Global Structural Steel Fabrication Market Size, Share, Growth Analysis Service (Metal Welding, Metal Forming, Metal Cutting, Metal Shearing, Metal Folding, Metal Rolling, Others), End Use Industry (Construction, Automotive, Manufacturing, Energy & Power, Electronics, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176855

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

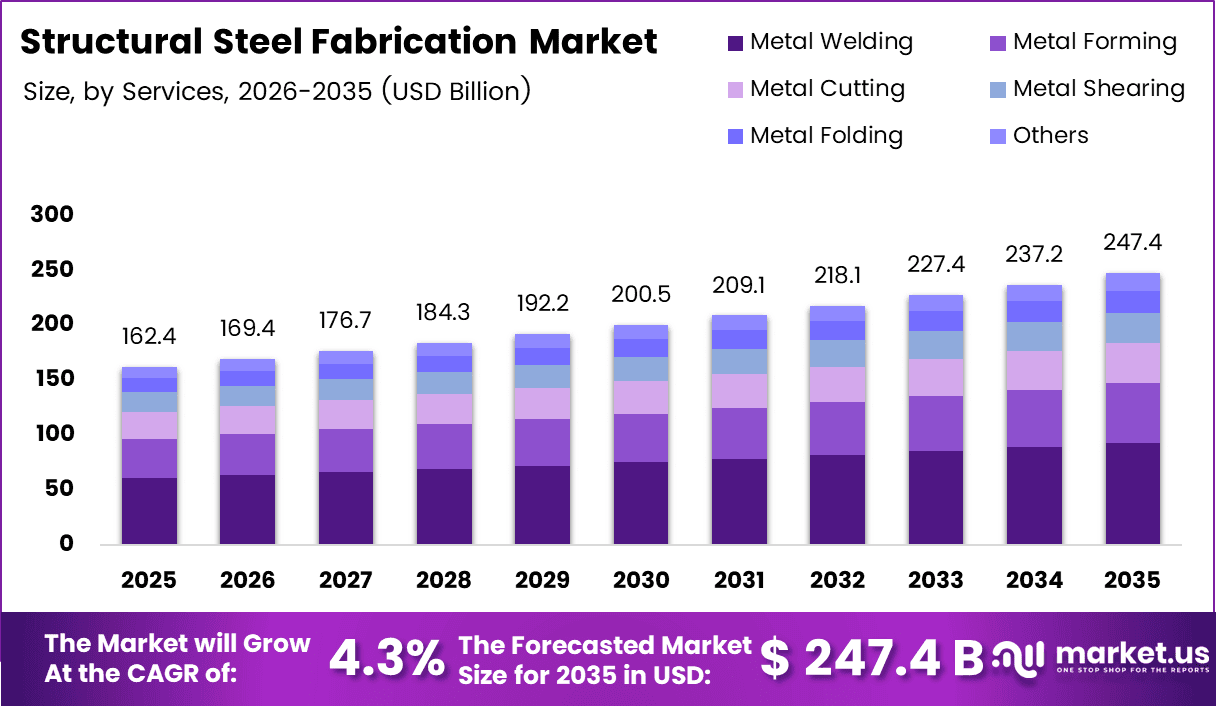

Global Structural Steel Fabrication Market size is expected to be worth around USD 247.4 Billion by 2035 from USD 162.4 Billion in 2025, growing at a CAGR of 4.3% during the forecast period 2026 to 2035.

Structural steel fabrication involves cutting, bending, welding, and assembling steel components to create frameworks for buildings, bridges, and industrial structures. This process transforms raw Stainless steel into load-bearing elements that form the skeleton of construction projects. Moreover, it encompasses various techniques including metal forming, shearing, and rolling.

The market serves critical infrastructure needs across construction, automotive, and energy sectors. Fabricated steel provides superior strength-to-weight ratios compared to traditional building materials. Additionally, prefabricated components enable faster project completion and reduced on-site labor requirements. Consequently, demand continues rising for engineered steel solutions in commercial and industrial applications.

Growth opportunities emerge from urbanization and infrastructure modernization initiatives worldwide. Governments increasingly invest in transportation networks, renewable energy facilities, and smart city developments. Furthermore, the shift toward modular construction methodologies accelerates adoption of prefabricated structural steel systems. Therefore, specialized fabrication service providers experience expanding market opportunities.

Technological advancements reshape fabrication capabilities through automation and digital integration. Building Information Modeling enables precise component manufacturing and streamlined project coordination. However, manufacturers face challenges from volatile raw material pricing and substantial equipment investment requirements. Nevertheless, industry adoption of high-strength lightweight steel grades enhances structural performance.

According to Yena Engineering, manufacturing steel contains carbon content ranging from 0.20 to 0.60%, with common grades including SAE 1030, SAE 1040, and C30. These specifications ensure optimal structural integrity for diverse applications. Additionally, sulfur-added steels like C30R contain 0.020 to 0.035% sulfur for enhanced machinability.

The construction segment dominates market demand due to extensive requirements for commercial buildings and infrastructure projects. Asia Pacific leads regional growth supported by rapid industrialization and urban expansion. Moreover, renewable energy installations increasingly utilize structural steel for wind turbines and solar panel frameworks. Consequently, the market trajectory remains positive throughout the forecast period.

Sustainability considerations drive preference for recyclable steel solutions and environmentally responsible fabrication processes. Digital transformation through robotics and automated welding systems improves production efficiency and quality consistency. Furthermore, outsourcing trends enable construction firms to access specialized fabrication expertise. Therefore, the market presents substantial opportunities for established manufacturers and emerging service providers.

Key Takeaways

- The global Structural Steel Fabrication Market is projected to reach USD 247.4 Billion by 2035, growing at a CAGR of 4.3% from 2025 to 2035

- Metal Welding service segment dominates with 37.5% market share in 2025

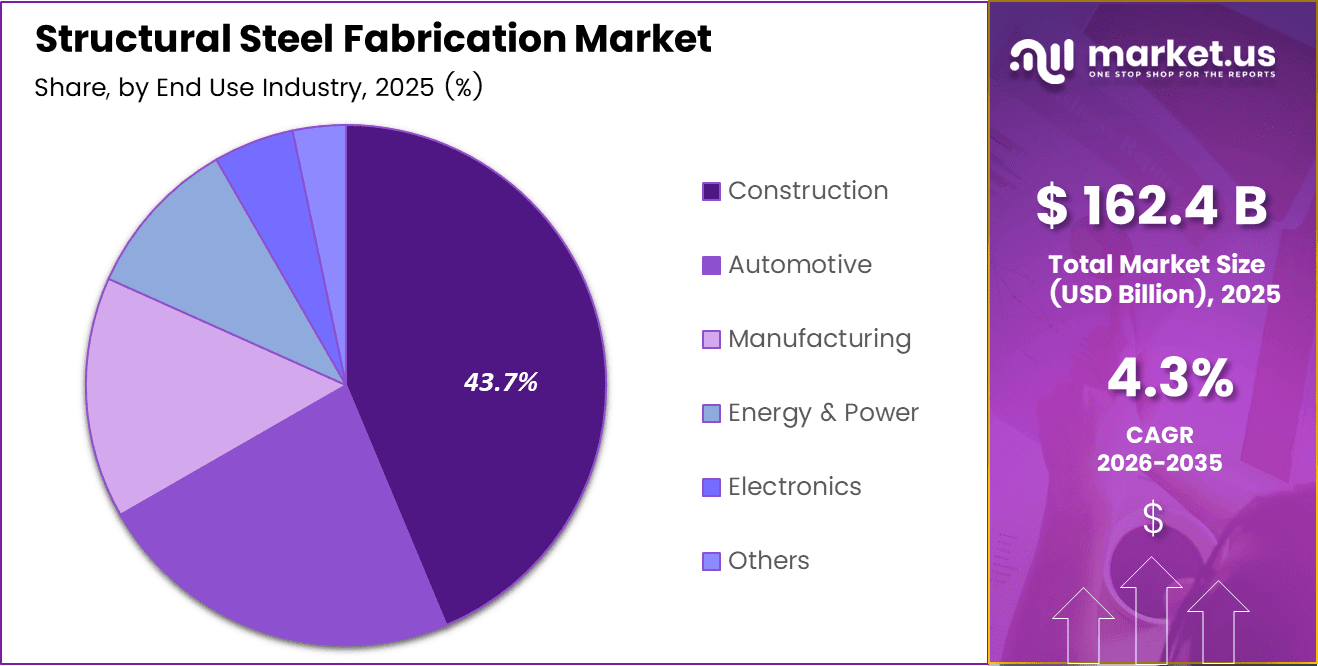

- Construction end-use industry leads with 43.7% market share in 2025

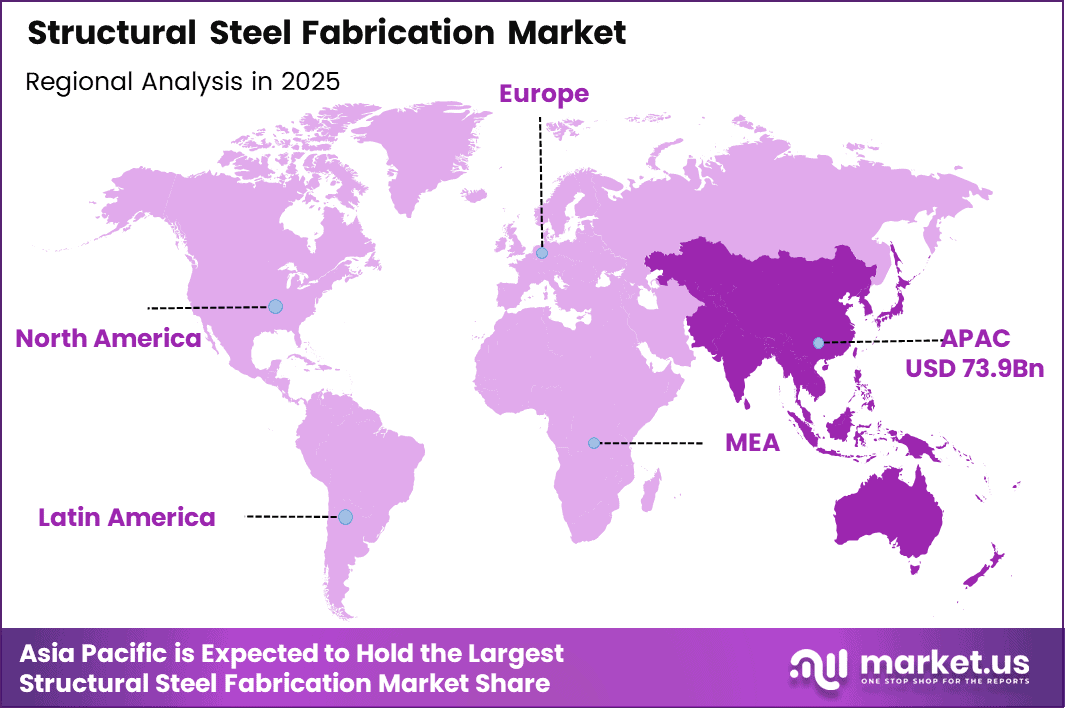

- Asia Pacific region holds dominant position with 45.5% market share, valued at USD 73.9 Billion

- Market valued at USD 162.4 Billion in 2025 with steady growth expected through 2035

Service Analysis

Metal Welding dominates with 37.5% due to its critical role in joining structural components and ensuring structural integrity.

In 2025, Metal Welding held a dominant market position in the Service segment of Structural Steel Fabrication Market, with a 37.5% share. This service remains essential for creating permanent joints between steel members in construction and industrial applications. Advanced welding technologies improve joint strength and reduce production time significantly. Consequently, metal welding maintains its leadership position across all fabrication services.

Metal Forming services shape steel into desired configurations through pressing, stamping, and molding processes. These techniques enable creation of complex geometrical components for architectural and engineering applications. Moreover, precision forming ensures dimensional accuracy required for modern construction projects. Therefore, this segment experiences steady demand across manufacturing and construction industries globally.

Metal Cutting operations utilize laser, plasma, and waterjet technologies to achieve precise steel component dimensions. Automated cutting systems enhance production efficiency while minimizing material waste throughout fabrication processes. Additionally, computer-controlled equipment ensures consistent quality across large-scale fabrication runs. Consequently, this service segment supports various industries requiring custom steel components with tight tolerances.

Metal Shearing provides straight-line cutting capabilities for sheet metal and plate steel materials used in structural applications. This process offers cost-effective solutions for high-volume production requirements with consistent edge quality. Furthermore, modern shearing equipment handles various steel thicknesses and grades efficiently. Therefore, metal shearing remains integral to fabrication workflows for standard component production.

Metal Folding creates precise bends and angles in steel components for architectural and structural applications. Advanced press brake technology enables complex fold sequences with high repeatability and accuracy. Moreover, folding operations reduce welding requirements and improve structural aesthetics. Consequently, this service supports custom fabrication needs across construction and manufacturing sectors.

Metal Rolling forms curved and cylindrical steel sections for architectural features, tanks, and structural members. Specialized waterjet produces consistent radii and complex curvatures required for modern designs. Additionally, rolling processes maintain material integrity while achieving desired shapes. Therefore, this service addresses specific project requirements where curved steel elements enhance functionality.

Others category encompasses specialized fabrication services including surface treatment, assembly, and finishing operations. These value-added services enhance corrosion resistance, appearance, and installation readiness of fabricated components. Furthermore, integrated service offerings provide comprehensive solutions for complex projects. Consequently, supplementary services strengthen fabricator competitiveness in demanding market segments.

End Use Industry Analysis

Construction dominates with 43.7% due to extensive structural steel requirements in commercial, residential, and infrastructure projects.

In 2025, Construction held a dominant market position in the End Use Industry segment of Structural Steel Fabrication Market, with a 43.7% share. High-rise buildings, bridges, and industrial facilities require substantial quantities of fabricated structural steel components. Furthermore, prefabricated steel frameworks reduce construction timelines and labor costs significantly. Consequently, construction remains the primary demand driver for fabrication services worldwide.

Automotive industry utilizes structural steel fabrication for manufacturing assembly line equipment, vehicle frames, and production infrastructure. Precision-fabricated components ensure operational efficiency in automotive manufacturing facilities and support automated systems. Moreover, steel structures support heavy machinery and testing equipment throughout production processes. Therefore, this segment maintains consistent demand for specialized fabrication services.

Manufacturing sector requires custom steel structures for warehouses, production facilities, and material handling equipment across diverse industries. Fabricated steel provides durability and load-bearing capacity essential for industrial operations and heavy equipment installations. Additionally, modular steel systems enable rapid facility expansion and reconfiguration as business needs evolve. Consequently, manufacturing facilities increasingly adopt engineered steel solutions.

Energy & Power sector demands robust structural steel for power plants, transmission towers, and renewable energy installations. These applications require components engineered to withstand extreme loads, environmental conditions, and operational stresses. Moreover, offshore platforms and wind turbine structures utilize specialized heavy fabrication capabilities. Therefore, energy infrastructure development drives substantial fabrication demand globally.

Electronics industry employs structural steel fabrication for cleanroom facilities, equipment frames, and precision manufacturing infrastructure. These applications demand tight tolerances and contamination-free fabrication processes to meet stringent industry standards. Furthermore, modular steel systems support flexible facility layouts for evolving technology requirements. Consequently, electronics manufacturing Service drives demand for specialized fabrication services.

Others category includes diverse applications across aerospace, mining, agriculture, and defense sectors requiring custom steel fabrication. These specialized industries demand unique engineering solutions and compliance with specific regulatory standards. Additionally, emerging applications in data centers and logistics facilities expand market opportunities. Therefore, diversified end-use applications provide stable demand across economic cycles.

Key Market Segments

Service

- Metal Welding

- Metal Forming

- Metal Cutting

- Metal Shearing

- Metal Folding

- Metal Rolling

- Others

End Use Industry

- Construction

- Automotive

- Manufacturing

- Energy & Power

- Electronics

- Others

Drivers

Large-Scale Infrastructure Development Drives Market Expansion

Governments worldwide invest heavily in transportation networks, airports, and public infrastructure requiring structural steel frameworks. These mega-projects demand substantial quantities of fabricated steel components for bridges, terminals, and transit systems. Moreover, infrastructure modernization initiatives in developing economies create sustained demand. Consequently, fabrication service providers experience consistent order volumes from public sector projects.

Energy sector development fuels demand for structural steel in power generation facilities and transmission infrastructure. Renewable energy installations require specialized steel structures for wind turbines, solar farms, and hydroelectric projects. Additionally, oil and gas facilities utilize heavy fabricated components for offshore platforms and processing equipment. Therefore, energy infrastructure investments directly stimulate fabrication market growth across regions.

Commercial and industrial construction projects increasingly adopt steel framing for superior load-bearing capacity and design flexibility. Steel frameworks enable creation of large open spaces without internal columns in warehouses and retail facilities. Furthermore, prefabricated steel systems reduce construction timelines compared to traditional building methods. Consequently, architects and developers prefer structural steel solutions for modern commercial developments.

Restraints

Raw Material Price Volatility Constrains Fabrication Profitability

Steel prices fluctuate significantly based on global supply-demand dynamics, trade policies, and raw material availability. Fabricators struggle to maintain consistent profit margins when input costs vary unpredictably throughout project lifecycles. Moreover, long-term contracts with fixed pricing expose manufacturers to financial losses during price spikes. Consequently, smaller fabrication businesses face particular vulnerability to commodity market volatility.

Procurement challenges intensify when steel mills prioritize high-volume customers during supply shortages. Fabricators must maintain inventory buffers to ensure project continuity, increasing working capital requirements. Additionally, currency fluctuations in international steel purchases create additional cost uncertainties. Therefore, effective risk management strategies become essential for sustained profitability in fabrication operations.

Advanced fabrication facilities require substantial capital investment in CNC cutting equipment, automated welding systems, and material handling infrastructure. Small and medium enterprises often lack financial resources to upgrade aging equipment and adopt modern technologies. Furthermore, specialized machinery demands skilled operators and ongoing maintenance expenditures. Consequently, capital intensity creates barriers to entry and limits competitive capabilities for smaller market participants.

Growth Factors

Modular Construction Methodology Accelerates Market Adoption

Pre-engineered building systems gain popularity due to faster assembly, quality consistency, and reduced on-site labor requirements. Modular steel structures enable simultaneous site preparation and component fabrication, compressing overall project schedules. Moreover, factory-controlled manufacturing ensures superior quality standards compared to field construction. Consequently, developers increasingly specify modular steel solutions for commercial and industrial projects.

Renewable energy expansion drives structural steel demand for wind turbine towers, solar panel mounting systems, and energy storage facilities. These installations require precision-fabricated components engineered for specific environmental conditions and structural loads. Additionally, government incentives for clean energy development accelerate project pipelines requiring steel fabrication services. Therefore, the renewable sector represents significant growth opportunities throughout the forecast period.

Construction firms increasingly outsource fabrication activities to specialized manufacturers possessing advanced equipment and technical expertise. This trend allows builders to focus on core construction activities while leveraging fabricator capabilities. Furthermore, outsourcing reduces capital requirements and operational overhead for general contractors. Consequently, dedicated fabrication service providers experience expanding market opportunities as outsourcing adoption increases across construction industries globally.

Emerging Trends

Digital Technologies Transform Fabrication Operations

Building Information Modeling integration enables seamless coordination between design, fabrication, and construction phases of projects. Digital models facilitate clash detection, optimize material utilization, and improve component fit accuracy. Moreover, automated data transfer from BIM systems to fabrication equipment eliminates manual programming errors. Consequently, digital workflows enhance productivity and reduce costly rework throughout project execution.

Robotics and automation technologies revolutionize fabrication workshops through consistent weld quality and increased production throughput. Automated systems operate continuously with minimal supervision, reducing labor costs and improving safety outcomes. Additionally, robotic welding achieves superior precision compared to manual operations for complex geometries. Therefore, fabricators invest in automation to maintain competitive advantages in efficiency and quality.

Sustainability priorities drive adoption of high-strength low-alloy steels offering equivalent performance with reduced material consumption. These advanced grades enable lighter structural designs while maintaining required load capacities. Furthermore, steel’s infinite recyclability supports circular economy objectives and reduces environmental impact. Consequently, environmentally conscious specifications increasingly favor structural steel over less sustainable building materials.

Regional Analysis

Asia Pacific Dominates the Structural Steel Fabrication Market with a Market Share of 45.5%, Valued at USD 73.9 Billion

Asia Pacific leads global market growth driven by rapid urbanization, infrastructure development, and industrial expansion across China, India, and Southeast Asian nations. Government initiatives supporting smart cities and transportation networks generate substantial steel fabrication demand. Moreover, the region’s manufacturing base requires continuous expansion of production facilities utilizing structural steel frameworks. Consequently, Asia Pacific maintains dominant market position with 45.5% share valued at USD 73.9 Billion.

North America Structural Steel Fabrication Market Trends

North America demonstrates steady market growth supported by infrastructure renewal projects and commercial construction activity. Advanced fabrication capabilities and stringent quality standards characterize the regional market. Additionally, reshoring manufacturing operations drives demand for industrial facility construction. Therefore, United States and Canada maintain significant fabrication capacity serving diverse end-use industries.

Europe Structural Steel Fabrication Market Trends

Europe emphasizes sustainable construction practices and energy-efficient building designs incorporating structural steel systems. Strict environmental regulations promote recyclable materials and low-carbon fabrication processes. Moreover, renovation of aging infrastructure creates ongoing demand for steel components. Consequently, European fabricators focus on high-value specialized applications and advanced engineering solutions.

Middle East & Africa Structural Steel Fabrication Market Trends

Middle East experiences robust growth from mega-projects including commercial towers, hospitality developments, and transportation infrastructure. Oil revenues fund ambitious construction initiatives requiring extensive steel fabrication capabilities. Additionally, diversification strategies drive industrial development beyond energy sectors. Therefore, regional fabrication capacity expands to support continued economic development objectives.

Latin America Structural Steel Fabrication Market Trends

Latin America shows gradual market expansion supported by mining infrastructure, energy projects, and urban development initiatives. Economic fluctuations create periodic demand variations affecting fabrication activity levels. Nevertheless, long-term infrastructure needs ensure sustained market opportunities. Consequently, regional fabricators serve both domestic construction and export markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

O’Neal Manufacturing Service operates as a leading provider of structural steel fabrication with comprehensive capabilities across cutting, forming, and welding services. The company serves diverse industries including construction, automotive, and energy with advanced fabrication facilities. Moreover, their extensive geographic footprint enables rapid project delivery across North America. Consequently, O’Neal maintains strong market positioning through operational excellence and customer service capabilities.

BTD Manufacturing Inc. specializes in precision steel fabrication for complex industrial and commercial applications requiring stringent quality standards. Their investments in automated equipment and skilled workforce enable consistent delivery of high-tolerance components. Additionally, BTD’s engineering support services assist clients in optimizing designs for manufacturability. Therefore, the company captures premium market segments demanding superior fabrication expertise and reliability.

Kapco Metal Stamping delivers specialized metal forming and fabrication services utilizing advanced stamping technologies for automotive and industrial customers. The company’s focus on continuous improvement and lean manufacturing principles enhances operational efficiency. Furthermore, strategic capacity expansions position Kapco for sustained growth in key market segments. Consequently, their reputation for quality and innovation strengthens competitive advantages.

Mayville Engineering Company, Inc. provides comprehensive fabrication solutions combining engineering expertise with advanced manufacturing capabilities for diverse industrial applications. Their vertically integrated operations encompass design, prototyping, and full-scale production services. Moreover, Mayville’s customer-centric approach builds long-term partnerships with major manufacturing firms. Therefore, the company maintains steady revenue growth through value-added fabrication services.

Key players

- O’Neal Manufacturing Service

- BTD Manufacturing Inc.

- Kapco Metal Stamping

- Mayville Engineering Company, Inc.

- Watson Engineering Inc.

- Standard Iron

- lronform Corporation

- EVS Metal Fabrication

- LancerFab Tech Pvt. Ltd.

- Pennar Industries

- JSW Severfield Structures

- Epack Prefab

- Onshore Construction Co.

- Geodesic Techniques

- SKV Engineering India Private Limited

- Other Key Players

Recent Developments

- December 2024 – Eight Quarter Advisors announced the successful acquisition of Ozark Steel Fabricators by Dakota Holdings, strengthening Dakota’s fabrication capabilities and market presence. This strategic transaction expands service offerings and geographic coverage for structural steel solutions across multiple industries.

- January 2026 – Tri-Mach Group (TMG) completed the acquisition of Smith Steel & Fabrication, enhancing their integrated manufacturing capabilities. The acquisition enables TMG to offer comprehensive fabrication services and strengthens their position in the Canadian industrial market.

Report Scope

Report Features Description Market Value (2025) USD 162.4 Billion Forecast Revenue (2035) USD 247.4 Billion CAGR (2026-2035) 4.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Service (Metal Welding, Metal Forming, Metal Cutting, Metal Shearing, Metal Folding, Metal Rolling, Others), End Use Industry (Construction, Automotive, Manufacturing, Energy & Power, Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape O’Neal Manufacturing Service, BTD Manufacturing Inc., Kapco Metal Stamping, Mayville Engineering Company, Inc., Watson Engineering Inc., Standard Iron, lronform Corporation, EVS Metal Fabrication, LancerFab Tech Pvt. Ltd., Pennar Industries, JSW Severfield Structures, Epack Prefab, Onshore Construction Co., Geodesic Techniques, SKV Engineering India Private Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Structural Steel Fabrication MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Structural Steel Fabrication MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- O'Neal Manufacturing Service

- BTD Manufacturing Inc.

- Kapco Metal Stamping

- Mayville Engineering Company, Inc.

- Watson Engineering Inc.

- Standard Iron

- lronform Corporation

- EVS Metal Fabrication

- LancerFab Tech Pvt. Ltd.

- Pennar Industries

- JSW Severfield Structures

- Epack Prefab

- Onshore Construction Co.

- Geodesic Techniques

- SKV Engineering India Private Limited

- Other Key Players