Global Subsea Manifolds Market Size, Share Report By Type (Template Manifold, Cluster Manifold, Pipeline End Manifold (PLEM)), By Application (Production, Injection), By Water Depth (Deep Water, Shallow Water) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154744

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

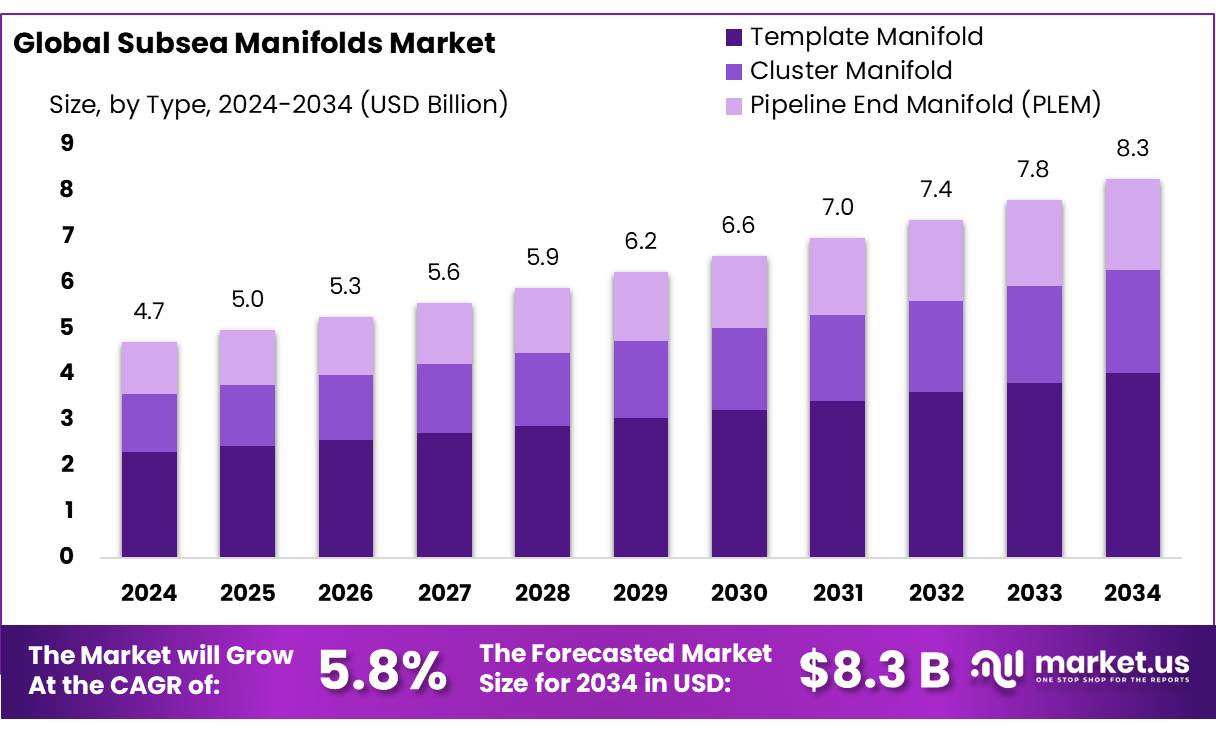

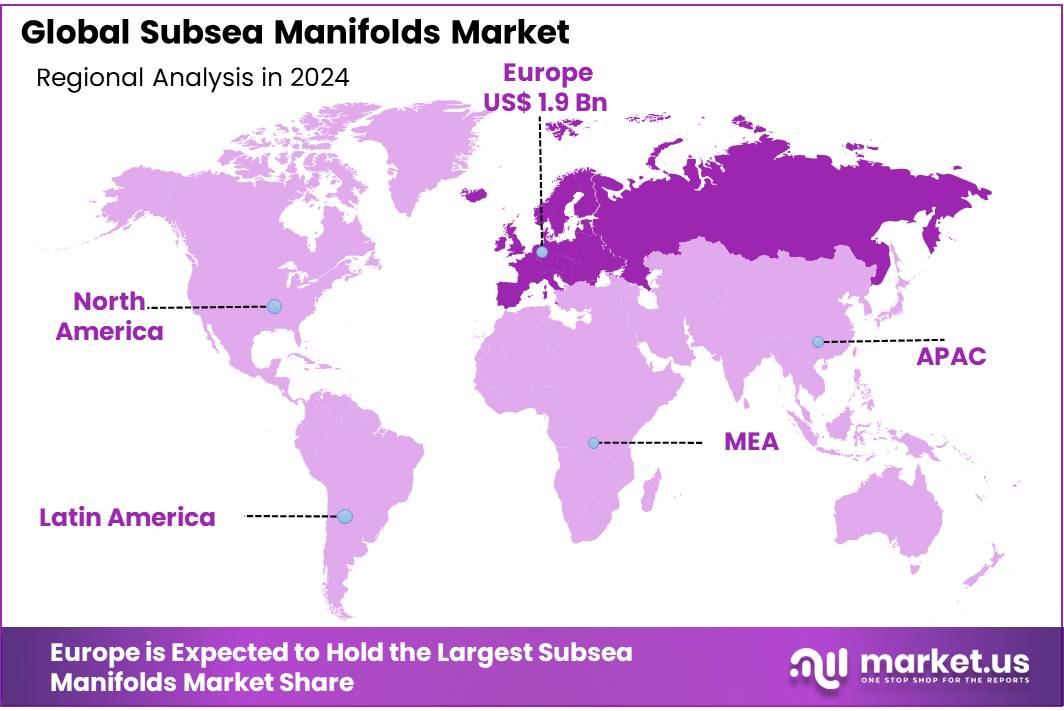

The Global Subsea Manifolds Market size is expected to be worth around USD 8.3 Billion by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 41.8% share, holding USD 1.9 Billion in revenue.

Subsea manifolds are critical subsea infrastructure enabling fluid routing between multiple wells and production pipelines. These engineered structures serve both production and injection functions in deepwater oil and gas fields and are increasingly deployed in ultra‑deepwater operations. Their flexibility in combining inputs from multiple wells enhances reservoir utilisation and reduces surface facility requirements.

Government policies have also stimulated sector growth. In India, for instance, the New Exploration Licensing Policy (NELP) has enabled private and multinational participation in frontier basin exploration, addressing under‑explored sedimentary areas and aiming to reduce import dependency on petroleum by supporting domestic exploration efforts. The government has targeted reduction of oil import dependency below 80% by 2030, necessitating increased deepwater offshore development.

Government regulations and safety mandates also play a role. The U.S. Bureau of Safety and Environmental Enforcement (BSEE) has introduced new rules for ultra‑high pressure, high‑temperature deepwater drilling, requiring rigorous equipment standards and third‑party reviews for projects above 15,000 PSI or 350 °F, directly impacting design criteria for advanced subsea manifolds.

Further, Indian onshore fabrication achievements such as the KG‑DWN Cluster II U‑Field gas manifold, installed at ~1,400 m depth, reflect national self‑reliance efforts under the “Aatmanirbhar Bharat” initiative. In addition, European initiatives such as the North Seas Energy Cooperation target 260 GW of offshore wind capacity by 2050, which will necessitate robust subsea connections and infrastructure within the energy grid.

In the UK, data from the North Sea’s offshore landscape show that 1500 oil wells are expected to be decommissioned between 2026 and 2030, prompting regulatory and safety-focused platforms like OSPAR 98/3 regarding removal of offshore installations; this necessitates new subsea infrastructure planning and decommissioning strategies estimated to cost £19 billion by 2030, rising to £23 billion by 2040.

According to federal energy data, U.S. federal offshore oil and gas production in the Gulf of Mexico accounted for approximately 15 % of total U.S. crude oil production and around 2 % of dry natural gas output in 2022. Projections by the U.S. Energy Information Administration (EIA) anticipate this contribution will remain near 13 % of U.S. crude output in 2025 and 2026, with average natural gas output in Gulf offshore areas approximated at 1.72 Bcf per day in 2025 and 1.64 Bcf per day in 2026. These offshore volumes highlight ongoing demand for subsea facilities such as manifolds, especially in tie‑back and expansion projects.

Key Takeaways

- Subsea Manifolds Market size is expected to be worth around USD 8.3 Billion by 2034, from USD 4.7 Billion in 2024, growing at a CAGR of 5.8%.

- Template Manifold held a dominant market position, capturing more than a 48.9% share of the subsea manifolds market.

- Production held a dominant market position, capturing more than a 72.3% share of the subsea manifolds market.

- Deep Water held a dominant market position, capturing more than a 67.8% share of the subsea manifolds market.

- Europe emerged as a dominant region in the subsea manifolds market, accounting for 41.8% of global demand, equivalent to approximately USD 1.9 billion.

By Type Analysis

Template Manifold dominates with 48.9% share thanks to robust design and reliable performance

In 2024, Template Manifold held a dominant market position, capturing more than a 48.9% share of the subsea manifolds market. These templates are highly favored for their robust layout and modular design, which allows multiple well connections and simplifies subsea operations. They are especially popular in mature offshore fields and deepwater projects where stability and ease of intervention are critical.

The share held by this type reflects strong confidence from operators in its flexibility, as template manifolds streamline installation and maintenance. In 2025, demand for template designs is expected to remain high as companies focus on deepwater reservoir development and cost-efficient subsea infrastructure, reinforcing the template’s leading role in the market.

By Application Analysis

Production subsea manifolds lead with 72.3% share as they support core oil and gas extraction

In 2024, Production held a dominant market position, capturing more than a 72.3% share of the subsea manifolds market. This high share reflects the essential role of production manifolds in offshore oil and gas projects, where they manage fluid flow from subsea wells to surface facilities.

Production manifolds are preferred due to their efficient design, which supports multiple wells and flexible flow control under high‑pressure conditions. Operators rely on this solution to optimize reservoir output and ensure safe, continuous extraction. In 2025, continued development of offshore fields and increased deepwater activity are expected to sustain demand for production manifolds, reinforcing their leadership in the overall subsea infrastructure market.

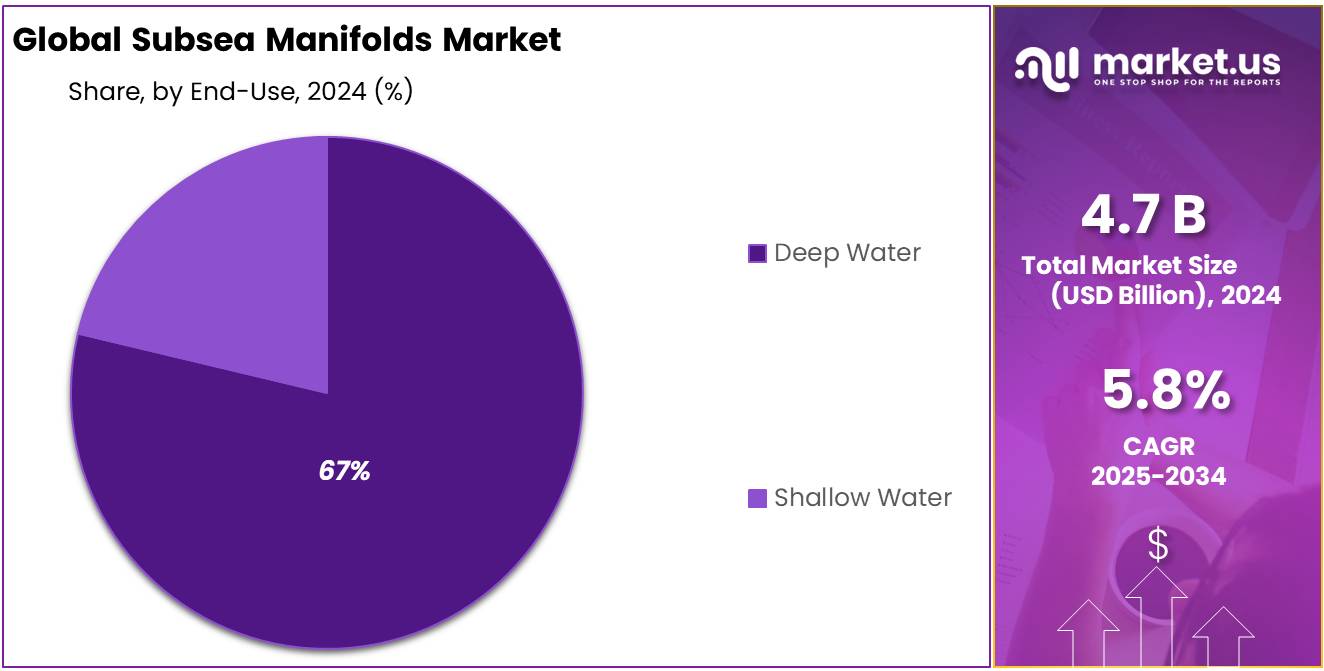

By Water Depth Analysis

Deep Water subsea manifolds dominate with 67.8% share because they meet complex offshore needs

In 2024, Deep Water held a dominant market position, capturing more than a 67.8% share of the subsea manifolds market. The large share demonstrates how deepwater installations—typically at depths beyond 500 meters—are driving demand for high-specification subsea infrastructure. These systems must withstand high pressure, intense corrosion, and complex well architectures, making deepwater manifolds the go-to choice for offshore oil and gas operators.

Their robust design accommodates multi-well tie-ins and dynamic flow control, supporting efficient extraction in challenging undersea environments. Looking into 2025, expansion of offshore projects in regions like West Africa, Brazil, and the Gulf of Mexico is expected to sustain the dominance of deepwater subsea manifolds, reinforcing their central position in the market.

Key Market Segments

By Type

- Template Manifold

- Cluster Manifold

- Pipeline End Manifold (PLEM)

By Application

- Production

- Injection

By Water Depth

- Deep Water

- Shallow Water

Emerging Trends

Integration of Digital Twin Technology for Predictive Maintenance

A significant advancement in subsea manifold technology is the adoption of digital twin systems, which create virtual replicas of physical subsea assets to monitor their real-time performance and predict maintenance needs. This innovation is transforming how offshore oil and gas operations manage equipment reliability and operational efficiency.

Digital twins enable operators to simulate and analyze the behavior of subsea manifolds under various conditions without physical intervention. By integrating sensors and real-time data analytics, these virtual models provide insights into potential issues before they lead to equipment failure. For instance, a study on floating offshore wind turbines demonstrated that diagnostic digital twins could detect anomalies hours before actual failures, allowing for timely interventions and reducing downtime .

The implementation of digital twin technology aligns with the industry’s push towards automation and remote monitoring, which are crucial for operations in challenging offshore environments. By leveraging these digital models, companies can optimize maintenance schedules, extend the lifespan of subsea manifolds, and enhance overall safety.

This trend is supported by industry leaders and governmental initiatives. For example, Subsea7’s 2024 annual report highlights their commitment to integrating digital solutions to improve the efficiency and sustainability of offshore energy projects . Additionally, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) has introduced new regulations for offshore oil drillers utilizing advanced technology to operate at extreme depths and pressures, emphasizing the importance of safety and innovation in subsea operations.

Drivers

Increased Demand for Offshore Oil and Gas Production

Subsea manifolds are integral to offshore oil and gas production, connecting multiple subsea wells to surface facilities and ensuring the smooth flow of hydrocarbons. One of the primary drivers of the growth in this market is the ever-increasing demand for energy, particularly from offshore oil and gas fields. As countries strive to meet energy needs, exploration and extraction in deep-water offshore reserves have become more critical. Subsea manifolds play a key role in making these operations efficient and cost-effective.

The offshore oil and gas sector has seen a steady rise in investments. For instance, global oil production from offshore fields is projected to account for 30% of the world’s total oil production by 2040, according to the International Energy Agency (IEA). The deep-water and ultra-deep-water exploration areas, where subsea manifolds are most commonly deployed, are expected to contribute significantly to this growing production. Offshore fields are attractive because they contain substantial reserves of untapped oil and gas that can be difficult or impossible to extract from land-based sources.

Another major factor driving the need for subsea manifolds is the shift toward more cost-efficient and environmentally friendly energy production methods. The implementation of advanced subsea technology, such as manifolds, reduces the need for extensive surface infrastructure, minimizes environmental impact, and helps in maintaining long-term sustainability. Subsea manifolds are essential in enabling the remote operation of subsea wells, reducing the need for costly interventions, and improving operational safety.

In terms of financials, large-scale projects such as ExxonMobil’s $10 billion investment in offshore oil projects in Guyana demonstrate the critical role that subsea manifolds play. The oil giant’s offshore developments rely heavily on subsea production systems, where manifolds are crucial for the effective operation of wells. Similarly, companies like Shell, BP, and Equinor have made significant strides in offshore fields, incorporating advanced subsea manifolds as part of their infrastructure.

Restraints

High Initial Investment and Maintenance Costs

One of the primary challenges faced by the subsea manifold market is the significant capital required for initial investment and ongoing maintenance. The installation of subsea manifolds involves high upfront costs, which can be a major barrier, particularly for smaller companies or projects with limited budgets. The technology and materials required for subsea manifolds must withstand harsh underwater conditions, which makes them more expensive to design, manufacture, and deploy compared to traditional onshore infrastructure.

The initial cost of subsea production systems can range from tens of millions to hundreds of millions of dollars, depending on the complexity of the project. For example, a single subsea manifold can cost between $10 million and $30 million, while larger systems can exceed these figures. On top of that, the installation involves complex engineering, specialized equipment, and experienced personnel. In deep-water or ultra-deep-water fields, the costs can increase significantly due to the technical challenges posed by operating at great depths and pressures. These factors together make the overall expenditure for subsea manifold systems extremely high.

Moreover, subsea systems require regular maintenance and repairs to ensure optimal performance. The remote location of many offshore fields, often miles from shore, adds to the difficulty and expense of maintenance. For example, the cost of mobilizing vessels and underwater robots for inspections or repairs can be significant. According to reports from the International Association of Oil and Gas Producers (IOGP), maintenance costs for offshore fields can account for up to 20% of total operational expenses. These additional ongoing costs are a considerable challenge for operators, especially when oil prices fluctuate and budgets are constrained.

Governments have also introduced regulations that further heighten the financial burden. For instance, the U.S. government’s regulations for offshore oil and gas operations require companies to implement stricter safety and environmental protection measures, which can raise costs. While these regulations are necessary for safety and sustainability, they contribute to the overall expense of subsea systems.

Opportunity

Government Support and Technological Advancements Driving Subsea Manifold Growth

Governments worldwide are recognizing the strategic importance of offshore energy resources and are implementing policies to encourage exploration and development. For instance, in the United States, the Bureau of Ocean Energy Management (BOEM) has been actively leasing offshore areas in the Gulf of Mexico, facilitating the expansion of subsea infrastructure. In Brazil, the government has been offering incentives for deepwater exploration, leading to increased investments in subsea technologies. Similarly, in the United Kingdom, the government has been supporting offshore wind projects, which often require subsea manifolds for energy transmission.

Technological innovations are playing a crucial role in the growth of the subsea manifolds market. The development of high-pressure subsea equipment has enabled the exploitation of previously inaccessible deepwater reserves.

For example, Chevron’s Anchor project in the Gulf of Mexico utilizes subsea equipment capable of withstanding pressures up to 20,000 psi, marking a significant milestone in deepwater oil production. Moreover, advancements in subsea processing technologies are enhancing the efficiency and reliability of subsea manifolds. The integration of digital technologies, such as the Subsea Internet of Things (SIoT), is enabling real-time monitoring and predictive maintenance, thereby reducing operational costs and downtime.

The combination of supportive government policies and technological advancements is creating a conducive environment for the growth of the subsea manifolds market. With increasing investments in offshore exploration and the continuous development of subsea technologies, the market is poised for sustained growth in the coming years.

Regional Insights

Europe leads with 41.8% share, generating USD 1.9 billion in 2024 thanks to mature offshore infrastructure

In 2024, Europe emerged as a dominant region in the subsea manifolds market, accounting for 41.8% of global demand, equivalent to approximately USD 1.9 billion in revenues. This strong position reflects the region’s extensive legacy of offshore oil and gas production, particularly in the North Sea, where numerous mature fields continue to require advanced subsea infrastructure. Operators in the UK, Norway, Germany, and Netherlands rely heavily on subsea manifolds to optimize production from multiple wells, manage complex well interconnections, and maximize recovery from aging reservoirs.

In addition, the emphasis on safety, regulatory compliance, and environmental standards across Europe has pushed demand toward high‑quality, robust manifold systems. By 2025, strong orderbook momentum for North Sea redevelopment and brownfield upgrade projects is expected to sustain Europe’s commanding share. Continued focus on deepwater exploration, decommissioning support, and technical innovation—such as steel weight reduction and flow management automation—will reinforce Europe’s status as a region of strategic importance in the subsea manifold market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

As a market research analyst, it is observed that TechnipFMC’s subsea division generated approximately USD 8.4 billion to 8.8 billion in revenue in 2024, reflecting strong execution in offshore delivery and a modest rise from prior outlooks. The adjusted EBITDA margin is projected at 19–20%, highlighting disciplined cost control and improved profitability in subsea offerings. TechnipFMC maintains a robust global presence and backlog, underpinned by demand in deepwater developments and template manifold deployments across markets.

In 2024, Aker Solutions achieved revenue of NOK 53.2 billion (about USD 5.0 billion) and an EBITDA of NOK 4.6 billion, with a margin of 8.7%. Order intake was NOK 40.1 billion, close to book‑to‑bill of 0.8x, and backlog stood at NOK 60.9 billion by year-end. The firm’s strength in OneSubsea joint-venture and subsea tree and manifold solutions supports its continued leadership in European deepwater campaigns.

As a market research analyst, it is noted that Baker Hughes posted full‑year operating income of USD 3.081 billion and net income of USD 3.008 billion in 2024, demonstrating strong profitability across its energy technology offerings, which include subsea equipment and manifold systems. Its footprint spans over 120 countries, enabling wide support for offshore projects and equipment deployments. Continued investment in subsea flow-control technologies positions Baker Hughes as a core player in offshore infrastructure.

In 2024, the integrated SLB / OneSubsea subsea business achieved USD 1.93 billion in revenue from its acquired Aker subsea operations, while the broader SLB group reported USD 36.29 billion in total revenue and USD 4.46 billion in net income, after acquisition integration. SLB’s involvement in manifold systems, control systems, and integrated production packages under OneSubsea supports its leadership in delivering complex subsea infrastructure, particularly in deepwater regions.

Top Key Players Outlook

- Technip

- Aker Solutions

- Baker Hughes Company

- SLB

- Subsea7

- Halliburton Company

- Weatherford

- NOV

- Jotne Group

Recent Industry Developments

In 2024, TechnipFMC’s Subsea division generated USD 7,819.9 million in revenue, marking a 21.5% increase over the USD 6,434.8 million recorded in 2023.

In 2024, Baker Hughes reported full‑year operating income of USD 3.081 billion and total net income of USD 3.008 billion, reflecting solid performance across its business segments.

Report Scope

Report Features Description Market Value (2024) USD 4.7 Bn Forecast Revenue (2034) USD 8.3 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Template Manifold, Cluster Manifold, Pipeline End Manifold (PLEM)), By Application (Production, Injection), By Water Depth (Deep Water, Shallow Water) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Technip, Aker Solutions, Baker Hughes Company, SLB, Subsea7, Halliburton Company, Weatherford, NOV, Jotne Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Technip

- Aker Solutions

- Baker Hughes Company

- SLB

- Subsea7

- Halliburton Company

- Weatherford

- NOV

- Jotne Group