Global Sun Care Cosmetics Market Size, Share, Growth Analysis By Product (SPF Foundation, SPF Spray, SPF Lotion, SPF BB Creams, SPF Sunscreen, Tinted Moisturizers, SPF Primers, Others), By Type (Conventional, Organic), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 150007

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Size

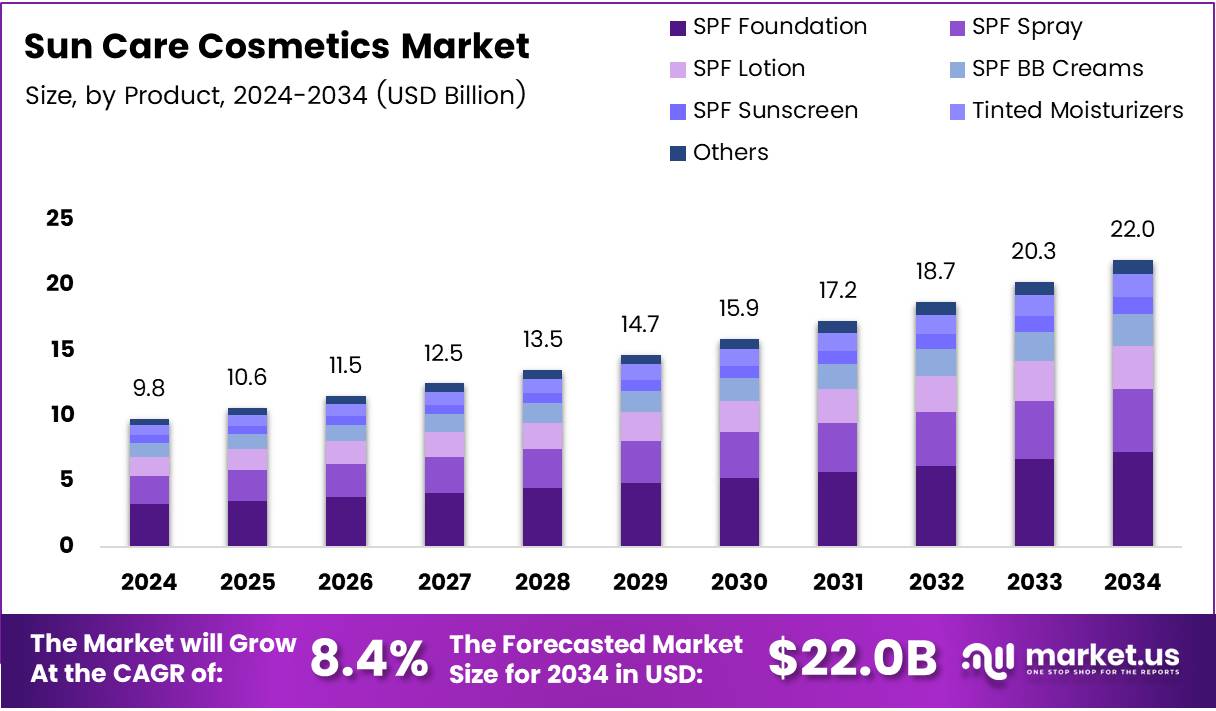

The Global Sun Care Cosmetics Market size is expected to be worth around USD 22.0 Billion by 2034, from USD 9.8 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. This growth is driven by increasing consumer awareness about skin protection, rising demand for anti-aging products, and the growing preference for multifunctional sun care solutions.

Key Takeaways

- The Global Sun Care Cosmetics Market is projected to reach USD 22.0 Billion by 2034, growing at a CAGR of 8.4% from 2025 to 2034.

- SPF Foundation held a dominant position in the By Product Analysis segment in 2024, with a 24.1% share.

- Conventional products led the By Type Analysis segment in 2024, with an 83.7% share.

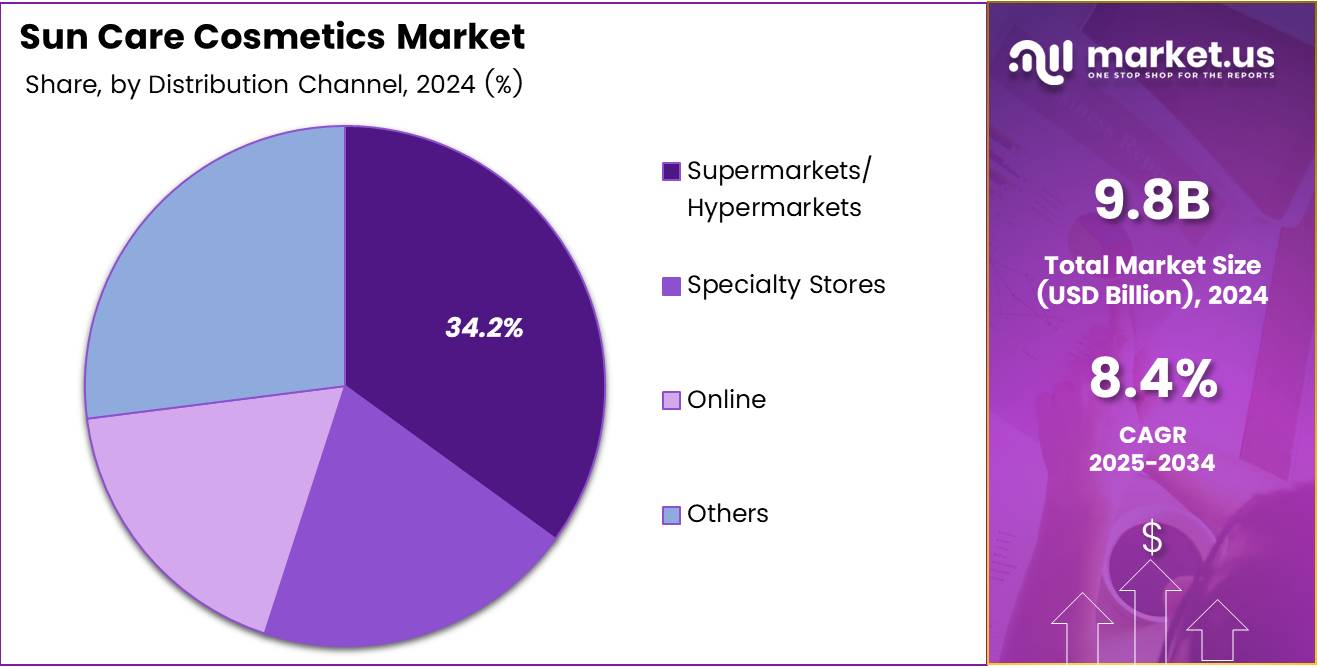

- Supermarkets/Hypermarkets dominated the By Distribution Channel Analysis segment in 2024, with a 34.2% share.

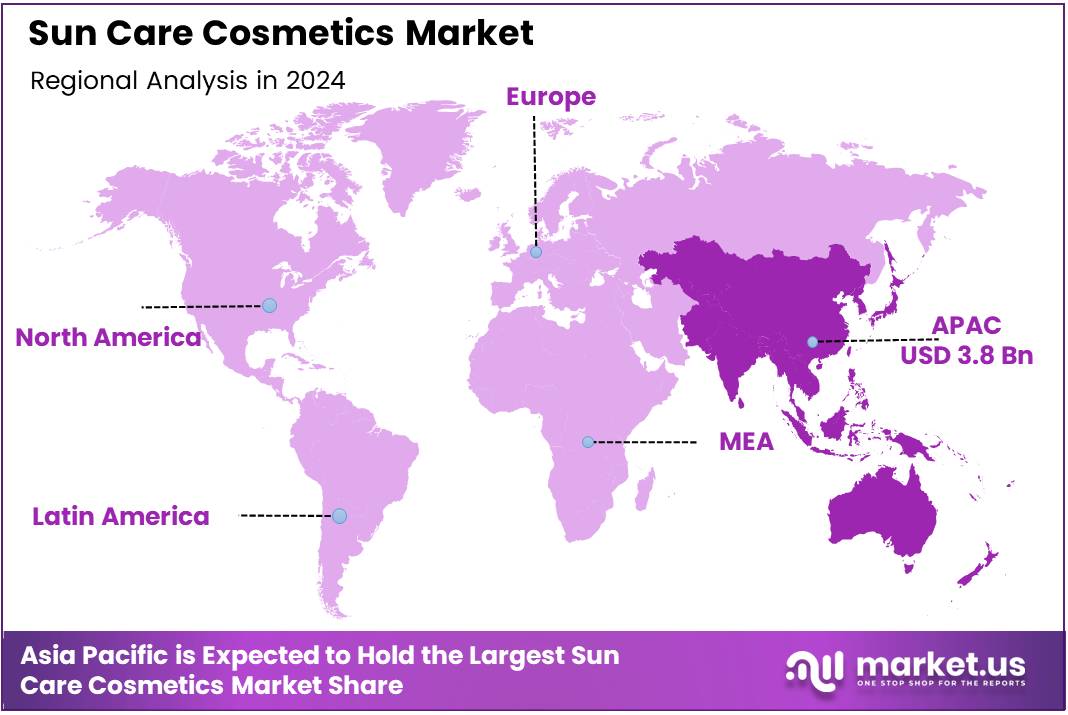

- Asia Pacific led the global market, accounting for 39.2% of the share, valued at USD 3.8 Billion.

Report Overview

The Sun Care Cosmetics market has witnessed substantial growth driven by the increasing awareness of the harmful effects of UV rays on skin health. Consumers are becoming more vigilant about skincare, leading to a rising demand for sunscreens and other sun protection products.

The market is expanding due to this heightened awareness, alongside advancements in product formulations, such as mineral-based and organic sunscreens. Moreover, the rising popularity of multi-functional products that combine skincare benefits with sun protection is contributing to this growth.

According to Anagen, the United States leads the sun care market, generating approximately $1.88 billion in revenue. This dominance reflects the robust consumer base and the country’s commitment to sun protection products.

Government regulations, particularly in the U.S., play a significant role in ensuring product efficacy and safety, further supporting the market’s growth. Regulatory bodies like the FDA set stringent guidelines for sunscreen efficacy, which has enhanced consumer confidence in these products.

The gender gap in sunscreen usage highlights the opportunities for targeted marketing strategies. According to the National Library of Medicine (NLM), women are nearly twice as likely to use sunscreen as men, with 43.6 percent of women using sunscreen compared to 23.4% of men. This suggests that brands could focus on raising awareness among male consumers about the importance of sun protection, particularly with the growing trend of men’s skincare.

Dermatologists, as mentioned by the American Academy of Dermatology (AAD), recommend using sunscreens with an SPF of at least 30, as these products block 97% of the sun’s UVB rays. This recommendation is shaping product development trends, as consumers seek higher SPF options to enhance skin protection. The preference for high-performance sunscreens is expected to drive the demand for advanced formulations in the sun care market.

Furthermore, the International Agency for Research on Cancer (IARC) reports that eight countries accounted for 70% of the consumption in dollar terms, with the European Union and the USA representing about 75% of the global sunscreen market. This concentration indicates that while the market is robust in key regions, there is significant potential for growth in emerging markets where sun care awareness is still developing.

Product Analysis

SPF Foundation leads with 24.1% as consumers embrace all-in-one sun protection and makeup.

In 2024, SPF Foundation held a dominant market position in the By Product Analysis segment of the Sun Care Cosmetics Market, with a 24.1% share. Its dual functionality as both a cosmetic and a protective skincare product has made it a favorite among consumers seeking convenience without compromising on sun defense.

SPF Spray followed closely, preferred for its easy, even application. It appeals to active consumers needing on-the-go protection. SPF Lotion also retained steady demand as a traditional format trusted for its moisturizing and protective qualities.

SPF BB Creams continued to rise in popularity for their light texture and skin-tone matching properties. SPF Sunscreen, though classic, faced competition from multifunctional products but remained essential for users prioritizing broad-spectrum defense.

Tinted Moisturizers attracted buyers who prefer a subtle coverage with SPF benefits, while SPF Primers became a staple in pre-makeup routines for long-lasting wear and protection. The Others category includes emerging hybrid formats contributing to niche demand.

Type Analysis

Conventional dominates with 83.7% as consumers stick to familiar and widely available sun care options.

In 2024, Conventional held a dominant market position in the By Type Analysis segment of the Sun Care Cosmetics Market, with a 83.7% share. This overwhelming preference indicates that most consumers continue to rely on tried-and-tested formulations, often driven by affordability, availability, and established brand trust.

Despite the growing interest in clean beauty and sustainability, Organic sun care products faced challenges in scaling due to higher prices and limited accessibility. While Organic continues to carve out a niche, especially among environmentally conscious buyers, it remains a smaller segment in terms of overall volume.

The gap highlights a strong consumer inclination toward mainstream sun care offerings that ensure performance and affordability, even as awareness around ingredient transparency grows.

Distribution Channel Analysis

Supermarkets/Hypermarkets lead with 34.2% as one-stop convenience drives purchases.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Sun Care Cosmetics Market, with a 34.2% share. These retail formats remain favored for their wide product assortments, regular promotions, and physical availability, making them ideal for impulse and routine purchases.

Specialty Stores followed as the go-to destination for informed buyers seeking expert recommendations or premium sun care brands. These stores offer curated selections that appeal to beauty-conscious and skincare-focused consumers.

Online channels continued gaining traction due to ease of access, home delivery, and a growing number of digital-first beauty brands. However, the online experience lacks the tactile benefits of in-store shopping, which some consumers still value.

The Others category, comprising pharmacies and convenience stores, supported niche and emergency purchases, contributing modestly to total market share.

Key Market Segments

By Product

- SPF Foundation

- SPF Spray

- SPF Lotion

- SPF BB Creams

- SPF Sunscreen

- Tinted Moisturizers

- SPF Primers

- Others

By Type

- Conventional

- Organic

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online

- Others

Drivers

Increasing Awareness of Skin Health Drives Market Growth

The growing awareness about the harmful effects of sun exposure is pushing more people to use sun care cosmetics. Consumers are becoming more educated about the risks of UV radiation, such as skin cancer, sunburn, and premature aging. This awareness has created a stronger demand for daily-use sun protection products.

As more people seek ways to maintain youthful skin, anti-aging sun care products are gaining popularity. Many consumers are choosing sunscreens that include ingredients like antioxidants and moisturizers, which help prevent signs of aging while protecting the skin from the sun.

In developing countries, the expanding middle class is also playing a role in driving the sun care cosmetics market. As incomes rise, more consumers can afford premium skincare products, including high-quality sunscreens. This shift is opening new growth opportunities for brands in regions like Asia, Latin America, and Africa.

Outdoor activities such as hiking, swimming, and beach vacations are on the rise globally. As people spend more time outside, the need for effective sun protection grows. This trend is boosting demand for various sun care formats, including lotions, sprays, and sticks suitable for active lifestyles.

Restraints

Rising Production Costs of High-Quality Ingredients Challenge Market Stability

Sun care cosmetics often require advanced ingredients to offer effective UV protection and skin benefits. However, the cost of sourcing and producing these high-quality ingredients is rising. This makes it harder for manufacturers to maintain competitive prices.

Government regulations on cosmetic products have become stricter, especially concerning sun care. Manufacturers must follow detailed safety and testing guidelines, which can delay product launches and increase compliance costs.

Some sun care ingredients are known to harm the environment, especially marine ecosystems. Chemicals like oxybenzone and octinoxate can damage coral reefs, leading to growing restrictions. This environmental concern limits the use of certain formulations and challenges product development.

The skincare market is also seeing a rise in alternative solutions like moisturizers with SPF, BB creams, and natural oils. These options create strong competition for traditional sunscreens, forcing sun care brands to innovate to stay relevant.

Growth Factors

Development of Natural and Organic Sun Care Products Unlocks Market Potential

There is growing demand for natural and organic sun care products, as consumers are becoming more conscious of what they apply to their skin. These formulations use plant-based and mineral ingredients, making them attractive to health-conscious buyers.

Brands are also expanding their product lines to suit different skin types and tones. This shift is making sun care more inclusive, offering solutions for sensitive skin, oily skin, and darker complexions. Customization is helping brands connect with a broader audience.

Multifunctional sun care products that combine sun protection with skincare benefits are gaining traction. Consumers now prefer products that offer SPF along with hydration, anti-aging, or anti-pollution benefits, driving innovation in formulations.

Emerging markets are seeing a rise in disposable income, especially in Asia and Africa. As more consumers in these regions prioritize skincare, sun care brands have the opportunity to expand their presence and tap into new customer bases.

Emerging Trends

Focus on Eco-Friendly and Sustainable Packaging Shapes Consumer Preferences

Consumers are increasingly choosing sun care products that use eco-friendly packaging. Brands are shifting toward recyclable materials and minimalistic designs to reduce environmental impact, which aligns with growing sustainability concerns.

Reef-safe sunscreen is another major trend. New formulations exclude harmful chemicals that damage marine life, particularly coral reefs. This shift is supported by both consumer demand and regulatory actions in places like Hawaii and Palau.

Cruelty-free sun care products are also in demand. Ethical shoppers are looking for brands that do not test on animals and are transparent about their practices. This factor is becoming a key differentiator in the competitive market.

Wearable technology that monitors UV exposure is gaining popularity. These devices, often linked to mobile apps, help users track sun exposure in real-time. This trend encourages the use of sun care products by increasing awareness of daily sun risks.

Regional Analysis

Asia Pacific Dominates the Sun Care Cosmetics Market with a Market Share of 39.2%, Valued at USD 3.8 Billion

Asia Pacific leads the global sun care cosmetics market, accounting for 39.2% of the market share, with a value of USD 3.8 Billion. This dominance is driven by growing consumer awareness of skin health and increased demand for sun protection products, especially in countries like Japan, China, and India. The rapid urbanization and rising disposable income in the region further bolster the market’s growth.

North America Sun Care Cosmetics Market Trends

North America holds a significant portion of the sun care cosmetics market, fueled by high consumer awareness and advanced skincare routines in the U.S. and Canada. The demand for SPF products is consistently high, driven by the increasing concern over skin cancer and the desire for anti-aging benefits. The region is expected to continue its growth as consumers embrace a more holistic approach to skincare and sun protection.

Europe Sun Care Cosmetics Market Trends

Europe also plays a crucial role in the global sun care market, with a strong presence in countries like Germany, France, and the U.K. The region’s market growth is driven by high demand for sunscreens, particularly among health-conscious consumers. Strict regulations on product formulations and safety standards further support the region’s commitment to quality and innovation in sun protection products.

Latin America Sun Care Cosmetics Market Trends

Latin America is experiencing growing interest in sun care cosmetics, driven by increasing awareness of UV-related skin damage and the rising availability of affordable products. While the market share remains smaller compared to other regions, the demand for SPF products is steadily growing, particularly in Brazil and Mexico. The market is expected to expand as more consumers prioritize skincare and sun protection.

Middle East and Africa Sun Care Cosmetics Market Trends

The Middle East and Africa (MEA) region exhibits a growing demand for sun care products, especially due to the high levels of sun exposure in many countries. The demand for SPF products is on the rise, particularly in regions with hot climates. Despite the challenges of economic disparities across the region, the market is anticipated to grow as awareness of skin health and the benefits of sun protection products increase.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Sun Care Cosmetics Company Insights

In 2024, the global Sun Care Cosmetics market is dominated by several key players, each contributing to growth through innovation and expanding product offerings. Coty Inc. has strengthened its position in the market with a focus on enhancing its sunscreen product portfolio, leveraging established brands to attract a diverse consumer base seeking effective sun protection solutions.

Johnson & Johnson Services, Inc. continues to lead with its trusted and clinically backed products, emphasizing skin health and dermatological safety, which resonates with consumers increasingly prioritizing both beauty and wellness. Their robust presence in the over-the-counter sunscreen category has solidified their market share.

The Clorox Company has made strategic inroads into the sun care space, diversifying its portfolio to cater to consumers seeking eco-friendly and skin-sensitive sun protection solutions. Their commitment to sustainability resonates with environmentally conscious customers, which has driven growth in this segment.

Beiersdorf AG remains a strong contender, known for its Nivea brand, which is synonymous with affordable yet high-quality skincare. The company’s innovation in providing high-SPF protection combined with moisturizing properties has positioned it as a go-to brand for consumers seeking both value and effectiveness in sun care products.

These companies continue to drive competition and shape the market by meeting changing consumer demands, from dermatological efficacy to sustainability, making them critical players in the global sun care cosmetics landscape.

Top Key Players in the Market

- Coty Inc.

- Johnson & Johnson Services, Inc.

- The Clorox Company

- Beiersdorf AG

- Shiseido Company Ltd.

- Unilever

- Groupe Clarins

- Naos

- The Estée Lauder Companies Inc.

- L’Oréal Groupe

Recent Developments

- In January 2025, Ras Luxury Skincare successfully raised US$5 million in a Series A funding round, with Unilever Ventures taking the lead, supporting the brand’s further expansion in the luxury skincare market.

- In December 2024, Sugar Cosmetics secured US$4.5 million in a recent funding round, aimed at boosting the brand’s growth and market presence within the competitive beauty industry.

- In November 2024, Crown Affair closed a US$9 million Series B funding round, with True Beauty Ventures leading the investment, signaling a strong demand for their innovative haircare products.

Report Scope

Report Features Description Market Value (2024) USD 9.8 Billion Forecast Revenue (2034) USD 22.0 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (SPF Foundation, SPF Spray, SPF Lotion, SPF BB Creams, SPF Sunscreen, Tinted Moisturizers, SPF Primers, Others), By Type (Conventional, Organic), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Coty Inc., Johnson & Johnson Services, Inc., The Clorox Company, Beiersdorf AG, Shiseido Company Ltd., Unilever, Groupe Clarins, Naos, The Estée Lauder Companies Inc., L’Oréal Groupe Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Coty Inc.

- Johnson & Johnson Services, Inc.

- The Clorox Company

- Beiersdorf AG

- Shiseido Company Ltd.

- Unilever

- Groupe Clarins

- Naos

- The Estée Lauder Companies Inc.

- L'Oréal Groupe