Global Sugar Decorations And Inclusions Market Size, Share, And Industry Analysis Report By Type (Jimmies, Quins, Dragees, Nonpareils, Caramel Inclusions, Sanding and Course Sugar, Single Pieces), By Colorant (Artificial, Natural), By Application (Cereals and Snack Bars, Ice-creams and Frozen Desserts, Chocolates and Confectionery Products, Cakes and Pastries, Others), By End User (Home Bakers, Food Manufacturers, Foodservice Industry), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170091

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

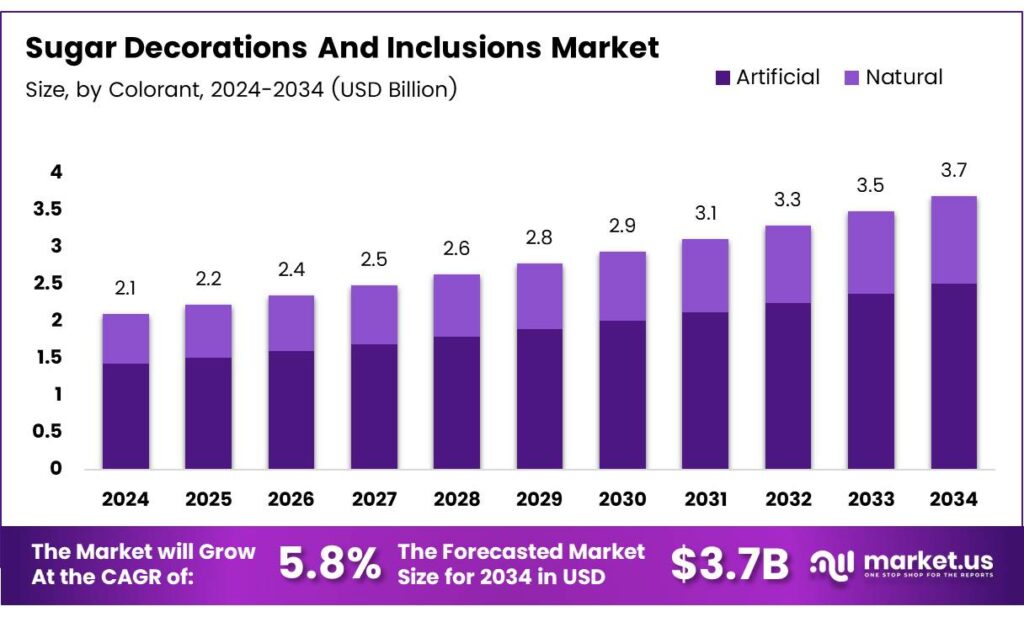

The Global Sugar Decorations and Inclusions Market size is expected to be worth around USD 3.7 billion by 2034, from USD 2.1 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Sugar Decorations and Inclusions Market represents a fast-modernizing segment within global bakery, confectionery, and premium dessert value chains. It includes sprinkles, dragees, fondants, caramel inclusions, and decorative sugar pieces that enhance texture, color, and consumer appeal. This category increasingly aligns with clean-label preferences and premium experiential snacking trends.

Growing demand for bakery innovation continues to influence this market. As consumers seek visually rich cakes, pastries, and frozen desserts, manufacturers upgrade decorative formats with natural colors and plant-based inclusions. Meanwhile, digital baking culture and social-commerce platforms encourage frequent home experimentation, accelerating small-batch decorative sugar consumption globally.

- As the category grows, understanding core confectionery science remains essential. According to the Food and Agriculture Organization (FAO) definitions, boiled sweets are created by heating sugar and water to 150–166 °C until almost no moisture remains and a glassy mass forms. Similarly, fondant consists of minute sugar crystals suspended in saturated syrup, used widely for cake décor.

Global confectionery patterns reinforce the market’s momentum. According to the International Sugar Organization (ISO), sugar confectionery accounts for about 39% of global candy consumption, while chocolate holds 61%. ISO notes that consumption rises sharply in emerging economies such as Brazil, India, China, and Japan, reflecting expanding middle-class demand.

Key Takeaways

- The Global Sugar Decorations and Inclusions Market reached USD 2.1 billion in 2024 and is projected to hit USD 3.7 billion by 2034, at a steady 5.8% CAGR from 2025 to 2034.

- Jimmy’s led the By Type segment with a dominant 23.7% share.

- Artificial colorants dominated the By Colorant segment with a strong 74.2% share.

- Cereals and Snack Bars held the highest share in the Application segment at 24.3% in 2024.

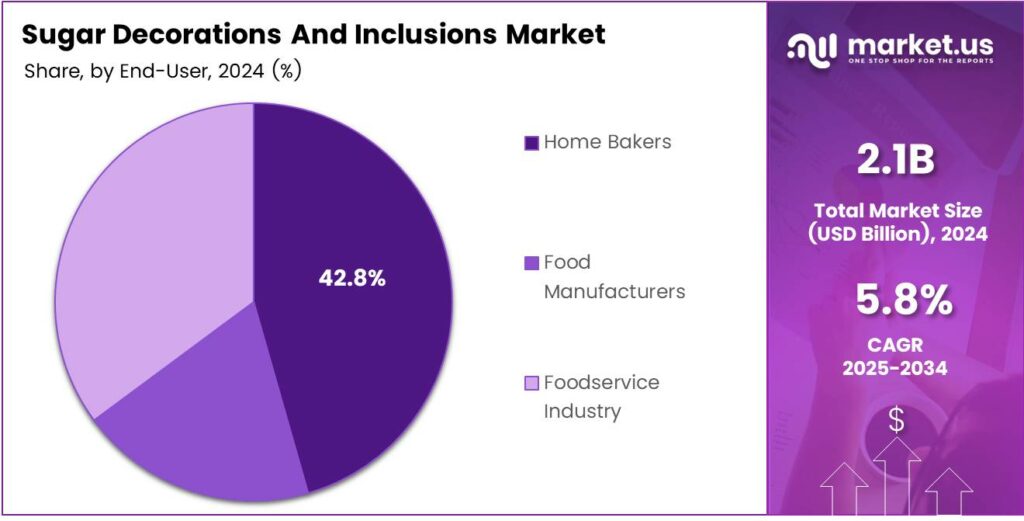

- Home Bakers were the leading end-user group, capturing 42.8% of total demand in 2024.

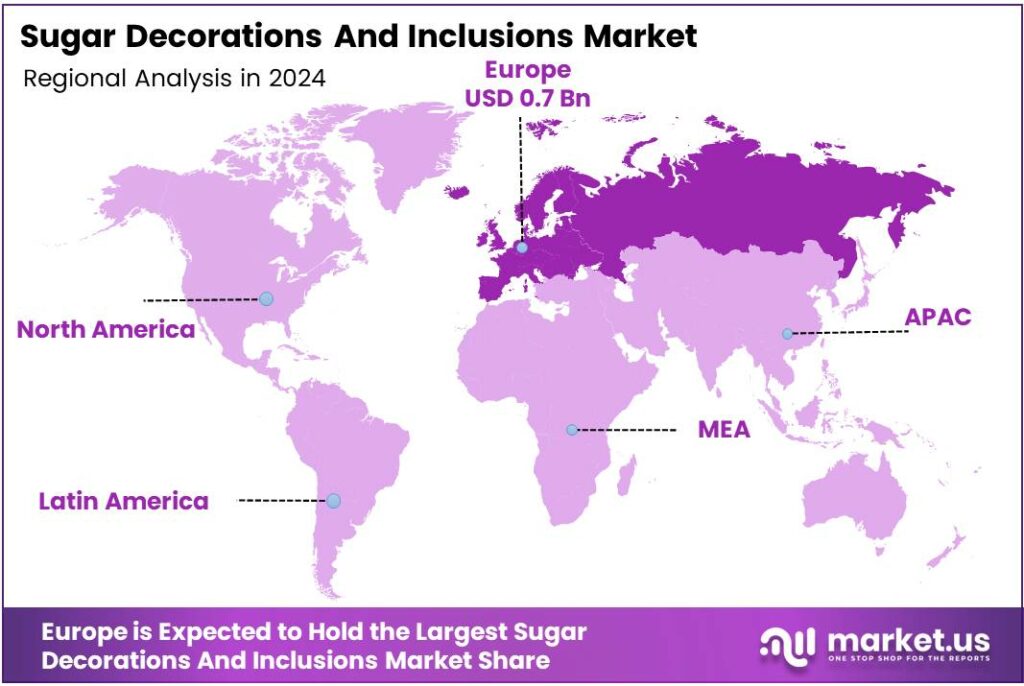

- Europe remained the top regional market with a 37.5% share, valued at USD 0.7 billion.

By Type Analysis

Jimmies dominate the segment with 23.7% due to strong use in bakery toppings and everyday confectionery.

In 2024, Jimmies held a dominant market position in the By Type Analysis segment of the Sugar Decorations and Inclusions Market, with a 23.7% share. Their versatility and cost-efficiency encouraged broader usage across cakes, cupcakes, and commercial confectionery lines, supporting steady industrial adoption.

Quins continued gaining traction as brands introduced colorful, shaped toppings for seasonal campaigns. Their visual appeal supported steady inclusion across bakery aisles, while manufacturers expanded themed assortments. This helped deliver consistent category engagement among home bakers and packaged dessert producers seeking novelty-driven decoration formats.

Dragees found stable demand in premium desserts as metallic finishes enhanced product aesthetics. Their role in wedding cakes and high-end pastries strengthened adoption. Moreover, foodservice operators used dragees to differentiate plated desserts. This gradual premiumization continued, encouraging steady growth within specialized decoration offerings.

Nonpareils experienced resilient demand with their small size supporting even coverage on confectionery surfaces. Brands used them widely in ice creams, cookies, and baked snacks. Their crunch profile added textural appeal, while affordable pricing enabled large-volume purchases for mass-market products.

By Colorant Analysis

Artificial colorants dominate with 74.2% because they offer stability, cost efficiency, and broader shade availability.

In 2024, Artificial colorants held a dominant market position in the By Colorant Analysis segment of the Sugar Decorations And Inclusions Market, with a 74.2% share. Their ability to withstand heat and maintain color during processing ensured widespread acceptance across industrial and commercial applications.

Natural colorants continued gaining interest as clean-label preferences increased. Although they lacked the dominance of artificial options, they attracted manufacturers seeking plant-based decorations. Their use expanded in premium bakery goods, organic products, and specialty confectionery, where transparency of ingredients shaped consumer purchase decisions.

By Application Analysis

Cereals and Snack Bars dominate with 24.3% due to the rising use of decorative sweet toppings in packaged breakfast and snack products.

In 2024, Cereals and Snack Bars held a dominant market position in the By Application Analysis segment of the Sugar Decorations and Inclusions Market, with a 24.3% share. Their integration improved visual appeal and flavor variety, supporting brand innovation in children’s cereals and energy-focused snack lines.

Ice-creams and frozen desserts steadily incorporated toppings to enhance indulgence and texture. Manufacturers used sprinkles, dragees, and flavored inclusions to diversify offerings. The trend toward artisanal ice cream formats supported experimentation with layered toppings and vibrant decorations.

Chocolates and confectionery products relied on decorations to strengthen product differentiation. Inclusions added crunch, color, and thematic appeal. Seasonal launches around festivals expanded decorative usage, helping brands sell limited-edition assortments while improving premium positioning.

By End User Analysis

Home Bakers dominate with 42.8% supported by rising DIY baking, e-commerce availability, and social-media-driven decoration trends.

In 2024, Home Bakers held a dominant market position in the By End User Analysis segment of the Sugar Decorations and Inclusions Market, with a 42.8% share. Growing participation in home baking, festive celebrations, and online tutorial culture significantly boosted demand for varied decorative toppings.

Food Manufacturers used decorations for product innovation and visual differentiation. Their adoption extended across large bakery lines, confectionery items, snack bars, and dessert mixes. Higher production volumes prompted consistent procurement of sprinkles, inclusions, and sanding sugars for standardized industrial applications.

The Foodservice Industry incorporated decorations for plated desserts, pastries, and specialty beverages. Restaurants, cafés, and quick-service chains relied on decorative elements to enhance visual appeal and customer experience, reinforcing the role of toppings in menu innovation.

Key Market Segments

By Type

- Jimmies

- Quins

- Dragees

- Nonpareils

- Caramel Inclusions

- Sanding and Course Sugar

- Single Pieces

By Colorant

- Artificial

- Natural

By Application

- Cereals and Snack Bars

- Ice-creams and Frozen Desserts

- Chocolates and Confectionery Products

- Cakes and Pastries

- Others

By End User

- Home Bakers

- Food Manufacturers

- Foodservice Industry

Emerging Trends

Social Media Influence Accelerates Decorative Innovation Trends

Digital platforms such as Instagram and TikTok significantly shape buying behavior in the dessert and bakery category. Visually striking cakes, donuts, and pastries encourage consumers to replicate similar designs, increasing demand for stylish sugar decorations.

- The FAO, world sugar-crop production rose by 122 million tonnes, driven mainly by sugarcane supply growth. This gives manufacturers enough raw material flexibility to innovate with natural sweeteners, fruit-based colors, and plant-derived coatings.

Influencers and home-baking creators play a major role in promoting decorative ideas. Their content drives impulse purchases and introduces consumers to new product formats. This ecosystem strengthens market visibility. The rise of premium dessert cafés also contributes to trending factors.

Drivers

Rising Demand for Cake and Dessert Customization Drives Market Growth

Growing interest in personalized cakes, pastries, and festive desserts strongly boosts demand for sugar decorations and inclusions. Consumers prefer visually appealing bakery items, encouraging manufacturers to launch innovative shapes, colors, and textures. This shift supports stable growth across retail and foodservice channels.

- The rise of home-baking culture, fueled by social media inspiration, continues pushing demand upward. According to the USDA Economic Research Service, U.S. consumers had access to 123.5 pounds of caloric sweeteners per person. Food manufacturers increasingly rely on decorative sugar elements to improve product visibility and shelf appeal.

These inclusions help brands differentiate in a crowded market, especially in seasonal and limited-edition launches. The expansion of premium bakery chains also supports the market. Many professional bakers prioritize high-quality decorations to enhance product value. Growing retail promotions during festive seasons amplify this demand.

Restraints

Rising Raw Material Costs Limit Market Expansion

Volatility in sugar prices creates consistent challenges for producers of decorative inclusions. Since sugar acts as a primary ingredient, rising input costs directly reduce manufacturing margins and restrict large-scale expansion. Colorants, stabilizers, and specialty coatings also face fluctuating prices due to global supply chain disruptions.

- This instability forces companies to adjust production cycles and pricing strategies, affecting long-term planning. The International Cocoa Organization (ICCO) estimated global chocolate confectionery sales volume at 7.6 million tonnes, up from 7.5 million tonnes. More chocolate treats mean more sprinkles, sugar pearls, and inclusions added for visual appeal and texture.

Small bakeries and home bakers often react quickly to price changes, reducing purchases of premium decorative items during inflationary periods. This sensitivity slows overall market momentum in cost-pressured environments. Regulatory scrutiny on artificial colors and additives further restrains the segment. Manufacturers must reformulate products to meet evolving safety guidelines, increasing production complexity.

Growth Factors

Growing Shift Toward Natural and Clean-Label Decorations Creates New Opportunities

Increasing consumer preference for natural ingredients opens fresh opportunities for manufacturers producing clean-label sugar decorations. Natural colors derived from fruits, vegetables, and plants are gaining strong acceptance across bakery and confectionery applications.

Food brands are reformulating products to remove synthetic additives. This transition encourages suppliers to innovate with plant-based colorants and minimally processed sugar inclusions. As clean-label demand rises globally, new product launches continue expanding.

Premium bakery chains and artisanal dessert creators actively seek unique, naturally sourced textures and toppings. This trend supports higher-value offerings within the market, improving profitability for suppliers with strong R&D capabilities. Growth in vegan, organic, and allergen-free desserts also creates additional market space.

Regional Analysis

Europe Dominates the Sugar Decorations and Inclusions Market with a Market Share of 37.5%, Valued at USD 0.7 Billion

Europe holds the leading position in the Sugar Decorations and Inclusions Market due to its strong bakery culture, high consumption of premium confectionery, and rapid innovation in decorative ingredients. The region’s dominance at 37.5% and valuation of USD 0.7 billion is supported by increasing demand for artisan pastries, festive bakery themes, and clean-label decorative formats.

North America demonstrates steady growth driven by rising consumption of ready-to-eat cakes, cupcakes, and confectionery products across retail and QSR channels. Consumers increasingly prefer visually appealing, themed bakery items, boosting demand for sprinkles, dragees, and flavored inclusions. Strong penetration of home-baking culture and festive-season product launches further contribute to market expansion.

Asia Pacific is emerging as one of the fastest-growing regions, fueled by expanding bakery chains, growing café culture, and Western-style dessert adoption. Rising disposable incomes and rapid urbanization enhance consumer spending on premium bakery items. The region is witnessing increased use of colorful inclusions, chocolate toppings, and decorative sugar products in modern retail and foodservice outlets.

The U.S. shows strong adoption driven by large-scale industrial bakery operations, home-baking trends, and heightened demand for themed confectionery. Seasonal launches, customized dessert formats, and rising interest in natural-color sugar decorations support market growth. The country also benefits from robust innovation in texture, color stability, and clean-label decorative solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dr. Oetker continues to anchor the Sugar Decorations and Inclusions Market with its deep penetration in retail baking and foodservice channels. The company leverages strong brand trust, wide flavour portfolios, and innovative seasonal themes to keep home bakers and industrial clients engaged. Its growing focus on cleaner labels and premium decorations positions it well as consumers trade up to more visually appealing desserts.

Kerry Inc. brings a solutions-driven approach, integrating sugar decorations into broader taste, texture, and nutrition systems for global food manufacturers. Its scale in ingredients, R&D centres, and co-creation with bakery and cereal brands allows rapid customisation across formats and colourants. By aligning inclusions with health-forward and sustainability narratives, Kerry strengthens its strategic supplier status with multinational customers.

Barry Callebaut uses its leadership in chocolate and compound coatings to expand value-added decorations and inclusions for confectionery and bakery customers. The firm focuses on premium textures, colour innovations, and indulgent flavour pairings that help brands differentiate in crowded retail shelves. Its ability to integrate decorations into turnkey chocolate solutions makes it a preferred innovation partner for global confectionery launches.

Pecan Deluxe Candy Company operates as a specialist in customised inclusions, serving ice cream, QSR, and bakery brands with tailored pieces and textures. Its agility in small-batch innovation and willingness to co-develop concepts give it a competitive edge with fast-moving customers. By balancing indulgent profiles with portion control and cost efficiency, the company remains well-positioned in private label and co-manufacturing channels.

Top Key Players in the Market

- Dr. Oetker

- Kerrry Inc.

- Barry Callebaut

- Pecan Deluxe Candy Company

- Signature Brands LLC

- Hanns G. Werner GMBH + Co.KG

- Carroll Industries NZ Ltd.

- Paulaur

- The Baker’s Kitchen

- Xiamen Yasin Industry and Trade Co, Ltd.

Recent Developments

- In 2025, Dr. Oetker introduced Giant Sprinkles, designed to add vibrant, oversized color to celebration cakes and cupcakes, emphasizing ease of use for home bakers. The company launched Birthday Toppers and Birthday Candles, aimed at creating memorable, customizable baked goods with minimal effort.

- In 2024, Kerry released its 2025 Food and Beverage Taste Trends report, highlighting opportunities in bakery products with added fiber or protein for longer shelf life, alongside confectionery flavors like caramel, chocolate orange, and chili chocolate, directly relevant to flavored inclusions and toppings.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 3.7 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Jimmies, Quins, Dragees, Nonpareils, Caramel Inclusions, Sanding and Course Sugar, Single Pieces), By Colorant (Artificial, Natural), By Application (Cereals and Snack Bars, Ice-creams and Frozen Desserts, Chocolates and Confectionery Products, Cakes and Pastries, Others), By End User (Home Bakers, Food Manufacturers, Foodservice Industry) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Dr. Oetker, Kerrry Inc., Barry Callebaut, Pecan Deluxe Candy Company, Signature Brands LLC, Hanns G. Werner GMBH + Co.KG, Carroll Industries NZ Ltd., Paulaur, The Baker’s Kitchen, Xiamen Yasin Industry and Trade Co, Ltd. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Sugar Decorations and Inclusions MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Sugar Decorations and Inclusions MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Dr. Oetker

- Kerrry Inc.

- Barry Callebaut

- Pecan Deluxe Candy Company

- Signature Brands LLC

- Hanns G. Werner GMBH + Co.KG

- Carroll Industries NZ Ltd.

- Paulaur

- The Baker's Kitchen

- Xiamen Yasin Industry and Trade Co, Ltd.