Global Strawberry Jam Market By Product Type (Seedless Strawberry Jam, Whole Strawberry Jam), By Packaging Types (Bottles, Cups, Jars, Pouches, Others), By Flavor (Classic Strawberry, Strawberry with Herbs, Strawberry with Mixed Berries), By Ingredient (Low-Sugar, Regular, Sugar-Free), By Preservative (Preservative-Free, With Preservatives), By Application (Bakery Products, Beverages, Confectioneries, Dairy Products, Others), By End Use (Home use, Commercial use), By Distribution Channel (Supermarkets, Hypermarkets, E-commerce Websites, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133122

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Packaging Types Analysis

- By Flavor Analysis

- By Ingredient Analysis

- By Preservative Analysis

- By Application Analysis

- By End-Use Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

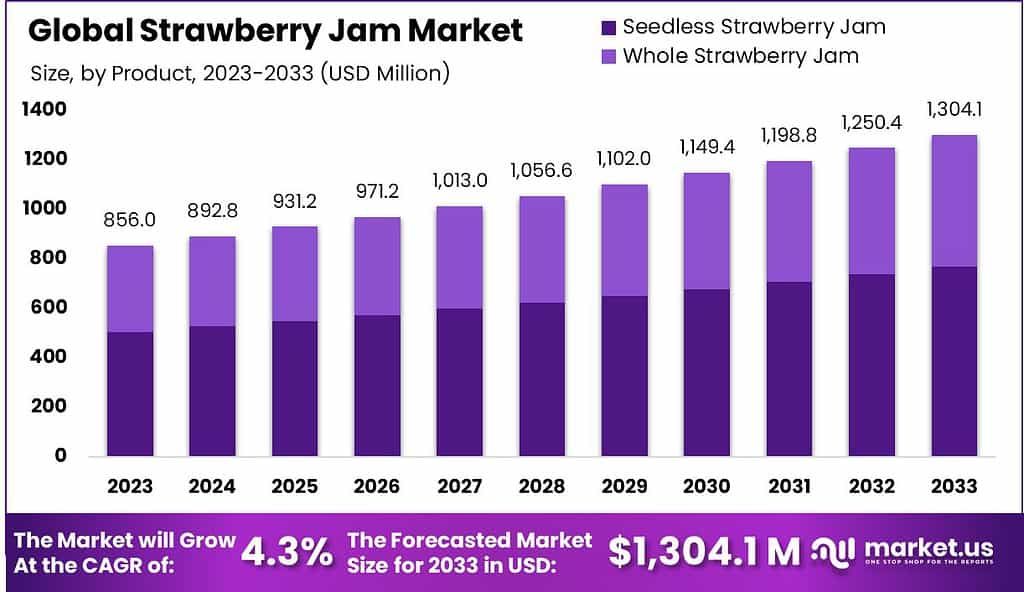

The Global Strawberry Jam Market size is expected to be worth around USD 1304.1 Million by 2033, from USD 856.0 Million in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

The Strawberry Jam Market encompasses the production, distribution, and sales of strawberry-based preserves globally. This market segment is differentiated by the utilization of strawberries as a primary ingredient, appealing widely due to its versatility in flavors and formulations. Consumer preferences are increasingly leaning towards organic and sugar-free options, driving innovation and expansion in product offerings.

The demand for strawberry jam in the market has been growing steadily. People all around the world enjoy it as a breakfast staple, as well as a sweet addition to various desserts. Over recent years, more people are looking for jams that use natural ingredients and less sugar, which has led companies to adapt and offer these healthier options. Strawberry jam, being a popular flavor, is found in nearly every supermarket.

The market for strawberry jam is quite popular and continues to attract attention from consumers around the world. People of all ages enjoy strawberry jam for its sweet and fruity flavor, which makes it a favorite for spreading on bread, mixing into yogurts, and using in various desserts.

Nutritionally, strawberries themselves are low in calories and rich in vitamins and fiber, making them a healthful choice. On average, each person in the U.S. consumes about 4.85 pounds of fresh and frozen strawberries annually, highlighting their popularity

The market is characterized by frequent product launches, mergers, acquisitions, and partnerships. For example, Welch Foods is expanding its operations in Michigan with a $26.2 million investment, creating new jobs and boosting local economic growth. Companies are continually innovating, offering low-sugar and sugar-free jams to cater to health-conscious consumers

The export and import dynamics of strawberry jam are influenced by global agricultural policies, trade agreements, and regional preferences for jam types and flavors. Europe is highlighted as a rapidly growing market due to traditional consumption patterns and a preference for high-quality, organic jams.

Government regulations play a significant role in the industry, particularly concerning food safety and labeling requirements. The industry must comply with local and international standards that govern the use of additives, sugar content, and packaging. Government initiatives also focus on supporting sustainable agricultural practices and organic certification to ensure product quality and safety

Key Takeaways

- The Global Strawberry Jam Market size is expected to be worth around USD 1304.1 Million by 2033, from USD 856.0 Million in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

- Seedless Strawberry Jam dominated with 59.1% of the Strawberry Jam Market.

- Bottles dominated the Strawberry Jam Market with a 36.4% share.

- Classic Strawberry dominated the market with a 68.2% share, driving growth.

- Regular dominated the Strawberry Jam Market with a 61.2% share.

- With Preservatives dominated the Strawberry Jam Market with a 61.2% share.

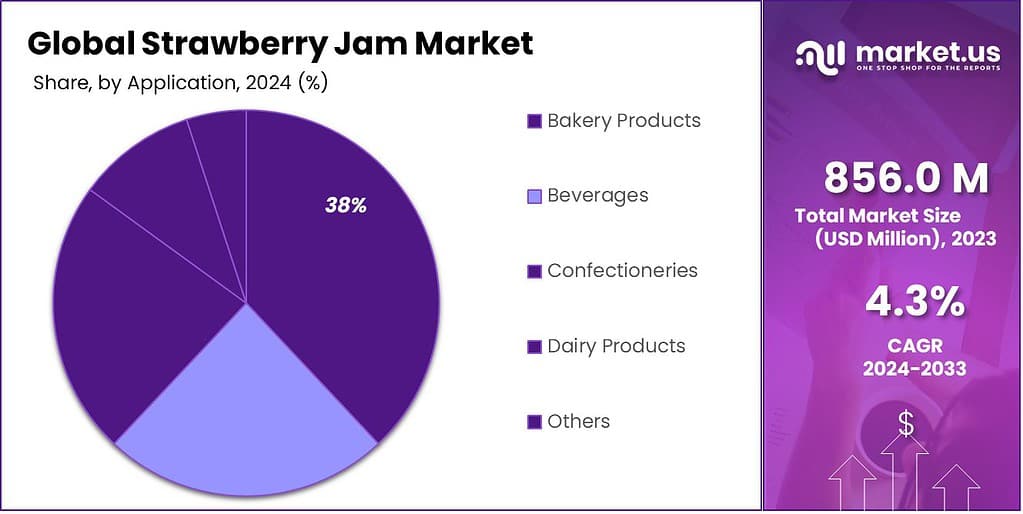

- Bakery Products dominated the Strawberry Jam Market, capturing 37.2% market share.

- Home Use dominated the Strawberry Jam Market’s End Use segment with 71.2%.

- Supermarkets dominated the strawberry jam market with a 42.2% share.

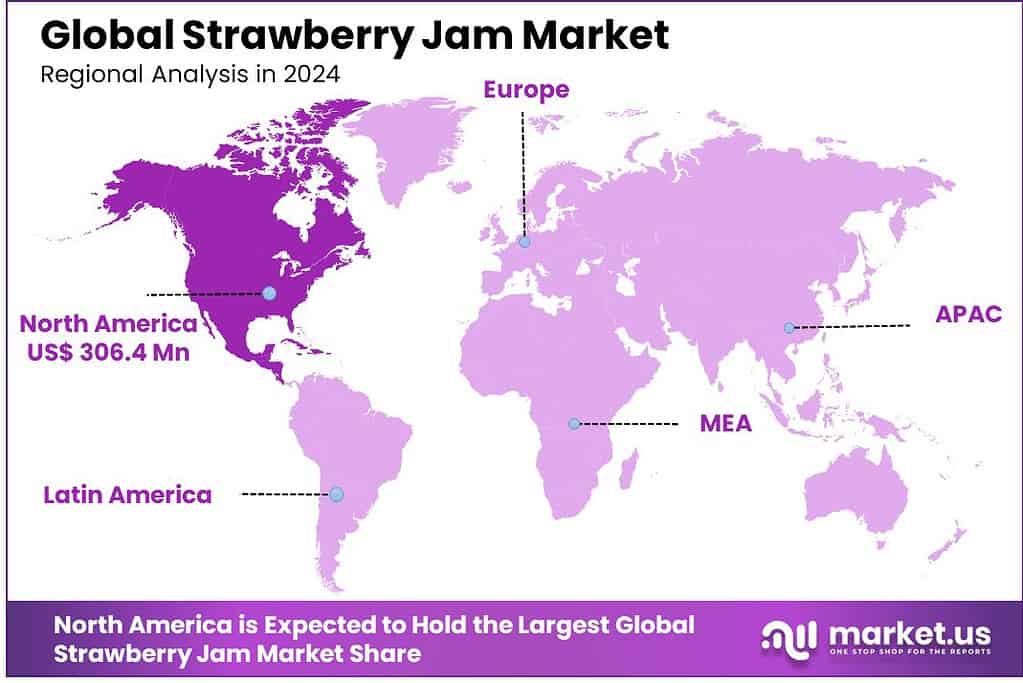

- North America dominates the global strawberry jam market with a 35% share at USD 306.4 million.

By Product Type Analysis

Seedless Strawberry Jam dominated with 59.1% of the Strawberry Jam Market.

In 2023, Seedless Strawberry Jam held a dominant market position in the “By Product Type” segment of the Strawberry Jam Market, capturing more than a 59.1% share. This segment outperformed Whole Strawberry Jam, which accounted for the remainder of the market share. The preference for Seedless Strawberry Jam can be attributed to consumer demand for smoother textures and the absence of seeds, which are often seen as undesirable by certain demographics, including young children and the elderly.

The Whole Strawberry Jam segment, while smaller, still maintains a substantial presence in the market. It appeals primarily to consumers who favor a more traditional texture and the rustic aesthetic of whole fruit inclusions. This segment’s market dynamics are influenced by a niche consumer base that values sensory experience and perceived naturalness in their jam selections.

The differing consumer preferences underline the stratification within the Strawberry Jam Market and highlight the importance of product type segmentation in understanding consumer behavior and market trends.

By Packaging Types Analysis

Bottles dominated the Strawberry Jam Market with a 36.4% share.

In 2023, Bottles held a dominant position in the By Packaging Types segment of the Strawberry Jam Market, accounting for over 36.4% of the market share. This prominence can be attributed to the growing consumer preference for durable and reusable packaging, as well as their widespread availability across retail outlets. Bottles offer superior preservation capabilities, making them ideal for maintaining product freshness, which resonates well with health-conscious consumers.

Cups emerged as the second-largest category, securing approximately 22.7% of the market. Their rise is supported by the increasing demand for single-serving options in fast-paced urban lifestyles. These are particularly popular in the food service industry, including cafeterias and airlines, where portion control is crucial.

Jars, traditionally associated with homemade and premium jams, captured 18.9% of the market. They are favored for their aesthetic appeal and reusability, which aligns with the growing sustainability trends. Premium brands often use jars to enhance product differentiation and brand perception.

Pouches, with an 11.5% share, are gaining traction due to their lightweight and eco-friendly nature. They offer convenience for on-the-go consumption and reduce transportation costs due to their compact size. Pouches are particularly appealing to younger consumers and health-conscious individuals seeking quick energy boosts.

By Flavor Analysis

Classic Strawberry dominated the market with a 68.2% share, driving growth.

In 2023, Classic Strawberry held a dominant market position in the By Flavor segment of the Strawberry Jam Market, capturing more than 68.2% of the total market share. This flavor continues to be the preferred choice among consumers due to its traditional taste and widespread appeal, making it a staple in households and food service sectors. The segment’s growth is further fueled by increasing demand for simple and nostalgic flavors, particularly in North America and Europe, where breakfast spreads remain integral to daily routines.

Meanwhile, Strawberry with Herbs has emerged as a niche yet rapidly growing sub-segment, accounting for approximately 12.7% of the market share in 2023. This category benefits from rising consumer interest in gourmet and artisanal products, driven by trends favoring unique flavor profiles and health benefits associated with herbs. Products in this segment often cater to health-conscious consumers and food enthusiasts seeking innovative taste experiences.

Strawberries with Mixed Berries contributed to 19.1% of the market share, showcasing a strong performance as a versatile option appealing to a broader demographic. The blend of strawberries with complementary berries like blueberries, raspberries, and blackberries enhances the product’s nutritional value and flavor complexity. This segment is particularly popular in regions where mixed berry consumption is culturally ingrained, such as Scandinavia and parts of Asia-Pacific.

By Ingredient Analysis

Regular dominated the Strawberry Jam Market with a 61.2% share.

In 2023, Regular held a dominant market position in the By Regular segment of the Strawberry Jam Market, capturing more than 61.2% share. This segment’s performance can be attributed to its widespread consumer acceptance, affordability, and consistent flavor profile, making it a staple in households globally. Regular strawberry jam appeals to a broad demographic due to its balanced sweetness and widespread availability across retail and online channels.

The Low-Sugar segment accounted for 25.7% of the market share, driven by increasing health awareness and a growing demand for reduced-calorie options. This category has gained traction among health-conscious consumers, particularly those managing weight or sugar intake. Product innovations featuring natural sweeteners like stevia and monk fruit have enhanced the appeal of low-sugar variants, contributing to a steady growth trajectory.

Meanwhile, the Sugar-Free segment represented 13.1% of the market share, serving a niche but expanding consumer base. This category targets individuals with specific dietary needs, including diabetics and those adhering to ketogenic or low-carb diets. Technological advancements in sugar replacement formulations and heightened awareness regarding health and wellness trends have been instrumental in the segment’s growth.

By Preservative Analysis

With Preservatives dominated the Strawberry Jam Market with a 61.2% share.

In 2023, With Preservatives held a dominant market position in the By Preservative segment of the Strawberry Jam Market, capturing more than 61.2% of the total market share. The segment’s prominence can be attributed to the extended shelf life and enhanced stability offered by preservative-added jams, meeting the demands of both retailers and consumers for long-lasting products.

The Preservative-Free segment, while accounting for a smaller share, has been gaining traction due to the rising consumer inclination toward organic and natural products. Health-conscious consumers, particularly in developed markets, are driving the demand for preservative-free jams, viewing them as a safer and healthier alternative. This trend aligns with the growing emphasis on clean-label products and transparency in ingredient sourcing.

By Application Analysis

Bakery Products dominated the Strawberry Jam Market, capturing 37.2% market share.

In 2023, Bakery Products held a dominant market position in the By Application segment of the Strawberry Jam Market, capturing more than 37.2% of the total market share. This leadership can be attributed to the growing consumption of strawberry jam in baked goods such as bread, muffins, and pastries, which remain staples in various regions. The versatility of strawberry jam as a filling and topping has further cemented its use in bakery items, driven by increasing consumer demand for convenient and flavorful breakfast options.

Beverages accounted for approximately 18.5% of the market share. The growing popularity of fruit-based beverages, including smoothies and flavored milk, has spurred the adoption of strawberry jam as a natural sweetener and flavor enhancer. The segment is also benefiting from the rising trend of health-conscious consumers opting for fruit-infused drinks.

Confectioneries followed closely, with a 16.3% share. Strawberry jam is widely used in candies, chocolates, and gummies, where its distinct flavor and color appeal to a broad consumer base, particularly children and young adults. Seasonal demand during festive occasions further boosts this segment.

The Dairy Products segment represented around 14.7% of the market. Strawberry jam is extensively utilized in products such as yogurt, ice creams, and cheesecakes, driven by its ability to enhance flavor and visual appeal. The growing preference for premium and artisanal dairy products has further fueled its demand.

By End-Use Analysis

Home Use dominated the Strawberry Jam Market’s End Use segment with 71.2%.

In 2023, Home Use dominated the By End Use segment of the Strawberry Jam Market, accounting for a significant market share of 71.2%. Valued at approximately $2.3 billion, this segment benefitted from the increasing preference for home-prepared meals and breakfast items, including jams and spreads. The rising trend of at-home consumption, driven by a growing inclination toward convenient, ready-to-eat products, contributed to this strong market performance.

Conversely, the Commercial Use segment, which includes applications in bakeries, restaurants, and food service providers, held a comparatively smaller share of 28.8%, valued at $930 million. The growth of this segment is primarily driven by the expanding food service industry, particularly in urban areas. The increasing use of strawberry jam in pastries, desserts, and breakfast menus has fueled demand.

By Distribution Channel Analysis

Supermarkets dominated the strawberry jam market with a 42.2% share.

In 2023, Supermarkets held a dominant market position in the By Distribution Channel segment of the Strawberry Jam Market, capturing more than 42.2% of the total market share. This leadership can be attributed to the wide reach of supermarkets, their ability to offer competitive pricing, and their status as a one-stop shop for groceries and related products. Supermarkets cater to a broad consumer base, including price-sensitive and brand-conscious customers, making them the preferred distribution channel for strawberry jam.

Hypermarkets followed closely, accounting for 27.5% of the market share. Their spacious layouts and extensive product assortments offer consumers a variety of brands and packaging sizes, appealing to bulk buyers and families. The convenience of purchasing multiple items under one roof, coupled with promotional discounts, has reinforced their market position.

E-commerce websites experienced significant growth, securing 20.3% of the market share. The increasing penetration of online shopping platforms, particularly among tech-savvy and urban populations, has contributed to this rise. E-commerce offers convenience, home delivery, and access to a wider range of products, including premium and imported strawberry jam brands, which are not always available in physical stores.

Key Market Segments

By Product Type

- Seedless Strawberry Jam

- Whole Strawberry Jam

By Packaging Types

- Bottles

- Cups

- Jars

- Pouches

- Others

By Flavor

- Classic Strawberry

- Strawberry with Herbs

- Strawberry with Mixed Berries

By Ingredient

- Low-Sugar

- Regular

- Sugar-Free

By Preservative

- Preservative-Free

- With Preservatives

By Application

- Bakery Products

- Beverages

- Confectioneries

- Dairy Products

- Others

By End Use

- Home use

- Commercial use

By Distribution Channel

- Supermarkets

- Hypermarkets

- E-commerce Websites

- Others

Driving factors

Increasing Consumer Preference for Organic and Natural Products

The escalating consumer preference for organic and natural products is significantly enhancing the strawberry jam market. This trend can be attributed to a growing awareness of the health benefits associated with organic foods, including reduced exposure to pesticides and chemicals. Consumers are increasingly seeking clean-label products, which are perceived as healthier and safer.

Organic strawberry jam, being aligned with these preferences, enjoys heightened demand. Market data indicates that the organic food sector has been expanding at a robust rate, with global sales reaching approximately $97 billion in 2021, suggesting a fertile environment for the growth of organic strawberry jam.

Rising Demand for Convenience Foods

Convenience is a paramount factor driving consumer choices today, influencing the strawberry jam market positively. Busy lifestyles and increased employment rates have heightened the demand for quick and easy meal solutions, where strawberry jam serves as a versatile and convenient option. This demand intersects notably with the breakfast market and the surge in fast breakfast solutions like toast and sandwiches.

The convenience food sector, which encompasses ready-to-eat products like packaged sandwiches, has been witnessing substantial growth, projected to expand at a compound annual growth rate (CAGR) of around 4.5% through the next decade. This growth directly propels the consumption of strawberry jam, positioning it as a staple in quick meal preparations.

Growth in Bakery and Snack Industries

The expansion of the bakery and snack industries emerges as a critical driver for the strawberry jam market. With an increase in consumer spending on bakery products, such as pastries, bread, and other baked goods, the demand for complementary products like strawberry jam is also rising. The bakery sector, growing at a steady CAGR of 3.5% globally, underscores the potential for increased strawberry jam usage as a filling and a spread.

Furthermore, the snack industry’s innovation, incorporating fruit spreads into snacks and bars, amplifies this demand. The synergy between these industries creates a robust platform for the sustained growth of the strawberry jam market, fueled by both direct consumption and usage as an ingredient.

Restraining Factors

Impact of High Sugar Content Concerns on the Strawberry Jam Market

High sugar content in strawberry jam is increasingly becoming a concern among health-conscious consumers. This has a direct impact on the demand for traditional strawberry jams, which are typically high in sugar. Public health campaigns and increasing awareness about the negative effects of excessive sugar consumption have led to a more cautious consumer approach towards sugary products.

The market response has seen an uptick in the development and marketing of reduced sugar and sugar-free alternatives. Although this shift poses a challenge to the traditional market, it also presents new growth avenues for manufacturers who adapt to these preferences.

Market Saturation in Developed Economies

Market saturation in developed economies significantly impacts the growth trajectory of the strawberry jam market. In regions such as North America and Western Europe, the jam market is mature, with high product penetration and intense competition among established brands. This saturation leads to fierce competition on pricing and innovation, making it difficult for new entrants to gain a foothold and for existing players to expand their market share.

Brands may find growth opportunities primarily in niche markets, such as organic or exotic-flavored jams, which can appeal to a segment willing to experiment beyond traditional offerings.

Consumer Shift Towards Low-Carb and Keto Diets

The growing popularity of low-carb and ketogenic diets has a considerable impact on the strawberry jam market, where traditional products are often high in carbohydrates. As these dietary trends emphasize reduced sugar and carb intake, demand for conventional strawberry jam may decline.

However, this also stimulates market innovation, leading to the creation of jam products that align with these health trends. Manufacturers are increasingly producing jams that are low in sugar and carbs, using alternative sweeteners that cater to the dietary preferences of this consumer base.

Growth Opportunity

Development of Reduced Sugar and Sugar-Free Variants

The rising demand for healthier food options has paved the way for reduced sugar and sugar-free strawberry jams. With consumers becoming increasingly health-conscious, particularly regarding sugar intake, companies are innovating to meet these preferences.

These healthier alternatives not only cater to those managing diabetes or other health concerns but also appeal to the broader wellness-focused demographic. This shift aligns with the global trend toward functional and fortified foods, offering a major growth avenue for manufacturers.

Enhancement of Supply Chain and Logistics

Efficient supply chain management remains crucial in the perishable goods sector. In 2024, investments in advanced logistics, including cold chain systems, are set to enhance product freshness and reduce wastage.

This improvement ensures that strawberry jam products reach markets with optimal quality, boosting consumer satisfaction and brand loyalty. Additionally, expanding distribution channels through e-commerce and retail partnerships will further drive accessibility and growth.

Targeting Health and Wellness Trends

The health and wellness movement continues to influence food choices globally. Strawberry jams enriched with organic ingredients added vitamins, or superfoods can tap into this lucrative market segment. As consumers seek products that align with their healthy lifestyles, brands that position themselves as health-conscious and sustainable will likely see increased demand.

Latest Trends

Focus on Local and Regional Flavors

In 2024, the strawberry jam market is anticipated to witness heightened demand for products that highlight local and regional flavors. Consumers are increasingly drawn to artisanal and regionally sourced jams, valuing authenticity and a connection to their local culture. Brands leveraging this trend by incorporating unique regional strawberry varieties or traditional preparation methods are poised to gain a competitive edge.

Dietary Trends Influencing Product Formulations

The rising influence of health-conscious dietary trends, such as low-sugar, organic, and clean-label products, is reshaping the strawberry jam market. Formulations with reduced sugar, natural sweeteners like stevia, or added functional ingredients (e.g., probiotics) are expected to see increased market penetration.

Additionally, the demand for allergen-free and vegan-friendly options continues to grow, as consumers prioritize both health and ethical considerations in their purchasing decisions.

Technological Advancements in Food Processing

Technological innovation in food processing is playing a pivotal role in enhancing product quality and shelf life. Advanced pasteurization and vacuum concentration techniques allow for the retention of natural flavor and nutritional content in strawberry jams, while also improving production efficiency. Moreover, developments in packaging technology, such as vacuum-sealed or sustainable materials, are expected to further appeal to eco-conscious consumers.

Regional Analysis

North America dominates the global strawberry jam market with a 35% share at USD 306.4 million.

North America: Dominating the market with a 35% share, equivalent to approximately USD 306.4 million, North America’s leadership is driven by high consumer demand for premium and organic products. The United States, as a leading producer and consumer of strawberries, significantly contributes to this dominance.

Europe holds a substantial market share, propelled by a rich tradition of fruit preserves and a strong preference for natural and artisanal products. Countries like Germany, France, and the United Kingdom are key contributors, with Germany’s market size and forecast indicating steady growth.

Asia Pacific this region is experiencing rapid growth, with a projected Compound Annual Growth Rate (CAGR) exceeding 5% from 2022 to 2030. The expansion is fueled by increasing disposable incomes, urbanization, and a growing inclination toward Western dietary habits. China, in particular, has been identified as a potential market for exported products, driven by rising domestic consumption and an expanding food processing industry.

Latin America market here is growing steadily, supported by the region’s robust agricultural base and a burgeoning interest in fruit-based spreads. Brazil stands out as a significant contributor, with its market size and forecast indicating positive trends.

Middle East & Africa this region is witnessing moderate growth, attributed to increasing consumer awareness and the gradual adoption of Western food products. The market size and forecast for countries within this region suggest a steady upward trajectory.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global strawberry jam market is dominated by several key players, each contributing to the market’s growth through innovation, expansion, and strong brand presence. Among these companies, B&G Foods, Bonne Maman, Nestlé, and The J.M. Smucker Company stand out for their significant influence.

B&G Foods has a robust portfolio that includes established brands like Polaner and Musselman’s. Its focus on quality and broad distribution network makes it a key player in the North American market. The company’s ability to offer both premium and budget-friendly options allows it to cater to diverse consumer preferences, driving its continued growth in the strawberry jam segment.

Bonne Maman is a premium brand known for its high-quality, all-natural ingredients. The brand’s commitment to traditional French recipes and rustic packaging has cultivated a strong consumer following. Its focus on natural, preservative-free products aligns well with growing consumer demand for healthier, more transparent food options, which positions it strongly for market growth.

Nestlé, a global food giant, continues to leverage its vast distribution channels and product innovation. With a diversified portfolio, Nestlé’s strategy often involves enhancing the health aspect of its products. For example, they focus on reducing sugar content in their jams, which caters to the growing health-conscious consumer base. This makes Nestlé a key player in the evolving market trends.

The J.M. Smucker Company is another significant player, particularly in the North American market. With brands like Smucker’s leading the way, it has been a household name for decades. The company’s emphasis on convenience, quality, and product variety (including organic and reduced-sugar options) ensures its continued leadership in the strawberry jam sector.

Market Key Players

- B&G Foods

- BINA

- Bonne Maman

- Cascadian Farm

- ConAgra Foods

- Danone

- Del Monte Foods

- Ferrero

- Frulact

- General Mills

- Hormel Foods

- Incorporated

- Jelly Belly Candy Company

- Kellogg’s

- Kraft Foods

- Mars

- McCormick & Company

- Mondelez International

- Nestle

- PepsiCo

- St. Dalfour

- The Hain Celestial Group

- The J.M. Smucker Company

- The Kraft Heinz Company

- Tiptree Farm

- TreeHouse Foods

- Unilever.

- Valio Ltd.

- Welch Foods Inc.

Recent Development

- In April 2024, Meghan Markle introduced strawberry jam as the inaugural product of her lifestyle brand, American Riviera Orchard. She distributed 50 limited-edition jars to select influencers, generating significant attention and social media buzz.

- In April 2024, Buckingham Palace featured its strawberry preserve on Instagram, coinciding with Markle’s jam release. This move was perceived by some as a strategic response to Markle’s product launch.

- In June 2024, British strawberry growers began exporting to Japan, catering to the demand for high-quality strawberries in Japanese tea rooms. This shift was driven by declining EU exports and the pursuit of more profitable markets.

Report Scope

Report Features Description Market Value (2023) USD 856.0 Billion Forecast Revenue (2033) USD 1304.1 Million CAGR (2024-2032) 4.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered B&G Foods, BINA, Bonne Maman, Cascadian Farm, ConAgra Foods, Danone, Del Monte Foods, Ferrero, Frulact, General Mills, Hormel Foods, Incorporated, Jelly Belly Candy Company, Kellogg’s, Kraft Foods, Mars, McCormick & Company, Mondelez International, Nestle, PepsiCo, St. Dalfour, The Hain Celestial Group, The J.M. Smucker Company, The Kraft Heinz Company, Tiptree Farm, TreeHouse Foods, Unilever., Valio Ltd., Welch Foods Inc. Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape By Product Type (Seedless Strawberry Jam, Whole Strawberry Jam), By Packaging Types (Bottles, Cups, Jars, Pouches, Others), By Flavor (Classic Strawberry, Strawberry with Herbs, Strawberry with Mixed Berries), By Ingredient (Low-Sugar, Regular, Sugar-Free), By Preservative (Preservative-Free, With Preservatives), By Application (Bakery Products, Beverages, Confectioneries, Dairy Products, Others), By End Use (Home use, Commercial use), By Distribution Channel (Supermarkets, Hypermarkets, E-commerce Websites, Others) Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- B&G Foods

- BINA

- Bonne Maman

- Cascadian Farm

- ConAgra Foods

- Danone

- Del Monte Foods

- Ferrero

- Frulact

- General Mills

- Hormel Foods

- Incorporated

- Jelly Belly Candy Company

- Kellogg's

- Kraft Foods

- Mars

- McCormick & Company

- Mondelez International

- Nestle

- PepsiCo

- St. Dalfour

- The Hain Celestial Group

- The J.M. Smucker Company

- The Kraft Heinz Company

- Tiptree Farm

- TreeHouse Foods

- Unilever.

- Valio Ltd.

- Welch Foods Inc.