pursue opportunities to create super generics with novel drug-device combinations, such as autoinjectors or transdermal systems, expanding applications in autoimmune disorders for precise self-administration of biologics. Companies engineer value-added versions of central nervous system agents, incorporating abuse-deterrent properties to enhance safety in pain management protocols.

These innovations facilitate applications in respiratory therapeutics, delivering inhaled formulations with improved lung deposition for asthma and chronic obstructive pulmonary disease control. Opportunities arise in metabolic syndrome treatments, where multi-API super generics consolidate therapies for hypertension, dyslipidemia, and hyperglycemia into convenient single units.

Firms advance modified-release profiles that align dosing with circadian rhythms, optimizing efficacy in hormone replacement therapies. Enterprises invest in patient-centric designs that improve adherence in geriatric populations managing multiple comorbidities through simplified administration.

Industry participants advance nanotechnology-based super generics to overcome solubility barriers, enabling effective oral delivery of previously challenging molecules in gastrointestinal disorder treatments. Developers refine complex formulations that incorporate permeation enhancers, broadening utility in dermatological applications for topical agents with superior skin penetration.

Market leaders prioritize regulatory pathways for hybrid approvals that highlight clinical advantages, supporting differentiation in competitive therapeutic categories like anti-infectives. Innovators integrate digital health features into packaging for dose-tracking in psychiatric medications, enhancing compliance in long-term therapy.

Companies emphasize sustainability in production processes to reduce environmental impact while maintaining cost-effectiveness for widespread adoption. Ongoing efforts focus on personalized super generics that adapt to pharmacogenomic profiles, driving precision in oncology supportive care and beyond.

Key Takeaways

- In 2024, the market generated a revenue of US$ 84.2 Billion, with a CAGR of 7.1%, and is expected to reach US$ 167.2 Billion by the year 2034.

- The product type segment is divided into oral solid dosage forms, inhalable dosage forms, injectables, topical dosage forms and others, with oral solid dosage forms taking the lead in 2024 with a market share of 44.8%.

- Considering route of administration, the market is divided into oral, topical, injectable and others. Among these, oral held a significant share of 57.4%.

- Furthermore, concerning the application segment, the market is segregated into oncology, chronic pain, central nervous system (CNS) disorders, cardiovascular diseases, respiratory disorders and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 36.9% in the market.

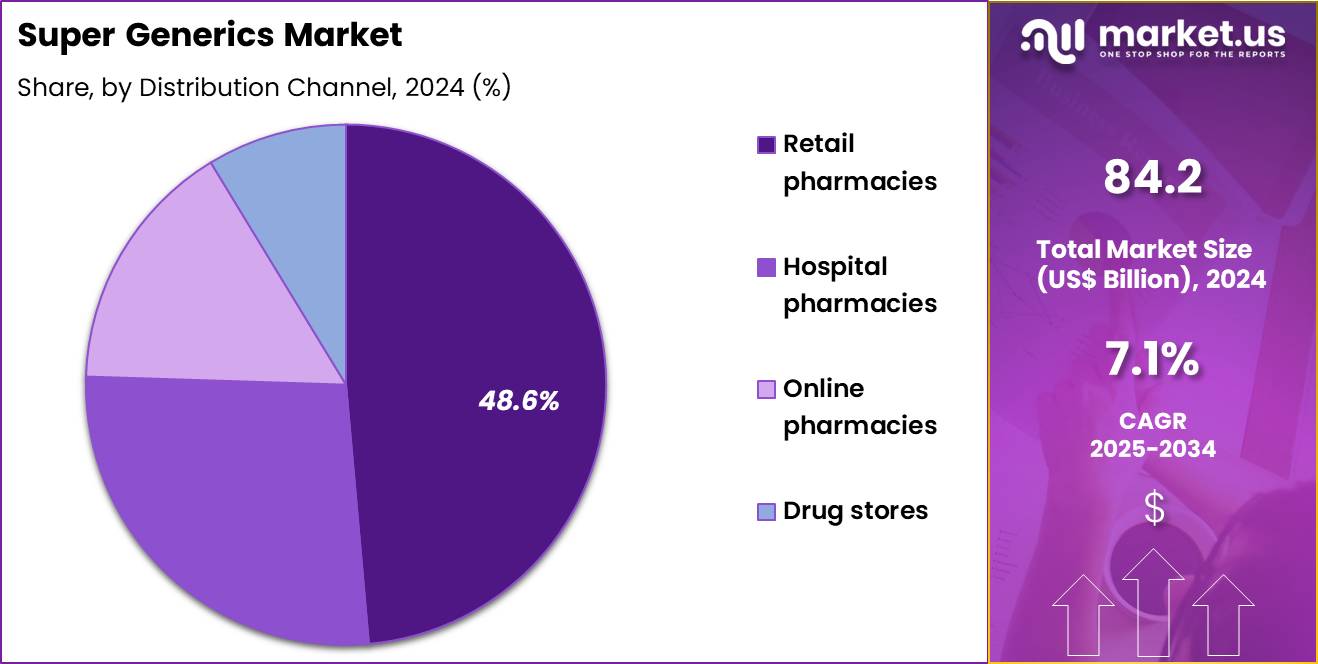

- The distribution channel segment is segregated into retail pharmacies, hospital pharmacies, online pharmacies and drug stores, with the retail pharmacies segment leading the market, holding a revenue share of 48.6%.

- North America led the market by securing a market share of 44.2% in 2024.

Product Type Analysis

Oral solid dosage forms accounted for 44.8% of growth within product type and continue to anchor the Super Generics market. Manufacturers favor tablets and capsules due to scalable production and consistent quality control. Patients prefer these formats due to ease of administration and portability. Super generics often incorporate modified release or improved bioavailability within oral solids, which strengthens differentiation. Regulatory pathways remain clearer for oral solids compared to complex injectables.

Cost efficiencies support competitive pricing strategies across therapeutic classes. Fixed dose combinations enhance therapeutic adherence in chronic conditions. Stability profiles favor longer shelf life and broader distribution reach. Contract manufacturing capabilities support rapid scale up. Clinicians routinely prescribe oral solids as first line therapies. Improved excipient technologies support enhanced absorption. Patient compliance remains higher with familiar dosage forms.

Oral solids align well with outpatient treatment models. Packaging efficiencies support retail distribution. Reformulation strategies extend product lifecycles. Manufacturers prioritize oral solids for pipeline expansion. Global acceptance supports market penetration. Innovation continues through enteric and sustained release designs. The segment is expected to retain leadership through manufacturing efficiency. Overall growth reflects patient acceptance and regulatory familiarity.

Route of Administration Analysis

The oral route represented 57.4% of growth and remains the dominant administration pathway in the Super Generics market. Patients increasingly favor oral therapies due to non invasive dosing. Healthcare systems promote oral treatments to reduce hospital dependence. Super generics leverage oral delivery to enhance bioavailability and reduce dosing frequency. Chronic disease management benefits strongly from oral regimens.

Physicians prefer oral options for long term therapy adherence. Pharmaceutical developers optimize pharmacokinetics through advanced formulations. Cost advantages support wider access across income groups. Oral therapies align with self administration trends. Distribution logistics remain simpler for oral products. Reduced need for trained administration staff improves adoption.

Oral dosing supports outpatient oncology and chronic care. Patient comfort improves treatment persistence. Regulatory agencies maintain well defined oral approval frameworks. Oral products integrate well with fixed dose combinations. E commerce channels favor oral formulations.

Innovation continues in taste masking and controlled release. The segment is anticipated to grow alongside chronic disease prevalence. Healthcare providers emphasize convenience in prescribing decisions. Overall dominance reflects accessibility and patient centric care models.

Application Analysis

Oncology contributed 36.9% of growth within application and stands as the leading therapeutic area in the Super Generics market. Rising global cancer incidence drives sustained demand for cost effective therapies. Super generics improve access to advanced oncology treatments after patent expiry. Pharmaceutical firms focus on reformulated oncology drugs with improved safety profiles. Oral oncology super generics support outpatient treatment paradigms. Healthcare systems prioritize affordability in cancer care.

Improved bioavailability enhances therapeutic outcomes. Combination regimens increase reliance on differentiated generics. Patient adherence improves through simplified dosing schedules. Oncology pipelines emphasize lifecycle management strategies. Physicians increasingly adopt super generics to manage treatment costs. Regulatory incentives support oncology drug approvals.

Market entry timelines shorten through established pathways. Hospital burden reduces with oral oncology adoption. Emerging markets show rising oncology treatment uptake. Supportive care drugs also contribute to growth. Oncology remains innovation intensive within super generics. The segment is projected to expand due to unmet affordability needs. Cost containment policies reinforce adoption. Overall growth reflects clinical demand and economic necessity.

Distribution Channel Analysis

Retail pharmacies captured 48.6% of growth and dominate the distribution landscape for Super Generics. Patients rely on retail pharmacies for routine prescription fulfillment. Accessibility and geographic reach strengthen retail dominance. Pharmacist recommendations influence brand substitution decisions. Super generics benefit from strong shelf presence. Retail pharmacies support chronic therapy continuity.

Insurance reimbursement systems integrate closely with retail dispensing. Patient trust in local pharmacies improves acceptance. Retail chains expand specialty drug offerings. Point of sale education enhances adherence. Urbanization increases pharmacy density. Retail settings support price comparison and transparency. Super generics align well with retail cost saving initiatives.

Loyalty programs encourage repeat purchases. Digital prescription integration streamlines dispensing. Retail pharmacies support rapid market penetration. Manufacturers prioritize retail partnerships. Consumer convenience drives channel preference. The segment is expected to grow with outpatient care expansion. Overall dominance reflects accessibility, trust, and volume driven distribution.

Key Market Segments

By Product Type

- Oral solid dosage forms

- Inhalable dosage forms

- Injectables

- Topical dosage forms

- Others

By Route of Administration

- Oral

- Topical

- Injectable

- Others

By Application

- Oncology

- Chronic Pain

- Central Nervous System (CNS) Disorders

- Cardiovascular Diseases

- Respiratory Disorders

- Others

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Drug Stores

Drivers

Increasing submissions for complex generic drugs is driving the market

The super generics market is propelled by the increasing submissions for complex generic drugs, which include value-added formulations that offer improved efficacy or delivery systems over standard generics. Pharmaceutical companies are submitting more applications for complex generics to capitalize on patent expirations of branded drugs, driving innovation in super generics.

Regulatory agencies like the FDA encourage these submissions through guidance on complex products, facilitating market entry for enhanced generics. Healthcare providers benefit from super generics that provide therapeutic advantages, such as better patient compliance through modified release mechanisms. Academic research supports the development of super generics by validating their bioequivalence and superior attributes.

Global demand for affordable yet advanced therapeutics sustains the momentum for complex generic submissions. Economic pressures on healthcare budgets favor super generics as cost-effective alternatives to branded products. Patient outcomes improve with super generics that address limitations of traditional generics, like reduced side effects.

Pharmaceutical investments in R&D for complex formulations align with submission trends to meet market needs. The U.S. Food and Drug Administration reported 121 complex product ANDA submissions in FY 2023, increasing to 138 in FY 2024.

Restraints

High regulatory hurdles for complex formulations are restraining the market

The super generics market is restrained by high regulatory hurdles for complex formulations, which require extensive data to demonstrate equivalence and safety compared to simpler generics. Manufacturers must conduct additional studies to validate the added value in super generics, extending timelines and increasing costs. Regulatory agencies demand rigorous risk assessments for modifications in delivery systems, complicating approval processes.

Healthcare innovation slows as companies navigate detailed guidance on complex products, delaying market entry. Academic efforts to standardize testing for super generics face challenges in meeting regulatory expectations. Global inconsistencies in approval criteria hinder international commercialization of super generics.

Economic burdens from prolonged development phases deter smaller firms from entering the market. Patient access to advanced generics is limited by the time-intensive nature of regulatory reviews. Ethical considerations in ensuring product quality add layers to the approval burden. These factors collectively limit the pace of super generics adoption and market expansion.

Opportunities

Patent expiries of blockbuster drugs is creating growth opportunities

The super generics market harbors growth opportunities through patent expiries of blockbuster drugs, allowing developers to introduce value-added versions with improved features like extended release or combination therapies. Pharmaceutical firms can capitalize on these expiries to capture market share with super generics that offer therapeutic advantages over standard copies.

Regulatory pathways for complex generics facilitate the introduction of super generics post-patent loss. Healthcare systems benefit from cost savings while providing enhanced treatment options for chronic conditions. Academic partnerships explore formulations that address limitations of original drugs, expanding super generics applications.

Global market entry for super generics aligns with expiries in high-value therapeutic areas like oncology and cardiology. Economic incentives from reduced R&D costs compared to novel drugs encourage investment in super generics. Patient care improves with super generics that enhance adherence and efficacy.

Pharmaceutical strategies focus on super generics to extend product life cycles beyond basic generics. The U.S. Food and Drug Administration’s list of off-patent, off-exclusivity drugs without an approved generic provides opportunities for super generics development.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors fuel expansion in the Super Generics market as escalating global healthcare budgets and patent expirations on blockbuster drugs boost demand for enhanced, cost-effective alternatives. Companies capitalize on economic growth in emerging regions, where rising disposable incomes accelerate adoption of value-added generics with improved formulations.

Yet, volatile inflation rates compel manufacturers to absorb higher raw material and labor expenses, eroding profitability and hindering market penetration in price-sensitive areas. Geopolitical uncertainties, such as trade disputes between major powers like the US and China, interrupt active pharmaceutical ingredient supplies and escalate logistics challenges for global players.

Firms counter these disruptions by forging diversified alliances across stable regions, enhancing supply chain robustness and opening new collaborative opportunities. Current US tariffs, imposing 20-25% duties on imported APIs from key suppliers like India and China, inflate production costs for super generics reliant on foreign components.

Domestic producers gain an edge as these tariffs stimulate investments in local facilities, fostering job creation and technological advancements within the industry. Ultimately, ongoing innovations in drug delivery systems empower the sector to overcome obstacles, driving resilient growth and broader accessibility worldwide.

Latest Trends

Launch of generic versions of complex therapeutics is a recent trend

In 2024, the super generics market has witnessed a prominent trend toward the launch of generic versions of complex therapeutics, exemplifying value-added innovations in formulation and delivery. Manufacturers are introducing generics with enhanced properties, such as improved bioavailability, to compete in high-value segments.

Healthcare providers adopt these super generics for their ability to offer similar efficacy to branded drugs at lower costs. Regulatory approvals for complex generics in 2024 highlight the trend’s momentum in therapeutic areas like oncology. Clinical applications benefit from super generics that incorporate advanced technologies for better patient outcomes. Academic studies evaluate the performance of these launches to inform future developments.

Global distribution expands access to super generics in emerging markets following approvals. Patient preferences shift toward affordable alternatives with added benefits from complex formulations. Ethical protocols ensure the launches prioritize safety and equivalence. Teva Pharmaceuticals USA, Inc. received FDA approval for generic Midostaurin Capsules 25 mg on April 29, 2024, representing a complex kinase inhibitor super generic.

Regional Analysis

North America is leading the Super Generics Market

In 2024, North America commanded a 44.2% share of the global super generics market, stimulated by escalating healthcare costs and a push for affordable yet enhanced therapeutic alternatives that offer improved bioavailability, reduced side effects, and extended-release profiles compared to standard generics.

Pharmaceutical firms intensified development of these value-added products to address patent expirations on blockbuster drugs, targeting conditions like hypertension and diabetes through reformulated versions that comply with stringent regulatory pathways for bioequivalence and additional clinical benefits. Federal incentives encouraged biosimilar and complex generic pathways, enabling faster market entry for super generics in oncology and neurology, where patient adherence remains critical.

Rising chronic disease burdens among aging populations amplified prescriptions for user-friendly formulations, while insurance formularies favored cost-effective options with proven therapeutic advantages. Collaborative efforts between manufacturers and research institutions refined excipient technologies, optimizing dissolution rates for gastrointestinal-sensitive compounds.

Supply partnerships streamlined distribution of tamper-resistant packaging, ensuring accessibility in diverse healthcare settings. Regulatory harmonization further supported innovation, bridging gaps in underserved therapeutic areas. The U.S. Food and Drug Administration approved 856 abbreviated new drug applications in fiscal year 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry leaders envision dynamic progression in super generics throughout Asia Pacific over the forecast period, fueled by governmental mandates for affordable pharmaceuticals and strategic investments in local manufacturing to counter rising non-communicable disease loads. Developers prioritize reformulated generics with enhanced stability for tropical climates, addressing unmet needs in cardiovascular and respiratory therapies amid urbanization trends.

Health authorities expedite approvals for complex generics, equipping public formularies with cost-efficient alternatives to imported brands in high-population nations. Biotech entities customize delivery mechanisms, optimizing pharmacokinetics for ethnic-specific metabolisms in antidiabetic and anti-inflammatory segments. Regional consortia conduct bioequivalence trials, validating superior profiles to bolster export competitiveness.

Pharmaceutical alliances forge technology transfers, enabling small enterprises to scale production of extended-release variants compliant with international standards. Community programs promote awareness of therapeutic equivalents, fostering uptake in rural pharmacies grappling with accessibility barriers. China’s Center for Drug Evaluation recommended approving 3,041 chemical generic drug marketing applications in 2024.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key participants in the Super Generics market accelerate growth by engineering differentiated medicines that enhance therapeutic performance or patient adherence while preserving generic-level affordability. Firms build competitive pipelines through reformulated APIs, advanced delivery mechanisms, and fixed-dose combinations that achieve regulatory distinction beyond standard copies.

Commercial leadership emphasizes swift launches, formulary access, and aggressive channel execution to gain traction in high-volume therapeutic areas. Development teams focus on process optimization, bioequivalence precision, and scalable production to compress timelines and control cost structures.

Market expansion strategies prioritize regions with favorable substitution policies and large off-patent drug demand. Teva Pharmaceutical Industries operates as a leading force with a globally integrated generics platform, strong regulatory execution, and proven capability to commercialize complex value-added generics at scale.

Top Key Players

- Teva Pharmaceutical Industries

- Sun Pharmaceutical Industries

- Dr. Reddy’s Laboratories

- Lupin Limited

- Cipla Limited

- Viatris

- Aurobindo Pharma

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals

- Alkem Laboratories

Recent Developments

- For the fiscal year ending in 2025, Dr. Reddy’s Laboratories reported record revenues exceeding US$ 3.8 billion, reflecting strong performance from its differentiated product strategy. During 2025, the company launched multiple complex generics in key markets, including linaclotide-based therapies for chronic idiopathic constipation. By prioritizing peptides, oncology assets, GLP-1 therapies, and biosimilars, and reinvesting cash flows from its legacy portfolio, Dr. Reddy’s is broadening the super generics market with products that offer enhanced complexity, improved delivery, and stronger competitive positioning compared with standard generics.

- Following its spin-off from Novartis, Sandoz reported net sales of US$2.48 billion in the first quarter of 2025, underscoring early momentum as an independent generics and biosimilars company. In February 2025, Sandoz launched a biosimilar version of ustekinumab in the US for plaque psoriasis, reinforcing its complex-first strategy. With a pipeline of roughly 400 generic medicines focused on biosimilars, respiratory products, and injectable technologies, Sandoz is actively driving expansion of the super generics market by shifting emphasis toward technically advanced products that deliver added clinical value and differentiation.

Report Scope

Report Features Description Market Value (2024) US$ 84.2 Billion Forecast Revenue (2034) US$ 167.2 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oral Solid Dosage Forms, Inhalable Dosage Forms, Injectables, Topical Dosage Forms and Others), By Route of Administration (Oral, Topical, Injectable and Others), By Application (Oncology, Chronic Pain, Central Nervous System (CNS) Disorders, Cardiovascular Diseases, Respiratory Disorders and Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies and Drug Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teva Pharmaceutical Industries, Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, Lupin Limited, Cipla Limited, Viatris, Aurobindo Pharma, Glenmark Pharmaceuticals, Torrent Pharmaceuticals, Alkem Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teva Pharmaceutical Industries

- Sun Pharmaceutical Industries

- Dr. Reddy’s Laboratories

- Lupin Limited

- Cipla Limited

- Viatris

- Aurobindo Pharma

- Glenmark Pharmaceuticals

- Torrent Pharmaceuticals

- Alkem Laboratories