Global Stroke Rehabilitation Market Analysis By Stroke (Ischemic Stroke, Hemorrhagic Stroke, Transient Ischemic Attack), By End-User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Long-Term Centers, Home Care Settings, Rehabilitation Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155433

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

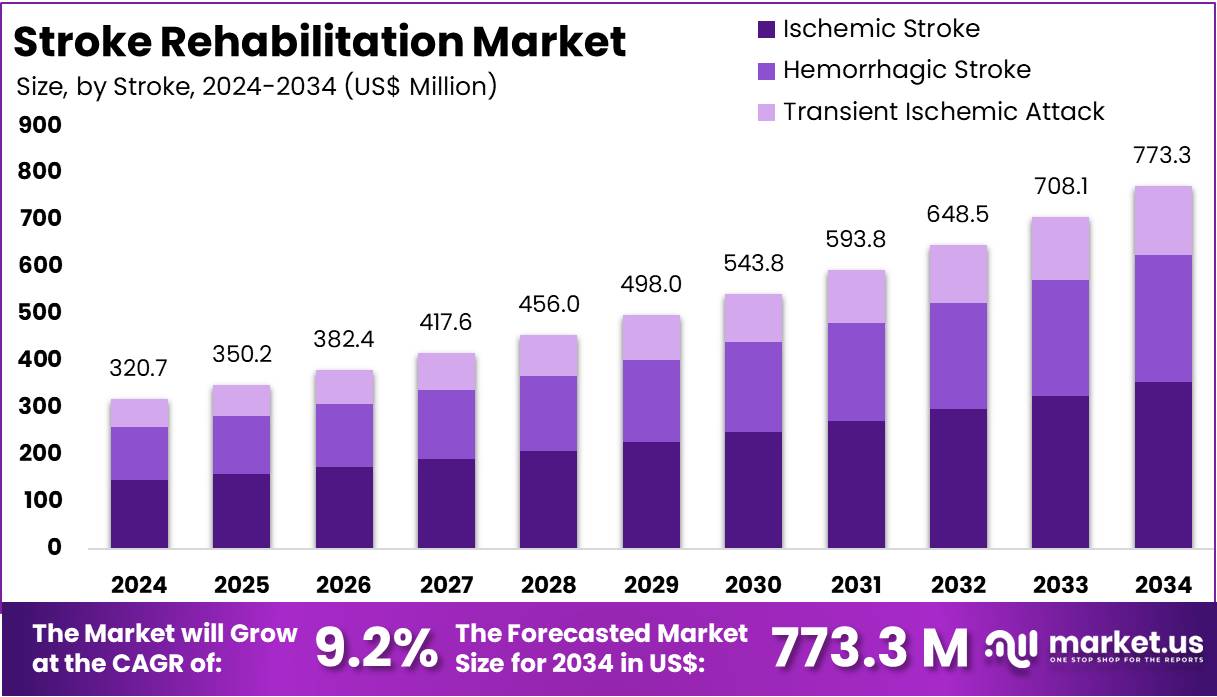

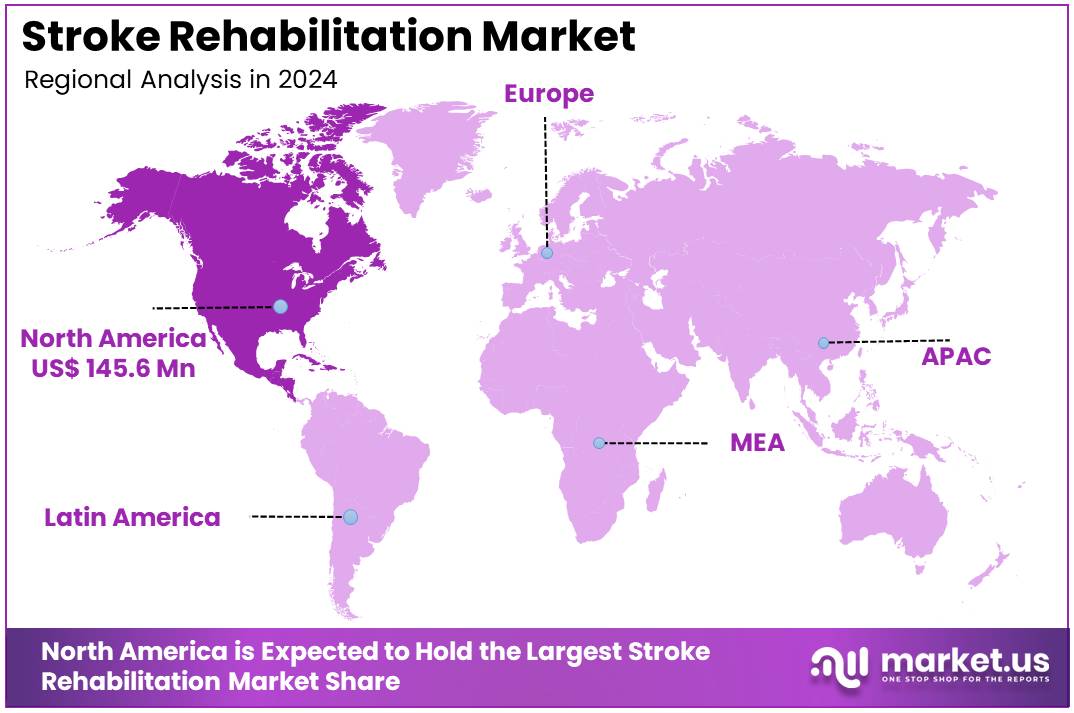

The Global Stroke Rehabilitation Market size is expected to be worth around US$ 773.3 Million by 2034, from US$ 320.7 Million in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 45.5% share and holds US$ 145.6 Million market value for the year.

Stroke rehabilitation is a patient-centered process aimed at restoring independence and improving quality of life after a stroke. According to the World Stroke Organization, 1 in 4 adults over age 25 will experience a stroke in their lifetime, making it a leading cause of disability. Rehabilitation involves physical therapy to improve mobility, occupational therapy for daily living skills, speech therapy for communication, and psychological support. Early initiation, often within days, is associated with better functional recovery and reintegration into community life.

Global demand for stroke rehabilitation is rising due to an expanding survivor population and a persistent care gap. WHO estimates that 2.4–2.6 billion people live with conditions that could benefit from rehabilitation, with over 50% of needs unmet in many low- and middle-income countries. For example, improved acute stroke care has increased survival rates, sustaining demand for multidisciplinary services. This unmet need drives investment in rehabilitation infrastructure, workforce expansion, and technology adoption.

Population ageing is a key driver of growth. A 2024 UN assessment projects that by the late 2070s, the number of people aged 65+ will reach 2.2 billion, exceeding children under 18. Stroke risk rises significantly with age, which will expand the rehabilitation caseload globally. For instance, older adults often require longer rehabilitation periods and ongoing community-based care, increasing demand for service continuity and resource allocation.

Lifestyle and health risk factors further reinforce market expansion. WHO reports 1.28–1.3 billion adults with hypertension, with 80% inadequately treated. The International Diabetes Federation notes 589 million adults with diabetes in 2024, costing US$1 trillion annually. In addition, about 16% of adults are obese and 43% overweight, according to 2022 data. These conditions increase stroke risk, creating a steady flow of patients into rehabilitation systems across all income settings.

Policy initiatives are creating structural momentum. In May 2023, the World Health Assembly adopted resolution WHA76.6 to strengthen rehabilitation within health systems. This aligns with WHO’s Rehabilitation 2030 initiative, encouraging integration at all care levels. For example, the UK’s NICE guidelines recommend early supported discharge to community teams and the use of tele-rehabilitation. In the United States, CMS reimbursement codes for Remote Therapeutic Monitoring (e.g., 98975, 98976, 98977) now enable therapists to deliver and bill for home-based device-supported rehabilitation.

Technology adoption is reshaping care models. Studies by NIH/NINDS highlight the potential of virtual reality, robotics, and high-intensity gait training to increase therapy intensity and accessibility. Evidence shows that tele-rehabilitation can achieve arm-motor recovery outcomes comparable to in-clinic therapy, making it a viable solution for remote or underserved populations. As broadband access grows and digital health reimbursement expands, the use of home-based rehabilitation platforms is expected to accelerate.

Economic and workforce factors also shape the market. The World Stroke Organization estimates the global cost of stroke at US$890 billion annually, or 0.66% of global GDP, with projections nearly doubling by 2050 without stronger recovery measures. Workforce shortages remain significant, with WHO noting fewer than 10 rehabilitation practitioners per million people in many low- and middle-income countries. This gap drives adoption of task-sharing, assistive technologies, and public-private partnerships to meet demand efficiently.

Key Takeaways

- The global stroke rehabilitation market is projected to reach US$ 773.3 million by 2034, growing from US$ 320.7 million in 2024.

- The market is expected to expand at a compound annual growth rate (CAGR) of 9.2% from 2025 to 2034, indicating sustained growth potential.

- In 2024, the ischemic stroke category led the stroke segment, accounting for more than 78.3% of the total market share.

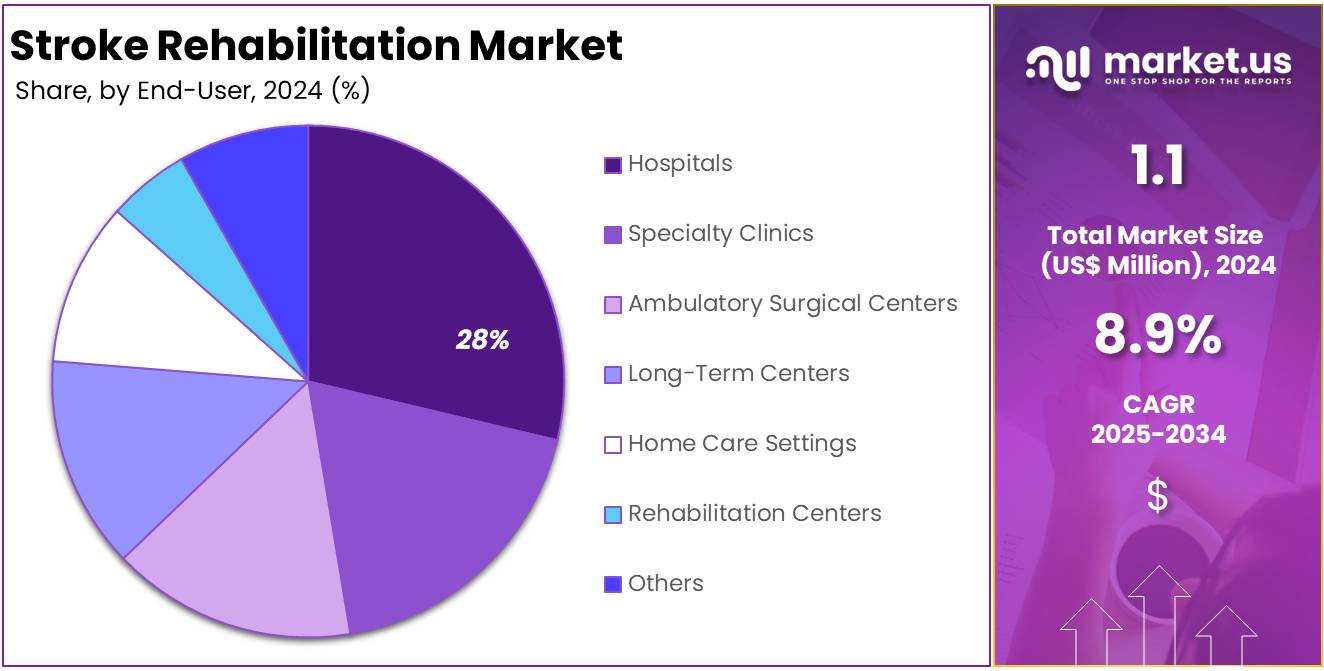

- Hospitals dominated the end-user segment in 2024, capturing over 27.4% of the stroke rehabilitation market share globally.

- North America emerged as the leading regional market in 2024, holding a 45.5% share valued at approximately US$ 145.6 million.

Stroke Analysis

In 2024, the Ischemic Stroke Section held a dominant market position in the Stroke Segment of the Stroke Rehabilitation Market, and captured more than a 78.3% share. This leadership was attributed to the higher occurrence of ischemic strokes compared to other stroke types. Such strokes result from restricted blood flow to the brain. This leads to significant physical and mental impairment. The demand for rehabilitation is high. Recovery often requires a longer time. A multidisciplinary approach to treatment is frequently necessary.

The prevalence of ischemic stroke cases has increased the need for advanced rehabilitation solutions. Therapies include physical rehabilitation, occupational assistance, and speech-language interventions. Each plays a vital role in improving patient outcomes. Continuous innovation in rehabilitation techniques supports this segment’s growth. Hospitals and specialized centers are expanding their service offerings. Increased awareness of stroke recovery has also contributed. The ischemic stroke segment is projected to maintain strong demand in the coming years.

The Hemorrhagic Stroke segment occupies a smaller market share. This condition is caused by bleeding in or around the brain. It leads to severe neurological complications. Rehabilitation in these cases is intensive and requires advanced care. Patients often need long-term inpatient treatment. Neurorehabilitation programs are critical for regaining functionality. Although less common than ischemic strokes, survival rates are improving. Rising awareness of available treatments is supporting gradual growth in this segment. Demand is expected to rise as medical facilities expand their stroke care capabilities.

The Transient Ischemic Attack (TIA) segment holds the smallest share in the stroke rehabilitation market. TIA, often called a “mini-stroke,” occurs due to a temporary blockage of blood flow to the brain. Symptoms resolve quickly, so rehabilitation needs are comparatively lower. However, such events are often a warning sign of future strokes. Preventive rehabilitation, lifestyle modification programs, and patient education are essential in this segment. Adoption is growing slowly, driven by preventive healthcare trends and improved screening programs.

End-User Analysis

In 2024, the Hospitals section held a dominant market position in the End-User segment of the Stroke Rehabilitation Market, and captured more than a 27.4% share. This position was supported by well-developed medical infrastructure and a large pool of skilled professionals. Hospitals provided immediate post-stroke treatment along with full rehabilitation services. They offered access to multidisciplinary teams that improved patient recovery rates. These facilities became the first choice for comprehensive care, particularly in severe stroke cases requiring coordinated medical and rehabilitation efforts.

Specialty clinics also maintained a notable market presence. Their strength lay in providing focused treatment plans and personalized rehabilitation programs. Many of these clinics adopted advanced physiotherapy and occupational therapy methods. The targeted approach supported faster recovery and improved patient satisfaction. Such facilities were preferred by individuals seeking specialized care for specific rehabilitation needs. Their capacity to deliver high-quality, patient-centered services contributed to their consistent growth in the overall stroke rehabilitation market.

Ambulatory surgical centers experienced steady growth during the period. These centers provided cost-effective treatment options with shorter recovery times. They offered outpatient rehabilitation services that were both convenient and accessible. Patients appreciated the flexibility and reduced hospital stay associated with these facilities. This segment attracted individuals with milder impairments who could manage their recovery without prolonged admission. The competitive pricing and efficient care delivery helped strengthen their market position among cost-conscious patients seeking quality rehabilitation services.

Long-term care centers saw increased demand from patients with severe disabilities. These facilities provided extended rehabilitation and round-the-clock nursing support. Their role was critical for stroke survivors needing continuous assistance. Home care settings also gained attention, with growing adoption of tele-rehabilitation tools and remote monitoring systems. Rehabilitation centers retained strong market relevance by focusing on holistic recovery, including cognitive and physical therapies. Other end-users, such as community health facilities, addressed needs in underserved areas, offering affordable and accessible rehabilitation solutions.

Key Market Segments

By Stroke

- Ischemic Stroke

- Hemorrhagic Stroke

- Transient Ischemic Attack

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Long-Term Centers

- Home Care Settings

- Rehabilitation Centers

- Others

Drivers

Rising Global Stroke Cases Fueling Rehabilitation Demand

According to the World Stroke Organization (2022), more than 12.2 million new strokes occur globally each year, with over 101 million people living with stroke. This scale highlights the massive and ongoing need for rehabilitation. For example, stroke remains a leading cause of death, with around 6.5 million deaths annually (GBD 2019 data). Such high incidence rates are driving sustained demand for recovery services. Healthcare systems are increasingly focusing on post-stroke care to improve outcomes and reduce long-term disability.

Aging populations are a significant factor in this trend. The United Nations’ World Population Prospects 2024 confirms that the share of people aged 65+ is rising rapidly and will accelerate through mid-century. Older adults are at higher risk of stroke due to natural health decline and chronic conditions. For instance, age-related cardiovascular diseases make stroke more likely, and survivors often require long-term rehabilitation. This demographic shift ensures that demand for stroke recovery services will keep growing worldwide.

Lifestyle-related health risks also contribute to the rising stroke burden. According to the World Health Organization (2022), about 16% of adults globally are obese and 43% are overweight, conditions linked to higher stroke risk. Hypertension, diabetes, and smoking remain prevalent and under-controlled. For example, poorly managed hypertension significantly increases the chance of stroke, adding more patients to the rehabilitation pool. These persistent risk factors sustain high incidence rates, further expanding the need for recovery programs and related healthcare services.

The rehabilitation gap remains large, especially in low- and middle-income countries. In many countries, more than 50% of those who need rehabilitation do not receive it. For example, inadequate infrastructure and specialist shortages delay recovery and worsen disability. This unmet demand creates opportunities for investment in both public and private healthcare systems to expand rehabilitation capacity. In the United States, the scale of the issue is also significant. According to the American Heart Association reports 162,890 stroke deaths in 2021. With cardiovascular disease consuming 12% of total US health expenditures, rehabilitation remains a major healthcare priority.

Restraints

High Cost and Limited Reimbursement

According to the World Stroke Organization (2022), 86% of stroke deaths and 89% of disability-adjusted life years (DALYs) occur in low- and lower-middle-income countries. This highlights the urgent need for affordable rehabilitation solutions. However, advanced rehabilitation technologies, such as robotic-assisted devices and virtual reality tools, are costly. For instance, a systematic review (2024) reported robotic systems costing around $150,000 plus annual maintenance. These high acquisition costs restrict adoption, particularly in resource-constrained settings, thereby limiting access to effective post-stroke care.

The high cost of advanced stroke rehabilitation therapies remains a critical market restraint. Study data from the U.S. (2024) show mean inpatient post-stroke costs at $40,243 and outpatient costs at $27,426, with inpatient care being the largest expense. Rehabilitation alone can cost $70,601 annually for inpatients, as per a 2022 societal-perspective analysis. Such financial intensity discourages healthcare facilities from investing in advanced systems and hinders patients’ ability to access comprehensive rehabilitation services.

Limited reimbursement policies further exacerbate the affordability challenge. For example, in many countries, insurance coverage prioritizes basic rehabilitation methods and excludes costly, technology-driven therapies. Patients often bear the full expense of advanced treatments, such as exoskeleton training costing $18.36 per session or robotic therapy courses priced at $3,952 per patient. This financial burden leads to lower utilization of innovative solutions and slows market growth in stroke rehabilitation.

Opportunities

AI and VR Integration in Stroke Rehabilitation

The integration of AI and VR in stroke recovery presents a significant commercial opportunity due to its clinical and economic impact. Studies from 2022–2024 indicate that VR-augmented therapy improves motor and functional outcomes compared to conventional therapy. AI adds predictive triage, adaptive dosing, and continuous remote monitoring, enabling scalable solutions for both clinical and home-based rehabilitation programs.

AI’s role in stroke rehabilitation is supported by recent advances in outcome prediction and therapy personalization. For example, 2024 studies show that machine-learning models can predict hourly functional outcomes within 72 hours of admission, assisting clinicians in assigning the right therapy intensity. Technical reviews highlight AI’s use in adaptive progression, movement-quality assessment, and adherence nudges—often in combination with VR-based tele-rehabilitation. These approaches have been shown to improve engagement and consistency in home-based therapy programs.

The economic rationale for AI and VR integration is clear. In the U.S., stroke-related costs exceed $56 billion annually. Digital rehabilitation programs that reduce hospital stays, enable intensive home-based therapy, and prevent disability progression have the potential to significantly offset healthcare expenses. For instance, VR-enabled exercises combined with AI-driven monitoring can reduce readmissions and improve functional independence. This combination supports value-based care models, which prioritize improved patient outcomes at reduced long-term costs.

Reimbursement incentives further strengthen adoption potential. The Centers for Medicare & Medicaid Services (CMS) introduced Remote Therapeutic Monitoring (RTM) codes—CPT 98980/98981—allowing providers to bill for remote therapy management. These codes align with hybrid models that combine in-clinic and at-home AI/VR rehabilitation. As technology becomes more affordable and accessible, adoption is expected to accelerate in both urban and rural healthcare settings. This shift will likely expand reach, improve convenience, and enhance the quality of stroke rehabilitation programs.

Trends

Rise of Home-Based Stroke Rehabilitation with Digital Support

The stroke rehabilitation landscape is experiencing a notable transformation with the rise of home-based, digitally supported solutions. According to recent market trends, tele-rehabilitation (TR) platforms and remote patient monitoring are enabling patients to recover in their own homes while maintaining regular contact with healthcare providers. This model reduces the need for frequent hospital visits and allows for personalized therapy plans. For example, healthcare systems are increasingly adopting these solutions to enhance patient engagement, lower care costs, and expand access, particularly for rural or mobility-challenged populations.

Clinical evidence supports the effectiveness of home-based TR in post-stroke recovery. A large randomized trial comparing home-based TR with in-clinic therapy for upper-limb rehabilitation found non-inferior gains in motor function, demonstrating high adherence and scalability potential. For instance, meta-analyses from 2023–2024 reported improved balance and health-related quality of life when using TR compared with standard care. Furthermore, virtual-reality–based TR showed superior outcomes versus conventional approaches, underscoring its role as a viable, evidence-backed rehabilitation model.

Remote patient monitoring is becoming an integral part of rehabilitation pathways. According to a 2022 American Heart Association review, trials have shown the value of wearables and sensor-based monitoring in supporting home programs across motor, cognitive, and activity domains. For example, continuous data collection enables clinicians to track progress in real time, adjust therapy intensity, and provide timely interventions. This integration of monitoring technology enhances consistency in therapy, supports faster recovery, and contributes to a broader shift toward digital health adoption in post-stroke care.

Adoption patterns indicate steady but modest integration into mainstream rehabilitation services. A 2024 national study of over 21 million PT/OT visits during 2020–2021 found that 2.5% of patients received at least one TR session, with usage peaking at 10.9% in April 2020 before stabilizing (Archives of Physical Medicine & Rehabilitation). For example, adoption varied significantly by state, from 10.4% in California to only 0.3% in Wyoming. This data highlights early diffusion, the persistence of TR as a complementary care option, and opportunities for targeted policy and reimbursement strategies to drive further market penetration.

Regional Analysis

North America led the stroke rehabilitation market in 2024, securing over 45.5% share with a market value of US$ 145.6 million. This leadership was supported by advanced healthcare infrastructure, higher adoption of innovative rehabilitation technologies, and the presence of specialized stroke rehabilitation centers. For example, integration of AI-based and robotic rehabilitation systems has accelerated adoption rates. Early diagnosis and multidisciplinary care teams have improved recovery outcomes, strengthening the region’s dominance.

The high prevalence of stroke cases has been a major growth driver. In the United States, more than 795,000 people experience a stroke annually, with one occurring every 40 seconds. Canada reported approximately 108,700 cases each year, equivalent to one every five minutes, according to the Heart and Stroke Foundation of Canada. These figures reflect the large at-risk aging population, which continues to create consistent demand for advanced rehabilitation services and devices.

Economic capacity has further underpinned adoption. In 2023, U.S. healthcare spending reached US$ 13,432 per person, significantly exceeding other high-income nations. Canada’s per-capita spending was US$ 6,319 (USD PPP). The financial burden of stroke is substantial, with U.S. stroke-related costs totaling US$ 56.2 billion in 2019–2020, including care, medicines, and productivity losses. This economic impact has created an imperative for effective rehabilitation pathways.

Government initiatives and reimbursement frameworks have played a crucial role in driving adoption. For instance, Medicare covers inpatient rehabilitation care under specific clinical criteria, while Certified Inpatient Rehabilitation Facilities (IRFs) are listed and compared nationally. Such mechanisms have improved access and throughput. Strong acute-to-rehabilitation pathways have also contributed to lower 30-day mortality rates—4.3% in the U.S. compared to the OECD average of 7.8%.

The region’s dominance is expected to continue, supported by investments in tele-rehabilitation and home-based therapy solutions. According to market projections, the shift toward personalized rehabilitation plans will enhance patient outcomes and strengthen market penetration, particularly in remote and underserved areas.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Amal XR is positioned as a virtual reality rehabilitation provider specializing in neuro and musculoskeletal conditions, including post-stroke recovery. Its gamified VR modules target upper and lower limb practice, balance, and cognition, supported by clinician dashboards. The solution is designed for hospitals, rehab centers, and home use, aiming to improve adherence and engagement in post-acute care. The company’s strategic edge lies in cost-efficient, scalable VR deployment. However, wider clinical validation beyond pilot studies is required, and lengthy procurement cycles in public healthcare may delay adoption.

Cognimate focuses on hand function and cognitive rehabilitation through its sensorized “smart glove” and app-based therapeutic games. The platform supports both clinic and home settings, emphasizing neuroplasticity, biofeedback, and gamification. Its strategic strength lies in targeting the underserved fine-motor rehabilitation segment, with potential recurring revenue from clinic-to-home continuity. Although FDA-listed, scaling will require robust independent trial evidence and established payer pathways. Drop Digital Health, meanwhile, delivers AI-driven tele-rehabilitation through its K•HERO® platform, enabling clinician-like guidance without wearables and aiming to address therapist shortages in EU markets.

Health Care at Home India Pvt. Ltd. (HCAH) operates as a large-scale, out-of-hospital care provider offering multidisciplinary stroke rehabilitation across home-care and transition-care centers. The company benefits from a multi-city presence, brand recognition, and integrated service delivery. Its strategic advantage is the ability to consolidate India’s neuro-rehab services market. However, standardizing care quality across locations and ensuring therapist availability remain operational challenges. Across the market, these players illustrate diverse technological and service-based strategies, with growth potential linked to evidence generation, regulatory milestones, and integration into health system reimbursement models.

Market Key Players

- Amal XR

- ARN Labs

- Cognimate

- Drop Digital Health

- Health Care at Home India Pvt. Ltd.

- IRegained Inc.

- Jefferson Health

- Jogo Health

- Pneumbra Inc.

- Restorative Therapies

- Saebo Inc.

- TeleRegain

- UT Southwestern Medical Center

- Zynex Medical Inc.

Recent Developments

- In March 2024: Amal XR continued advancing its rehabilitation platform. The company maintains a 2D tracking solution using tablet or laptop cameras, which enhances accessibility and enables tele-rehabilitation, especially in underserved or remote regions. Additionally, development is underway for 3D tracking hardware and integration of haptic feedback, promising higher precision in motion tracking and enriched patient interaction in the near future.

- In July 2024: IRegained Inc. secured a major distribution partnership with Performance Health to market, sell, and distribute its MyHand device, which aids stroke survivors in regaining hand function, across the U.S. This move to commercial production follows FDA approval received in January 2023, enabling the device to enter the U.S. market.

Report Scope

Report Features Description Market Value (2024) US$ 320.7 Million Forecast Revenue (2034) US$ 773.3 Million CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Stroke (Ischemic Stroke, Hemorrhagic Stroke, Transient Ischemic Attack), By End-User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Long-Term Centers, Home Care Settings, Rehabilitation Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amal XR, ARN Labs, Cognimate, Drop Digital Health, Health Care at Home India Pvt. Ltd., IRegained Inc., Jefferson Health, Jogo Health, Pneumbra Inc., Restorative Therapies, Saebo Inc., TeleRegain, UT Southwestern Medical Center, Zynex Medical Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stroke Rehabilitation MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Stroke Rehabilitation MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amal XR

- ARN Labs

- Cognimate

- Drop Digital Health

- Health Care at Home India Pvt. Ltd.

- IRegained Inc.

- Jefferson Health

- Jogo Health

- Pneumbra Inc.

- Restorative Therapies

- Saebo Inc.

- TeleRegain

- UT Southwestern Medical Center

- Zynex Medical Inc.